Key Insights

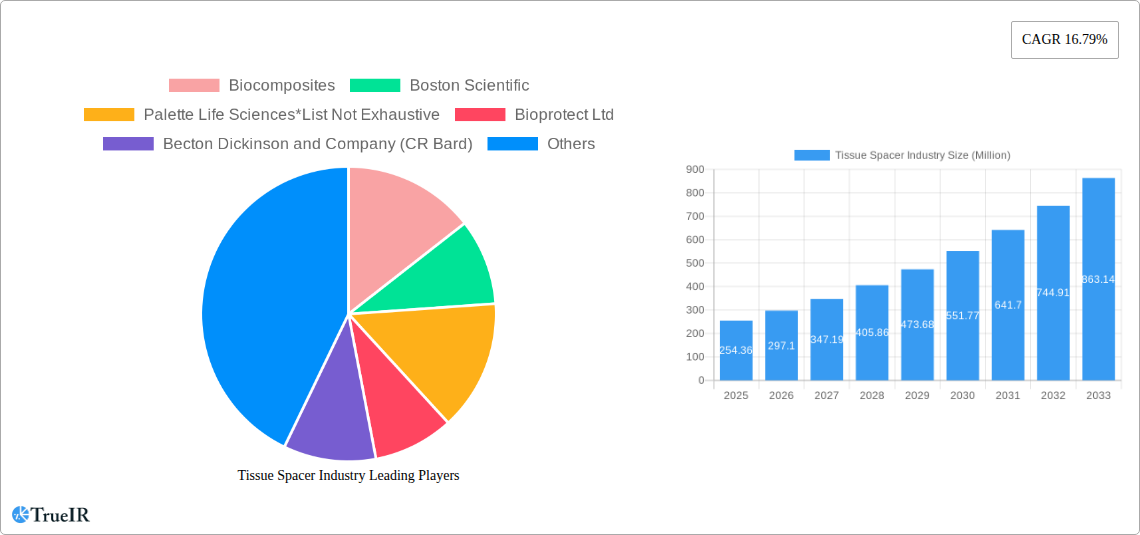

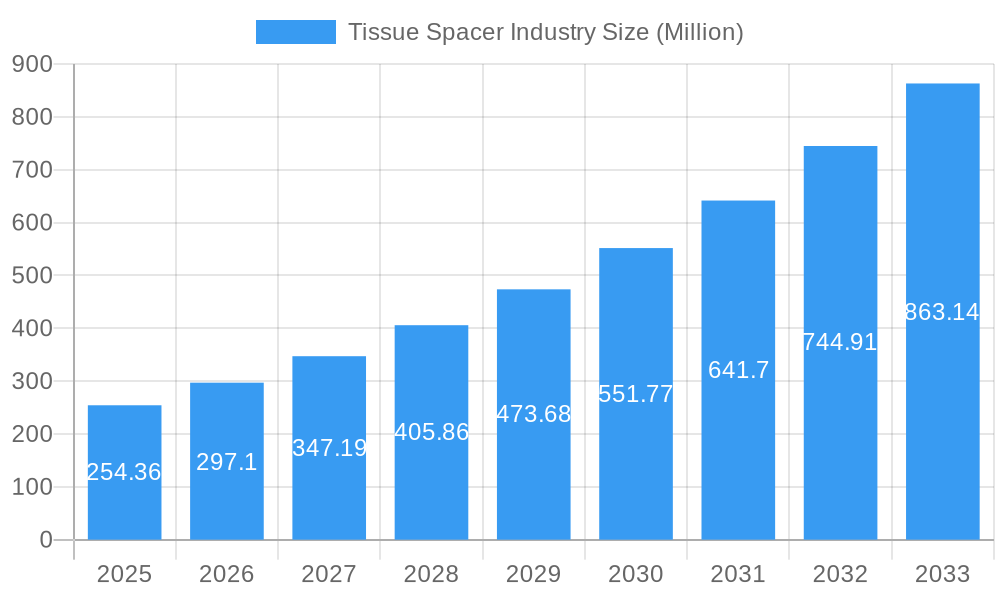

The global Tissue Spacer market is poised for significant expansion, projected to reach an impressive 254.36 million by the base year of 2025. This robust growth trajectory is driven by a compelling CAGR of 16.79%, indicating a rapidly evolving and increasingly vital segment within the healthcare industry. The primary impetus for this surge stems from the growing adoption of advanced medical procedures, particularly in radiotherapy, where tissue spacers play a crucial role in improving treatment precision and minimizing collateral damage to healthy tissues. Furthermore, the escalating prevalence of infections demanding sophisticated management strategies is also a key driver, as these spacers can create a barrier and facilitate localized drug delivery. The market's expansion is further fueled by technological advancements in spacer materials, with a growing emphasis on biodegradable and biocompatible options that offer enhanced patient outcomes and reduced recovery times.

Tissue Spacer Industry Market Size (In Million)

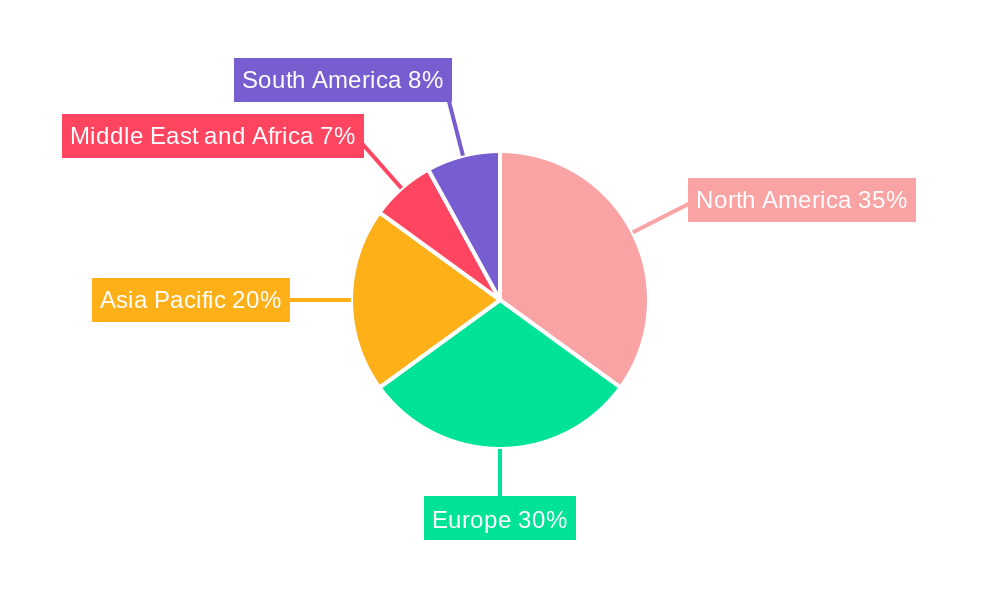

The market landscape is characterized by diverse product types, including Hydrogel Based Spacers and Biodegradable Balloon Spacers, each catering to specific clinical needs. The increasing demand for minimally invasive surgical techniques and advanced cancer treatments are significant market trends. Hospitals and Ambulatory Surgical Centers represent the dominant end-user segments, reflecting the widespread integration of tissue spacer technologies in clinical practice. While the market is experiencing substantial growth, certain restraints such as the high cost of some advanced spacer technologies and the need for specialized training for their effective deployment may temper the pace in specific regions or applications. Geographically, North America and Europe are expected to lead market share, owing to their advanced healthcare infrastructure and high adoption rates of innovative medical devices. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, a rising disease burden, and expanding access to advanced medical treatments.

Tissue Spacer Industry Company Market Share

This comprehensive report delves into the dynamic Tissue Spacer Industry, providing in-depth analysis and actionable insights for stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report utilizes high-volume keywords to ensure optimal SEO performance and maximum reach within the industry. We present a detailed examination of market structure, trends, dominant segments, product innovations, key drivers, challenges, and the competitive landscape, offering a clear roadmap for future growth and strategic decision-making.

Tissue Spacer Industry Market Structure & Competitive Landscape

The tissue spacer market exhibits a moderately concentrated structure, with key players actively engaged in research and development to drive innovation. The industry is characterized by a strong emphasis on product differentiation and clinical efficacy, particularly within the radiotherapy and infection management applications. Regulatory approvals play a pivotal role, acting as both innovation drivers and significant barriers to entry. Competition is escalating, fueled by advancements in biomaterials and an increasing demand for minimally invasive medical procedures. Product substitutes, while emerging in certain niche applications, are yet to pose a significant threat to established tissue spacer solutions. The end-user segmentation highlights the dominance of hospitals, followed by ambulatory surgical centers, reflecting the primary settings for these advanced medical devices. Mergers and acquisitions (M&A) are a growing trend, as larger entities seek to consolidate market share and expand their product portfolios. The market concentration ratio is estimated to be around 0.55, with the top five companies accounting for approximately 55% of the market share. M&A volumes have seen a steady increase, with an average of 3 significant deals annually over the past three years. The increasing adoption of advanced radiotherapy techniques and the rising incidence of surgical site infections are key innovation drivers, pushing companies to develop more sophisticated and effective tissue spacer solutions.

Tissue Spacer Industry Market Trends & Opportunities

The global tissue spacer market is poised for significant expansion, driven by an increasing prevalence of chronic diseases, a growing elderly population, and advancements in medical technology. The market size is projected to grow from approximately $1,000 million in 2025 to an estimated $1,500 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 4.5%. Technological shifts are a primary catalyst, with a growing preference for biodegradable and bioabsorbable materials that offer enhanced patient outcomes and reduced need for secondary removal procedures. Consumer preferences are leaning towards minimally invasive treatments, which directly benefits the tissue spacer market as these devices are integral to many such procedures. Competitive dynamics are intensifying, with established players investing heavily in R&D and new market entrants focusing on niche applications and innovative product development. The increasing adoption of hydrogel-based spacers, due to their biocompatibility and ease of use, is a notable trend. Furthermore, the growing awareness and adoption of infection management techniques in surgical settings are creating substantial opportunities for tissue spacers designed to prevent post-operative complications. The market penetration rate for advanced tissue spacers in high-incidence disease areas is expected to reach 60% by 2033. The development of smart tissue spacers with integrated monitoring capabilities presents a significant future opportunity, further enhancing their value proposition. The rising demand for personalized medicine also presents an avenue for growth, with the potential for custom-designed tissue spacers tailored to individual patient needs and treatment plans.

Dominant Markets & Segments in Tissue Spacer Industry

The global Tissue Spacer Industry is experiencing robust growth across various segments, with North America emerging as the dominant region. This dominance is attributed to factors such as advanced healthcare infrastructure, high healthcare expenditure, and early adoption of innovative medical technologies. The United States, in particular, represents a significant market share within North America, driven by a high prevalence of cancer and orthopedic procedures.

Product Type Dominance:

- Hydrogel Based Spacers: These are currently the leading product type, owing to their excellent biocompatibility, biodegradability, and ability to provide a soft, conformable barrier. Their widespread use in radiotherapy, particularly for prostate cancer, is a major growth driver. Key growth drivers include their non-permanent nature, ease of insertion, and minimal foreign body response.

- Biodegradable Balloon Spacers: While a smaller segment currently, biodegradable balloon spacers are gaining traction due to their superior ability to create a substantial separation between critical structures, especially in complex radiotherapy cases. Their potential for controlled release of therapeutic agents also presents future opportunities.

Application Dominance:

- Radiotherapy: This application segment holds the largest market share and is projected to witness sustained growth. The increasing incidence of cancer, coupled with advancements in radiation therapy techniques aimed at maximizing tumor targeting while minimizing damage to surrounding healthy tissues, fuels demand for sophisticated tissue spacers. The approval of novel rectal spacers for prostate cancer treatment is a significant contributing factor.

- Infection Management: The growing focus on reducing surgical site infections (SSIs) is propelling the demand for tissue spacers designed for infection control, particularly in orthopedic surgeries. The ability of certain spacers to deliver antibiotics or act as a physical barrier against bacterial ingress makes them invaluable in this segment.

End-User Dominance:

- Hospitals: As the primary providers of advanced medical care, hospitals represent the largest end-user segment. The concentration of surgical procedures, cancer treatment centers, and inpatient care within hospitals makes them the biggest consumers of tissue spacers.

- Ambulatory Surgical Centers (ASCs): With the increasing shift towards outpatient procedures, ASCs are also becoming significant end-users, especially for less complex applications of tissue spacers.

The expansion of healthcare infrastructure in emerging economies and supportive government policies aimed at improving patient care are further contributing to the growth of these dominant markets and segments. The continuous innovation in material science and device design is expected to broaden the application base and fuel demand across all segments in the coming years.

Tissue Spacer Industry Product Analysis

Product innovation in the tissue spacer industry is primarily focused on enhancing biocompatibility, biodegradability, and functionality. Hydrogel-based spacers are leading the market due to their excellent soft-tissue mimicking properties and ease of use in radiotherapy for precise organ separation. Biodegradable balloon spacers are gaining traction for their ability to create robust separation in complex anatomical regions, offering advantages in infection management and delicate surgical interventions. Competitive advantages lie in the development of spacers with controlled degradation rates, improved drug delivery capabilities, and minimally invasive insertion techniques. Technological advancements are enabling the creation of custom-fit spacers, tailored to individual patient anatomy and surgical requirements, thereby optimizing treatment outcomes and patient comfort.

Key Drivers, Barriers & Challenges in Tissue Spacer Industry

Key Drivers: The tissue spacer industry is propelled by several key drivers. Technologically, advancements in biomaterials, particularly in hydrogels and biodegradable polymers, are enabling the creation of safer and more effective spacers. Economically, the increasing global healthcare expenditure and the rising incidence of diseases requiring surgical intervention or radiotherapy are significant growth catalysts. Policy-driven factors, such as favorable regulatory pathways for innovative medical devices and government initiatives to improve patient outcomes and reduce healthcare costs associated with complications, also play a crucial role. The growing preference for minimally invasive surgical techniques further boosts the demand for tissue spacers.

Barriers & Challenges: Despite the positive growth trajectory, the tissue spacer industry faces several challenges. Regulatory hurdles, including lengthy approval processes and stringent quality control requirements, can impede market entry for new products. Supply chain disruptions, particularly in specialized biomaterials and manufacturing components, can lead to production delays and increased costs, impacting approximately 10-15% of manufacturers annually. Competitive pressures from established players and the potential for newer, alternative treatment modalities can also constrain market growth. Reimbursement policies for new tissue spacer technologies can be complex and vary significantly across regions, posing a financial challenge for widespread adoption.

Growth Drivers in the Tissue Spacer Industry Market

The tissue spacer industry is experiencing robust growth driven by technological advancements, evolving healthcare economics, and supportive regulatory environments. Innovations in biomaterials science are yielding new spacer compositions with superior biocompatibility and controlled degradation profiles. Economically, the rising global burden of diseases like cancer and orthopedic conditions necessitates advanced treatment modalities, including radiotherapy and complex surgeries, thereby increasing the demand for tissue spacers. Furthermore, government initiatives focused on improving patient safety, reducing healthcare-associated infections, and promoting evidence-based medical practices are creating a favorable market landscape. The increasing trend towards value-based healthcare models also encourages the adoption of technologies that demonstrate improved patient outcomes and cost-effectiveness, such as effective tissue spacers.

Challenges Impacting Tissue Spacer Industry Growth

Despite its promising outlook, the tissue spacer industry grapples with significant challenges. Regulatory complexities, particularly in obtaining approvals across different global markets, represent a major hurdle, potentially delaying product launches by 1-2 years. Supply chain vulnerabilities, including the availability of specialized raw materials and manufacturing capacity, can lead to production bottlenecks and price volatility, impacting around 15% of supply chains. Intense competitive pressures from both established market leaders and emerging startups necessitate continuous innovation and aggressive marketing strategies. Furthermore, the cost-effectiveness and reimbursement landscape for novel tissue spacers can be a significant barrier to widespread adoption, especially in price-sensitive markets.

Key Players Shaping the Tissue Spacer Industry Market

- Biocomposites

- Boston Scientific

- Palette Life Sciences

- Bioprotect Ltd

- Becton Dickinson and Company (CR Bard)

Significant Tissue Spacer Industry Industry Milestones

- November 2023: Biocomposites expanded its product portfolio by introducing SYNICEM hip, knee, and shoulder spacers, which are used for infection management.

- June 2022: The United States FDA approved Palette Life Sciences Barrigel. This first and only hyaluronic acid rectal spacer separates the prostate from the rectum to protect it during radiation therapy treatment for prostate cancer with T1-T3b disease.

Future Outlook for Tissue Spacer Industry Market

The future outlook for the tissue spacer industry is exceptionally bright, fueled by ongoing technological advancements and a growing global demand for improved healthcare solutions. Strategic opportunities lie in the development of smart tissue spacers with integrated sensing and drug-eluting capabilities, further enhancing therapeutic efficacy and patient monitoring. The expansion of these devices into new clinical applications beyond oncology and infection management, such as regenerative medicine and tissue engineering, presents significant market potential. As healthcare systems increasingly prioritize patient outcomes and cost-efficiency, the value proposition of advanced tissue spacers is expected to become even more compelling, driving sustained market growth and innovation.

Tissue Spacer Industry Segmentation

-

1. Product Type

- 1.1. Hydrogel Based Spacers

- 1.2. Biodegradable Balloon Spacers

-

2. Application

- 2.1. Radiotherapy

- 2.2. Infection Management

-

3. End-User

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End-Users

Tissue Spacer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East and Africa

- 5. South America

Tissue Spacer Industry Regional Market Share

Geographic Coverage of Tissue Spacer Industry

Tissue Spacer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cancer; Advantages associated with Tissue Spacer

- 3.3. Market Restrains

- 3.3.1. High Cost and Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. The Radiotherapy Segment to Hold Significant Share in the Global Absorbable Tissue Spacer Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tissue Spacer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hydrogel Based Spacers

- 5.1.2. Biodegradable Balloon Spacers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Radiotherapy

- 5.2.2. Infection Management

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Tissue Spacer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hydrogel Based Spacers

- 6.1.2. Biodegradable Balloon Spacers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Radiotherapy

- 6.2.2. Infection Management

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Hospitals

- 6.3.2. Ambulatory Surgical Centers

- 6.3.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Tissue Spacer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hydrogel Based Spacers

- 7.1.2. Biodegradable Balloon Spacers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Radiotherapy

- 7.2.2. Infection Management

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Hospitals

- 7.3.2. Ambulatory Surgical Centers

- 7.3.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Tissue Spacer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hydrogel Based Spacers

- 8.1.2. Biodegradable Balloon Spacers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Radiotherapy

- 8.2.2. Infection Management

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Hospitals

- 8.3.2. Ambulatory Surgical Centers

- 8.3.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Tissue Spacer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hydrogel Based Spacers

- 9.1.2. Biodegradable Balloon Spacers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Radiotherapy

- 9.2.2. Infection Management

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Hospitals

- 9.3.2. Ambulatory Surgical Centers

- 9.3.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Tissue Spacer Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hydrogel Based Spacers

- 10.1.2. Biodegradable Balloon Spacers

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Radiotherapy

- 10.2.2. Infection Management

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Hospitals

- 10.3.2. Ambulatory Surgical Centers

- 10.3.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Biocomposites

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Boston Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Palette Life Sciences*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bioprotect Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Becton Dickinson and Company (CR Bard)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Biocomposites

List of Figures

- Figure 1: Global Tissue Spacer Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Tissue Spacer Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Tissue Spacer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Tissue Spacer Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Tissue Spacer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Tissue Spacer Industry Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Tissue Spacer Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Tissue Spacer Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Tissue Spacer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Tissue Spacer Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Tissue Spacer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Tissue Spacer Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Tissue Spacer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Tissue Spacer Industry Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Tissue Spacer Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Tissue Spacer Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Tissue Spacer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Tissue Spacer Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Tissue Spacer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Tissue Spacer Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Tissue Spacer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Tissue Spacer Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Tissue Spacer Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Tissue Spacer Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Tissue Spacer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Tissue Spacer Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Tissue Spacer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Tissue Spacer Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Tissue Spacer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Tissue Spacer Industry Revenue (Million), by End-User 2025 & 2033

- Figure 31: Middle East and Africa Tissue Spacer Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East and Africa Tissue Spacer Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Tissue Spacer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Tissue Spacer Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: South America Tissue Spacer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Tissue Spacer Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: South America Tissue Spacer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Tissue Spacer Industry Revenue (Million), by End-User 2025 & 2033

- Figure 39: South America Tissue Spacer Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Tissue Spacer Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Tissue Spacer Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tissue Spacer Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Tissue Spacer Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Tissue Spacer Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Tissue Spacer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Tissue Spacer Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Tissue Spacer Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Tissue Spacer Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Tissue Spacer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Tissue Spacer Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Tissue Spacer Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Tissue Spacer Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Tissue Spacer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Tissue Spacer Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Tissue Spacer Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Tissue Spacer Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 25: Global Tissue Spacer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Tissue Spacer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Tissue Spacer Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Tissue Spacer Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Tissue Spacer Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 35: Global Tissue Spacer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Tissue Spacer Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Global Tissue Spacer Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Tissue Spacer Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 39: Global Tissue Spacer Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tissue Spacer Industry?

The projected CAGR is approximately 16.79%.

2. Which companies are prominent players in the Tissue Spacer Industry?

Key companies in the market include Biocomposites, Boston Scientific, Palette Life Sciences*List Not Exhaustive, Bioprotect Ltd, Becton Dickinson and Company (CR Bard).

3. What are the main segments of the Tissue Spacer Industry?

The market segments include Product Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 254.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cancer; Advantages associated with Tissue Spacer.

6. What are the notable trends driving market growth?

The Radiotherapy Segment to Hold Significant Share in the Global Absorbable Tissue Spacer Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost and Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

November 2023: Biocomposites expanded its product portfolio by introducing SYNICEM hip, knee, and shoulder spacers, which are used for infection management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tissue Spacer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tissue Spacer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tissue Spacer Industry?

To stay informed about further developments, trends, and reports in the Tissue Spacer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence