Key Insights

The South African Diabetes Drugs and Devices Market is projected for substantial expansion, reaching an estimated market size of $2.73 billion by 2033. This growth, with a Compound Annual Growth Rate (CAGR) of 7.2% from a base year of 2025, is fueled by rising diabetes prevalence, an aging demographic, and increased patient and physician adoption of advanced treatment modalities. Key drivers include the escalating demand for innovative self-monitoring blood glucose devices, continuous glucose monitoring (CGM) systems, and insulin pumps. Pharmaceutical advancements, encompassing oral antidiabetic drugs and next-generation insulin therapies, are also significantly contributing to market momentum.

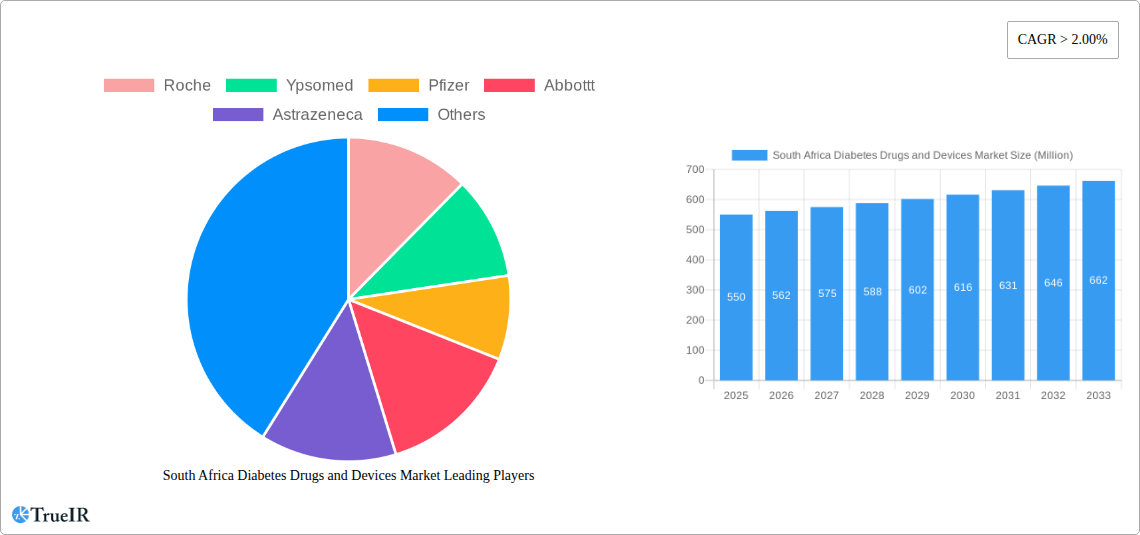

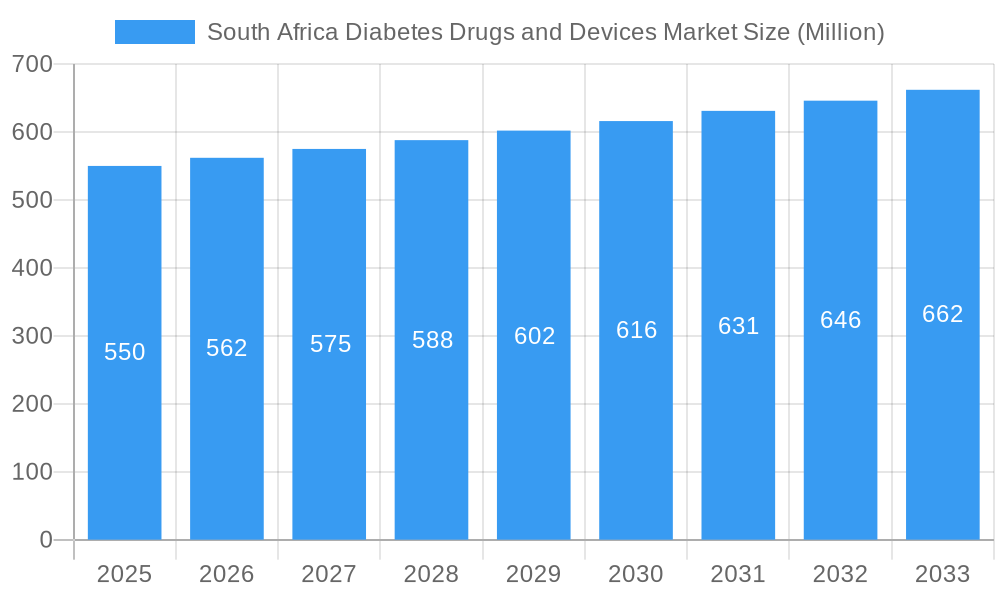

South Africa Diabetes Drugs and Devices Market Market Size (In Billion)

Emerging trends such as digital health integration, telemedicine for chronic disease management, and a focus on preventative care will further shape the market. While the cost of advanced technologies and accessibility challenges in remote regions may present restraints, leading players like Roche, Abbott, Medtronic, Novo Nordisk, and Sanofi are driving innovation through robust R&D investments. The market's segmentation reflects a dual focus on patient self-management solutions and comprehensive pharmacological interventions.

South Africa Diabetes Drugs and Devices Market Company Market Share

This comprehensive report delivers an SEO-optimized analysis of the South Africa Diabetes Drugs and Devices Market. It incorporates high-volume keywords including "diabetes treatment South Africa," "insulin pumps South Africa," "glucose monitoring devices," "oral antidiabetic drugs," and key competitor names, targeting industry professionals, researchers, and decision-makers. The analysis covers market structure, trends, dominant segments, product innovations, drivers, challenges, and the competitive landscape. The study period spans 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, offering a strategic outlook for diabetes management in South Africa.

South Africa Diabetes Drugs and Devices Market Market Structure & Competitive Landscape

The South Africa Diabetes Drugs and Devices Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, particularly in the insulin and continuous glucose monitoring (CGM) segments. Innovation drivers are heavily influenced by technological advancements in drug delivery systems, novel therapeutic compounds, and increasingly sophisticated monitoring devices. Regulatory impacts, overseen by bodies like the South African Health Products Regulatory Authority (SAHPRA), play a crucial role in product approvals, pricing, and market access, ensuring patient safety and efficacy. Product substitutes exist across both drug and device categories, with oral anti-diabetic agents offering alternatives to insulin for Type 2 diabetes management, and traditional blood glucose meters serving as a lower-cost alternative to CGMs. End-user segmentation is driven by diabetes type (Type 1, Type 2, gestational), age, and socio-economic factors, influencing product adoption and accessibility. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their portfolios, gain market access, and leverage synergistic capabilities. For instance, the acquisition of smaller diagnostic companies by larger pharmaceutical giants or device manufacturers has been a notable trend, contributing to an estimated xx M&A volumes in the historical period. The market's competitive intensity is further shaped by brand loyalty, patent expiries, and the introduction of new generic drugs.

South Africa Diabetes Drugs and Devices Market Market Trends & Opportunities

The South Africa Diabetes Drugs and Devices Market is poised for significant expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025–2033. This growth trajectory is fueled by a confluence of factors, including a rising prevalence of diabetes, increasing healthcare expenditure, and a growing awareness of advanced diabetes management solutions. The market size is estimated to reach xx Million by 2033, a substantial increase from its estimated xx Million in 2025. Technological shifts are prominently driving this expansion, with a notable transition towards digital health solutions. The adoption of Continuous Blood Glucose Monitoring (CGM) systems is rapidly increasing, driven by their ability to provide real-time glucose data, reduce the burden of finger pricks, and enable more personalized treatment plans. Similarly, advancements in insulin pump technology, offering automated insulin delivery, are gaining traction among patients requiring intensive insulin therapy. Consumer preferences are increasingly leaning towards user-friendly, integrated, and data-driven diabetes management tools that empower individuals to take a more active role in their health. This shift also presents opportunities for telehealth platforms and mobile applications that integrate with diabetes devices, offering remote patient monitoring and virtual consultations. Competitive dynamics are intensifying as both global pharmaceutical giants and specialized medical device manufacturers vie for market dominance. Key players are focusing on strategic partnerships, product innovation, and expanding their distribution networks to capture market share. The growing demand for combination therapies and biosimilar insulin products also presents emerging opportunities for manufacturers. Furthermore, government initiatives aimed at improving chronic disease management and increasing access to affordable healthcare solutions are creating a favorable environment for market growth. The increasing focus on preventative care and early diagnosis of diabetes further bolsters the demand for diagnostic tools and medications, contributing to the overall market expansion and offering lucrative opportunities for market penetration across various segments.

Dominant Markets & Segments in South Africa Diabetes Drugs and Devices Market

The South Africa Diabetes Drugs and Devices Market exhibits significant dominance across several key segments, driven by a combination of disease prevalence, technological adoption, and healthcare infrastructure.

Dominant Drug Segments:

- Insulin Drugs: This segment continues to be a cornerstone of diabetes treatment, particularly for Type 1 diabetes and advanced Type 2 diabetes. The increasing incidence of diabetes and the need for effective glycemic control maintain its leading position.

- Growth Drivers:

- High prevalence of Type 1 and Type 2 diabetes requiring insulin.

- Advancements in insulin formulations (e.g., ultra-long-acting insulins).

- Government and private sector initiatives to ensure access to essential insulin therapies.

- Increasing preference for basal-bolus regimens for better glycemic control.

- Growth Drivers:

- Oral Anti-Diabetes Drugs: This segment remains highly significant due to its widespread use in managing Type 2 diabetes, often as a first-line treatment. The affordability and ease of administration contribute to its sustained dominance.

- Growth Drivers:

- High prevalence of Type 2 diabetes.

- Availability of a wide range of oral medications with varying mechanisms of action.

- Patient preference for non-injectable treatment options.

- Introduction of newer oral agents with improved efficacy and safety profiles.

- Growth Drivers:

Dominant Device Segments:

- Monitoring Devices (Self-monitoring Blood Glucose Devices): While facing competition from CGMs, self-monitoring blood glucose (SMBG) devices remain dominant due to their established presence, affordability, and widespread availability across all socio-economic strata.

- Growth Drivers:

- Cost-effectiveness and accessibility.

- Established user base and physician recommendation.

- Continued need for routine glucose monitoring.

- Growth Drivers:

- Management Devices (Insulin Syringes, Insulin Cartridges, Disposable Pens): These essential delivery tools for insulin maintain a strong market presence due to their direct association with insulin therapy, which is a primary treatment modality.

- Growth Drivers:

- Direct link to insulin administration.

- Established infrastructure for their distribution and use.

- Affordability and ease of use for a broad patient population.

- Growth Drivers:

Emerging and High-Growth Segments:

- Monitoring Devices (Continuous Blood Glucose Monitoring - CGM): This segment is experiencing exponential growth driven by technological innovation, improved patient outcomes, and a shift towards proactive diabetes management.

- Growth Drivers:

- Technological advancements offering greater accuracy and convenience.

- Significant reduction in hospitalizations due to acute diabetes events (as evidenced by Abbott's FreeStyle Libre study).

- Integration with insulin pumps for closed-loop systems.

- Growing awareness of CGM benefits among patients and healthcare providers.

- Growth Drivers:

- Management Devices (Insulin Pump): Insulin pumps, particularly those with advanced features like automated insulin delivery, are witnessing increasing adoption among individuals with Type 1 diabetes and certain Type 2 diabetes patients requiring intensive management.

- Growth Drivers:

- Improved glycemic control and reduced risk of hypoglycemia.

- Enhanced quality of life and flexibility for users.

- Integration with CGM for hybrid closed-loop systems.

- Growing patient demand for sophisticated diabetes management solutions.

- Growth Drivers:

The dominance of these segments is further reinforced by the increasing prevalence of diabetes in South Africa, government health policies aimed at improving chronic disease management, and the growing investment in healthcare infrastructure and accessibility.

South Africa Diabetes Drugs and Devices Market Product Analysis

The South Africa Diabetes Drugs and Devices Market is characterized by a continuous stream of product innovations aimed at enhancing patient outcomes and improving the user experience. In the drug segment, advancements focus on developing novel therapeutic agents with improved efficacy, reduced side effects, and more convenient dosing regimens. For instance, the development of once-weekly insulin formulations by companies like Novo Nordisk signifies a major leap in patient convenience and adherence. In the devices sector, innovation is centered on miniaturization, enhanced connectivity, and increased automation. Continuous Glucose Monitoring (CGM) systems are becoming more sophisticated, offering real-time data, trend arrows, and predictive alerts, while insulin pumps are evolving towards hybrid closed-loop systems that automatically adjust insulin delivery based on CGM readings. These technological advancements provide significant competitive advantages by addressing unmet patient needs, improving treatment adherence, and empowering individuals with diabetes to better manage their condition. The market fit for these innovative products is driven by their ability to offer tangible benefits such as reduced glycemic variability, fewer hypoglycemic events, and an improved quality of life for patients.

Key Drivers, Barriers & Challenges in South Africa Diabetes Drugs and Devices Market

Key Drivers:

The South Africa Diabetes Drugs and Devices Market is propelled by several key drivers. The escalating prevalence of diabetes, driven by lifestyle changes and an aging population, forms the fundamental demand impetus. Technological advancements in both pharmaceuticals and medical devices, such as novel drug formulations and sophisticated CGM systems, are continuously improving treatment efficacy and patient convenience. Economic factors, including increasing healthcare expenditure and growing disposable incomes, enable greater access to advanced diabetes management solutions. Furthermore, supportive government policies and public health initiatives aimed at improving chronic disease management and promoting preventative care significantly contribute to market growth by increasing awareness and subsidizing treatments.

Barriers & Challenges:

Despite robust growth, the market faces significant barriers and challenges. High costs associated with advanced diabetes drugs and devices can limit accessibility for a substantial portion of the South African population, particularly those in lower socio-economic brackets. Regulatory hurdles and lengthy approval processes for new products can impede market entry and slow down the adoption of innovative solutions. Supply chain complexities, including distribution challenges and the risk of counterfeit products, can disrupt availability and compromise patient safety. Intense competitive pressure from established players and the emergence of generics can impact pricing strategies and profitability. Lastly, a persistent lack of comprehensive diabetes education and awareness programs can hinder optimal disease management and the adoption of advanced technologies.

Growth Drivers in the South Africa Diabetes Drugs and Devices Market Market

The growth drivers in the South Africa Diabetes Drugs and Devices Market are multifaceted. Technologically, the ongoing development of advanced insulin formulations, such as once-weekly insulins, and the increasing sophistication of insulin pumps and continuous glucose monitoring systems are revolutionizing diabetes care and driving adoption. Economically, rising healthcare expenditure coupled with a growing middle class with higher disposable incomes is increasing the affordability and accessibility of these treatments. Regulatory support, including government initiatives focused on chronic disease management and potential subsidies for essential diabetes medications and devices, plays a crucial role in expanding market reach. Furthermore, a growing understanding of the long-term complications of uncontrolled diabetes is encouraging proactive management and the uptake of more effective solutions.

Challenges Impacting South Africa Diabetes Drugs and Devices Market Growth

Several challenges significantly impact the growth of the South Africa Diabetes Drugs and Devices Market. Regulatory complexities, including stringent approval processes and evolving reimbursement policies, can create delays and increase the cost of bringing new products to market. Supply chain issues, such as logistical hurdles in remote areas and the risk of medication stock-outs, can disrupt consistent patient access to essential treatments and devices. Intense competitive pressures from both global pharmaceutical companies and local generic manufacturers can lead to price erosion, impacting profitability. Furthermore, the high cost of advanced diabetes management technologies, such as insulin pumps and continuous glucose monitors, remains a significant barrier for a large segment of the population, limiting market penetration despite their clinical benefits.

Key Players Shaping the South Africa Diabetes Drugs and Devices Market Market

- Roche

- Ypsomed

- Pfizer

- Abbott

- AstraZeneca

- Eli Lilly

- Sanofi

- Novartis

- Medtronic

- Tandem

- Insulet

- Novo Nordisk

- Dexcom

Significant South Africa Diabetes Drugs and Devices Market Industry Milestones

- October 2022: Novo Nordisk announced headline results from the ONWARDS 5 phase 3a trial with once-weekly insulin icodec in people with type 2 diabetes. The ONWARDS 5 trial was a 52-week, open-label efficacy and safety treat-to-target trial investigating once-weekly insulin versus once-daily basal insulin (insulin degludec or insulin glargine U100/U300). This milestone signifies a major advancement in convenient insulin therapy, potentially transforming treatment adherence.

- September 2022: Abbott announced new data from the Real-World Evidence of the FreeStyle Libre study showing that using FreeStyle Libre, a continuous glucose monitoring system, significantly reduced the rate of hospitalizations due to acute diabetes events for people with Type 2 diabetes on once-daily (basal) insulin therapy. This finding underscores the clinical and economic benefits of CGM technology in preventing costly acute diabetes complications.

Future Outlook for South Africa Diabetes Drugs and Devices Market Market

The future outlook for the South Africa Diabetes Drugs and Devices Market is highly promising, driven by an expanding patient population and continuous technological innovation. Strategic opportunities lie in increasing the accessibility and affordability of advanced therapies and devices through collaborations with government healthcare programs and private insurers. The growing demand for integrated diabetes management solutions, combining smart devices with digital health platforms, presents a significant avenue for growth. Furthermore, a heightened focus on preventative care and early diagnosis will likely spur the adoption of diagnostic tools and early-stage treatment interventions. The market is expected to witness further advancements in personalized medicine, with treatments and devices tailored to individual patient needs, ultimately contributing to improved glycemic control and enhanced quality of life for millions in South Africa.

South Africa Diabetes Drugs and Devices Market Segmentation

-

1. Devices

-

1.1. Monitoring Devices

- 1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.2. Continuous Blood Glucose Monitoring

-

1.2. Management Devices

- 1.2.1. Insulin Pump

- 1.2.2. Insulin Syringes

- 1.2.3. Insulin Cartridges

- 1.2.4. Disposable Pens

-

1.1. Monitoring Devices

-

2. Drugs

- 2.1. Oral Anti-Diabetes Drugs

- 2.2. Insulin Drugs

- 2.3. Combination Drugs

- 2.4. Non-Insulin Injectable Drugs

South Africa Diabetes Drugs and Devices Market Segmentation By Geography

- 1. South Africa

South Africa Diabetes Drugs and Devices Market Regional Market Share

Geographic Coverage of South Africa Diabetes Drugs and Devices Market

South Africa Diabetes Drugs and Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. The continuous Glucose Monitoring Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.2. Continuous Blood Glucose Monitoring

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Insulin Cartridges

- 5.1.2.4. Disposable Pens

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Drugs

- 5.2.1. Oral Anti-Diabetes Drugs

- 5.2.2. Insulin Drugs

- 5.2.3. Combination Drugs

- 5.2.4. Non-Insulin Injectable Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ypsomed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pfizer

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbottt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astrazeneca

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novartis

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Medtronic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tandem

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Insulet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dexcom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: South Africa Diabetes Drugs and Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Diabetes Drugs and Devices Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Diabetes Drugs and Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 2: South Africa Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: South Africa Diabetes Drugs and Devices Market Revenue billion Forecast, by Drugs 2020 & 2033

- Table 4: South Africa Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 5: South Africa Diabetes Drugs and Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South Africa Diabetes Drugs and Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: South Africa Diabetes Drugs and Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 8: South Africa Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 9: South Africa Diabetes Drugs and Devices Market Revenue billion Forecast, by Drugs 2020 & 2033

- Table 10: South Africa Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 11: South Africa Diabetes Drugs and Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South Africa Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Diabetes Drugs and Devices Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the South Africa Diabetes Drugs and Devices Market?

Key companies in the market include Roche, Ypsomed, Pfizer, Abbottt, Astrazeneca, Eli Lilly, Sanofi, Novartis, Medtronic, Tandem, Insulet, Novo Nordisk, Dexcom.

3. What are the main segments of the South Africa Diabetes Drugs and Devices Market?

The market segments include Devices, Drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.73 billion as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

The continuous Glucose Monitoring Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

October 2022: Novo Nordisk announced headline results from the ONWARDS 5 phase 3a trial with once-weekly insulin icodec in people with type 2 diabetes. The ONWARDS 5 trial was a 52-week, open-label efficacy and safety treat-to-target trial investigating once-weekly insulin versus once-daily basal insulin (insulin degludec or insulin glargine U100/U300).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Diabetes Drugs and Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Diabetes Drugs and Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Diabetes Drugs and Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Diabetes Drugs and Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence