Key Insights

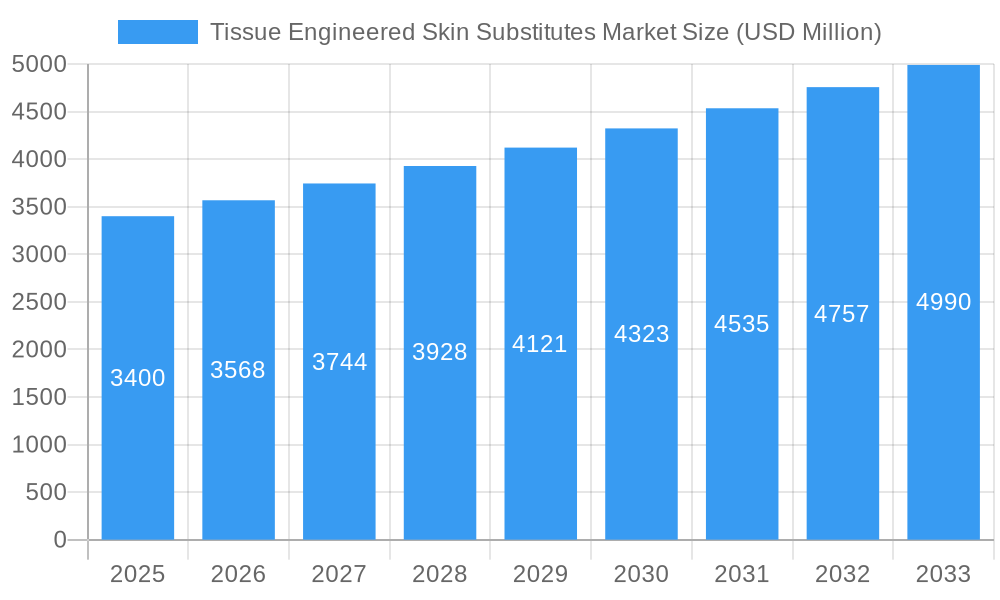

The global Tissue Engineered Skin Substitutes Market is poised for significant expansion, projected to reach an estimated USD 3.4 billion in 2025. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033. The market's upward trajectory is primarily driven by the increasing prevalence of chronic and acute wounds, often associated with an aging global population and a rise in chronic diseases such as diabetes and vascular conditions. Advancements in regenerative medicine and bioengineering are continuously introducing more effective and sophisticated skin substitutes, offering improved healing outcomes and reduced patient recovery times. Furthermore, the growing demand for less invasive treatment options and the increasing number of ambulatory surgical centers performing dermatological and reconstructive procedures contribute to the market's positive outlook.

Tissue Engineered Skin Substitutes Market Market Size (In Billion)

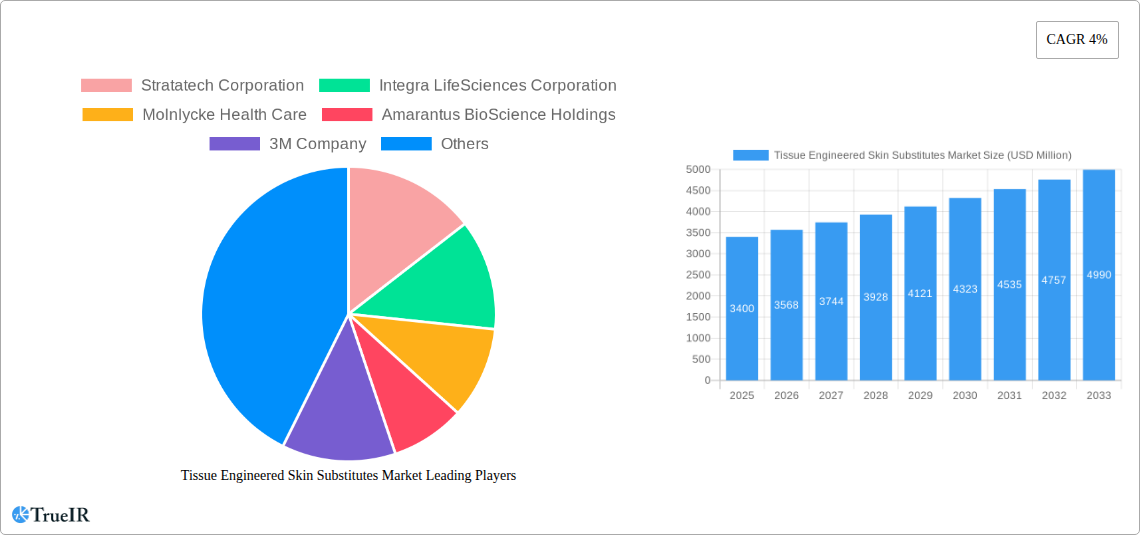

The market is segmented into natural and synthetic product types, with applications spanning chronic wounds, acute wounds, and specialized treatments. Hospitals and clinics represent the largest end-user segment due to their role in treating complex wound cases. Key players such as Integra LifeSciences Corporation, Molnlycke Health Care, 3M Company, and Smith & Nephew plc are actively investing in research and development, as well as strategic collaborations, to enhance their product portfolios and expand their market reach. While the market demonstrates strong potential, restraints such as high product costs and the need for specialized training for application can pose challenges. However, ongoing technological innovations and increasing healthcare expenditure worldwide are expected to mitigate these limitations, paving the way for substantial market penetration.

Tissue Engineered Skin Substitutes Market Company Market Share

Tissue Engineered Skin Substitutes Market: Comprehensive Market Analysis & Forecast (2019-2033)

Unlock deep insights into the rapidly evolving Tissue Engineered Skin Substitutes Market. This definitive report provides a comprehensive analysis of market size, trends, drivers, challenges, and competitive landscape, offering actionable intelligence for stakeholders aiming to capitalize on opportunities in wound care and regenerative medicine. With a detailed examination of product types, applications, and end-user segments, this report equips you with the data and strategic foresight needed to navigate this dynamic industry.

Tissue Engineered Skin Substitutes Market Market Structure & Competitive Landscape

The Tissue Engineered Skin Substitutes Market is characterized by moderate to high concentration, with key players investing heavily in research and development to drive innovation. Regulatory approvals and clinical trial successes serve as significant innovation drivers, while stringent reimbursement policies and the availability of traditional wound care alternatives present regulatory impacts and product substitutes. End-user segmentation reveals a strong preference for hospital and clinic settings due to complex wound management needs, though ambulatory surgical centers are also witnessing growth. Mergers and acquisitions (M&A) activity is a critical aspect of the market's evolution, with approximately xx M&A deals observed during the historical period (2019-2024), signaling consolidation and strategic expansion by leading entities. The market's trajectory is influenced by ongoing technological advancements and the increasing prevalence of chronic diseases.

- Market Concentration: Dominated by a mix of large, established corporations and emerging biotech firms.

- Innovation Drivers: Novel biomaterials, advanced manufacturing techniques, and a focus on improved patient outcomes.

- Regulatory Impacts: FDA and EMA approvals are critical gating factors for market entry and product adoption.

- Product Substitutes: Traditional bandages, autografts, and allografts continue to be alternatives.

- End-User Segmentation: Hospitals and clinics represent the largest share, followed by ambulatory surgical centers.

- M&A Trends: Strategic acquisitions to expand product portfolios and market reach are prevalent.

Tissue Engineered Skin Substitutes Market Market Trends & Opportunities

The Tissue Engineered Skin Substitutes Market is poised for substantial growth, with an estimated market size of xx billion USD in the base year 2025, projected to reach xx billion USD by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and a growing awareness of the efficacy of advanced wound care solutions. Technological shifts are central to this growth, with innovations in biomaterial science, stem cell technologies, and biofabrication enabling the development of more sophisticated and patient-specific skin substitutes. These advancements are leading to improved healing times, reduced scarring, and enhanced functional and aesthetic outcomes, thereby influencing consumer preferences towards these advanced solutions. The increasing global prevalence of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, is a primary market driver. The aging global population contributes significantly to this trend, as older individuals are more susceptible to developing chronic wounds. Furthermore, rising healthcare expenditure and a growing emphasis on regenerative medicine are creating fertile ground for market penetration. Competitive dynamics are intensifying, with companies actively engaged in product development, strategic partnerships, and market expansion to capture a larger share. The development of regenerative therapies that mimic the natural healing process is a key area of focus, offering significant potential for reducing patient morbidity and healthcare costs. The adoption of these advanced substitutes in various clinical settings, including hospitals, clinics, and specialized wound care centers, is expected to accelerate. Moreover, the increasing demand for minimally invasive procedures and faster recovery times further bolsters the market's growth trajectory. The integration of smart technologies and personalized medicine approaches within skin substitutes represents a significant future opportunity, promising to revolutionize wound management.

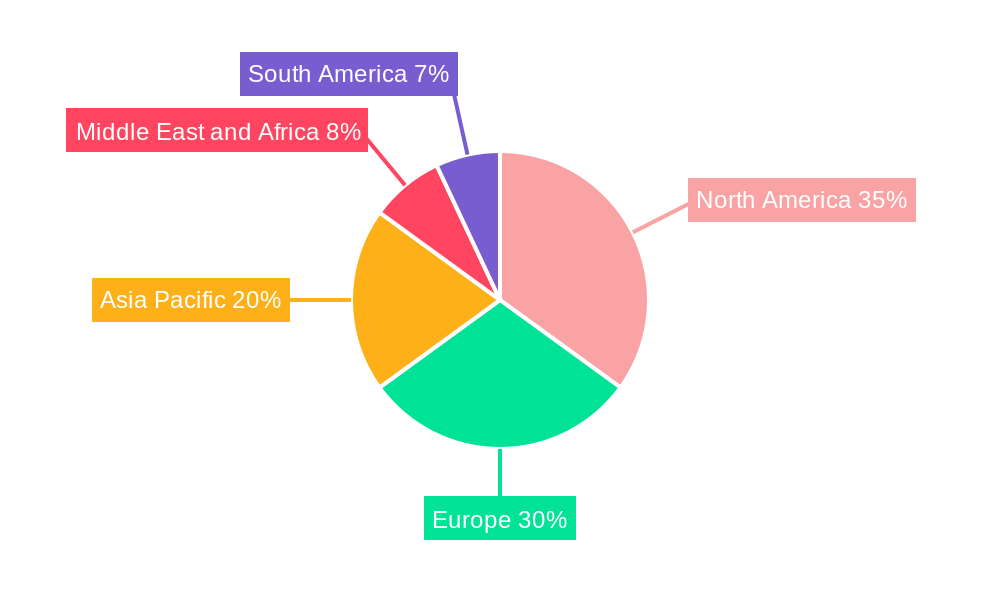

Dominant Markets & Segments in Tissue Engineered Skin Substitutes Market

The Tissue Engineered Skin Substitutes Market exhibits distinct regional dominance and segment leadership, driven by a combination of healthcare infrastructure, policy support, and disease prevalence. North America is identified as the leading region, primarily due to its advanced healthcare system, high disposable income, significant investment in R&D, and a large patient population suffering from chronic wounds, particularly diabetes. Within North America, the United States spearheads the market, supported by favorable regulatory pathways and a strong presence of key market players.

Product Type Dominance:

- Natural Skin Substitutes: Currently hold a dominant share due to their biocompatibility and inherent healing properties, often derived from human or animal tissues. These are preferred for complex wound scenarios where a biological matrix is crucial for regeneration.

- Synthetic Skin Substitutes: Witnessing rapid growth owing to their cost-effectiveness, scalability, and potential for customization. Innovations in synthetic materials are continuously improving their performance and mimicking natural tissue functions.

Application Dominance:

- Chronic Wounds: This segment is the largest and fastest-growing application area. The increasing incidence of diabetic foot ulcers, venous leg ulcers, and pressure ulcers globally necessitates advanced treatment modalities like tissue-engineered skin.

- Acute Wounds: Including burns and traumatic injuries, also represent a significant application, with demand driven by the need for rapid wound closure and infection prevention.

End-User Dominance:

- Hospital and Clinic: This segment commands the largest market share, as these settings are equipped to manage complex wounds and are where most advanced medical procedures are performed.

- Ambulatory Surgical Centers: Growing segment, reflecting the trend towards outpatient wound care and specialized surgical interventions.

Key growth drivers in these dominant segments include robust healthcare expenditure, proactive government initiatives promoting wound care awareness and treatment, and the presence of leading companies investing in localized manufacturing and distribution networks. The growing emphasis on value-based healthcare further propels the adoption of effective and cost-efficient solutions like tissue-engineered skin substitutes.

Tissue Engineered Skin Substitutes Market Product Analysis

The Tissue Engineered Skin Substitutes Market is defined by continuous product innovation, aiming to replicate the complexity and functionality of native human skin. Key advancements include the development of bioengineered scaffolds with tunable properties, the incorporation of growth factors and stem cells to accelerate healing, and the creation of multilayered constructs mimicking epidermal and dermal layers. These products offer significant competitive advantages by promoting faster wound closure, reducing scarring, minimizing infection risk, and improving aesthetic outcomes. Applications span a wide spectrum, from treating chronic wounds like diabetic foot ulcers and venous leg ulcers to managing acute injuries such as severe burns and surgical site infections. The market fit is enhanced by the ability of these substitutes to provide a moist wound environment, facilitate cell migration and proliferation, and reduce the need for painful autograft harvesting.

Key Drivers, Barriers & Challenges in Tissue Engineered Skin Substitutes Market

Key Drivers:

- Rising Incidence of Chronic Wounds: The global surge in conditions like diabetes and vascular diseases directly fuels the demand for effective wound healing solutions.

- Technological Advancements: Innovations in biomaterials, stem cell therapy, and biofabrication are creating more effective and versatile skin substitutes.

- Aging Global Population: Older individuals are more prone to chronic conditions and slower wound healing, increasing the need for advanced treatments.

- Increasing Healthcare Expenditure: Growing investments in healthcare infrastructure and regenerative medicine worldwide support market expansion.

Barriers & Challenges:

- High Cost of Products: The complex manufacturing processes and advanced technology often result in high prices, limiting accessibility for some patient populations.

- Regulatory Hurdles: Obtaining approvals from regulatory bodies can be a lengthy and expensive process, slowing down market entry for new products.

- Reimbursement Policies: Inconsistent and restrictive reimbursement policies in certain regions can impede adoption.

- Limited Awareness and Training: A lack of widespread awareness among healthcare professionals and patients about the benefits of tissue-engineered skin substitutes can hinder uptake.

Growth Drivers in the Tissue Engineered Skin Substitutes Market Market

The Tissue Engineered Skin Substitutes Market is propelled by a dynamic interplay of technological progress, economic factors, and evolving healthcare policies. Technological advancements, such as the development of sophisticated biomimetic scaffolds and the integration of cell-based therapies, are creating highly effective wound healing solutions. Economically, increasing healthcare expenditure globally, coupled with a growing focus on value-based care that prioritizes effective and efficient treatments, provides a strong impetus for market growth. Policy-driven factors, including government initiatives aimed at improving chronic disease management and wound care outcomes, further support the adoption of these advanced regenerative products. The increasing prevalence of chronic conditions like diabetes and the aging global population are substantial underlying drivers creating a sustained demand.

Challenges Impacting Tissue Engineered Skin Substitutes Market Growth

Despite significant growth potential, the Tissue Engineered Skin Substitutes Market faces several challenges. Regulatory complexities and the stringent approval processes in various regions can significantly delay product launches and increase development costs, posing a considerable barrier. Supply chain issues related to the sourcing of raw materials and maintaining the viability of biological components can impact product availability and cost-effectiveness. Competitive pressures from established traditional wound care methods and the emergence of novel therapeutic approaches also exert influence. Furthermore, the high cost associated with many advanced tissue-engineered skin substitutes can limit their widespread adoption, particularly in resource-constrained healthcare settings, impacting market penetration.

Key Players Shaping the Tissue Engineered Skin Substitutes Market Market

- Stratatech Corporation

- Integra LifeSciences Corporation

- Molnlycke Health Care

- Amarantus BioScience Holdings

- 3M Company

- Organogenesis Inc

- Smith & Nephew plc

- Tissue Regenix

Significant Tissue Engineered Skin Substitutes Market Industry Milestones

- 2023: Launch of novel bio-engineered dermal substitute with enhanced growth factor delivery.

- 2022: Acquisition of a leading cell therapy company by a major medical device manufacturer to expand regenerative medicine portfolio.

- 2021: FDA approval for a new allogeneic cellular therapy for severe burns, demonstrating progress in cellular treatments.

- 2020: Significant increase in research funding for wound healing technologies, driven by COVID-19 related patient care needs.

- 2019: Introduction of advanced synthetic scaffolds with improved biocompatibility and degradation profiles.

Future Outlook for Tissue Engineered Skin Substitutes Market Market

The future outlook for the Tissue Engineered Skin Substitutes Market is exceptionally promising, driven by sustained innovation and an expanding unmet need. The market is anticipated to witness accelerated growth as technological advancements in biomaterials, cellular therapies, and biofabrication mature, leading to more sophisticated and cost-effective solutions. The increasing global burden of chronic wounds, coupled with an aging population, will continue to fuel demand. Strategic opportunities lie in the development of personalized wound care solutions, the integration of smart technologies for wound monitoring, and expansion into emerging markets with growing healthcare infrastructures. The focus on regenerative medicine and reducing healthcare costs associated with chronic wound management will further solidify the market's upward trajectory, promising significant advancements in patient outcomes and therapeutic efficacy.

Tissue Engineered Skin Substitutes Market Segmentation

-

1. Product type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Chronic Wounds

- 2.2. Acute Wounds

-

3. End-User

- 3.1. Hospital and Clinic

- 3.2. Ambulatory Surgical Center

- 3.3. Others

Tissue Engineered Skin Substitutes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Tissue Engineered Skin Substitutes Market Regional Market Share

Geographic Coverage of Tissue Engineered Skin Substitutes Market

Tissue Engineered Skin Substitutes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 As the global population ages

- 3.2.2 the prevalence of age-related conditions

- 3.2.3 such as diabetes and venous insufficiency

- 3.2.4 increases. These conditions contribute to a higher incidence of chronic wounds that require advanced treatment options like TESS

- 3.3. Market Restrains

- 3.3.1 Tissue-engineered skin substitutes are expensive

- 3.3.2 limiting access for many patients and posing a challenge for healthcare providers seeking cost-effective wound care solutions

- 3.4. Market Trends

- 3.4.1 The development of autologous skin substitutes

- 3.4.2 using the patient’s own cells

- 3.4.3 is expected to grow as advancements in tissue engineering make personalized treatments more accessible and effective

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tissue Engineered Skin Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Chronic Wounds

- 5.2.2. Acute Wounds

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospital and Clinic

- 5.3.2. Ambulatory Surgical Center

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. North America Tissue Engineered Skin Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Chronic Wounds

- 6.2.2. Acute Wounds

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Hospital and Clinic

- 6.3.2. Ambulatory Surgical Center

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. Europe Tissue Engineered Skin Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Chronic Wounds

- 7.2.2. Acute Wounds

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Hospital and Clinic

- 7.3.2. Ambulatory Surgical Center

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. Asia Pacific Tissue Engineered Skin Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Chronic Wounds

- 8.2.2. Acute Wounds

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Hospital and Clinic

- 8.3.2. Ambulatory Surgical Center

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Middle East and Africa Tissue Engineered Skin Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Chronic Wounds

- 9.2.2. Acute Wounds

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Hospital and Clinic

- 9.3.2. Ambulatory Surgical Center

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. South America Tissue Engineered Skin Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 10.1.1. Natural

- 10.1.2. Synthetic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Chronic Wounds

- 10.2.2. Acute Wounds

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Hospital and Clinic

- 10.3.2. Ambulatory Surgical Center

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stratatech Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Integra LifeSciences Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Molnlycke Health Care

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amarantus BioScience Holdings

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Organogenesis Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Smith & Nephew plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tissue Regenix

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Stratatech Corporation

List of Figures

- Figure 1: Global Tissue Engineered Skin Substitutes Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Tissue Engineered Skin Substitutes Market Revenue (undefined), by Product type 2025 & 2033

- Figure 3: North America Tissue Engineered Skin Substitutes Market Revenue Share (%), by Product type 2025 & 2033

- Figure 4: North America Tissue Engineered Skin Substitutes Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Tissue Engineered Skin Substitutes Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Tissue Engineered Skin Substitutes Market Revenue (undefined), by End-User 2025 & 2033

- Figure 7: North America Tissue Engineered Skin Substitutes Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Tissue Engineered Skin Substitutes Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Tissue Engineered Skin Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Tissue Engineered Skin Substitutes Market Revenue (undefined), by Product type 2025 & 2033

- Figure 11: Europe Tissue Engineered Skin Substitutes Market Revenue Share (%), by Product type 2025 & 2033

- Figure 12: Europe Tissue Engineered Skin Substitutes Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: Europe Tissue Engineered Skin Substitutes Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Tissue Engineered Skin Substitutes Market Revenue (undefined), by End-User 2025 & 2033

- Figure 15: Europe Tissue Engineered Skin Substitutes Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Tissue Engineered Skin Substitutes Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Tissue Engineered Skin Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue (undefined), by Product type 2025 & 2033

- Figure 19: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue Share (%), by Product type 2025 & 2033

- Figure 20: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue (undefined), by End-User 2025 & 2033

- Figure 23: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Tissue Engineered Skin Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue (undefined), by Product type 2025 & 2033

- Figure 27: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue Share (%), by Product type 2025 & 2033

- Figure 28: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue (undefined), by End-User 2025 & 2033

- Figure 31: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Tissue Engineered Skin Substitutes Market Revenue (undefined), by Product type 2025 & 2033

- Figure 35: South America Tissue Engineered Skin Substitutes Market Revenue Share (%), by Product type 2025 & 2033

- Figure 36: South America Tissue Engineered Skin Substitutes Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: South America Tissue Engineered Skin Substitutes Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Tissue Engineered Skin Substitutes Market Revenue (undefined), by End-User 2025 & 2033

- Figure 39: South America Tissue Engineered Skin Substitutes Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Tissue Engineered Skin Substitutes Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Tissue Engineered Skin Substitutes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 2: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 6: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 13: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 15: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 23: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 25: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 33: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 35: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 40: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 41: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 42: Global Tissue Engineered Skin Substitutes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Tissue Engineered Skin Substitutes Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tissue Engineered Skin Substitutes Market?

The projected CAGR is approximately 14.6%.

2. Which companies are prominent players in the Tissue Engineered Skin Substitutes Market?

Key companies in the market include Stratatech Corporation, Integra LifeSciences Corporation, Molnlycke Health Care, Amarantus BioScience Holdings, 3M Company, Organogenesis Inc, Smith & Nephew plc, Tissue Regenix.

3. What are the main segments of the Tissue Engineered Skin Substitutes Market?

The market segments include Product type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

As the global population ages. the prevalence of age-related conditions. such as diabetes and venous insufficiency. increases. These conditions contribute to a higher incidence of chronic wounds that require advanced treatment options like TESS.

6. What are the notable trends driving market growth?

The development of autologous skin substitutes. using the patient’s own cells. is expected to grow as advancements in tissue engineering make personalized treatments more accessible and effective.

7. Are there any restraints impacting market growth?

Tissue-engineered skin substitutes are expensive. limiting access for many patients and posing a challenge for healthcare providers seeking cost-effective wound care solutions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tissue Engineered Skin Substitutes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tissue Engineered Skin Substitutes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tissue Engineered Skin Substitutes Market?

To stay informed about further developments, trends, and reports in the Tissue Engineered Skin Substitutes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence