Key Insights

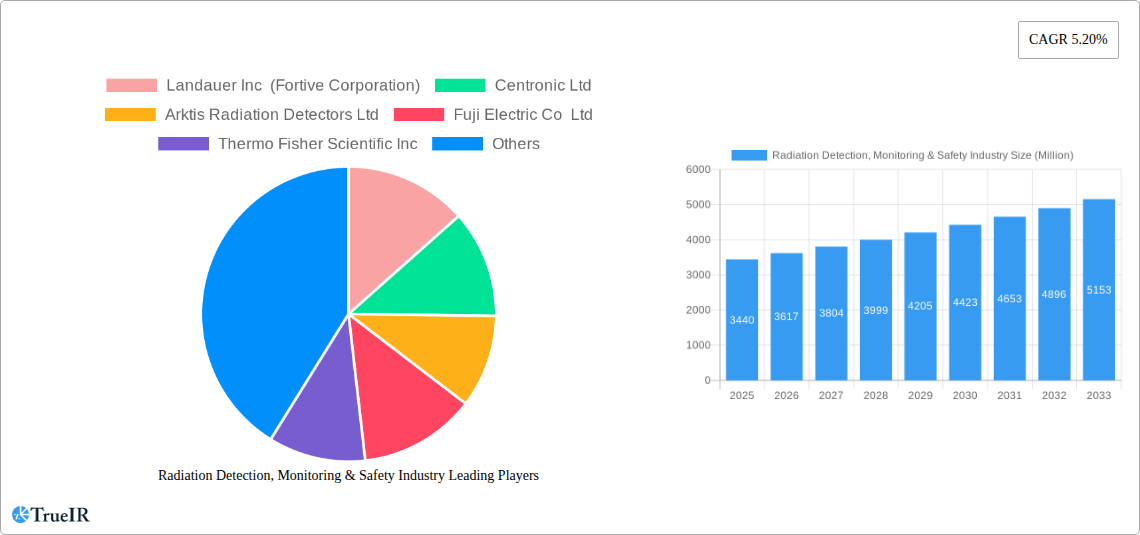

The global Radiation Detection, Monitoring & Safety market is poised for significant expansion, projected to reach $3.44 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.20% over the forecast period of 2025-2033. This growth trajectory is primarily fueled by increasing concerns regarding radiation exposure in various sectors, alongside stringent regulatory frameworks mandating the use of advanced detection and monitoring technologies. Key drivers include the escalating adoption of radiation detection solutions in the medical and healthcare industry for diagnostic imaging and radiation therapy, as well as in industrial applications for quality control and safety protocols. Furthermore, the growing emphasis on homeland security and defense, coupled with the expanding energy and power sector, particularly nuclear power, are substantial contributors to market demand. Innovations in portable and highly sensitive radiation detection devices, along with the integration of IoT and AI for real-time monitoring and data analytics, are shaping market trends and enhancing the efficacy of safety measures.

Radiation Detection, Monitoring & Safety Industry Market Size (In Billion)

The market is segmented into Detection and Monitoring, and Safety product types, catering to diverse end-user industries such as Medical and Healthcare, Industrial, Homeland Security and Defense, and Energy and Power. While the market exhibits strong growth potential, certain restraints, such as the high initial cost of sophisticated equipment and the need for specialized training for operation and maintenance, could pose challenges. However, the continuous technological advancements and the increasing awareness of radiation risks are expected to outweigh these limitations. Major players like Thermo Fisher Scientific Inc., Landauer Inc., and Mirion Technologies Inc. are actively involved in research and development, product innovation, and strategic collaborations to capture a larger market share. The market is anticipated to witness substantial growth across all major regions, with North America and Europe currently leading in adoption due to established regulatory environments and advanced technological infrastructure. Asia is emerging as a key growth region, driven by increasing investments in healthcare and industrial sectors.

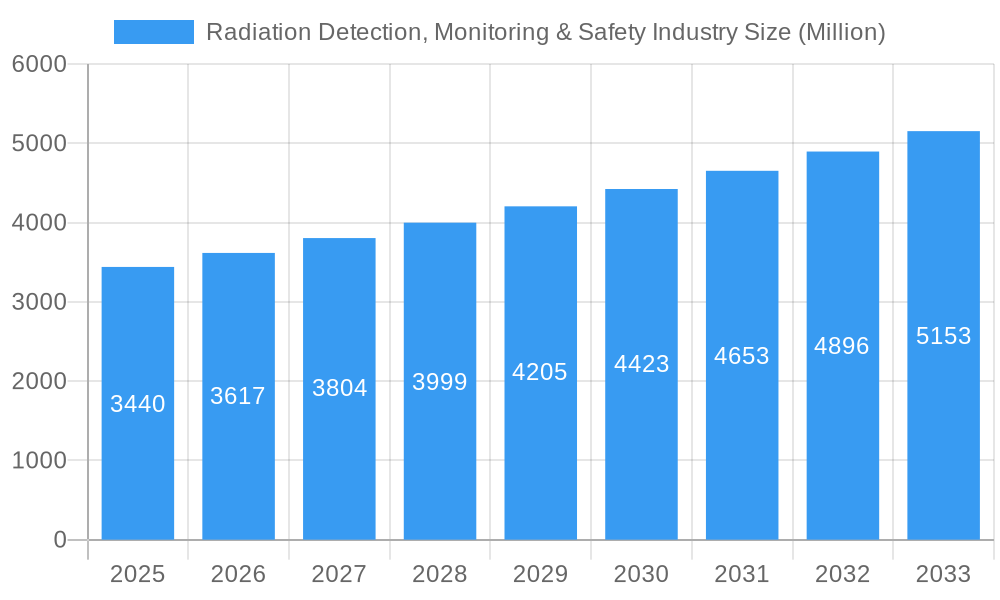

Radiation Detection, Monitoring & Safety Industry Company Market Share

Radiation Detection, Monitoring & Safety Industry Market Analysis: Unveiling Trends, Opportunities, and Competitive Dynamics (2019-2033)

This comprehensive report delves into the dynamic Radiation Detection, Monitoring & Safety Industry, providing an in-depth analysis of market structure, competitive landscape, key trends, and future outlook. With an estimated market value of 10 Million in the base year of 2025, the industry is poised for significant expansion, projected to reach 10 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. The study meticulously examines the market from 2019 to 2033, with a deep dive into the historical period of 2019-2024 and a focus on the base and estimated year of 2025. This report is an indispensable resource for stakeholders seeking to understand the intricacies of radiation safety solutions, nuclear detection equipment, radiation monitoring systems, and personal radiation detectors.

Radiation Detection, Monitoring & Safety Industry Market Structure & Competitive Landscape

The Radiation Detection, Monitoring & Safety Industry exhibits a moderately concentrated market structure, with a blend of large multinational corporations and specialized niche players. Innovation serves as a key differentiator, driven by advancements in sensor technology, data analytics, and miniaturization, leading to the development of more sensitive, accurate, and user-friendly radiation detection and monitoring devices. Regulatory frameworks, particularly concerning nuclear safety, public health, and industrial hygiene, significantly influence market dynamics and compliance requirements, creating both opportunities and barriers to entry. Product substitutes, while present in certain low-risk applications, are generally limited in areas requiring high precision and reliability for radiation protection. End-user segmentation by industry – including Medical and Healthcare, Industrial, Homeland Security and Defense, and Energy and Power – reveals distinct purchasing behaviors and demand drivers. Mergers and acquisitions (M&A) activity, estimated at XX during the historical period, is a notable trend, consolidating market share and expanding product portfolios. The estimated market concentration ratio stands at approximately XX%, indicating the presence of leading players.

Radiation Detection, Monitoring & Safety Industry Market Trends & Opportunities

The Radiation Detection, Monitoring & Safety Industry is experiencing a transformative period marked by substantial market size growth, projected to exceed 10 Million by 2033. This expansion is fueled by increasing global awareness of radiation hazards, stringent regulatory mandates for occupational safety, and the escalating need for advanced security solutions. Technological shifts are central to this growth, with ongoing innovations in sensor materials, real-time data transmission, artificial intelligence for anomaly detection, and the development of compact, wearable radiation monitoring devices. Consumer preferences are evolving towards integrated systems that offer comprehensive radiation safety management and seamless data integration for improved decision-making. The competitive landscape is intensifying, with companies focusing on product differentiation, cost-effectiveness, and expanding their global reach.

Key trends shaping the market include:

- Advancements in Detector Technology: The development of next-generation detectors with enhanced sensitivity, spectral resolution, and reduced false alarm rates is a critical trend. This includes innovations in semiconductor detectors, scintillators, and gas-filled detectors.

- Rise of IoT and Connected Devices: The integration of the Internet of Things (IoT) is enabling real-time remote monitoring, data logging, and early warning systems for radiation levels, improving overall safety and response capabilities.

- Miniaturization and Portability: There is a strong demand for smaller, lighter, and more portable radiation detection equipment, facilitating widespread use by first responders, industrial workers, and in personal safety applications.

- Increased Focus on Homeland Security and Defense: Growing geopolitical uncertainties and the threat of radiological terrorism are driving significant investment in advanced radiation detection systems for border security, critical infrastructure protection, and military applications.

- Growing Demand in Healthcare: The expanding use of nuclear medicine, radiation therapy, and diagnostic imaging in healthcare necessitates robust radiation monitoring and safety protocols to protect patients and medical professionals.

- Stricter Regulatory Compliance: Evolving national and international regulations regarding radiation exposure limits and safety standards are compelling industries to invest in advanced radiation measurement instruments.

- Emerging Markets and Developing Economies: As industrialization and nuclear energy adoption increase in developing nations, the demand for radiation detection and safety solutions is expected to surge.

Opportunities abound for companies that can offer innovative, cost-effective, and compliant radiation safety solutions. This includes developing intelligent monitoring systems, providing comprehensive training and support services, and addressing the unique needs of diverse end-user industries. The market penetration rate for advanced radiation detection technologies is expected to increase significantly across all key sectors.

Dominant Markets & Segments in Radiation Detection, Monitoring & Safety Industry

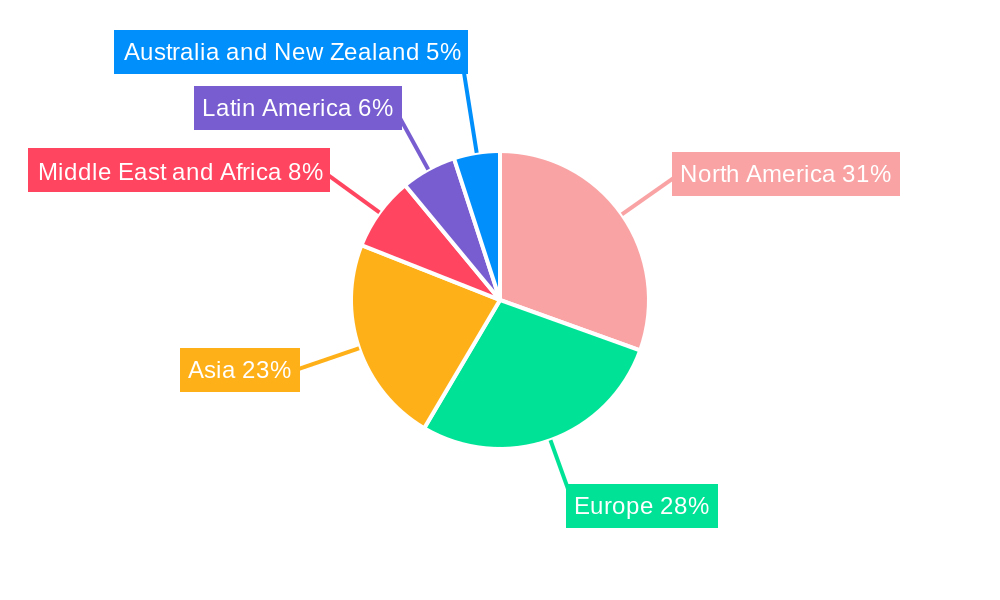

The Radiation Detection, Monitoring & Safety Industry is characterized by distinct regional dominance and segment leadership. Globally, North America and Europe currently represent the largest markets, driven by well-established regulatory frameworks, significant investment in defense and healthcare, and a high level of technological adoption. However, the Asia-Pacific region is witnessing the most rapid growth, fueled by expanding industrial sectors, increasing nuclear power investments, and rising government spending on public safety and homeland security initiatives.

Within the Product Type segmentation, Detection and Monitoring solutions are the dominant segment, accounting for an estimated XX% of the market share. This is attributed to the widespread need for continuous surveillance, incident detection, and compliance monitoring across various industries. The Safety segment, encompassing personal protective equipment and radiation shielding, also holds substantial market presence.

The End-user Industry segmentation reveals:

- Medical and Healthcare: This sector is a major driver, utilizing radiation detection equipment for diagnostic imaging, radiation therapy, and nuclear medicine. The increasing prevalence of cancer and the growing demand for advanced medical treatments contribute to sustained growth.

- Industrial: Industries such as oil and gas, mining, and manufacturing employ radiation monitoring systems for process control, quality assurance, and worker safety, particularly in sectors involving radioactive materials or high-energy processes.

- Homeland Security and Defense: This segment is a crucial market, with significant demand for radiation detectors for border control, threat assessment, emergency response, and military applications. The ongoing need for robust security measures against radiological and nuclear threats is a key growth catalyst.

- Energy and Power: The nuclear power industry, while facing evolving landscapes, remains a significant consumer of radiation detection and safety solutions for plant operation, maintenance, and waste management.

- Other End-user Industries: This category includes research institutions, academic laboratories, and environmental monitoring agencies, all of which require specialized radiation measurement instruments.

Key growth drivers within dominant segments include:

- Infrastructure Development: Government investments in new power plants, healthcare facilities, and security infrastructure directly correlate with increased demand for radiation detection and safety equipment.

- Stringent Policy Implementation: The enforcement of stricter radiation safety standards and regulations by governmental bodies mandates the adoption of advanced monitoring and detection technologies.

- Technological Advancements: Innovations leading to more accurate, portable, and cost-effective radiation detection solutions are expanding their accessibility and application across a wider range of industries and end-users.

- Growing Public Health Concerns: Increased awareness of the long-term health impacts of radiation exposure is driving demand for better radiation monitoring in both occupational and environmental settings.

Radiation Detection, Monitoring & Safety Industry Product Analysis

The Radiation Detection, Monitoring & Safety Industry is witnessing a continuous stream of product innovations aimed at enhancing performance, usability, and cost-effectiveness. Key advancements include the development of highly sensitive and selective sensors for various radiation types (alpha, beta, gamma, neutron), improved miniaturization for portable and wearable devices, and the integration of wireless communication for real-time data transmission and remote monitoring. These innovations find critical applications in medical diagnostics and therapy, industrial process control, homeland security threat detection, and environmental monitoring. Competitive advantages are being built upon superior accuracy, faster response times, extended battery life, robust data logging capabilities, and user-friendly interfaces, ensuring effective radiation protection and compliance.

Key Drivers, Barriers & Challenges in Radiation Detection, Monitoring & Safety Industry

Key Drivers: The Radiation Detection, Monitoring & Safety Industry is propelled by several key drivers. Technologically, advancements in sensor materials and miniaturization are leading to more accurate and portable devices. Economically, increasing global investments in nuclear energy, healthcare infrastructure, and national security are creating robust demand. Policy-driven factors, such as stringent occupational safety regulations and homeland security mandates, are compelling industries to adopt advanced radiation safety solutions. For instance, the increasing adoption of advanced radiation monitoring systems in industrial settings is directly linked to compliance with evolving safety standards.

Key Barriers & Challenges: Despite the growth, the industry faces significant challenges. Regulatory hurdles, particularly the complex and evolving nature of international safety standards, can create compliance burdens and slow down market entry for new products. Supply chain issues, including the availability of specialized raw materials and components for advanced detectors, can impact production timelines and costs, with an estimated impact of XX% on product availability during certain periods. Competitive pressures from established players and the need for continuous R&D to stay ahead of technological advancements also pose challenges. Furthermore, the high initial investment cost for certain sophisticated radiation detection equipment can be a restraint for smaller organizations.

Growth Drivers in the Radiation Detection, Monitoring & Safety Industry Market

The growth of the Radiation Detection, Monitoring & Safety Industry is significantly influenced by technological innovation, economic expansion, and evolving regulatory landscapes. Technologically, breakthroughs in semiconductor physics and materials science are leading to the development of highly sensitive and selective radiation detectors with enhanced capabilities, such as spectral analysis and faster response times. Economically, the global surge in infrastructure development, particularly in the energy sector (including nuclear power expansion) and healthcare, directly translates into increased demand for radiation monitoring and safety equipment. Regulatory drivers, such as stricter occupational health and safety standards and heightened national security concerns, are compelling industries and governments to invest in advanced radiation detection systems. For example, the increasing implementation of radiation safety protocols in healthcare settings is a direct response to regulatory mandates and a growing emphasis on patient and staff well-being.

Challenges Impacting Radiation Detection, Monitoring & Safety Industry Growth

Several challenges impact the growth trajectory of the Radiation Detection, Monitoring & Safety Industry. Regulatory complexities, with varying national and international standards, can create compliance burdens and hinder global product harmonization. Supply chain disruptions, especially for specialized electronic components and rare earth materials crucial for advanced detectors, can lead to production delays and increased costs, with potential impacts on delivery times estimated at XX%. Competitive pressures are intense, requiring significant ongoing investment in research and development to maintain a competitive edge and innovate in areas like miniaturization and artificial intelligence integration for radiation safety solutions. Additionally, the high initial capital expenditure required for some advanced radiation monitoring systems can act as a restraint for smaller enterprises and in developing economies.

Key Players Shaping the Radiation Detection, Monitoring & Safety Industry Market

- Landauer Inc (Fortive Corporation)

- Centronic Ltd

- Arktis Radiation Detectors Ltd

- Fuji Electric Co Ltd

- Thermo Fisher Scientific Inc

- Amray Group Limited

- ORTEC (Ametek Inc)

- Mirion Technologies Inc

- Burlington Medical LLC

- ATOMTEX SP

- Radiation Detection Company

- Teledyne FLIR Systems Inc

- RAE Systems Inc (Honeywell International Inc)

- Unfors RaySafe AB

Significant Radiation Detection, Monitoring & Safety Industry Industry Milestones

- January 2024: The US military announced a significant upgrade of its radiation detection capabilities by adopting the new "Radiological Detection System" from D-Tect Systems (a division of Ludlum). This modular system, capable of customized external probes for specific detection needs like alpha or neutron radiation, replaces the 35-year-old AN/PDR-77 and AN/VDR-2 detectors, enhancing battlefield radiation awareness and safety.

- October 2023: Honeywell launched its infrared-based FS24X Plus Flame Detector. This advanced detector is designed to swiftly identify and suppress hydrogen flames, preventing them from escalating into major fires and thereby protecting personnel and facilities from the risks associated with hydrogen production and usage. The FS24X Plus is capable of detecting flames even in challenging conditions such as rain, fog, or smoke, utilizing infrared radiation, which extends beyond visible light and precedes radio waves in the electromagnetic spectrum, for effective detection and information transmission.

Future Outlook for Radiation Detection, Monitoring & Safety Industry Market

The future outlook for the Radiation Detection, Monitoring & Safety Industry is exceptionally positive, driven by a confluence of factors. Continued advancements in sensor technology, including quantum dot-based detectors and AI-powered analytics, will further enhance the precision and speed of radiation detection and monitoring. The growing global emphasis on nuclear safety, coupled with the expanding applications of nuclear technology in medicine and energy, will sustain robust demand. Furthermore, the increasing threat landscape, necessitating enhanced homeland security measures, will continue to fuel investment in advanced radiation detection systems. Strategic opportunities lie in developing integrated, smart radiation safety solutions that offer real-time data, predictive analytics, and seamless connectivity, catering to the evolving needs of diverse end-user industries and ensuring a safer environment for all. The market is projected to experience sustained growth, with an estimated market value reaching 10 Million by 2033.

Radiation Detection, Monitoring & Safety Industry Segmentation

-

1. Product Type

- 1.1. Detection and Monitoring

- 1.2. Safety

-

2. End-user Industry

- 2.1. Medical and Healthcare

- 2.2. Industrial

- 2.3. Homeland Security and Defense

- 2.4. Energy and Power

- 2.5. Other End-user Industries

Radiation Detection, Monitoring & Safety Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Radiation Detection, Monitoring & Safety Industry Regional Market Share

Geographic Coverage of Radiation Detection, Monitoring & Safety Industry

Radiation Detection, Monitoring & Safety Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence of Cancer and Other Chronic Diseases; Growing Use of Drones for Radiation Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Medical and Healthcare Industry to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Detection, Monitoring & Safety Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Detection and Monitoring

- 5.1.2. Safety

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Medical and Healthcare

- 5.2.2. Industrial

- 5.2.3. Homeland Security and Defense

- 5.2.4. Energy and Power

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Radiation Detection, Monitoring & Safety Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Detection and Monitoring

- 6.1.2. Safety

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Medical and Healthcare

- 6.2.2. Industrial

- 6.2.3. Homeland Security and Defense

- 6.2.4. Energy and Power

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Radiation Detection, Monitoring & Safety Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Detection and Monitoring

- 7.1.2. Safety

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Medical and Healthcare

- 7.2.2. Industrial

- 7.2.3. Homeland Security and Defense

- 7.2.4. Energy and Power

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Radiation Detection, Monitoring & Safety Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Detection and Monitoring

- 8.1.2. Safety

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Medical and Healthcare

- 8.2.2. Industrial

- 8.2.3. Homeland Security and Defense

- 8.2.4. Energy and Power

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Radiation Detection, Monitoring & Safety Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Detection and Monitoring

- 9.1.2. Safety

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Medical and Healthcare

- 9.2.2. Industrial

- 9.2.3. Homeland Security and Defense

- 9.2.4. Energy and Power

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Radiation Detection, Monitoring & Safety Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Detection and Monitoring

- 10.1.2. Safety

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Medical and Healthcare

- 10.2.2. Industrial

- 10.2.3. Homeland Security and Defense

- 10.2.4. Energy and Power

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Radiation Detection, Monitoring & Safety Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Detection and Monitoring

- 11.1.2. Safety

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Medical and Healthcare

- 11.2.2. Industrial

- 11.2.3. Homeland Security and Defense

- 11.2.4. Energy and Power

- 11.2.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Landauer Inc (Fortive Corporation)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Centronic Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Arktis Radiation Detectors Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Fuji Electric Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Thermo Fisher Scientific Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Amray Group Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ORTEC (Ametek Inc )

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Mirion Technologies Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Burlington Medical LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ATOMTEX SP

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Radiation Detection Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Teledyne FLIR Systems Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 RAE Systems Inc (Honeywell International Inc )

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Unfors RaySafe AB

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Landauer Inc (Fortive Corporation)

List of Figures

- Figure 1: Global Radiation Detection, Monitoring & Safety Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Radiation Detection, Monitoring & Safety Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Radiation Detection, Monitoring & Safety Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Radiation Detection, Monitoring & Safety Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Australia and New Zealand Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Australia and New Zealand Radiation Detection, Monitoring & Safety Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Latin America Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Latin America Radiation Detection, Monitoring & Safety Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Latin America Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 33: Middle East and Africa Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Middle East and Africa Radiation Detection, Monitoring & Safety Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Middle East and Africa Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Radiation Detection, Monitoring & Safety Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Radiation Detection, Monitoring & Safety Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Radiation Detection, Monitoring & Safety Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Detection, Monitoring & Safety Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Radiation Detection, Monitoring & Safety Industry?

Key companies in the market include Landauer Inc (Fortive Corporation), Centronic Ltd, Arktis Radiation Detectors Ltd, Fuji Electric Co Ltd, Thermo Fisher Scientific Inc, Amray Group Limited, ORTEC (Ametek Inc ), Mirion Technologies Inc, Burlington Medical LLC, ATOMTEX SP, Radiation Detection Company, Teledyne FLIR Systems Inc, RAE Systems Inc (Honeywell International Inc ), Unfors RaySafe AB.

3. What are the main segments of the Radiation Detection, Monitoring & Safety Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence of Cancer and Other Chronic Diseases; Growing Use of Drones for Radiation Monitoring.

6. What are the notable trends driving market growth?

Medical and Healthcare Industry to be the Largest End User.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

January 2024: The US military made the decision to upgrade its radiation detection equipment by adopting the new "Radiological Detection System" produced by D-Tect Systems, a division of Ludlum based in Utah. This system is modular, allowing for customization with various external probes to meet specific detection needs, such as alpha or neutron detection. The outdated AN/PDR-77 and AN/VDR-2 radiation detectors, which had been in use for 35 years, were replaced with this new technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiation Detection, Monitoring & Safety Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiation Detection, Monitoring & Safety Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiation Detection, Monitoring & Safety Industry?

To stay informed about further developments, trends, and reports in the Radiation Detection, Monitoring & Safety Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence