Key Insights

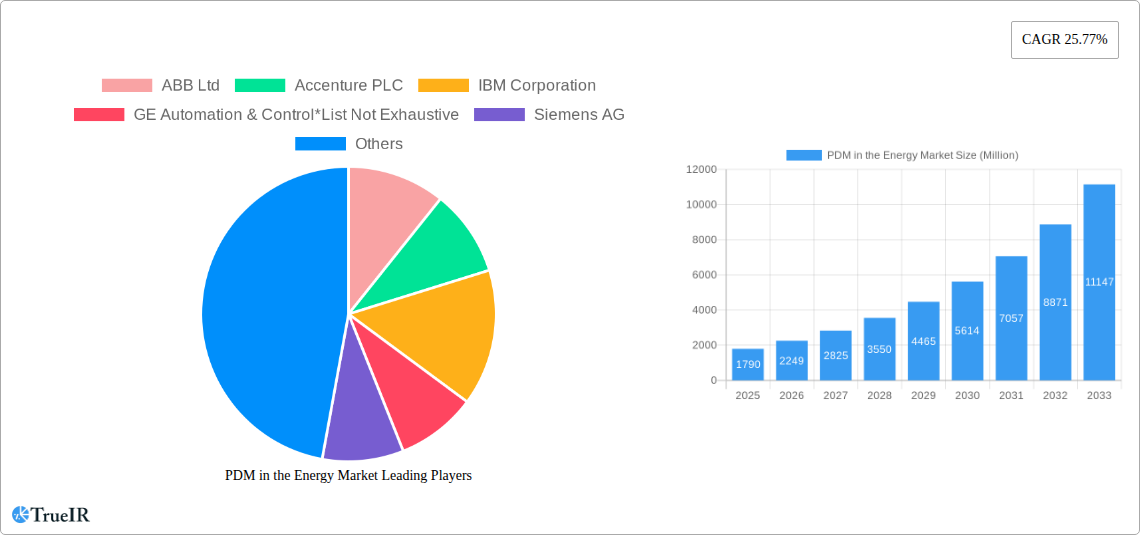

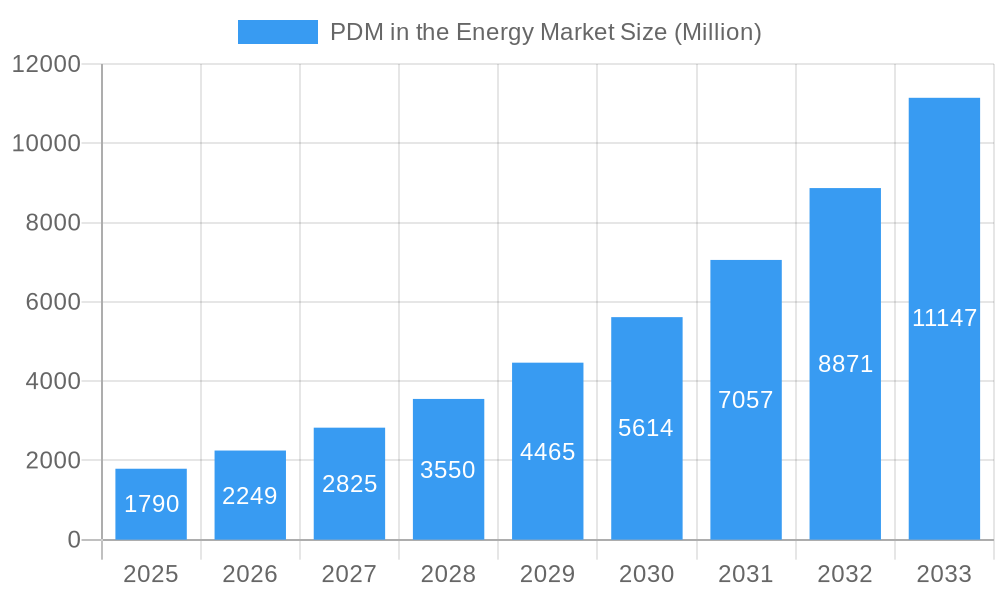

The Product Data Management (PDM) in the Energy Market is experiencing remarkable expansion, projected to reach a significant $1.79 billion by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 25.77% during the forecast period of 2025-2033. The sector is witnessing a strong demand for integrated solutions and comprehensive services, with a noticeable shift towards cloud-based deployments over traditional on-premise systems. Key drivers include the escalating need for efficient asset management, stringent regulatory compliance, and the growing complexity of energy infrastructure projects. The energy sector's ongoing digital transformation, coupled with the imperative to optimize operational efficiency and reduce downtime, positions PDM solutions as critical tools for managing vast amounts of product and project data throughout the lifecycle of energy assets. Companies are increasingly investing in PDM to streamline workflows, enhance collaboration, and ensure data integrity, ultimately leading to improved decision-making and cost savings.

PDM in the Energy Market Market Size (In Billion)

This dynamic market is characterized by several emerging trends that are shaping its trajectory. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into PDM systems is gaining traction, enabling predictive maintenance, anomaly detection, and enhanced data analytics for better performance monitoring. Furthermore, the increasing adoption of the Industrial Internet of Things (IIoT) across the energy value chain generates a continuous stream of data that PDM systems are essential for managing and analyzing. However, the market also faces certain restraints, including the significant upfront investment required for implementing sophisticated PDM solutions and the challenges associated with data security and privacy concerns, particularly in cloud environments. Interoperability issues between disparate legacy systems and the need for skilled personnel to manage and leverage these advanced PDM platforms also present hurdles. Despite these challenges, the relentless pursuit of operational excellence and the imperative to adapt to evolving energy landscapes will continue to drive robust growth in the PDM for the Energy Market.

PDM in the Energy Market Company Market Share

Here's a comprehensive, SEO-optimized report description for PDM in the Energy Market, adhering to all your specifications.

PDM in the Energy Market: Forecast to 2033 – Unlocking Efficiency and Sustainability Through Predictive Maintenance

This in-depth report provides a definitive analysis of the Predictive Maintenance (PDM) in the Energy Market, offering critical insights for stakeholders navigating this rapidly evolving sector. From 2019 to 2033, with a base year of 2025, this study meticulously examines market dynamics, technological advancements, and strategic imperatives. Discover how leading companies like ABB Ltd, Accenture PLC, IBM Corporation, GE Automation & Control, Siemens AG, Banner Engineering Corp, Schneider Electric, Robert Bosch GmbH, Intel Corporation, and SAP SE are leveraging PDM to optimize operations, enhance asset reliability, and drive sustainable energy solutions. This report is essential for understanding the future of energy infrastructure management, anticipating challenges, and capitalizing on emerging opportunities within the global PDM landscape.

PDM in the Energy Market Market Structure & Competitive Landscape

The PDM in the Energy Market is characterized by a dynamic and increasingly consolidated structure, driven by the relentless pursuit of operational efficiency and the imperative for energy sustainability. Market concentration is influenced by significant investments in advanced analytics and AI-powered solutions. Innovation is primarily fueled by the demand for enhanced asset lifecycle management, reduced downtime, and predictive failure detection across critical energy infrastructure. Regulatory impacts, particularly those promoting green energy transitions and data security, are shaping market entry and operational strategies. Product substitutes, while present in traditional maintenance approaches, are progressively being outpaced by the superior predictive capabilities of PDM solutions. End-user segmentation within the energy sector spans power generation, transmission, distribution, renewables, and oil & gas, each with distinct PDM adoption drivers. Mergers & Acquisitions (M&A) activity is expected to remain robust as larger players seek to integrate cutting-edge technologies and expand their service portfolios, further consolidating market share. The increasing complexity of energy grids and the aging of existing infrastructure are key drivers pushing for greater adoption of sophisticated PDM strategies.

PDM in the Energy Market Market Trends & Opportunities

The PDM in the Energy Market is poised for substantial growth, driven by a confluence of technological advancements, increasing operational demands, and a global push towards sustainable energy practices. The market size is projected to expand significantly, with a compound annual growth rate (CAGR) of approximately 15-20% forecasted for the period of 2025–2033. This expansion is propelled by technological shifts, most notably the widespread adoption of the Internet of Things (IoT), enabling real-time data collection from a vast array of energy assets, from turbines and transformers to solar panels and wind farms. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are becoming increasingly sophisticated, offering unparalleled predictive accuracy for asset failure, thereby minimizing unplanned downtime and reducing maintenance costs. Consumer preferences are shifting towards more reliable and environmentally conscious energy services, which PDM directly supports by optimizing asset performance and reducing energy wastage. Competitive dynamics are intensifying, with a clear trend towards integrated solutions that combine hardware, software, and advanced analytics. Opportunities abound for companies that can offer end-to-end predictive maintenance solutions, encompassing everything from sensor deployment and data integration to AI-driven diagnostics and proactive intervention strategies. The increasing complexity of global energy grids, coupled with the aging of critical infrastructure, creates a persistent need for advanced maintenance solutions. Furthermore, the global drive towards decarbonization and the expansion of renewable energy sources necessitate robust PDM strategies to ensure the reliability and efficiency of these new energy assets. The integration of PDM with digital twins and other digital transformation initiatives presents a significant avenue for future growth and market penetration. The market penetration rate of PDM solutions is expected to surge as organizations recognize the substantial return on investment through reduced operational expenditures and enhanced asset longevity.

Dominant Markets & Segments in PDM in the Energy Market

The PDM in the Energy Market exhibits strong dominance within cloud-based deployment models, reflecting a global trend towards flexible, scalable, and accessible predictive maintenance solutions. Cloud platforms offer distinct advantages, including lower upfront infrastructure costs, easier data management and analysis, and enhanced collaboration capabilities among remote teams. This segment is experiencing rapid expansion as energy companies embrace digital transformation and seek to leverage advanced analytics without the burden of managing complex on-premise IT environments.

- Cloud Deployment Model Dominance: The scalability and cost-effectiveness of cloud-based PDM are key drivers. This model facilitates real-time data processing and analysis from distributed energy assets, enabling faster insights and more agile decision-making.

- Services Offering Strength: The Services segment within PDM is equally dominant. This includes a wide range of offerings such as consulting, implementation, data analytics, system integration, and ongoing support. Energy companies often rely on specialized service providers to deploy and manage complex PDM systems, leveraging their expertise to maximize ROI.

- Solutions Offering Growth: While services are crucial, the Solutions segment, encompassing the software and platforms that power PDM, is also a major growth area. These solutions are increasingly integrated with IoT devices and AI capabilities to provide comprehensive asset monitoring and predictive insights.

The dominance of these segments is underpinned by several key growth drivers:

- Infrastructure Modernization: Aging energy infrastructure globally necessitates advanced maintenance strategies to prevent failures and extend asset life. PDM plays a crucial role in identifying potential issues before they escalate.

- Policy Support for Green Energy: Government initiatives and international agreements promoting renewable energy and energy efficiency directly boost the adoption of PDM. Ensuring the reliability of solar, wind, and other renewable assets is paramount.

- Digital Transformation Imperatives: Energy companies are increasingly investing in digital technologies to enhance operational efficiency, reduce costs, and improve safety. PDM is a cornerstone of this digital transformation.

- Increasing Complexity of Energy Grids: The integration of diverse energy sources, smart grid technologies, and distributed energy resources creates a more complex operational environment, demanding sophisticated monitoring and maintenance solutions like PDM.

PDM in the Energy Market Product Analysis

The PDM in the Energy Market is characterized by a rapid evolution of product offerings, driven by advancements in AI, IoT, and big data analytics. Solutions are increasingly focusing on providing real-time anomaly detection, remaining useful life (RUL) estimation, and prescriptive maintenance recommendations. Competitive advantages are derived from the accuracy of predictive models, the seamless integration with existing energy management systems, and the user-friendliness of the interfaces. Technological advancements such as edge computing for localized data processing and enhanced cybersecurity measures are becoming standard. The market fit for these products is exceptionally strong, addressing critical needs for asset reliability, operational cost reduction, and improved safety across the entire energy value chain, from generation to distribution.

Key Drivers, Barriers & Challenges in PDM in the Energy Market

Key Drivers:

- Technological Advancements: The proliferation of IoT sensors, AI algorithms, and cloud computing platforms significantly enhances the capabilities and affordability of PDM solutions.

- Economic Efficiency: PDM significantly reduces unscheduled downtime, minimizes costly repairs, and optimizes maintenance schedules, leading to substantial cost savings.

- Regulatory Compliance & Sustainability: Growing environmental regulations and the push for sustainable energy practices incentivize the adoption of PDM to ensure efficient and reliable asset performance.

Barriers & Challenges:

- High Initial Investment: The upfront cost of implementing comprehensive PDM systems, including sensors, software, and integration, can be a significant barrier for some organizations.

- Data Integration & Quality Issues: Siloed data systems and inconsistent data quality across different assets can hinder the effectiveness of predictive models, impacting accuracy and reliability.

- Skill Gap & Workforce Training: A shortage of skilled personnel capable of implementing, operating, and interpreting data from PDM systems presents a challenge to widespread adoption.

- Cybersecurity Concerns: The increased reliance on connected devices and cloud platforms raises concerns about data breaches and cyberattacks on critical energy infrastructure.

Growth Drivers in the PDM in the Energy Market Market

The PDM in the Energy Market is propelled by several interconnected growth drivers. Technological innovation is paramount, with the continuous advancement of AI, ML, and IoT providing increasingly sophisticated tools for asset monitoring and failure prediction. Economically, the undeniable ROI from reduced downtime and optimized maintenance costs is a primary motivator for investment. Furthermore, evolving regulatory landscapes that emphasize energy efficiency, sustainability, and grid reliability are creating a strong demand for effective PDM solutions. For instance, initiatives like the European Union's investment in Morocco's green energy sector are directly fostering the adoption of PDM technologies. The increasing complexity of energy infrastructure and the growing integration of renewable energy sources also necessitate robust predictive maintenance strategies to ensure consistent and reliable power supply.

Challenges Impacting PDM in the Energy Market Growth

Several significant challenges are impacting the growth of the PDM in the Energy Market. Regulatory complexities surrounding data privacy and security can slow down the implementation of cloud-based solutions. Supply chain issues for specialized sensors and hardware components can lead to project delays and increased costs. Moreover, intense competitive pressures from established players and emerging technology providers necessitate continuous innovation and competitive pricing strategies. The substantial initial investment required for comprehensive PDM system deployment remains a considerable barrier for many smaller utilities and organizations. Furthermore, the need for specialized expertise to effectively implement and manage these systems creates a skill gap that can hinder wider adoption.

Key Players Shaping the PDM in the Energy Market Market

- ABB Ltd

- Accenture PLC

- IBM Corporation

- GE Automation & Control

- Siemens AG

- Banner Engineering Corp

- Schneider Electric

- Robert Bosch GmbH

- Intel Corporation

- SAP SE

Significant PDM in the Energy Market Industry Milestones

- September 2022: Atlas AI partnered with the Rockefeller Foundation to leverage satellite data and ML for Sub-Saharan African countries (Kenya, Rwanda, Uganda, Nigeria) to address green infrastructure investment gaps and accelerate climate action. This highlights the growing role of predictive analytics in sustainable development.

- June 2022: Hinduja Tech entered the IoT market with Senseye, an AI-powered platform for machine reliability and predictive maintenance, integrating with SAP automotive solutions to predict machine failures and improve asset care. This signifies the expansion of AI-driven PDM into new verticals.

- February 2022: The European Union announced a EUR 1.6 billion (USD 1,690 million) investment in Morocco's green energy sector, promoting green and digital transition. This initiative is expected to significantly boost the demand for predictive maintenance solutions to ensure the efficiency and reliability of new green energy infrastructure.

Future Outlook for PDM in the Energy Market Market

The future outlook for the PDM in the Energy Market is exceptionally promising, characterized by sustained high growth and increasing integration of advanced technologies. Strategic opportunities lie in the continued expansion of cloud-based solutions, enhanced AI-driven predictive accuracy, and the development of prescriptive maintenance capabilities that offer automated repair recommendations. The global drive towards decarbonization and the electrification of transportation will further fuel demand for robust PDM solutions to manage the reliability of renewable energy assets and electric vehicle charging infrastructure. Companies that can offer integrated, end-to-end PDM platforms, coupled with strong data analytics services, will be well-positioned to capture significant market share. The market potential is immense, driven by the ongoing need to optimize asset performance, reduce operational costs, and ensure the resilience of the global energy supply.

PDM in the Energy Market Segmentation

-

1. Offering

- 1.1. Solutions

- 1.2. Services

-

2. Deployment Model

- 2.1. On-premise

- 2.2. Cloud

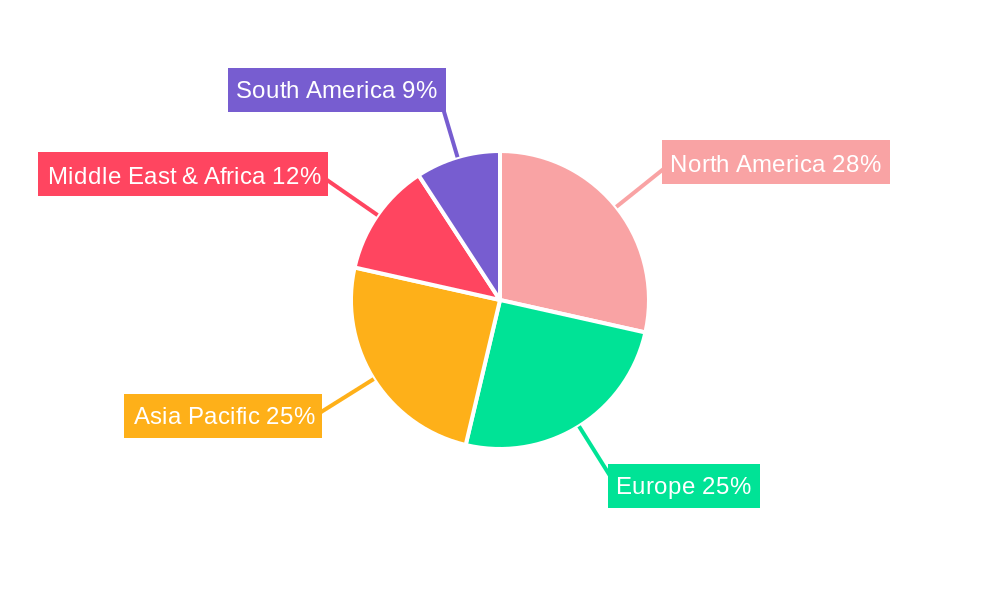

PDM in the Energy Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

PDM in the Energy Market Regional Market Share

Geographic Coverage of PDM in the Energy Market

PDM in the Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in the Energy Sector; Increasing Adoption of Automation

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About the Benefits of Sports Analytics Solutions

- 3.4. Market Trends

- 3.4.1. Solutions Segment is Anticipated to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PDM in the Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America PDM in the Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. South America PDM in the Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Europe PDM in the Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Middle East & Africa PDM in the Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Asia Pacific PDM in the Energy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accenture PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Automation & Control*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Banner Engineering Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Robert Bosch GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intel Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAP SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global PDM in the Energy Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America PDM in the Energy Market Revenue (Million), by Offering 2025 & 2033

- Figure 3: North America PDM in the Energy Market Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America PDM in the Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 5: North America PDM in the Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 6: North America PDM in the Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America PDM in the Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America PDM in the Energy Market Revenue (Million), by Offering 2025 & 2033

- Figure 9: South America PDM in the Energy Market Revenue Share (%), by Offering 2025 & 2033

- Figure 10: South America PDM in the Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 11: South America PDM in the Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 12: South America PDM in the Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America PDM in the Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe PDM in the Energy Market Revenue (Million), by Offering 2025 & 2033

- Figure 15: Europe PDM in the Energy Market Revenue Share (%), by Offering 2025 & 2033

- Figure 16: Europe PDM in the Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 17: Europe PDM in the Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 18: Europe PDM in the Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe PDM in the Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa PDM in the Energy Market Revenue (Million), by Offering 2025 & 2033

- Figure 21: Middle East & Africa PDM in the Energy Market Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Middle East & Africa PDM in the Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 23: Middle East & Africa PDM in the Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 24: Middle East & Africa PDM in the Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa PDM in the Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific PDM in the Energy Market Revenue (Million), by Offering 2025 & 2033

- Figure 27: Asia Pacific PDM in the Energy Market Revenue Share (%), by Offering 2025 & 2033

- Figure 28: Asia Pacific PDM in the Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 29: Asia Pacific PDM in the Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 30: Asia Pacific PDM in the Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific PDM in the Energy Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global PDM in the Energy Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global PDM in the Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 3: Global PDM in the Energy Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global PDM in the Energy Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 5: Global PDM in the Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 6: Global PDM in the Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global PDM in the Energy Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 11: Global PDM in the Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 12: Global PDM in the Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global PDM in the Energy Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 17: Global PDM in the Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 18: Global PDM in the Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global PDM in the Energy Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 29: Global PDM in the Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 30: Global PDM in the Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global PDM in the Energy Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 38: Global PDM in the Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 39: Global PDM in the Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific PDM in the Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PDM in the Energy Market?

The projected CAGR is approximately 25.77%.

2. Which companies are prominent players in the PDM in the Energy Market?

Key companies in the market include ABB Ltd, Accenture PLC, IBM Corporation, GE Automation & Control*List Not Exhaustive, Siemens AG, Banner Engineering Corp, Schneider Electric, Robert Bosch GmbH, Intel Corporation, SAP SE.

3. What are the main segments of the PDM in the Energy Market?

The market segments include Offering, Deployment Model.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in the Energy Sector; Increasing Adoption of Automation.

6. What are the notable trends driving market growth?

Solutions Segment is Anticipated to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness About the Benefits of Sports Analytics Solutions.

8. Can you provide examples of recent developments in the market?

September 2022: Electricity Growth and Use in Developing Economies Atlas AI, a predictive analytics platform, partnered with the Rockefeller Foundation, a US-based energy research organization, to assist Sub-Saharan African countries such as Kenya, Rwanda, Uganda, and Nigeria in addressing the impending green infrastructure investment gap and accelerating climate action initiatives through the use of satellite data and machine learning (ML) technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PDM in the Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PDM in the Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PDM in the Energy Market?

To stay informed about further developments, trends, and reports in the PDM in the Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence