Key Insights

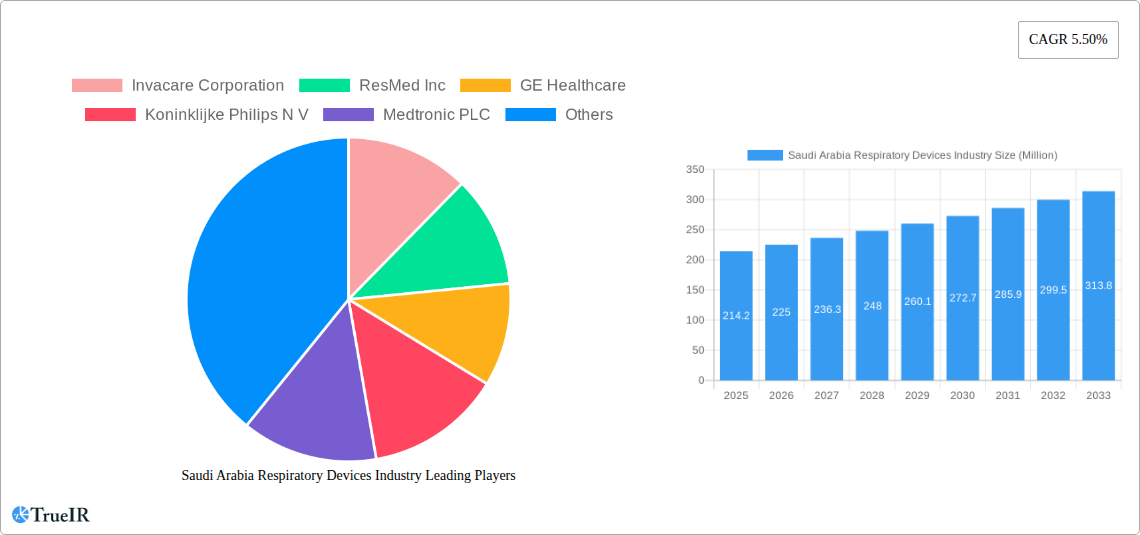

The Saudi Arabia Respiratory Devices Industry is poised for significant expansion, with a market size estimated at $214.2 million in 2025, projecting a robust compound annual growth rate (CAGR) of 5.15% through 2033. This growth is primarily propelled by a rising prevalence of respiratory conditions, including asthma, chronic obstructive pulmonary disease (COPD), and sleep apnea, exacerbated by lifestyle changes and environmental factors. The increasing adoption of advanced diagnostic and monitoring devices, such as spirometers and pulse oximeters, coupled with the growing demand for therapeutic devices like CPAP and ventilators, are key market drivers. Furthermore, government initiatives focused on enhancing healthcare infrastructure and patient care are creating a favorable ecosystem for market participants. The burgeoning elderly population in Saudi Arabia also contributes to the escalating demand for respiratory support solutions.

Saudi Arabia Respiratory Devices Industry Market Size (In Million)

The market is segmented into Diagnostic and Monitoring Devices, Therapeutic Devices, and Disposables, each exhibiting distinct growth trajectories. Diagnostic and monitoring devices are gaining traction due to their crucial role in early detection and management of respiratory ailments. Therapeutic devices, essential for managing chronic respiratory diseases, are witnessing sustained demand, particularly from homecare settings. The disposables segment, encompassing masks and breathing circuits, is intrinsically linked to the usage of therapeutic devices, reflecting a steady growth pattern. Key industry players are actively investing in research and development to introduce innovative products and expand their market reach within the Kingdom. Challenges such as the high cost of advanced devices and the need for skilled healthcare professionals to operate them are present but are being addressed through technological advancements and training programs.

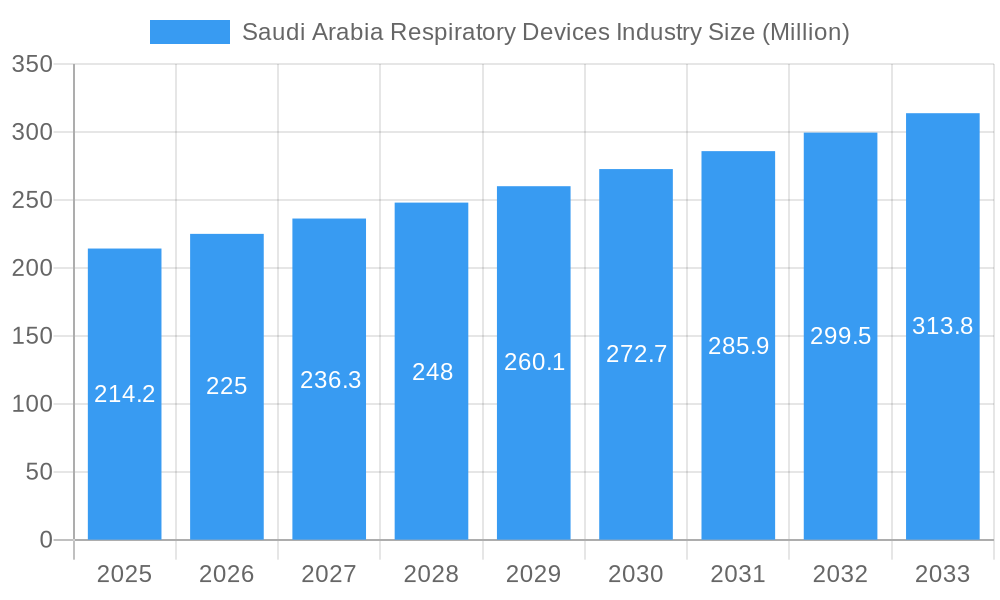

Saudi Arabia Respiratory Devices Industry Company Market Share

Saudi Arabia Respiratory Devices Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Saudi Arabia respiratory devices market, forecasting its trajectory from 2019 to 2033, with a base year of 2025 and a robust forecast period of 2025–2033. Leveraging high-volume keywords such as "Saudi Arabia respiratory devices," "respiratory diagnostics," "therapeutic respiratory equipment," "oxygen concentrators Saudi Arabia," "ventilators market," and "CPAP devices GCC," this SEO-optimized report is designed to empower industry stakeholders with actionable insights. Delve into market size, segmentation, competitive landscape, emerging trends, and strategic opportunities within this rapidly evolving sector.

Saudi Arabia Respiratory Devices Industry Market Structure & Competitive Landscape

The Saudi Arabia respiratory devices market exhibits a dynamic structure, characterized by a moderate to high level of concentration among a select group of global and regional players. Innovation serves as a primary driver, fueled by continuous research and development in areas like smart diagnostics, portable ventilators, and advanced drug delivery systems. Regulatory frameworks, while evolving, play a crucial role in ensuring product quality and patient safety. The threat of product substitutes is relatively low for critical therapeutic devices, but advancements in non-invasive monitoring techniques could impact certain diagnostic segments. End-user segmentation is primarily driven by healthcare facilities, home care settings, and specialized clinics. Mergers and acquisitions (M&A) are active, with an estimated 15-20 M&A activities annually between 2019 and 2024, consolidating market share and expanding product portfolios. For instance, a key competitor might acquire a smaller player specializing in disposable respiratory accessories to strengthen its offering. Concentration ratios, particularly within the ventilator and CPAP segments, hover around 60-70% for the top five players.

- Market Concentration: Dominated by established multinational corporations and a growing presence of local distributors.

- Innovation Drivers: Technological advancements in AI-powered diagnostics, miniaturization of devices, and enhanced patient monitoring capabilities.

- Regulatory Impacts: Stringent approval processes by the Saudi Food and Drug Authority (SFDA) ensure high product standards.

- Product Substitutes: Limited for critical life-support equipment, but evolving diagnostic technologies present some substitution potential.

- End-User Segmentation: Hospitals, clinics, long-term care facilities, and home healthcare providers represent key market segments.

- M&A Trends: Ongoing consolidation and strategic partnerships to expand market reach and product offerings.

Saudi Arabia Respiratory Devices Industry Market Trends & Opportunities

The Saudi Arabia respiratory devices market is poised for significant expansion, driven by a confluence of demographic shifts, increasing prevalence of respiratory diseases, and substantial government investment in healthcare infrastructure. The market size, estimated at USD 450 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% through 2033, reaching an estimated USD 800 million. Technological shifts are pivotal, with the integration of artificial intelligence (AI) and the Internet of Medical Things (IoMT) revolutionizing diagnostics and patient management. Wearable respiratory sensors, advanced telemedicine platforms for remote patient monitoring, and smart inhalers are gaining traction, offering enhanced patient convenience and improved treatment adherence. Consumer preferences are increasingly leaning towards user-friendly, portable, and cost-effective solutions, particularly in the home care segment. Competitive dynamics are intensifying, with players focusing on product differentiation, strategic partnerships, and expanding their distribution networks. The rising awareness about sleep apnea and the subsequent demand for CPAP devices, estimated to reach USD 150 million by 2033, represents a significant opportunity. Furthermore, the increasing adoption of advanced ventilators, valued at USD 200 million in 2033, is a key growth area. The market penetration for diagnostic spirometers is expected to reach 40% by 2033, indicating a substantial untapped potential. The growing incidence of Chronic Obstructive Pulmonary Disease (COPD) and asthma, coupled with an aging population, is a strong underlying factor driving demand for a wide array of respiratory solutions. Opportunities also lie in developing localized manufacturing capabilities to reduce import dependency and cater to specific regional needs. The growing adoption of nebulizers, projected to reach USD 120 million by 2033, highlights the demand for effective drug delivery for various respiratory ailments.

Dominant Markets & Segments in Saudi Arabia Respiratory Devices Industry

The Therapeutic Devices segment is the dominant force within the Saudi Arabia respiratory devices market, accounting for an estimated 55% of the market share in 2025. Within this segment, CPAP Devices and Ventilators are the leading product categories, driven by the escalating prevalence of sleep disorders like obstructive sleep apnea and the critical need for life-support in intensive care settings. The market for CPAP devices is projected to grow at a CAGR of 8.2%, reaching an estimated USD 150 million by 2033. Ventilators, crucial for managing respiratory failure, are expected to witness a CAGR of 7.8%, securing a market value of USD 200 million by 2033. The increasing demand for Oxygen Concentrators, essential for managing chronic respiratory conditions like COPD, is also a significant growth driver, projected to reach USD 130 million by 2033 with a CAGR of 6.9%.

- Dominant Segment: Therapeutic Devices

- Key Growth Drivers for Therapeutic Devices:

- Rising incidence of chronic respiratory diseases (COPD, asthma).

- Increasing prevalence of sleep apnea disorders.

- Expansion of healthcare infrastructure and hospital capacities.

- Government initiatives promoting home healthcare.

- Technological advancements leading to more efficient and user-friendly devices.

- Key Growth Drivers for Therapeutic Devices:

- Leading Product Categories within Therapeutic Devices:

- CPAP Devices: Driven by the growing diagnosis of sleep apnea.

- Ventilators: Essential for critical care and post-surgical recovery.

- Oxygen Concentrators: Crucial for chronic respiratory disease management.

- Nebulizers: Essential for efficient drug delivery in asthma and COPD patients.

- Diagnostic and Monitoring Devices Segment: This segment, valued at USD 180 million in 2025, is expected to grow at a CAGR of 6.8%.

- Key Growth Drivers for Diagnostic and Monitoring Devices:

- Increasing emphasis on early diagnosis and preventive healthcare.

- Technological advancements in portable and AI-enabled diagnostic tools.

- Growing awareness of respiratory health among the population.

- Prominent Products: Pulse Oximeters, Spirometers, and Sleep Test Devices are key contributors.

- Key Growth Drivers for Diagnostic and Monitoring Devices:

- Disposables Segment: This segment, though smaller, is vital for ongoing patient care and is expected to grow at a CAGR of 6.5%, reaching USD 70 million by 2033.

- Key Growth Drivers for Disposables:

- Increasing patient volumes requiring ongoing respiratory support.

- Hygiene and infection control protocols in healthcare settings.

- Comfort and efficacy of advanced mask and breathing circuit designs.

- Key Products: Masks and Breathing Circuits are the primary drivers of this segment.

- Key Growth Drivers for Disposables:

Saudi Arabia Respiratory Devices Industry Product Analysis

The Saudi Arabia respiratory devices market is characterized by a constant stream of product innovations aimed at enhancing patient outcomes and operational efficiency. From advanced CPAP devices with integrated humidification and smart algorithms for personalized therapy, to highly portable and accurate pulse oximeters for remote patient monitoring, the focus is on user-centric design and technological integration. Innovations in ventilators are driving towards less invasive modes of ventilation and improved patient-ventilator synchrony. The development of nebulizer systems with enhanced particle delivery efficiency and the introduction of intelligent inhalers with dose tracking capabilities further exemplify the market's commitment to improving treatment efficacy and patient adherence. These advancements not only address unmet clinical needs but also create significant competitive advantages for manufacturers.

Key Drivers, Barriers & Challenges in Saudi Arabia Respiratory Devices Industry

Key Drivers: The Saudi Arabia respiratory devices market is propelled by several critical factors. Firstly, the rising prevalence of chronic respiratory diseases such as COPD and asthma, coupled with an aging population, directly fuels demand for therapeutic and diagnostic devices. Secondly, substantial government investment in healthcare infrastructure, including the expansion of hospitals, specialized respiratory clinics, and the promotion of home healthcare services, creates a fertile ground for market growth. Thirdly, increasing public awareness regarding respiratory health and the benefits of early diagnosis and treatment further bolsters market penetration. Lastly, technological advancements leading to more efficient, user-friendly, and connected respiratory devices are crucial growth catalysts.

Barriers & Challenges: Despite the promising growth, the market faces several challenges. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of essential components and finished goods, potentially affecting market accessibility. Stringent regulatory approvals from the SFDA, while ensuring quality, can sometimes lead to extended product launch timelines. Intense competition from established global players and emerging regional manufacturers exerts downward pressure on pricing. Furthermore, the initial cost of advanced respiratory equipment can be a barrier for some healthcare providers and individual consumers, particularly in the home care segment. Addressing these challenges will be crucial for sustained market expansion.

Growth Drivers in the Saudi Arabia Respiratory Devices Industry Market

The Saudi Arabia respiratory devices market is experiencing robust growth driven by several key factors. The escalating burden of respiratory illnesses, including asthma, COPD, and the growing concern around sleep-related breathing disorders like sleep apnea, forms the bedrock of demand. Government initiatives focused on enhancing healthcare accessibility and quality, such as the Vision 2030 healthcare transformation programs, are leading to significant investments in medical infrastructure and technology adoption. Technological advancements are continuously introducing more sophisticated, user-friendly, and portable diagnostic and therapeutic devices, enhancing patient care and expanding market reach into home healthcare settings. The increasing disposable income and rising health consciousness among the Saudi population also contribute to the demand for advanced respiratory solutions.

Challenges Impacting Saudi Arabia Respiratory Devices Industry Growth

Several challenges can impede the growth trajectory of the Saudi Arabia respiratory devices industry. Supply chain vulnerabilities, including the reliance on imports for critical components and finished goods, can lead to price volatility and availability issues, particularly during global crises. Navigating the complex regulatory landscape for medical devices, although crucial for patient safety, can present lengthy approval processes for new products. Intense competition, both from established multinational corporations and a growing number of local distributors, can exert pressure on profit margins. Furthermore, the initial high cost of advanced respiratory equipment can be a significant barrier for widespread adoption, especially in underserviced regions or among lower-income populations. Ensuring consistent after-sales service and technical support across the nation is also a logistical challenge.

Key Players Shaping the Saudi Arabia Respiratory Devices Industry Market

- Invacare Corporation

- ResMed Inc

- GE Healthcare

- Koninklijke Philips N V

- Medtronic PLC

- Fisher & Paykel Healthcare Limited

- Dragerwerk AG

- GlaxoSmithKline PLC

Significant Saudi Arabia Respiratory Devices Industry Industry Milestones

- March 2022: Avon Protection showcased its advanced respiratory and head protection portfolio, including the FM50 respirator, MP-PAPR, and F90 helmet, at the inaugural World Defense Show in Riyadh, signaling growing interest in specialized respiratory solutions within the region.

- February 2022: Starpharma secured an exclusive sales and distribution agreement for its antiviral nasal spray VIRALEZE in Saudi Arabia and eight other countries across the GCC region. VIRALEZE's registration as a medical device highlights the growing regulatory acceptance and market potential for innovative respiratory health products.

Future Outlook for Saudi Arabia Respiratory Devices Industry Market

The future outlook for the Saudi Arabia respiratory devices industry is exceptionally promising, characterized by sustained growth and innovation. The market is projected to expand significantly, driven by increasing healthcare expenditure, a growing aging population susceptible to respiratory ailments, and a burgeoning demand for advanced home-care solutions. Opportunities abound for companies focusing on the development and adoption of smart, connected devices that facilitate remote patient monitoring and personalized treatment. The Saudi government's commitment to healthcare modernization, exemplified by its Vision 2030 agenda, will continue to foster an environment conducive to technological advancements and increased market penetration for high-quality respiratory devices. Strategic partnerships, localized manufacturing initiatives, and a focus on addressing unmet clinical needs will be key to capitalizing on this dynamic market.

Saudi Arabia Respiratory Devices Industry Segmentation

-

1. Type

-

1.1. By Diagnostic and Monitoring Devices

- 1.1.1. Spirometers

- 1.1.2. Sleep Test Devices

- 1.1.3. Peak Flow Meters

- 1.1.4. Pulse Oximeters

- 1.1.5. Capnographs

- 1.1.6. Other Diagnostic and Monitoring Devices

-

1.2. By Therapeutic Devices

- 1.2.1. CPAP Devices

- 1.2.2. BiPAP Devices

- 1.2.3. Humidifiers

- 1.2.4. Nebulizers

- 1.2.5. Oxygen Concentrators

- 1.2.6. Ventilators

- 1.2.7. Inhalers

- 1.2.8. Other Therapeutic Devices

-

1.3. By Disposables

- 1.3.1. Masks

- 1.3.2. Breathing Circuits

- 1.3.3. Other Disposables

-

1.1. By Diagnostic and Monitoring Devices

Saudi Arabia Respiratory Devices Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Respiratory Devices Industry Regional Market Share

Geographic Coverage of Saudi Arabia Respiratory Devices Industry

Saudi Arabia Respiratory Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Respiratory Disorders; Rising Government Initiatives and Large Patient Population

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Inhalers Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Respiratory Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. By Diagnostic and Monitoring Devices

- 5.1.1.1. Spirometers

- 5.1.1.2. Sleep Test Devices

- 5.1.1.3. Peak Flow Meters

- 5.1.1.4. Pulse Oximeters

- 5.1.1.5. Capnographs

- 5.1.1.6. Other Diagnostic and Monitoring Devices

- 5.1.2. By Therapeutic Devices

- 5.1.2.1. CPAP Devices

- 5.1.2.2. BiPAP Devices

- 5.1.2.3. Humidifiers

- 5.1.2.4. Nebulizers

- 5.1.2.5. Oxygen Concentrators

- 5.1.2.6. Ventilators

- 5.1.2.7. Inhalers

- 5.1.2.8. Other Therapeutic Devices

- 5.1.3. By Disposables

- 5.1.3.1. Masks

- 5.1.3.2. Breathing Circuits

- 5.1.3.3. Other Disposables

- 5.1.1. By Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Invacare Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ResMed Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fisher & Paykel Healthcare Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dragerwerk AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GlaxoSmithKline PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Invacare Corporation

List of Figures

- Figure 1: Saudi Arabia Respiratory Devices Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Respiratory Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Respiratory Devices Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Saudi Arabia Respiratory Devices Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Respiratory Devices Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Saudi Arabia Respiratory Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Respiratory Devices Industry?

The projected CAGR is approximately 5.15%.

2. Which companies are prominent players in the Saudi Arabia Respiratory Devices Industry?

Key companies in the market include Invacare Corporation, ResMed Inc, GE Healthcare, Koninklijke Philips N V, Medtronic PLC, Fisher & Paykel Healthcare Limited, Dragerwerk AG, GlaxoSmithKline PLC.

3. What are the main segments of the Saudi Arabia Respiratory Devices Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders; Rising Government Initiatives and Large Patient Population.

6. What are the notable trends driving market growth?

Inhalers Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

In March 2022, Avon Protection demonstrated its respiratory and head protection portfolio, including Avon Protection's FM50 respirator, MP-PAPR, and the F90 helmet at the first World Defense Show in Riyadh, Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Respiratory Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Respiratory Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Respiratory Devices Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Respiratory Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence