Key Insights

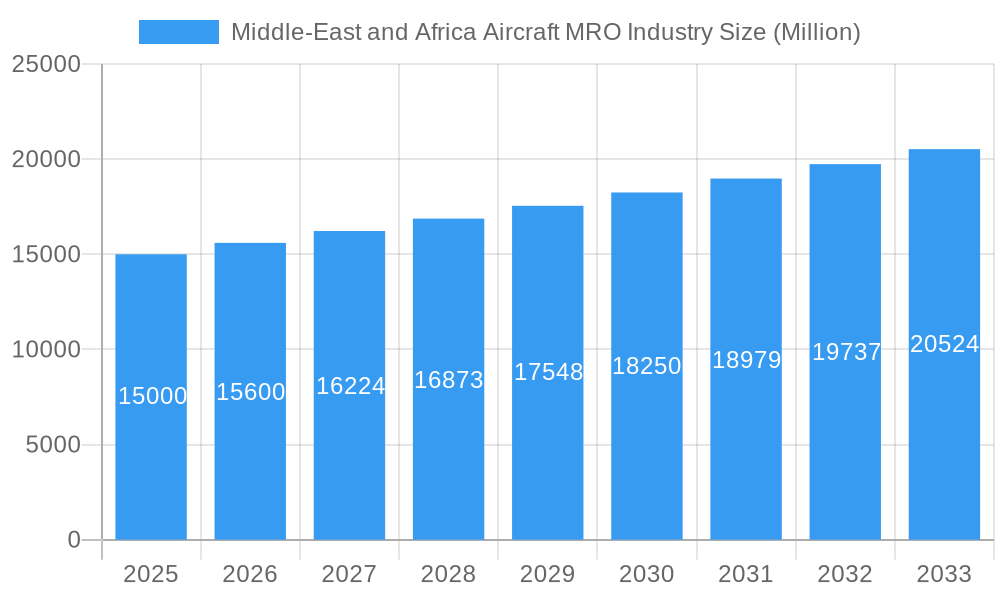

The Middle East and Africa Aircraft Maintenance, Repair, and Overhaul (MRO) market is projected for substantial expansion, driven by a robust aviation sector, escalating air travel demand, and a growing aircraft fleet. The market is estimated at 3.72 billion in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 14.46% over the forecast period. Key growth accelerators include the expansion of low-cost carriers, significant government investment in airport infrastructure, and a rising middle class fueling increased air travel. Moreover, the aging global aircraft fleet necessitates ongoing MRO services, further contributing to market growth. The market is segmented by end-user (commercial, military, general aviation) and MRO type (airframe, engine, component & modifications, line maintenance). While the commercial segment currently leads, the military and general aviation sectors are expected to experience notable growth due to increased defense spending and rising private aviation. Regional market penetration varies, with established aviation hubs such as South Africa and the UAE demonstrating higher activity compared to other nations. The competitive environment features prominent players like Ethiopian Airlines and Turkish Technic, driving innovation and service enhancements. However, economic instability and potential infrastructure limitations present ongoing challenges, requiring strategic investment and effective regulatory frameworks for sustained growth.

Middle-East and Africa Aircraft MRO Industry Market Size (In Billion)

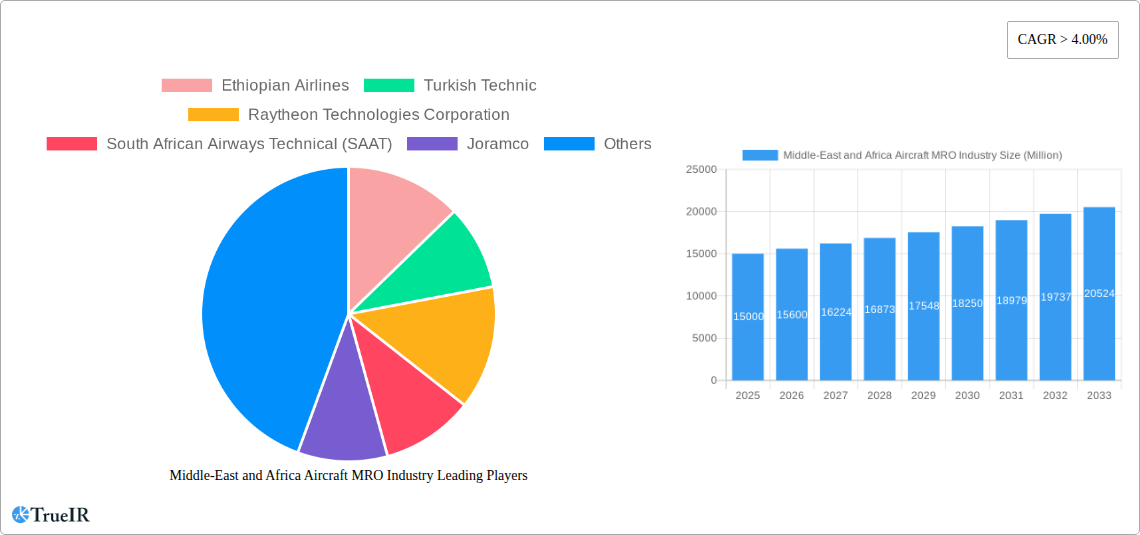

Competitive dynamics in the Middle East and Africa Aircraft MRO market are shaped by a mix of established international providers and agile regional operators. International firms leverage global expertise and networks, while regional companies capitalize on local market understanding and proximity to clients. This dynamic creates a balanced competitive landscape offering opportunities for both established and emerging entities. Strategic alliances and collaborations are increasingly common, enabling resource sharing, expertise exchange, and the development of comprehensive MRO solutions. Future market trends may include consolidation through mergers and acquisitions to enhance scale, broaden service portfolios, and improve operational efficiency. Technological advancements, particularly in predictive maintenance and digitalization, are critical, necessitating investment in advanced technologies and skilled workforce development to maintain a competitive edge. Adherence to government regulations and safety standards is paramount for operational compliance and industry integrity.

Middle-East and Africa Aircraft MRO Industry Company Market Share

Middle East & Africa Aircraft MRO Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Middle East and Africa Aircraft Maintenance, Repair, and Overhaul (MRO) industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive data from 2019-2024 (historical period), a base year of 2025, and forecasting to 2033, this report paints a comprehensive picture of market size, growth trajectory, and future potential. The total market value in 2025 is estimated at $XX Million and is projected to reach $XX Million by 2033, exhibiting a robust CAGR of XX%.

Middle-East and Africa Aircraft MRO Industry Market Structure & Competitive Landscape

The Middle East and Africa Aircraft MRO market is characterized by a moderate level of concentration, with a few large players and numerous smaller, specialized firms. The Herfindahl-Hirschman Index (HHI) is estimated at XX in 2025, indicating a moderately concentrated market. Key drivers of innovation include advancements in technologies such as predictive maintenance and digital twin solutions. Regulatory frameworks, such as those governing aviation safety and environmental standards, significantly influence market dynamics. Product substitution, primarily through the adoption of more efficient and sustainable MRO technologies, is also a noteworthy factor.

The market is segmented by end-user (commercial, military, general aviation) and MRO type (airframe, engine, components & modifications, line maintenance). Significant mergers and acquisitions (M&A) activity is observed, with XX major transactions recorded between 2019 and 2024, totaling approximately $XX Million in value. This activity reflects the industry's ongoing consolidation and pursuit of scale and efficiency.

- Market Concentration: HHI of XX in 2025.

- M&A Activity: XX major transactions (2019-2024), totaling $XX Million.

- Innovation Drivers: Predictive maintenance, digital twin technologies.

- Regulatory Impacts: Stringent safety and environmental regulations.

- End-User Segmentation: Dominated by commercial aviation, with growing military and general aviation segments.

Middle-East and Africa Aircraft MRO Industry Market Trends & Opportunities

The Middle East and Africa Aircraft MRO market is experiencing significant growth, fueled by factors such as the region's expanding airline industry, increasing aircraft fleet size, and government investments in infrastructure. The market size is estimated at $XX Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Technological advancements, including the implementation of advanced diagnostic tools and predictive analytics, are improving operational efficiency and reducing downtime. The increasing adoption of sustainable practices is also shaping market dynamics, along with shifts in consumer preferences toward cost-effectiveness and faster turnaround times. The competitive landscape is evolving with increased focus on strategic partnerships and collaborations to expand service offerings and geographical reach. Market penetration of advanced MRO technologies, such as big data analytics, is currently at XX% and is expected to reach XX% by 2033.

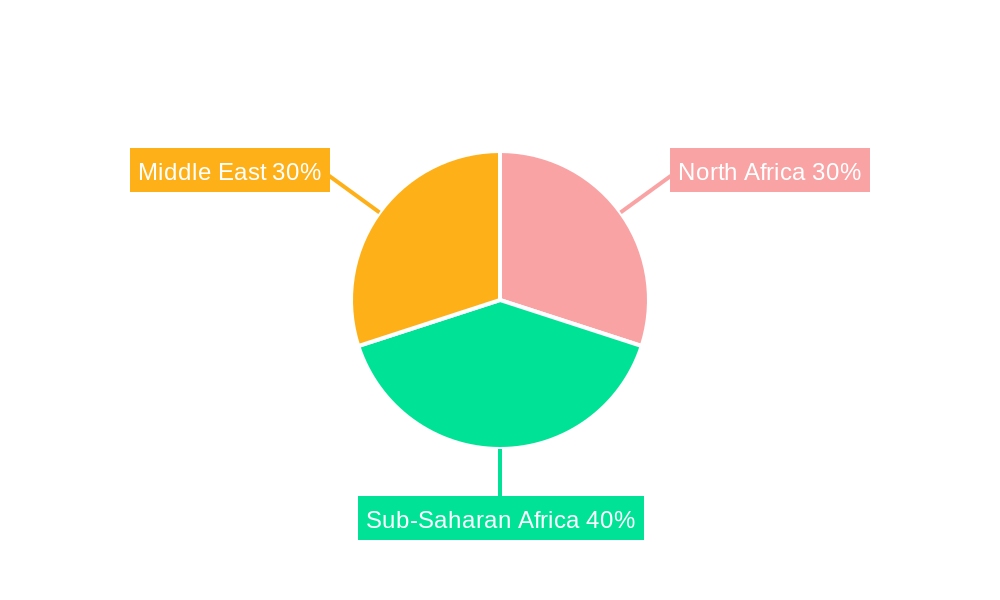

Dominant Markets & Segments in Middle-East and Africa Aircraft MRO Industry

The Middle East region, particularly the UAE and Saudi Arabia, represents the largest and fastest-growing segment of the Middle East and Africa Aircraft MRO market. Strong airline growth, significant investments in aviation infrastructure, and supportive government policies contribute to its dominance. The commercial aviation segment is the largest end-user, accounting for approximately XX% of the market in 2025. Within MRO types, airframe MRO and engine MRO hold the largest shares, driven by the need for regular maintenance and overhaul of aircraft components.

- Key Growth Drivers in the Middle East:

- Significant investment in aviation infrastructure.

- Supportive government policies and initiatives.

- Strong growth of airlines in the region.

- Key Growth Drivers in the Commercial Segment:

- Expanding airline fleets and increased flight operations.

- Growing demand for cost-effective and efficient MRO services.

- Key Growth Drivers in Airframe MRO:

- Aging aircraft fleets requiring regular maintenance and repairs.

- Increasing adoption of advanced maintenance technologies.

Middle-East and Africa Aircraft MRO Industry Product Analysis

The Aircraft MRO industry is characterized by continuous product innovation, driven by the need for improved efficiency, cost reduction, and enhanced safety. Technological advancements in areas like predictive maintenance, digital twins, and advanced materials are leading to more efficient and reliable MRO solutions. These innovations provide competitive advantages by reducing downtime, improving aircraft availability, and extending lifespan. The market demonstrates a clear preference for integrated MRO solutions that streamline the entire maintenance process.

Key Drivers, Barriers & Challenges in Middle-East and Africa Aircraft MRO Industry

Key Drivers:

- Rapid growth of air travel in the region.

- Increasing age of aircraft fleets requiring more maintenance.

- Government investments in aviation infrastructure.

- Technological advancements like predictive maintenance and AI.

Challenges:

- Supply chain disruptions impacting the availability of spare parts and materials.

- Regulatory complexities and compliance requirements.

- Intense competition and price pressure from global MRO providers. This is estimated to reduce profit margins by approximately XX% over the forecast period.

Growth Drivers in the Middle-East and Africa Aircraft MRO Industry Market

The MEA Aircraft MRO market is driven by a combination of factors, primarily the region's burgeoning aviation sector, including increased air travel demand and a growing number of aircraft in operation. Technological advancements in maintenance and repair processes further fuel market expansion. Government regulations promoting safety and efficiency within the aviation industry, coupled with foreign direct investments (FDI) in aviation infrastructure, significantly contribute to the market’s growth.

Challenges Impacting Middle-East and Africa Aircraft MRO Industry Growth

Significant challenges impacting growth include the volatility of fuel prices affecting airline profitability and MRO investment. Supply chain disruptions, particularly for specialized parts and components, are impacting turnaround times and operational efficiency. Further, the competitive landscape, with established global players and emerging regional operators, exerts pressure on pricing and profitability. Stringent safety regulations and compliance requirements also pose challenges.

Key Players Shaping the Middle-East and Africa Aircraft MRO Industry Market

- Ethiopian Airlines

- Turkish Technic

- Raytheon Technologies Corporation

- South African Airways Technical (SAAT)

- Joramco

- AMMROC

- Egyptair Maintenance & Engineering

- Safran SA

- Etihad Airways Engineering LLC

- Air France Industries KLM Engineering & Maintenance

- Sanad Aerotech

- Lufthansa Technik AG

- General Electric Company

- Emirates Engineering

- Saudia Aerospace Engineering Industries

Significant Middle-East and Africa Aircraft MRO Industry Industry Milestones

- 2021: Ethiopian Airlines invests $XX Million in new MRO facility.

- 2022: Turkish Technic secures a major contract with a Middle Eastern airline.

- 2023: Safran SA launches a new generation of engine maintenance technology.

- 2024: A significant merger occurs between two regional MRO providers.

Future Outlook for Middle-East and Africa Aircraft MRO Industry Market

The future of the Middle East and Africa Aircraft MRO market looks promising, with sustained growth driven by increased air travel, fleet expansion, and technological advancements. The adoption of digital technologies, such as predictive maintenance and AI-powered diagnostics, will further enhance operational efficiency and reduce costs. Strategic collaborations and partnerships among MRO providers and airlines will continue to shape market dynamics. The market presents significant opportunities for investment and innovation in sustainable aviation technologies and advanced maintenance solutions.

Middle-East and Africa Aircraft MRO Industry Segmentation

-

1. MRO Type

- 1.1. Airframe MRO

- 1.2. Engine MRO

- 1.3. Component and Modifications MRO

- 1.4. Line Maintenance

-

2. End-User

- 2.1. Commercial

- 2.2. Military

- 2.3. General Aviation

-

3. Geography

-

3.1. Middle-East and Africa

- 3.1.1. Saudi Arabia

- 3.1.2. United Arab Emirates

- 3.1.3. Turkey

- 3.1.4. South Africa

- 3.1.5. Egypt

- 3.1.6. Rest of Middle-East and Africa

-

3.1. Middle-East and Africa

Middle-East and Africa Aircraft MRO Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Turkey

- 1.4. South Africa

- 1.5. Egypt

- 1.6. Rest of Middle East and Africa

Middle-East and Africa Aircraft MRO Industry Regional Market Share

Geographic Coverage of Middle-East and Africa Aircraft MRO Industry

Middle-East and Africa Aircraft MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Engine MRO Segment Held the Largest Market Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Aircraft MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe MRO

- 5.1.2. Engine MRO

- 5.1.3. Component and Modifications MRO

- 5.1.4. Line Maintenance

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Military

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East and Africa

- 5.3.1.1. Saudi Arabia

- 5.3.1.2. United Arab Emirates

- 5.3.1.3. Turkey

- 5.3.1.4. South Africa

- 5.3.1.5. Egypt

- 5.3.1.6. Rest of Middle-East and Africa

- 5.3.1. Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Turkish Technic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raytheon Technologies Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 South African Airways Technical (SAAT)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Joramco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AMMROC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Egyptair Maintenance & Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Etihad Airways Engineering LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Air France Industries KLM Engineering & Maintenanc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sanad Aerotech

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lufthansa Technik AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 General Electric Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Emirates Engineering

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Saudia Aerospace Engineering Industries

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Middle-East and Africa Aircraft MRO Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Aircraft MRO Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Turkey Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Egypt Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Middle East and Africa Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Aircraft MRO Industry?

The projected CAGR is approximately 14.46%.

2. Which companies are prominent players in the Middle-East and Africa Aircraft MRO Industry?

Key companies in the market include Ethiopian Airlines, Turkish Technic, Raytheon Technologies Corporation, South African Airways Technical (SAAT), Joramco, AMMROC, Egyptair Maintenance & Engineering, Safran SA, Etihad Airways Engineering LLC, Air France Industries KLM Engineering & Maintenanc, Sanad Aerotech, Lufthansa Technik AG, General Electric Company, Emirates Engineering, Saudia Aerospace Engineering Industries.

3. What are the main segments of the Middle-East and Africa Aircraft MRO Industry?

The market segments include MRO Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.72 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Engine MRO Segment Held the Largest Market Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Aircraft MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Aircraft MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Aircraft MRO Industry?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Aircraft MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence