Key Insights

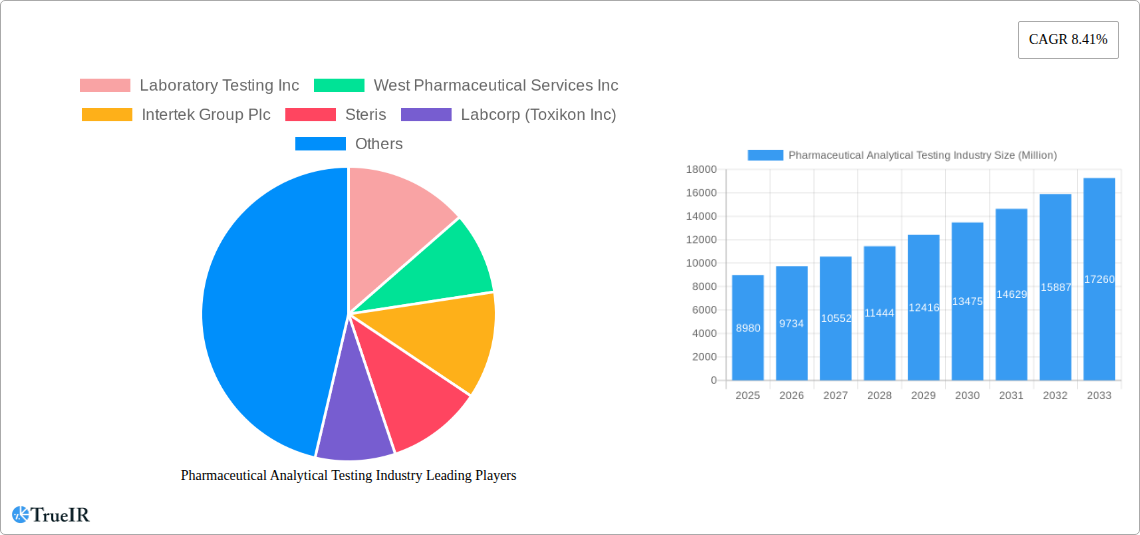

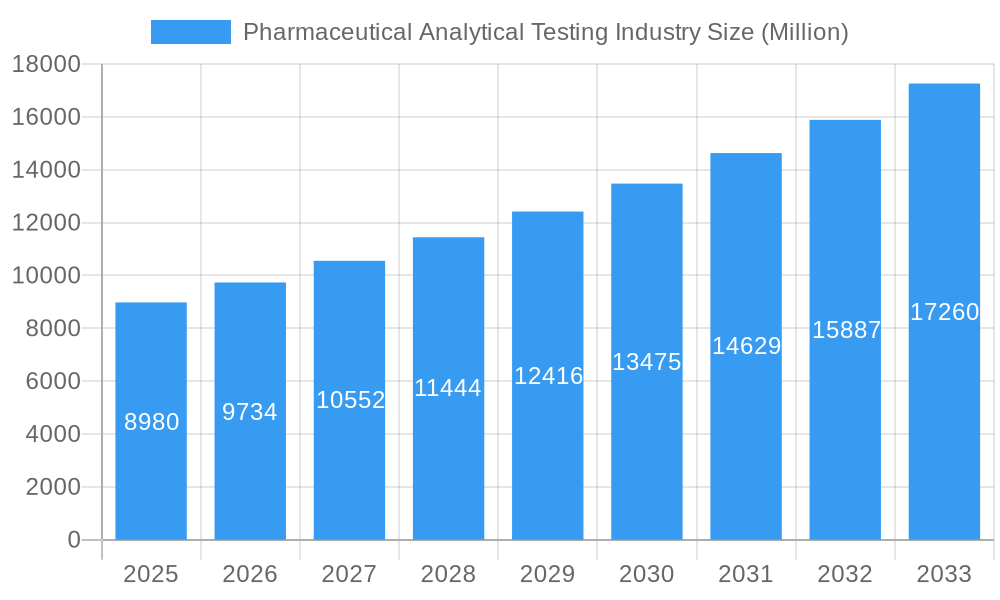

The Pharmaceutical Analytical Testing Industry is experiencing robust growth, with a current market size estimated at $8.98 billion in 2025. This expansion is propelled by a Compound Annual Growth Rate (CAGR) of 8.41%, projecting the market to reach significant new heights by 2033. Key drivers fueling this trajectory include the escalating complexity of drug development, the increasing demand for novel therapeutics, and stringent regulatory mandates worldwide that necessitate rigorous quality control and assurance throughout the drug lifecycle. The pharmaceutical sector's continuous innovation in biologics, personalized medicine, and advanced drug delivery systems further amplifies the need for sophisticated analytical testing services. Furthermore, the growing prevalence of chronic diseases and an aging global population contribute to an increased demand for pharmaceutical products, thereby directly influencing the market for their essential analytical testing.

Pharmaceutical Analytical Testing Industry Market Size (In Billion)

The market is segmented into critical service types, including Bioanalytical Testing, Method Development & Validation, Stability Testing, and Drug Substances Testing, each playing a vital role in ensuring drug safety, efficacy, and compliance. Trends such as the adoption of advanced analytical technologies like mass spectrometry and chromatography, alongside an increasing reliance on outsourcing analytical testing to specialized contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs), are shaping the industry landscape. Major players like Laboratory Testing Inc, West Pharmaceutical Services Inc, Intertek Group Plc, Steris, Labcorp, Eurofins Scientific, SGS SA, Boston Analytical, and Pace Analytical Services are strategically expanding their capabilities and global presence to meet this growing demand. While the market demonstrates strong growth potential, potential restraints such as high operational costs, a shortage of skilled analytical scientists, and the evolving regulatory frameworks present challenges that industry stakeholders must navigate to sustain this upward momentum.

Pharmaceutical Analytical Testing Industry Company Market Share

Unlock the Future of Pharma: Comprehensive Pharmaceutical Analytical Testing Industry Market Report (2019-2033)

Gain unparalleled insights into the rapidly evolving pharmaceutical analytical testing industry. This in-depth report, covering the study period 2019–2033 with a base year of 2025, provides a critical analysis of market dynamics, growth opportunities, and competitive strategies. Essential for pharmaceutical manufacturers, CROs, regulatory bodies, and investors, this report equips you with the data and foresight to navigate this critical sector. Featuring high-volume keywords such as pharmaceutical testing, drug analysis, bioanalytical services, method validation, and stability studies, this report is meticulously crafted for maximum SEO impact and reader engagement.

Pharmaceutical Analytical Testing Industry Market Structure & Competitive Landscape

The pharmaceutical analytical testing industry exhibits a moderately concentrated market structure, driven by the intricate scientific expertise, substantial capital investment required for advanced instrumentation, and stringent regulatory compliance. Innovation remains a paramount driver, with companies continuously investing in R&D to develop novel analytical techniques and accelerate drug development timelines. Regulatory impacts, particularly from agencies like the FDA and EMA, significantly shape market offerings, demanding rigorous quality control and validation protocols. Product substitutes, while existing in the form of in-house testing capabilities for some larger pharmaceutical firms, are often outpaced by the specialized services and economies of scale offered by dedicated analytical testing providers.

End-user segmentation is diverse, encompassing:

- Small Molecule Drugs: Requiring precise chemical characterization.

- Biologics: Demanding complex protein and gene analysis.

- Vaccines: Needing extensive safety and potency testing.

- Medical Devices: Subject to material and biocompatibility assessments.

Mergers and acquisitions (M&A) are a significant trend, with an estimated XX M volume in M&A activity during the historical period, consolidating market share and expanding service portfolios. Key players are actively acquiring smaller niche laboratories to enhance their geographic reach and technological capabilities. The competitive landscape is characterized by a blend of large, global contract research organizations (CROs) and specialized, boutique laboratories, each vying for market dominance through technological superiority, comprehensive service offerings, and strong client relationships.

Pharmaceutical Analytical Testing Industry Market Trends & Opportunities

The pharmaceutical analytical testing industry is poised for substantial growth, projected to expand significantly from its 2025 estimated market size of USD 75,000 Million. This upward trajectory is fueled by an increasing number of drug approvals, a growing pipeline of complex biologics, and a heightened emphasis on drug quality and safety. The market is projected to achieve a CAGR of 12.5% during the forecast period of 2025–2033. Technological advancements are at the forefront of this expansion, with the integration of artificial intelligence (AI) and machine learning (ML) in data analysis, automation in high-throughput screening, and the adoption of advanced spectroscopic and chromatographic techniques driving efficiency and precision.

Consumer preferences, driven by patient demand for safer and more effective treatments, are pushing pharmaceutical companies to invest more heavily in preclinical and clinical analytical testing. This translates to increased demand for specialized services such as impurity profiling, stability testing under various conditions, and comprehensive bioanalytical testing for pharmacokinetics and pharmacodynamics. The competitive dynamics are intensifying, with a clear emphasis on speed, accuracy, and cost-effectiveness. Companies that can offer end-to-end solutions, from early-stage method development to late-stage commercial batch release testing, are gaining a significant competitive edge.

The increasing prevalence of chronic diseases and the growing elderly population worldwide are contributing to a robust pipeline of new drug development, directly benefiting the analytical testing sector. Furthermore, the trend towards personalized medicine and the development of novel drug delivery systems, such as mRNA vaccines and gene therapies, necessitate highly specialized and sensitive analytical methods, creating new market niches and opportunities. The market penetration rate of advanced analytical techniques is expected to rise considerably as regulatory bodies continue to push for higher standards of drug quality and patient safety. The burgeoning biopharmaceutical sector, in particular, is a major growth engine, demanding intricate characterization and quality control for complex biological molecules.

Dominant Markets & Segments in Pharmaceutical Analytical Testing Industry

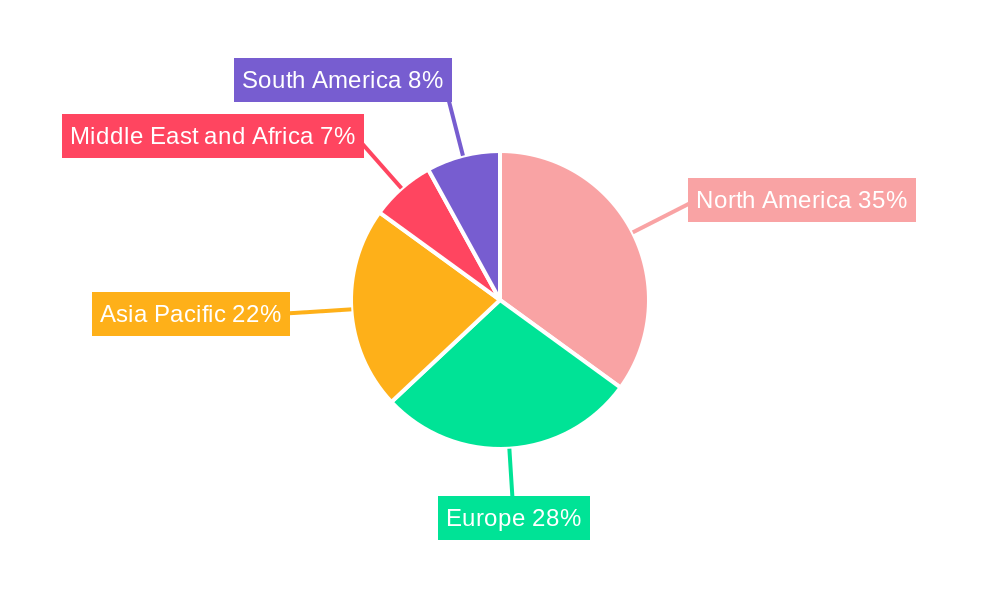

The North America region currently dominates the pharmaceutical analytical testing industry, with the United States leading as the single largest market. This dominance is attributed to a robust pharmaceutical and biotechnology ecosystem, a high concentration of R&D activities, and stringent regulatory requirements that necessitate extensive analytical testing. The presence of major pharmaceutical companies and a well-established network of contract research organizations (CROs) further solidify its position.

Within the service types, Bioanalytical Testing and Stability Testing are the largest and most rapidly growing segments.

Bioanalytical Testing: This segment is driven by the increasing development of biologics, vaccines, and advanced therapeutic modalities. Key growth drivers include:

- Rising Biologics Pipeline: A surge in the development of monoclonal antibodies, gene therapies, and cell therapies requires sophisticated bioanalytical methods for characterization and quantification.

- Personalized Medicine: The growing demand for targeted therapies necessitates precise measurement of drug concentrations in biological matrices.

- Complex Biomarkers: The identification and validation of new biomarkers for disease diagnosis and treatment monitoring further boost demand.

Stability Testing: This segment is critical for ensuring drug efficacy and safety throughout its shelf life. Growth is propelled by:

- Extended Shelf-Life Requirements: Pharmaceutical companies aim for longer shelf lives to improve distribution and accessibility.

- Global Regulatory Mandates: Strict guidelines from regulatory bodies worldwide mandate comprehensive stability studies under various climatic conditions.

- Supply Chain Complexity: Globalized supply chains necessitate rigorous testing to ensure product integrity during transit and storage.

Method Development & Validation also represents a significant segment, essential for the reliable and reproducible testing of new drug candidates. The increasing complexity of drug molecules and the need for faster development cycles drive innovation in this area. Drug Substances Testing remains a foundational segment, ensuring the quality and purity of active pharmaceutical ingredients (APIs).

The expansion of pharmaceutical manufacturing capabilities and research facilities in emerging markets, particularly in Asia-Pacific, presents significant future growth opportunities. Government initiatives to promote local drug manufacturing and R&D, coupled with a growing patient population, are contributing to the rapid expansion of analytical testing services in these regions.

Pharmaceutical Analytical Testing Industry Product Analysis

The pharmaceutical analytical testing industry is characterized by a continuous stream of product innovations focused on enhancing precision, speed, and sensitivity. Advancements in mass spectrometry (LC-MS/MS), chromatography (HPLC, GC), and advanced spectroscopic techniques are enabling more accurate impurity profiling, structural elucidation, and quantification of active pharmaceutical ingredients (APIs) and their metabolites. The application of these technologies spans from early-stage drug discovery, supporting compound identification and characterization, to late-stage quality control, ensuring batch-to-batch consistency and regulatory compliance. Competitive advantages are increasingly derived from the ability to offer integrated solutions, such as comprehensive stability testing programs that utilize predictive modeling, and specialized bioanalytical services for novel therapeutic modalities like cell and gene therapies.

Key Drivers, Barriers & Challenges in Pharmaceutical Analytical Testing Industry

Key Drivers: The pharmaceutical analytical testing industry is propelled by several key factors:

- Increasing R&D Investments: Pharmaceutical and biotechnology companies are escalating investments in drug discovery and development, leading to higher demand for analytical services.

- Stringent Regulatory Landscape: Evolving and rigorous regulatory requirements from bodies like the FDA and EMA necessitate comprehensive and accurate testing throughout the drug lifecycle.

- Growth in Biologics and Biosimilars: The expanding pipeline of complex biologics and the increasing development of biosimilars require specialized analytical expertise.

- Technological Advancements: The adoption of cutting-edge technologies like AI, automation, and advanced analytical instrumentation enhances efficiency and data quality.

Barriers & Challenges: Despite strong growth prospects, the industry faces significant challenges:

- High Capital Expenditure: The cost of acquiring and maintaining advanced analytical equipment and infrastructure is substantial.

- Talent Shortage: A scarcity of skilled analytical scientists and technicians can impede growth and service delivery.

- Regulatory Compliance Costs: Adhering to ever-changing regulatory standards can be time-consuming and costly.

- Price Pressures: Competitive market dynamics and the demand for cost-effective solutions can impact profit margins.

- Supply Chain Disruptions: Global events can impact the availability of critical reagents, consumables, and equipment, affecting testing timelines.

Growth Drivers in the Pharmaceutical Analytical Testing Industry Market

The pharmaceutical analytical testing industry's growth is primarily propelled by escalating global R&D expenditure in the pharmaceutical and biotechnology sectors, a direct response to the increasing burden of chronic diseases and the demand for novel therapeutics. The tightening regulatory environment worldwide, emphasizing enhanced drug safety, efficacy, and quality, mandates more comprehensive and sophisticated analytical testing. Furthermore, the burgeoning field of biologics, including vaccines, monoclonal antibodies, and advanced therapies like gene and cell therapies, inherently requires specialized and sensitive analytical techniques for characterization and quality control. Technological advancements, such as the integration of automation, artificial intelligence (AI) for data analysis, and the adoption of high-resolution mass spectrometry and advanced chromatography, are enhancing efficiency, accuracy, and speed, thereby driving market expansion.

Challenges Impacting Pharmaceutical Analytical Testing Industry Growth

Several key challenges can impact the growth of the pharmaceutical analytical testing industry. The significant capital investment required for state-of-the-art analytical instrumentation and infrastructure presents a substantial barrier to entry and expansion, particularly for smaller players. Furthermore, a persistent shortage of highly skilled analytical scientists and technicians can limit service capacity and innovation. Maintaining compliance with the increasingly complex and evolving global regulatory landscape requires continuous investment in expertise and quality systems, adding to operational costs. Intense market competition, with numerous global and regional players, often leads to price pressures, impacting profitability. Finally, disruptions in global supply chains for critical reagents, consumables, and equipment can lead to extended lead times and project delays, affecting the overall efficiency of the testing process.

Key Players Shaping the Pharmaceutical Analytical Testing Industry Market

- Laboratory Testing Inc

- West Pharmaceutical Services Inc

- Intertek Group Plc

- Steris

- Labcorp (Toxikon Inc)

- Eurofins Scientific

- SGS SA

- Boston Analytical

- Pace Analytical Services

Significant Pharmaceutical Analytical Testing Industry Industry Milestones

- March 2024: LGM Pharma invested over USD 2 million to expand its analytical testing services and include drug delivery suppository manufacturing capabilities by 50% in its facility in Rosenburg, Texas. This strategic expansion enhances its integrated service offering and capacity for specialized drug delivery solutions.

- January 2024: Kindeva Drug Delivery increased its analytical service capabilities by launching a new global business unit, which provides integrated and stand-alone analytical support to pharmaceutical, biopharmaceutical, and medical device companies. This move signifies a commitment to broadening its service portfolio and catering to a wider client base.

Future Outlook for Pharmaceutical Analytical Testing Industry Market

The future outlook for the pharmaceutical analytical testing industry is exceptionally robust, driven by an insatiable demand for new and improved therapeutics. Strategic opportunities lie in the continued expansion of bioanalytical services to support the rapidly growing biologics and personalized medicine markets. Investment in advanced technologies, including AI and automation, will be crucial for enhancing efficiency and offering more predictive analytical solutions. The increasing focus on drug lifecycle management, including post-market surveillance and generic drug development, will sustain demand for routine quality control and stability testing. Emerging markets, with their expanding pharmaceutical manufacturing bases, represent significant untapped potential. The industry is expected to witness further consolidation through M&A, as larger players seek to enhance their comprehensive service offerings and global reach.

Pharmaceutical Analytical Testing Industry Segmentation

-

1. Service Type

- 1.1. Bioanalytical Testing

- 1.2. Method Development & Validation

- 1.3. Stability Testing

- 1.4. Drug Substances Testing

- 1.5. Other Service Types

Pharmaceutical Analytical Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pharmaceutical Analytical Testing Industry Regional Market Share

Geographic Coverage of Pharmaceutical Analytical Testing Industry

Pharmaceutical Analytical Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Clinical Trials; Focus on Analytical Testing of Biologics and Biosimilars; Increased Trend of Outsourcing Laboratory Testing Services

- 3.3. Market Restrains

- 3.3.1. Complex Regulatory Framework for Maintaining Laboratories; Challenges in the Development of Proper Analytical Techniques

- 3.4. Market Trends

- 3.4.1. Stability Testing Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Bioanalytical Testing

- 5.1.2. Method Development & Validation

- 5.1.3. Stability Testing

- 5.1.4. Drug Substances Testing

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Bioanalytical Testing

- 6.1.2. Method Development & Validation

- 6.1.3. Stability Testing

- 6.1.4. Drug Substances Testing

- 6.1.5. Other Service Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Bioanalytical Testing

- 7.1.2. Method Development & Validation

- 7.1.3. Stability Testing

- 7.1.4. Drug Substances Testing

- 7.1.5. Other Service Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Bioanalytical Testing

- 8.1.2. Method Development & Validation

- 8.1.3. Stability Testing

- 8.1.4. Drug Substances Testing

- 8.1.5. Other Service Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East and Africa Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Bioanalytical Testing

- 9.1.2. Method Development & Validation

- 9.1.3. Stability Testing

- 9.1.4. Drug Substances Testing

- 9.1.5. Other Service Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. South America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Bioanalytical Testing

- 10.1.2. Method Development & Validation

- 10.1.3. Stability Testing

- 10.1.4. Drug Substances Testing

- 10.1.5. Other Service Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Laboratory Testing Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 West Pharmaceutical Services Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Steris

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Labcorp (Toxikon Inc)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurofins Scientific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SGS SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boston Analytical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pace Analytical Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Laboratory Testing Inc

List of Figures

- Figure 1: Global Pharmaceutical Analytical Testing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 7: Europe Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: Europe Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 19: South America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: South America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: GCC Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 30: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Analytical Testing Industry?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Pharmaceutical Analytical Testing Industry?

Key companies in the market include Laboratory Testing Inc, West Pharmaceutical Services Inc, Intertek Group Plc, Steris, Labcorp (Toxikon Inc), Eurofins Scientific, SGS SA, Boston Analytical, Pace Analytical Services.

3. What are the main segments of the Pharmaceutical Analytical Testing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Clinical Trials; Focus on Analytical Testing of Biologics and Biosimilars; Increased Trend of Outsourcing Laboratory Testing Services.

6. What are the notable trends driving market growth?

Stability Testing Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Complex Regulatory Framework for Maintaining Laboratories; Challenges in the Development of Proper Analytical Techniques.

8. Can you provide examples of recent developments in the market?

March 2024: LGM Pharma invested over USD 2 million to expand its analytical testing services and include drug delivery suppository manufacturing capabilities by 50% in its facility in Rosenburg, Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Analytical Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Analytical Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Analytical Testing Industry?

To stay informed about further developments, trends, and reports in the Pharmaceutical Analytical Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence