Key Insights

The global Ureteral Stents Market is projected to reach $624.35 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 6.36% through 2033. Key growth drivers include the rising incidence of kidney stones, increasing prevalence of urinary tract infections, and growing demand for minimally invasive urological procedures. Innovations in stent materials and design, enhancing patient comfort and reducing complications, further propel market expansion. The market is segmented by product type, including open-ended, close-ended, double pigtail, and multiloop stents, addressing diverse clinical requirements. Primary applications are kidney stones and urinary tract infections, with kidney transplants and other urological interventions contributing to market diversification. Major market participants like Cook Medical, Teleflex Inc., Becton Dickinson and Company (C R Bard), B Braun, and Boston Scientific are actively pursuing innovation and strategic partnerships.

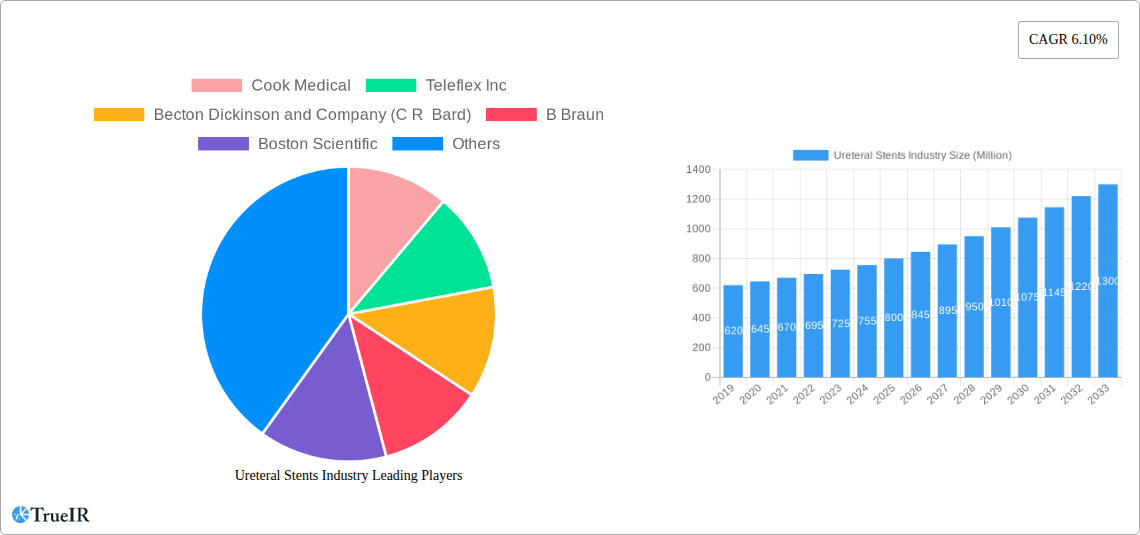

Ureteral Stents Industry Market Size (In Million)

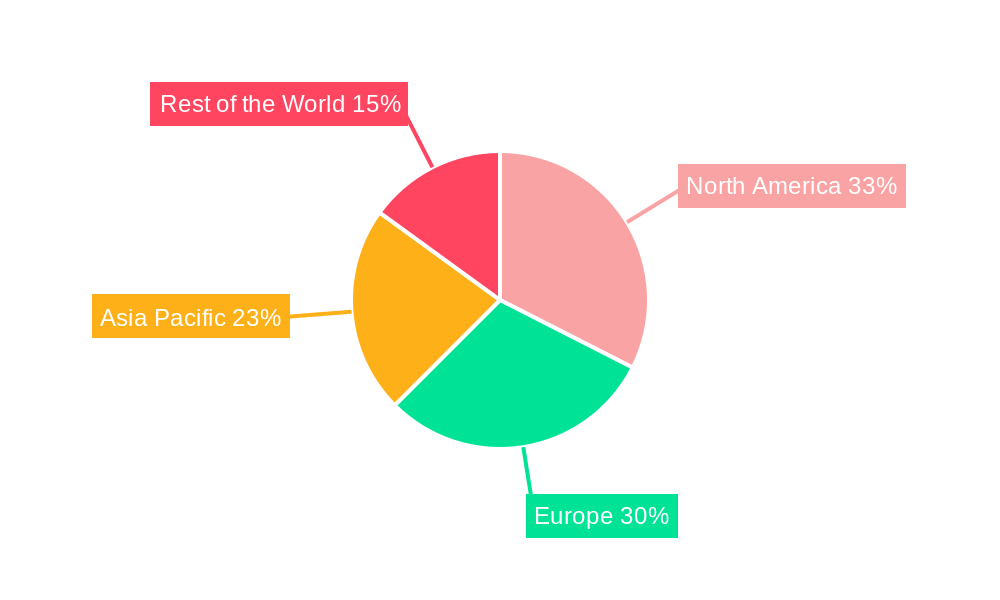

North America and Europe currently lead the ureteral stent market, supported by advanced healthcare infrastructure, high patient awareness, and favorable reimbursement policies. The Asia Pacific region is expected to exhibit the most rapid growth, driven by increasing adoption of advanced medical technologies, an aging population, and a developing urology sector. Emerging markets in the Rest of the World also offer significant opportunities as healthcare access and awareness improve. Market growth is tempered by potential complications such as stent migration, encrustation, and infection, alongside the cost of advanced stent technologies. However, continuous research and development focused on mitigating these challenges, coupled with a global emphasis on urinary tract health, are expected to sustain the positive market trajectory.

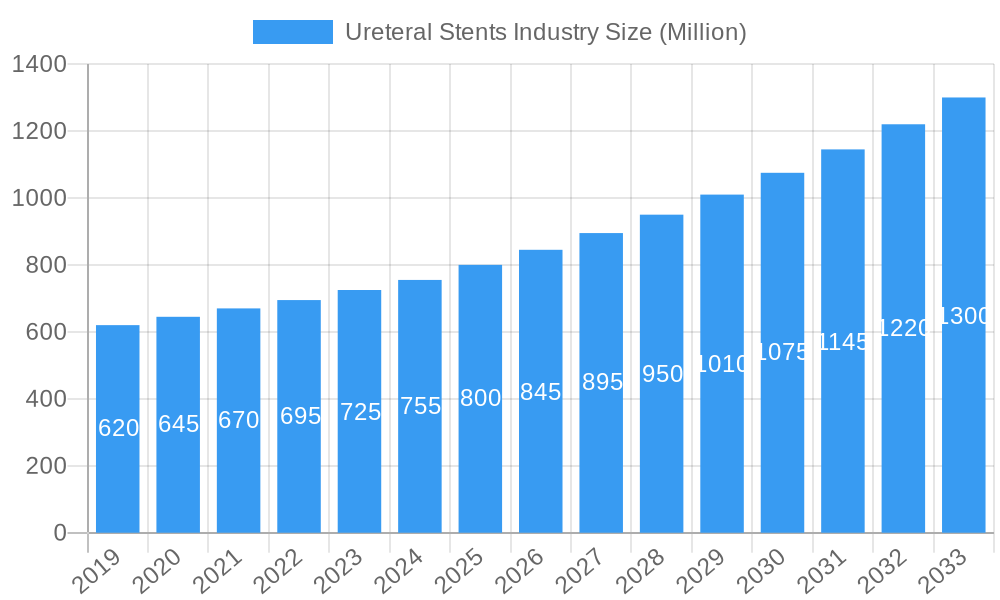

Ureteral Stents Industry Company Market Share

Ureteral Stents Industry Market Structure & Competitive Landscape

The ureteral stents market is characterized by a moderately concentrated structure, with key players such as Cook Medical, Teleflex Inc, Becton Dickinson and Company (C R Bard), B Braun, and Boston Scientific holding significant market shares. Innovation remains a primary driver, focusing on developing biocompatible materials, advanced coatings to reduce encrustation and infection, and minimally invasive delivery systems. Regulatory frameworks, particularly stringent approvals from agencies like the FDA and EMA, significantly influence market entry and product development timelines. The threat of product substitutes, such as percutaneous nephrostomy tubes or alternative treatment modalities for certain conditions, is present but generally mitigated by the established efficacy and convenience of ureteral stents. End-user segmentation includes urologists, nephrologists, and interventional radiologists, with preferences leaning towards stents offering improved patient comfort, reduced complication rates, and ease of removal. Mergers and acquisitions (M&A) activity, while not historically rampant, contributes to market consolidation. For instance, the acquisition of Uromed by Boston Scientific in 20XX underscored a strategic move to expand product portfolios and market reach. The estimated volume of M&A deals in the past five years is approximately 5 to 10, each valued between $50 million and $200 million, reflecting strategic acquisitions rather than widespread consolidation. The concentration ratio among the top five players is estimated to be around 65-70%.

Ureteral Stents Industry Market Trends & Opportunities

The global ureteral stents market is poised for substantial expansion, driven by an increasing prevalence of urological conditions and advancements in medical technology. The market size, estimated at $750 million in the base year of 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033, reaching an estimated value of $1.2 billion by 2033. This robust growth is fueled by several interconnected trends. The rising incidence of kidney stones, a primary application for ureteral stents, is a significant market accelerant. Factors such as changing dietary habits, sedentary lifestyles, and improved diagnostic capabilities contribute to this upward trend. Furthermore, the increasing number of kidney transplant surgeries necessitates the use of ureteral stents to ensure patency and prevent ureteral complications, thereby expanding the application base.

Technological shifts are profoundly reshaping the ureteral stent landscape. Manufacturers are actively investing in research and development to create innovative stent designs and materials. This includes the development of bio-absorbable stents that eliminate the need for a second procedure for removal, advanced coatings that minimize encrustation, biofilm formation, and patient discomfort, and improved stent delivery systems for enhanced procedural efficiency and patient safety. The recognition of Boston Scientific's Tria Ureteral Stent with a Bronze Edison Award for its proprietary surface technology highlights this focus on innovation designed to prevent salt deposit accumulation. Moreover, the 510k clearance granted by the FDA for a novel urinary stent by University Hospitals signifies ongoing innovation in stent design and functionality.

Consumer preferences are evolving towards less invasive procedures and improved patient outcomes. Patients and healthcare providers are increasingly seeking ureteral stents that offer better biocompatibility, reduced pain and discomfort, and lower rates of complications such as urinary tract infections (UTIs) and stent migration. This demand for improved patient experience is driving the development of softer, more flexible stent materials and designs.

The competitive dynamics within the ureteral stents industry are characterized by a blend of established market leaders and emerging players. Companies are competing on product innovation, clinical efficacy, regulatory approvals, and strategic partnerships. Market penetration rates for ureteral stents in developed economies are already high due to established healthcare infrastructure and awareness. However, significant opportunities for growth exist in emerging economies where access to advanced urological care is expanding. The development of cost-effective yet high-quality ureteral stents is crucial for capturing market share in these regions. Opportunities also lie in exploring new applications beyond traditional uses, such as in minimally invasive surgical procedures beyond basic urology.

Dominant Markets & Segments in Ureteral Stents Industry

The ureteral stents industry exhibits distinct regional and segment dominance, driven by a confluence of healthcare infrastructure, disease prevalence, and technological adoption. Geographically, North America, particularly the United States, currently leads the market due to its advanced healthcare systems, high disposable incomes, and proactive adoption of innovative medical technologies. Europe follows closely, with countries like Germany, the UK, and France demonstrating significant market penetration driven by robust healthcare policies and an aging population prone to urological issues. Asia Pacific presents the fastest-growing regional market, propelled by increasing awareness, improving healthcare infrastructure, and a large patient pool suffering from kidney stones and other urological ailments.

Within product types, the Double Pigtail stent segment holds a dominant position. This is primarily attributed to its widespread use in managing a variety of conditions, including post-operative drainage, ureteral obstruction due to stones or tumors, and urinary tract infections (UTIs). The double pigtail design effectively anchors the stent within the kidney pelvis and bladder, minimizing migration and ensuring reliable drainage.

The Application: Kidney Stones segment is unequivocally the largest and most influential within the ureteral stents industry. The global burden of kidney stones is immense and continues to rise due to lifestyle factors, diet, and climate change. Ureteral stents are a cornerstone in the management of symptomatic kidney stones, both during and after procedures like extracorporeal shock wave lithotripsy (ESWL) and ureteroscopy with laser lithotripsy, serving to relieve obstruction and facilitate stone fragment passage.

- Key Growth Drivers for Kidney Stone Application Dominance:

- Increasing Global Prevalence: Rising rates of obesity, metabolic syndrome, and dehydration contribute to a higher incidence of kidney stones worldwide.

- Advancements in Lithotripsy: Improvements in ESWL and ureteroscopic techniques lead to more effective stone removal, often requiring stenting for post-procedure management.

- Minimally Invasive Procedures: The preference for less invasive treatments for kidney stones inherently favors the use of ureteral stents over more invasive alternatives.

- Diagnostic Improvements: Enhanced imaging techniques lead to earlier and more accurate diagnosis of kidney stones, increasing the patient pool requiring intervention and stenting.

While Kidney Stones dominate, the Application: Kidney Transplant segment is experiencing significant growth. The increasing number of successful kidney transplants globally, driven by advancements in surgical techniques and organ procurement, directly translates to a higher demand for ureteral stents to maintain ureteral patency and prevent complications post-transplantation.

The Close-Ended and Multiloop stent segments, while smaller in market share compared to Double Pigtail, cater to specific clinical needs and are important niche markets. Close-ended stents are often used when a greater degree of sealing is required, while multiloop designs offer unique anchoring capabilities.

Ureteral Stents Industry Product Analysis

The ureteral stents industry is witnessing continuous product innovation focused on enhancing patient outcomes and procedural efficiency. Key product advancements include the development of novel biomaterials with improved biocompatibility and reduced inflammatory responses, advanced surface coatings designed to resist biofilm formation and encrustation (as exemplified by Boston Scientific's Tria Ureteral Stent), and improved delivery systems for easier and safer insertion and removal. These innovations aim to minimize complications such as infection, pain, and stent migration, leading to better patient comfort and reduced hospital stays. Competitive advantages are being carved out through the development of stents with enhanced radiopacity for better visualization during imaging, bio-absorbable materials that eliminate the need for secondary removal procedures, and tailor-made designs for specific anatomical challenges or applications.

Key Drivers, Barriers & Challenges in Ureteral Stents Industry

Key Drivers:

The ureteral stents industry is propelled by several critical factors. The escalating global prevalence of urological conditions, most notably kidney stones and urinary tract infections, is a primary driver, creating a consistent demand for effective stenting solutions. Technological advancements in stent design and materials, focusing on enhanced biocompatibility, reduced encrustation, and improved patient comfort, are also significant growth catalysts. Furthermore, the growing number of minimally invasive urological procedures, such as ureteroscopy and lithotripsy, directly necessitates the use of ureteral stents for drainage and to prevent complications. Favorable healthcare policies and reimbursement structures in developed economies also contribute to market expansion by ensuring access to these medical devices.

Barriers & Challenges:

Despite strong growth prospects, the ureteral stents industry faces considerable challenges. Stringent regulatory approval processes in various regions can lead to extended product launch timelines and increased development costs. Supply chain disruptions, as witnessed in recent global events, can impact the availability of raw materials and finished goods, leading to price volatility and potential shortages. Intense competition among established players and emerging companies exerts pressure on pricing and profit margins. Moreover, the risk of complications associated with ureteral stents, such as infection, pain, and stent migration, necessitates ongoing research and development to mitigate these issues and maintain patient trust. The development of alternative treatment modalities, though currently limited, also presents a potential long-term challenge.

Growth Drivers in the Ureteral Stents Industry Market

Key growth drivers in the ureteral stents industry include the relentless increase in the global incidence of kidney stones, driven by lifestyle changes and an aging population. Technological innovations leading to enhanced biocompatibility, reduced encrustation, and improved patient comfort are creating significant market opportunities. The expanding landscape of minimally invasive urological surgeries, such as ureteroscopy and lithotripsy, directly fuels the demand for ureteral stents as essential supportive devices. Moreover, favorable reimbursement policies in key markets and a growing focus on interventional urology contribute to the industry's upward trajectory. The increasing number of successful kidney transplant surgeries also presents a substantial growth avenue.

Challenges Impacting Ureteral Stents Industry Growth

Several factors impede the growth of the ureteral stents industry. Stringent and time-consuming regulatory approval pathways in major markets can delay product launches and increase research and development expenditure. Supply chain vulnerabilities, including raw material availability and logistics, can lead to production disruptions and price fluctuations. Intense competition among a consolidated set of key players and emerging manufacturers often leads to pricing pressures, impacting profitability. Furthermore, the inherent risks of complications associated with ureteral stents, such as infection, pain, and migration, necessitate continuous efforts to improve product safety and efficacy. The threat of alternative treatment modalities, though currently limited, also poses a long-term concern.

Key Players Shaping the Ureteral Stents Industry Market

- Cook Medical

- Teleflex Inc

- Becton Dickinson and Company (C R Bard)

- B Braun

- Boston Scientific

- Uromed

- Allium Medical

- Olympus America

- Coloplast

Significant Ureteral Stents Industry Industry Milestones

- June 2022: Boston Scientific received a Bronze Edison Award for its Tria Ureteral Stent, recognized for its proprietary surface technology designed to prevent urine calcium and magnesium salt deposits.

- May 2022: The United States Food and Drug Administration granted 510k clearance for a novel urinary stent developed by Dean Secrest and Lee Ponsky, MD, at University Hospitals (UH) in Cleveland.

Future Outlook for Ureteral Stents Industry Market

The future outlook for the ureteral stents industry is exceptionally promising, driven by sustained growth catalysts. Anticipate continued innovation in stent materials, coatings, and delivery systems, leading to enhanced patient outcomes and procedural ease. The expanding prevalence of urological conditions globally, coupled with a growing demand for minimally invasive treatments, will ensure robust market expansion. Emerging economies represent significant untapped potential, offering opportunities for market penetration through the introduction of cost-effective and high-quality stent solutions. Strategic collaborations, product portfolio expansions through M&A, and a continued focus on addressing unmet clinical needs will be key to navigating the competitive landscape and capitalizing on the substantial market potential projected over the forecast period.

Ureteral Stents Industry Segmentation

-

1. Product Type

- 1.1. Open-Ended

- 1.2. Close-Ended

- 1.3. Double Pigtail

- 1.4. Multiloop

-

2. Application

- 2.1. Kidney Stones

- 2.2. Kidney Transplant

- 2.3. Urinary Tract Infection

- 2.4. Other Applications

Ureteral Stents Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Ureteral Stents Industry Regional Market Share

Geographic Coverage of Ureteral Stents Industry

Ureteral Stents Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Urological Disorders; Awarness Campaigns Initiated by Government and Other Organization

- 3.3. Market Restrains

- 3.3.1. Risk of Infection

- 3.4. Market Trends

- 3.4.1. Urinary Tract Infection Segment is Expected to Exibhit a Significant Growth Rate in the Ureteral Stent Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ureteral Stents Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Open-Ended

- 5.1.2. Close-Ended

- 5.1.3. Double Pigtail

- 5.1.4. Multiloop

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Kidney Stones

- 5.2.2. Kidney Transplant

- 5.2.3. Urinary Tract Infection

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Ureteral Stents Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Open-Ended

- 6.1.2. Close-Ended

- 6.1.3. Double Pigtail

- 6.1.4. Multiloop

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Kidney Stones

- 6.2.2. Kidney Transplant

- 6.2.3. Urinary Tract Infection

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Ureteral Stents Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Open-Ended

- 7.1.2. Close-Ended

- 7.1.3. Double Pigtail

- 7.1.4. Multiloop

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Kidney Stones

- 7.2.2. Kidney Transplant

- 7.2.3. Urinary Tract Infection

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Ureteral Stents Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Open-Ended

- 8.1.2. Close-Ended

- 8.1.3. Double Pigtail

- 8.1.4. Multiloop

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Kidney Stones

- 8.2.2. Kidney Transplant

- 8.2.3. Urinary Tract Infection

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Ureteral Stents Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Open-Ended

- 9.1.2. Close-Ended

- 9.1.3. Double Pigtail

- 9.1.4. Multiloop

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Kidney Stones

- 9.2.2. Kidney Transplant

- 9.2.3. Urinary Tract Infection

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cook Medical

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Teleflex Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Becton Dickinson and Company (C R Bard)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 B Braun

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Boston Scientific

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Uromed

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Allium Medical

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Olympus America

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Coloplast

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Cook Medical

List of Figures

- Figure 1: Global Ureteral Stents Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Ureteral Stents Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Ureteral Stents Industry Revenue (million), by Product Type 2025 & 2033

- Figure 4: North America Ureteral Stents Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Ureteral Stents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Ureteral Stents Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Ureteral Stents Industry Revenue (million), by Application 2025 & 2033

- Figure 8: North America Ureteral Stents Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Ureteral Stents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Ureteral Stents Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Ureteral Stents Industry Revenue (million), by Country 2025 & 2033

- Figure 12: North America Ureteral Stents Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Ureteral Stents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Ureteral Stents Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Ureteral Stents Industry Revenue (million), by Product Type 2025 & 2033

- Figure 16: Europe Ureteral Stents Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 17: Europe Ureteral Stents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Ureteral Stents Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Ureteral Stents Industry Revenue (million), by Application 2025 & 2033

- Figure 20: Europe Ureteral Stents Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Ureteral Stents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Ureteral Stents Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Ureteral Stents Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Europe Ureteral Stents Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Ureteral Stents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Ureteral Stents Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Ureteral Stents Industry Revenue (million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Ureteral Stents Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Ureteral Stents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Ureteral Stents Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Ureteral Stents Industry Revenue (million), by Application 2025 & 2033

- Figure 32: Asia Pacific Ureteral Stents Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Ureteral Stents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Ureteral Stents Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Ureteral Stents Industry Revenue (million), by Country 2025 & 2033

- Figure 36: Asia Pacific Ureteral Stents Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Ureteral Stents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Ureteral Stents Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Ureteral Stents Industry Revenue (million), by Product Type 2025 & 2033

- Figure 40: Rest of the World Ureteral Stents Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 41: Rest of the World Ureteral Stents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Rest of the World Ureteral Stents Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Rest of the World Ureteral Stents Industry Revenue (million), by Application 2025 & 2033

- Figure 44: Rest of the World Ureteral Stents Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Rest of the World Ureteral Stents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Rest of the World Ureteral Stents Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Rest of the World Ureteral Stents Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Rest of the World Ureteral Stents Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Ureteral Stents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Ureteral Stents Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ureteral Stents Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Ureteral Stents Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Ureteral Stents Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Ureteral Stents Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Ureteral Stents Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Ureteral Stents Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Ureteral Stents Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Global Ureteral Stents Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Ureteral Stents Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Ureteral Stents Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Ureteral Stents Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Ureteral Stents Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Ureteral Stents Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 20: Global Ureteral Stents Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Ureteral Stents Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: Global Ureteral Stents Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Ureteral Stents Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Ureteral Stents Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Germany Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: France Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Italy Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Spain Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Ureteral Stents Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 38: Global Ureteral Stents Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Ureteral Stents Industry Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Ureteral Stents Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Ureteral Stents Industry Revenue million Forecast, by Country 2020 & 2033

- Table 42: Global Ureteral Stents Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: China Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Japan Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: India Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Australia Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Ureteral Stents Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Ureteral Stents Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Ureteral Stents Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 56: Global Ureteral Stents Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 57: Global Ureteral Stents Industry Revenue million Forecast, by Application 2020 & 2033

- Table 58: Global Ureteral Stents Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Ureteral Stents Industry Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Ureteral Stents Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ureteral Stents Industry?

The projected CAGR is approximately 6.36%.

2. Which companies are prominent players in the Ureteral Stents Industry?

Key companies in the market include Cook Medical, Teleflex Inc, Becton Dickinson and Company (C R Bard), B Braun, Boston Scientific, Uromed, Allium Medical, Olympus America, Coloplast.

3. What are the main segments of the Ureteral Stents Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 624.35 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Urological Disorders; Awarness Campaigns Initiated by Government and Other Organization.

6. What are the notable trends driving market growth?

Urinary Tract Infection Segment is Expected to Exibhit a Significant Growth Rate in the Ureteral Stent Market.

7. Are there any restraints impacting market growth?

Risk of Infection.

8. Can you provide examples of recent developments in the market?

In June 2022, Boston Scientific has been recognized with a Bronze Edison Award in the Science and Medical category for its Tria Ureteral Stent, the first stent made with a proprietary surface technology designed to provide protection against the accumulation of both urine calcium and magnesium salt deposits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ureteral Stents Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ureteral Stents Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ureteral Stents Industry?

To stay informed about further developments, trends, and reports in the Ureteral Stents Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence