Key Insights

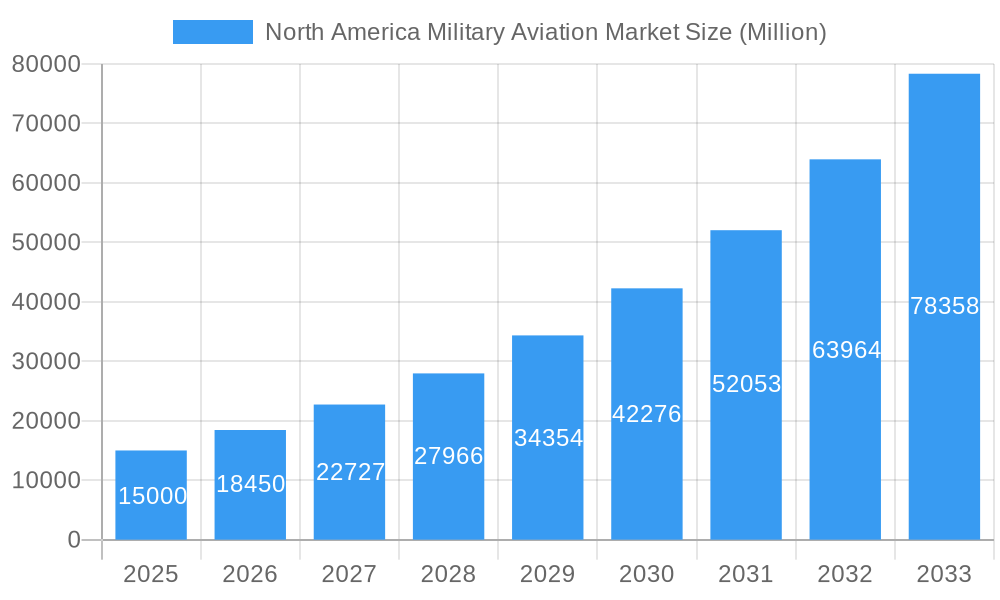

The North American military aviation market, encompassing fixed-wing aircraft and encompassing the United States, Canada, and Mexico, is experiencing robust growth. Driven by increasing defense budgets across the region, modernization initiatives to replace aging fleets, and the ongoing need for advanced technological capabilities in aerial warfare, the market is projected to maintain a significant Compound Annual Growth Rate (CAGR) of 23.50% from 2025 to 2033. Key players like Textron, Lockheed Martin, Boeing, Airbus, Leonardo, and Northrop Grumman are actively involved in developing and supplying advanced aircraft systems, fueling this expansion. The United States, as the largest military spender in the region, significantly contributes to the market's value, while Canada and Mexico also play important roles, albeit with smaller contributions. Technological advancements, particularly in unmanned aerial vehicles (UAVs) and next-generation fighter jets, are shaping market trends. However, potential budgetary constraints and shifts in geopolitical priorities could act as restraints on the market's long-term trajectory.

North America Military Aviation Market Market Size (In Billion)

The significant growth is further fueled by the continuous demand for enhanced surveillance capabilities, improved pilot training technologies, and sophisticated avionics. While the market is dominated by large established players, the emergence of smaller innovative companies focused on specialized technologies and niche segments presents a dynamic competitive landscape. The market segmentation by aircraft type (fixed-wing, rotary-wing, etc.), further allows for a granular understanding of specific growth opportunities. For example, the demand for advanced fighter jets is likely to be a major growth driver in the coming years. Data from 2019-2024 suggests a strong upward trend, confirming the continued growth forecast for the next decade, making it an attractive sector for investors and industry participants alike.

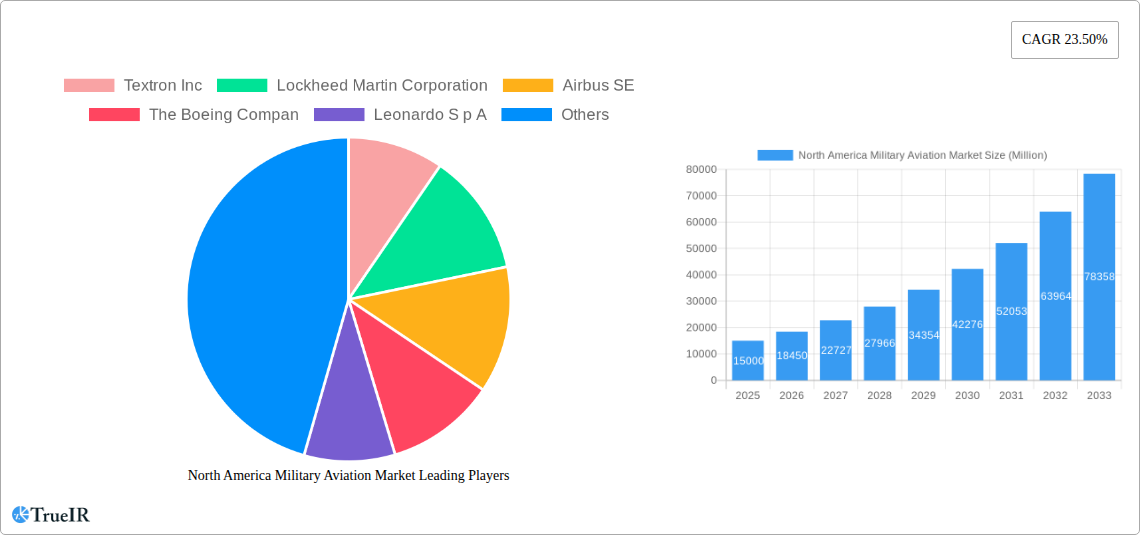

North America Military Aviation Market Company Market Share

This dynamic report provides a detailed analysis of the North America military aviation market, encompassing the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking a comprehensive understanding of this rapidly evolving sector. The report leverages extensive market research and data analysis to illuminate growth drivers, challenges, and future market potential. With a focus on key players like Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Company, Leonardo S.p.A, and Northrop Grumman Corporation, this report is a must-have resource for navigating the complexities of the North American military aviation landscape. The report’s detailed segmentation by aircraft type (Fixed-Wing Aircraft) and country (Canada, Mexico, United States, Rest of North America) allows for a granular understanding of market dynamics.

North America Military Aviation Market Structure & Competitive Landscape

The North American military aviation market exhibits a moderately concentrated structure, with a few dominant players capturing significant market share. However, the market is dynamic, characterized by continuous innovation and technological advancements. Stringent regulatory frameworks governing military procurement and safety standards significantly impact market players. Product substitutes are limited, given the specialized nature of military aircraft. The market is primarily segmented by end-user (military branches – Army, Air Force, Navy etc.) with substantial M&A activity observed in recent years.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Ongoing research and development in areas like stealth technology, unmanned aerial vehicles (UAVs), and advanced avionics drive market innovation.

- Regulatory Impacts: Stringent export controls and security clearances influence market access and partnerships.

- Product Substitutes: Limited substitutes exist due to the specialized nature of military aircraft; however, the increasing capability of commercial UAVs presents a potential long-term challenge.

- End-User Segmentation: The market is segmented by military branch (Army, Navy, Air Force), with the US Air Force representing the largest segment.

- M&A Trends: The past five years have witnessed xx M&A transactions, primarily focused on consolidating technological capabilities and expanding market reach.

North America Military Aviation Market Trends & Opportunities

The North American military aviation market is experiencing robust growth, driven by factors such as increasing defense budgets, geopolitical instability, technological advancements, and modernization initiatives across various military branches. The market size is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological shifts towards unmanned systems and advanced sensor technologies are reshaping the competitive landscape. Demand for next-generation fighter jets, helicopters, and surveillance aircraft is driving substantial market growth. The market penetration rate of advanced technologies like AI and machine learning in military aviation is expected to increase significantly in the coming years. This growth creates opportunities for both established players and emerging companies specializing in specific niche technologies.

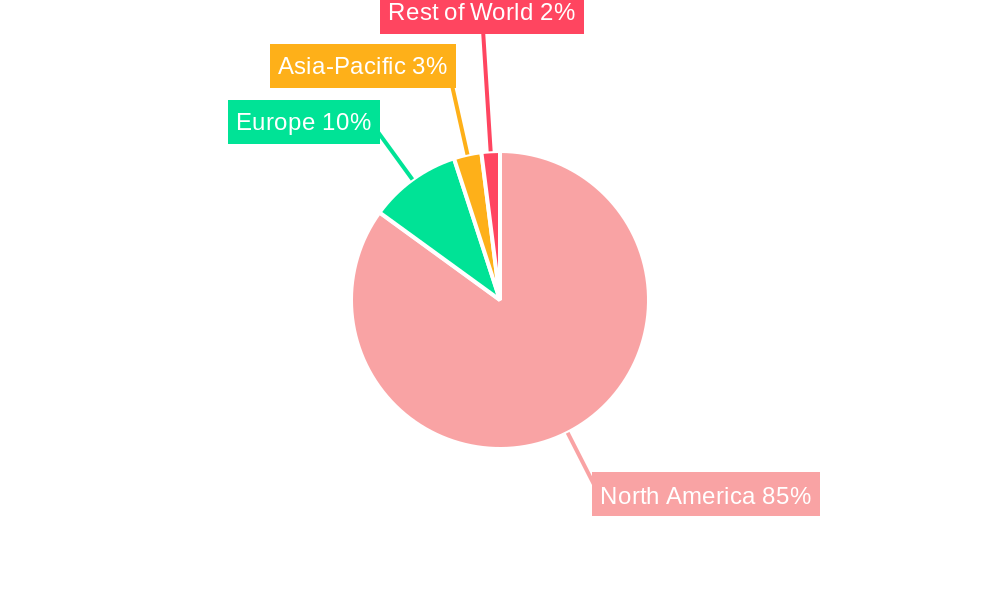

Dominant Markets & Segments in North America Military Aviation Market

The United States dominates the North American military aviation market, accounting for the largest share of revenue and volume. This dominance stems from substantial defense budgets, a large and technologically advanced military, and a strong domestic manufacturing base.

- United States:

- Key Growth Drivers: High defense spending, ongoing military modernization programs, robust domestic aerospace industry.

- Canada:

- Key Growth Drivers: Investments in air force modernization, participation in North American defense collaborations.

- Mexico:

- Key Growth Drivers: Increased internal security concerns, collaborations with US on counter-narcotics operations.

- Rest of North America:

- Key Growth Drivers: Limited but growing demand for military aviation equipment, primarily driven by regional security concerns.

The Fixed-Wing Aircraft segment constitutes the largest portion of the market, owing to the significant demand for fighter jets, bombers, transport aircraft, and surveillance planes.

North America Military Aviation Market Product Analysis

The North American military aviation market is characterized by continuous product innovation, focusing on enhancing performance, improving survivability, and incorporating advanced technologies. This includes the development of stealth aircraft, unmanned combat aerial vehicles (UCAVs), and advanced sensor systems for improved situational awareness. These innovations are driven by the need to maintain a technological edge over potential adversaries. The market fit for these advanced products is strong, given the increasing emphasis on modernization and technological superiority within the military aviation sector.

Key Drivers, Barriers & Challenges in North America Military Aviation Market

Key Drivers: Technological advancements (e.g., AI, autonomous systems, hypersonic technology), increasing defense budgets, geopolitical uncertainties, and the need for military modernization are driving market growth.

Challenges: Supply chain disruptions impacting the timely procurement of critical components, stringent regulatory hurdles (e.g., export controls), and intense competition among established aerospace companies pose significant challenges to market growth. These challenges can lead to project delays, increased costs, and reduced profitability for companies involved in the military aviation sector.

Growth Drivers in the North America Military Aviation Market Market

Increased defense spending, technological advancements in areas like AI and unmanned systems, and the growing need for modernization across various military branches are key factors driving market growth. Government initiatives promoting domestic manufacturing and strategic partnerships also play a crucial role.

Challenges Impacting North America Military Aviation Market Growth

Supply chain vulnerabilities, complex regulatory landscapes, and intense competition among major players pose considerable challenges to sustained market growth. These challenges can result in project delays, cost overruns, and reduced profitability for market participants.

Key Players Shaping the North America Military Aviation Market Market

Significant North America Military Aviation Market Industry Milestones

- February 2023: Boeing received a contract from the US Air Force for E-7 Airborne Early Warning & Control Aircraft. This highlights the continued demand for advanced surveillance and command-and-control systems.

- March 2023: Boeing was awarded a contract to manufacture 184 AH-64E Apache attack helicopters, demonstrating the ongoing demand for attack helicopters and bolstering Boeing's position in the market.

- May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters to Germany, worth USD 8.5 billion. This signifies substantial international demand for US-manufactured military helicopters.

Future Outlook for North America Military Aviation Market Market

The North American military aviation market is poised for continued growth, driven by sustained defense spending, technological advancements, and the ongoing need for military modernization. Opportunities exist for companies focusing on developing advanced technologies like AI, autonomous systems, and hypersonic capabilities. The market's long-term outlook remains positive, with significant potential for innovation and expansion.

North America Military Aviation Market Segmentation

-

1. Sub Aircraft Type

-

1.1. Fixed-Wing Aircraft

- 1.1.1. Multi-Role Aircraft

- 1.1.2. Training Aircraft

- 1.1.3. Transport Aircraft

- 1.1.4. Others

-

1.2. Rotorcraft

- 1.2.1. Multi-Mission Helicopter

- 1.2.2. Transport Helicopter

-

1.1. Fixed-Wing Aircraft

North America Military Aviation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Military Aviation Market Regional Market Share

Geographic Coverage of North America Military Aviation Market

North America Military Aviation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Military Aviation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 5.1.1. Fixed-Wing Aircraft

- 5.1.1.1. Multi-Role Aircraft

- 5.1.1.2. Training Aircraft

- 5.1.1.3. Transport Aircraft

- 5.1.1.4. Others

- 5.1.2. Rotorcraft

- 5.1.2.1. Multi-Mission Helicopter

- 5.1.2.2. Transport Helicopter

- 5.1.1. Fixed-Wing Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Boeing Compan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Leonardo S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Northrop Grumman Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: North America Military Aviation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Military Aviation Market Share (%) by Company 2025

List of Tables

- Table 1: North America Military Aviation Market Revenue Million Forecast, by Sub Aircraft Type 2020 & 2033

- Table 2: North America Military Aviation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Military Aviation Market Revenue Million Forecast, by Sub Aircraft Type 2020 & 2033

- Table 4: North America Military Aviation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Military Aviation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Military Aviation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Military Aviation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Military Aviation Market?

The projected CAGR is approximately 23.50%.

2. Which companies are prominent players in the North America Military Aviation Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Leonardo S p A, Northrop Grumman Corporation.

3. What are the main segments of the North America Military Aviation Market?

The market segments include Sub Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.March 2023: Boeing has been awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers. The US government announced USD 1.95 million, indicating that the helicopter will be delivered to the US military and overseas buyers - specifically Australia and Egypt - as a part of the paramilitary process to the Foreign Service (FMS) from the US government. Contract completion is expected by the end of 2027.February 2023: Boeing received a contract from the US Air Force for E-7 Airborne Early Warning & Control Aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Military Aviation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Military Aviation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Military Aviation Market?

To stay informed about further developments, trends, and reports in the North America Military Aviation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence