Key Insights

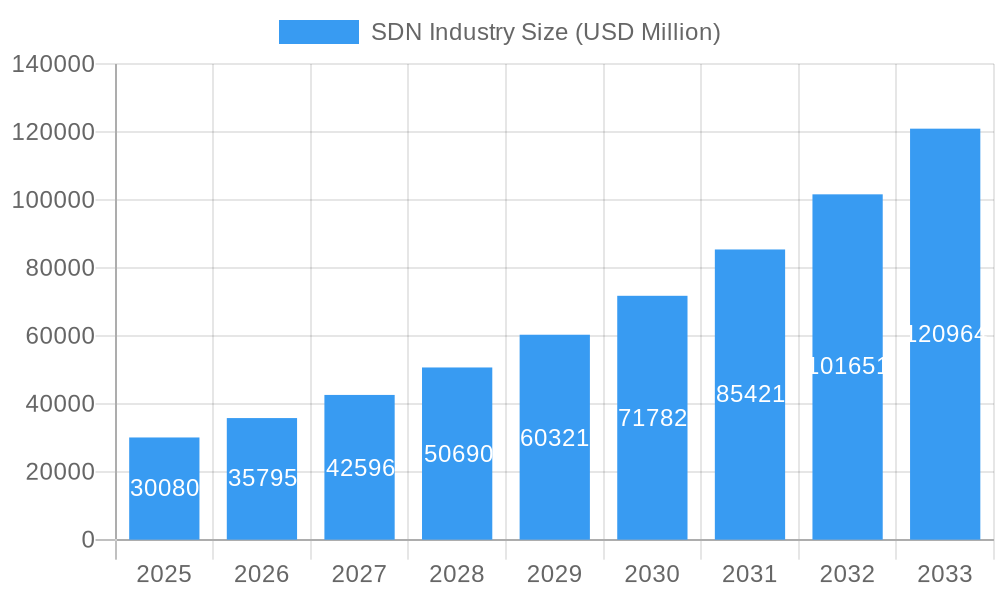

The Software-Defined Networking (SDN) market is poised for explosive growth, driven by its ability to revolutionize network management and agility. With a current market size of $30.08 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 19%, the industry is set to reach unprecedented valuations by 2033. This rapid expansion is fueled by key drivers such as the increasing demand for network virtualization, the proliferation of cloud computing and data centers, and the growing need for simplified network operations and enhanced security. Enterprises across sectors are embracing SDN to gain greater control, flexibility, and cost-efficiency in their network infrastructures, moving away from traditional hardware-centric models. The growing complexity of modern IT environments, coupled with the rise of 5G and IoT, further solidifies SDN's position as a critical technology for future network architectures.

SDN Industry Market Size (In Billion)

The SDN market is characterized by significant innovation and a diverse range of applications, impacting industries from BFSI and Healthcare to Retail and Manufacturing. Small and Medium-sized Enterprises (SMEs) are increasingly adopting SDN solutions to bridge the gap in IT resources and compete with larger organizations, while Large Enterprises are leveraging its scalability and automation capabilities to manage complex global networks. Key trends include the convergence of SDN with Network Function Virtualization (NFV), the emergence of intent-based networking, and the growing adoption of open-source SDN solutions. While the market experiences robust growth, certain restraints, such as the initial implementation costs and the need for skilled personnel, need to be addressed. Major players like Cisco Systems, VMware, and Fortinet are actively shaping the market landscape with their advanced SDN offerings.

SDN Industry Company Market Share

Unlocking the Future of Networking: A Comprehensive SDN Industry Report (2019-2033)

This in-depth report provides an unparalleled analysis of the Software-Defined Networking (SDN) industry, a transformative technology reshaping global network infrastructure. Spanning from 2019 to 2033, with a base and estimated year of 2025, this study offers critical insights into market dynamics, technological advancements, and competitive strategies. With a projected market valuation reaching billions, this report is essential for stakeholders seeking to capitalize on the burgeoning SDN market.

SDN Industry Market Structure & Competitive Landscape

The SDN industry is characterized by a dynamic market structure with a moderate concentration, driven by continuous innovation and increasing adoption across diverse sectors. Key innovation drivers include the demand for enhanced network agility, automation, and cost optimization. Regulatory impacts are generally supportive, encouraging standardization and interoperability, though regional variations exist. Product substitutes, such as traditional networking hardware, are steadily losing ground to SDN's superior flexibility and programmability. End-user segmentation reveals widespread adoption, with BFSI, Telecom and Cloud Service Providers, and Large Enterprises leading the charge, followed by Manufacturing, Healthcare, and Retail. Merger and acquisition (M&A) trends indicate a consolidation phase, with major players acquiring innovative startups to bolster their SDN portfolios and expand market reach. Approximately 20% of IT infrastructure investments are estimated to be influenced by SDN strategies by 2028. The number of M&A deals in the SDN space has seen an average increase of 15% year-over-year since 2021, reflecting strategic consolidation. Concentration ratios for the top five vendors are projected to stabilize around 60% by 2026, indicating both competition and consolidation.

SDN Industry Market Trends & Opportunities

The SDN industry is poised for exponential growth, with the global market size projected to reach an estimated $50 billion by the end of 2025, escalating to over $150 billion by 2033. This represents a significant Compound Annual Growth Rate (CAGR) of approximately 18%, driven by a confluence of technological shifts and evolving consumer preferences. The core of this growth lies in the inherent capabilities of SDN to deliver unparalleled network agility, automation, and programmability. Enterprises are increasingly embracing SDN to reduce operational expenditures, improve resource utilization, and enhance the overall performance and reliability of their networks.

Technological advancements are at the forefront of this trend. The integration of Artificial Intelligence (AI) and Machine Learning (ML) within SDN controllers is enabling more intelligent traffic management, predictive analytics, and proactive issue resolution. Network Function Virtualization (NFV), a complementary technology, is further accelerating the adoption of SDN by allowing network functions to be deployed as software on standard hardware, thus reducing reliance on proprietary physical appliances. This paradigm shift empowers organizations to deploy and scale network services on-demand, a critical requirement in today's fast-paced digital landscape.

Consumer preferences are also playing a pivotal role. Businesses of all sizes are demanding more flexible, scalable, and cost-effective networking solutions. The rise of cloud computing, the proliferation of IoT devices, and the increasing need for robust cybersecurity solutions all contribute to the growing demand for SDN's capabilities. Organizations are looking for networks that can adapt to fluctuating workloads, support new applications, and provide enhanced security without incurring prohibitive capital expenditures. The market penetration rate for SDN solutions in large enterprises is estimated to exceed 70% by 2028, while SMEs are showing a rapid adoption curve, projected to reach 45% by the same year. The competitive dynamics are intensifying, with established networking giants heavily investing in SDN R&D and startups offering niche, innovative solutions. This creates a vibrant ecosystem where collaboration and competition drive rapid innovation. The opportunity lies in providing end-to-end SDN solutions, including hardware, software, and professional services, tailored to the specific needs of various industry verticals. Furthermore, the development of open-source SDN platforms and standardization efforts will continue to foster a more accessible and interoperable SDN ecosystem, opening doors for new market entrants and specialized service providers.

Dominant Markets & Segments in SDN Industry

The Software-Defined Networking (SDN) industry's dominance is most pronounced in regions and segments that are at the forefront of digital transformation and possess robust technological infrastructure. North America and Europe currently lead the global SDN market, driven by significant investments in 5G deployment, cloud computing, and the increasing adoption of digital technologies by enterprises. Within these regions, specific countries like the United States, Germany, and the United Kingdom are key contributors to market growth, owing to their advanced IT ecosystems and supportive government policies.

The Telecom and Cloud Service Providers segment stands out as the largest and fastest-growing end-user segment in the SDN market. This is primarily due to their critical need for highly scalable, agile, and cost-efficient networks to support the exponential growth in data traffic, mobile services, and cloud-based offerings. SDN enables these providers to automate network operations, dynamically allocate resources, and quickly deploy new services, thereby enhancing their competitive edge and improving customer experiences. The infrastructure investments by these providers alone are estimated to account for over 40% of the total SDN market expenditure by 2027.

Large Enterprises also represent a significant segment, driven by their commitment to digital transformation initiatives. These organizations leverage SDN to create more flexible and responsive IT environments, enabling them to adapt rapidly to changing business demands, improve application performance, and reduce operational complexities. The BFSI sector, with its stringent security and compliance requirements, is increasingly adopting SDN for its enhanced security features and granular control capabilities.

The Manufacturing sector is witnessing growing adoption of SDN for Industrial IoT (IIoT) applications, enabling better factory automation, real-time data analysis, and improved supply chain visibility. Healthcare organizations are exploring SDN for secure and efficient data management, remote patient monitoring, and enhanced communication. While SMEs are a growing segment, their adoption is often driven by managed service providers and cloud-based SDN solutions due to resource constraints.

Key growth drivers across these segments include the relentless pursuit of operational efficiency, the need for enhanced network security, the demand for greater network agility and automation, and the continuous innovation in SDN technologies, such as AI/ML integration and open-source solutions. Government initiatives promoting digital infrastructure and the increasing adoption of cloud-native applications further bolster the growth of the SDN market.

SDN Industry Product Analysis

SDN products are revolutionizing network management through enhanced programmability, automation, and centralized control. Innovations focus on intelligent controllers, software-defined switches, and integrated security solutions. These products offer significant competitive advantages by enabling dynamic traffic management, simplified network provisioning, and reduced operational costs. Key applications span network virtualization, cloud orchestration, data center networking, and enterprise WAN optimization, providing businesses with unprecedented agility and efficiency.

Key Drivers, Barriers & Challenges in SDN Industry

Key Drivers:

- Technological Advancements: The ongoing development of AI/ML in network management, coupled with the maturation of NFV, is a primary growth catalyst.

- Demand for Agility & Automation: Businesses require networks that can rapidly adapt to changing demands and automate complex tasks for efficiency gains.

- Cost Optimization: SDN promises significant reductions in operational expenditures through centralized management and resource optimization.

- Cloud & IoT Growth: The expansion of cloud services and the proliferation of IoT devices necessitate more scalable and flexible network infrastructures.

Barriers & Challenges:

- Integration Complexity: Integrating SDN with existing legacy network infrastructure can be challenging and time-consuming.

- Security Concerns: While SDN can enhance security, initial implementations and evolving threats pose ongoing security challenges.

- Vendor Lock-in: Concerns about proprietary solutions and the need for interoperability remain a hurdle.

- Skill Gap: A shortage of skilled professionals to design, implement, and manage SDN environments limits widespread adoption.

- Regulatory Hurdles: Evolving regulatory landscapes in certain regions can create compliance challenges.

Growth Drivers in the SDN Industry Market

The SDN industry is propelled by a powerful combination of technological advancements and evolving business needs. The relentless pursuit of network agility and automation by organizations of all sizes is a paramount driver, enabling faster service deployment and response to dynamic market conditions. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into SDN controllers is unlocking new levels of network intelligence, predictive analytics, and proactive issue resolution. The ongoing expansion of cloud computing services and the burgeoning Internet of Things (IoT) ecosystem also create a significant demand for the scalable and flexible network architectures that SDN provides. Economic factors, such as the drive for cost optimization and reduced operational expenditures, further fuel adoption. Finally, government initiatives and industry-wide standardization efforts are creating a more favorable environment for SDN deployment.

Challenges Impacting SDN Industry Growth

Despite its immense potential, the SDN industry faces several challenges that can impact its growth trajectory. The complexity of integrating SDN solutions with existing legacy network infrastructure remains a significant hurdle, often requiring substantial investments in time and resources. Security concerns, while SDN can bolster network defenses, also present challenges, particularly regarding the management of distributed control planes and the evolving threat landscape. The potential for vendor lock-in, especially with proprietary solutions, can deter organizations seeking open and interoperable environments. Furthermore, a persistent shortage of skilled professionals with expertise in SDN design, implementation, and management limits broader adoption. Regulatory complexities in certain geographical markets can also introduce compliance challenges, slowing down market penetration.

Key Players Shaping the SDN Industry Market

- Versa Networks

- HPE

- Dell EMC

- Fortinet

- VMware

- Juniper Networks

- Barracuda Networks

- Arista Networks

- Cisco Systems

- Huawei Technologies

Significant SDN Industry Industry Milestones

- February 2023: BICS, an international communications platform company, enhanced its network with a new SDN controller from Nokia. This development integrates an intelligence module for automated, optimal traffic routing, boosting user performance and preparing for 5G network slicing. The controller will manage flow and capacity across BICS's global network.

- July 2023: ActivePort Group launched its Global Edge Network-as-a-Service (NaaS) platform. This self-service, automated portal aims to revolutionize network building and management for businesses by offering a comprehensive solution for designing and deploying their data networks.

Future Outlook for SDN Industry Market

The future outlook for the SDN industry is exceptionally bright, marked by continued innovation and expanding market penetration. The increasing adoption of AI and machine learning will lead to more intelligent and self-optimizing networks, further enhancing efficiency and performance. The convergence of SDN with 5G, edge computing, and IoT will unlock new service possibilities and business models, particularly in sectors like industrial automation and smart cities. Strategic opportunities lie in providing end-to-end, secure, and highly scalable SDN solutions tailored to specific industry needs. The market's trajectory points towards a future where software-defined networking is not just an option but a fundamental pillar of modern IT infrastructure, driving unprecedented levels of agility, cost-effectiveness, and innovation. The projected market growth suggests that SDN will become an integral part of billions of network connections worldwide.

SDN Industry Segmentation

-

1. Organization size

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. End User

- 2.1. BFSI

- 2.2. Healthcare

- 2.3. Retail

- 2.4. Telecom and Cloud Service Providers

- 2.5. Manufacturing

- 2.6. Education

- 2.7. Other End Users

SDN Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

SDN Industry Regional Market Share

Geographic Coverage of SDN Industry

SDN Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising investment toward automation of network infrastructure; Increasing adoption of IoT and cloud services

- 3.3. Market Restrains

- 3.3.1. Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Telecom and Cloud-Based Service Provider is expected to witness a significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global SDN Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization size

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. Healthcare

- 5.2.3. Retail

- 5.2.4. Telecom and Cloud Service Providers

- 5.2.5. Manufacturing

- 5.2.6. Education

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Organization size

- 6. North America SDN Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Organization size

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. BFSI

- 6.2.2. Healthcare

- 6.2.3. Retail

- 6.2.4. Telecom and Cloud Service Providers

- 6.2.5. Manufacturing

- 6.2.6. Education

- 6.2.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Organization size

- 7. Europe SDN Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Organization size

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. BFSI

- 7.2.2. Healthcare

- 7.2.3. Retail

- 7.2.4. Telecom and Cloud Service Providers

- 7.2.5. Manufacturing

- 7.2.6. Education

- 7.2.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Organization size

- 8. Asia SDN Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Organization size

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. BFSI

- 8.2.2. Healthcare

- 8.2.3. Retail

- 8.2.4. Telecom and Cloud Service Providers

- 8.2.5. Manufacturing

- 8.2.6. Education

- 8.2.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Organization size

- 9. Latin America SDN Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Organization size

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. BFSI

- 9.2.2. Healthcare

- 9.2.3. Retail

- 9.2.4. Telecom and Cloud Service Providers

- 9.2.5. Manufacturing

- 9.2.6. Education

- 9.2.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Organization size

- 10. Middle East and Africa SDN Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Organization size

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. BFSI

- 10.2.2. Healthcare

- 10.2.3. Retail

- 10.2.4. Telecom and Cloud Service Providers

- 10.2.5. Manufacturing

- 10.2.6. Education

- 10.2.7. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Organization size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Versa Networks

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HPE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dell EMC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fortinet

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VMware

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Juniper Networks

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Barracuda Networks

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arista Networks

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cisco Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huawei Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Versa Networks

List of Figures

- Figure 1: Global SDN Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America SDN Industry Revenue (undefined), by Organization size 2025 & 2033

- Figure 3: North America SDN Industry Revenue Share (%), by Organization size 2025 & 2033

- Figure 4: North America SDN Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America SDN Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America SDN Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America SDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe SDN Industry Revenue (undefined), by Organization size 2025 & 2033

- Figure 9: Europe SDN Industry Revenue Share (%), by Organization size 2025 & 2033

- Figure 10: Europe SDN Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe SDN Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe SDN Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe SDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia SDN Industry Revenue (undefined), by Organization size 2025 & 2033

- Figure 15: Asia SDN Industry Revenue Share (%), by Organization size 2025 & 2033

- Figure 16: Asia SDN Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia SDN Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia SDN Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia SDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America SDN Industry Revenue (undefined), by Organization size 2025 & 2033

- Figure 21: Latin America SDN Industry Revenue Share (%), by Organization size 2025 & 2033

- Figure 22: Latin America SDN Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Latin America SDN Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America SDN Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America SDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa SDN Industry Revenue (undefined), by Organization size 2025 & 2033

- Figure 27: Middle East and Africa SDN Industry Revenue Share (%), by Organization size 2025 & 2033

- Figure 28: Middle East and Africa SDN Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: Middle East and Africa SDN Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa SDN Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa SDN Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global SDN Industry Revenue undefined Forecast, by Organization size 2020 & 2033

- Table 2: Global SDN Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global SDN Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global SDN Industry Revenue undefined Forecast, by Organization size 2020 & 2033

- Table 5: Global SDN Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global SDN Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global SDN Industry Revenue undefined Forecast, by Organization size 2020 & 2033

- Table 8: Global SDN Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global SDN Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global SDN Industry Revenue undefined Forecast, by Organization size 2020 & 2033

- Table 11: Global SDN Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global SDN Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global SDN Industry Revenue undefined Forecast, by Organization size 2020 & 2033

- Table 14: Global SDN Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global SDN Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global SDN Industry Revenue undefined Forecast, by Organization size 2020 & 2033

- Table 17: Global SDN Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global SDN Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the SDN Industry?

The projected CAGR is approximately 19%.

2. Which companies are prominent players in the SDN Industry?

Key companies in the market include Versa Networks, HPE, Dell EMC, Fortinet, VMware, Juniper Networks, Barracuda Networks, Arista Networks, Cisco Systems, Huawei Technologies.

3. What are the main segments of the SDN Industry?

The market segments include Organization size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising investment toward automation of network infrastructure; Increasing adoption of IoT and cloud services.

6. What are the notable trends driving market growth?

Telecom and Cloud-Based Service Provider is expected to witness a significant growth.

7. Are there any restraints impacting market growth?

Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

February 2023: The international communications platform company BICS has intensified its network with a new SDN controller established by Nokia. The new intelligence module primarily automates optimal traffic routing on the network, developing the overall performance for users while laying the groundwork for 5G network slicing. The new SDN controller would also manage flow and capacity routing throughout its global network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "SDN Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the SDN Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the SDN Industry?

To stay informed about further developments, trends, and reports in the SDN Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence