Key Insights

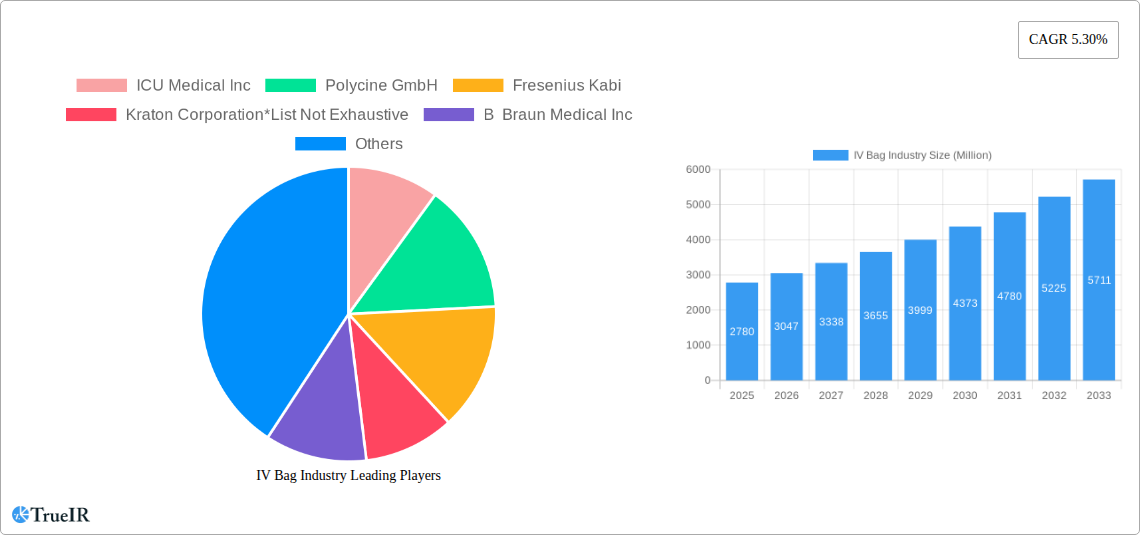

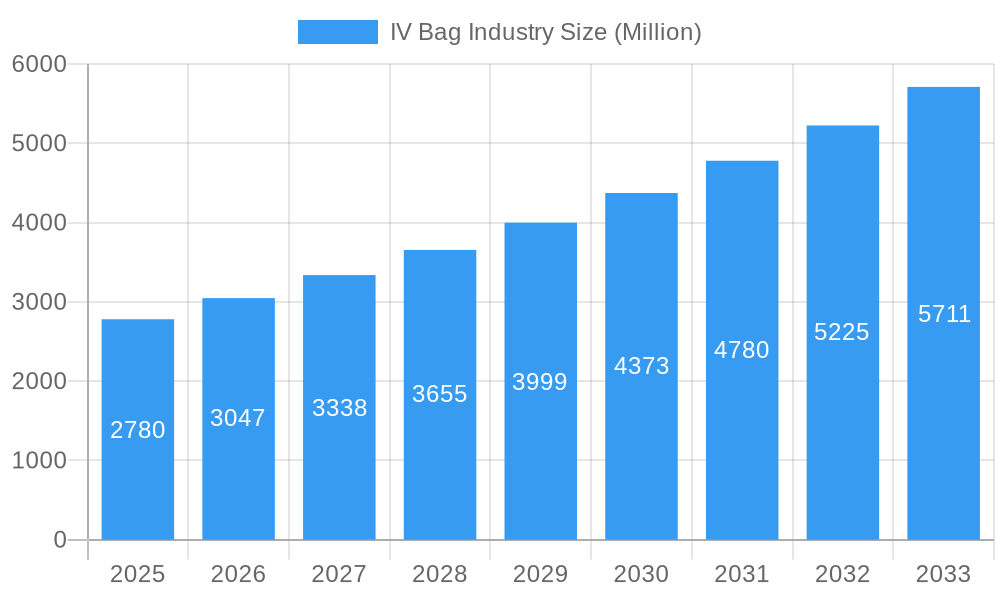

The global IV bag market is poised for robust expansion, projected to reach an estimated $2.78 billion in 2025 and exhibit a significant Compound Annual Growth Rate (CAGR) of 9.62% throughout the forecast period of 2025-2033. This upward trajectory is fueled by an increasing prevalence of chronic diseases, a rising demand for intravenous therapies, and advancements in medical device technology. The growing healthcare infrastructure, particularly in emerging economies, coupled with an aging global population, further accentuates the need for effective drug delivery systems like IV bags. Key drivers include the growing emphasis on patient safety, the development of novel drug formulations requiring specialized IV bag materials and designs, and the expanding application of IV therapies in various medical settings, from hospitals to homecare.

IV Bag Industry Market Size (In Billion)

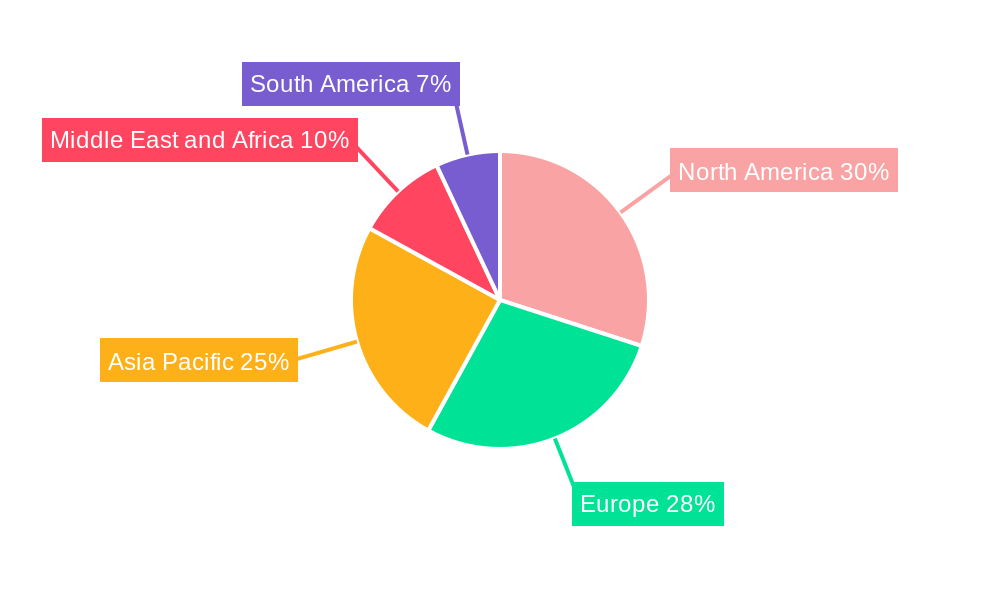

The market's segmentation offers a diverse landscape for stakeholders. In terms of material type, Polyethylene (PE) and Polyvinyl Chloride (PVC) are expected to dominate, given their cost-effectiveness and established use in medical applications. However, innovations in polymer science are leading to the increased adoption of other advanced materials offering enhanced barrier properties and biocompatibility. The capacity segment, with a focus on smaller volumes (0-250 ml and 250-500 ml), caters to the precise dosing requirements of modern pharmaceuticals and patient needs. Single-chamber bags remain the prevalent choice, but the multi-chamber segment is gaining traction for its ability to store and mix incompatible drugs. Geographically, North America and Europe are established strongholds, while the Asia Pacific region presents substantial growth opportunities due to its burgeoning healthcare sector and increasing medical expenditure. Restraints, such as stringent regulatory approvals and the potential for material leaching concerns, are being addressed through ongoing research and development by leading companies like ICU Medical Inc., Fresenius Kabi, and B. Braun Medical Inc.

IV Bag Industry Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the global IV bag industry. Leveraging high-volume keywords such as "IV bag market," "intravenous fluid bags," "medical packaging," and "pharmaceutical delivery systems," this report is designed to enhance search rankings and engage industry professionals. We delve into market structure, competitive dynamics, emerging trends, dominant segments, product innovations, key drivers, significant challenges, and the future outlook for the IV bag market, with a projected market size exceeding billions by 2033.

The report covers a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period spanning 2025–2033, building upon historical data from 2019–2024.

IV Bag Industry Market Structure & Competitive Landscape

The IV bag industry is characterized by a moderately concentrated market structure, with a few dominant players alongside a considerable number of smaller manufacturers. Innovation is a key driver, fueled by the increasing demand for advanced drug delivery systems, patient safety enhancements, and cost-effectiveness in healthcare. Regulatory impacts, such as stringent FDA and EMA guidelines for medical devices and packaging, significantly shape market entry and product development, often leading to a multi-billion dollar investment in compliance. Product substitutes, while limited due to specialized requirements, include glass bottles and pre-filled syringes for certain applications. End-user segmentation is broad, encompassing hospitals, clinics, ambulatory surgical centers, and home healthcare. Mergers and acquisitions (M&A) trends are notable, with companies consolidating to expand market reach, acquire new technologies, and achieve economies of scale. For instance, strategic acquisitions in the last few years have collectively represented billions in transaction value, aimed at strengthening portfolios and addressing evolving market needs. The competitive landscape is further defined by a focus on material science advancements, sterilization techniques, and the development of specialized bags for specific therapeutic areas.

IV Bag Industry Market Trends & Opportunities

The global IV bag market is experiencing robust growth, projected to surpass billions in value by 2033. This expansion is driven by several interconnected trends and opportunities. The escalating prevalence of chronic diseases worldwide, coupled with an aging global population, is significantly increasing the demand for intravenous therapies and, consequently, IV bags. Advancements in healthcare infrastructure, particularly in emerging economies, are further contributing to market penetration. Technological shifts are pivotal, with a move towards multi-chamber IV bags for complex drug formulations and ready-to-administer solutions that reduce preparation time and minimize the risk of medication errors. These innovations are attracting billions in research and development funding. Consumer preferences are evolving towards safer, more convenient, and environmentally sustainable IV bag options. Manufacturers are responding by developing PVC-free alternatives and exploring biodegradable materials, addressing a growing ethical and environmental concern. Competitive dynamics are intensifying, pushing companies to focus on product differentiation, supply chain resilience, and strategic partnerships. The development of specialized IV bags for targeted therapies, such as oncology and biologics, presents a significant growth opportunity. The increasing adoption of smart packaging technologies, integrating features like temperature monitoring and RFID tracking, is another emerging trend, promising enhanced patient safety and supply chain visibility, further contributing to the multi-billion dollar market potential. The CAGR for the IV bag market is projected to be in the range of xx%, reflecting sustained expansion. Market penetration rates are expected to rise across all regions, particularly in areas where access to advanced medical solutions is rapidly improving. The continuous innovation in materials science, such as the development of advanced polymers offering superior barrier properties and flexibility, is another key factor driving market evolution and the substantial investment in this sector.

Dominant Markets & Segments in IV Bag Industry

The IV bag industry exhibits significant dominance across various geographical regions and product segments. North America and Europe currently lead the market, driven by advanced healthcare infrastructure, high per capita healthcare spending, and the early adoption of innovative medical technologies. Countries like the United States and Germany are major contributors to this dominance, with their well-established hospital networks and stringent quality standards.

Material Type Dominance:

- Polyvinyl Chloride (PVC): Remains a dominant material due to its cost-effectiveness, flexibility, and proven track record in medical applications. However, concerns regarding plasticizers are driving the growth of alternatives, creating a dynamic market.

- Polyethylene (PE): Gaining traction due to its improved safety profile, especially in applications requiring flexibility and chemical resistance. Billions are invested in the research and development of advanced PE formulations.

- Polypropylene (PP): Increasingly used for specific applications, offering good chemical resistance and transparency.

- Other Material Types: Includes innovative blends and multi-layer films that offer enhanced barrier properties and compatibility with a wider range of pharmaceuticals.

Capacity Dominance:

- 500-1000 ml: This capacity segment represents a significant portion of the market, catering to a broad range of intravenous fluid and medication administrations in hospital settings.

- 250-500 ml: Also a substantial segment, used for smaller volume infusions and pediatric applications.

- 0-250 ml: Growing demand in home healthcare and for specific drug delivery applications.

Chamber Type Dominance:

- Single Chamber: Continues to be the most prevalent type due to its simplicity and cost-effectiveness for standard IV fluid administration.

- Multi Chamber: Witnessing rapid growth, especially for complex drug combinations and ready-to-use solutions, reducing preparation steps and enhancing patient safety. This segment is attracting billions in innovation funding.

Key growth drivers include increasing government initiatives for healthcare access, technological advancements in drug formulation requiring specialized IV bags, and a growing awareness of patient safety. For instance, infrastructure development in Asia-Pacific is opening new avenues for market penetration, contributing to the multi-billion dollar potential of these regions. Policies promoting the use of advanced medical devices and the increasing burden of diseases requiring long-term infusion therapies are further accelerating the growth of these dominant segments.

IV Bag Industry Product Analysis

Product innovation in the IV bag industry is primarily focused on enhancing drug stability, patient safety, and ease of use. Advancements in material science have led to the development of PVC-free bags, offering improved biocompatibility and reduced leaching concerns, thereby securing a multi-billion dollar market share. The emergence of multi-chamber IV bags allows for the simultaneous administration of multiple drugs without compromising their stability, a critical development for complex therapeutic regimens. Ready-to-administer (RTA) IV bags, like those recently launched, are gaining significant traction by simplifying preparation processes for healthcare professionals and minimizing the risk of errors. These innovations, coupled with improved sterilization techniques and advanced sealing technologies, provide competitive advantages by offering superior product integrity and shelf life.

Key Drivers, Barriers & Challenges in IV Bag Industry

The IV bag industry is propelled by several key drivers, including the rising global incidence of chronic diseases, an expanding elderly population, and advancements in pharmaceutical formulations that necessitate specialized delivery systems. The increasing adoption of home healthcare services and the growing demand for ready-to-administer drug solutions also contribute significantly to market growth, representing billions in potential revenue. Furthermore, technological innovations in materials and manufacturing processes enhance product safety and efficacy.

However, the industry faces considerable barriers and challenges. Stringent regulatory hurdles and the need for extensive product testing and approvals in different countries can slow down market entry and increase development costs, often amounting to billions in compliance expenses. Supply chain disruptions, particularly concerning raw material availability and price volatility, pose a significant risk. Competitive pressures from established players and emerging manufacturers also intensify, demanding continuous innovation and cost optimization. Potential health concerns associated with certain materials, leading to a push for alternatives, can disrupt established manufacturing processes and require substantial investment in new technologies.

Growth Drivers in the IV Bag Industry Market

The IV bag industry's growth is primarily fueled by the escalating prevalence of chronic diseases like diabetes and cancer, leading to a continuous demand for intravenous therapies. A consistently growing elderly population, more susceptible to various ailments requiring infusions, further bolsters market expansion, representing billions in sustained demand. Technological advancements in drug delivery systems, including the development of sophisticated multi-chamber bags for complex medications and ready-to-administer solutions, are crucial growth catalysts. Government initiatives aimed at improving healthcare access and infrastructure in developing nations, coupled with increasing investments in healthcare R&D, are creating new market opportunities and driving innovation, all contributing to a multi-billion dollar industry outlook.

Challenges Impacting IV Bag Industry Growth

The IV bag industry grapples with significant challenges that impact its growth trajectory. Stringent regulatory compliances across different geographies, requiring extensive validation and costly approvals, represent a substantial barrier, often involving billions in expenditure. Fluctuations in the prices of raw materials, such as polymers, and potential supply chain disruptions, exacerbated by geopolitical events, can affect manufacturing costs and product availability. Intense competition among global and regional players necessitates continuous investment in R&D to maintain market share and develop innovative products, a challenge for smaller entities. Furthermore, the evolving environmental regulations and the increasing demand for sustainable packaging solutions may require manufacturers to invest heavily in adopting new materials and manufacturing processes.

Key Players Shaping the IV Bag Industry Market

- ICU Medical Inc

- Polycine GmbH

- Fresenius Kabi

- Kraton Corporation

- B Braun Medical Inc

- Otsuka Holdings (Otsuka Pharmaceutical India Private Limited)

- Haemotronic

- Technoflex

- Baxter international Inc

- Sippex IV bags

- MedicoPack

Significant IV Bag Industry Industry Milestones

- February 2023: Bowmed Ibisqus launched a ready-to-administer Levofloxacin bag. The bag is packaged with a foil overwrap to protect the product from light, and the overwrap displays the essential product information. This launch signifies a move towards enhanced drug stability and user-friendly packaging.

- December 2022: Asahi Kasei Pharma launched Reclast for intravenous (i.v.) infusion bags for osteoporosis treatment, listed on Japan's National Health Insurance (NHI) drug price standard. This development highlights the increasing therapeutic applications for IV bags and their integration into national healthcare systems.

Future Outlook for IV Bag Industry Market

The future outlook for the IV bag industry is exceptionally promising, with sustained growth projected to reach unprecedented multi-billion dollar figures. Key growth catalysts include the continuous innovation in drug formulations, particularly biologics and gene therapies, which will demand more sophisticated and specialized IV bag solutions. The expanding healthcare infrastructure in emerging economies, coupled with the increasing trend towards home-based care, will significantly drive demand. Furthermore, the development of smart IV bags with integrated sensors for monitoring drug delivery and patient vitals presents a substantial market opportunity. Companies focusing on sustainable materials and advanced manufacturing techniques are poised to capture a larger market share, shaping a more efficient, safe, and environmentally conscious future for intravenous therapies.

IV Bag Industry Segmentation

-

1. Material Type

- 1.1. Polyethylene

- 1.2. Polyvinyl Chloride

- 1.3. Polypropylene

- 1.4. Other Material Types

-

2. Capacity

- 2.1. 0-250 ml

- 2.2. 250-500 ml

- 2.3. 500-1000 ml

-

3. Chamber Type

- 3.1. Single Chamber

- 3.2. Multi Chamber

IV Bag Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

IV Bag Industry Regional Market Share

Geographic Coverage of IV Bag Industry

IV Bag Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Chronic Diseases Coupled with Rising Geriatric Population; Increasing Number of Road Accidents and Surgeries

- 3.3. Market Restrains

- 3.3.1. The Risk of Leaching of Chemicals from Plastic IV Bags

- 3.4. Market Trends

- 3.4.1. Polypropylene Segment is Expected to Dominate the IV Bags Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IV Bag Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethylene

- 5.1.2. Polyvinyl Chloride

- 5.1.3. Polypropylene

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Capacity

- 5.2.1. 0-250 ml

- 5.2.2. 250-500 ml

- 5.2.3. 500-1000 ml

- 5.3. Market Analysis, Insights and Forecast - by Chamber Type

- 5.3.1. Single Chamber

- 5.3.2. Multi Chamber

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America IV Bag Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Polyethylene

- 6.1.2. Polyvinyl Chloride

- 6.1.3. Polypropylene

- 6.1.4. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Capacity

- 6.2.1. 0-250 ml

- 6.2.2. 250-500 ml

- 6.2.3. 500-1000 ml

- 6.3. Market Analysis, Insights and Forecast - by Chamber Type

- 6.3.1. Single Chamber

- 6.3.2. Multi Chamber

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe IV Bag Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Polyethylene

- 7.1.2. Polyvinyl Chloride

- 7.1.3. Polypropylene

- 7.1.4. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Capacity

- 7.2.1. 0-250 ml

- 7.2.2. 250-500 ml

- 7.2.3. 500-1000 ml

- 7.3. Market Analysis, Insights and Forecast - by Chamber Type

- 7.3.1. Single Chamber

- 7.3.2. Multi Chamber

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific IV Bag Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Polyethylene

- 8.1.2. Polyvinyl Chloride

- 8.1.3. Polypropylene

- 8.1.4. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Capacity

- 8.2.1. 0-250 ml

- 8.2.2. 250-500 ml

- 8.2.3. 500-1000 ml

- 8.3. Market Analysis, Insights and Forecast - by Chamber Type

- 8.3.1. Single Chamber

- 8.3.2. Multi Chamber

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East and Africa IV Bag Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Polyethylene

- 9.1.2. Polyvinyl Chloride

- 9.1.3. Polypropylene

- 9.1.4. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Capacity

- 9.2.1. 0-250 ml

- 9.2.2. 250-500 ml

- 9.2.3. 500-1000 ml

- 9.3. Market Analysis, Insights and Forecast - by Chamber Type

- 9.3.1. Single Chamber

- 9.3.2. Multi Chamber

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. South America IV Bag Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Polyethylene

- 10.1.2. Polyvinyl Chloride

- 10.1.3. Polypropylene

- 10.1.4. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Capacity

- 10.2.1. 0-250 ml

- 10.2.2. 250-500 ml

- 10.2.3. 500-1000 ml

- 10.3. Market Analysis, Insights and Forecast - by Chamber Type

- 10.3.1. Single Chamber

- 10.3.2. Multi Chamber

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ICU Medical Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Polycine GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fresenius Kabi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kraton Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 B Braun Medical Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Otsuka Holdings (Otsuka Pharmaceutical India Private Limited)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Haemotronic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Technoflex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baxter international Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sippex IV bags

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MedicoPack

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 ICU Medical Inc

List of Figures

- Figure 1: Global IV Bag Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America IV Bag Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 3: North America IV Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America IV Bag Industry Revenue (undefined), by Capacity 2025 & 2033

- Figure 5: North America IV Bag Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 6: North America IV Bag Industry Revenue (undefined), by Chamber Type 2025 & 2033

- Figure 7: North America IV Bag Industry Revenue Share (%), by Chamber Type 2025 & 2033

- Figure 8: North America IV Bag Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America IV Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe IV Bag Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 11: Europe IV Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe IV Bag Industry Revenue (undefined), by Capacity 2025 & 2033

- Figure 13: Europe IV Bag Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 14: Europe IV Bag Industry Revenue (undefined), by Chamber Type 2025 & 2033

- Figure 15: Europe IV Bag Industry Revenue Share (%), by Chamber Type 2025 & 2033

- Figure 16: Europe IV Bag Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe IV Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific IV Bag Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 19: Asia Pacific IV Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific IV Bag Industry Revenue (undefined), by Capacity 2025 & 2033

- Figure 21: Asia Pacific IV Bag Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 22: Asia Pacific IV Bag Industry Revenue (undefined), by Chamber Type 2025 & 2033

- Figure 23: Asia Pacific IV Bag Industry Revenue Share (%), by Chamber Type 2025 & 2033

- Figure 24: Asia Pacific IV Bag Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific IV Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa IV Bag Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 27: Middle East and Africa IV Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East and Africa IV Bag Industry Revenue (undefined), by Capacity 2025 & 2033

- Figure 29: Middle East and Africa IV Bag Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 30: Middle East and Africa IV Bag Industry Revenue (undefined), by Chamber Type 2025 & 2033

- Figure 31: Middle East and Africa IV Bag Industry Revenue Share (%), by Chamber Type 2025 & 2033

- Figure 32: Middle East and Africa IV Bag Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa IV Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America IV Bag Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 35: South America IV Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: South America IV Bag Industry Revenue (undefined), by Capacity 2025 & 2033

- Figure 37: South America IV Bag Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 38: South America IV Bag Industry Revenue (undefined), by Chamber Type 2025 & 2033

- Figure 39: South America IV Bag Industry Revenue Share (%), by Chamber Type 2025 & 2033

- Figure 40: South America IV Bag Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America IV Bag Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IV Bag Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: Global IV Bag Industry Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 3: Global IV Bag Industry Revenue undefined Forecast, by Chamber Type 2020 & 2033

- Table 4: Global IV Bag Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global IV Bag Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Global IV Bag Industry Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 7: Global IV Bag Industry Revenue undefined Forecast, by Chamber Type 2020 & 2033

- Table 8: Global IV Bag Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global IV Bag Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 13: Global IV Bag Industry Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 14: Global IV Bag Industry Revenue undefined Forecast, by Chamber Type 2020 & 2033

- Table 15: Global IV Bag Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global IV Bag Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 23: Global IV Bag Industry Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 24: Global IV Bag Industry Revenue undefined Forecast, by Chamber Type 2020 & 2033

- Table 25: Global IV Bag Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global IV Bag Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 33: Global IV Bag Industry Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 34: Global IV Bag Industry Revenue undefined Forecast, by Chamber Type 2020 & 2033

- Table 35: Global IV Bag Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global IV Bag Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 40: Global IV Bag Industry Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 41: Global IV Bag Industry Revenue undefined Forecast, by Chamber Type 2020 & 2033

- Table 42: Global IV Bag Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America IV Bag Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IV Bag Industry?

The projected CAGR is approximately 9.62%.

2. Which companies are prominent players in the IV Bag Industry?

Key companies in the market include ICU Medical Inc, Polycine GmbH, Fresenius Kabi, Kraton Corporation*List Not Exhaustive, B Braun Medical Inc, Otsuka Holdings (Otsuka Pharmaceutical India Private Limited), Haemotronic, Technoflex, Baxter international Inc, Sippex IV bags, MedicoPack.

3. What are the main segments of the IV Bag Industry?

The market segments include Material Type, Capacity, Chamber Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Chronic Diseases Coupled with Rising Geriatric Population; Increasing Number of Road Accidents and Surgeries.

6. What are the notable trends driving market growth?

Polypropylene Segment is Expected to Dominate the IV Bags Market.

7. Are there any restraints impacting market growth?

The Risk of Leaching of Chemicals from Plastic IV Bags.

8. Can you provide examples of recent developments in the market?

February 2023: Bowmed Ibisqus launched a ready-to-administer Levofloxacin bag. The bag is packaged with a foil overwrap to protect the product from light, and the overwrap displays the essential product information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IV Bag Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IV Bag Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IV Bag Industry?

To stay informed about further developments, trends, and reports in the IV Bag Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence