Key Insights

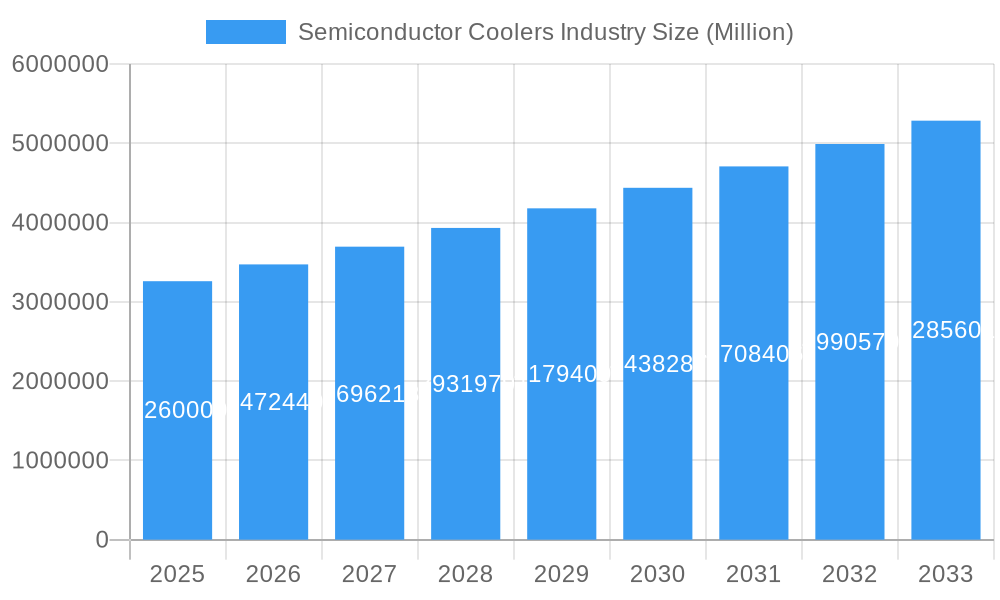

The global Semiconductor Coolers market is poised for significant expansion, currently valued at an estimated 3.26 million and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.40% through 2033. This upward trajectory is primarily driven by the escalating demand for advanced cooling solutions across a multitude of high-growth industries. The burgeoning space exploration initiatives, the relentless innovation in medical technology requiring precise temperature control, and the ever-increasing performance demands in military and defense applications are key accelerators. Furthermore, the commercial sector, with its widespread adoption of sophisticated electronics, and the transportation industry's push towards more efficient and reliable systems, are contributing substantially to market growth. Emerging trends like the miniaturization of electronic components and the development of more energy-efficient cooling technologies are also shaping the market landscape, pushing for greater innovation and adoption.

Semiconductor Coolers Industry Market Size (In Billion)

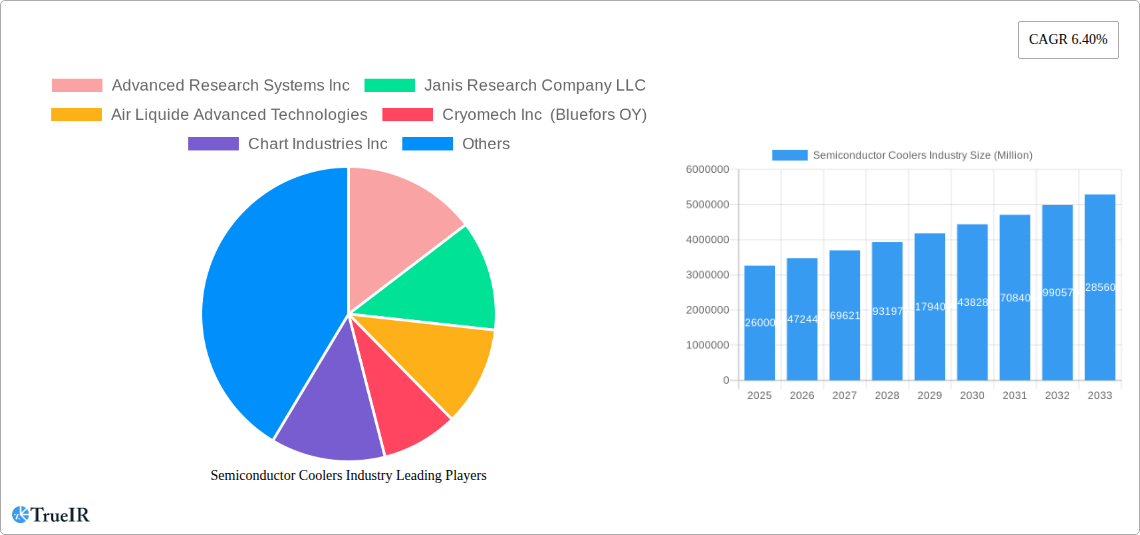

Despite the strong growth outlook, the market faces certain restraints that require strategic consideration by industry players. The high cost associated with advanced cooling technologies, particularly for specialized applications, can pose a barrier to entry for some sectors. Additionally, the complexity of integration into existing systems and the need for specialized maintenance expertise can also influence adoption rates. However, ongoing research and development efforts aimed at cost reduction and enhanced user-friendliness are expected to mitigate these challenges. Key players in this dynamic market include industry leaders like Advanced Research Systems Inc, Janis Research Company LLC, Air Liquide Advanced Technologies, Cryomech Inc (Bluefors OY), Chart Industries Inc, Eaton Corporation PLC, Sunpower Inc (AMETEK Inc ), Sumitomo Heavy Industries Limited, Ricor Systems, Northrop Grumman Corporation, Stirling Cryogenics BV, and Thales Group, among others, all actively contributing to technological advancements and market expansion.

Semiconductor Coolers Industry Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the global Semiconductor Coolers industry. Leveraging high-volume keywords such as "semiconductor cooling solutions," "cryogenic technology," "thermal management," "advanced cooling systems," and specific end-user verticals like "space cooling," "healthcare refrigeration," and "military thermal management," this report is designed to enhance search rankings and engage key industry stakeholders. The study encompasses a comprehensive historical period (2019–2024), a base year (2025), and an extensive forecast period (2025–2033), offering unparalleled insights into market dynamics, trends, opportunities, and the competitive landscape.

Semiconductor Coolers Industry Market Structure & Competitive Landscape

The Semiconductor Coolers industry is characterized by a moderate market concentration, with several key players vying for market share. Innovation drivers, primarily the relentless demand for enhanced performance and miniaturization in electronics across sectors like aerospace, healthcare, and defense, fuel competitive dynamics. Regulatory impacts, particularly those concerning energy efficiency standards and material safety, are also shaping product development and market access. Product substitutes, though limited in niche high-performance applications, exist in broader thermal management solutions, necessitating continuous technological advancement. End-user segmentation is diverse, with significant contributions from space applications requiring ultra-low temperatures, healthcare for sensitive equipment, and military for robust operational reliability. Mergers and acquisitions (M&A) trends are evident, driven by the desire to expand product portfolios, gain access to new technologies, and consolidate market presence. For instance, estimated M&A volumes have seen a steady increase, potentially reaching over $500 Million in the past five years, reflecting strategic consolidation efforts. Concentration ratios for top players are estimated to be around 40-50%, indicating a blend of established leaders and emerging innovators.

Semiconductor Coolers Industry Market Trends & Opportunities

The global Semiconductor Coolers market is poised for substantial growth, driven by an escalating demand for sophisticated thermal management solutions across a multitude of high-tech industries. The market size is projected to witness a robust compound annual growth rate (CAGR) of approximately 7.5% over the forecast period (2025–2033), potentially reaching a market valuation exceeding $15 Billion by 2033. This expansion is fueled by transformative technological shifts, including the development of more efficient cryocoolers, thermoelectric cooling advancements, and the integration of AI in thermal control systems for predictive maintenance and optimized performance. Consumer preferences are increasingly leaning towards compact, energy-efficient, and highly reliable cooling systems, particularly in sectors such as advanced computing, medical diagnostics, and space exploration. Competitive dynamics are intensifying, with companies focusing on product differentiation through enhanced cooling capacities, reduced power consumption, and extended operational lifespans. Emerging opportunities lie in the development of specialized cooling solutions for quantum computing, advanced semiconductor manufacturing processes, and the burgeoning space economy. Market penetration rates for advanced semiconductor coolers are expected to rise significantly as more industries recognize the critical role of precise temperature control in achieving optimal performance and longevity of sensitive electronic components. The increasing complexity and heat generation of next-generation semiconductors, coupled with the drive for miniaturization, are creating a perpetual need for superior cooling technologies. This creates fertile ground for innovative solutions that can efficiently dissipate heat without compromising performance or increasing the overall footprint of electronic devices. The evolution of materials science is also playing a crucial role, enabling the development of new thermoelectric materials and advanced heat sinks that further enhance cooling efficiency. Furthermore, the growing adoption of IoT devices and the increasing demand for high-performance computing in areas like AI and big data analytics necessitate robust thermal management to prevent performance degradation and component failure. The space industry's ambitious plans for interplanetary exploration and satellite constellations will continue to be a significant demand driver, requiring coolers capable of operating in extreme environments. Similarly, the healthcare sector’s reliance on sensitive diagnostic and imaging equipment, as well as advancements in cryogenic medicine, will ensure a steady demand for reliable cooling solutions.

Dominant Markets & Segments in Semiconductor Coolers Industry

The Space segment is emerging as a dominant force in the Semiconductor Coolers industry, driven by ambitious governmental and private space exploration initiatives. This sector demands high-performance, reliable, and ultra-low temperature cooling solutions for scientific instruments, satellite electronics, and long-duration missions. The growth in this segment is propelled by significant investments in satellite constellations, manned spaceflights, and deep-space probes. Government agencies worldwide, alongside private aerospace companies, are investing billions of dollars annually in space-related technologies, directly impacting the demand for specialized cooling systems.

- Key Growth Drivers in the Space Segment:

- Increased Satellite Deployments: The proliferation of small satellites and large constellations for communication, Earth observation, and scientific research requires numerous cooling systems.

- Deep Space Exploration Missions: Missions to Mars, Jupiter, and beyond necessitate advanced cryocoolers to maintain the functionality of sensitive scientific payloads in extreme thermal environments.

- Commercial Spaceflight Growth: The burgeoning private space sector, including space tourism and orbital research, is creating new avenues for the application of semiconductor coolers.

- Technological Advancements: Continuous innovation in cryocooler technology, such as closed-cycle refrigerators and pulse tube coolers, is enabling more efficient and compact cooling solutions for space applications.

While Space leads, the Healthcare segment also holds substantial market share, driven by the increasing sophistication of medical devices. This includes cooling for MRI machines, CT scanners, blood analyzers, and cold chain logistics for pharmaceuticals and vaccines. The ongoing advancements in medical diagnostics and the growing emphasis on precision medicine contribute to a consistent demand for reliable thermal management.

The Military segment is another significant contributor, requiring robust cooling solutions for radar systems, electronic warfare equipment, and communication devices operating in demanding environments. The need for enhanced battlefield capabilities and the modernization of defense infrastructure are key growth catalysts.

The Commercial segment, encompassing data centers, high-performance computing, and advanced electronics manufacturing, represents a broad and expanding market. The exponential growth of data generation and processing fuels the demand for efficient cooling in server farms.

The Transportation segment, particularly in the context of electric vehicles and advanced driver-assistance systems (ADAS), is beginning to show significant growth potential as these systems require thermal management for power electronics and sensors.

Semiconductor Coolers Industry Product Analysis

Product innovations in the Semiconductor Coolers industry are focused on achieving higher cooling efficiencies, lower power consumption, and increased reliability. Key product types include cryocoolers, thermoelectric coolers (TECs), and advanced heat sinks. Applications span from ultra-low temperature cooling for scientific research and quantum computing to precise temperature control for sensitive medical equipment and high-power electronics. Competitive advantages are derived from technological superiority, miniaturization, and the ability to operate in extreme environments. For example, advancements in closed-cycle cryocoolers offer extended operational lifespans and precise temperature stability, crucial for space and research applications.

Key Drivers, Barriers & Challenges in Semiconductor Coolers Industry

Key Drivers:

- Technological Advancements: Innovations in cryogenics and thermoelectric materials are enabling more efficient and compact cooling solutions.

- Growing Demand from High-Tech Industries: Sectors like aerospace, healthcare, and computing require sophisticated thermal management for their advanced electronics.

- Miniaturization Trends: The push for smaller, more powerful devices necessitates advanced cooling technologies.

- Energy Efficiency Mandates: Increasing focus on reducing energy consumption drives demand for efficient cooling systems.

Barriers & Challenges:

- High Development Costs: Research and development for cutting-edge cooling technologies can be substantial.

- Supply Chain Volatility: Disruptions in the supply of specialized materials and components can impact production.

- Regulatory Compliance: Adhering to stringent safety and environmental regulations can add complexity and cost.

- Intense Competition: The market features established players and emerging innovators, leading to price pressures and the need for continuous differentiation. For instance, the cost of advanced materials and specialized manufacturing processes can limit widespread adoption in cost-sensitive applications, presenting a significant barrier.

Growth Drivers in the Semiconductor Coolers Industry Market

Key growth drivers for the Semiconductor Coolers industry are primarily technological advancements and the expanding applications in critical sectors. The continuous innovation in cryocooler efficiency and the development of novel thermoelectric materials are paramount. The ever-increasing demand for superior thermal management in burgeoning fields such as quantum computing, advanced medical imaging, and next-generation semiconductor manufacturing serves as a powerful catalyst. Furthermore, governmental investments in space exploration and defense modernization, coupled with stringent energy efficiency standards across industries, are significant economic and regulatory drivers. The pursuit of miniaturization in electronics also propels the need for smaller, yet more potent, cooling solutions.

Challenges Impacting Semiconductor Coolers Industry Growth

Several challenges impact the growth of the Semiconductor Coolers industry. The high cost associated with research, development, and the manufacturing of advanced cooling systems can be a significant barrier, especially for smaller companies or in price-sensitive market segments. Supply chain disruptions, including the availability of rare earth elements and specialized components, can lead to production delays and increased costs. Regulatory complexities related to environmental impact, material sourcing, and product safety also present hurdles that require careful navigation. Moreover, intense competitive pressures from both established global players and agile new entrants necessitate continuous innovation and cost optimization to maintain market relevance.

Key Players Shaping the Semiconductor Coolers Industry Market

- Advanced Research Systems Inc

- Janis Research Company LLC

- Air Liquide Advanced Technologies

- Cryomech Inc (Bluefors OY)

- Chart Industries Inc

- Eaton Corporation PLC

- Sunpower Inc (AMETEK Inc )

- Sumitomo Heavy Industries Limited

- Ricor Systems

- Northrop Grumman Corporation

- Stirling Cryogenics BV

- Thales Group

Significant Semiconductor Coolers Industry Industry Milestones

- March 2023: Chart Industries and Nikola Corporation, a global leader in zero-emission transportation, energy supply, and infrastructure solutions through their HYLA brand, announced a strategic partnership focused on liquid hydrogen storage tanks, transport trailers, and mobile/modular hydrogen refueling stations. This collaboration aims to enhance the capacity to generate power from fuel using cryocooler products, impacting the transportation and energy infrastructure sectors.

- October 2022: Air Liquide entered into a contractual agreement with Avio to design a cutting-edge cryogenic tank for the upper stage of the upcoming Vega-E launcher. This new-generation tank will accommodate oxygen-methane propellants and store oxygen at -182°C and methane at -161°C, supporting the advancement of next-generation launch vehicles and impacting the space industry by enabling efficient propellant storage for future missions scheduled from 2026.

Future Outlook for Semiconductor Coolers Industry Market

The future outlook for the Semiconductor Coolers industry is exceptionally promising, driven by persistent demand for advanced thermal management solutions. Strategic opportunities lie in the expanding aerospace sector, the growing sophistication of healthcare technologies, and the relentless evolution of computing power, including quantum computing. The ongoing focus on energy efficiency and sustainability will further propel the adoption of advanced cooling systems. Market potential is vast, with opportunities to develop specialized coolers for emerging applications like advanced AI hardware, novel scientific instruments, and next-generation energy storage systems. The industry is expected to witness continued innovation, leading to smaller, more powerful, and more energy-efficient cooling solutions that will be integral to technological progress across all major sectors.

Semiconductor Coolers Industry Segmentation

-

1. End-user Vertical

- 1.1. Space

- 1.2. Healthcare

- 1.3. Military

- 1.4. Commercial

- 1.5. Transportation

- 1.6. Other End-user Verticals

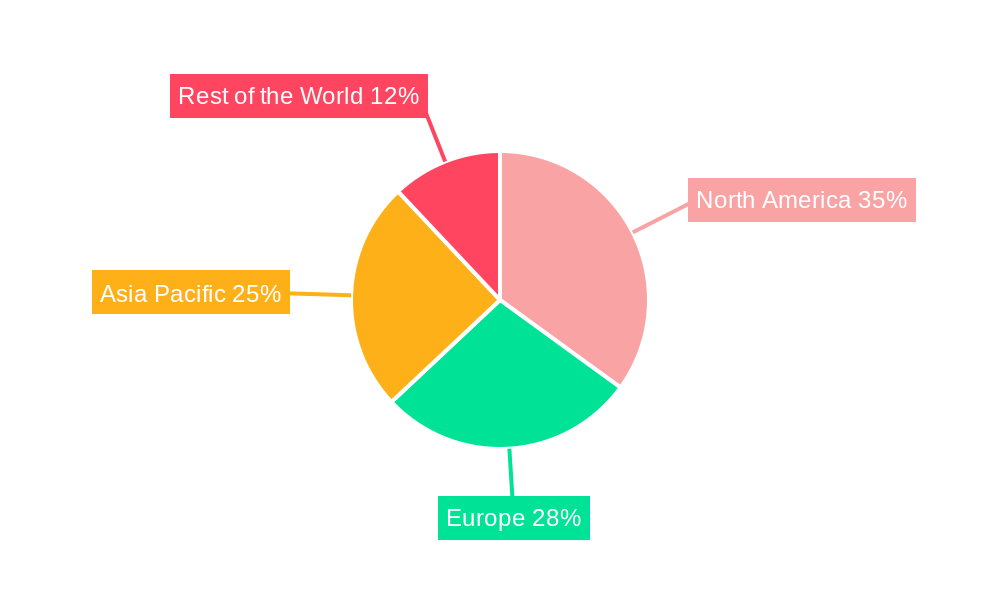

Semiconductor Coolers Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Semiconductor Coolers Industry Regional Market Share

Geographic Coverage of Semiconductor Coolers Industry

Semiconductor Coolers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Medical and Healthcare Services in Developing Economies; Increasing Production of Liquefied Natural Gas

- 3.3. Market Restrains

- 3.3.1. Performance Constraint of Cryocoolers

- 3.4. Market Trends

- 3.4.1. Healthcare to be the Largest End-user Vertical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Coolers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Space

- 5.1.2. Healthcare

- 5.1.3. Military

- 5.1.4. Commercial

- 5.1.5. Transportation

- 5.1.6. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. North America Semiconductor Coolers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.1.1. Space

- 6.1.2. Healthcare

- 6.1.3. Military

- 6.1.4. Commercial

- 6.1.5. Transportation

- 6.1.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7. Europe Semiconductor Coolers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.1.1. Space

- 7.1.2. Healthcare

- 7.1.3. Military

- 7.1.4. Commercial

- 7.1.5. Transportation

- 7.1.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8. Asia Pacific Semiconductor Coolers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.1.1. Space

- 8.1.2. Healthcare

- 8.1.3. Military

- 8.1.4. Commercial

- 8.1.5. Transportation

- 8.1.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9. Rest of the World Semiconductor Coolers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.1.1. Space

- 9.1.2. Healthcare

- 9.1.3. Military

- 9.1.4. Commercial

- 9.1.5. Transportation

- 9.1.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Advanced Research Systems Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Janis Research Company LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Air Liquide Advanced Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cryomech Inc (Bluefors OY)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Chart Industries Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Eaton Corporation PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sunpower Inc (AMETEK Inc )

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sumitomo Heavy Industries Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ricor Systems

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Northrop Grumman Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Stirling Cryogenics BV

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Thales Group*List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Advanced Research Systems Inc

List of Figures

- Figure 1: Global Semiconductor Coolers Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Semiconductor Coolers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 3: North America Semiconductor Coolers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 4: North America Semiconductor Coolers Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Semiconductor Coolers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Semiconductor Coolers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: Europe Semiconductor Coolers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: Europe Semiconductor Coolers Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Semiconductor Coolers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Semiconductor Coolers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Asia Pacific Semiconductor Coolers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Asia Pacific Semiconductor Coolers Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Semiconductor Coolers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Semiconductor Coolers Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Rest of the World Semiconductor Coolers Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Rest of the World Semiconductor Coolers Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Semiconductor Coolers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Coolers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 2: Global Semiconductor Coolers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Semiconductor Coolers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Semiconductor Coolers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Semiconductor Coolers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Semiconductor Coolers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Semiconductor Coolers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Semiconductor Coolers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Semiconductor Coolers Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Semiconductor Coolers Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Coolers Industry?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Semiconductor Coolers Industry?

Key companies in the market include Advanced Research Systems Inc, Janis Research Company LLC, Air Liquide Advanced Technologies, Cryomech Inc (Bluefors OY), Chart Industries Inc, Eaton Corporation PLC, Sunpower Inc (AMETEK Inc ), Sumitomo Heavy Industries Limited, Ricor Systems, Northrop Grumman Corporation, Stirling Cryogenics BV, Thales Group*List Not Exhaustive.

3. What are the main segments of the Semiconductor Coolers Industry?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Medical and Healthcare Services in Developing Economies; Increasing Production of Liquefied Natural Gas.

6. What are the notable trends driving market growth?

Healthcare to be the Largest End-user Vertical.

7. Are there any restraints impacting market growth?

Performance Constraint of Cryocoolers.

8. Can you provide examples of recent developments in the market?

March 2023: Chart Industries and Nikola Corporation, a global leader in zero-emission transportation, energy supply, and infrastructure solutions through their HYLA brand, announced a strategic partnership. This collaboration encompasses the production of liquid hydrogen storage tanks, transport trailers, and the development of mobile and modular hydrogen refueling stations for rapid deployment. Additionally, the agreement entails further cooperation in advancing hydrogen technology for infrastructure and onboard fuel systems in trucks. These investments are set to enhance the company's capacity to generate power from fuel using cryocooler products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Coolers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Coolers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Coolers Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Coolers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence