Key Insights

The North American feed testing market is projected to reach $539.05 million by 2025, demonstrating significant growth fueled by escalating consumer demand for safe and high-quality animal products. This demand mandates stringent regulatory adherence concerning feed safety and nutritional composition, driving the adoption of advanced testing methodologies. Key growth catalysts include heightened concerns over foodborne illnesses linked to contaminated feed, increased awareness of mycotoxin impacts on animal health and productivity, and the expanding implementation of precision feeding strategies. The market's segmentation mirrors the diverse animal feed industry, with ruminant feed testing holding a substantial share due to the extensive cattle population and ruminants' susceptibility to specific pathogens and toxins. Poultry and swine feed testing segments are also prominent, supported by high-volume production in North America. The growing popularity of pet food, driven by elevated consumer expectations for ingredient quality and safety, contributes to the pet food testing segment's expansion. Technological advancements in analytical techniques, such as PCR-based pathogen detection and advanced chromatography for pesticide residue analysis, are further accelerating market growth.

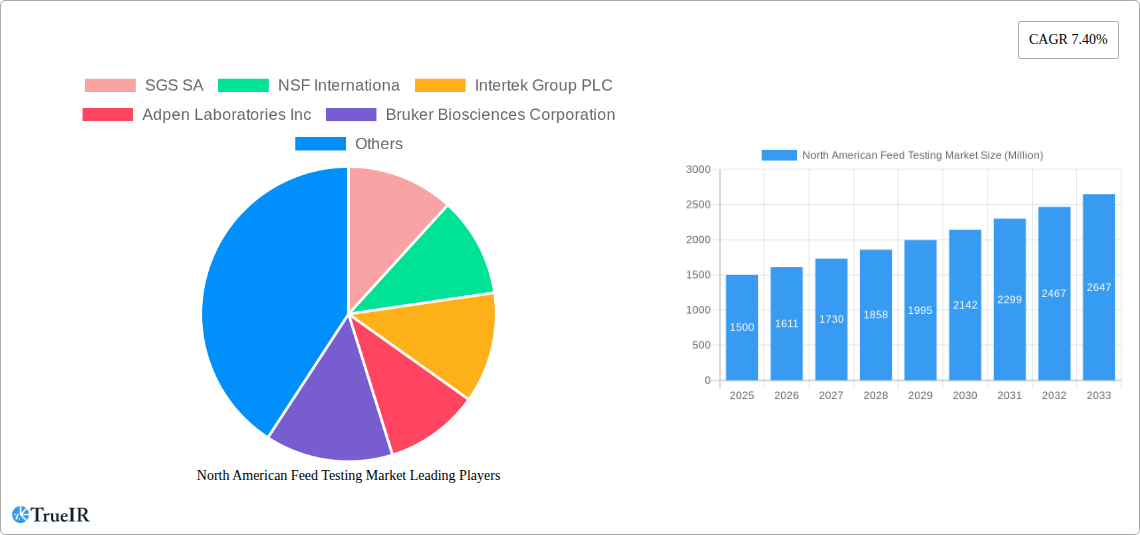

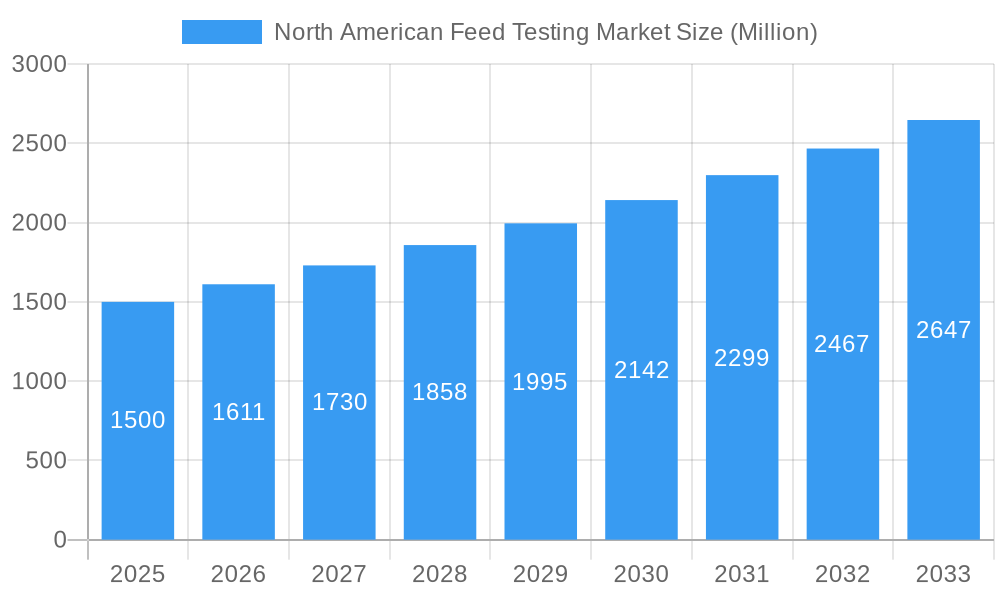

North American Feed Testing Market Market Size (In Million)

Market expansion is further propelled by intensified research and development efforts focused on enhancing testing procedure accuracy, speed, and cost-effectiveness. The emergence of rapid diagnostic tools and on-site testing solutions facilitates swift detection and response to potential contamination, thereby minimizing economic losses. However, substantial investments in advanced analytical instruments and the requirement for specialized expertise present certain market expansion challenges. Nevertheless, the long-term outlook is robust, with the market anticipated to sustain a compound annual growth rate (CAGR) of 7.7% from the 2025 base year. Leading market participants are strategically investing in enhancing their testing capacities and global presence to leverage increasing demand. A significant trend involves the growing adoption of integrated analytical platforms that combine diverse testing methods, streamlining the feed testing process and reducing overall expenses.

North American Feed Testing Market Company Market Share

North American Feed Testing Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the North American feed testing market, offering invaluable insights for stakeholders across the entire value chain. With a detailed examination spanning the period from 2019 to 2033, this report leverages robust data and expert analysis to provide a clear understanding of market dynamics, trends, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx% during the forecast period (2025-2033).

North American Feed Testing Market Structure & Competitive Landscape

The North American feed testing market is characterized by a moderately concentrated competitive landscape. Key players such as SGS SA, NSF International, Intertek Group PLC, Eurofins Scientific, and others hold significant market share, driving innovation and shaping industry standards. The Herfindahl-Hirschman Index (HHI) for the market in 2025 is estimated at xx, indicating a moderately concentrated market.

Several factors influence the market structure:

- Innovation Drivers: Continuous advancements in analytical technologies, such as PCR, ELISA, and LC-MS/MS, are driving market growth by improving accuracy and efficiency of testing. The demand for faster, more sensitive, and cost-effective testing solutions is constantly increasing.

- Regulatory Impacts: Stringent government regulations regarding feed safety and quality in North America, particularly concerning pathogen detection and pesticide residue limits, are key drivers for increased testing. Compliance demands fuel market growth.

- Product Substitutes: Limited viable substitutes exist for accurate and reliable feed testing methods. The critical nature of accurate results for animal health and food safety ensures the demand for professional testing services.

- End-User Segmentation: The market caters to a diverse range of end-users, including feed manufacturers, agricultural producers, regulatory bodies, and research institutions, each with specific testing requirements. Poultry and swine feed testing accounts for the largest segment, driven by high production volume and stringent regulations.

- M&A Trends: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with larger companies strategically acquiring smaller players to expand their service portfolios and geographical reach. The total M&A volume from 2019 to 2024 is estimated at xx transactions.

North American Feed Testing Market Trends & Opportunities

The North American feed testing market is experiencing robust growth, driven by several key factors. Increasing consumer demand for safe and high-quality food products necessitates stringent feed quality control measures. This, coupled with the growing awareness of food safety and animal health, fosters continuous growth in the market.

Technological advancements, particularly the development and adoption of rapid and automated testing methods, are significantly enhancing testing efficiency and reducing turnaround time. This is complemented by the increasing demand for comprehensive testing panels that encompass pathogen detection, pesticide residue analysis, nutritional labeling, and mycotoxin screening. The market size is projected to expand from xx Million in 2025 to xx Million by 2033, with the highest growth rate expected in the segments of pathogen testing and mycotoxin testing due to increased concerns about foodborne illnesses and potential health hazards linked to mycotoxins.

Dominant Markets & Segments in North American Feed Testing Market

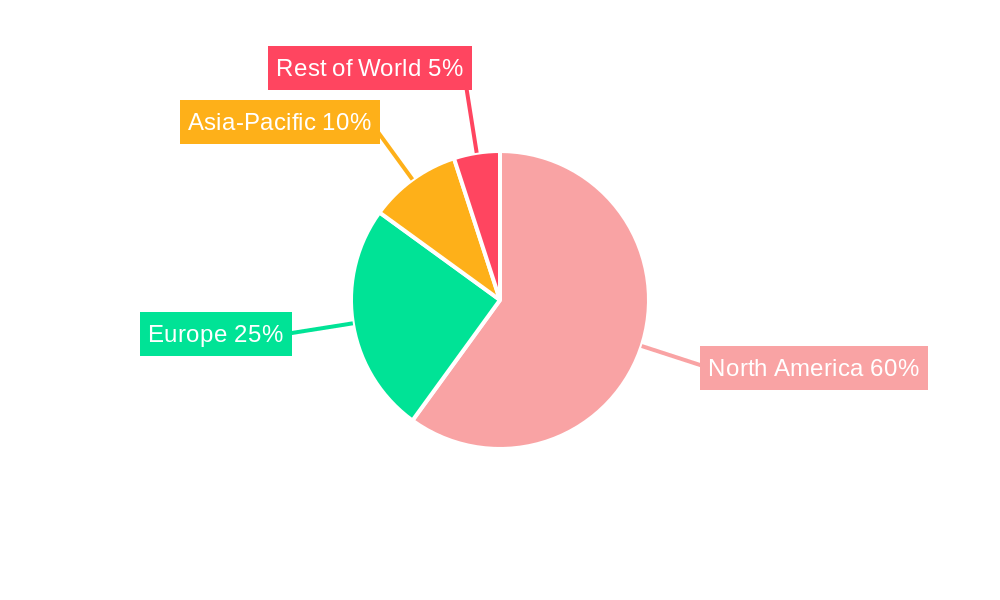

The poultry feed segment is a cornerstone of the North American feed testing market, propelled by the sheer volume of poultry production and the critical need for ensuring its safety through stringent regulatory compliance. Within North America, the United States commands the largest regional market share, a position reinforced by its extensive agricultural output and well-established regulatory infrastructure for feed safety.

Key Growth Drivers & Dominant Segments:

- Poultry Feed: Characterized by high production volumes, rigorous regulatory oversight, and a strong consumer preference for safe and high-quality poultry products, this segment stands out as a primary driver.

- Swine Feed: Mirroring the dynamics of the poultry sector, swine feed testing is significantly influenced by demanding regulatory frameworks and substantial production levels, contributing to sustained market growth.

- Pathogen Testing: The escalating global concern surrounding foodborne illnesses has intensified the demand for rapid, accurate, and reliable pathogen detection methods in animal feed.

- Mycotoxin Testing: An increasing awareness of the detrimental health impacts associated with mycotoxin contamination in feed has directly fueled a surge in demand for sophisticated mycotoxin analysis.

- Nutrient Analysis: Ensuring optimal nutrient profiles in animal feed is crucial for animal health and productivity, driving consistent demand for detailed nutritional testing.

- Residue Testing: With growing concerns about antimicrobial resistance and the presence of other chemical residues, testing for these contaminants is becoming increasingly vital for compliance and safety.

Detailed Analysis: The pronounced growth and dominance of the poultry feed segment are largely attributed to heightened regulatory scrutiny, evolving consumer expectations for premium and safe poultry products, and the inherent susceptibility of poultry feed to contamination by pathogens and mycotoxins. Advances in rapid pathogen detection technologies, coupled with enhanced efficiency in mycotoxin analysis, continue to solidify this segment's leadership position. Furthermore, the increasing focus on animal welfare and the production of healthier livestock directly translates into a greater emphasis on comprehensive feed analysis, encompassing everything from nutritional content to the absence of harmful contaminants.

North American Feed Testing Market Product Analysis

The market features a diverse range of testing products and services, including advanced analytical techniques such as PCR, ELISA, LC-MS/MS, and other sophisticated technologies. These methods provide accurate and rapid detection of pathogens, pesticides, mycotoxins, and nutritional components, ensuring the quality and safety of animal feed. The continuous improvement in test speed, accuracy, and cost-effectiveness through technological advancements positions the market for strong future growth. The growing availability of comprehensive testing panels addressing multiple analytical needs further boosts market penetration.

Key Drivers, Barriers & Challenges in North American Feed Testing Market

Key Drivers:

- Stringent Regulations: Robust governmental mandates and evolving food safety legislation across North America are foundational drivers for comprehensive feed testing to ensure quality and prevent contamination.

- Technological Advancements: Continuous innovation in analytical instrumentation and methodologies, leading to faster, more sensitive, and cost-effective testing solutions, significantly propels market adoption.

- Consumer Demand for Safe & Sustainable Food: A well-informed and increasingly health-conscious consumer base is actively demanding transparency and assurance of safety throughout the food production chain, directly impacting feed testing requirements.

- Focus on Animal Health & Welfare: A growing emphasis on animal well-being, disease prevention, and optimized nutrition necessitates advanced feed testing to support these objectives.

- Globalization of Food Supply Chains: The interconnected nature of global food production and trade amplifies the need for standardized and rigorous feed testing to maintain safety and prevent cross-border contamination.

Challenges & Restraints:

- High Capital Investment & Operational Costs: The adoption of cutting-edge testing technologies and maintaining sophisticated laboratory infrastructure can represent a significant financial barrier, particularly for smaller feed producers.

- Navigating Regulatory Landscapes: The presence of varying regulatory standards and compliance requirements across different provinces, states, and federal bodies within North America can create complexities and compliance hurdles.

- Supply Chain Vulnerabilities: Global geopolitical events, natural disasters, and logistical challenges can disrupt the availability of critical testing reagents, consumables, and specialized equipment, impacting testing capacity and turnaround times. For instance, such disruptions contributed to a notable reduction in overall testing capacity in previous years.

- Talent Acquisition & Retention: The need for skilled analytical chemists, microbiologists, and technicians to operate advanced equipment and interpret complex data presents an ongoing challenge for the industry.

- Data Management & Interpretation: The increasing volume and complexity of feed testing data necessitate robust systems for storage, analysis, and actionable interpretation, which can be a hurdle for some organizations.

Growth Drivers in the North American Feed Testing Market Market

The market's growth is fueled by stringent food safety regulations, technological advancements leading to faster and more accurate testing, and the rising demand for safe animal feed from consumers. Stringent governmental regulations, such as those from the FDA and USDA, compel feed manufacturers to invest in rigorous testing. Furthermore, technological innovation, including the development of rapid and highly sensitive tests, makes testing more efficient and cost-effective.

Challenges Impacting North American Feed Testing Market Growth

Challenges include the high cost of advanced testing technologies, which may limit access for smaller producers. Complex and potentially conflicting regulations across different states and provinces add regulatory burden, while supply chain issues, particularly concerning essential reagents and equipment, may impact testing capacity. Competitive pressures, including pricing wars, also constrain profitability.

Key Players Shaping the North American Feed Testing Market Market

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- Genon Laboratories Ltd

- Eurofins Scientific

- Invisible Sentinel Inc

Significant North American Feed Testing Market Industry Milestones

- 2020: Introduction of rapid PCR-based pathogen detection kits significantly reducing testing times.

- 2021: Several major players expanded their service portfolios to offer comprehensive testing packages.

- 2022: Implementation of stricter mycotoxin regulations in several states leading to increased testing demand.

- 2023: Successful merger between two leading feed testing companies expanding market coverage.

Future Outlook for North American Feed Testing Market Market

The North American feed testing market is poised for continued growth driven by the ever-increasing demand for safe and high-quality animal feed and the continuous development of innovative testing technologies. Strategic partnerships between testing companies and feed manufacturers are expected to further accelerate market expansion. The market holds significant potential for growth in emerging technologies, such as next-generation sequencing and advanced sensor technologies for real-time monitoring of feed quality.

North American Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North American Feed Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Feed Testing Market Regional Market Share

Geographic Coverage of North American Feed Testing Market

North American Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increasing Government Regulations Driving Growth of Pet Food Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bruker Biosciences Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetic ID NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genon Laboratories Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: North American Feed Testing Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North American Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North American Feed Testing Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North American Feed Testing Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Feed Testing Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the North American Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the North American Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 539.05 million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increasing Government Regulations Driving Growth of Pet Food Testing Market.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Feed Testing Market?

To stay informed about further developments, trends, and reports in the North American Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence