Key Insights

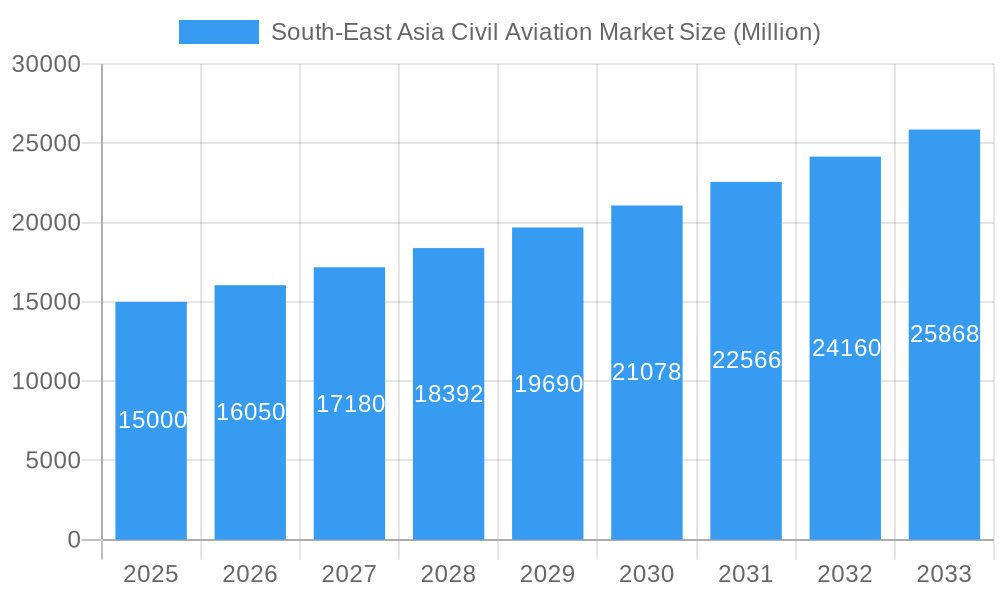

The South-East Asia civil aviation market is poised for significant expansion, driven by escalating passenger volumes, robust economic growth, and a burgeoning middle class. Enhanced connectivity, fueled by substantial investments in airport infrastructure across key hubs, further propels this growth. Despite economic uncertainties, the adoption of fuel-efficient technologies and sustainable aviation practices ensures a positive long-term outlook. We forecast the market size to reach $50.84 billion by 2031, with a compound annual growth rate (CAGR) of 4.3% from a 2024 base year. Intense competition among global manufacturers like Airbus and Boeing, alongside regional players, fosters innovation in aircraft design and operational efficiency. Government initiatives supporting regional connectivity and workforce development also contribute to the market's upward trajectory.

South-East Asia Civil Aviation Market Market Size (In Billion)

Within the South-East Asia civil aviation market, commercial aircraft dominate, primarily serving the growing passenger travel demand. The freighter aircraft segment is projected for considerable growth, propelled by the expanding e-commerce landscape and the necessity for efficient regional cargo movement. General aviation, though a smaller segment, offers specialized service opportunities. Key economies such as China, India, and Indonesia present substantial growth potential, while hubs like Singapore and Malaysia remain pivotal for aviation operations. A nuanced understanding of these segments and regional dynamics is crucial for market stakeholders.

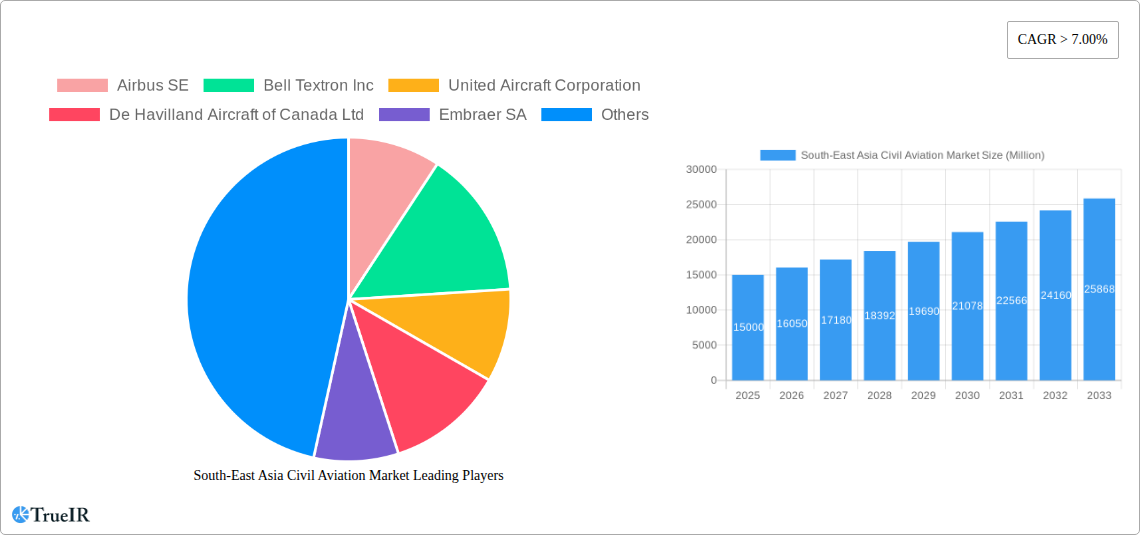

South-East Asia Civil Aviation Market Company Market Share

South-East Asia Civil Aviation Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the South-East Asia civil aviation market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period, utilizing 2025 as the base year and leveraging extensive data from 2019-2024. This in-depth analysis incorporates key market segments, competitive dynamics, and future growth projections, enabling informed strategic planning. High-impact keywords throughout ensure maximum visibility in search results.

South-East Asia Civil Aviation Market Structure & Competitive Landscape

The South-East Asia civil aviation market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players such as Airbus SE, Boeing, and COMAC dominate the commercial aircraft segment, while smaller players like ATR and De Havilland Aircraft of Canada Ltd. cater to niche markets. The market's competitive landscape is shaped by factors including technological innovation (e.g., fuel-efficient aircraft, advanced avionics), regulatory changes (e.g., safety standards, emissions regulations), and increasing demand for air travel. The market is experiencing significant M&A activity, with an estimated xx Million in deals closed during the historical period (2019-2024).

- Market Concentration: Moderate, with an estimated HHI of xx in 2025.

- Innovation Drivers: Fuel efficiency, advanced avionics, sustainable aviation fuels.

- Regulatory Impacts: Stringent safety standards, emissions regulations, and airspace management.

- Product Substitutes: Limited, primarily high-speed rail for short-haul routes.

- End-User Segmentation: Airlines, cargo operators, general aviation.

- M&A Trends: Significant activity, with an estimated xx Million in deals (2019-2024), driven by consolidation and market expansion strategies.

South-East Asia Civil Aviation Market Market Trends & Opportunities

The South-East Asia civil aviation market is experiencing robust growth, driven by factors such as rising disposable incomes, expanding tourism, and increasing urbanization. The market size is projected to reach xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the introduction of more fuel-efficient aircraft and advanced air traffic management systems, are further boosting market expansion. Consumer preferences are shifting towards enhanced in-flight experiences and convenient connectivity, presenting opportunities for airlines and technology providers. Competitive dynamics are intensified by the entry of low-cost carriers and the continuous expansion of major airlines within the region. Market penetration of air travel continues to grow, reaching an estimated xx% in 2025.

Dominant Markets & Segments in South-East Asia Civil Aviation Market

Within South-East Asia, Indonesia and the Philippines represent the leading markets, driven by burgeoning populations, expanding tourism, and robust economic growth. The commercial aircraft segment constitutes the largest share of the market, fueled by airlines’ fleet modernization and expansion plans.

- Key Growth Drivers (Indonesia & Philippines):

- Rapidly expanding middle class and tourism sector.

- Government investments in airport infrastructure.

- Liberalization of aviation policies.

- Commercial Aircraft Segment Dominance: Driven by increasing passenger traffic and fleet modernization.

- General Aviation Segment Growth: Moderate growth, driven by increasing demand for business and private aviation services.

The General Aviation sector displays slower yet steady growth, spurred by business expansion, private leisure, and specialized services. However, regulatory hurdles and infrastructural gaps may impede its potential.

South-East Asia Civil Aviation Market Product Analysis

The market showcases a diverse product portfolio, encompassing various aircraft types tailored to varying operational needs. Technological advancements in areas such as aerodynamics, materials science, and engine efficiency are driving the development of fuel-efficient and environmentally friendly aircraft. These innovations directly impact operational costs, sustainability compliance, and competitive positioning within the market. The market fit focuses heavily on aircraft suited to regional connectivity and short-to-medium-haul routes, reflective of the region's geographical layout and transportation demands.

Key Drivers, Barriers & Challenges in South-East Asia Civil Aviation Market

Key Drivers: The market's expansion is fueled by strong economic growth, burgeoning tourism, and government investments in aviation infrastructure. Technological advancements in aircraft design and air traffic management are further enhancing operational efficiency and capacity. Liberalization policies are fostering competition and attracting investment.

Challenges: The market faces challenges such as airspace congestion, infrastructure limitations, and regulatory complexities. Supply chain disruptions, heightened by geopolitical instability, and the increasing cost of aviation fuel, remain significant headwinds. Furthermore, intense competition amongst airlines can impact profitability.

Growth Drivers in the South-East Asia Civil Aviation Market Market

Growth is fueled by rising disposable incomes, expanding tourism, and governmental investments in infrastructure. Technological innovations like fuel-efficient aircraft further propel growth. Economic liberalization and supportive government policies further facilitate expansion.

Challenges Impacting South-East Asia Civil Aviation Market Growth

Significant challenges include airspace congestion, limited airport capacity, and regulatory hurdles. Supply chain disruptions and volatile fuel prices also hinder market expansion. Competition among airlines and pilot shortages pose additional constraints.

Key Players Shaping the South-East Asia Civil Aviation Market Market

Significant South-East Asia Civil Aviation Market Industry Milestones

- 2022: Significant expansion of low-cost carrier operations in several Southeast Asian countries.

- 2023: Introduction of new air traffic management systems to enhance efficiency.

- 2024: Several key infrastructure projects, such as new airports and runways, initiated across the region.

- 2025: Launch of several new fuel-efficient aircraft models.

Future Outlook for South-East Asia Civil Aviation Market Market

The South-East Asia civil aviation market is poised for continued growth, driven by the region’s robust economic expansion and increasing demand for air travel. Strategic opportunities lie in investments in sustainable aviation technologies, infrastructure development, and route expansion. The market's potential is vast, with significant growth anticipated across all segments, creating attractive prospects for both established players and new entrants.

South-East Asia Civil Aviation Market Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aircraft

- 1.1.1. Passenger Aircraft

- 1.1.2. Freighter Aircraft

-

1.2. General Aviation

- 1.2.1. Business Jet

- 1.2.2. Helicopters

- 1.2.3. Piston Fixed-Wing Aircraft

- 1.2.4. Turboprop Aircraft

-

1.1. Commercial Aircraft

-

2. Geography

- 2.1. Singapore

- 2.2. Thailand

- 2.3. Indonesia

- 2.4. Malaysia

- 2.5. Philippines

- 2.6. Rest of South-East Asia

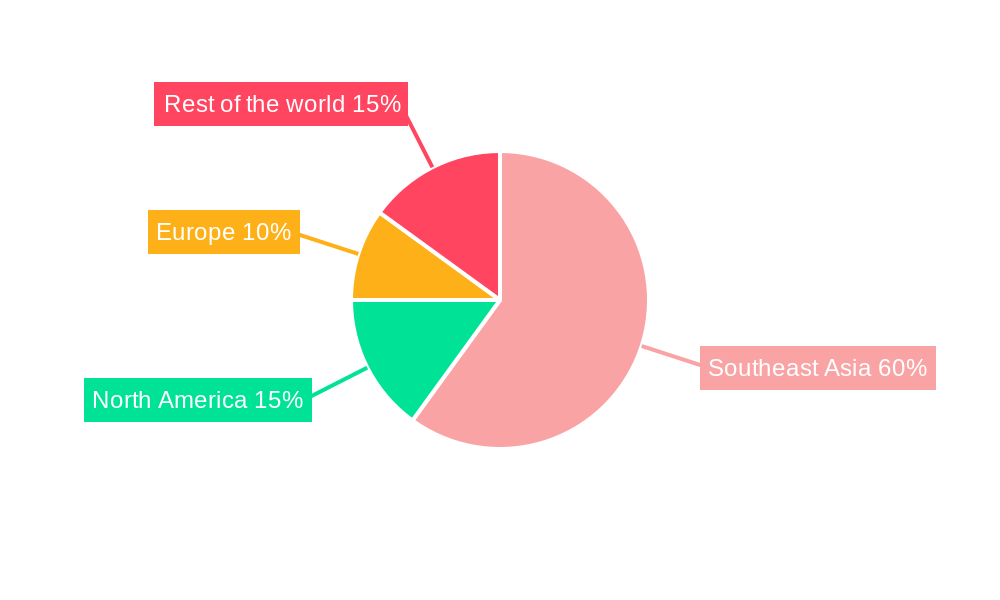

South-East Asia Civil Aviation Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Indonesia

- 4. Malaysia

- 5. Philippines

- 6. Rest of South East Asia

South-East Asia Civil Aviation Market Regional Market Share

Geographic Coverage of South-East Asia Civil Aviation Market

South-East Asia Civil Aviation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Segment Will Showcase Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asia Civil Aviation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aircraft

- 5.1.1.1. Passenger Aircraft

- 5.1.1.2. Freighter Aircraft

- 5.1.2. General Aviation

- 5.1.2.1. Business Jet

- 5.1.2.2. Helicopters

- 5.1.2.3. Piston Fixed-Wing Aircraft

- 5.1.2.4. Turboprop Aircraft

- 5.1.1. Commercial Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Indonesia

- 5.2.4. Malaysia

- 5.2.5. Philippines

- 5.2.6. Rest of South-East Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.3.2. Thailand

- 5.3.3. Indonesia

- 5.3.4. Malaysia

- 5.3.5. Philippines

- 5.3.6. Rest of South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Singapore South-East Asia Civil Aviation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aircraft

- 6.1.1.1. Passenger Aircraft

- 6.1.1.2. Freighter Aircraft

- 6.1.2. General Aviation

- 6.1.2.1. Business Jet

- 6.1.2.2. Helicopters

- 6.1.2.3. Piston Fixed-Wing Aircraft

- 6.1.2.4. Turboprop Aircraft

- 6.1.1. Commercial Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Singapore

- 6.2.2. Thailand

- 6.2.3. Indonesia

- 6.2.4. Malaysia

- 6.2.5. Philippines

- 6.2.6. Rest of South-East Asia

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Thailand South-East Asia Civil Aviation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aircraft

- 7.1.1.1. Passenger Aircraft

- 7.1.1.2. Freighter Aircraft

- 7.1.2. General Aviation

- 7.1.2.1. Business Jet

- 7.1.2.2. Helicopters

- 7.1.2.3. Piston Fixed-Wing Aircraft

- 7.1.2.4. Turboprop Aircraft

- 7.1.1. Commercial Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Singapore

- 7.2.2. Thailand

- 7.2.3. Indonesia

- 7.2.4. Malaysia

- 7.2.5. Philippines

- 7.2.6. Rest of South-East Asia

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Indonesia South-East Asia Civil Aviation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aircraft

- 8.1.1.1. Passenger Aircraft

- 8.1.1.2. Freighter Aircraft

- 8.1.2. General Aviation

- 8.1.2.1. Business Jet

- 8.1.2.2. Helicopters

- 8.1.2.3. Piston Fixed-Wing Aircraft

- 8.1.2.4. Turboprop Aircraft

- 8.1.1. Commercial Aircraft

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Singapore

- 8.2.2. Thailand

- 8.2.3. Indonesia

- 8.2.4. Malaysia

- 8.2.5. Philippines

- 8.2.6. Rest of South-East Asia

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Malaysia South-East Asia Civil Aviation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aircraft

- 9.1.1.1. Passenger Aircraft

- 9.1.1.2. Freighter Aircraft

- 9.1.2. General Aviation

- 9.1.2.1. Business Jet

- 9.1.2.2. Helicopters

- 9.1.2.3. Piston Fixed-Wing Aircraft

- 9.1.2.4. Turboprop Aircraft

- 9.1.1. Commercial Aircraft

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Singapore

- 9.2.2. Thailand

- 9.2.3. Indonesia

- 9.2.4. Malaysia

- 9.2.5. Philippines

- 9.2.6. Rest of South-East Asia

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Philippines South-East Asia Civil Aviation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aircraft

- 10.1.1.1. Passenger Aircraft

- 10.1.1.2. Freighter Aircraft

- 10.1.2. General Aviation

- 10.1.2.1. Business Jet

- 10.1.2.2. Helicopters

- 10.1.2.3. Piston Fixed-Wing Aircraft

- 10.1.2.4. Turboprop Aircraft

- 10.1.1. Commercial Aircraft

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Singapore

- 10.2.2. Thailand

- 10.2.3. Indonesia

- 10.2.4. Malaysia

- 10.2.5. Philippines

- 10.2.6. Rest of South-East Asia

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Rest of South East Asia South-East Asia Civil Aviation Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11.1.1. Commercial Aircraft

- 11.1.1.1. Passenger Aircraft

- 11.1.1.2. Freighter Aircraft

- 11.1.2. General Aviation

- 11.1.2.1. Business Jet

- 11.1.2.2. Helicopters

- 11.1.2.3. Piston Fixed-Wing Aircraft

- 11.1.2.4. Turboprop Aircraft

- 11.1.1. Commercial Aircraft

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Singapore

- 11.2.2. Thailand

- 11.2.3. Indonesia

- 11.2.4. Malaysia

- 11.2.5. Philippines

- 11.2.6. Rest of South-East Asia

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Airbus SE

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bell Textron Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 United Aircraft Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 De Havilland Aircraft of Canada Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Embraer SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bombardier Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 COMAC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ATR

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 The Boeing Company

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Airbus SE

List of Figures

- Figure 1: South-East Asia Civil Aviation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South-East Asia Civil Aviation Market Share (%) by Company 2025

List of Tables

- Table 1: South-East Asia Civil Aviation Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: South-East Asia Civil Aviation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: South-East Asia Civil Aviation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South-East Asia Civil Aviation Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 5: South-East Asia Civil Aviation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South-East Asia Civil Aviation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: South-East Asia Civil Aviation Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 8: South-East Asia Civil Aviation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: South-East Asia Civil Aviation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: South-East Asia Civil Aviation Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 11: South-East Asia Civil Aviation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South-East Asia Civil Aviation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South-East Asia Civil Aviation Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 14: South-East Asia Civil Aviation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: South-East Asia Civil Aviation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South-East Asia Civil Aviation Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 17: South-East Asia Civil Aviation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: South-East Asia Civil Aviation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: South-East Asia Civil Aviation Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 20: South-East Asia Civil Aviation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: South-East Asia Civil Aviation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asia Civil Aviation Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the South-East Asia Civil Aviation Market?

Key companies in the market include Airbus SE, Bell Textron Inc, United Aircraft Corporation, De Havilland Aircraft of Canada Ltd, Embraer SA, Bombardier Inc, COMAC, ATR, The Boeing Company.

3. What are the main segments of the South-East Asia Civil Aviation Market?

The market segments include Aircraft Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.84 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Segment Will Showcase Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asia Civil Aviation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asia Civil Aviation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asia Civil Aviation Market?

To stay informed about further developments, trends, and reports in the South-East Asia Civil Aviation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence