Key Insights

The US residential real estate market, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 2.04%, presents a dynamic landscape shaped by several key factors. The market size, estimated at $X million in 2025 (assuming a reasonable market size based on publicly available data for similar markets), is driven by robust population growth, particularly in desirable urban and suburban areas, coupled with continued low interest rates stimulating buyer demand. Strong demand for apartments and condominiums, particularly in densely populated metropolitan regions, continues to outweigh the supply, contributing to price appreciation. However, this growth is tempered by several constraints, including rising construction costs, limited housing inventory in certain areas, and potential interest rate fluctuations. The segment breakdown reveals a significant share held by apartments and condominiums, reflecting a shift toward urban living and multi-family dwellings. The leading players in this competitive market, including Simon Property Group, Mill Creek Residential, and others, are continuously adapting their strategies to navigate market shifts, focusing on sustainable development, technological integration, and diverse property offerings to meet evolving consumer preferences. The market's performance is further nuanced by regional variations, with some areas experiencing more pronounced growth than others.

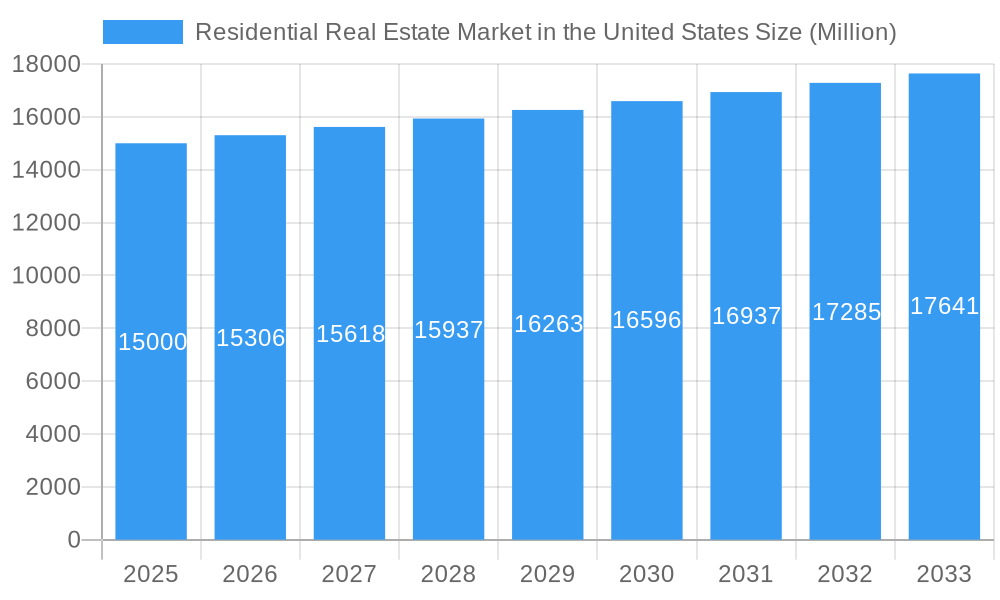

Residential Real Estate Market in the United States Market Size (In Billion)

Looking ahead to 2033, projections suggest continued but moderated expansion within the US residential real estate sector. While demographic shifts and economic factors are anticipated to remain supportive of market growth, potential headwinds, such as inflation and economic uncertainty, will require ongoing analysis. The success of individual developers and real estate companies will hinge on their ability to anticipate market trends, effectively manage costs, and deliver innovative and appealing housing options to a diverse range of buyers and renters. Key trends include increased adoption of smart home technology, a rise in sustainable building practices, and evolving preferences for flexible living arrangements. Analyzing these factors, coupled with a granular regional breakdown, offers a clearer understanding of market opportunities and challenges.

Residential Real Estate Market in the United States Company Market Share

Residential Real Estate Market in the United States: 2019-2033 Forecast Report

This comprehensive report delivers an in-depth analysis of the dynamic US residential real estate market, projecting trends from 2019 to 2033. Leveraging extensive data and expert insights, this study provides invaluable intelligence for investors, developers, and industry professionals seeking to navigate this evolving landscape. The report features detailed segmentation by property type (apartments and condominiums, landed houses and villas), identifying key growth drivers, challenges, and opportunities across the market. We analyze market concentration, competitive dynamics, and significant industry milestones, providing a 360° view of this multi-billion-dollar market.

Residential Real Estate Market in the United States Market Structure & Competitive Landscape

The US residential real estate market is characterized by a moderately concentrated structure, with a few major players commanding significant market share, alongside numerous smaller regional and local firms. Concentration ratios vary significantly by segment and geographic location. For instance, the multifamily apartment sector shows higher concentration in major metropolitan areas compared to the single-family home market. The Herfindahl-Hirschman Index (HHI) for the national market is estimated at xx, indicating a moderately concentrated market. Innovation is driven by technological advancements such as proptech solutions (e.g., online listing platforms, virtual tours, smart home technology) and evolving consumer preferences. Regulatory impacts, particularly zoning laws and building codes, significantly influence development patterns and housing affordability. Product substitutes, such as co-living spaces and shared ownership models, are gaining traction, impacting the traditional market. End-user segmentation is crucial, encompassing first-time homebuyers, families, retirees, and investors, each with distinct needs and preferences.

- M&A activity: The period 2019-2024 witnessed xx billion USD in M&A transactions, reflecting consolidation trends. Large players like Blackstone, with its USD 6 billion acquisition of Preferred Apartment Communities in 2022, significantly influence market dynamics.

Residential Real Estate Market in the United States Market Trends & Opportunities

The US residential real estate market exhibits robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by several factors. The market size is estimated to reach xx billion USD by 2025 and xx billion USD by 2033. Technological advancements, such as online platforms and virtual reality technologies, are transforming how properties are marketed and sold. Consumer preferences are shifting towards sustainable and energy-efficient housing, creating opportunities for green building initiatives. The rise of remote work and changing lifestyle preferences are influencing demand patterns, particularly in suburban and rural areas. Competitive dynamics are characterized by increasing competition amongst large national players and regional firms, along with the emergence of innovative business models. Market penetration rates for various property types are also steadily increasing, with significant regional variations.

Dominant Markets & Segments in Residential Real Estate Market in the United States

The leading segments within the US residential real estate market are apartments and condominiums, particularly in densely populated urban areas. Landed houses and villas dominate in suburban and rural regions. Specific regional markets exhibit strong performance due to favorable economic conditions and population growth.

Key Growth Drivers for Apartments and Condominiums:

- Increasing urbanization and population density in major metropolitan areas.

- Strong rental demand driven by Millennial and Gen Z preferences.

- Government incentives and affordable housing initiatives.

Key Growth Drivers for Landed Houses and Villas:

- Growing preference for spacious living and outdoor spaces.

- Suburbanization trends driven by remote work opportunities.

- Improved infrastructure in suburban and rural communities.

The dominance of specific regions is analyzed in detail, considering various factors like job growth, economic stability, and infrastructure development.

Residential Real Estate Market in the United States Product Analysis

Product innovations focus on incorporating smart home technology, sustainable building materials, and energy-efficient designs. The emphasis is on enhancing convenience, comfort, and environmental sustainability. These advancements cater to evolving consumer preferences and provide competitive advantages for developers and builders.

Key Drivers, Barriers & Challenges in Residential Real Estate Market in the United States

Key Drivers: Strong population growth, increasing urbanization, low interest rates (historically), and government incentives for homeownership fuel market growth. Technological advancements such as PropTech enhance efficiency and accessibility.

Key Challenges: Supply chain disruptions causing material shortages and cost increases. Stricter lending standards and affordability concerns limit purchasing power. Regulatory hurdles and lengthy permitting processes hinder development. Increasing competition among developers creates pressure on pricing and profit margins. These challenges contribute to volatility and uncertainty in the market.

Growth Drivers in the Residential Real Estate Market in the United States Market

The key growth drivers remain consistent: robust population growth, particularly in urban centers, increasing disposable income, favorable government policies (when applicable), and the ongoing demand for housing. Technological advancements continue to boost efficiency and transparency.

Challenges Impacting Residential Real Estate Market in the United States Growth

Persisting supply chain disruptions, affordability concerns limiting purchasing power, and the tightening of lending standards remain significant headwinds. Regulatory changes and their associated complexities can slow down projects, and intense competition from established players and new entrants puts pressure on margins.

Key Players Shaping the Residential Real Estate Market in the United States Market

- Simon Property Group

- Mill Creek Residential

- RE/MAX

- Alliance Residential

- Equity Residential

- Greystar Real Estate Partners

- Keller Williams Realty Inc

- Essex Property Trust

- Brookfield

- The Michaels Organization

- AvalonBay Communities

- Lincoln Property Company

Significant Residential Real Estate Market in the United States Industry Milestones

- May 2022: Resource REIT Inc. sold all outstanding shares to Blackstone Real Estate Income Trust Inc. for USD 3.7 billion, highlighting consolidation in the REIT sector.

- February 2022: Blackstone's USD 6 billion acquisition of Preferred Apartment Communities demonstrates the increasing interest in the multifamily rental sector by major players.

Future Outlook for Residential Real Estate Market in the United States Market

The US residential real estate market is poised for continued growth, driven by long-term demographic trends and ongoing demand for housing. Strategic opportunities exist in sustainable development, technological integration, and catering to evolving consumer preferences. However, careful management of supply chain challenges and navigating regulatory complexities will remain crucial for sustained success. The market's future performance depends on effectively addressing affordability concerns and maintaining a balance between supply and demand.

Residential Real Estate Market in the United States Segmentation

-

1. Property Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Residential Real Estate Market in the United States Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Residential Real Estate Market in the United States Regional Market Share

Geographic Coverage of Residential Real Estate Market in the United States

Residential Real Estate Market in the United States REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Plan Towards Urban Rail Development

- 3.3. Market Restrains

- 3.3.1. Italy’s Fragmented Approach to Tenders

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. North America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 7. South America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 8. Europe Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 9. Middle East & Africa Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 10. Asia Pacific Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 11. Brazil Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Mexico Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Argentina Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Colombia Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Chile Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Rest of Latin America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2025

- 17.2. Company Profiles

- 17.2.1 Simon Property Group

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Mill Creek Residential

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 RE/MAX

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Alliance Residential

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Equity Residential

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Greystar Real Estate Partners

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Keller Williams Realty Inc **List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Essex Property Trust

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Brookfield

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 The Michaels Organization

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 AvalonBay Communities

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Lincoln Property Company

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Simon Property Group

List of Figures

- Figure 1: Global Residential Real Estate Market in the United States Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Brazil Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 3: Brazil Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 4: Mexico Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 5: Mexico Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 6: Argentina Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 7: Argentina Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 8: Colombia Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 9: Colombia Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 10: Chile Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 11: Chile Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 12: Rest of Latin America Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 13: Rest of Latin America Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2025 & 2033

- Figure 15: North America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2025 & 2033

- Figure 16: North America Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2025 & 2033

- Figure 19: South America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2025 & 2033

- Figure 20: South America Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Residential Real Estate Market in the United States Revenue (Million), by Property Type 2025 & 2033

- Figure 23: Europe Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2025 & 2033

- Figure 24: Europe Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Property Type 2025 & 2033

- Figure 27: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2025 & 2033

- Figure 28: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 29: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

- Figure 30: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Property Type 2025 & 2033

- Figure 31: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2025 & 2033

- Figure 32: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Country 2025 & 2033

- Figure 33: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2020 & 2033

- Table 3: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2020 & 2033

- Table 17: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2020 & 2033

- Table 22: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Argentina Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of South America Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2020 & 2033

- Table 27: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 28: United Kingdom Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Germany Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Italy Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Spain Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Russia Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Benelux Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Nordics Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2020 & 2033

- Table 38: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Turkey Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Israel Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: GCC Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: North Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East & Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2020 & 2033

- Table 46: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2020 & 2033

- Table 47: China Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Japan Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Korea Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: ASEAN Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Oceania Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in the United States?

The projected CAGR is approximately 2.04%.

2. Which companies are prominent players in the Residential Real Estate Market in the United States?

Key companies in the market include Simon Property Group, Mill Creek Residential, RE/MAX, Alliance Residential, Equity Residential, Greystar Real Estate Partners, Keller Williams Realty Inc **List Not Exhaustive, Essex Property Trust, Brookfield, The Michaels Organization, AvalonBay Communities, Lincoln Property Company.

3. What are the main segments of the Residential Real Estate Market in the United States?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Investment Plan Towards Urban Rail Development.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

Italy’s Fragmented Approach to Tenders.

8. Can you provide examples of recent developments in the market?

May 2022: Resource REIT Inc. completed the sale of all of its outstanding shares of common stock to Blackstone Real Estate Income Trust Inc. for USD 14.75 per share in an all-cash deal valued at USD 3.7 billion, including the assumption of the REIT's debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in the United States," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in the United States report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in the United States?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in the United States, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence