Key Insights

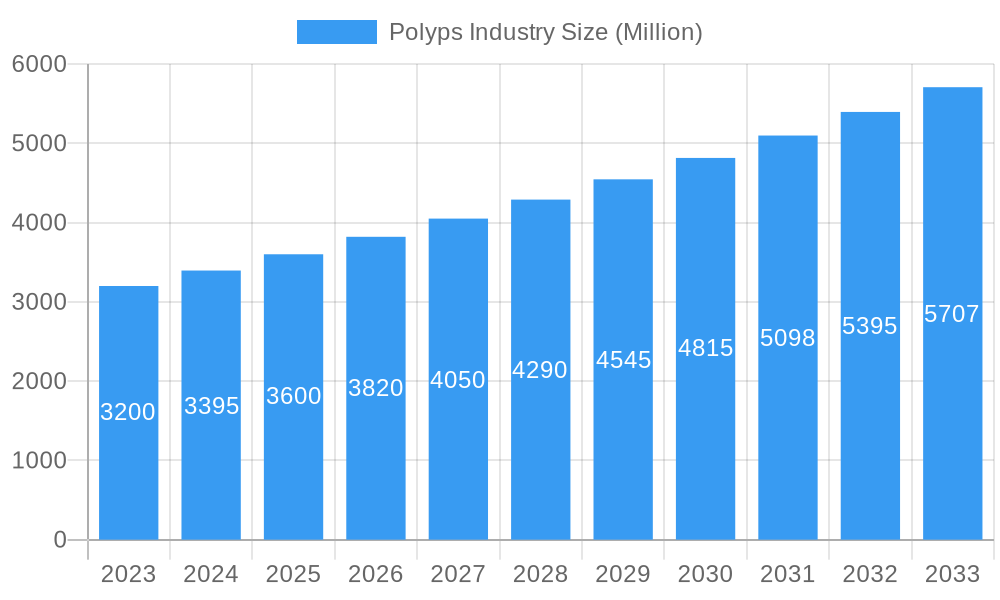

The global polyps market is projected for significant expansion, estimated to reach 71.6 million by 2024, driven by a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This growth is underpinned by the increasing incidence of polyp-related conditions, including nasal and gastrointestinal polyps, influenced by lifestyle, environmental shifts, and an aging demographic. Enhanced diagnostic technologies facilitate earlier and more precise detection, bolstering market demand. The advent of novel therapeutic agents, such as targeted biologics and advanced drug formulations, also acts as a key growth stimulant, promising improved efficacy and patient outcomes. Growing awareness of the long-term complications of untreated polyps, such as chronic sinusitis, asthma exacerbations, and potential malignancy, is encouraging proactive intervention and treatment seeking.

Polyps Industry Market Size (In Million)

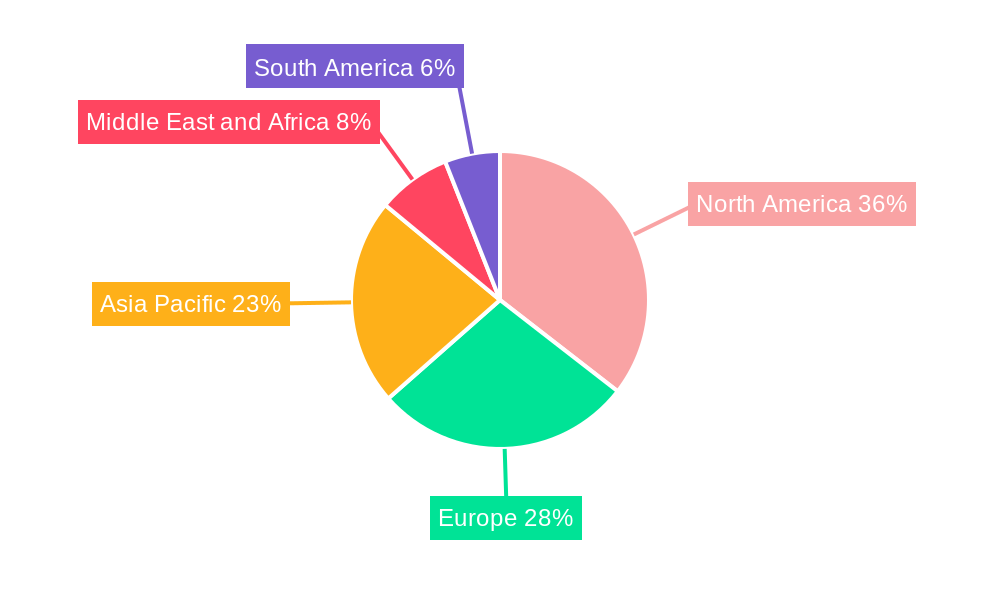

Emerging trends shaping the market include the rising adoption of minimally invasive surgical procedures and the expansion of telemedicine for polyp management and follow-up. Personalized treatment strategies, customized to individual patient profiles and polyp characteristics, are gaining prominence. Potential market restraints include the high cost of advanced diagnostics and novel therapies, alongside reimbursement challenges within diverse healthcare systems. The competitive arena features major pharmaceutical and biotechnology firms engaged in intensive research and development. Key segments like Corticosteroids and Antibiotics drug classes, Oral and Nasal administration routes, and Hospital Pharmacies as a primary distribution channel are anticipated to experience substantial growth, aligning with current treatment protocols. North America and Europe currently dominate the market, while Asia Pacific exhibits significant growth potential due to escalating healthcare expenditure and increasing disease prevalence.

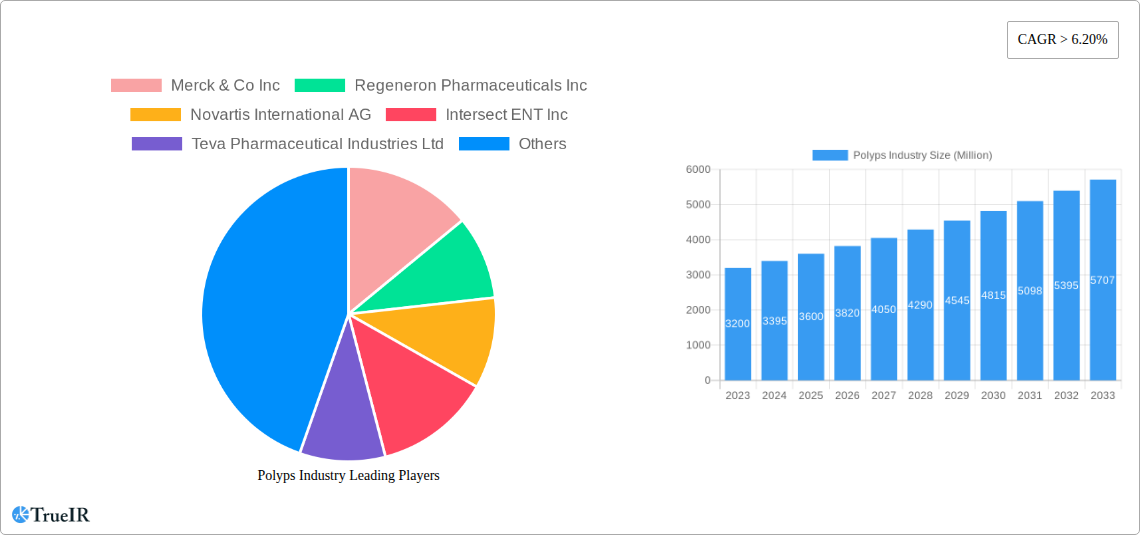

Polyps Industry Company Market Share

Dynamic SEO-Optimized Report Description: Polyps Industry Market Analysis 2025-2033

This comprehensive report offers an in-depth analysis of the global Polyps Industry, a rapidly evolving sector driven by advancements in pharmaceutical research and a growing awareness of respiratory and sinus health. Leveraging high-volume keywords such as "nasal polyps treatment," "sinusitis management," "corticosteroids for polyps," and "respiratory drug market," this report is designed to provide unparalleled insights for stakeholders seeking to understand market dynamics, emerging trends, and future growth trajectories. Our analysis covers the historical period from 2019 to 2024, with a base year of 2025, and extends through a robust forecast period of 2025 to 2033. Gain a competitive edge with data-driven intelligence on market size, segmentation, competitive landscape, and key growth drivers.

Polyps Industry Market Structure & Competitive Landscape

The Polyps Industry exhibits a moderately concentrated market structure, characterized by a blend of established pharmaceutical giants and specialized biotech firms. Innovation drivers, such as the development of novel drug delivery systems and targeted therapies for polyp reduction, are intensely competitive. Regulatory impacts from bodies like the FDA and EMA significantly shape market access and product approval timelines. Product substitutes, including surgical interventions and alternative medicine approaches, present a notable competitive pressure. End-user segmentation primarily revolves around patients with chronic rhinosinusitis with nasal polyps (CRSwNP) and allergic rhinitis. Mergers and Acquisitions (M&A) trends are gradually increasing as companies seek to consolidate portfolios and expand their presence in this lucrative market. For instance, the historical M&A volume in the past five years has been estimated at over 500 Million, indicating a strategic consolidation drive. Concentration ratios, while fluctuating, suggest that the top 5 players command a significant market share, exceeding 60% of the total revenue.

- Key players in M&A activities: Merck & Co Inc, Regeneron Pharmaceuticals Inc, Novartis International AG, Pfizer Inc, GlaxoSmithKline PLC.

- Innovation focus areas: Biologics, targeted therapies, advanced nasal spray technologies.

- Regulatory influence: Stringent approval processes for new drug entities and improved formulations.

Polyps Industry Market Trends & Opportunities

The global Polyps Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is fueled by a rising prevalence of chronic rhinosinusitis with nasal polyps (CRSwNP), exacerbated by environmental factors and increasing awareness of its debilitating impact on quality of life. Technological shifts are central to this growth, with a particular emphasis on the development and adoption of biologics and advanced corticosteroid formulations that offer enhanced efficacy and reduced systemic side effects. Patient preferences are increasingly leaning towards non-invasive treatment options, driving innovation in nasal drug delivery systems and oral medications. The competitive dynamics are intensifying, with key players investing heavily in research and development to launch next-generation therapies and gain market share. Opportunities abound for companies focusing on personalized medicine approaches and combination therapies that address the multifaceted nature of polyp formation. Market penetration rates for advanced treatments are expected to rise as healthcare providers and patients become more aware of their benefits. The market size is projected to reach an estimated 35,000 Million by 2030.

- Market Size Expansion: Driven by increasing diagnosis rates and the unmet need for more effective treatments.

- Biologics Dominance: A significant trend towards the use of monoclonal antibodies for targeted polyp reduction.

- Patient-Centric Innovations: Focus on improved convenience, reduced side effects, and enhanced treatment adherence.

- Digital Health Integration: Opportunities in remote patient monitoring and telehealth for chronic polyp management.

- Emerging Markets Potential: Untapped markets with growing healthcare infrastructure and increasing disposable incomes.

Dominant Markets & Segments in Polyps Industry

The dominance within the Polyps Industry is multifaceted, with distinct leadership observed across various segments. In terms of Drug Class, Corticosteroids continue to hold a leading position due to their established efficacy and broad applicability. However, the rapid growth of Biologics, a sub-segment of "Others" for this analysis, is challenging this dominance, offering targeted mechanisms of action. Regionally, North America is a dominant market, driven by advanced healthcare infrastructure, high disease prevalence, and robust R&D investment by major pharmaceutical companies. Within the Route of Administration, Nasal delivery remains paramount, offering direct access to the affected tissue. This segment is experiencing significant innovation, with advancements in spray technology and formulation. However, Oral administration is also gaining traction, particularly for systemic conditions or as an adjunct therapy. The Distribution Channel landscape is led by Hospital Pharmacies, reflecting the severity of cases often managed in clinical settings. Nonetheless, Retail Pharmacies and a burgeoning Online Pharmacy segment are expanding their reach, driven by patient convenience and the increasing availability of over-the-counter and prescription-based medications. Key growth drivers in North America include high disposable incomes, a strong focus on chronic disease management, and favorable reimbursement policies.

- Leading Drug Class: Corticosteroids, with significant ongoing research in advanced formulations and delivery.

- Emerging Drug Class: Biologics demonstrating high efficacy in severe and refractory cases, contributing to the "Others" segment's growth.

- Dominant Route of Administration: Nasal, with innovations in metered-dose sprays and targeted delivery systems.

- Growing Route of Administration: Oral, offering systemic benefits and convenience.

- Primary Distribution Channel: Hospital Pharmacies, catering to complex patient needs and specialized treatments.

- Expanding Distribution Channels: Retail Pharmacies and Online Pharmacies, driven by accessibility and convenience.

- Geographic Leadership: North America, supported by advanced healthcare systems and high R&D expenditure.

Polyps Industry Product Analysis

Product innovation in the Polyps Industry is primarily focused on enhancing efficacy, improving safety profiles, and optimizing patient convenience. Novel corticosteroid formulations with advanced release mechanisms are entering the market, offering prolonged therapeutic effects and reduced dosing frequency. Biologics, such as monoclonal antibodies targeting specific inflammatory pathways like IL-4, IL-5, and IgE, represent a significant technological advancement, offering a targeted approach for severe polyp cases. Competitive advantages are being carved out through superior efficacy in polyp shrinkage, reduced recurrence rates, and a better side-effect profile compared to existing treatments. The market fit is strong for products that address the unmet needs of patients suffering from chronic, recurrent, or severe nasal polyposis. Estimated product innovation investment stands at over 800 Million annually.

Key Drivers, Barriers & Challenges in Polyps Industry

The Polyps Industry is propelled by several key drivers, including the increasing global prevalence of chronic respiratory conditions like CRSwNP, a growing demand for less invasive and more effective treatments, and continuous advancements in pharmaceutical research and development, particularly in biologics and targeted therapies. Economic factors, such as rising healthcare expenditure and growing disposable incomes in emerging economies, also contribute to market growth. Policy-driven initiatives aimed at improving respiratory health awareness and access to care further bolster the market.

However, significant barriers and challenges exist. Regulatory hurdles, including lengthy and costly approval processes for new drugs, pose a substantial restraint. Supply chain complexities and the potential for disruptions, especially for biologics requiring specialized handling, can impact market availability. Intense competitive pressures from both branded and generic manufacturers, as well as from alternative treatment modalities like surgery, also challenge market growth. The high cost of novel therapies, particularly biologics, can limit patient access and create reimbursement challenges, estimated to impact over 15% of potential patients.

Growth Drivers in the Polyps Industry Market

Key growth drivers for the Polyps Industry include the escalating incidence of allergic rhinitis and chronic rhinosinusitis (CRS), leading to a higher diagnosis rate of nasal polyps. Significant investments in R&D by leading pharmaceutical companies are yielding novel therapeutic agents, especially biologics, that offer targeted treatment for severe cases. Technological advancements in drug delivery systems, such as precision nasal sprays and inhalers, are enhancing treatment efficacy and patient compliance. Furthermore, increasing healthcare expenditure globally and a growing patient awareness regarding the impact of polyps on quality of life are creating a favorable market environment. Government initiatives promoting respiratory health and chronic disease management also contribute to sustained growth.

Challenges Impacting Polyps Industry Growth

Several challenges continue to impact the Polyps Industry's growth trajectory. The stringent regulatory pathways for drug approval, characterized by extensive clinical trials and rigorous documentation, can delay market entry and increase development costs. Complex supply chain logistics, particularly for temperature-sensitive biologics, present a significant operational hurdle, potentially leading to product shortages. Intense competition from established players and the threat of generic drugs entering the market can erode profit margins. Additionally, the high cost of advanced therapies, such as biologics, can limit accessibility for a considerable patient population, leading to affordability concerns and potential under-treatment of the disease. Estimated market penetration for biologics is currently around 40% of the eligible patient pool.

Key Players Shaping the Polyps Industry Market

- Merck & Co Inc

- Regeneron Pharmaceuticals Inc

- Novartis International AG

- Intersect ENT Inc

- Teva Pharmaceutical Industries Ltd

- F Hoffmann-La Roche AG

- Pfizer Inc

- OptiNose US

- Norton Waterford Ltd

- GlaxoSmithKline PLC

- Sanofi S A

Significant Polyps Industry Industry Milestones

- 2019: FDA approval of Dupixent (dupilumab) by Regeneron Pharmaceuticals Inc. and Sanofi S A for chronic rhinosinusitis with nasal polyps.

- 2020: Launch of new corticosteroid nasal spray formulations with improved efficacy and longer duration of action by major pharmaceutical companies.

- 2021: Increased investment in biologics research and development targeting specific inflammatory pathways implicated in polyp formation.

- 2022: Emergence of novel oral medications showing promise in managing polyp size and reducing inflammation.

- 2023: Growing adoption of telehealth services for managing chronic rhinosinusitis patients, including those with polyps.

- 2024: Significant clinical trial results published for next-generation biologics demonstrating higher response rates in refractory polyp cases.

Future Outlook for Polyps Industry Market

The future outlook for the Polyps Industry is exceptionally promising, driven by continued innovation and an increasing understanding of the disease pathology. Strategic opportunities lie in the development of personalized medicine approaches, tailoring treatments based on individual patient biomarkers. The expansion of biologics into earlier lines of therapy and the refinement of combination treatment strategies will be crucial growth catalysts. Furthermore, advancements in drug delivery technologies promise to enhance patient adherence and therapeutic outcomes. The untapped potential in emerging markets, coupled with a growing global focus on respiratory health, indicates substantial market expansion opportunities in the coming years. The market is projected to reach an estimated 50,000 Million by 2033.

Polyps Industry Segmentation

-

1. Drug Class

- 1.1. Corticosteroids

- 1.2. Antibiotics

- 1.3. Leukotriene Inhibitors

- 1.4. Others

-

2. Route of Administration

- 2.1. Oral

- 2.2. Nasal

- 2.3. Others

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Retail Pharmacies

- 3.3. Online Pharmacies

Polyps Industry Segmentation By Geography

-

1. North America

- 1.1. United states

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Polyps Industry Regional Market Share

Geographic Coverage of Polyps Industry

Polyps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Prevalence of Various Immunological Disorders along with the Increasing Geriatric Population; Huge Product Pipeline of Nasal Polyps Treatment with Growing Research Activities

- 3.3. Market Restrains

- 3.3.1. ; High Cost and Complications Associated with Sinus Surgeries; Adverse Reactions Associated with Steroid Therapies

- 3.4. Market Trends

- 3.4.1. Corticosteroids Segment by Drug Class is Expected to Hold the Largest Market Share in the Nasal Polyps Treatment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Corticosteroids

- 5.1.2. Antibiotics

- 5.1.3. Leukotriene Inhibitors

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Nasal

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Retail Pharmacies

- 5.3.3. Online Pharmacies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Polyps Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Corticosteroids

- 6.1.2. Antibiotics

- 6.1.3. Leukotriene Inhibitors

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Oral

- 6.2.2. Nasal

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospital Pharmacies

- 6.3.2. Retail Pharmacies

- 6.3.3. Online Pharmacies

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Polyps Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Corticosteroids

- 7.1.2. Antibiotics

- 7.1.3. Leukotriene Inhibitors

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Oral

- 7.2.2. Nasal

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospital Pharmacies

- 7.3.2. Retail Pharmacies

- 7.3.3. Online Pharmacies

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Polyps Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Corticosteroids

- 8.1.2. Antibiotics

- 8.1.3. Leukotriene Inhibitors

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Oral

- 8.2.2. Nasal

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospital Pharmacies

- 8.3.2. Retail Pharmacies

- 8.3.3. Online Pharmacies

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Polyps Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Corticosteroids

- 9.1.2. Antibiotics

- 9.1.3. Leukotriene Inhibitors

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Route of Administration

- 9.2.1. Oral

- 9.2.2. Nasal

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospital Pharmacies

- 9.3.2. Retail Pharmacies

- 9.3.3. Online Pharmacies

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Polyps Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Corticosteroids

- 10.1.2. Antibiotics

- 10.1.3. Leukotriene Inhibitors

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Route of Administration

- 10.2.1. Oral

- 10.2.2. Nasal

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospital Pharmacies

- 10.3.2. Retail Pharmacies

- 10.3.3. Online Pharmacies

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merck & Co Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Regeneron Pharmaceuticals Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis International AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intersect ENT Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teva Pharmaceutical Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 F Hoffmann-La Roche AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pfizer Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OptiNose US

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Norton Waterford Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GlaxoSmithKline PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sanofi S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Merck & Co Inc

List of Figures

- Figure 1: Global Polyps Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Polyps Industry Revenue (million), by Drug Class 2025 & 2033

- Figure 3: North America Polyps Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 4: North America Polyps Industry Revenue (million), by Route of Administration 2025 & 2033

- Figure 5: North America Polyps Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 6: North America Polyps Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: North America Polyps Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Polyps Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Polyps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polyps Industry Revenue (million), by Drug Class 2025 & 2033

- Figure 11: Europe Polyps Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 12: Europe Polyps Industry Revenue (million), by Route of Administration 2025 & 2033

- Figure 13: Europe Polyps Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 14: Europe Polyps Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Polyps Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Polyps Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Polyps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Polyps Industry Revenue (million), by Drug Class 2025 & 2033

- Figure 19: Asia Pacific Polyps Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 20: Asia Pacific Polyps Industry Revenue (million), by Route of Administration 2025 & 2033

- Figure 21: Asia Pacific Polyps Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 22: Asia Pacific Polyps Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Polyps Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Polyps Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Polyps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Polyps Industry Revenue (million), by Drug Class 2025 & 2033

- Figure 27: Middle East and Africa Polyps Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 28: Middle East and Africa Polyps Industry Revenue (million), by Route of Administration 2025 & 2033

- Figure 29: Middle East and Africa Polyps Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 30: Middle East and Africa Polyps Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East and Africa Polyps Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East and Africa Polyps Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Polyps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Polyps Industry Revenue (million), by Drug Class 2025 & 2033

- Figure 35: South America Polyps Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 36: South America Polyps Industry Revenue (million), by Route of Administration 2025 & 2033

- Figure 37: South America Polyps Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 38: South America Polyps Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 39: South America Polyps Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Polyps Industry Revenue (million), by Country 2025 & 2033

- Figure 41: South America Polyps Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyps Industry Revenue million Forecast, by Drug Class 2020 & 2033

- Table 2: Global Polyps Industry Revenue million Forecast, by Route of Administration 2020 & 2033

- Table 3: Global Polyps Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Polyps Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Polyps Industry Revenue million Forecast, by Drug Class 2020 & 2033

- Table 6: Global Polyps Industry Revenue million Forecast, by Route of Administration 2020 & 2033

- Table 7: Global Polyps Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Polyps Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United states Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Polyps Industry Revenue million Forecast, by Drug Class 2020 & 2033

- Table 13: Global Polyps Industry Revenue million Forecast, by Route of Administration 2020 & 2033

- Table 14: Global Polyps Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Polyps Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Polyps Industry Revenue million Forecast, by Drug Class 2020 & 2033

- Table 23: Global Polyps Industry Revenue million Forecast, by Route of Administration 2020 & 2033

- Table 24: Global Polyps Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Polyps Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: India Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Australia Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Polyps Industry Revenue million Forecast, by Drug Class 2020 & 2033

- Table 33: Global Polyps Industry Revenue million Forecast, by Route of Administration 2020 & 2033

- Table 34: Global Polyps Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Polyps Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: GCC Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Global Polyps Industry Revenue million Forecast, by Drug Class 2020 & 2033

- Table 40: Global Polyps Industry Revenue million Forecast, by Route of Administration 2020 & 2033

- Table 41: Global Polyps Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Polyps Industry Revenue million Forecast, by Country 2020 & 2033

- Table 43: Brazil Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Polyps Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyps Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Polyps Industry?

Key companies in the market include Merck & Co Inc, Regeneron Pharmaceuticals Inc, Novartis International AG, Intersect ENT Inc, Teva Pharmaceutical Industries Ltd, F Hoffmann-La Roche AG, Pfizer Inc, OptiNose US, Norton Waterford Ltd, GlaxoSmithKline PLC, Sanofi S A.

3. What are the main segments of the Polyps Industry?

The market segments include Drug Class, Route of Administration, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.6 million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Prevalence of Various Immunological Disorders along with the Increasing Geriatric Population; Huge Product Pipeline of Nasal Polyps Treatment with Growing Research Activities.

6. What are the notable trends driving market growth?

Corticosteroids Segment by Drug Class is Expected to Hold the Largest Market Share in the Nasal Polyps Treatment Market.

7. Are there any restraints impacting market growth?

; High Cost and Complications Associated with Sinus Surgeries; Adverse Reactions Associated with Steroid Therapies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyps Industry?

To stay informed about further developments, trends, and reports in the Polyps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence