Key Insights

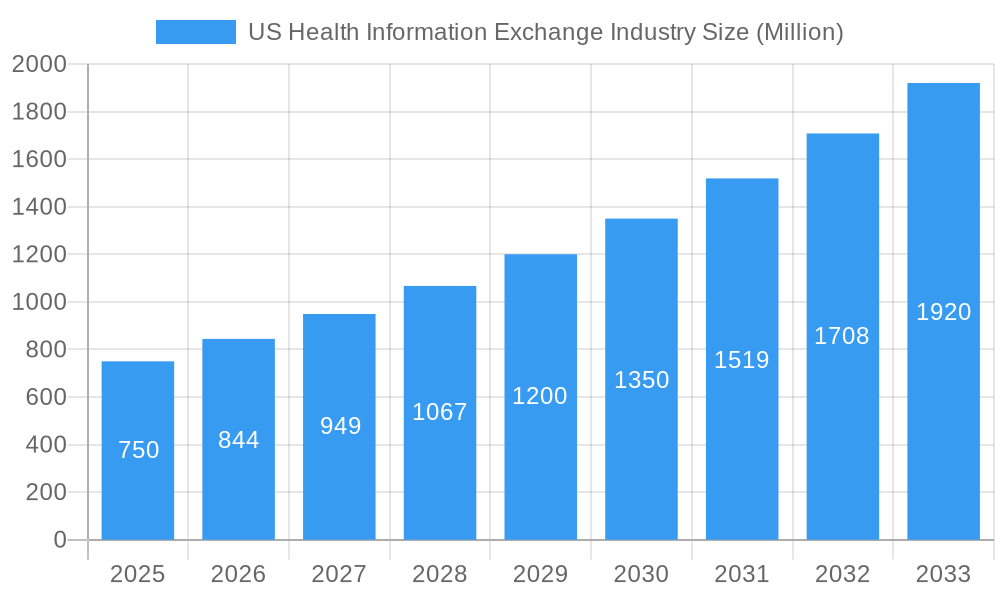

The US Health Information Exchange (HIE) market is poised for robust expansion, driven by an estimated current market size of $0.66 billion and projected to grow at a Compound Annual Growth Rate (CAGR) of 12.12% through 2033. This dynamic growth is fueled by a confluence of critical factors. The escalating need for seamless interoperability among healthcare providers to improve patient care coordination and reduce medical errors is paramount. Furthermore, government initiatives promoting digital health records and data sharing, coupled with the increasing adoption of electronic health records (EHRs), create a fertile ground for HIE solutions. The demand for enhanced patient safety, efficient workflow management, and secure messaging capabilities within healthcare organizations also significantly contributes to market expansion. As healthcare systems grapple with the complexities of managing vast amounts of patient data, HIEs offer a crucial solution for unifying disparate information, leading to more informed clinical decisions and improved patient outcomes.

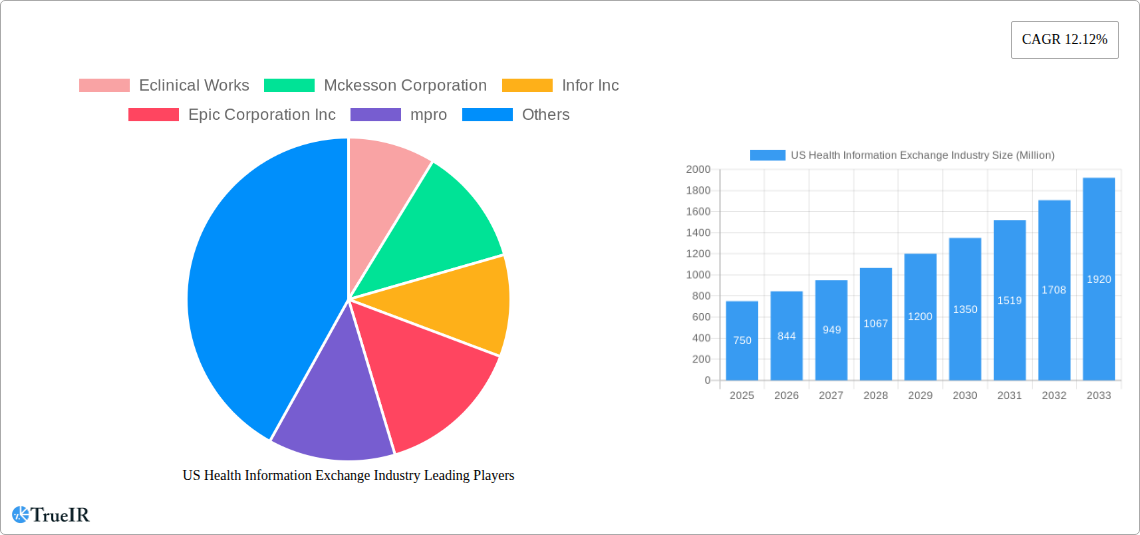

US Health Information Exchange Industry Market Size (In Million)

The market's trajectory is further shaped by evolving implementation models, with hybrid approaches gaining traction by leveraging the strengths of both centralized and decentralized systems. The setup types, encompassing private, public, and hybrid clouds, offer flexibility to cater to diverse organizational needs. Key applications like internal interfacing, secure messaging, workflow management, and web portal development are central to the value proposition of HIE. The exchange types, including direct exchange, query-based exchange, and consumer-mediated exchange, reflect the growing patient empowerment in accessing and managing their health information. Component-wise, the Enterprise Master Person Index (EMPI), Healthcare Provider Directory (HPD), and Clinical Data Repository are foundational elements enabling effective data exchange. Leading players like eClinical Works, McKesson Corporation, and Epic Corporation are actively innovating and expanding their offerings, contributing to the competitive yet collaborative landscape of the US HIE market.

US Health Information Exchange Industry Company Market Share

Here's a dynamic, SEO-optimized report description for the US Health Information Exchange Industry, designed for immediate use without modification:

US Health Information Exchange Industry Market Analysis 2019-2033: Growth, Trends, and Competitive Landscape

This comprehensive report provides an in-depth analysis of the US Health Information Exchange (HIE) Industry, offering critical insights into market dynamics, competitive strategies, and future growth trajectories. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving healthcare data landscape. We leverage high-volume keywords to enhance search engine rankings and engage industry professionals.

US Health Information Exchange Industry Market Structure & Competitive Landscape

The US Health Information Exchange (HIE) industry exhibits a moderately concentrated market structure, driven by significant innovation and evolving regulatory frameworks. Key players like Epic Corporation Inc., Cerner Corporation, and McKesson Corporation hold substantial market share, influencing the adoption of HIE solutions. Innovation drivers include the push for interoperability, advancements in cloud computing, and the increasing demand for real-time patient data access. Regulatory impacts, such as HIPAA and the 21st Century Cures Act, continue to shape market entry and operational strategies. Product substitutes, while limited in direct HIE functionality, can include point-to-point data integrations or manual data transfer methods. End-user segmentation spans hospitals, clinics, laboratories, pharmacies, and health plans, each with unique HIE needs. Mergers and acquisitions (M&A) are a significant trend, with an estimated volume of 150+ M&A deals observed in the historical period, consolidating market players and expanding service offerings. Concentration ratios are estimated to be around 65%, indicating a significant presence of top-tier companies.

US Health Information Exchange Industry Market Trends & Opportunities

The US Health Information Exchange (HIE) industry is poised for substantial growth, projected to reach over $15 Billion by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and an increasing emphasis on value-based care. Technological shifts are at the forefront, with the widespread adoption of cloud-based HIE solutions, enabling greater scalability, flexibility, and cost-effectiveness. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing data analytics within HIE platforms, facilitating predictive insights and personalized patient care. Secure messaging and patient portals are becoming standard features, empowering patients with greater control over their health information and fostering active participation in their care journey. The demand for seamless interoperability between disparate electronic health record (EHR) systems remains a primary driver, pushing vendors to develop standardized data formats and robust integration capabilities. Consumer preferences are increasingly leaning towards consolidated health records accessible through user-friendly interfaces, driving the demand for consumer-mediated exchange models. Competitive dynamics are intensifying, with existing players continuously innovating and new entrants seeking to disrupt the market with specialized solutions. The market penetration rate for advanced HIE functionalities is estimated to grow from 50% in 2025 to 75% by 2033. Opportunities abound in areas such as public health surveillance, population health management, and the development of specialized HIE networks for niche healthcare segments like mental health or long-term care. The increasing volume of healthcare data generated daily necessitates efficient and secure exchange mechanisms, making HIE an indispensable component of modern healthcare delivery. The shift towards telehealth and remote patient monitoring further amplifies the need for real-time data sharing, creating a robust market for HIE solutions that can support these evolving care models. The market size for HIE solutions was estimated at $8 Billion in the base year of 2025.

Dominant Markets & Segments in US Health Information Exchange Industry

The US Health Information Exchange industry's dominance is characterized by specific implementation models, setup types, applications, exchange types, and core components.

Implementation Model: The Hybrid Model is emerging as the dominant approach, combining the strengths of both Centralized/Consolidated and Decentralized/Federated models. This allows for flexibility in data storage and access, catering to diverse organizational needs. Centralized models, while offering strong data governance, can face scalability challenges, whereas decentralized models provide flexibility but can lead to data silos. Hybrid models offer a balanced solution.

Setup Type: Private HIE solutions are currently leading, driven by the need for enhanced security and control over sensitive patient data within individual healthcare organizations or consortia. Public HIEs are gaining traction with government initiatives promoting broader data sharing and interoperability. The market share of private HIEs is estimated at 60% in 2025.

Application: Internal Interfacing remains a core application, enabling seamless data flow within an organization's existing IT infrastructure. However, Patient Safety is rapidly becoming a paramount application, with HIEs playing a critical role in preventing medical errors by providing clinicians with comprehensive patient histories. Secure Messaging and Workflow Management are also significant contributors to market growth.

Exchange Type: Direct Exchange is the most prevalent exchange type, facilitating the secure, push-based transmission of health information between known trusted participants. Query-based Exchange is also crucial for retrieving patient records on demand, particularly in emergency situations. Consumer-mediated Exchange is a growing segment, empowering patients to actively participate in sharing their data.

Component: The Enterprise Master Person Index (EMPI) is a foundational component, ensuring unique patient identification across disparate systems. Clinical Data Repositories are essential for storing and managing aggregated patient data. Healthcare Provider Directories (HPD) and Record Locator Services (RLS) are critical for locating and accessing patient information efficiently. "Other Components" encompass advanced analytics, patient portals, and specialized data integration tools, all contributing to the overall functionality and value of HIE solutions. The market for EMPI solutions alone is projected to exceed $1 Billion by 2033.

US Health Information Exchange Industry Product Analysis

Product innovation in the US Health Information Exchange industry is focused on enhancing interoperability, security, and usability. Key advancements include AI-powered data aggregation and analytics for predictive care, robust patient portal development for consumer engagement, and secure messaging platforms that streamline clinical communication. Competitive advantages are derived from seamless integration with existing EHR systems, compliance with evolving privacy regulations, and the ability to support diverse data exchange models. The market is witnessing the development of specialized HIE solutions tailored for specific healthcare needs, such as public health reporting or chronic disease management, solidifying their market fit and driving adoption.

Key Drivers, Barriers & Challenges in US Health Information Exchange Industry

The US Health Information Exchange industry is propelled by significant growth drivers. Technological advancements in cloud computing and AI, coupled with government initiatives like the push for interoperability, are key factors. The increasing demand for value-based care and improved patient outcomes also fuels adoption. Economic drivers include the potential for cost savings through reduced duplication of services and improved efficiency.

However, the industry faces notable barriers and challenges. Regulatory complexities surrounding data privacy and security, such as HIPAA compliance, remain a significant hurdle. Interoperability challenges between disparate EHR systems persist, hindering seamless data flow. High implementation costs and a lack of standardized data formats also present restraints. Competitive pressures from established EHR vendors and emerging health tech companies can also impact market growth. Supply chain issues for hardware and specialized integration services can cause delays, with an estimated impact on project timelines by 10-15%.

Growth Drivers in the US Health Information Exchange Industry Market

Key growth drivers in the US Health Information Exchange industry include the increasing emphasis on interoperability mandated by regulatory bodies like the Office of the National Coordinator for Health Information Technology (ONC). Technological advancements, particularly in cloud-based infrastructure, enable scalable and secure data sharing. The shift towards value-based care models incentivizes healthcare providers to improve care coordination and patient outcomes through efficient data exchange. Furthermore, the growing adoption of telehealth and remote patient monitoring necessitates robust HIE capabilities to ensure seamless data flow for continuous patient care.

Challenges Impacting US Health Information Exchange Industry Growth

Challenges impacting US Health Information Exchange industry growth include significant regulatory complexities, particularly ensuring ongoing compliance with evolving HIPAA and HITECH Act provisions, which can add substantial overhead. Interoperability issues between diverse Electronic Health Record (EHR) systems from various vendors remain a persistent barrier, leading to data fragmentation and integration difficulties. High upfront implementation costs and ongoing maintenance expenses can be prohibitive for smaller healthcare organizations. Moreover, market fragmentation and the presence of numerous competing vendors can lead to confusion and slow down adoption. The ongoing need for data security and privacy protection against cyber threats requires continuous investment and vigilance.

Key Players Shaping the US Health Information Exchange Industry Market

- Eclinical Works

- McKesson Corporation

- Infor Inc

- Epic Corporation Inc

- mpro

- Cerner Corporation

- Optum Inc

- Allscripts Healthcare Solutions Inc

- Nextgen Healthcare Information Systems LLC

- Newgen Software Technologies

- Conifer Health Solutions

- Medicity Inc

Significant US Health Information Exchange Industry Industry Milestones

- October 2022: Mpowered Health launched its xChange, the United States consumer-mediated healthcare data exchange, enabling health plans, health systems, and other healthcare organizations to request and obtain medical records from consumers with their consent.

- March 2022: mpro5 Inc announced its launch into the United States market with a strategy of enabling the collection and leverage of real-time data to simplify the most complex operational challenges in healthcare and hospitals.

Future Outlook for US Health Information Exchange Industry Market

The future outlook for the US Health Information Exchange industry is exceptionally bright, driven by an accelerated push towards a fully interoperable healthcare ecosystem. Strategic opportunities lie in the integration of advanced analytics and AI to unlock predictive insights and personalized medicine, further enhancing patient care and operational efficiency. The increasing adoption of consumer-mediated exchange models presents significant potential for patient empowerment and engagement. As healthcare systems increasingly focus on population health management and value-based care, the demand for robust HIE solutions capable of facilitating seamless data sharing and care coordination will only intensify, promising continued market expansion and innovation.

US Health Information Exchange Industry Segmentation

-

1. Implementation Model

- 1.1. Centralized/Consolidated Models

- 1.2. Decentralized/Federated Models

- 1.3. Hybrid Model

-

2. Setup Type

- 2.1. Private

- 2.2. Public

-

3. Application

- 3.1. Internal Interfacing

- 3.2. Secure Messaging

- 3.3. Workflow Management

- 3.4. Web Portal Development

- 3.5. Patient Safety

-

4. Exchange Type

- 4.1. Direct Exchange

- 4.2. Query-based Exchange

- 4.3. Consumer-mediated Exchange

-

5. Component

- 5.1. Enterprise Master Person Index (EMPI)

- 5.2. Healthcare Provider Directory (HPD)

- 5.3. Record Locator Service (RLS)

- 5.4. Clinical Data Repository

- 5.5. Other Components

US Health Information Exchange Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

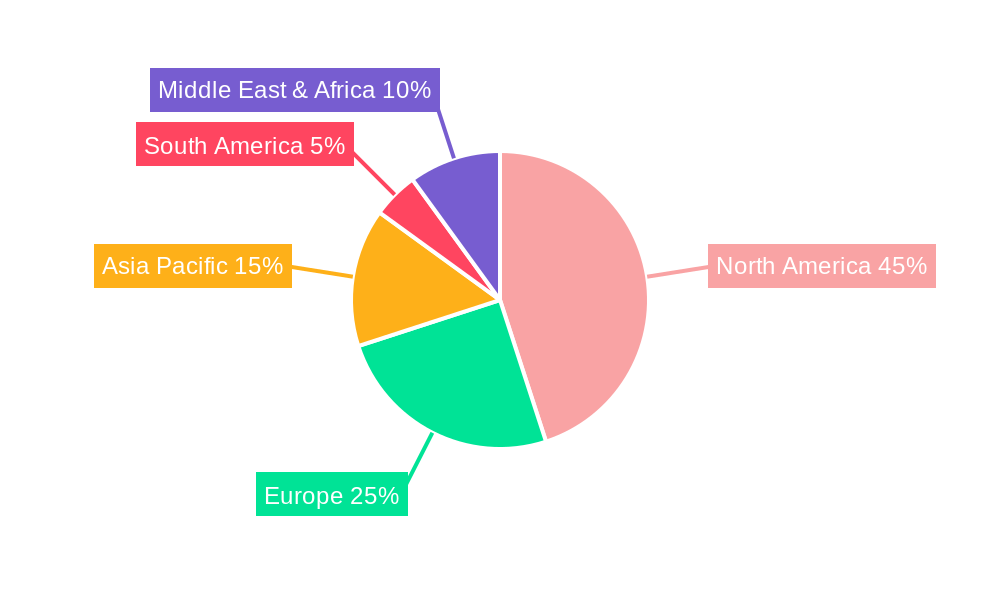

US Health Information Exchange Industry Regional Market Share

Geographic Coverage of US Health Information Exchange Industry

US Health Information Exchange Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Electronic Health Records Resulting in the Expansion of the Market; Government Support via Various Programs and Incentives; Reduction in Healthcare Cost and Improved Efficacy

- 3.3. Market Restrains

- 3.3.1. Huge Initial Infrastructural Investment and Slow Return on Investment; Data Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. The Decentralized/Federated Model is Expected to Hold a Notable Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Health Information Exchange Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Implementation Model

- 5.1.1. Centralized/Consolidated Models

- 5.1.2. Decentralized/Federated Models

- 5.1.3. Hybrid Model

- 5.2. Market Analysis, Insights and Forecast - by Setup Type

- 5.2.1. Private

- 5.2.2. Public

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Internal Interfacing

- 5.3.2. Secure Messaging

- 5.3.3. Workflow Management

- 5.3.4. Web Portal Development

- 5.3.5. Patient Safety

- 5.4. Market Analysis, Insights and Forecast - by Exchange Type

- 5.4.1. Direct Exchange

- 5.4.2. Query-based Exchange

- 5.4.3. Consumer-mediated Exchange

- 5.5. Market Analysis, Insights and Forecast - by Component

- 5.5.1. Enterprise Master Person Index (EMPI)

- 5.5.2. Healthcare Provider Directory (HPD)

- 5.5.3. Record Locator Service (RLS)

- 5.5.4. Clinical Data Repository

- 5.5.5. Other Components

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Implementation Model

- 6. North America US Health Information Exchange Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Implementation Model

- 6.1.1. Centralized/Consolidated Models

- 6.1.2. Decentralized/Federated Models

- 6.1.3. Hybrid Model

- 6.2. Market Analysis, Insights and Forecast - by Setup Type

- 6.2.1. Private

- 6.2.2. Public

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Internal Interfacing

- 6.3.2. Secure Messaging

- 6.3.3. Workflow Management

- 6.3.4. Web Portal Development

- 6.3.5. Patient Safety

- 6.4. Market Analysis, Insights and Forecast - by Exchange Type

- 6.4.1. Direct Exchange

- 6.4.2. Query-based Exchange

- 6.4.3. Consumer-mediated Exchange

- 6.5. Market Analysis, Insights and Forecast - by Component

- 6.5.1. Enterprise Master Person Index (EMPI)

- 6.5.2. Healthcare Provider Directory (HPD)

- 6.5.3. Record Locator Service (RLS)

- 6.5.4. Clinical Data Repository

- 6.5.5. Other Components

- 6.1. Market Analysis, Insights and Forecast - by Implementation Model

- 7. South America US Health Information Exchange Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Implementation Model

- 7.1.1. Centralized/Consolidated Models

- 7.1.2. Decentralized/Federated Models

- 7.1.3. Hybrid Model

- 7.2. Market Analysis, Insights and Forecast - by Setup Type

- 7.2.1. Private

- 7.2.2. Public

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Internal Interfacing

- 7.3.2. Secure Messaging

- 7.3.3. Workflow Management

- 7.3.4. Web Portal Development

- 7.3.5. Patient Safety

- 7.4. Market Analysis, Insights and Forecast - by Exchange Type

- 7.4.1. Direct Exchange

- 7.4.2. Query-based Exchange

- 7.4.3. Consumer-mediated Exchange

- 7.5. Market Analysis, Insights and Forecast - by Component

- 7.5.1. Enterprise Master Person Index (EMPI)

- 7.5.2. Healthcare Provider Directory (HPD)

- 7.5.3. Record Locator Service (RLS)

- 7.5.4. Clinical Data Repository

- 7.5.5. Other Components

- 7.1. Market Analysis, Insights and Forecast - by Implementation Model

- 8. Europe US Health Information Exchange Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Implementation Model

- 8.1.1. Centralized/Consolidated Models

- 8.1.2. Decentralized/Federated Models

- 8.1.3. Hybrid Model

- 8.2. Market Analysis, Insights and Forecast - by Setup Type

- 8.2.1. Private

- 8.2.2. Public

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Internal Interfacing

- 8.3.2. Secure Messaging

- 8.3.3. Workflow Management

- 8.3.4. Web Portal Development

- 8.3.5. Patient Safety

- 8.4. Market Analysis, Insights and Forecast - by Exchange Type

- 8.4.1. Direct Exchange

- 8.4.2. Query-based Exchange

- 8.4.3. Consumer-mediated Exchange

- 8.5. Market Analysis, Insights and Forecast - by Component

- 8.5.1. Enterprise Master Person Index (EMPI)

- 8.5.2. Healthcare Provider Directory (HPD)

- 8.5.3. Record Locator Service (RLS)

- 8.5.4. Clinical Data Repository

- 8.5.5. Other Components

- 8.1. Market Analysis, Insights and Forecast - by Implementation Model

- 9. Middle East & Africa US Health Information Exchange Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Implementation Model

- 9.1.1. Centralized/Consolidated Models

- 9.1.2. Decentralized/Federated Models

- 9.1.3. Hybrid Model

- 9.2. Market Analysis, Insights and Forecast - by Setup Type

- 9.2.1. Private

- 9.2.2. Public

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Internal Interfacing

- 9.3.2. Secure Messaging

- 9.3.3. Workflow Management

- 9.3.4. Web Portal Development

- 9.3.5. Patient Safety

- 9.4. Market Analysis, Insights and Forecast - by Exchange Type

- 9.4.1. Direct Exchange

- 9.4.2. Query-based Exchange

- 9.4.3. Consumer-mediated Exchange

- 9.5. Market Analysis, Insights and Forecast - by Component

- 9.5.1. Enterprise Master Person Index (EMPI)

- 9.5.2. Healthcare Provider Directory (HPD)

- 9.5.3. Record Locator Service (RLS)

- 9.5.4. Clinical Data Repository

- 9.5.5. Other Components

- 9.1. Market Analysis, Insights and Forecast - by Implementation Model

- 10. Asia Pacific US Health Information Exchange Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Implementation Model

- 10.1.1. Centralized/Consolidated Models

- 10.1.2. Decentralized/Federated Models

- 10.1.3. Hybrid Model

- 10.2. Market Analysis, Insights and Forecast - by Setup Type

- 10.2.1. Private

- 10.2.2. Public

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Internal Interfacing

- 10.3.2. Secure Messaging

- 10.3.3. Workflow Management

- 10.3.4. Web Portal Development

- 10.3.5. Patient Safety

- 10.4. Market Analysis, Insights and Forecast - by Exchange Type

- 10.4.1. Direct Exchange

- 10.4.2. Query-based Exchange

- 10.4.3. Consumer-mediated Exchange

- 10.5. Market Analysis, Insights and Forecast - by Component

- 10.5.1. Enterprise Master Person Index (EMPI)

- 10.5.2. Healthcare Provider Directory (HPD)

- 10.5.3. Record Locator Service (RLS)

- 10.5.4. Clinical Data Repository

- 10.5.5. Other Components

- 10.1. Market Analysis, Insights and Forecast - by Implementation Model

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eclinical Works

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mckesson Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infor Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Epic Corporation Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 mpro

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cerner Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Optum Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Allscripts Healthcare Solutions Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nextgen Healthcare Information Systems LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Newgen Software Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Conifer Health Solutions

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Medicity Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Eclinical Works

List of Figures

- Figure 1: Global US Health Information Exchange Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Health Information Exchange Industry Revenue (Million), by Implementation Model 2025 & 2033

- Figure 3: North America US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2025 & 2033

- Figure 4: North America US Health Information Exchange Industry Revenue (Million), by Setup Type 2025 & 2033

- Figure 5: North America US Health Information Exchange Industry Revenue Share (%), by Setup Type 2025 & 2033

- Figure 6: North America US Health Information Exchange Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America US Health Information Exchange Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America US Health Information Exchange Industry Revenue (Million), by Exchange Type 2025 & 2033

- Figure 9: North America US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2025 & 2033

- Figure 10: North America US Health Information Exchange Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: North America US Health Information Exchange Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: North America US Health Information Exchange Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America US Health Information Exchange Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America US Health Information Exchange Industry Revenue (Million), by Implementation Model 2025 & 2033

- Figure 15: South America US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2025 & 2033

- Figure 16: South America US Health Information Exchange Industry Revenue (Million), by Setup Type 2025 & 2033

- Figure 17: South America US Health Information Exchange Industry Revenue Share (%), by Setup Type 2025 & 2033

- Figure 18: South America US Health Information Exchange Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: South America US Health Information Exchange Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: South America US Health Information Exchange Industry Revenue (Million), by Exchange Type 2025 & 2033

- Figure 21: South America US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2025 & 2033

- Figure 22: South America US Health Information Exchange Industry Revenue (Million), by Component 2025 & 2033

- Figure 23: South America US Health Information Exchange Industry Revenue Share (%), by Component 2025 & 2033

- Figure 24: South America US Health Information Exchange Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America US Health Information Exchange Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Health Information Exchange Industry Revenue (Million), by Implementation Model 2025 & 2033

- Figure 27: Europe US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2025 & 2033

- Figure 28: Europe US Health Information Exchange Industry Revenue (Million), by Setup Type 2025 & 2033

- Figure 29: Europe US Health Information Exchange Industry Revenue Share (%), by Setup Type 2025 & 2033

- Figure 30: Europe US Health Information Exchange Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Europe US Health Information Exchange Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Europe US Health Information Exchange Industry Revenue (Million), by Exchange Type 2025 & 2033

- Figure 33: Europe US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2025 & 2033

- Figure 34: Europe US Health Information Exchange Industry Revenue (Million), by Component 2025 & 2033

- Figure 35: Europe US Health Information Exchange Industry Revenue Share (%), by Component 2025 & 2033

- Figure 36: Europe US Health Information Exchange Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe US Health Information Exchange Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Implementation Model 2025 & 2033

- Figure 39: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2025 & 2033

- Figure 40: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Setup Type 2025 & 2033

- Figure 41: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Setup Type 2025 & 2033

- Figure 42: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Application 2025 & 2033

- Figure 43: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Application 2025 & 2033

- Figure 44: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Exchange Type 2025 & 2033

- Figure 45: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2025 & 2033

- Figure 46: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Component 2025 & 2033

- Figure 47: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Component 2025 & 2033

- Figure 48: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Implementation Model 2025 & 2033

- Figure 51: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2025 & 2033

- Figure 52: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Setup Type 2025 & 2033

- Figure 53: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Setup Type 2025 & 2033

- Figure 54: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Application 2025 & 2033

- Figure 55: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Application 2025 & 2033

- Figure 56: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Exchange Type 2025 & 2033

- Figure 57: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2025 & 2033

- Figure 58: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Component 2025 & 2033

- Figure 59: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Component 2025 & 2033

- Figure 60: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2020 & 2033

- Table 2: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2020 & 2033

- Table 3: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2020 & 2033

- Table 5: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global US Health Information Exchange Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2020 & 2033

- Table 8: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2020 & 2033

- Table 9: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2020 & 2033

- Table 11: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2020 & 2033

- Table 17: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2020 & 2033

- Table 18: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2020 & 2033

- Table 20: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 21: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2020 & 2033

- Table 26: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2020 & 2033

- Table 27: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2020 & 2033

- Table 29: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 30: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2020 & 2033

- Table 41: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2020 & 2033

- Table 42: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2020 & 2033

- Table 44: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 45: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2020 & 2033

- Table 53: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2020 & 2033

- Table 54: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 55: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2020 & 2033

- Table 56: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 57: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Health Information Exchange Industry?

The projected CAGR is approximately 12.12%.

2. Which companies are prominent players in the US Health Information Exchange Industry?

Key companies in the market include Eclinical Works, Mckesson Corporation, Infor Inc, Epic Corporation Inc, mpro, Cerner Corporation, Optum Inc, Allscripts Healthcare Solutions Inc, Nextgen Healthcare Information Systems LLC, Newgen Software Technologies, Conifer Health Solutions, Medicity Inc.

3. What are the main segments of the US Health Information Exchange Industry?

The market segments include Implementation Model, Setup Type, Application, Exchange Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Electronic Health Records Resulting in the Expansion of the Market; Government Support via Various Programs and Incentives; Reduction in Healthcare Cost and Improved Efficacy.

6. What are the notable trends driving market growth?

The Decentralized/Federated Model is Expected to Hold a Notable Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Huge Initial Infrastructural Investment and Slow Return on Investment; Data Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

In October 2022, Mpowered Health launched its xChange, the United States consumer-mediated healthcare data exchange. The exchange enables health plans, health systems, and other healthcare organizations to request and obtain medical records from consumers with their consent.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Health Information Exchange Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Health Information Exchange Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Health Information Exchange Industry?

To stay informed about further developments, trends, and reports in the US Health Information Exchange Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence