Key Insights

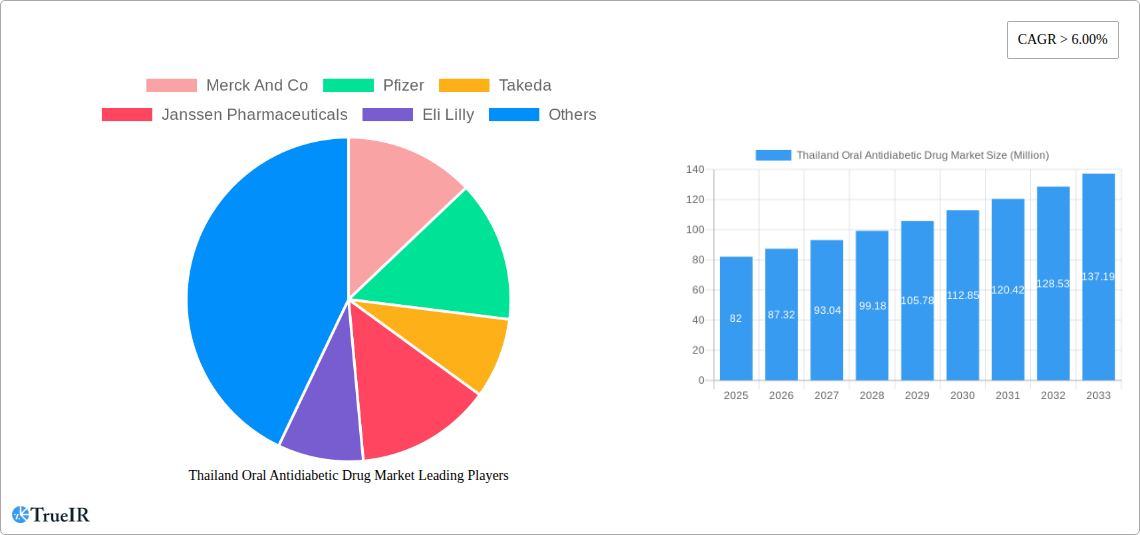

The Thailand oral antidiabetic drug market, valued at approximately $82 million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key factors. The rising prevalence of diabetes in Thailand, driven by increasing urbanization, sedentary lifestyles, and changing dietary habits, significantly contributes to market growth. Furthermore, an aging population increases susceptibility to diabetes, bolstering demand for oral antidiabetic medications. Increased healthcare awareness and improved access to healthcare services in Thailand also play a crucial role in driving market expansion. The market is segmented into various drug classes, including Biguanides (primarily Metformin), Alpha-Glucosidase Inhibitors, SGLT-2 inhibitors (like Ipragliflozin), DPP-4 inhibitors (like Vildagliptin), Sulfonylureas, and Meglitinides, each catering to specific patient needs and treatment preferences. Competition among major pharmaceutical players like Merck, Pfizer, Takeda, and others drives innovation and the availability of a wide range of treatment options. However, potential market restraints could include pricing pressures, the emergence of generic drugs, and the growing adoption of injectable therapies. Future growth will likely be influenced by ongoing research and development in diabetes treatments, governmental healthcare initiatives, and the evolving landscape of diabetes management strategies in Thailand.

Thailand Oral Antidiabetic Drug Market Market Size (In Million)

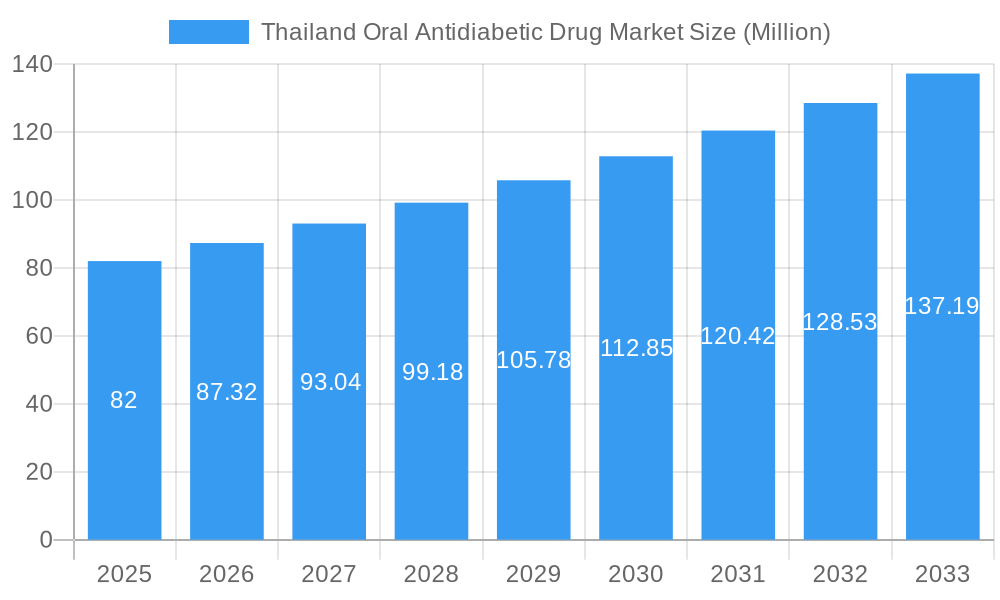

The competitive landscape is characterized by the presence of several multinational pharmaceutical companies, each vying for market share through product innovation, strategic partnerships, and marketing efforts. The market is likely to witness a shift towards newer drug classes, such as SGLT-2 inhibitors and DPP-4 inhibitors, given their proven efficacy and safety profiles. However, the continued dominance of Metformin, a cost-effective and widely prescribed biguanide, is expected. Government regulations and healthcare policies focusing on diabetes prevention and management will significantly influence market dynamics. The focus on affordable and accessible diabetes care will likely shape the strategic decisions of pharmaceutical companies and influence market pricing strategies. The market’s evolution will also be shaped by technological advancements in diabetes diagnosis and management, along with ongoing public health initiatives to control the growing prevalence of this chronic condition in Thailand.

Thailand Oral Antidiabetic Drug Market Company Market Share

Thailand Oral Antidiabetic Drug Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Thailand oral antidiabetic drug market, offering invaluable insights for stakeholders across the pharmaceutical industry. From market size projections and competitive landscapes to segment-specific growth drivers and future outlook, this report equips you with the data-driven intelligence needed to navigate this evolving market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024.

Thailand Oral Antidiabetic Drug Market Market Structure & Competitive Landscape

The Thailand oral antidiabetic drug market exhibits a moderately concentrated structure, with key players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive landscape. Innovation drives market growth, with companies investing heavily in R&D for novel drug formulations and delivery systems. Regulatory approvals from the Thai FDA significantly impact market entry and product lifecycle. Generic competition exerts downward pressure on pricing, while the rising prevalence of diabetes fuels market expansion. Product substitution, primarily between different classes of oral antidiabetic drugs, is a significant factor. The market comprises various end-users, including hospitals, pharmacies, and clinics. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx Million USD in transaction value between 2019 and 2024.

- Market Concentration: Moderately concentrated, with HHI estimated at xx in 2025.

- Innovation Drivers: R&D investment in new drug formulations and delivery systems.

- Regulatory Impacts: Thai FDA approvals heavily influence market access.

- Product Substitutes: Competition between different classes of oral antidiabetic drugs.

- End-User Segmentation: Hospitals, pharmacies, and clinics.

- M&A Trends: Moderate activity, with an estimated xx Million USD in transaction value (2019-2024).

Thailand Oral Antidiabetic Drug Market Market Trends & Opportunities

The Thailand oral antidiabetic drug market is experiencing robust growth, driven by the escalating prevalence of type 2 diabetes and an aging population. The market size is projected to reach xx Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements, such as the development of novel drug delivery systems and personalized medicine approaches, are creating new opportunities. Consumer preferences are shifting towards more convenient and effective therapies with improved safety profiles. Intense competition among established players and new entrants is shaping market dynamics. Market penetration rates for various drug classes vary, with Metformin maintaining a dominant share. The increasing awareness of diabetes and improved healthcare access further fuel market growth.

Dominant Markets & Segments in Thailand Oral Antidiabetic Drug Market

The dominant segment within the Thailand oral antidiabetic drug market is Metformin, which accounts for the largest market share due to its cost-effectiveness and efficacy. Other significant segments include DPP-4 inhibitors and SGLT-2 inhibitors, witnessing substantial growth.

- Key Growth Drivers:

- Increasing prevalence of type 2 diabetes.

- Rising healthcare expenditure.

- Growing awareness of diabetes management.

- Government initiatives to improve healthcare access.

- Market Dominance: Metformin holds the largest market share, followed by DPP-4 and SGLT-2 inhibitors. The Alpha-Glucosidase Inhibitors segment shows moderate growth. The Biguanides segment maintains a significant presence due to the popularity of Metformin. The Sulfonylureas and Meglitinides segments show stable market performance. The SGLT-2 inhibitors segment, particularly Suglat (Ipragliflozin), exhibits notable growth potential due to its efficacy and benefits. The DPP-4 inhibitor segment, with Galvus (Vildagliptin) as a key player, maintains a consistent market position. The Alpha-Glucosidase Inhibitors segment shows moderate growth, while the Dopamine D2 receptor agonist segment (Bromocriptin) holds a niche market position.

Thailand Oral Antidiabetic Drug Market Product Analysis

The Thailand oral antidiabetic drug market showcases a diverse range of products across various drug classes. Technological advancements are leading to the development of novel formulations with improved bioavailability, reduced side effects, and enhanced patient compliance. The market is witnessing the introduction of new-generation drugs with superior efficacy and safety profiles. Competition is fierce, driving innovation and the introduction of products tailored to specific patient needs and preferences.

Key Drivers, Barriers & Challenges in Thailand Oral Antidiabetic Drug Market

Key Drivers: The rising prevalence of diabetes in Thailand, coupled with increasing healthcare expenditure and government initiatives to improve diabetes management, are significant drivers. Technological advancements leading to the development of novel drug formulations and delivery systems also contribute to market growth.

Challenges and Restraints: The market faces challenges such as high drug prices, affordability issues, and the complexities of the regulatory environment. Supply chain disruptions and the intense competition among various players also pose significant hurdles. The impact of these factors can be quantified in terms of reduced market penetration and slower growth rates.

Growth Drivers in the Thailand Oral Antidiabetic Drug Market Market

The increasing prevalence of diabetes, coupled with rising healthcare spending and government initiatives supporting improved diabetes care, are key growth drivers. Technological innovations in drug development and delivery systems also contribute significantly.

Challenges Impacting Thailand Oral Antidiabetic Drug Market Growth

High drug prices, limited affordability, and complex regulatory hurdles restrict market growth. Furthermore, supply chain vulnerabilities and intense competition among pharmaceutical companies present considerable challenges.

Key Players Shaping the Thailand Oral Antidiabetic Drug Market Market

Significant Thailand Oral Antidiabetic Drug Market Industry Milestones

- May 2022: Mounjaro (tirzepatide) injection approved for improved blood sugar control in adults with type 2 diabetes. This approval introduced a new, highly effective treatment option, impacting the competitive landscape.

- March 2023: Daewoong Pharmaceutical's Envlo filed for product licenses in Indonesia, Philippines, and Thailand. This indicates potential market entry and increased competition within the region.

Future Outlook for Thailand Oral Antidiabetic Drug Market Market

The Thailand oral antidiabetic drug market is poised for continued growth, driven by the escalating prevalence of diabetes, technological advancements, and increasing healthcare expenditure. Strategic partnerships, product diversification, and the development of innovative therapies present significant opportunities for market expansion and improved patient outcomes. The market is expected to witness increased competition, particularly from generic drugs.

Thailand Oral Antidiabetic Drug Market Segmentation

-

1. Drug Type

- 1.1. Biguanides

- 1.2. Alpha-Glucosidase Inhibitors

- 1.3. Dopamine D2 receptor agonist

- 1.4. SGLT-2 inhibitors

- 1.5. DPP-4 inhibitors

- 1.6. Sulfonylureas

- 1.7. Meglitinides

-

2. Region

- 2.1. Greater Bangkok

- 2.2. Central and Eastern Region

- 2.3. Northern Region

- 2.4. Northeastern and Southern Region

Thailand Oral Antidiabetic Drug Market Segmentation By Geography

- 1. Thailand

Thailand Oral Antidiabetic Drug Market Regional Market Share

Geographic Coverage of Thailand Oral Antidiabetic Drug Market

Thailand Oral Antidiabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Sulfonylureas Segment Occupied the Highest Market Share in the Thailand Oral Anti-Diabetic Drugs Market in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Oral Antidiabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Biguanides

- 5.1.2. Alpha-Glucosidase Inhibitors

- 5.1.3. Dopamine D2 receptor agonist

- 5.1.4. SGLT-2 inhibitors

- 5.1.5. DPP-4 inhibitors

- 5.1.6. Sulfonylureas

- 5.1.7. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Greater Bangkok

- 5.2.2. Central and Eastern Region

- 5.2.3. Northern Region

- 5.2.4. Northeastern and Southern Region

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: Thailand Oral Antidiabetic Drug Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Oral Antidiabetic Drug Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Oral Antidiabetic Drug Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 2: Thailand Oral Antidiabetic Drug Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 3: Thailand Oral Antidiabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Thailand Oral Antidiabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Thailand Oral Antidiabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Thailand Oral Antidiabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Thailand Oral Antidiabetic Drug Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 8: Thailand Oral Antidiabetic Drug Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 9: Thailand Oral Antidiabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Thailand Oral Antidiabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Thailand Oral Antidiabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Thailand Oral Antidiabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Oral Antidiabetic Drug Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Thailand Oral Antidiabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Thailand Oral Antidiabetic Drug Market?

The market segments include Drug Type, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD 82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Sulfonylureas Segment Occupied the Highest Market Share in the Thailand Oral Anti-Diabetic Drugs Market in the current year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

March 2023: Daewoong Pharmaceutical's Envlo to enter the global market in full swing with filing for product licenses in three ASEAN countries. Submitted an NDA to Indonesia, Philippines, and Thailand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Oral Antidiabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Oral Antidiabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Oral Antidiabetic Drug Market?

To stay informed about further developments, trends, and reports in the Thailand Oral Antidiabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence