Key Insights

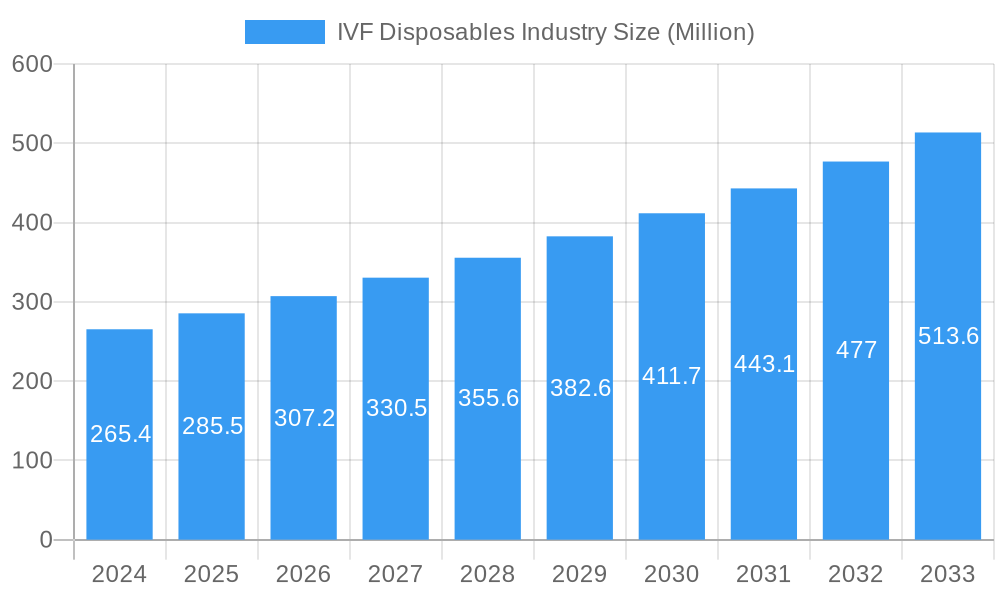

The global In Vitro Fertilization (IVF) Disposables market is poised for significant expansion, projected to reach a substantial $265.4 million by 2024, with a robust Compound Annual Growth Rate (CAGR) of 7.66% during the forecast period of 2025-2033. This growth is primarily fueled by the increasing prevalence of infertility globally, driven by factors such as delayed childbearing, lifestyle choices, and environmental influences. The rising awareness and accessibility of fertility treatments, coupled with advancements in IVF technologies and a growing acceptance of assisted reproductive technologies (ART), are further propelling market momentum. The segment of Reagents and Media, particularly cryopreservation and semen processing media, is expected to witness strong demand owing to their critical role in successful fertilization and embryo development. Furthermore, the increasing preference for Fresh Embryo IVF over Frozen Embryo IVF in certain regions, coupled with a rise in Donor Egg IVF, highlights the evolving landscape of fertility treatments and the associated demand for specialized disposables.

IVF Disposables Industry Market Size (In Million)

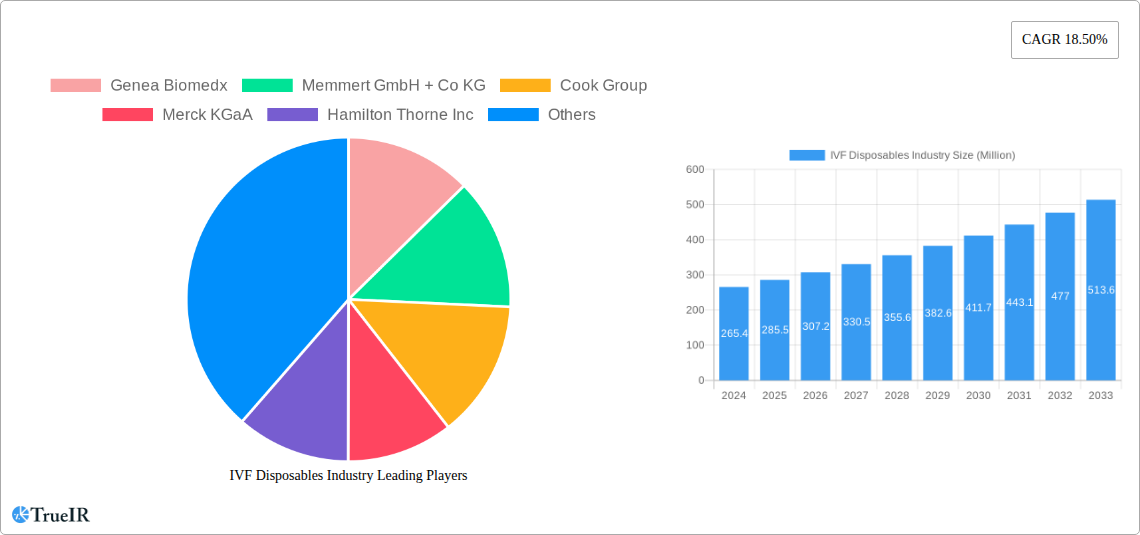

Key market drivers include the escalating number of fertility clinics and hospitals investing in state-of-the-art IVF infrastructure, alongside continuous innovation in disposable product design to enhance efficiency and reduce contamination risks. Technological advancements in areas like sperm separation systems and incubators are also contributing to market growth. However, the market may face certain restraints, such as the high cost of IVF procedures, which can limit accessibility for some demographics, and stringent regulatory compliances governing the manufacturing and use of medical disposables. Despite these challenges, the expanding global reach of key players like Genea Biomedx, Cook Group, Merck KGaA, and Thermo Fisher Scientific, coupled with a focus on emerging markets, indicates a positive outlook for the IVF Disposables industry. The market's trajectory is strongly influenced by regional advancements in healthcare infrastructure and reproductive health policies.

IVF Disposables Industry Company Market Share

Unlock deep insights into the global IVF Disposables Market, a critical sector within assisted reproductive technologies. This in-depth report covers the Study Period of 2019–2033, with a Base Year of 2025 and an Estimated Year of 2025, followed by a detailed Forecast Period of 2025–2033, building upon a robust Historical Period of 2019–2024. We leverage high-volume keywords such as "IVF consumables," "fertility treatments," "reproductive health," "embryo culture," "gamete cryopreservation," and "infertility solutions" to enhance searchability and attract industry professionals, researchers, and investors. The report provides a holistic view of market dynamics, competitive strategies, technological advancements, and future opportunities, ensuring a comprehensive understanding of this rapidly evolving industry. The estimated market size for IVF disposables is projected to reach USD 5 million in the base year.

IVF Disposables Industry Market Structure & Competitive Landscape

The IVF Disposables Industry is characterized by a moderately concentrated market structure, with a notable presence of both established multinational corporations and emerging regional players. Innovation is a primary driver, fueled by continuous advancements in reproductive technologies and a growing demand for personalized fertility treatments. Regulatory impacts, while stringent, are also shaping market entry and product development, emphasizing safety and efficacy. Product substitutes are limited, with a strong emphasis on specialized, single-use items designed for optimal biological outcomes.

Key aspects of the market structure and competitive landscape include:

- Market Concentration: The top five companies are estimated to hold xx% of the market share. M&A activities are expected to continue, particularly among smaller firms looking to gain scale or access specialized technologies.

- Innovation Drivers:

- Development of advanced sperm separation systems for improved sperm quality.

- Introduction of novel cryopreservation media to enhance cell viability post-thaw.

- Focus on single-use, sterile disposables to minimize contamination risks.

- Integration of smart technologies within incubators for precise environmental control.

- Regulatory Impacts: Stringent FDA and EMA regulations are paramount, influencing product design, manufacturing processes, and post-market surveillance. Compliance ensures patient safety and builds market trust.

- Product Substitutes: While direct substitutes are scarce, advancements in non-IVF fertility treatments, such as minimally invasive procedures and advanced diagnostics, represent indirect competitive pressures.

- End-User Segmentation: Fertility clinics are the dominant end-users, accounting for an estimated xx% of the market, followed by hospitals and other research institutions.

- M&A Trends: Recent M&A activities indicate a consolidation trend, with larger entities acquiring smaller innovative companies to broaden their product portfolios and geographic reach. The volume of M&A deals is predicted to reach xx in the forecast period.

IVF Disposables Industry Market Trends & Opportunities

The IVF Disposables Market is experiencing robust growth, projected to expand significantly from an estimated USD 5 million in the base year to reach USD 15 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx%. This expansion is driven by a confluence of increasing infertility rates globally, rising awareness and acceptance of fertility treatments, and significant technological advancements. Consumer preferences are leaning towards more efficient, safer, and minimally invasive reproductive procedures, directly impacting the demand for high-quality, specialized IVF disposables.

Technological shifts are at the forefront of market evolution. The development of sophisticated Sperm Separation Systems is enhancing the success rates of insemination. The continuous improvement in Incubator technology, such as those with advanced environmental control and monitoring capabilities, is crucial for optimal embryo development. Furthermore, the growing reliance on Cryosystems for preserving gametes and embryos underscores the importance of reliable cryopreservation media and advanced cryopreservation techniques, including Cryopreservation Media and Semen Processing Media. The increasing popularity of Frozen Embryo IVF and Donor Egg IVF further amplifies the demand for specialized disposable products that ensure sterility and prevent cross-contamination.

Market penetration rates for IVF disposables are steadily increasing, especially in developed economies, due to higher disposable incomes and greater access to advanced healthcare facilities. The competitive dynamics are characterized by intense R&D efforts to develop next-generation disposables that offer improved performance, reduced risk of error, and enhanced patient comfort. Opportunities abound for companies that can innovate in areas such as single-use diagnostic tools within the IVF workflow, advanced culture media that mimic natural physiological conditions, and cost-effective disposable solutions for emerging markets. The growing demand for personalized medicine in fertility treatment also presents an opportunity for specialized disposable kits tailored to individual patient needs. The global market size for IVF disposables is expected to witness a substantial increase, creating lucrative prospects for stakeholders.

Dominant Markets & Segments in IVF Disposables Industry

The IVF Disposables Industry is segmented across various product types, technologies, and end-users, with specific markets and segments demonstrating remarkable dominance and growth potential.

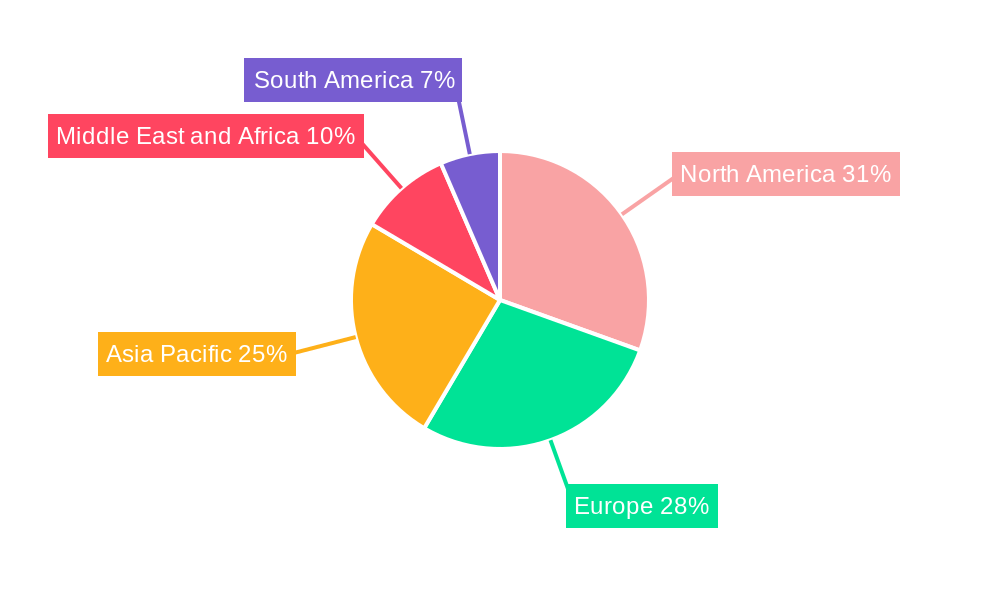

Dominant Regions: North America, particularly the United States, currently leads the IVF Disposables Market. This dominance is attributed to:

- High Prevalence of Infertility: A significant number of couples seeking fertility treatments.

- Advanced Healthcare Infrastructure: Availability of cutting-edge fertility clinics and hospitals.

- Strong Reimbursement Policies: Supportive insurance coverage for IVF procedures in many states.

- Higher Disposable Incomes: Enabling greater access to expensive fertility treatments and associated disposables.

- Early Adoption of New Technologies: A propensity to embrace innovative IVF disposables and equipment.

Dominant Segments:

Type: Accessories and Disposable

- This segment is projected to be the largest contributor to the IVF Disposables Market.

- Growth Drivers:

- The inherent need for sterile, single-use items in every IVF procedure to prevent contamination and ensure patient safety.

- Increasing procedural volumes directly translate to higher consumption of consumables like petri dishes, culture flasks, pipettes, and specialized tubing.

- Technological advancements leading to the development of novel, high-performance disposables designed for specific stages of IVF, such as embryo culture and cryopreservation.

- Cost-effectiveness and ease of use compared to reusable alternatives, especially in high-volume clinics.

Technology: Frozen Embryo IVF

- This technology segment holds significant sway due to the increasing preference for elective single embryo transfer (eSET) and the proven success rates of frozen embryo transfers.

- Growth Drivers:

- Improved cryopreservation techniques and media have enhanced embryo survival rates post-thaw, making frozen embryo IVF a more reliable and attractive option.

- The ability to freeze excess embryos for future use provides patients with more control and reduces the need for repeated ovarian stimulation.

- This technology necessitates a range of specialized disposables for freezing, thawing, and subsequent culture.

End User: Fertility Clinics

- Fertility clinics are the primary consumers of IVF disposables, accounting for an estimated xx% of the market share.

- Growth Drivers:

- The specialized nature of IVF procedures necessitates dedicated facilities and expert personnel, making clinics the central hubs for these treatments.

- Concentration of expertise and technology within these clinics drives the demand for a comprehensive array of IVF disposables.

- Increasing establishment of new fertility clinics globally, especially in emerging economies, directly fuels the demand for these products.

The market's trajectory is also influenced by the growing adoption of Donor Egg IVF, which further diversifies the range of disposables required, from specialized media for oocyte handling to advanced culture systems. While Instrument segments like Incubators and Cryosystems represent significant capital investments, the consistent and high-volume consumption of Reagents and Media, particularly Cryopreservation Media and Semen Processing Media, solidifies their importance within the overall market landscape.

IVF Disposables Industry Product Analysis

The IVF Disposables Industry is witnessing a surge in product innovation driven by the relentless pursuit of higher success rates in fertility treatments. Key product innovations include advancements in embryo culture dishes that provide optimal microenvironments, cryopreservation vials with enhanced sealing mechanisms for superior cryoprotectant integrity, and specialized pipettes designed for precise oocyte and embryo handling. These products are critical for applications ranging from sperm preparation and insemination to embryo culture and vitrification. Competitive advantages are being built on enhanced sterility, reduced toxicity, improved biomimicry of physiological conditions, and user-friendly designs that minimize the risk of human error. The focus remains on disposable items that directly impact the viability and developmental potential of gametes and embryos, ensuring a sterile and controlled environment throughout the IVF process.

Key Drivers, Barriers & Challenges in IVF Disposables Industry

The IVF Disposables Industry is propelled by several key drivers and concurrently faces significant barriers and challenges.

Key Drivers:

- Rising Infertility Rates: A growing global population experiencing infertility due to lifestyle factors, delayed childbearing, and environmental influences is the primary catalyst for IVF services and, consequently, disposables.

- Technological Advancements: Continuous innovation in incubators, cryopreservation techniques, and media formulations drives demand for specialized and higher-quality disposables. For instance, the development of advanced sperm separation systems directly increases the need for compatible disposable components.

- Increasing Awareness and Accessibility: Greater public awareness of fertility treatments and improving access through expanded insurance coverage and government initiatives are expanding the market.

- Growing Acceptance of Assisted Reproductive Technologies (ART): Societal acceptance of ART, including Donor Egg IVF and Frozen Embryo IVF, fuels consistent demand.

Barriers & Challenges:

- Stringent Regulatory Landscape: Navigating complex and evolving regulations from bodies like the FDA and EMA requires significant investment in compliance, impacting R&D and market entry timelines. This includes strict protocols for sterilization and biocompatibility.

- High Cost of Production and R&D: Developing cutting-edge, sterile disposables demands substantial investment in research, development, and sophisticated manufacturing processes, which can be a barrier for smaller companies.

- Supply Chain Vulnerabilities: Global supply chain disruptions, as seen with raw material shortages and shipping delays, can impact the availability and cost of essential disposable components, affecting production schedules and pricing.

- Competitive Pricing Pressures: While innovation drives value, intense competition, particularly from emerging markets, can lead to pricing pressures, impacting profit margins. The estimated impact of supply chain disruptions on market growth is xx%.

Growth Drivers in the IVF Disposables Industry Market

The IVF Disposables Industry Market is experiencing substantial growth driven by a confluence of factors. Technological innovation remains paramount, with ongoing development in Sperm Separation Systems, advanced Incubators, and efficient Cryosystems necessitating a corresponding evolution in disposable components. Economically, rising disposable incomes in developing nations and increasing healthcare expenditure are making fertility treatments more accessible, thereby expanding the market for IVF disposables. Policy-driven initiatives, such as government support for fertility treatments and improved insurance coverage in various regions, further stimulate demand. The increasing preference for Frozen Embryo IVF and Donor Egg IVF directly boosts the consumption of specialized cryopreservation media and associated disposables. The estimated growth rate attributed to technological advancements is xx% annually.

Challenges Impacting IVF Disposables Industry Growth

Despite its robust growth trajectory, the IVF Disposables Industry faces several significant challenges. Regulatory complexities are a constant hurdle, requiring extensive validation and adherence to strict quality standards for every disposable item. Supply chain issues, including raw material sourcing and logistics, can lead to production delays and increased costs, impacting the availability of critical consumables. Competitive pressures, particularly from manufacturers offering lower-cost alternatives, can squeeze profit margins and necessitate continuous innovation to maintain market share. The high capital investment required for state-of-the-art manufacturing facilities and rigorous quality control processes also presents a barrier to entry for new players. The estimated cost of regulatory compliance for a new product launch is USD 0.5 million.

Key Players Shaping the IVF Disposables Industry Market

The IVF Disposables Industry is shaped by a dynamic ecosystem of leading companies committed to advancing reproductive technologies through innovative disposable solutions. These key players are instrumental in driving market growth and setting new standards for quality and performance.

- Genea Biomedx

- Memmert GmbH + Co KG

- Cook Group

- Merck KGaA

- Hamilton Thorne Inc

- Vitrolife

- Esco Medical

- Nidacon International AB

- FUJIFILM Holdings Corporation

- CooperSurgical Fertility Company

- Thermo Fisher Scientific

Significant IVF Disposables Industry Industry Milestones

The IVF Disposables Industry has been marked by strategic developments and product launches that have significantly influenced market dynamics and technological adoption.

- January 2023: BioPharma Dynamics, a United Kingdom Supplier, expanded its offerings to include chemically defined and serum-free cell media solutions, crucial for the advancements in the cell and gene therapy industry which has implications for ART research and development.

- May 2022: Cook Medical launched the next-generation MINC+ benchtop incubator in the United States and Canada. This launch was notable for its inclusion of the DishTrace platform, a sophisticated data management tool that integrates incubator functionality with PC software, enhancing precision and traceability in embryo culture.

Future Outlook for IVF Disposables Industry Market

The future outlook for the IVF Disposables Industry is exceptionally bright, characterized by sustained growth and transformative innovation. Strategic opportunities lie in the development of AI-integrated disposables that offer real-time data analytics during embryo culture, personalized media formulations tailored to individual patient genetics, and advanced biocompatible materials that further enhance embryo viability. The increasing global prevalence of infertility, coupled with advancements in assisted reproductive technologies, will continue to drive demand. Furthermore, the expanding reach of IVF services into emerging economies presents a significant market potential for cost-effective yet high-quality disposable solutions. The market is poised for growth, with a focus on precision, safety, and improved patient outcomes, estimated to reach USD 15 million by 2033.

IVF Disposables Industry Segmentation

-

1. Type

-

1.1. Instrument

- 1.1.1. Sperm Separation System

- 1.1.2. Incubator

- 1.1.3. Cryosystem

- 1.1.4. Other Instruments

-

1.2. Reagents and Media

- 1.2.1. Cryopreservation Media

- 1.2.2. Semen Processing Media

- 1.2.3. Other Reagents and Mdedia

- 1.3. Accessories and Disposable

-

1.1. Instrument

-

2. Technology

- 2.1. Fresh Embryo IVF

- 2.2. Frozen Embryo IVF

- 2.3. Donor Egg IVF

-

3. End User

- 3.1. Hospitals

- 3.2. Fertility Clinics

- 3.3. Other End Users

IVF Disposables Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

IVF Disposables Industry Regional Market Share

Geographic Coverage of IVF Disposables Industry

IVF Disposables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Global Infertility Rates and Delayed Pregnancies Among Women; Rising Research and Development for Technological Advancement in IVF Devices

- 3.3. Market Restrains

- 3.3.1. Low Success Rate of IVF Procedures and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Fertility Clinics are Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IVF Disposables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instrument

- 5.1.1.1. Sperm Separation System

- 5.1.1.2. Incubator

- 5.1.1.3. Cryosystem

- 5.1.1.4. Other Instruments

- 5.1.2. Reagents and Media

- 5.1.2.1. Cryopreservation Media

- 5.1.2.2. Semen Processing Media

- 5.1.2.3. Other Reagents and Mdedia

- 5.1.3. Accessories and Disposable

- 5.1.1. Instrument

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fresh Embryo IVF

- 5.2.2. Frozen Embryo IVF

- 5.2.3. Donor Egg IVF

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Fertility Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America IVF Disposables Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Instrument

- 6.1.1.1. Sperm Separation System

- 6.1.1.2. Incubator

- 6.1.1.3. Cryosystem

- 6.1.1.4. Other Instruments

- 6.1.2. Reagents and Media

- 6.1.2.1. Cryopreservation Media

- 6.1.2.2. Semen Processing Media

- 6.1.2.3. Other Reagents and Mdedia

- 6.1.3. Accessories and Disposable

- 6.1.1. Instrument

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Fresh Embryo IVF

- 6.2.2. Frozen Embryo IVF

- 6.2.3. Donor Egg IVF

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Fertility Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe IVF Disposables Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Instrument

- 7.1.1.1. Sperm Separation System

- 7.1.1.2. Incubator

- 7.1.1.3. Cryosystem

- 7.1.1.4. Other Instruments

- 7.1.2. Reagents and Media

- 7.1.2.1. Cryopreservation Media

- 7.1.2.2. Semen Processing Media

- 7.1.2.3. Other Reagents and Mdedia

- 7.1.3. Accessories and Disposable

- 7.1.1. Instrument

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Fresh Embryo IVF

- 7.2.2. Frozen Embryo IVF

- 7.2.3. Donor Egg IVF

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Fertility Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific IVF Disposables Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Instrument

- 8.1.1.1. Sperm Separation System

- 8.1.1.2. Incubator

- 8.1.1.3. Cryosystem

- 8.1.1.4. Other Instruments

- 8.1.2. Reagents and Media

- 8.1.2.1. Cryopreservation Media

- 8.1.2.2. Semen Processing Media

- 8.1.2.3. Other Reagents and Mdedia

- 8.1.3. Accessories and Disposable

- 8.1.1. Instrument

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Fresh Embryo IVF

- 8.2.2. Frozen Embryo IVF

- 8.2.3. Donor Egg IVF

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Fertility Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa IVF Disposables Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Instrument

- 9.1.1.1. Sperm Separation System

- 9.1.1.2. Incubator

- 9.1.1.3. Cryosystem

- 9.1.1.4. Other Instruments

- 9.1.2. Reagents and Media

- 9.1.2.1. Cryopreservation Media

- 9.1.2.2. Semen Processing Media

- 9.1.2.3. Other Reagents and Mdedia

- 9.1.3. Accessories and Disposable

- 9.1.1. Instrument

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Fresh Embryo IVF

- 9.2.2. Frozen Embryo IVF

- 9.2.3. Donor Egg IVF

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Fertility Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America IVF Disposables Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Instrument

- 10.1.1.1. Sperm Separation System

- 10.1.1.2. Incubator

- 10.1.1.3. Cryosystem

- 10.1.1.4. Other Instruments

- 10.1.2. Reagents and Media

- 10.1.2.1. Cryopreservation Media

- 10.1.2.2. Semen Processing Media

- 10.1.2.3. Other Reagents and Mdedia

- 10.1.3. Accessories and Disposable

- 10.1.1. Instrument

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Fresh Embryo IVF

- 10.2.2. Frozen Embryo IVF

- 10.2.3. Donor Egg IVF

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Fertility Clinics

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Genea Biomedx

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Memmert GmbH + Co KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cook Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hamilton Thorne Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vitrolife

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Esco Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nidacon International AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FUJIFILM Holdings Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CooperSurgical Fertility Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thermo Fisher Scientific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Genea Biomedx

List of Figures

- Figure 1: Global IVF Disposables Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America IVF Disposables Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America IVF Disposables Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America IVF Disposables Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 5: North America IVF Disposables Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America IVF Disposables Industry Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America IVF Disposables Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America IVF Disposables Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America IVF Disposables Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe IVF Disposables Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe IVF Disposables Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe IVF Disposables Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 13: Europe IVF Disposables Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe IVF Disposables Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe IVF Disposables Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe IVF Disposables Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe IVF Disposables Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific IVF Disposables Industry Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific IVF Disposables Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific IVF Disposables Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Asia Pacific IVF Disposables Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific IVF Disposables Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific IVF Disposables Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific IVF Disposables Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific IVF Disposables Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa IVF Disposables Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa IVF Disposables Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa IVF Disposables Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 29: Middle East and Africa IVF Disposables Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa IVF Disposables Industry Revenue (undefined), by End User 2025 & 2033

- Figure 31: Middle East and Africa IVF Disposables Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa IVF Disposables Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa IVF Disposables Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America IVF Disposables Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: South America IVF Disposables Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America IVF Disposables Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 37: South America IVF Disposables Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: South America IVF Disposables Industry Revenue (undefined), by End User 2025 & 2033

- Figure 39: South America IVF Disposables Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America IVF Disposables Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America IVF Disposables Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IVF Disposables Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global IVF Disposables Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Global IVF Disposables Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global IVF Disposables Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global IVF Disposables Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global IVF Disposables Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: Global IVF Disposables Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global IVF Disposables Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global IVF Disposables Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global IVF Disposables Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Global IVF Disposables Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global IVF Disposables Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global IVF Disposables Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global IVF Disposables Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 24: Global IVF Disposables Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global IVF Disposables Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global IVF Disposables Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global IVF Disposables Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Global IVF Disposables Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global IVF Disposables Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global IVF Disposables Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global IVF Disposables Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 41: Global IVF Disposables Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 42: Global IVF Disposables Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America IVF Disposables Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IVF Disposables Industry?

The projected CAGR is approximately 7.66%.

2. Which companies are prominent players in the IVF Disposables Industry?

Key companies in the market include Genea Biomedx, Memmert GmbH + Co KG, Cook Group, Merck KGaA, Hamilton Thorne Inc, Vitrolife, Esco Medical, Nidacon International AB, FUJIFILM Holdings Corporation, CooperSurgical Fertility Company, Thermo Fisher Scientific.

3. What are the main segments of the IVF Disposables Industry?

The market segments include Type, Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Global Infertility Rates and Delayed Pregnancies Among Women; Rising Research and Development for Technological Advancement in IVF Devices.

6. What are the notable trends driving market growth?

Fertility Clinics are Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Low Success Rate of IVF Procedures and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

January 2023: BioPharma Dynamics, a United Kingdom Supplier, expanded to provide chemically defined and serum-free cell media solutions for the cell and gene therapy industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IVF Disposables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IVF Disposables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IVF Disposables Industry?

To stay informed about further developments, trends, and reports in the IVF Disposables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence