Key Insights

The global large satellite market is projected for substantial growth, propelled by escalating demand for advanced communication, earth observation, and navigation solutions. The market is forecast to achieve a compound annual growth rate (CAGR) of 9.24%, expanding from its current market size of 79.21 billion in the base year 2025 to a significantly larger valuation by the end of the forecast period. Key growth drivers include the rapid deployment of commercial satellite constellations for global broadband internet services and increased government investment in national security and defense applications requiring high-performance satellites. Technological innovations in propulsion systems, especially electric propulsion, are enabling the development of larger, more capable satellites with extended operational lifespans and reduced launch expenditures. Furthermore, the increasing utilization of large satellites in scientific research for space observation and climate monitoring is a significant contributor to market expansion. The market is segmented by orbit class, with geostationary orbit (GEO) satellites holding the largest share due to their optimal positioning for communication services, and by end-user, with the commercial sector leading, reflecting the growing privatization of space infrastructure and exploration.

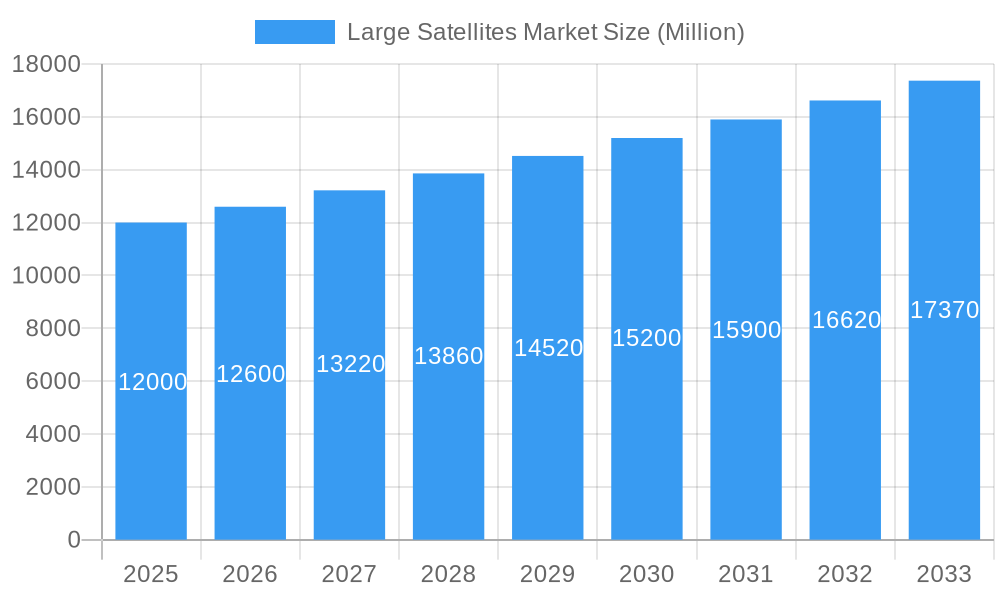

Large Satellites Market Market Size (In Billion)

Despite a positive growth trajectory, market expansion faces certain constraints. The high cost of satellite launches remains a considerable barrier, particularly for heavier and larger satellite payloads. Navigating complex regulatory frameworks and fostering international cooperation for satellite traffic management and orbital debris mitigation present ongoing challenges. Nevertheless, continuous advancements in launch vehicle technology and the development of more robust international space regulations are anticipated to alleviate these restraints over the long term. The competitive landscape is characterized by prominent aerospace corporations and governmental space agencies, primarily in North America, Europe, and Asia, actively pursuing innovation and strategic alliances to enhance their market positions. The future of the market is poised for ongoing technological breakthroughs, the emergence of NewSpace ventures, and increasing global collaboration to harness the vast potential of space-based technologies, ensuring considerable future expansion.

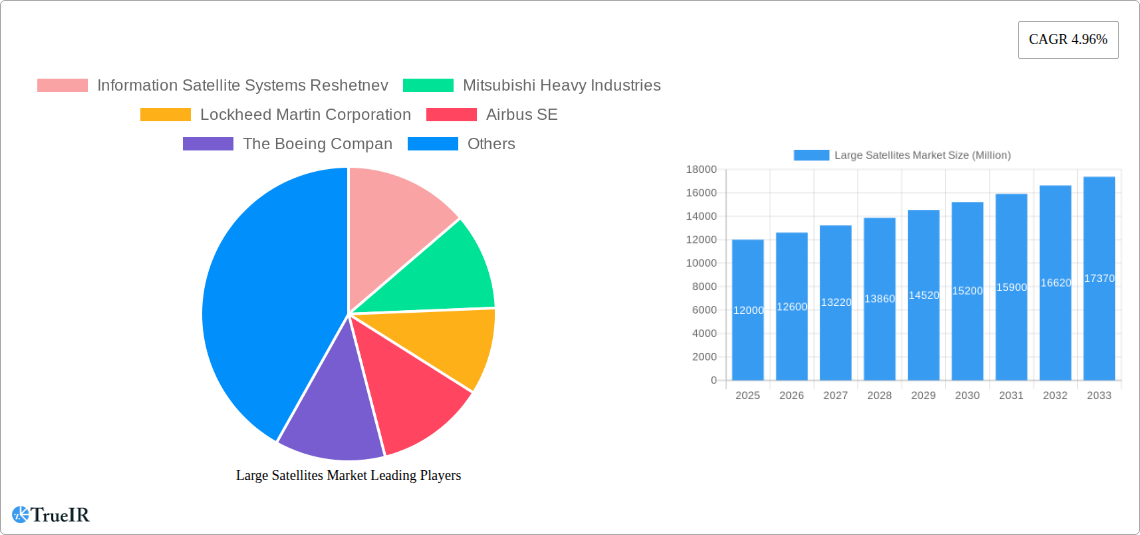

Large Satellites Market Company Market Share

Large Satellites Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the global Large Satellites Market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market trends, competitive dynamics, and future growth projections. The report leverages extensive data analysis and expert insights to provide a comprehensive understanding of this rapidly evolving sector. The market is projected to reach xx Million by 2033.

Large Satellites Market Market Structure & Competitive Landscape

The Large Satellites market is characterized by a moderately concentrated structure, with a select group of established players holding significant market share. Prominent participants include Information Satellite Systems Reshetnev, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, The Boeing Company, China Aerospace Science and Technology Corporation (CASC), Thales, Maxar Technologies Inc, and the Indian Space Research Organisation (ISRO). These entities leverage their extensive expertise, substantial capital resources, and robust technological capabilities to maintain their positions.

Several factors contribute to this market concentration. The immense capital investment required for research, development, manufacturing, and launch, coupled with the need for highly specialized technological expertise and navigating complex regulatory approvals, creates significant barriers to entry. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be around [Insert HHI Value Here], substantiating its moderately concentrated nature. Continuous innovation in critical areas such as advanced propulsion systems (electric, gas-based, liquid fuel), optimized satellite designs for enhanced efficiency and longevity, and cutting-edge communication capabilities serves as a primary catalyst for market expansion and a key differentiator for competitive advantage.

The regulatory environment, particularly concerning crucial aspects like space debris mitigation and the equitable allocation of spectrum resources, exerts a considerable influence on market dynamics. The ongoing evolution of satellite technology necessitates a continuous replacement cycle, where older, less efficient satellites are substituted with next-generation designs offering superior performance and advanced functionalities. Merger and acquisition (M&A) activity within the Large Satellites Market is a notable trend, with an estimated [Insert M&A Value Here] Million in deals recorded between 2019 and 2024. These strategic consolidations aim to bolster market share, acquire proprietary technologies, and expand operational reach into new geographical territories. The diverse needs of end-users, segmented across commercial, military & government, and other sectors, directly shape the demand for specialized large satellite solutions.

- Market Concentration: Moderately concentrated, with HHI estimated at [Insert HHI Value Here].

- Innovation Drivers: Cutting-edge propulsion technology, advanced satellite design methodologies, and next-generation communication capabilities.

- Regulatory Impacts: Significant, with key influences on space debris mitigation strategies and spectrum allocation policies.

- Product Substitutes: A continuous cycle of technological upgrades and advancements leads to inherent market substitution.

- M&A Trends: Active M&A landscape, with an estimated [Insert M&A Value Here] Million in transactions recorded between 2019-2024.

Large Satellites Market Market Trends & Opportunities

The Large Satellites market is experiencing robust growth, driven by increasing demand for communication, Earth observation, navigation, and space observation services. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. This growth is fueled by several key factors: increasing adoption of satellite-based technologies across various sectors, advancements in satellite technology resulting in enhanced capabilities and reduced costs, and the rising need for reliable and high-bandwidth communication solutions.

Technological advancements, particularly in miniaturization, high-throughput satellite technology, and electric propulsion, are shaping market trends. The consumer preference is shifting towards more efficient, cost-effective, and versatile satellite systems with enhanced operational lifetime. Market competition is intensifying, with companies continually innovating to offer superior products and services. The global market penetration rate for large satellites is currently estimated at xx%, expected to increase to xx% by 2033. Furthermore, strategic partnerships and collaborations are becoming increasingly crucial in driving market expansion.

Dominant Markets & Segments in Large Satellites Market

The GEO (Geosynchronous Earth Orbit) segment currently holds the largest market share within the Orbit Class category, driven by its established position in communication applications. However, the LEO (Low Earth Orbit) segment exhibits the highest growth potential, thanks to the growing demand for high-resolution imagery and low-latency communication.

Orbit Class:

- GEO: Dominant market share, driven by communication applications.

- LEO: Highest growth potential, due to increasing demand for high-resolution imagery and low-latency communication.

- MEO: Steady growth, catering to niche applications.

End User:

- Commercial: Largest segment, driven by the expanding telecommunications and Earth observation industries.

- Military & Government: Significant market share due to increasing defense budgets and national security priorities.

- Other: A smaller segment catering to research, scientific, and other niche applications.

Propulsion Tech:

- Electric Propulsion: Gaining traction due to higher efficiency and longer mission life.

- Gas-Based: Maintains a dominant market share due to reliability and maturity.

- Liquid Fuel: Utilized in specific applications requiring high-thrust capabilities.

Application:

- Communication: Largest application segment.

- Earth Observation: Growing significantly due to applications in agriculture, environmental monitoring, etc.

- Navigation: Important market segment.

- Space Observation: A niche but important application.

Key Growth Drivers (vary by segment):

- Infrastructure Development: Expansion of ground stations and related infrastructure support satellite deployments.

- Government Policies: Space exploration initiatives and regulatory support for the industry fosters growth.

- Technological Advancements: Innovation in propulsion, communication, and satellite design drives efficiency and cost reductions.

Large Satellites Market Product Analysis

Significant advancements in materials science, state-of-the-art propulsion systems, and sophisticated communication technologies are fueling innovation within the Large Satellites sector. These developments are leading to the creation of satellites that are not only more efficient and cost-effective but also possess enhanced capabilities, offering superior performance and extended operational lifespans. New generations of large satellites are meticulously optimized for specific applications, including high-throughput satellite communications, precise Earth observation, and reliable navigation services, thereby significantly improving their market relevance and appeal. Competitive differentiation is primarily achieved through the optimization of satellite designs, the utilization of proprietary technologies, and the demonstrated ability to precisely meet the unique and demanding requirements of a diverse customer base.

Key Drivers, Barriers & Challenges in Large Satellites Market

Key Drivers:

The propulsion for growth in the Large Satellites market is driven by several key factors. These include rapid technological advancements leading to more capable and versatile satellites, a burgeoning demand for essential satellite-based services such as telecommunications, global positioning, and detailed Earth observation, and substantial government investment in space exploration and defense initiatives. Furthermore, an increasing influx of private capital into the space industry is significantly accelerating the pace of market expansion and innovation.

Challenges and Restraints:

The market faces several significant challenges and restraints that can impede growth. These include the exceedingly high development and launch costs associated with large satellites, navigating complex and stringent regulatory frameworks, the inherent risk of satellite failures during operation, and the intricate nature of the global supply chain. Competition from alternative communication technologies, such as advanced terrestrial fiber optic networks, presents a formidable challenge. Additionally, the growing problem of space debris poses a substantial threat to the integrity and longevity of operational satellites, necessitating robust mitigation strategies.

Growth Drivers in the Large Satellites Market Market

Technological advancements, including electric propulsion and improved communication payloads, are driving significant cost reductions and improved performance. Increased demand for satellite-based services in diverse sectors (communication, navigation, defense, and earth observation) fuels growth. Supportive government policies and increased private investment are additional catalysts.

Challenges Impacting Large Satellites Market Growth

The growth trajectory of the Large Satellites Market is significantly impacted by several critical challenges. Foremost among these are the substantial financial outlays required for launch operations, the intricate and often lengthy regulatory processes, and the ever-present risk of satellite malfunctions or mission failures. Competition from alternative terrestrial technologies, coupled with the growing concerns surrounding the increasing volume of space debris, further complicates operational planning and long-term market sustainability. The potential for geopolitical instability and the increasing possibility of space-based conflicts introduce an element of uncertainty into future market development.

Key Players Shaping the Large Satellites Market Market

Significant Large Satellites Market Industry Milestones

- September 2022: China successfully launched two BeiDou satellites, enhancing its navigation capabilities and showcasing advancements in satellite technology.

- January 2023: Airbus partnered with the UK Department of Defense, strengthening its position in the defense satellite market and highlighting the growing importance of space-based defense systems.

- January 2023: Airbus secured a 15-year contract with the Belgian Ministry of Defense for tactical satellite communication services, underscoring the increasing demand for secure satellite communication in the military and government sectors.

Future Outlook for Large Satellites Market Market

The Large Satellites Market is projected to sustain a robust growth trajectory in the coming years, propelled by continuous technological innovation, an escalating demand for sophisticated satellite-enabled services, and supportive government policies that foster space development. Strategic alliances and an increased commitment of private investment are expected to be pivotal in shaping the market's future direction. Significant opportunities lie in the development of next-generation satellites with enhanced functionalities and reduced cost profiles, a strategic focus on emerging markets, and the proactive development and implementation of effective space debris mitigation solutions. Overall, the market is anticipated to witness substantial expansion, fueled by ongoing technological breakthroughs and a continually growing global demand.

Large Satellites Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Large Satellites Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

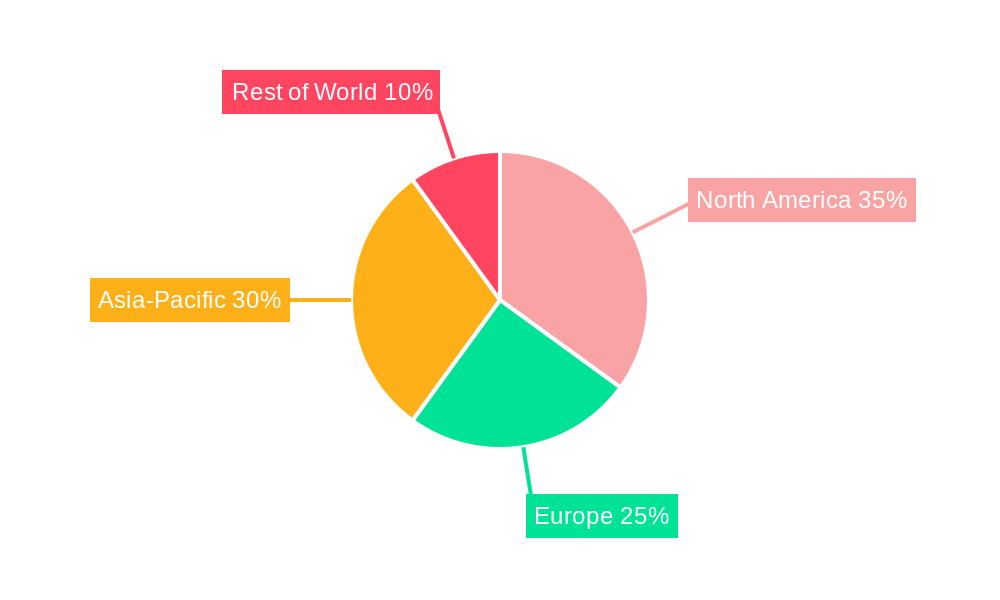

Large Satellites Market Regional Market Share

Geographic Coverage of Large Satellites Market

Large Satellites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The increasing number of satellites with long lifespans helps the Asia-Pacific region maintain a substantial market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Earth Observation

- 6.1.3. Navigation

- 6.1.4. Space Observation

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Orbit Class

- 6.2.1. GEO

- 6.2.2. LEO

- 6.2.3. MEO

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial

- 6.3.2. Military & Government

- 6.3.3. Other

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6.4.1. Electric

- 6.4.2. Gas based

- 6.4.3. Liquid Fuel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Earth Observation

- 7.1.3. Navigation

- 7.1.4. Space Observation

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Orbit Class

- 7.2.1. GEO

- 7.2.2. LEO

- 7.2.3. MEO

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial

- 7.3.2. Military & Government

- 7.3.3. Other

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7.4.1. Electric

- 7.4.2. Gas based

- 7.4.3. Liquid Fuel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Earth Observation

- 8.1.3. Navigation

- 8.1.4. Space Observation

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Orbit Class

- 8.2.1. GEO

- 8.2.2. LEO

- 8.2.3. MEO

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial

- 8.3.2. Military & Government

- 8.3.3. Other

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8.4.1. Electric

- 8.4.2. Gas based

- 8.4.3. Liquid Fuel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Earth Observation

- 9.1.3. Navigation

- 9.1.4. Space Observation

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Orbit Class

- 9.2.1. GEO

- 9.2.2. LEO

- 9.2.3. MEO

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial

- 9.3.2. Military & Government

- 9.3.3. Other

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9.4.1. Electric

- 9.4.2. Gas based

- 9.4.3. Liquid Fuel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Large Satellites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Earth Observation

- 10.1.3. Navigation

- 10.1.4. Space Observation

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Orbit Class

- 10.2.1. GEO

- 10.2.2. LEO

- 10.2.3. MEO

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Commercial

- 10.3.2. Military & Government

- 10.3.3. Other

- 10.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10.4.1. Electric

- 10.4.2. Gas based

- 10.4.3. Liquid Fuel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Information Satellite Systems Reshetnev

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsubishi Heavy Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Aerospace Science and Technology Corporation (CASC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thales

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maxar Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indian Space Research Organisation (ISRO)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Information Satellite Systems Reshetnev

List of Figures

- Figure 1: Global Large Satellites Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 5: North America Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 6: North America Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 9: North America Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 10: North America Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 13: South America Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 15: South America Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 16: South America Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 17: South America Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: South America Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 19: South America Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 20: South America Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Europe Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 25: Europe Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 26: Europe Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 27: Europe Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 28: Europe Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 29: Europe Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 30: Europe Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 33: Middle East & Africa Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Middle East & Africa Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 35: Middle East & Africa Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 36: Middle East & Africa Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 37: Middle East & Africa Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East & Africa Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 39: Middle East & Africa Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 40: Middle East & Africa Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Large Satellites Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Large Satellites Market Revenue (billion), by Application 2025 & 2033

- Figure 43: Asia Pacific Large Satellites Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Asia Pacific Large Satellites Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 45: Asia Pacific Large Satellites Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 46: Asia Pacific Large Satellites Market Revenue (billion), by End User 2025 & 2033

- Figure 47: Asia Pacific Large Satellites Market Revenue Share (%), by End User 2025 & 2033

- Figure 48: Asia Pacific Large Satellites Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 49: Asia Pacific Large Satellites Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 50: Asia Pacific Large Satellites Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Large Satellites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Global Large Satellites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 16: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 17: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 18: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 24: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 26: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 38: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 39: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 40: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Large Satellites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 48: Global Large Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 49: Global Large Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 50: Global Large Satellites Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 51: Global Large Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Large Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Large Satellites Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Large Satellites Market?

Key companies in the market include Information Satellite Systems Reshetnev, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, China Aerospace Science and Technology Corporation (CASC), Thales, Maxar Technologies Inc, Indian Space Research Organisation (ISRO).

3. What are the main segments of the Large Satellites Market?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 79.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The increasing number of satellites with long lifespans helps the Asia-Pacific region maintain a substantial market share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: The UK government announced its plans to harness the space defense capabilities of Airbus Defense and Space under a new major partnership agreement. The company, one of UK's leading space companies, has become a partner of the UK Department of Defense Missile Defense Center (MDC), the country's center of excellence for missile defense.January 2023: Airbus signed a contract with the Belgian Ministry of Defense to provide tactical satellite communications services to the armed forces for a period of 15 years. Airbus plans to launch a new ultra-high frequency (UHF) communications service by 2024 for the armed forces of other European nations and NATO allies.September 2022: China successfully sent two BeiDou satellites into space from the Xichang Satellite Launch Center. The new satellites and boosters were developed by the China Academy of Space Technology (CAST) and the China Academy of Launch Vehicle Technology, under the China Aerospace Science and Technology Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Large Satellites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Large Satellites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Large Satellites Market?

To stay informed about further developments, trends, and reports in the Large Satellites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence