Key Insights

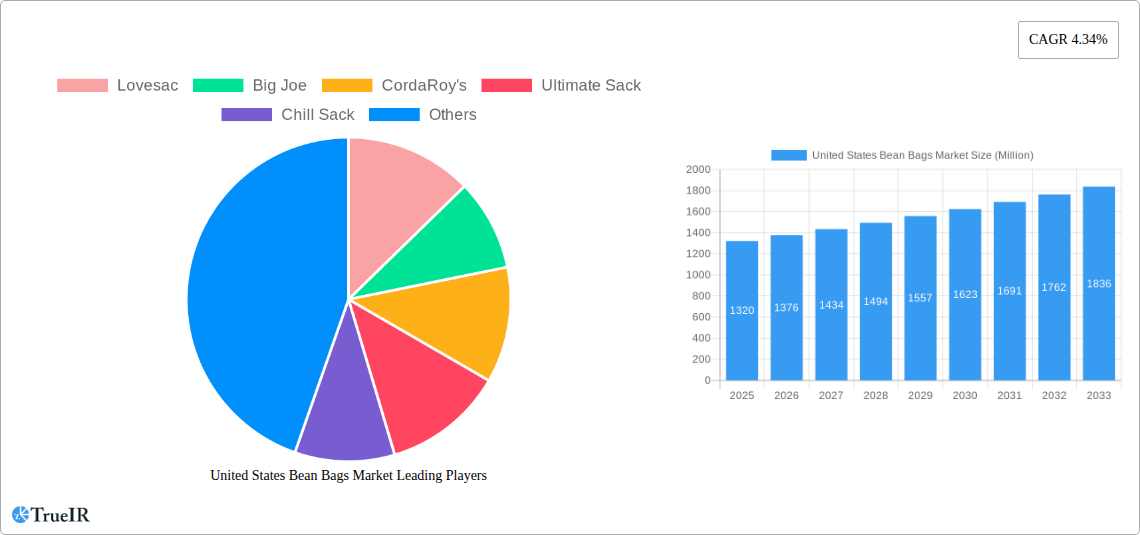

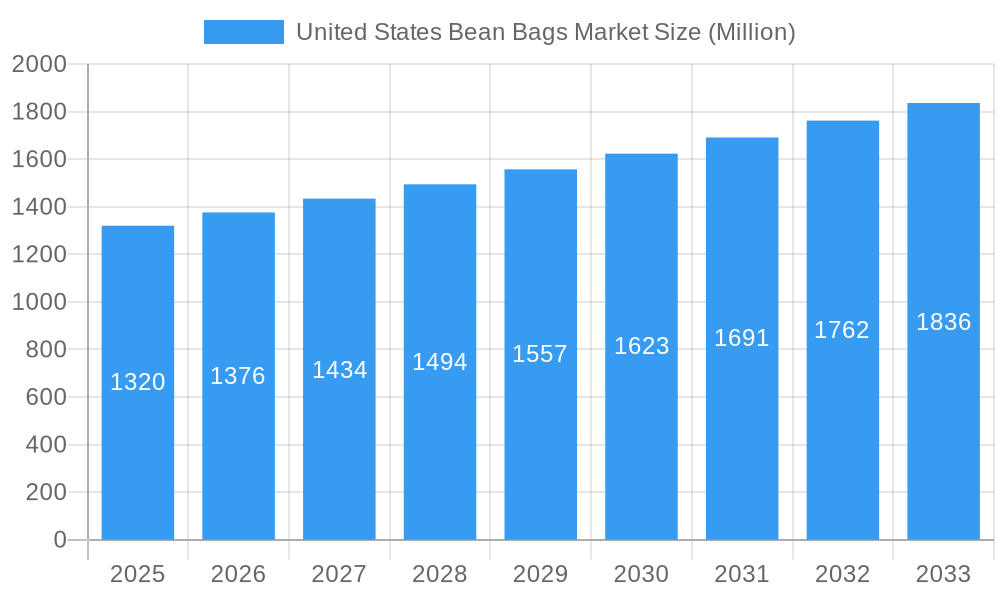

The United States bean bag market, valued at $1.32 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.34% from 2025 to 2033. This growth is fueled by several key drivers. The increasing popularity of comfortable and versatile furniture for both residential and commercial spaces is a significant factor. Consumers are increasingly seeking relaxed and informal seating options that cater to diverse lifestyles and preferences, favoring bean bags for their adaptability and affordability compared to traditional seating. Furthermore, the rise of e-commerce has significantly broadened market accessibility, allowing for a wider reach and increased sales. Innovative designs incorporating modern aesthetics, enhanced durability, and functional features like built-in cup holders or storage compartments also contribute to market expansion. However, the market faces certain restraints, including potential concerns about durability and longevity compared to traditional furniture. Competition from established furniture brands offering similar comfort options also plays a role. Segmentation within the market reveals diverse options categorized by size, material (microsuede, faux leather, cotton), filling (polystyrene beads, memory foam), and style (classic, modern, gaming). Leading brands like Lovesac, Big Joe, and Chill Sack are key players shaping the market through product innovation and marketing strategies.

United States Bean Bags Market Market Size (In Billion)

The forecast for the US bean bag market indicates continued expansion, driven by evolving consumer preferences and technological advancements. The introduction of eco-friendly materials and sustainable manufacturing processes is anticipated to garner significant attention and drive market growth in the coming years. Strategic partnerships between brands and interior designers to showcase bean bags in upscale settings will further enhance market perception and penetration. Targeted marketing campaigns highlighting the versatility and comfort of bean bags for various applications, from home theaters to student dorm rooms, will be instrumental in sustaining the current growth trajectory. While competition remains a factor, the market's adaptable nature and consistent innovation ensure its continued relevance in the evolving furniture landscape.

United States Bean Bags Market Company Market Share

United States Bean Bags Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the United States bean bag market, offering invaluable insights for industry professionals, investors, and market strategists. Leveraging extensive market research and analysis covering the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils crucial trends, opportunities, and challenges shaping this vibrant sector. The report's comprehensive analysis includes detailed segmentation, competitive landscapes, and future growth projections, offering a 360° view of the US bean bag market.

United States Bean Bags Market Market Structure & Competitive Landscape

The US bean bag market exhibits a moderately fragmented structure, with several key players vying for market share. The market concentration ratio (CR4) is estimated at xx%, indicating a competitive landscape with no single dominant entity. Innovation plays a significant role, with companies continually introducing new designs, materials, and functionalities to cater to evolving consumer preferences. Regulatory impacts, primarily concerning product safety and material standards, are relatively low, posing minimal immediate challenges. Substitute products, such as traditional seating options (sofas, armchairs), compete for market share; however, the unique comfort and versatility of bean bags maintain their appeal.

End-user segmentation primarily focuses on residential consumers, with a growing segment targeting commercial applications like waiting rooms, gaming lounges, and student dormitories. Mergers and acquisitions (M&A) activity has been moderate in the historical period (2019-2024), with approximately xx M&A deals recorded. However, future consolidation is anticipated as larger players seek to expand their market reach and product portfolios. Further analysis reveals a positive correlation between increased disposable income and bean bag sales, indicating a potential for growth driven by improving economic conditions. The market displays robust growth potential driven by increasing consumer preference for comfortable and versatile furniture.

United States Bean Bags Market Market Trends & Opportunities

The US bean bag market is experiencing robust growth, with an estimated market size of $xx Million in 2025. This growth trajectory is projected to continue, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of $xx Million by 2033. This growth is propelled by several key factors, including:

- Shifting Consumer Preferences: Consumers increasingly prioritize comfort, relaxation, and flexible furniture solutions, all of which bean bags excel at providing.

- Technological Advancements: Innovation in materials, such as improved filling materials and durable fabrics, has enhanced bean bag quality and longevity.

- Growing E-commerce Adoption: The rise of online retail has facilitated easy access to a wider variety of bean bag styles and brands, bolstering market penetration.

- Increased Disposable Income: Growing disposable income levels, especially among younger demographics, contribute to increased spending on home furnishings.

- Competitive Dynamics: Existing players are continuously launching innovative products and expanding their distribution networks, driving market competition and consumer choice.

Market penetration rate for bean bags in the US household furniture market remains relatively low, indicating significant untapped potential for future growth.

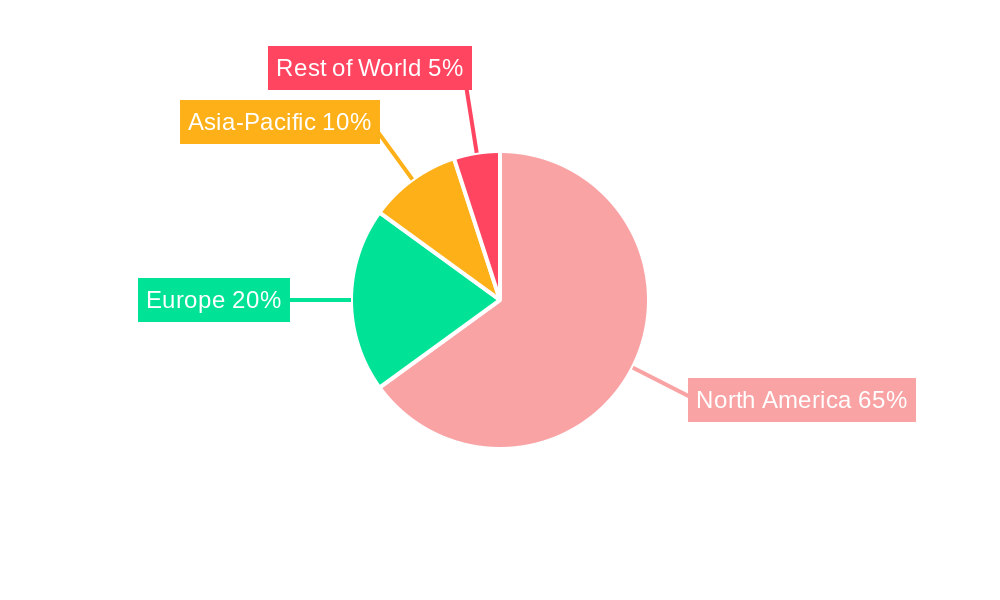

Dominant Markets & Segments in United States Bean Bags Market

While data on specific regional dominance is limited, preliminary analysis suggests that the Western and Southern regions of the United States demonstrate higher-than-average market penetration rates for bean bags, potentially due to factors such as climate and lifestyle preferences.

- Key Growth Drivers (Western and Southern Regions):

- Higher adoption rates in casual living styles.

- Preference for outdoor furniture suitable for patios and gardens.

- Stronger online retail presence compared to other regions.

Further, the market is segmented by product type (size, material, shape), price point, and distribution channels. Analysis indicates that the segment with the highest growth potential is the premium-priced bean bags (>$xx Million) which are characterized by high-quality materials and modern designs. The increasing focus on aesthetic appeal and customization are key contributing factors to the market's strong growth.

United States Bean Bags Market Product Analysis

Bean bag innovations focus on enhancing comfort, durability, and aesthetics. Technological advancements include the use of high-density foam fillings, water-resistant fabrics, and modular designs allowing for customization. These improvements cater to varied consumer needs, ranging from simple relaxation to multi-functional use as seating, beds, or even pet beds. Competitive advantages are derived from unique designs, superior materials, and effective branding strategies. The overall product landscape displays a shift towards more stylish and versatile bean bags that integrate seamlessly into modern home decor.

Key Drivers, Barriers & Challenges in United States Bean Bags Market

Key Drivers: The market is primarily driven by increasing consumer demand for comfortable and versatile seating, expanding e-commerce channels, and growing disposable incomes. Technological innovation in materials and designs also contributes to market growth.

Challenges: Supply chain disruptions, particularly regarding raw material sourcing, can impact production costs and availability. Moreover, increasing competition and the need for effective marketing strategies to differentiate products pose challenges to smaller players.

Growth Drivers in the United States Bean Bags Market Market

Technological advancements, particularly in materials and manufacturing processes, play a crucial role in driving market growth. The shift towards sustainable and eco-friendly materials also attracts environmentally conscious consumers. Economic factors, including rising disposable incomes and a preference for affordable yet comfortable furniture, further propel market expansion. Favourable government policies and regulations regarding product safety and standards contribute to a stable and supportive market environment.

Challenges Impacting United States Bean Bags Market Growth

Significant challenges include fluctuations in raw material costs impacting profitability and supply chain disruptions leading to production delays. Intense competition among established and emerging players requires continuous innovation and effective marketing to maintain market share. Finally, changing consumer preferences and the emergence of substitute products pose ongoing challenges.

Key Players Shaping the United States Bean Bags Market Market

- Lovesac

- Big Joe

- CordaRoy's

- Ultimate Sack

- Chill Sack

- Flash Furniture

- Jaxx Bean Bags

- Sumo Lounge

- Fatboy

- Comfy Sacks

Significant United States Bean Bags Market Industry Milestones

- August 2023: Lovesac launched its new Angled Sides Sactionals, enhancing design and comfort.

- September 2023: Big Joe Forklifts collaborated with Thoro.ai to advance AMR features and workforce capabilities.

- February 2024: Lovesac partnered with KidSuper for a multi-season collaboration, integrating street style into its bean bag designs.

Future Outlook for United States Bean Bags Market Market

The US bean bag market is poised for continued growth, driven by ongoing product innovation, expanding e-commerce reach, and evolving consumer preferences. Strategic opportunities lie in developing sustainable and customizable bean bags, expanding into new market segments (e.g., commercial applications), and leveraging digital marketing strategies to reach wider consumer bases. The market's future outlook remains positive, with significant potential for expansion and increased market penetration.

United States Bean Bags Market Segmentation

-

1. Product Type

- 1.1. Indoor

- 1.2. Outdoor

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Size

- 3.1. Small

- 3.2. Medium

- 3.3. Large

-

4. Distribution Channel

- 4.1. Offline

- 4.2. Online

United States Bean Bags Market Segmentation By Geography

- 1. United States

United States Bean Bags Market Regional Market Share

Geographic Coverage of United States Bean Bags Market

United States Bean Bags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Comfort and Versatility in Furniture; Growing Trend of Creating Flexible and Multifunctional Living Spaces

- 3.3. Market Restrains

- 3.3.1. Increasing Focus on Comfort and Versatility in Furniture; Growing Trend of Creating Flexible and Multifunctional Living Spaces

- 3.4. Market Trends

- 3.4.1. Rising Demand for Outdoor Furniture Market is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Bean Bags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Size

- 5.3.1. Small

- 5.3.2. Medium

- 5.3.3. Large

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Offline

- 5.4.2. Online

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lovesac

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Big Joe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CordaRoy's

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ultimate Sack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chill Sack

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flash Furniture

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jaxx Bean Bags

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumo Lounge

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fatboy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Comfy Sacks

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Lovesac

List of Figures

- Figure 1: United States Bean Bags Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Bean Bags Market Share (%) by Company 2025

List of Tables

- Table 1: United States Bean Bags Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Bean Bags Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Bean Bags Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States Bean Bags Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: United States Bean Bags Market Revenue Million Forecast, by Size 2020 & 2033

- Table 6: United States Bean Bags Market Volume Billion Forecast, by Size 2020 & 2033

- Table 7: United States Bean Bags Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States Bean Bags Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: United States Bean Bags Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: United States Bean Bags Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: United States Bean Bags Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: United States Bean Bags Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: United States Bean Bags Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: United States Bean Bags Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: United States Bean Bags Market Revenue Million Forecast, by Size 2020 & 2033

- Table 16: United States Bean Bags Market Volume Billion Forecast, by Size 2020 & 2033

- Table 17: United States Bean Bags Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: United States Bean Bags Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: United States Bean Bags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United States Bean Bags Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Bean Bags Market?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the United States Bean Bags Market?

Key companies in the market include Lovesac, Big Joe, CordaRoy's, Ultimate Sack, Chill Sack, Flash Furniture, Jaxx Bean Bags, Sumo Lounge, Fatboy, Comfy Sacks.

3. What are the main segments of the United States Bean Bags Market?

The market segments include Product Type, Application, Size, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Comfort and Versatility in Furniture; Growing Trend of Creating Flexible and Multifunctional Living Spaces.

6. What are the notable trends driving market growth?

Rising Demand for Outdoor Furniture Market is Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Focus on Comfort and Versatility in Furniture; Growing Trend of Creating Flexible and Multifunctional Living Spaces.

8. Can you provide examples of recent developments in the market?

February 2024: Lovesac and KidSuper unveiled a multi-season collaboration, fusing vibrant street style with luxury home furnishings. Lovesac, renowned for its signature Sacs, considered 'The World's Most Comfortable Seat,' revealed its Fall-Winter 2024 partnership with KidSuper, a fashion label synonymous with avant-garde street style.September 2023: In collaboration with Thoro.ai, Big Joe Forklifts intensified the development of advanced features for their leading AMR. They also bolstered their workforce, focusing on delivering seamless automation solutions to their clientele.August 2023: The Lovesac Company, renowned for its innovative Sactionals, introduced a new addition to its lineup. Dubbed Angled Sides, this modern design boasts sharp edges and an angular silhouette. It blends style with flexibility and total comfort, offering customers a complete home experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Bean Bags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Bean Bags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Bean Bags Market?

To stay informed about further developments, trends, and reports in the United States Bean Bags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence