Key Insights

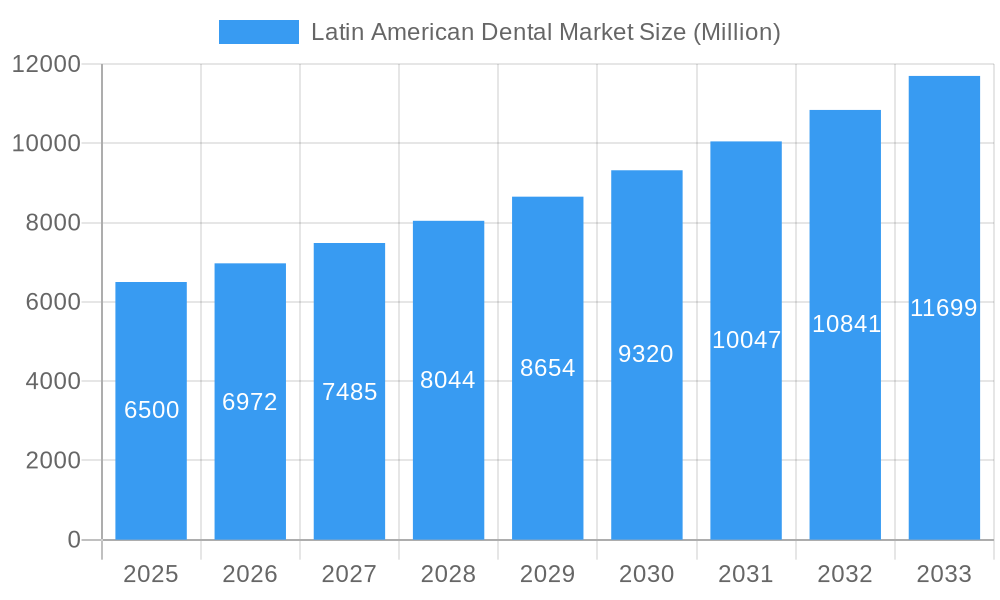

The Latin American dental market is projected to reach $0.74 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.53% through 2033. This expansion is driven by increasing dental awareness, demand for advanced oral care, and rising disposable incomes in key economies like Brazil and Mexico. Consumers are investing in premium dental treatments and products, from sophisticated diagnostic equipment to dental implants. A growing emphasis on preventive and cosmetic dentistry further stimulates market activity. Technological advancements, including digital dentistry solutions and advanced radiology, are enhancing treatment precision and patient experience, contributing to market momentum.

Latin American Dental Market Market Size (In Million)

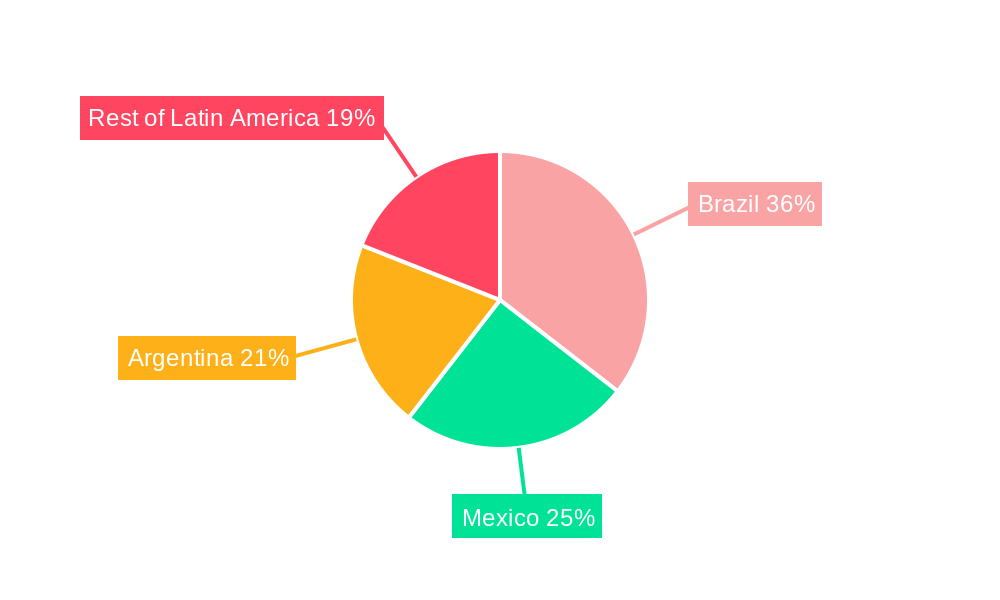

The market is segmented by product categories and treatment types. General and diagnostic equipment, including dental lasers and radiology equipment, is experiencing strong adoption for accurate diagnostics. Dental consumables, particularly dental biomaterials and implants, are growing due to increasing tooth loss and demand for restorative solutions. Orthodontics, endodontics, and prosthodontics are significant treatment drivers. Brazil holds a substantial market share, followed by Mexico and Argentina. While the cost of advanced equipment and infrastructure variations present restraints, government initiatives and private investments are improving dental accessibility and affordability.

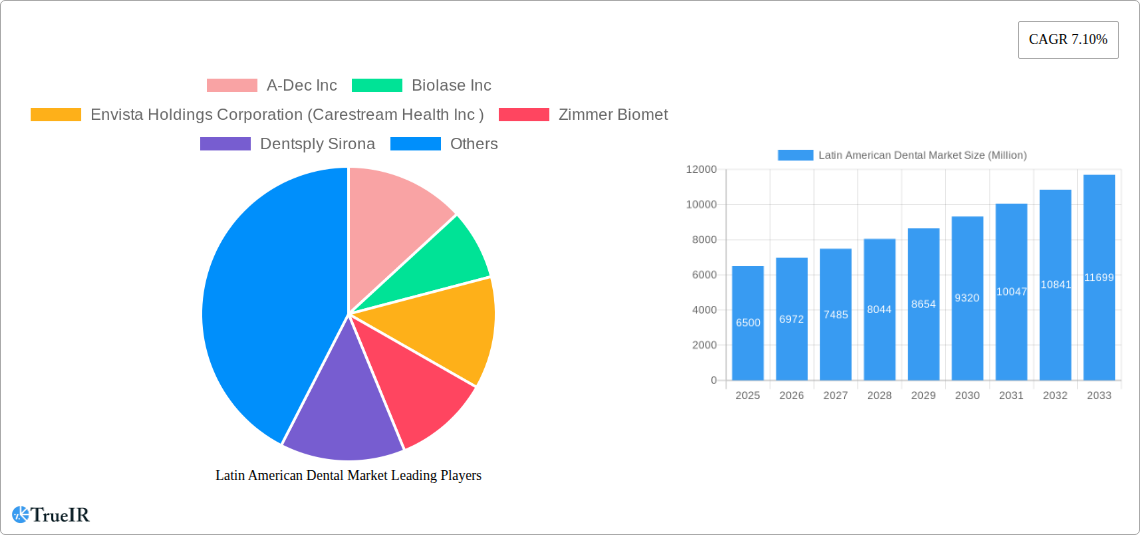

Latin American Dental Market Company Market Share

Comprehensive Analysis of the Latin American Dental Market: Trends, Opportunities, and Key Players (2019-2033)

This in-depth report provides a dynamic and SEO-optimized overview of the Latin American Dental Market. Uncover critical insights into market size, growth drivers, technological innovations, and competitive strategies shaping the future of oral healthcare across the region. Leveraging high-volume keywords like dental implants Latin America, orthodontic treatment Brazil, dental radiology equipment Mexico, and dental consumables market trends, this report is essential for stakeholders seeking to understand and capitalize on this burgeoning market. The study covers the historical period from 2019-2024, the base year of 2025, and forecasts growth through 2033.

Latin American Dental Market Market Structure & Competitive Landscape

The Latin American Dental Market exhibits a moderately consolidated structure, driven by significant innovation and a growing demand for advanced dental solutions. Key players like Dentsply Sirona, Straumann AG, and Envista Holdings Corporation (Carestream Health Inc.) hold substantial market shares, fueled by continuous product development and strategic expansions. Innovation is a primary driver, with companies investing heavily in R&D for digital dentistry solutions, advanced biomaterials, and minimally invasive treatment technologies. Regulatory landscapes, while varying by country, are increasingly focusing on patient safety and product efficacy, impacting market entry and product approvals. Product substitutes, such as traditional radiography versus advanced digital imaging, and conventional restorative materials versus high-performance ceramics, are constantly being redefined by technological advancements. End-user segmentation reveals a strong growth trajectory for both dental professionals seeking cutting-edge equipment and patients demanding high-quality, accessible dental care. Mergers and acquisitions (M&A) are a notable trend, with companies like the Straumann Group actively consolidating their presence through strategic acquisitions, such as integrating Neodent, to expand their product portfolios and geographical reach. The concentration ratio for top players is estimated to be around 45% in 2025, with ongoing M&A activities potentially increasing this figure.

Latin American Dental Market Market Trends & Opportunities

The Latin American Dental Market is experiencing robust growth, projected to reach approximately USD 7,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors, including rising disposable incomes, increasing awareness of oral hygiene, and a growing demand for aesthetic and restorative dental treatments. Technological shifts are profoundly impacting the market, with the adoption of digital dentistry technologies such as intraoral scanners, CAD/CAM systems, and 3D printing revolutionizing diagnostics and treatment planning. These advancements are enhancing precision, efficiency, and patient comfort. Consumer preferences are evolving towards less invasive procedures, aesthetically pleasing results, and personalized treatment plans, driving demand for advanced dental implants, crowns and bridges, and orthodontic solutions. Competitive dynamics are intensifying, with both established global players and emerging local manufacturers vying for market share. Opportunities lie in underserved rural areas, the growing demand for affordable yet high-quality dental care, and the continuous innovation in areas like dental lasers and biomaterials. The market penetration rate for advanced dental technologies, while still developing, is projected to increase significantly, offering substantial opportunities for market expansion and revenue generation. The increasing prevalence of dental caries and periodontal diseases across the region also presents a sustained demand for dental consumables and diagnostic equipment.

Dominant Markets & Segments in Latin American Dental Market

Brazil stands as the dominant market within the Latin American Dental Market, accounting for an estimated 35% of the total market revenue in 2025, valued at approximately USD 2,625 Million. This leadership is attributed to its large population, a well-established healthcare infrastructure, and proactive government initiatives promoting oral health. Mexico follows as a significant market, driven by a growing middle class and increasing investment in dental tourism, contributing an estimated 20% of the market share.

From a product perspective, Dental Consumables are the largest segment, projected to reach USD 3,000 Million by 2033. Within this segment, Dental Implants are a key growth driver, with an estimated market value of USD 1,200 Million in 2025. The increasing adoption of implant-supported prosthetics and the rising incidence of tooth loss due to aging populations and chronic diseases are propelling this sub-segment. General and Diagnostic Equipment, particularly Radiology Equipment and Dental Chair and Equipment, also holds substantial market share, valued at approximately USD 2,000 Million in 2025, driven by the need for advanced diagnostic tools and modern dental practice infrastructure.

In terms of treatment, Prosthodontics and Orthodontics represent the most significant segments, driven by the rising demand for cosmetic dentistry and the correction of malocclusion. The Orthodontic segment alone is expected to reach USD 1,000 Million by 2033.

Key Growth Drivers for Dominant Segments:

- Brazil & Mexico:

- Infrastructure Development: Increasing investment in modern dental clinics and hospitals.

- Government Policies: Supportive policies for healthcare access and oral hygiene awareness campaigns.

- Dental Tourism: Growing medical tourism attracting international patients seeking affordable dental procedures.

- Dental Consumables (especially Dental Implants):

- Technological Advancements: Innovations in implant materials and surgical techniques leading to higher success rates.

- Aging Population: Increased prevalence of tooth loss among older demographics.

- Patient Awareness: Growing understanding of the benefits of dental implants for oral function and aesthetics.

- General and Diagnostic Equipment (Radiology Equipment, Dental Chair & Equipment):

- Digitalization Trend: Adoption of digital X-rays, CBCT scanners, and advanced dental chairs for improved patient care and efficiency.

- Preventive Care Focus: Increased emphasis on early detection and diagnosis of dental issues.

- Treatment Segments (Prosthodontics & Orthodontics):

- Aesthetic Demands: Rising patient desire for improved smiles and facial aesthetics.

- Technological Innovations: Development of clear aligners and advanced prosthetic materials.

- Accessibility: Expansion of orthodontic and prosthodontic services at more affordable price points.

Latin American Dental Market Product Analysis

Innovations in the Latin American Dental Market are predominantly focused on enhancing precision, minimizing invasiveness, and improving patient outcomes. Dental Lasers are gaining traction for their versatility in soft tissue procedures and pain management. Advanced Radiology Equipment, including CBCT scanners, offers superior diagnostic accuracy. The Dental Chair and Equipment market is evolving with ergonomic designs and integrated digital technologies. In consumables, novel Dental Biomaterials are improving biocompatibility and integration, while advancements in Dental Implants offer higher success rates and faster healing. The development of high-strength, aesthetically superior Crowns and Bridges materials is also a significant trend, meeting the rising demand for cosmetic dentistry.

Key Drivers, Barriers & Challenges in Latin American Dental Market

Key Drivers:

- Technological Advancements: The rapid adoption of digital dentistry, including AI-powered diagnostics and 3D printing, is revolutionizing treatment.

- Economic Growth & Rising Incomes: Increasing disposable incomes across Latin America are enabling greater consumer spending on dental care.

- Government Initiatives: Public health programs promoting oral hygiene and improved access to dental services are driving demand.

- Growing Awareness: Increased patient education and awareness regarding the importance of oral health and the availability of advanced treatments.

Barriers & Challenges:

- Economic Volatility: Fluctuations in regional economies and currency devaluations can impact capital investments and consumer spending on elective procedures.

- Regulatory Hurdles: Diverse and evolving regulatory frameworks across different countries can pose challenges for product registration and market entry.

- Supply Chain Disruptions: Dependence on imported raw materials and finished goods can lead to vulnerabilities in the supply chain, impacting availability and pricing. Estimated impact of supply chain disruptions on market growth is around 1-2% annually.

- Affordability and Accessibility: Despite rising incomes, the cost of advanced dental treatments remains a barrier for a significant portion of the population, particularly in rural areas.

Growth Drivers in the Latin American Dental Market Market

Key growth drivers in the Latin American Dental Market are multifaceted, stemming from technological advancements and evolving consumer demands. The increasing adoption of digital dentistry, from CAD/CAM systems to AI-driven diagnostic tools, is enhancing efficiency and precision, thereby boosting market growth. Economically, rising disposable incomes in key markets like Brazil and Mexico are translating into increased spending on elective cosmetic procedures and advanced restorative treatments, such as dental implants. Regulatory support, with some governments implementing policies to improve oral healthcare access and reimbursement, further stimulates the market. The growing emphasis on preventive dentistry and improved oral hygiene awareness among the population is also a significant contributor.

Challenges Impacting Latin American Dental Market Growth

Several challenges are impacting the growth trajectory of the Latin American Dental Market. Regulatory complexities and differing approval processes across various countries can create significant hurdles for manufacturers and distributors seeking to expand their reach. Supply chain vulnerabilities, particularly concerning the import of specialized materials and components, can lead to delays and increased costs, estimated to add 3-5% to production costs during periods of significant disruption. Intense competitive pressure from both global giants and local players also necessitates continuous innovation and competitive pricing strategies. Furthermore, the affordability of advanced dental treatments remains a persistent issue for a large segment of the population, limiting the penetration of high-value products and services.

Key Players Shaping the Latin American Dental Market Market

- A-Dec Inc

- Biolase Inc

- Envista Holdings Corporation (Carestream Health Inc)

- Zimmer Biomet

- Dentsply Sirona

- Ivoclar Vivadent AG

- Straumann AG

- Dentium

- 3M Company

- Planmeca OY

Significant Latin American Dental Market Industry Milestones

- May 2022: Ortek Therapeutics, Inc. announced that the Brazilian Patent and Trademark Office issued a patent covering the Ortek-ECD, a revolutionary electronic cavity detection device that can detect tooth decay often missed by X-rays, impacting diagnostic equipment innovation.

- March 2022: Neodent, a leading Brazilian dental implant company in the Straumann Group, launched a new dental implant system, enhancing the dental implant segment and expanding Straumann's product offerings in the region.

Future Outlook for Latin American Dental Market Market

The future outlook for the Latin American Dental Market is highly promising, driven by continued technological innovation and increasing healthcare expenditure. Strategic opportunities lie in the expansion of digital dentistry solutions, offering enhanced precision and patient experience. The growing demand for personalized and minimally invasive treatments will fuel the market for advanced dental implants, biomaterials, and aesthetic dental devices. Investments in dental education and training programs will further empower dental professionals to adopt these new technologies. As economies stabilize and disposable incomes rise, market penetration for a wider range of dental products and services is expected to increase significantly, solidifying Latin America's position as a key growth region in the global dental industry.

Latin American Dental Market Segmentation

-

1. Product

-

1.1. General and Diagnostic Equipment

- 1.1.1. Dental Lasers

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic Equipment

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostic Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Mexico

- 3.4. Rest of Latin America

Latin American Dental Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Mexico

- 4. Rest of Latin America

Latin American Dental Market Regional Market Share

Geographic Coverage of Latin American Dental Market

Latin American Dental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Dental Diseases; Innovation in Dental Products

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Reimbursement of Dental Care and Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Dental Implant Segment is Expected to Dominate the Market in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin American Dental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostic Equipment

- 5.1.1.1. Dental Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic Equipment

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostic Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Mexico

- 5.3.4. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Mexico

- 5.4.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Brazil Latin American Dental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. General and Diagnostic Equipment

- 6.1.1.1. Dental Lasers

- 6.1.1.2. Radiology Equipment

- 6.1.1.3. Dental Chair and Equipment

- 6.1.1.4. Other General and Diagnostic Equipment

- 6.1.2. Dental Consumables

- 6.1.2.1. Dental Biomaterial

- 6.1.2.2. Dental Implants

- 6.1.2.3. Crowns and Bridges

- 6.1.2.4. Other Dental Consumables

- 6.1.3. Other Dental Devices

- 6.1.1. General and Diagnostic Equipment

- 6.2. Market Analysis, Insights and Forecast - by Treatment

- 6.2.1. Orthodontic

- 6.2.2. Endodontic

- 6.2.3. Periodontic

- 6.2.4. Prosthodontic

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Mexico

- 6.3.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Argentina Latin American Dental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. General and Diagnostic Equipment

- 7.1.1.1. Dental Lasers

- 7.1.1.2. Radiology Equipment

- 7.1.1.3. Dental Chair and Equipment

- 7.1.1.4. Other General and Diagnostic Equipment

- 7.1.2. Dental Consumables

- 7.1.2.1. Dental Biomaterial

- 7.1.2.2. Dental Implants

- 7.1.2.3. Crowns and Bridges

- 7.1.2.4. Other Dental Consumables

- 7.1.3. Other Dental Devices

- 7.1.1. General and Diagnostic Equipment

- 7.2. Market Analysis, Insights and Forecast - by Treatment

- 7.2.1. Orthodontic

- 7.2.2. Endodontic

- 7.2.3. Periodontic

- 7.2.4. Prosthodontic

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Mexico

- 7.3.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico Latin American Dental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. General and Diagnostic Equipment

- 8.1.1.1. Dental Lasers

- 8.1.1.2. Radiology Equipment

- 8.1.1.3. Dental Chair and Equipment

- 8.1.1.4. Other General and Diagnostic Equipment

- 8.1.2. Dental Consumables

- 8.1.2.1. Dental Biomaterial

- 8.1.2.2. Dental Implants

- 8.1.2.3. Crowns and Bridges

- 8.1.2.4. Other Dental Consumables

- 8.1.3. Other Dental Devices

- 8.1.1. General and Diagnostic Equipment

- 8.2. Market Analysis, Insights and Forecast - by Treatment

- 8.2.1. Orthodontic

- 8.2.2. Endodontic

- 8.2.3. Periodontic

- 8.2.4. Prosthodontic

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Mexico

- 8.3.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of Latin America Latin American Dental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. General and Diagnostic Equipment

- 9.1.1.1. Dental Lasers

- 9.1.1.2. Radiology Equipment

- 9.1.1.3. Dental Chair and Equipment

- 9.1.1.4. Other General and Diagnostic Equipment

- 9.1.2. Dental Consumables

- 9.1.2.1. Dental Biomaterial

- 9.1.2.2. Dental Implants

- 9.1.2.3. Crowns and Bridges

- 9.1.2.4. Other Dental Consumables

- 9.1.3. Other Dental Devices

- 9.1.1. General and Diagnostic Equipment

- 9.2. Market Analysis, Insights and Forecast - by Treatment

- 9.2.1. Orthodontic

- 9.2.2. Endodontic

- 9.2.3. Periodontic

- 9.2.4. Prosthodontic

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Mexico

- 9.3.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 A-Dec Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Biolase Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Envista Holdings Corporation (Carestream Health Inc )

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zimmer Biomet

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dentsply Sirona

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ivoclar Vivadent AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Straumann AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dentium

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 3M Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Planmeca OY

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 A-Dec Inc

List of Figures

- Figure 1: Latin American Dental Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin American Dental Market Share (%) by Company 2025

List of Tables

- Table 1: Latin American Dental Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Latin American Dental Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 3: Latin American Dental Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin American Dental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin American Dental Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Latin American Dental Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 7: Latin American Dental Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin American Dental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Latin American Dental Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Latin American Dental Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 11: Latin American Dental Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Latin American Dental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Latin American Dental Market Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Latin American Dental Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 15: Latin American Dental Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Latin American Dental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Latin American Dental Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: Latin American Dental Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 19: Latin American Dental Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin American Dental Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin American Dental Market?

The projected CAGR is approximately 4.53%.

2. Which companies are prominent players in the Latin American Dental Market?

Key companies in the market include A-Dec Inc, Biolase Inc, Envista Holdings Corporation (Carestream Health Inc ), Zimmer Biomet, Dentsply Sirona, Ivoclar Vivadent AG, Straumann AG, Dentium, 3M Company, Planmeca OY.

3. What are the main segments of the Latin American Dental Market?

The market segments include Product, Treatment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Dental Diseases; Innovation in Dental Products.

6. What are the notable trends driving market growth?

Dental Implant Segment is Expected to Dominate the Market in the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Proper Reimbursement of Dental Care and Lack of Awareness.

8. Can you provide examples of recent developments in the market?

May 2022: Ortek Therapeutics, Inc. announced that the Brazilian Patent and Trademark Office issued a patent covering the Ortek-ECD, a revolutionary electronic cavity detection device that can detect tooth decay often missed by X-rays.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin American Dental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin American Dental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin American Dental Market?

To stay informed about further developments, trends, and reports in the Latin American Dental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence