Key Insights

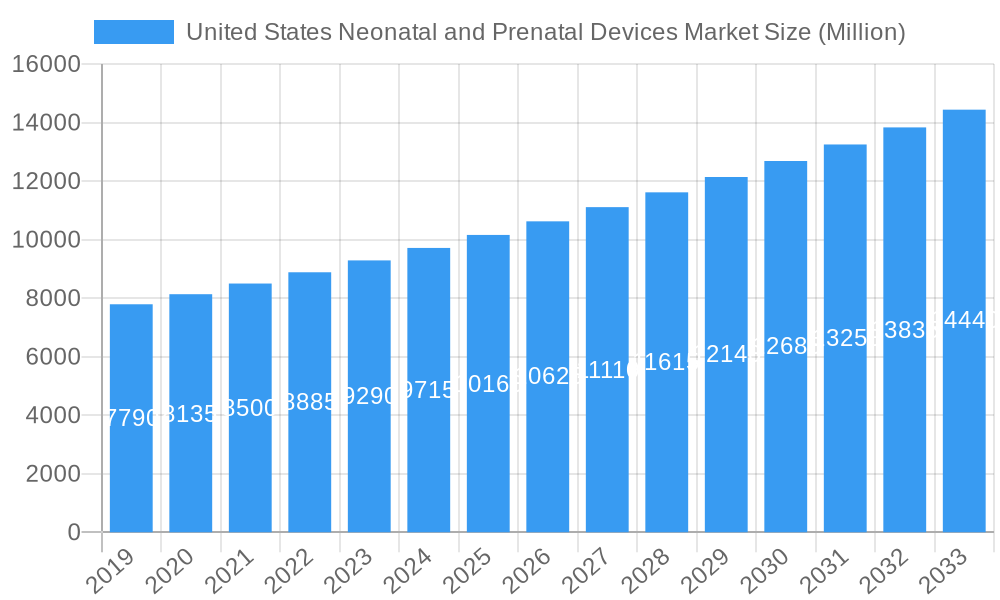

The United States Neonatal and Prenatal Devices Market is projected for substantial growth, driven by technological advancements and an increased focus on maternal and infant well-being. Anticipated to reach approximately $4.8 billion by 2020, the market is forecast to expand at a Compound Annual Growth Rate (CAGR) of 6.1% through 2033. This expansion is supported by growing awareness of early detection and monitoring for prenatal and neonatal complications. Key growth factors include the rising incidence of preterm births and congenital anomalies, leading to higher demand for advanced diagnostic and therapeutic equipment. Innovations such as sophisticated fetal imaging, non-invasive monitoring systems, and improved neonatal life support devices are enhancing market dynamism. Increased adoption of these technologies, favorable reimbursement policies, and government initiatives to reduce infant mortality further bolster this positive market trend.

United States Neonatal and Prenatal Devices Market Market Size (In Billion)

Market segmentation highlights significant demand across both prenatal and neonatal equipment categories. Within Prenatal and Fetal Equipment, Ultrasound and Ultrasonography Devices are expected to lead due to their critical role in routine prenatal care and anomaly detection. The Neonatal Equipment segment is equally robust, with Incubators and Respiratory Assistance and Monitoring Devices predicted to experience substantial growth, driven by improved survival rates of extremely premature infants and the need for specialized care. Potential restraints, such as the high cost of advanced devices and the requirement for skilled operators, may present challenges. However, continuous research and development investments by leading companies, coupled with strategic collaborations, are expected to mitigate these hurdles and sustain the market's upward trajectory, fostering ongoing innovation and improved patient outcomes.

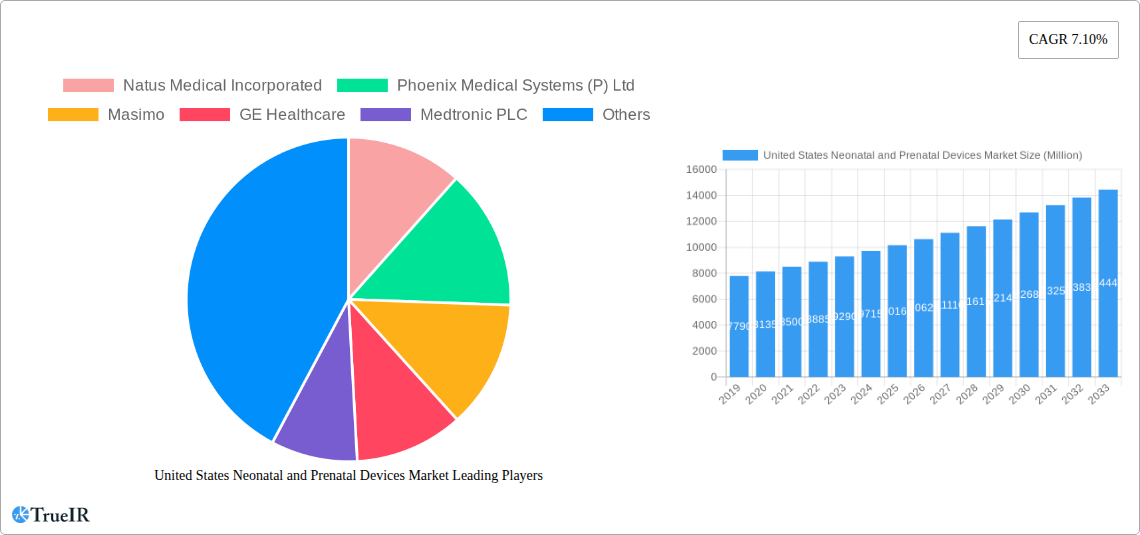

United States Neonatal and Prenatal Devices Market Company Market Share

This comprehensive report provides a definitive analysis of the United States Neonatal and Prenatal Devices Market, a vital sector for maternal and infant health. Covering the period from 2019 to 2033, with a base year of 2020 and a forecast period from 2020–2033, this research meticulously examines market dynamics, technological progress, and emerging opportunities. We delve into key segments, competitive strategies, and the influential role of industry developments in shaping the future of neonatal and prenatal care. This report is essential for stakeholders seeking to understand market penetration rates, CAGR projections, and strategic insights within this rapidly evolving landscape.

United States Neonatal and Prenatal Devices Market Market Structure & Competitive Landscape

The United States Neonatal and Prenatal Devices Market exhibits a moderately concentrated structure, with a few major players dominating a significant market share, estimated to be around 60% by key leaders in 2024. Innovation remains a primary driver, fueled by continuous research and development in areas like advanced imaging, real-time monitoring, and minimally invasive technologies. Regulatory impacts, particularly from the FDA, are substantial, influencing product approvals and market access. Product substitutes exist, such as traditional monitoring methods, but advanced digital and AI-driven solutions are increasingly preferred for their superior accuracy and insights. End-user segmentation reveals a strong reliance on hospitals, specialized neonatal intensive care units (NICUs), and birthing centers, which account for over 85% of device adoption. Mergers and acquisitions (M&A) trends are noticeable, with recent activity indicating a strategic push for market consolidation and portfolio expansion. For instance, there were approximately 5 significant M&A deals in the past two years, aimed at enhancing technological capabilities and expanding geographic reach.

United States Neonatal and Prenatal Devices Market Market Trends & Opportunities

The United States Neonatal and Prenatal Devices Market is poised for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and an increasing emphasis on improved maternal and infant health outcomes. The market size, projected to reach $12,500 Million by 2025, is expected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is underpinned by a rising incidence of premature births and complex pregnancies, necessitating sophisticated diagnostic and therapeutic equipment. Technological shifts are a significant catalyst, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) into diagnostic imaging and monitoring devices offering enhanced precision and predictive capabilities. The adoption of portable and wireless devices is also gaining traction, allowing for greater flexibility in care delivery and improved patient comfort.

Consumer preferences are increasingly leaning towards non-invasive and minimally disruptive technologies that provide real-time data and facilitate early intervention. This trend directly benefits the demand for advanced fetal heart monitors, neonatal monitoring devices, and sophisticated respiratory assistance systems. The competitive dynamics within the market are characterized by intense innovation and strategic collaborations aimed at capturing market share and addressing unmet clinical needs. Companies are investing heavily in R&D to develop next-generation devices that offer superior performance, enhanced safety, and cost-effectiveness.

The increasing awareness surrounding the importance of early neonatal care and the management of high-risk pregnancies is further bolstering market penetration rates. Government initiatives and healthcare policies that promote access to advanced medical technologies for maternal and child health also play a crucial role. Opportunities abound in the development of integrated care platforms that connect prenatal and neonatal devices, enabling seamless data sharing and comprehensive patient management. Furthermore, the growing demand for home-based neonatal monitoring solutions presents a significant avenue for market expansion. The sustained focus on improving neonatal survival rates and reducing infant mortality is a powerful underlying force propelling the market forward, creating a fertile ground for innovation and investment in the United States Neonatal and Prenatal Devices Market.

Dominant Markets & Segments in United States Neonatal and Prenatal Devices Market

The United States Neonatal and Prenatal Devices Market demonstrates dominance within key segments, primarily driven by the critical need for early detection, monitoring, and intervention in both prenatal and neonatal care.

Prenatal and Fetal Equipment: This segment holds a substantial market share, with Ultrasound and Ultrasonography Devices leading the pack. The widespread adoption of ultrasound technology for routine prenatal screenings, diagnostic assessments, and fetal anomaly detection is a primary growth driver. These devices are instrumental in providing vital insights into fetal development, placental health, and amniotic fluid levels.

- Ultrasound and Ultrasonography Devices: Continual advancements in 3D and 4D imaging, coupled with the increasing portability of ultrasound machines, are expanding their application across diverse healthcare settings, including remote and underserved areas.

- Fetal Heart Monitors: Essential for assessing fetal well-being during pregnancy and labor, these devices are experiencing sustained demand due to their role in reducing perinatal complications.

- Fetal Doppler: Offering a cost-effective and non-invasive method for listening to fetal heartbeats, fetal dopplers are widely used by healthcare providers and even for home monitoring.

- Fetal Magnetic Resonance Imaging (MRI): While a more specialized and expensive modality, fetal MRI is crucial for detailed anatomical assessment and diagnosis of complex fetal abnormalities, contributing to its growing importance.

- Fetal Pulse Oximeters: Used to monitor oxygen saturation levels in the fetus during labor, these devices are vital for identifying potential fetal distress and guiding timely interventions.

- Other Prenatal and Fetal Equipment: This category includes devices like fetal electrocardio-graphy (ECG) monitors and non-stress test (NST) equipment, which supplement routine monitoring.

Neonatal Equipment: The neonatal segment is equally crucial, driven by the increasing number of premature births and infants requiring intensive care.

- Incubators: These controlled environments are fundamental for maintaining the physiological stability of premature and ill newborns, with modern incubators offering advanced features for temperature, humidity, and oxygen control.

- Neonatal Monitoring Devices: This broad category encompasses a range of devices that continuously track vital signs such as heart rate, respiratory rate, blood pressure, and oxygen saturation. The demand for sophisticated, multi-parameter monitoring systems is on the rise.

- Phototherapy Equipment: Essential for treating neonatal jaundice, phototherapy devices are a staple in neonatal care units. Innovations focus on increasing treatment efficiency and patient comfort.

- Respiratory Assistance and Monitoring Devices: This segment includes ventilators, CPAP machines, and oxygen delivery systems, all critical for supporting the immature respiratory systems of newborns. The development of non-invasive ventilation techniques is a key trend.

- Other Neonatal Care Equipment: This includes devices like feeding tubes, suction devices, and specialized beds designed for neonates.

The dominance of these segments is reinforced by robust healthcare infrastructure, government policies supporting maternal and child health, and ongoing technological innovation that enhances diagnostic accuracy and therapeutic efficacy, ultimately leading to improved neonatal survival rates and better prenatal outcomes.

United States Neonatal and Prenatal Devices Market Product Analysis

The United States Neonatal and Prenatal Devices Market is characterized by continuous product innovation focused on enhancing diagnostic accuracy, improving patient outcomes, and increasing user-friendliness. Advanced ultrasound systems now offer higher resolution and real-time 3D/4D imaging for detailed fetal assessment. In neonatal care, incubators feature advanced climate control and integrated monitoring, while respiratory devices are becoming smaller, quieter, and more energy-efficient. The integration of AI and connectivity is a significant trend, enabling predictive analytics for fetal distress and remote patient monitoring for neonates. These innovations provide competitive advantages by offering superior clinical insights, reducing the risk of complications, and optimizing resource utilization in healthcare facilities.

Key Drivers, Barriers & Challenges in United States Neonatal and Prenatal Devices Market

Key Drivers:

- Technological Advancements: Continuous innovation in imaging, monitoring, and respiratory support technologies drives market growth. For example, the development of AI-powered diagnostic tools enhances early detection of abnormalities.

- Rising Incidence of Premature Births and High-Risk Pregnancies: An increasing number of complex pregnancies and premature births necessitate advanced neonatal and prenatal equipment.

- Growing Awareness of Maternal and Infant Health: Heightened awareness among the public and healthcare professionals about the importance of early intervention and comprehensive care fuels demand.

- Government Initiatives and Healthcare Policies: Favorable policies and increased healthcare spending aimed at improving maternal and child health outcomes significantly boost market adoption.

Key Barriers and Challenges:

- High Cost of Advanced Devices: The substantial initial investment required for cutting-edge neonatal and prenatal equipment can be a barrier for smaller healthcare facilities.

- Stringent Regulatory Approvals: The rigorous FDA approval process for medical devices can lead to extended development timelines and increased costs.

- Reimbursement Policies: Complex and evolving reimbursement policies for advanced medical technologies can impact market accessibility and adoption rates.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as witnessed in recent years, can affect the availability and pricing of critical components and finished devices.

- Skilled Workforce Shortage: A lack of adequately trained personnel to operate and maintain advanced neonatal and prenatal devices can pose a challenge to widespread implementation.

Growth Drivers in the United States Neonatal and Prenatal Devices Market Market

The United States Neonatal and Prenatal Devices Market is propelled by several key growth drivers. Technologically, the relentless pursuit of higher resolution imaging, real-time physiological monitoring, and AI-driven diagnostics significantly expands device capabilities and clinical utility. Economic factors, such as increasing healthcare expenditure and favorable insurance coverage for maternal and neonatal care, further stimulate market demand. Policy-driven factors, including government initiatives focused on reducing infant mortality rates and improving prenatal screening accessibility, play a crucial role in accelerating market growth. For instance, expanded Medicaid coverage for prenatal services encourages the use of advanced diagnostic tools.

Challenges Impacting United States Neonatal and Prenatal Devices Market Growth

Several challenges are impacting the growth of the United States Neonatal and Prenatal Devices Market. Regulatory complexities, particularly the stringent FDA approval pathways for novel technologies, can significantly prolong time-to-market and increase development costs. Supply chain issues, including component shortages and logistical bottlenecks, pose a constant threat to timely device production and delivery. Competitive pressures from both established players and emerging innovators necessitate continuous investment in R&D to maintain market relevance, which can strain resources for smaller companies. Furthermore, the high capital expenditure required for advanced equipment can limit adoption by smaller hospitals and clinics, particularly in underserved regions, thereby affecting market penetration.

Key Players Shaping the United States Neonatal and Prenatal Devices Market Market

- Natus Medical Incorporated

- Phoenix Medical Systems (P) Ltd

- Masimo

- GE Healthcare

- Medtronic PLC

- Vyaire Medical

- Getinge AB

- Koninklijke Philips NV

Significant United States Neonatal and Prenatal Devices Market Industry Milestones

- September 2022: Philips received FDA 510(k) clearance for the Ultrasound Compact system, enhancing portability and performance for prenatal imaging.

- July 2022: Maternova Inc. partnered with BirthTech Lda, Portugal, for the distribution of its Preemie Test in the United States, Europe, and Asia, a groundbreaking device clinically proven to accurately assess gestational age in newborns.

Future Outlook for United States Neonatal and Prenatal Devices Market Market

The future outlook for the United States Neonatal and Prenatal Devices Market is exceptionally promising, driven by an ongoing surge in technological innovation and a persistent focus on improving maternal and infant health outcomes. The integration of advanced technologies like AI, IoT, and telemedicine will further enhance diagnostic precision, enable remote patient monitoring, and facilitate more personalized care pathways. Strategic opportunities lie in developing cost-effective solutions, expanding access to underserved populations, and fostering collaborations that accelerate the adoption of next-generation devices. The market is poised for sustained growth as healthcare providers increasingly prioritize sophisticated, data-driven tools to ensure the well-being of mothers and newborns.

United States Neonatal and Prenatal Devices Market Segmentation

-

1. Product Type

-

1.1. Prenatal and Fetal Equipment

- 1.1.1. Ultrasound and Ultrasonography Devices

- 1.1.2. Fetal Doppler

- 1.1.3. Fetal Magnetic Resonance Imaging (MRI)

- 1.1.4. Fetal Heart Monitors

- 1.1.5. Fetal Pulse Oximeters

- 1.1.6. Other Prenatal and Fetal Equipment

-

1.2. Neonatal Equipment

- 1.2.1. Incubators

- 1.2.2. Neonatal Monitoring Devices

- 1.2.3. Phototherapy Equipment

- 1.2.4. Respiratory Assistance and Monitoring Devices

- 1.2.5. Other Neonatal Care Equipment

-

1.1. Prenatal and Fetal Equipment

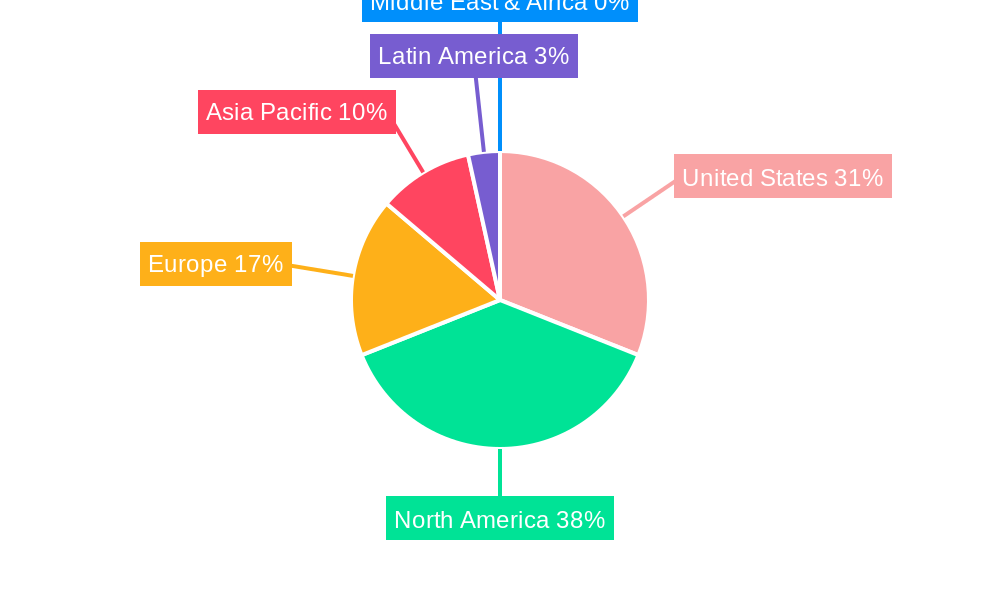

United States Neonatal and Prenatal Devices Market Segmentation By Geography

- 1. United States

United States Neonatal and Prenatal Devices Market Regional Market Share

Geographic Coverage of United States Neonatal and Prenatal Devices Market

United States Neonatal and Prenatal Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Preterm Births in the United States; Increasing Awareness for Prenatal and Neonatal Care; Government Initiatives to Provide Better Care for Prenatal and Neonatal Infants

- 3.3. Market Restrains

- 3.3.1. Risk of Nosocomial Infection from the Devices; Low Birth Rates

- 3.4. Market Trends

- 3.4.1. Neonatal Monitoring Devices are Expected to Witness Strong Growth Over the Forecast Period in Product Type Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Neonatal and Prenatal Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Prenatal and Fetal Equipment

- 5.1.1.1. Ultrasound and Ultrasonography Devices

- 5.1.1.2. Fetal Doppler

- 5.1.1.3. Fetal Magnetic Resonance Imaging (MRI)

- 5.1.1.4. Fetal Heart Monitors

- 5.1.1.5. Fetal Pulse Oximeters

- 5.1.1.6. Other Prenatal and Fetal Equipment

- 5.1.2. Neonatal Equipment

- 5.1.2.1. Incubators

- 5.1.2.2. Neonatal Monitoring Devices

- 5.1.2.3. Phototherapy Equipment

- 5.1.2.4. Respiratory Assistance and Monitoring Devices

- 5.1.2.5. Other Neonatal Care Equipment

- 5.1.1. Prenatal and Fetal Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Natus Medical Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Phoenix Medical Systems (P) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Masimo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GE Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vyaire Medical

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Getinge AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Koninklijke Philips NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Natus Medical Incorporated

List of Figures

- Figure 1: United States Neonatal and Prenatal Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Neonatal and Prenatal Devices Market Share (%) by Company 2025

List of Tables

- Table 1: United States Neonatal and Prenatal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: United States Neonatal and Prenatal Devices Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: United States Neonatal and Prenatal Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Neonatal and Prenatal Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: United States Neonatal and Prenatal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: United States Neonatal and Prenatal Devices Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 7: United States Neonatal and Prenatal Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: United States Neonatal and Prenatal Devices Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Neonatal and Prenatal Devices Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the United States Neonatal and Prenatal Devices Market?

Key companies in the market include Natus Medical Incorporated, Phoenix Medical Systems (P) Ltd, Masimo, GE Healthcare, Medtronic PLC, Vyaire Medical, Getinge AB, Koninklijke Philips NV.

3. What are the main segments of the United States Neonatal and Prenatal Devices Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Preterm Births in the United States; Increasing Awareness for Prenatal and Neonatal Care; Government Initiatives to Provide Better Care for Prenatal and Neonatal Infants.

6. What are the notable trends driving market growth?

Neonatal Monitoring Devices are Expected to Witness Strong Growth Over the Forecast Period in Product Type Segment.

7. Are there any restraints impacting market growth?

Risk of Nosocomial Infection from the Devices; Low Birth Rates.

8. Can you provide examples of recent developments in the market?

September 2022: Philips received FDA 510(k) clearance for the Ultrasound Compact system to optimize portability and performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Neonatal and Prenatal Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Neonatal and Prenatal Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Neonatal and Prenatal Devices Market?

To stay informed about further developments, trends, and reports in the United States Neonatal and Prenatal Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence