Key Insights

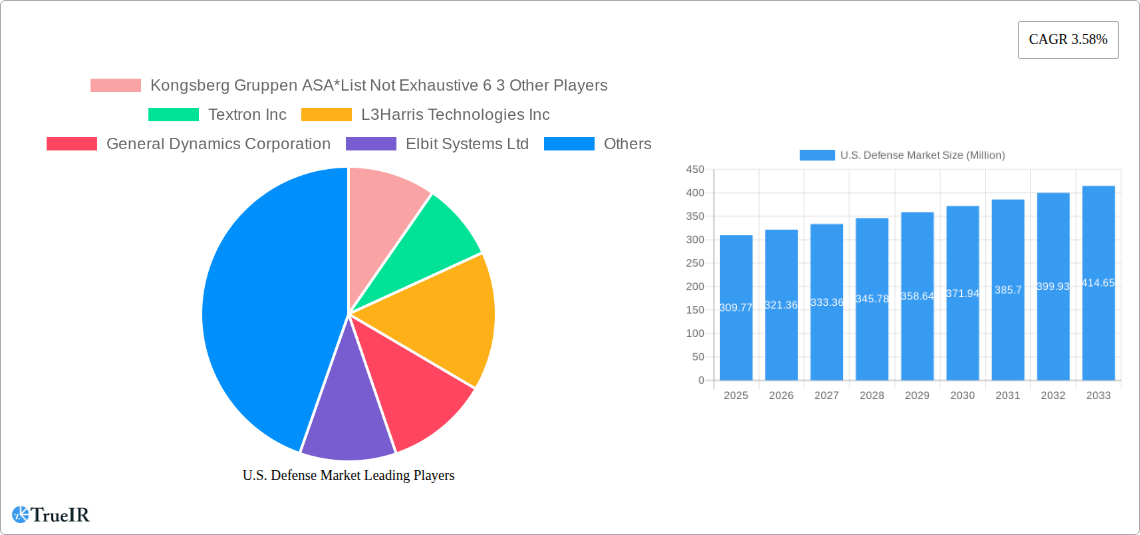

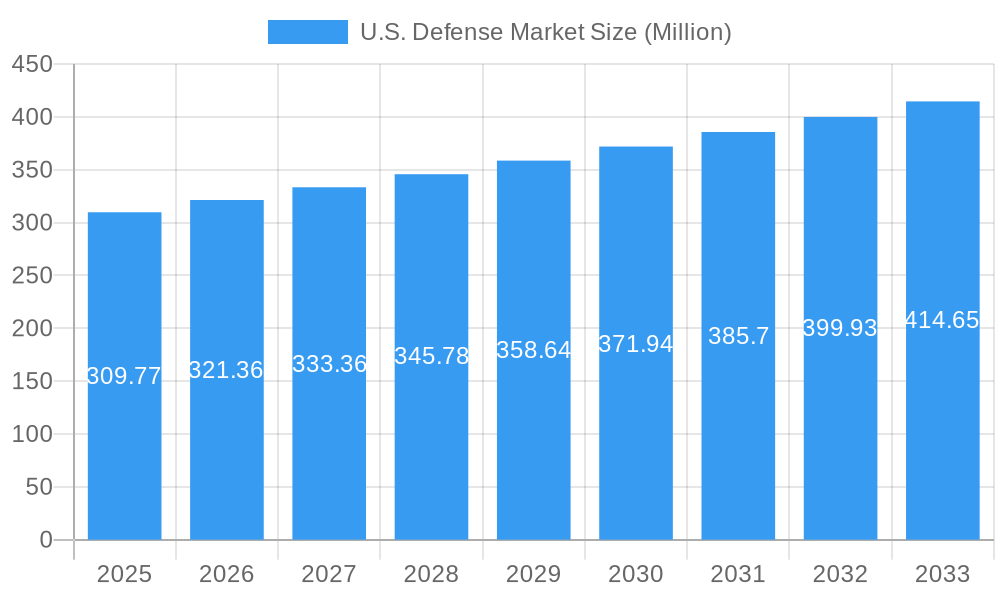

The U.S. defense market, a significant global player, is projected to maintain steady growth, with a Compound Annual Growth Rate (CAGR) of 3.58% from 2025 to 2033. In 2025, the market size is estimated at $309.77 billion. This growth is driven primarily by escalating geopolitical instability, necessitating increased defense spending on advanced technologies and modernization of existing systems across all branches of the armed forces. Key trends include the increasing adoption of unmanned systems (drones, autonomous vehicles), advancements in cyber warfare capabilities, and a focus on developing resilient and interconnected defense networks. Furthermore, the market sees strong demand for sophisticated weapons and ammunition, along with robust protection and training equipment. While the market shows strong growth potential, constraints include budgetary limitations, technological complexities associated with integrating new systems, and the need for sustained research and development investments to maintain a technological edge. The segmentation of the market reflects this diverse landscape, encompassing various branches of the armed forces (Army, Navy, Air Force), diverse equipment types (fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, C4ISR systems, and more), and a wide range of companies actively competing for market share.

U.S. Defense Market Market Size (In Million)

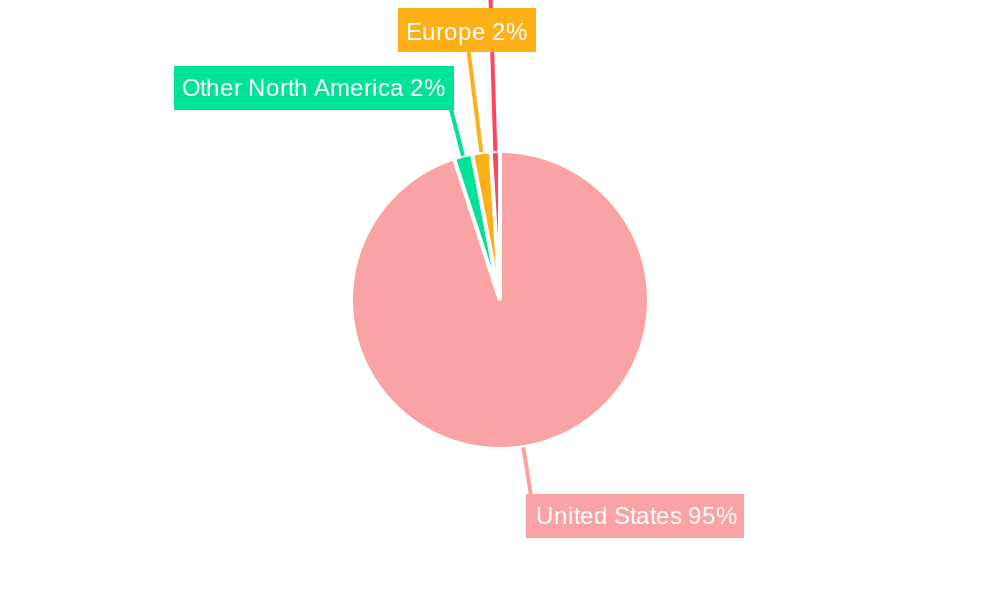

The regional breakdown shows the United States as the primary market driver, with substantial contributions expected from all its regions (Northeast, Southeast, Midwest, Southwest, West). This concentration reflects the nation's substantial defense budget and strategic importance. The competition within the market is fierce, with major players like Lockheed Martin, Boeing, Raytheon Technologies (RTX), General Dynamics, Northrop Grumman, and others vying for contracts and technological leadership. These companies are continually investing in R&D to improve existing capabilities and develop cutting-edge technologies to meet evolving security challenges. The forecast period of 2025-2033 presents significant opportunities for growth, but success will depend on factors such as effective strategic planning, adaptability to changing geopolitical dynamics, and the ability to deliver innovative and reliable solutions to the U.S. Department of Defense and its allied partners.

U.S. Defense Market Company Market Share

U.S. Defense Market: A Comprehensive Forecast Report (2019-2033)

This dynamic report provides a detailed analysis of the U.S. Defense Market, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025, this study unravels the market's structure, competitive landscape, dominant segments, and future growth trajectory. Expect in-depth analysis of market size, CAGR, and penetration rates, backed by robust quantitative and qualitative data.

U.S. Defense Market Market Structure & Competitive Landscape

The U.S. defense market is characterized by a high degree of consolidation, with a handful of major players controlling a significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, fueled by advancements in technologies such as AI, autonomous systems, and hypersonic weapons. Stringent regulatory frameworks, including export controls and cybersecurity regulations, significantly influence market dynamics. Product substitution is limited due to the specialized nature of defense products, though competition exists within specific segments.

The end-user segmentation comprises the Army, Navy, and Air Force, each with unique procurement priorities. Mergers and acquisitions (M&A) activity has been significant in recent years, with an estimated xx Million in M&A volume in 2024, driven by the pursuit of technological capabilities and market expansion. Key trends include:

- Increased focus on technological innovation: Companies are investing heavily in R&D to develop cutting-edge defense systems.

- Growing demand for unmanned systems: The adoption of drones and other unmanned platforms is increasing across all branches of the military.

- Consolidation through M&A: Strategic acquisitions are reshaping the competitive landscape.

- Stringent regulatory environment: Government regulations and compliance requirements are shaping market dynamics.

U.S. Defense Market Market Trends & Opportunities

The U.S. defense market exhibits robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. This growth is fueled by increasing geopolitical instability, technological advancements, and government spending on defense modernization. Significant technological shifts are reshaping the market, driving demand for advanced technologies such as artificial intelligence (AI), hypersonic weapons, and cyber warfare capabilities. Consumer preferences, in this context, are shaped by the military's need for superior technology, enhanced operational efficiency, and improved battlefield effectiveness. The competitive landscape is highly dynamic, with existing players investing in R&D and new entrants seeking to disrupt existing market segments. Market penetration rates vary significantly across different product categories, with certain segments experiencing higher growth than others. The market is also driven by the increasing need for advanced surveillance and reconnaissance systems, as well as sophisticated communication and intelligence networks. The demand for these systems is likely to drive significant growth in the coming years.

Dominant Markets & Segments in U.S. Defense Market

The U.S. defense market is dominated by the Army, with the highest spending and procurement activity. However, significant growth is expected across all three branches – Army, Navy, and Air Force – with a focus on modernization and technological upgrades. Within specific product categories, the following segments demonstrate strong growth potential:

- Fixed-wing Aircraft: Demand for advanced fighter jets and surveillance aircraft remains high.

- Unmanned Systems: The market for drones and other unmanned platforms is experiencing rapid expansion.

- C4ISR: Investment in command, control, communications, computers, intelligence, surveillance, and reconnaissance systems is continuously growing.

- Weapons and Ammunition: Modernization and upgrades of weapon systems are key drivers of market growth.

Key Growth Drivers:

- Increased defense budgets: Government spending on defense continues to be a major driver of market growth.

- Technological advancements: Innovations in areas such as AI and hypersonic weapons are reshaping the market.

- Geopolitical instability: Rising global tensions are leading to increased defense spending.

- Modernization initiatives: The need to upgrade aging military equipment is stimulating market demand.

The Navy segment is also seeing significant investment in new shipbuilding programs and technological upgrades, while the Air Force is focused on modernizing its fleet of fighter jets and upgrading its command and control systems. These factors contribute to the overall market dynamism and growth prospects within each branch.

U.S. Defense Market Product Analysis

Product innovation is a critical factor driving the U.S. defense market. Advances in materials science, artificial intelligence, and autonomous systems are leading to the development of more sophisticated and effective defense systems. This includes improvements in weapon accuracy, range, and lethality, as well as the development of more resilient and adaptable defense platforms. These advancements significantly impact market competitiveness, often providing a decisive advantage to those companies capable of integrating these technologies effectively. The market is witnessing increased adoption of these products, largely driven by the need to enhance military capabilities and maintain a technological edge.

Key Drivers, Barriers & Challenges in U.S. Defense Market

Key Drivers:

Technological advancements, including AI, hypersonic weapons, and unmanned systems, are paramount drivers. Economic factors such as increased defense budgets and government contracts also significantly contribute. Lastly, geopolitical instability necessitates ongoing military modernization, thereby boosting the market.

Challenges and Restraints:

Supply chain disruptions, particularly concerning critical components and materials, present a significant challenge. Complex regulatory hurdles, including lengthy approval processes and strict compliance requirements, can slow down product development and deployment. Furthermore, intense competition from established players and new entrants intensifies the pressure on margins and profitability. These challenges have a quantifiable impact on overall market growth, potentially slowing expansion if not adequately addressed.

Growth Drivers in the U.S. Defense Market Market

Technological advancements such as AI, hypersonic technology, and autonomous systems are key growth drivers, along with increasing geopolitical instability globally, leading to heightened defense spending. Favorable government policies and substantial defense budgets provide significant impetus for market expansion.

Challenges Impacting U.S. Defense Market Growth

Regulatory complexities, including export controls and environmental regulations, present significant hurdles. Supply chain vulnerabilities and disruptions, particularly for specialized components, impact production and timelines. The fierce competition among established and emerging players creates intense pressure and limits pricing power. These factors cumulatively impact the growth trajectory of the U.S. defense market.

Key Players Shaping the U.S. Defense Market Market

- Kongsberg Gruppen ASA

- Textron Inc

- L3Harris Technologies Inc

- General Dynamics Corporation

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Airbus SE

- Teledyne Technologies Incorporated

- General Atomics

- AeroVironment Inc

- BAE Systems PLC

- RTX Corporation

- Leidos Holdings Inc

- Huntington Ingalls Industries Inc

- Sig Sauer Inc

- CACI International Inc

- Saab A

- Northrop Grumman Corporation

- The Boeing Company

Significant U.S. Defense Market Industry Milestones

- 2021 (Q4): Lockheed Martin announces a significant contract for the production of F-35 fighter jets, impacting the fixed-wing aircraft segment.

- 2022 (Q2): General Dynamics unveils a new generation of armored vehicles, marking a significant advancement in ground vehicle technology.

- 2023 (Q1): A major merger between two defense contractors reshapes the competitive landscape. (Specific details of the merger are not available for this placeholder).

- 2024 (Q3): Successful testing of a new hypersonic weapon system by the U.S. military. (Specific company details are not available for this placeholder).

Future Outlook for U.S. Defense Market Market

The U.S. defense market is poised for continued growth, driven by ongoing technological advancements, increasing geopolitical uncertainties, and sustained government investments in defense modernization. Strategic opportunities exist across various segments, particularly in unmanned systems, artificial intelligence, and hypersonic weapons. The market’s long-term potential is significant, offering substantial prospects for companies capable of adapting to evolving technological landscapes and meeting the diverse needs of the U.S. military.

U.S. Defense Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

U.S. Defense Market Segmentation By Geography

- 1. U.S.

U.S. Defense Market Regional Market Share

Geographic Coverage of U.S. Defense Market

U.S. Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Air Force Segment to Exhibit the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kongsberg Gruppen ASA*List Not Exhaustive 6 3 Other Players

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Textron Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 L3Harris Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Dynamics Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Elbit Systems Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lockheed Martin Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Airbus SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teledyne Technologies Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Atomics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AeroVironment Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BAE Systems PLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 RTX Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Leidos Holdings Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Huntington Ingalls Industries Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sig Sauer Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 CACI International Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Saab A

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Northrop Grumman Corporation

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 The Boeing Company

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Kongsberg Gruppen ASA*List Not Exhaustive 6 3 Other Players

List of Figures

- Figure 1: U.S. Defense Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: U.S. Defense Market Share (%) by Company 2025

List of Tables

- Table 1: U.S. Defense Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: U.S. Defense Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: U.S. Defense Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: U.S. Defense Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: U.S. Defense Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: U.S. Defense Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: U.S. Defense Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: U.S. Defense Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: U.S. Defense Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: U.S. Defense Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: U.S. Defense Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: U.S. Defense Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Defense Market?

The projected CAGR is approximately 3.58%.

2. Which companies are prominent players in the U.S. Defense Market?

Key companies in the market include Kongsberg Gruppen ASA*List Not Exhaustive 6 3 Other Players, Textron Inc, L3Harris Technologies Inc, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, Airbus SE, Teledyne Technologies Incorporated, General Atomics, AeroVironment Inc, BAE Systems PLC, RTX Corporation, Leidos Holdings Inc, Huntington Ingalls Industries Inc, Sig Sauer Inc, CACI International Inc, Saab A, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the U.S. Defense Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 309.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Air Force Segment to Exhibit the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Defense Market?

To stay informed about further developments, trends, and reports in the U.S. Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence