Key Insights

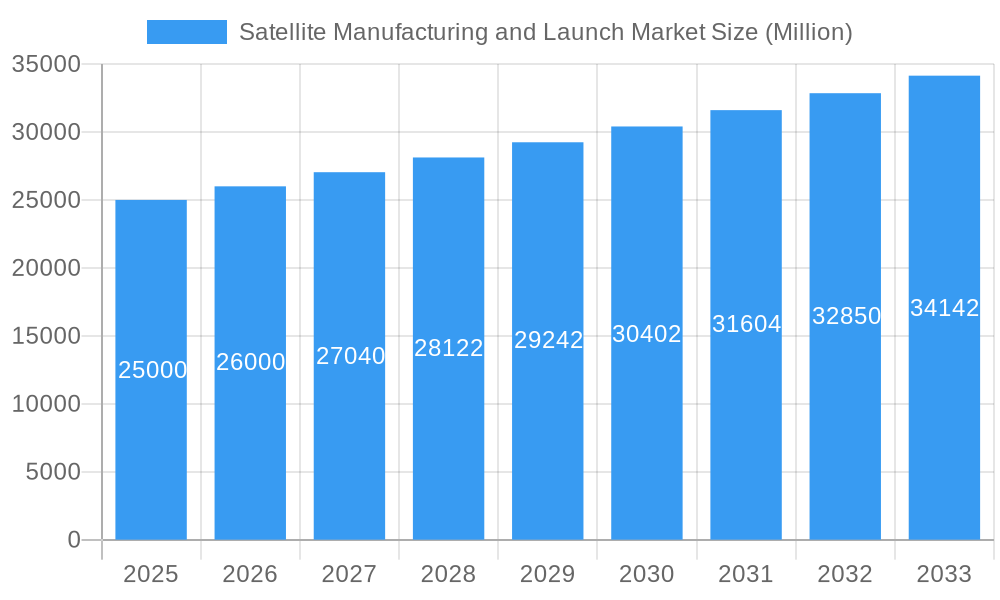

The global satellite manufacturing and launch market is projected for significant expansion, driven by increasing demand for advanced communication, Earth observation, and navigation services. The market is expected to achieve a Compound Annual Growth Rate (CAGR) of 13.63%, reaching a market size of $6.15 billion by the base year 2025. Key growth catalysts include the proliferation of cost-effective small satellite constellations, advancements in electric propulsion technology enhancing mission lifespans and reducing costs, and the expanding role of commercial entities fostering innovation. Government investments in national security and space infrastructure further bolster market growth. The market is segmented across orbit class (GEO, LEO, MEO), launch vehicle MTOW (heavy, light, medium), end-user (commercial, military & government), satellite subsystem, propulsion technology (electric, gas-based, liquid fuel), application, and satellite mass.

Satellite Manufacturing and Launch Market Market Size (In Billion)

Key challenges for the market include the high cost of launch services, regulatory complexities, and the ongoing need for innovation in satellite miniaturization and component reliability. Despite these hurdles, the long-term outlook for the satellite manufacturing and launch market remains exceptionally positive.

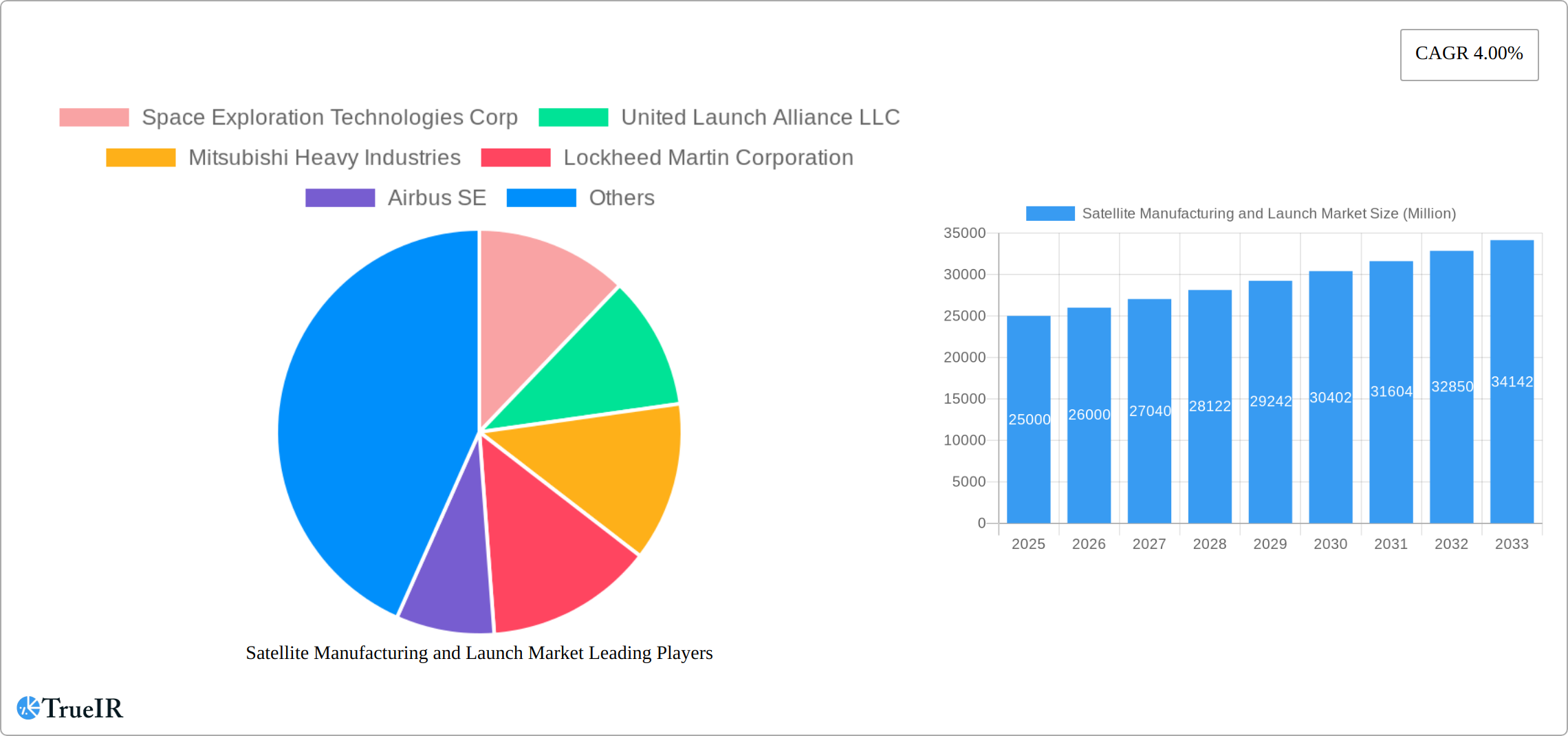

Satellite Manufacturing and Launch Market Company Market Share

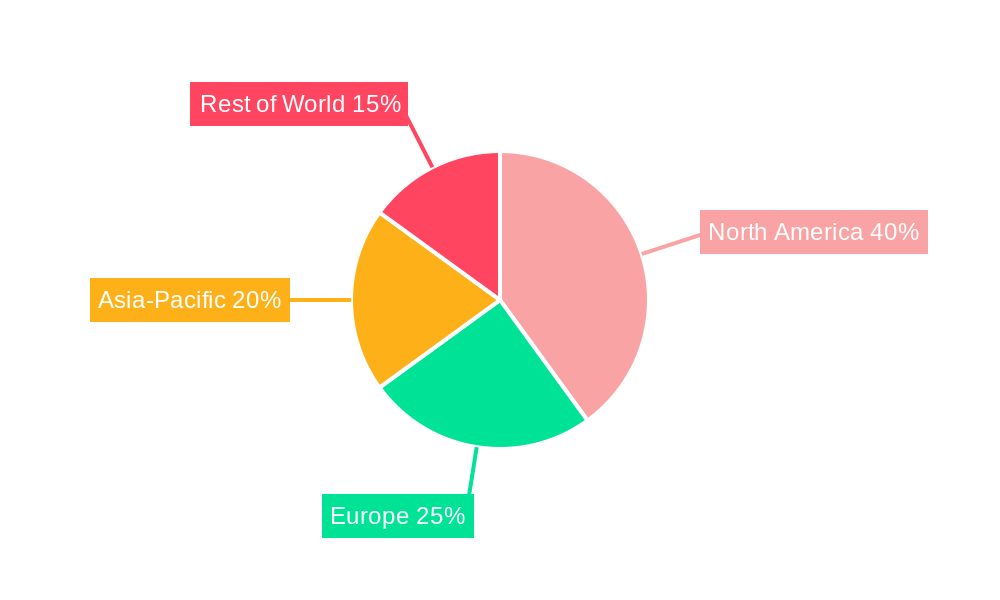

The competitive arena features established aerospace leaders and innovative startups. Major players such as SpaceX, United Launch Alliance, and Airbus are spearheading advancements in launch vehicles and satellite technology. Concurrently, specialized companies focusing on small satellite manufacturing and propulsion systems are vital contributors to market expansion. Geographically, market share is currently concentrated in regions with robust aerospace sectors, including North America, Europe, and select Asian countries. However, growing participation from emerging economies suggests a potential redistribution of market influence in the future. Ongoing technological progress, supportive government policies for space infrastructure, and expanding commercial satellite applications collectively signal substantial and sustained growth in this dynamic industry.

Satellite Manufacturing and Launch Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the global Satellite Manufacturing and Launch Market, offering invaluable insights into market size, growth drivers, competitive landscape, and future projections. With a focus on key segments and industry players, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. Expect detailed breakdowns across various segments, including orbit class (GEO, LEO, MEO), launch vehicle MTOW (heavy, light, medium), end-user (commercial, military & government, other), satellite subsystems (propulsion, bus & subsystems, solar arrays, structures, harness & mechanisms), propulsion technology (electric, gas-based, liquid fuel), application (communication, earth observation, navigation, space observation, others), and satellite mass (below 10kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg). Key players like Space Exploration Technologies Corp, United Launch Alliance LLC, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, and many more are analyzed in detail.

Satellite Manufacturing and Launch Market Market Structure & Competitive Landscape

The satellite manufacturing and launch market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a level of concentration that is subject to ongoing regulatory scrutiny. Innovation is a key driver, with companies constantly investing in research and development to improve launch capabilities, reduce costs, and develop advanced satellite technologies. Government regulations play a significant role, particularly in areas such as launch licensing, spectrum allocation, and export controls. The market also witnesses continuous mergers and acquisitions (M&A) activity, further shaping the competitive landscape. Over the historical period (2019-2024), the total value of M&A deals within the sector was approximately $xx Million, with a notable increase in activity observed in recent years.

Key Aspects:

- Market Concentration: Moderate, with a few dominant players and increasing competition from new entrants.

- Innovation Drivers: Miniaturization of satellites, reusable launch vehicles, and advanced propulsion systems.

- Regulatory Impacts: Stringent regulations related to launch permits, spectrum allocation, and international space law.

- Product Substitutes: Limited direct substitutes exist, but terrestrial communication networks can partially fulfill some satellite functions.

- End-User Segmentation: Commercial applications (communication, earth observation) dominate, but military and government demand for secure satellite systems remains substantial.

- M&A Trends: Growing M&A activity, driven by technological consolidation and expansion of market share.

Satellite Manufacturing and Launch Market Market Trends & Opportunities

The global satellite manufacturing and launch market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends: the increasing demand for high-bandwidth communication services, the growing adoption of satellite-based earth observation technologies for various applications (agriculture, environmental monitoring, disaster management), the increasing demand for navigation and positioning services, and the expansion of new space applications, such as space tourism and space-based resource extraction. Technological advancements are driving down launch costs and enhancing satellite capabilities, further fueling market expansion. Miniaturization of satellites, the development of reusable launch vehicles, and the increasing reliance on electric propulsion systems are significantly impacting the market. The market penetration rate of advanced satellite technologies, like IoT-enabled satellites, is growing steadily as well, demonstrating an increasing adoption across multiple end-user sectors. Competitive dynamics involve both established players and new entrants that are influencing pricing strategies, technological innovation, and market consolidation.

Dominant Markets & Segments in Satellite Manufacturing and Launch Market

The global satellite manufacturing and launch market is a dynamic landscape shaped by geographical distribution and technological advancements. North America currently holds the largest market share, fueled by robust government support, significant private investment, and a well-established space infrastructure. However, the Asia-Pacific region exhibits the most rapid growth trajectory, driven by substantial investments in national space programs, particularly from countries like China and India. This competition fosters innovation and accelerates market expansion.

Key Growth Drivers:

- Government Funding and Policy: Increased governmental allocations for space exploration and technological innovation are crucial catalysts. Supportive regulatory frameworks also streamline market entry and operations.

- Infrastructure Expansion: Continuous development of robust space infrastructure, encompassing launch facilities, ground stations, and related technologies, enables efficient satellite deployment and operation.

- Technological Breakthroughs: Miniaturization of satellites, the development of reusable launch vehicles, and advancements in propulsion systems (e.g., electric propulsion) are reducing costs and improving operational efficiency.

- Expanding Commercial Applications: The surging demand for satellite-based services across diverse sectors, including communication, Earth observation, navigation, and environmental monitoring, fuels market expansion. New applications in areas like IoT and space-based internet are further driving growth.

- NewSpace Companies and Private Investment: The rise of innovative NewSpace companies, coupled with increased private sector investment, introduces competition and fosters technological progress, leading to more cost-effective solutions.

Dominant Segments:

- Orbit Type: Low Earth Orbit (LEO) constellations are experiencing exponential growth, driven by the demand for global broadband internet access and other constellation-based services. Medium Earth Orbit (MEO) and Geostationary Earth Orbit (GEO) segments continue to be significant but are seeing a shift in demand.

- Launch Vehicle Capacity (MTOW): Medium-lift launch vehicles remain prevalent, but the demand for heavy-lift vehicles is increasing to accommodate larger and more complex satellites, particularly for government and commercial mega-constellations.

- End-User Sector: The commercial sector is the dominant end-user, encompassing telecommunications, Earth observation, navigation, and other applications. Government and military applications maintain significant relevance and are growing in specific segments.

- Satellite Subsystems: The satellite bus and its associated subsystems represent a substantial market segment, reflecting their critical role in satellite functionality and performance.

- Propulsion Systems: Electric propulsion systems are gaining market share due to their improved fuel efficiency and operational advantages, though traditional chemical propulsion remains significant.

- Satellite Applications: Communication services constitute the largest application segment, followed by Earth observation, navigation, and other emerging applications.

- Satellite Mass: The 100-500 kg satellite mass segment holds a considerable market share, reflecting the trend toward smaller, more cost-effective satellites.

Satellite Manufacturing and Launch Market Product Analysis

Recent innovations include advancements in electric propulsion, the development of smaller, more efficient satellites, and the emergence of reusable launch systems. These innovations are driving down costs and improving capabilities, making satellite technology more accessible and cost-effective for a wider range of applications. The key competitive advantage lies in technological superiority and cost-effectiveness. Companies are constantly seeking to improve launch reliability, shorten launch times, and enhance satellite performance to meet the diverse needs of various sectors.

Key Drivers, Barriers & Challenges in Satellite Manufacturing and Launch Market

Key Drivers:

- Technological Innovation: Advancements in electric propulsion, miniaturization, reusable launch vehicles, and improved manufacturing processes are lowering costs and enhancing satellite performance, thereby expanding market accessibility.

- Increased Service Demand: The escalating demand for satellite-based services across various sectors is a primary driver of market growth. This demand is fueled by both existing applications and emerging needs.

- Government Support and Policy: Continued government funding, supportive regulations, and strategic initiatives are crucial for fostering technological advancement and market expansion.

Challenges:

- High Launch Costs: High launch costs remain a substantial barrier, particularly for smaller companies and projects. Reducing launch costs through reusable launch vehicle technology and increased competition is essential for wider market adoption.

- Space Debris Mitigation: The increasing amount of space debris poses a significant threat to operational satellites and future missions, requiring international cooperation and proactive mitigation strategies.

- Regulatory Complexity: Navigating regulatory hurdles related to licensing, spectrum allocation, and international space law can create delays and increase project costs.

- Supply Chain Vulnerabilities: Supply chain complexities and potential disruptions can impact the availability and cost of essential components and materials, highlighting the need for resilient supply chain management.

Growth Drivers in the Satellite Manufacturing and Launch Market Market

The increasing demand for high-bandwidth communication services, particularly in underserved regions, and the expansion of new space applications like space tourism and space-based resource extraction are significant drivers. Moreover, government initiatives and funding programs stimulate growth in specific applications such as military surveillance and environmental monitoring.

Challenges Impacting Satellite Manufacturing and Launch Market Growth

The growth of the satellite manufacturing and launch market faces persistent challenges, including high launch costs, regulatory complexities, supply chain vulnerabilities, and the growing concern of space debris. Addressing these challenges requires collaborative efforts among governments, industry stakeholders, and international organizations to ensure the long-term sustainability and growth of the space industry.

Key Players Shaping the Satellite Manufacturing and Launch Market Market

- Space Exploration Technologies Corp

- United Launch Alliance LLC

- Mitsubishi Heavy Industries

- Lockheed Martin Corporation

- Airbus SE

- Sierra Nevada Corporation

- China Aerospace Science and Technology Corporation (CASC)

- Thales

- Ariane Group

- Maxar Technologies Inc

- Northrop Grumman Corporation

- Indian Space Research Organisation (ISRO)

- The Boeing Company

Significant Satellite Manufacturing and Launch Market Industry Milestones

- November 2022: Maxar Technologies' acquisition of Wovenware significantly enhanced its software engineering and AI capabilities, strengthening its position in the market.

- November 2022: The finalized agreement between EchoStar Corporation and Maxar Technologies for the manufacturing of the EchoStar XXIV (JUPITER™ 3) satellite marks a significant development in commercial satellite production.

- January 2023: Airbus secured a substantial 15-year contract with the Belgian Ministry of Defense for tactical satellite communication services, signaling a growing trend in government partnerships and highlighting the strategic importance of satellite communications.

- [Add other relevant recent milestones here]

Future Outlook for Satellite Manufacturing and Launch Market Market

The satellite manufacturing and launch market is projected to experience sustained robust growth, driven by the insatiable demand for data, continuous technological advancements that drive down costs, and the emergence of novel space-based applications. Companies that successfully develop innovative, cost-effective satellite technologies and launch systems are poised for significant success. The market presents substantial potential, particularly in developing regions with limited terrestrial infrastructure. The increasing focus on sustainability and space debris mitigation will also shape the future of the industry.

Satellite Manufacturing and Launch Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. Launch Vehicle Mtow

- 4.1. Heavy

- 4.2. Light

- 4.3. Medium

-

5. End User

- 5.1. Commercial

- 5.2. Military & Government

- 5.3. Other

-

6. Satellite Subsystem

- 6.1. Propulsion Hardware and Propellant

- 6.2. Satellite Bus & Subsystems

- 6.3. Solar Array & Power Hardware

- 6.4. Structures, Harness & Mechanisms

-

7. Propulsion Tech

- 7.1. Electric

- 7.2. Gas based

- 7.3. Liquid Fuel

Satellite Manufacturing and Launch Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Satellite Manufacturing and Launch Market Regional Market Share

Geographic Coverage of Satellite Manufacturing and Launch Market

Satellite Manufacturing and Launch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 5.4.1. Heavy

- 5.4.2. Light

- 5.4.3. Medium

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. Commercial

- 5.5.2. Military & Government

- 5.5.3. Other

- 5.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.6.1. Propulsion Hardware and Propellant

- 5.6.2. Satellite Bus & Subsystems

- 5.6.3. Solar Array & Power Hardware

- 5.6.4. Structures, Harness & Mechanisms

- 5.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.7.1. Electric

- 5.7.2. Gas based

- 5.7.3. Liquid Fuel

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Earth Observation

- 6.1.3. Navigation

- 6.1.4. Space Observation

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 6.2.1. 10-100kg

- 6.2.2. 100-500kg

- 6.2.3. 500-1000kg

- 6.2.4. Below 10 Kg

- 6.2.5. above 1000kg

- 6.3. Market Analysis, Insights and Forecast - by Orbit Class

- 6.3.1. GEO

- 6.3.2. LEO

- 6.3.3. MEO

- 6.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 6.4.1. Heavy

- 6.4.2. Light

- 6.4.3. Medium

- 6.5. Market Analysis, Insights and Forecast - by End User

- 6.5.1. Commercial

- 6.5.2. Military & Government

- 6.5.3. Other

- 6.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 6.6.1. Propulsion Hardware and Propellant

- 6.6.2. Satellite Bus & Subsystems

- 6.6.3. Solar Array & Power Hardware

- 6.6.4. Structures, Harness & Mechanisms

- 6.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6.7.1. Electric

- 6.7.2. Gas based

- 6.7.3. Liquid Fuel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Earth Observation

- 7.1.3. Navigation

- 7.1.4. Space Observation

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 7.2.1. 10-100kg

- 7.2.2. 100-500kg

- 7.2.3. 500-1000kg

- 7.2.4. Below 10 Kg

- 7.2.5. above 1000kg

- 7.3. Market Analysis, Insights and Forecast - by Orbit Class

- 7.3.1. GEO

- 7.3.2. LEO

- 7.3.3. MEO

- 7.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 7.4.1. Heavy

- 7.4.2. Light

- 7.4.3. Medium

- 7.5. Market Analysis, Insights and Forecast - by End User

- 7.5.1. Commercial

- 7.5.2. Military & Government

- 7.5.3. Other

- 7.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 7.6.1. Propulsion Hardware and Propellant

- 7.6.2. Satellite Bus & Subsystems

- 7.6.3. Solar Array & Power Hardware

- 7.6.4. Structures, Harness & Mechanisms

- 7.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7.7.1. Electric

- 7.7.2. Gas based

- 7.7.3. Liquid Fuel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Earth Observation

- 8.1.3. Navigation

- 8.1.4. Space Observation

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 8.2.1. 10-100kg

- 8.2.2. 100-500kg

- 8.2.3. 500-1000kg

- 8.2.4. Below 10 Kg

- 8.2.5. above 1000kg

- 8.3. Market Analysis, Insights and Forecast - by Orbit Class

- 8.3.1. GEO

- 8.3.2. LEO

- 8.3.3. MEO

- 8.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 8.4.1. Heavy

- 8.4.2. Light

- 8.4.3. Medium

- 8.5. Market Analysis, Insights and Forecast - by End User

- 8.5.1. Commercial

- 8.5.2. Military & Government

- 8.5.3. Other

- 8.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 8.6.1. Propulsion Hardware and Propellant

- 8.6.2. Satellite Bus & Subsystems

- 8.6.3. Solar Array & Power Hardware

- 8.6.4. Structures, Harness & Mechanisms

- 8.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8.7.1. Electric

- 8.7.2. Gas based

- 8.7.3. Liquid Fuel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Earth Observation

- 9.1.3. Navigation

- 9.1.4. Space Observation

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 9.2.1. 10-100kg

- 9.2.2. 100-500kg

- 9.2.3. 500-1000kg

- 9.2.4. Below 10 Kg

- 9.2.5. above 1000kg

- 9.3. Market Analysis, Insights and Forecast - by Orbit Class

- 9.3.1. GEO

- 9.3.2. LEO

- 9.3.3. MEO

- 9.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 9.4.1. Heavy

- 9.4.2. Light

- 9.4.3. Medium

- 9.5. Market Analysis, Insights and Forecast - by End User

- 9.5.1. Commercial

- 9.5.2. Military & Government

- 9.5.3. Other

- 9.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 9.6.1. Propulsion Hardware and Propellant

- 9.6.2. Satellite Bus & Subsystems

- 9.6.3. Solar Array & Power Hardware

- 9.6.4. Structures, Harness & Mechanisms

- 9.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9.7.1. Electric

- 9.7.2. Gas based

- 9.7.3. Liquid Fuel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Earth Observation

- 10.1.3. Navigation

- 10.1.4. Space Observation

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 10.2.1. 10-100kg

- 10.2.2. 100-500kg

- 10.2.3. 500-1000kg

- 10.2.4. Below 10 Kg

- 10.2.5. above 1000kg

- 10.3. Market Analysis, Insights and Forecast - by Orbit Class

- 10.3.1. GEO

- 10.3.2. LEO

- 10.3.3. MEO

- 10.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 10.4.1. Heavy

- 10.4.2. Light

- 10.4.3. Medium

- 10.5. Market Analysis, Insights and Forecast - by End User

- 10.5.1. Commercial

- 10.5.2. Military & Government

- 10.5.3. Other

- 10.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 10.6.1. Propulsion Hardware and Propellant

- 10.6.2. Satellite Bus & Subsystems

- 10.6.3. Solar Array & Power Hardware

- 10.6.4. Structures, Harness & Mechanisms

- 10.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10.7.1. Electric

- 10.7.2. Gas based

- 10.7.3. Liquid Fuel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Exploration Technologies Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Launch Alliance LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Heavy Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sierra Nevada Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Aerospace Science and Technology Corporation (CASC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ariane Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maxar Technologies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Indian Space Research Organisation (ISRO)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 The Boeing Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global Satellite Manufacturing and Launch Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 5: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 6: North America Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 7: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 8: North America Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 9: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 10: North America Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 11: North America Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: North America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 13: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 14: North America Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 15: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 16: North America Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 19: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: South America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 21: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 22: South America Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 23: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 24: South America Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 25: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 26: South America Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 27: South America Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 28: South America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 29: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 30: South America Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 31: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 32: South America Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 35: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 37: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 38: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 39: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 40: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 41: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 42: Europe Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 43: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 44: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 45: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 46: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 47: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 48: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 51: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 52: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 53: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 54: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 55: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 56: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 57: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 58: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 59: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 60: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 61: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 62: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 63: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 64: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 67: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 68: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 69: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 70: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 71: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 72: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 73: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 74: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 75: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 76: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 77: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 78: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 79: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 80: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 81: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 5: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 7: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 8: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 11: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 12: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 13: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 15: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 16: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United States Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Canada Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Mexico Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 22: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 23: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 24: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 26: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 27: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Argentina Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 33: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 34: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 35: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 37: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 38: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: United Kingdom Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: France Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Italy Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Spain Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Russia Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Benelux Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Nordics Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 49: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 50: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 51: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 52: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 53: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 54: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 55: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Turkey Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Israel Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: GCC Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: North Africa Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 63: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 64: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 65: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 66: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 67: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 68: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 69: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 70: China Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 71: India Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 73: South Korea Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: ASEAN Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 75: Oceania Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Manufacturing and Launch Market?

The projected CAGR is approximately 13.63%.

2. Which companies are prominent players in the Satellite Manufacturing and Launch Market?

Key companies in the market include Space Exploration Technologies Corp, United Launch Alliance LLC, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, Sierra Nevada Corporation, China Aerospace Science and Technology Corporation (CASC), Thales, Ariane Group, Maxar Technologies Inc, Northrop Grumman Corporation, Indian Space Research Organisation (ISRO), The Boeing Company.

3. What are the main segments of the Satellite Manufacturing and Launch Market?

The market segments include Application, Satellite Mass, Orbit Class, Launch Vehicle Mtow, End User, Satellite Subsystem, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.15 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Airbus has signed a contract with the Belgian Ministry of Defense, the company announced last week. Airbus will provide tactical satellite communications services to the armed forces for a period of 15 years. Airbus plans to launch a new ultra-high frequency (UHF) communications service by 2024 for the armed forces of other European nations and NATO allies.November 2022: EchoStar Corporation announced a revised agreement with Maxar Technologies to manufacture the EchoStar XXIV satellite, also known as JUPITER™ 3. The satellite, designed for EchoStar's Hughes Network Systems division, is being manufactured at Maxar's facility in Palo Alto, California.November 2022: Maxar Technologies has acquired software development and artificial intelligence company Wovenware. This acquisition adds significantly to Maxar's Software Engineering and AI capabilities

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Manufacturing and Launch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Manufacturing and Launch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Manufacturing and Launch Market?

To stay informed about further developments, trends, and reports in the Satellite Manufacturing and Launch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence