Key Insights

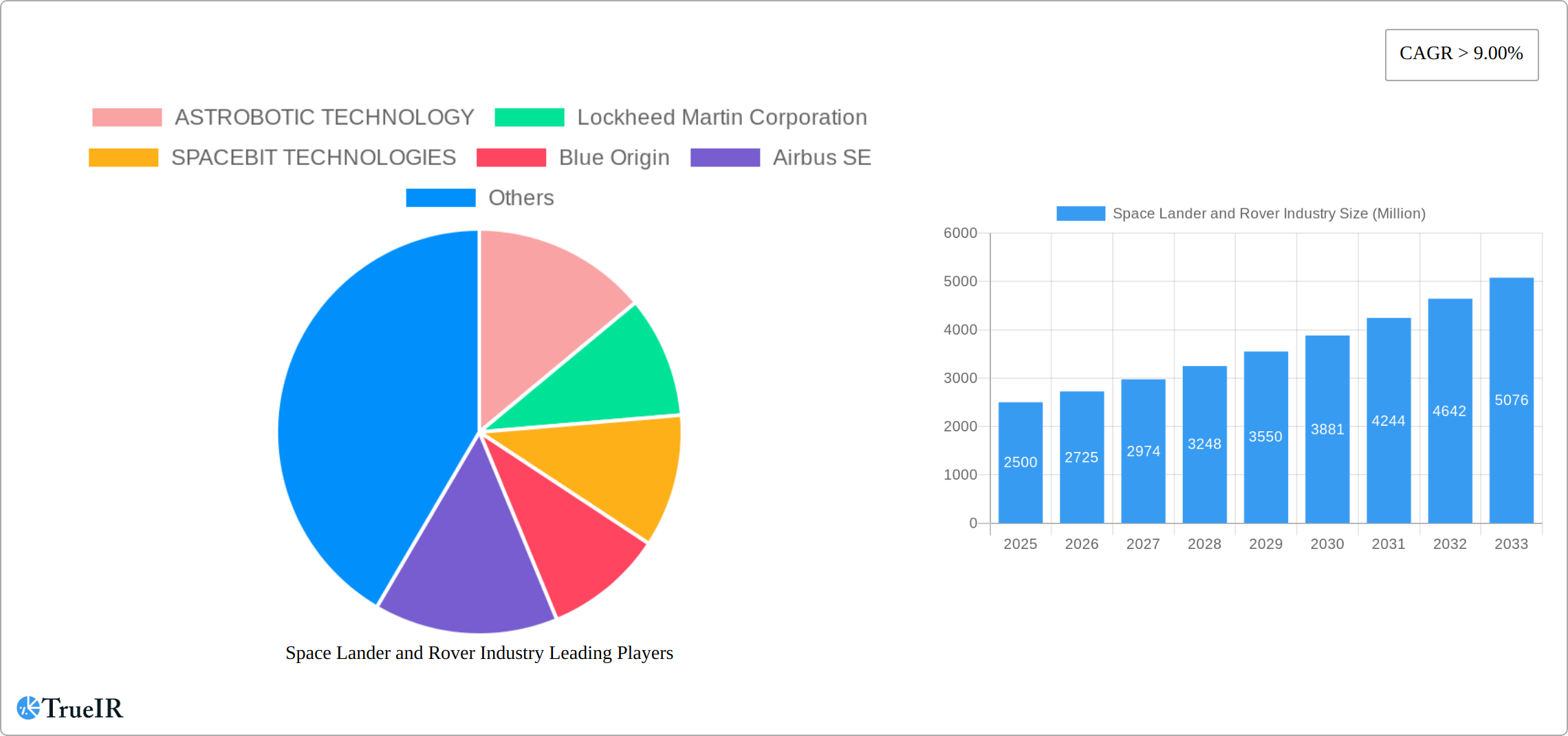

The space lander and rover industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 9% from 2025 to 2033. This expansion is fueled by several key drivers. Increased governmental investment in space exploration programs, particularly from nations like the U.S., China, and members of the European Space Agency, is a significant factor. Furthermore, the burgeoning private space sector, with companies like SpaceX, Blue Origin, and Astrobotic Technology leading the charge, is fostering innovation and competition, driving down costs and accelerating technological advancements. Growing interest in commercial lunar and Martian resource extraction, scientific research, and the potential for establishing human outposts on other celestial bodies are further contributing to the industry's upward trajectory. The market is segmented into lunar, Martian, and asteroid surface exploration, each presenting unique opportunities and challenges. The lunar segment currently holds the largest share, driven by increased accessibility and the proximity of the moon, making it an attractive proving ground for new technologies and strategies before venturing further into the solar system. The industry is also marked by significant technological advancements, including the development of more autonomous and robust rovers, advanced landing systems, and improved power sources, leading to extended mission durations and increased scientific output. While regulatory hurdles and the high cost of space missions remain challenges, the overall outlook for the space lander and rover industry remains exceptionally positive, poised for sustained and significant expansion over the coming decade.

Space Lander and Rover Industry Market Size (In Billion)

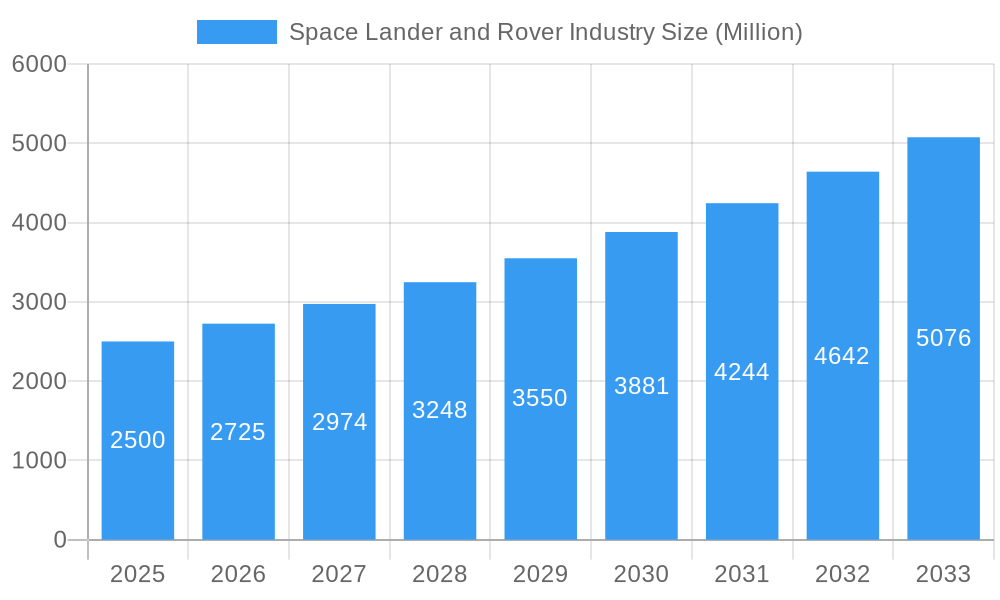

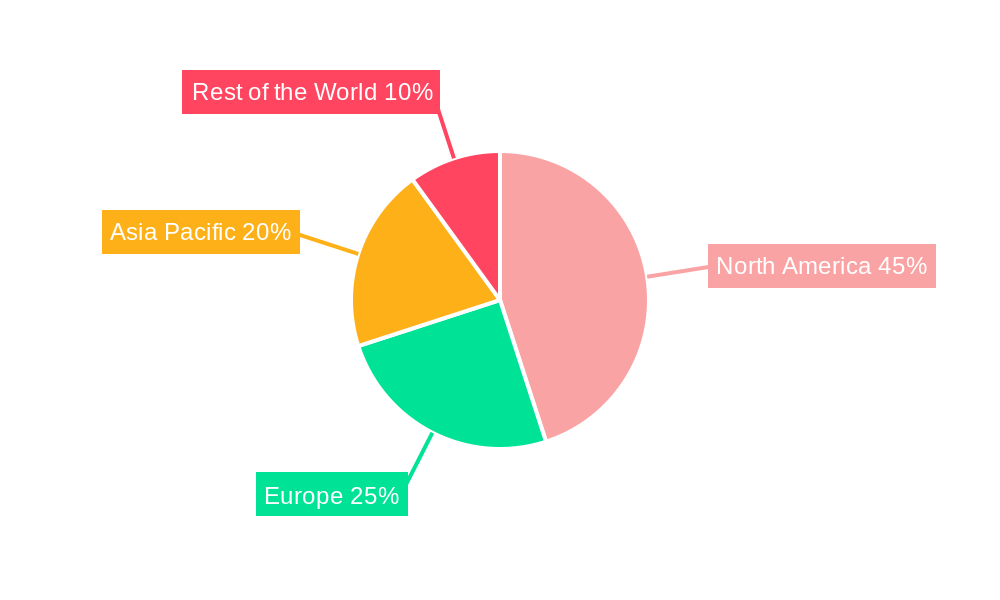

The competition within this dynamic landscape is intense, with both established aerospace giants (Lockheed Martin, Airbus, Northrop Grumman) and emerging space technology companies vying for market share. International collaboration is also a key feature, exemplified by the partnerships between governmental space agencies (NASA, ESA, JAXA, ISRO) and private sector companies. This collaborative approach allows for the sharing of resources and expertise, accelerating progress in technological development and mission execution. Geographic distribution of the market sees North America currently holding a substantial portion of the market share, due to the significant presence of major players and government funding. However, the Asia-Pacific region, particularly China and Japan, is expected to witness significant growth driven by increasing national space programs and investment. The expansion into the asteroid segment, though currently smaller, offers potentially high returns due to the potential for resource extraction and scientific discoveries. Future growth will largely hinge on technological advancements, successful mission deployments, and continued governmental and private investment.

Space Lander and Rover Industry Company Market Share

Space Lander and Rover Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the global Space Lander and Rover industry, projecting a market value exceeding $XX Million by 2033. This in-depth study covers market structure, competitive landscape, technological advancements, and future growth projections, offering invaluable insights for industry stakeholders, investors, and researchers. The report utilizes a robust data set spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), providing a complete understanding of market trends and future potential.

Space Lander and Rover Industry Market Structure & Competitive Landscape

The Space Lander and Rover industry is characterized by a dynamic and evolving market structure. While established aerospace giants like Lockheed Martin, Northrop Grumman, and Airbus SE continue to hold considerable influence and market share, the landscape is increasingly being shaped by agile and innovative startups such as Astrobotic Technology and ispace inc. This influx of new players is fostering heightened competition and driving rapid advancements. The sector's growth is intrinsically linked to cutting-edge developments in advanced robotics, sophisticated propulsion systems, and robust autonomous navigation capabilities. Critical to the industry's trajectory are the evolving regulatory frameworks that govern space exploration, launch operations, and in-space activities. Although alternative methods like orbital observations exist, they currently represent limited substitutes for direct surface exploration. The primary end-user base consists of national space agencies, including NASA, ESA, and JAXA, alongside private enterprises dedicated to deep space exploration and the burgeoning field of in-space resource utilization. The historical period between 2019 and 2024 saw a pronounced uptick in mergers and acquisitions, with a notable number of deals contributing to a collective valuation of approximately $XX Million. Concentration ratios indicate a moderately consolidated market, where the top 5 entities collectively commanded an estimated xx% of the market share in 2024.

- High Barriers to Entry: The industry presents significant hurdles for new entrants, including substantial capital investment requirements, the necessity for highly specialized technical expertise, and adherence to rigorous regulatory and safety compliance standards.

- Increasing Collaboration: A discernible trend towards enhanced collaboration is evident, with an increasing number of partnerships forming between government agencies, private companies, and across international borders to undertake ambitious space missions.

- Focus on Reusability: The industry is actively pursuing the development and deployment of reusable landers and rovers as a strategic imperative to optimize cost-effectiveness and elevate operational efficiency.

- Technological Innovation: Continuous and rapid advancements in artificial intelligence, advanced robotics, and next-generation propulsion technologies are fundamentally redefining and reshaping the market's dynamics and potential.

Space Lander and Rover Industry Market Trends & Opportunities

The global Space Lander and Rover market is poised for substantial growth, exhibiting a CAGR of xx% during the forecast period (2025-2033), driven by increasing space exploration activities, growing demand for resource extraction from celestial bodies, and advancements in autonomous navigation and robotic technologies. Market penetration rates are increasing, particularly in the lunar exploration segment, as space agencies and private companies are investing heavily in missions involving landers and rovers. Consumer preferences (government and private entities) are moving towards advanced functionalities, like increased payload capacity, greater autonomy, and enhanced durability for harsh environments. Competitive dynamics are characterized by both cooperation and rivalry, with established players focusing on technological differentiation and new entrants leveraging innovative solutions. The market is experiencing a shift from government-dominated programs to a collaborative model that includes public-private partnerships. The increasing number of private companies entering the space exploration sector signifies a trend of market expansion and increased private investment. This trend fosters competition and innovation in the development of advanced technologies and missions.

Dominant Markets & Segments in Space Lander and Rover Industry

The Lunar Surface Exploration segment currently stands as the dominant force within the Space Lander and Rover market, accounting for approximately xx% of the total market value projected for 2025. This supremacy is largely attributable to the accelerating pace of missions dedicated to lunar exploration, significantly propelled by initiatives such as the Artemis program and other ambitious endeavors aimed at establishing a sustained human presence on the Moon. Mars Surface Exploration is another pivotal segment, experiencing robust growth fueled by persistent scientific and exploratory interest in understanding and potentially inhabiting the Red Planet. While still in its nascent stages of development, the Asteroids Surface Exploration market holds immense promise for substantial future expansion and resource discovery.

- Lunar Surface Exploration Growth Drivers:

- Augmented government funding allocated to lunar exploration initiatives.

- Growing strategic interest in the potential for lunar resource utilization.

- Technological breakthroughs enabling the execution of increasingly complex and sophisticated lunar missions.

- Mars Surface Exploration Growth Drivers:

- Sustained scientific curiosity focused on unraveling Martian geology and investigating the potential for past or present life.

- Long-term strategic planning for human expeditions to Mars.

- Advancements in critical life support systems and autonomous operational technologies.

- Asteroids Surface Exploration Growth Drivers:

- The significant economic potential associated with asteroid mining and resource extraction.

- Intensified scientific interest in characterizing asteroid composition and understanding their origins.

- Technological innovations enabling effective asteroid rendezvous and sample return missions.

The United States currently commands the largest market share within the Space Lander and Rover industry, a position bolstered by substantial investments from NASA and a thriving private sector. However, a growing number of nations, including China, Japan, and various European countries, are aggressively expanding their space exploration programs, leading to heightened global competition and a more geographically diverse market.

Space Lander and Rover Industry Product Analysis

Technological advancements are driving innovation in space lander and rover design. Recent innovations include improved propulsion systems, advanced AI-powered navigation and autonomous control, enhanced durability to withstand extreme environments, and increased payload capacity. These advancements enable more complex and far-reaching exploration missions, enhancing scientific discovery and resource utilization capabilities. The market is seeing a trend towards greater modularity and versatility, allowing for adaptation to different planetary bodies and mission objectives. These features translate to significant competitive advantages, enabling players to offer superior solutions to clients in government and private sectors.

Key Drivers, Barriers & Challenges in Space Lander and Rover Industry

Key Drivers:

- Increasing global government expenditure dedicated to space exploration endeavors.

- Pioneering advancements in robotics, artificial intelligence, and propulsion technologies.

- Escalating commercial interest and investment in the utilization of space-based resources.

- The collaborative spirit of international partnerships fostering joint missions and shared technological development.

Key Challenges:

- The prohibitive development and operational costs associated with space missions, with complex rover deployments estimated to cost upwards of $XX Million per mission.

- The inherent technological complexities and critical reliability concerns associated with operating in extreme extraterrestrial environments.

- Navigating stringent regulatory frameworks and rigorous safety protocols that can impact development timelines and project feasibility.

- Intense competition arising from both established industry leaders and a dynamic ecosystem of emerging startups.

Growth Drivers in the Space Lander and Rover Industry Market

Technological breakthroughs in robotics, AI, and propulsion systems significantly impact market growth. Increasing government and private investment in space exploration fuels further advancements. Favorable regulatory environments incentivize private sector involvement, leading to innovation and competitive pricing.

Challenges Impacting Space Lander and Rover Industry Growth

Regulatory uncertainties and evolving safety standards can lead to delays and cost overruns, especially in international collaborative projects. Supply chain complexities related to specialized components and materials pose significant risks. The need for specialized workforce creates talent shortages, increasing labor costs.

Key Players Shaping the Space Lander and Rover Industry Market

- ASTROBOTIC TECHNOLOGY

- Lockheed Martin Corporation

- SPACEBIT TECHNOLOGIES

- Blue Origin

- Airbus SE

- Canadian Space Agency

- ISRO

- National Aeronautics and Space Administration

- Roscosmos

- ispace inc

- Japanese Aerospace Exploration Agency (JAXA)

- Northrop Grumman Corporation

- China Academy of Space Technology

Significant Space Lander and Rover Industry Industry Milestones

- May 2021: Lockheed Martin partners with General Motors to develop next-generation lunar rovers.

- March 2021: NASA awards Northrop Grumman a contract (potential value USD 84.5 Million) for the Mars Ascent Vehicle and Sample Fetch Rover.

Future Outlook for Space Lander and Rover Industry Market

The Space Lander and Rover industry is on a trajectory for significant and sustained growth. This expansion will be propelled by ongoing and increasing government investments, a burgeoning private sector actively engaged in space ventures, and a continuous stream of transformative technological breakthroughs. The market presents abundant opportunities for companies specializing in critical areas such as advanced robotics, artificial intelligence, cutting-edge propulsion systems, and associated technological domains. The escalating global emphasis on lunar and Martian exploration, coupled with the emerging potential for asteroid mining, collectively paints a picture of a robust and dynamically expanding market poised for considerable development in the coming years.

Space Lander and Rover Industry Segmentation

-

1. Type

- 1.1. Lunar Surface Exploration

- 1.2. Mars Surface Exploration

- 1.3. Asteroids Surface Exploration

Space Lander and Rover Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Space Lander and Rover Industry Regional Market Share

Geographic Coverage of Space Lander and Rover Industry

Space Lander and Rover Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Focus On Space Exploration Driving the Demand for Landers and Rovers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lunar Surface Exploration

- 5.1.2. Mars Surface Exploration

- 5.1.3. Asteroids Surface Exploration

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lunar Surface Exploration

- 6.1.2. Mars Surface Exploration

- 6.1.3. Asteroids Surface Exploration

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lunar Surface Exploration

- 7.1.2. Mars Surface Exploration

- 7.1.3. Asteroids Surface Exploration

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lunar Surface Exploration

- 8.1.2. Mars Surface Exploration

- 8.1.3. Asteroids Surface Exploration

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lunar Surface Exploration

- 9.1.2. Mars Surface Exploration

- 9.1.3. Asteroids Surface Exploration

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ASTROBOTIC TECHNOLOGY

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lockheed Martin Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPACEBIT TECHNOLOGIES

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Blue Origin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Airbus SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Canadian Space Agency

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ISRO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 National Aeronautics and Space Administration

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roscosmos

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ispace inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Japanese Aerospace Exploration Agency (JAXA)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Northrop Grumman Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 China Academy of Space Technology

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 ASTROBOTIC TECHNOLOGY

List of Figures

- Figure 1: Global Space Lander and Rover Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Space Lander and Rover Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Lander and Rover Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Space Lander and Rover Industry?

Key companies in the market include ASTROBOTIC TECHNOLOGY, Lockheed Martin Corporation, SPACEBIT TECHNOLOGIES, Blue Origin, Airbus SE, Canadian Space Agency, ISRO, National Aeronautics and Space Administration, Roscosmos, ispace inc, Japanese Aerospace Exploration Agency (JAXA), Northrop Grumman Corporation, China Academy of Space Technology.

3. What are the main segments of the Space Lander and Rover Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Focus On Space Exploration Driving the Demand for Landers and Rovers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2021, Lockheed Martin announced that it has teamed up with General Motors to design the next generation of lunar rovers, capable of transporting astronauts across farther distances on the lunar surface.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Lander and Rover Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Lander and Rover Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Lander and Rover Industry?

To stay informed about further developments, trends, and reports in the Space Lander and Rover Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence