Key Insights

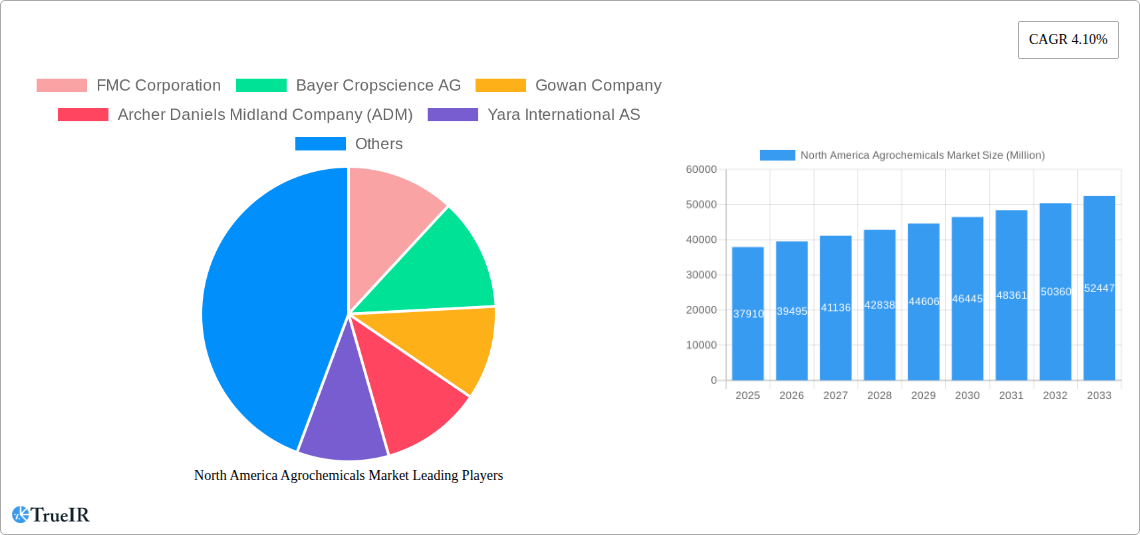

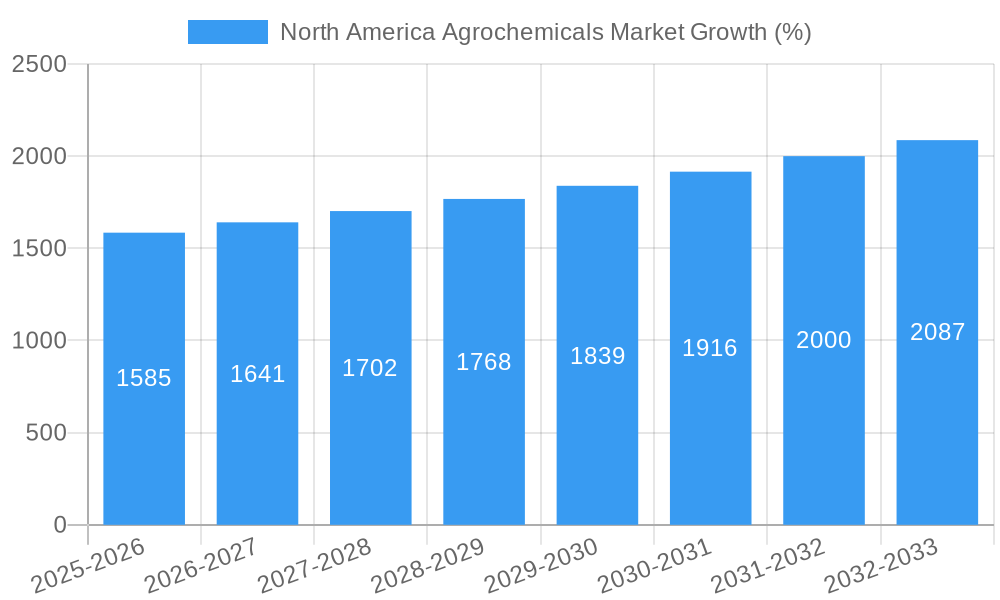

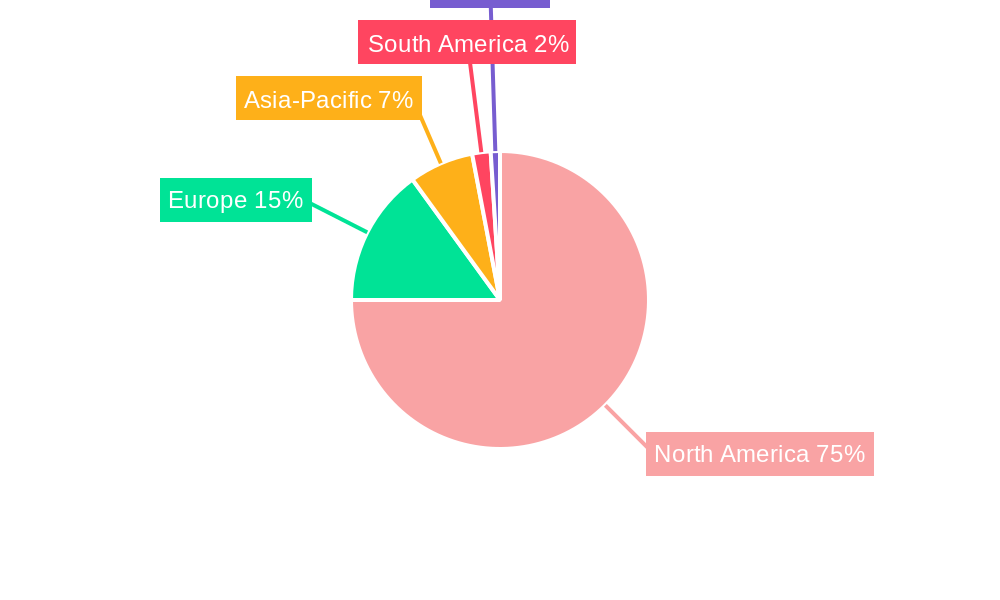

The North America agrochemicals market, valued at $37.91 billion in 2025, is projected to experience robust growth, driven by factors such as increasing agricultural production to meet rising global food demand, the growing adoption of precision agriculture technologies enhancing efficiency and yield, and a rising prevalence of crop diseases and pests necessitating effective pest and disease management strategies. The market's Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033 indicates a steady expansion, particularly fueled by the increasing acreage under cultivation and the ongoing development and adoption of more effective and sustainable agrochemical solutions. The segments within the market show varying growth trajectories. Fertilizers and pesticides are expected to remain dominant due to their essential role in crop production. However, adjuvants and plant growth regulators are poised for significant growth, driven by increasing demand for enhanced crop yields and improved crop quality. The application segments are equally diverse, with grains and cereals, pulses and oilseeds maintaining consistent market share, while fruits and vegetables and turf and ornamentals exhibit higher growth potential, reflecting increasing consumer demand and investment in landscaping. Competition among leading players such as FMC Corporation, Bayer Cropscience AG, and Syngenta AG is intense, stimulating innovation and the development of new, environmentally friendly products. The United States, Canada, and Mexico will continue to form the core of the North American market, with the US maintaining a substantial majority of the market share due to its extensive agricultural lands and technological advancements.

Growth within specific segments will be influenced by several factors. For example, the increasing adoption of no-till farming techniques is likely to fuel growth in the adjuvants segment, as these improve the efficacy of other agrochemicals in no-till situations. Similarly, growing concerns about environmental impact will drive increased demand for bio-based and low-impact pesticides and fertilizers, fostering innovation in this space. Governmental regulations related to agrochemical use, particularly concerning environmental protection, will also influence the market trajectory, potentially slowing down growth in certain segments while stimulating growth in others. This interplay of various factors contributes to the dynamic and evolving nature of the North American agrochemicals market.

North America Agrochemicals Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America agrochemicals market, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, segmentation, trends, and competitive dynamics. The analysis leverages extensive primary and secondary research, providing a robust foundation for strategic decision-making. This report is essential for businesses, investors, and researchers seeking to understand the evolving landscape of the North American agrochemicals sector. The market is estimated to be valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Agrochemicals Market Structure & Competitive Landscape

The North American agrochemicals market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, indicating a moderately consolidated structure. Innovation plays a crucial role, driven by the need for enhanced crop yields, pest control solutions, and sustainable agricultural practices. Stringent regulatory frameworks, including those concerning pesticide registration and environmental protection, significantly impact market dynamics. Product substitution, particularly towards biopesticides and biofertilizers, is gaining traction, driven by growing environmental awareness. The market is segmented by application (grains and cereals, pulses and oilseeds, fruits and vegetables, turf and ornamentals, other applications) and by type (fertilizers, pesticides, adjuvants, plant growth regulators).

Mergers and acquisitions (M&A) activity has been relatively robust in recent years, with xx major deals recorded between 2019 and 2024, totaling an estimated value of xx Million. These transactions reflect strategic consolidation efforts by larger players to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Moderately concentrated, with HHI of xx.

- Innovation Drivers: Demand for higher crop yields, sustainable agriculture, and pest control.

- Regulatory Impacts: Stringent environmental regulations shaping product development and approvals.

- Product Substitutes: Growing adoption of biopesticides and biofertilizers.

- End-User Segmentation: Diverse range of end-users, including large-scale farms, smallholder farmers, and landscaping companies.

- M&A Trends: Significant M&A activity, with xx deals totaling xx Million from 2019-2024.

North America Agrochemicals Market Market Trends & Opportunities

The North America agrochemicals market is witnessing robust growth, fueled by several key factors. Increasing agricultural production to meet growing global food demand is a primary driver. Technological advancements, such as precision agriculture and digital farming, are enhancing efficiency and productivity across the agricultural sector. Consumer preferences towards organic and sustainably produced food products are also influencing market dynamics, creating opportunities for bio-based agrochemicals. The competitive landscape is highly dynamic, with ongoing innovation and strategic partnerships shaping market competition.

The market is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration rates for new products, particularly those with enhanced efficacy and sustainability profiles, are expected to increase significantly. Shifting consumer preferences towards sustainably produced food are impacting the market, promoting the demand for organic and bio-based agrochemicals.

Dominant Markets & Segments in North America Agrochemicals Market

The United States constitutes the largest market within North America, driven by its extensive agricultural sector and high adoption rates of modern agricultural technologies. Within the type segment, pesticides hold the largest market share, reflecting the persistent threat of crop diseases and pests. The grains and cereals application segment dominates market demand due to the vast acreage under cultivation.

- Leading Region: United States

- Leading Type Segment: Pesticides

- Leading Application Segment: Grains and Cereals

Key Growth Drivers:

- US: Large agricultural sector, high technology adoption, favorable government policies.

- Pesticides: Persistent threat of crop diseases and pests, stringent regulations driving innovation.

- Grains & Cereals: Large acreage, high crop yields, and growing demand for food grains.

North America Agrochemicals Market Product Analysis

Technological advancements are driving product innovation in the agrochemicals market. This includes the development of targeted pesticides with reduced environmental impact, precision fertilizer delivery systems, and bio-based solutions, improving efficiency and reducing the environmental footprint of agriculture. The market is seeing a rise in products with improved efficacy, reduced application rates, and enhanced sustainability attributes, creating a competitive advantage for companies at the forefront of innovation.

Key Drivers, Barriers & Challenges in North America Agrochemicals Market

Key Drivers:

- Growing global food demand driving increased agricultural production.

- Technological advancements enhancing farm productivity and efficiency (precision agriculture, drone technology).

- Government support for sustainable agriculture practices and research and development.

Key Challenges:

- Stringent regulatory requirements for pesticide registration and environmental protection (impact: increased costs & longer approval times).

- Supply chain disruptions affecting the availability and pricing of raw materials.

- Intense competition among established players and emerging biopesticide companies.

Growth Drivers in the North America Agrochemicals Market Market

The North American agrochemicals market's growth is fueled by several factors. Increased demand for food due to population growth necessitates higher agricultural output, driving the demand for agrochemicals. Technological advancements like precision agriculture enhance efficiency and reduce environmental impact. Favorable government policies and subsidies also support market expansion.

Challenges Impacting North America Agrochemicals Market Growth

Challenges include stringent regulations that increase costs and extend approval processes. Supply chain disruptions impact raw material availability and prices. Intense competition from established and emerging players adds further pressure.

Key Players Shaping the North America Agrochemicals Market Market

- FMC Corporation

- Bayer Cropscience AG

- Gowan Company

- Archer Daniels Midland Company (ADM)

- Yara International AS

- Syngenta AG

- UPL Limited

- Adama Agricultural Solutions

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Significant North America Agrochemicals Market Industry Milestones

- 2020, Q4: Corteva Agriscience launches new fungicide with enhanced efficacy.

- 2021, Q1: Bayer Cropscience AG acquires a smaller biopesticide company.

- 2022, Q3: New regulations on pesticide use come into effect in California.

- 2023, Q2: FMC Corporation invests in a new manufacturing facility for biopesticides.

- 2024, Q4: Significant investment in research and development of sustainable agrochemicals announced by Syngenta AG.

Future Outlook for North America Agrochemicals Market Market

The North America agrochemicals market is poised for continued growth, driven by increasing demand for food, technological advancements in sustainable agriculture, and supportive government policies. Strategic investments in R&D, focus on sustainable solutions, and strategic partnerships are key factors determining future market success. The market is expected to witness further consolidation through mergers and acquisitions and a rise in innovative products with reduced environmental impacts.

North America Agrochemicals Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Agrochemicals Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agrochemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Rapid Adoption of Bio-based Agrochemicals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agrochemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Agrochemicals Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Agrochemicals Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Agrochemicals Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Agrochemicals Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 FMC Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bayer Cropscience AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gowan Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Archer Daniels Midland Company (ADM)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Yara International AS

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Syngenta AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 UPL Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Adama Agricultural Solutions

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Corteva Agriscience

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nufarm Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BASF SE

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 FMC Corporation

List of Figures

- Figure 1: North America Agrochemicals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Agrochemicals Market Share (%) by Company 2024

List of Tables

- Table 1: North America Agrochemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Agrochemicals Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: North America Agrochemicals Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: North America Agrochemicals Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: North America Agrochemicals Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: North America Agrochemicals Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: North America Agrochemicals Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: North America Agrochemicals Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: North America Agrochemicals Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: North America Agrochemicals Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: North America Agrochemicals Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: North America Agrochemicals Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: North America Agrochemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North America Agrochemicals Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: North America Agrochemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Agrochemicals Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: United States North America Agrochemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States North America Agrochemicals Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Canada North America Agrochemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Agrochemicals Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Agrochemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico North America Agrochemicals Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America North America Agrochemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of North America North America Agrochemicals Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: North America Agrochemicals Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: North America Agrochemicals Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 27: North America Agrochemicals Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: North America Agrochemicals Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 29: North America Agrochemicals Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: North America Agrochemicals Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: North America Agrochemicals Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: North America Agrochemicals Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: North America Agrochemicals Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: North America Agrochemicals Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: North America Agrochemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Agrochemicals Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 37: United States North America Agrochemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United States North America Agrochemicals Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: Canada North America Agrochemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Canada North America Agrochemicals Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: Mexico North America Agrochemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico North America Agrochemicals Market Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agrochemicals Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the North America Agrochemicals Market?

Key companies in the market include FMC Corporation, Bayer Cropscience AG, Gowan Company, Archer Daniels Midland Company (ADM), Yara International AS, Syngenta AG, UPL Limited, Adama Agricultural Solutions, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the North America Agrochemicals Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Rapid Adoption of Bio-based Agrochemicals.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agrochemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agrochemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agrochemicals Market?

To stay informed about further developments, trends, and reports in the North America Agrochemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence