Key Insights

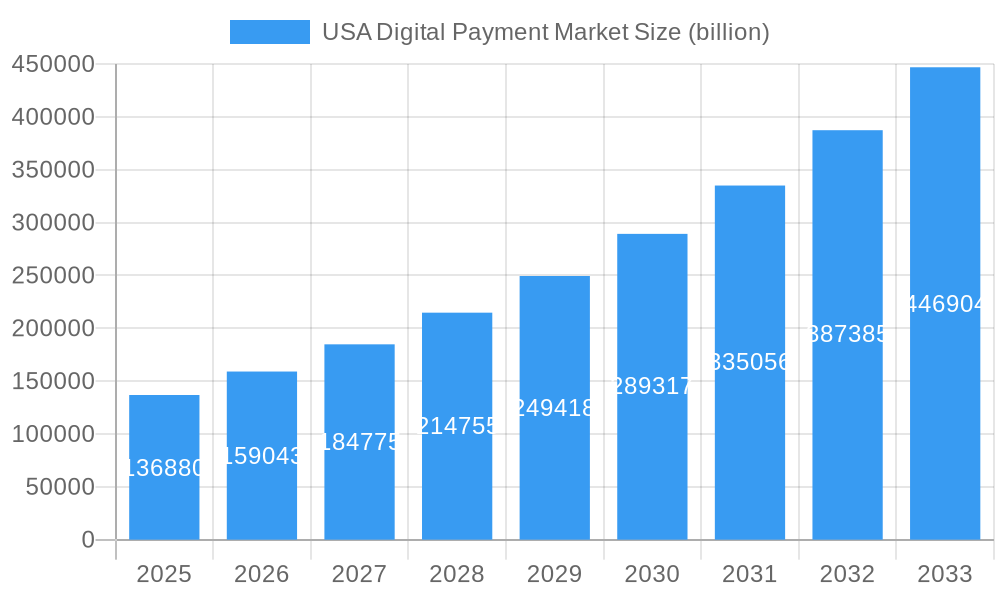

The US digital payment market is poised for substantial growth, projected to reach an impressive USD 136.88 billion by 2025, with an estimated compound annual growth rate (CAGR) of 16.2% extending through 2033. This robust expansion is fueled by a confluence of factors, primarily driven by the increasing adoption of smartphones and the proliferation of high-speed internet connectivity across the nation. Consumers are increasingly embracing the convenience and security offered by digital payment methods for everyday transactions, from retail purchases and entertainment to essential healthcare services and hospitality bookings. The shift away from traditional cash transactions is a defining characteristic, with innovations in payment technology constantly emerging to meet evolving consumer demands.

USA Digital Payment Market Market Size (In Billion)

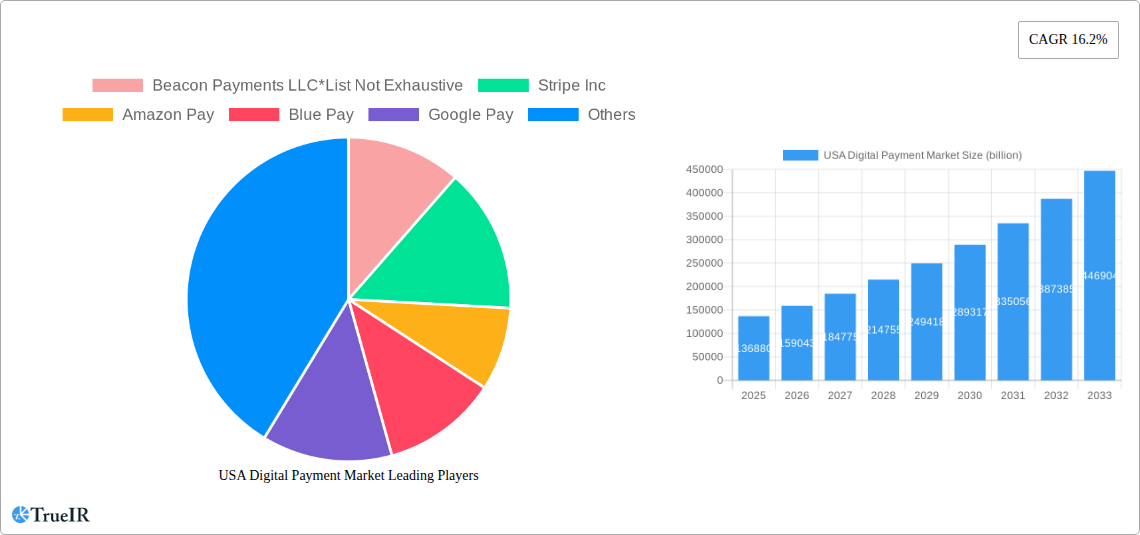

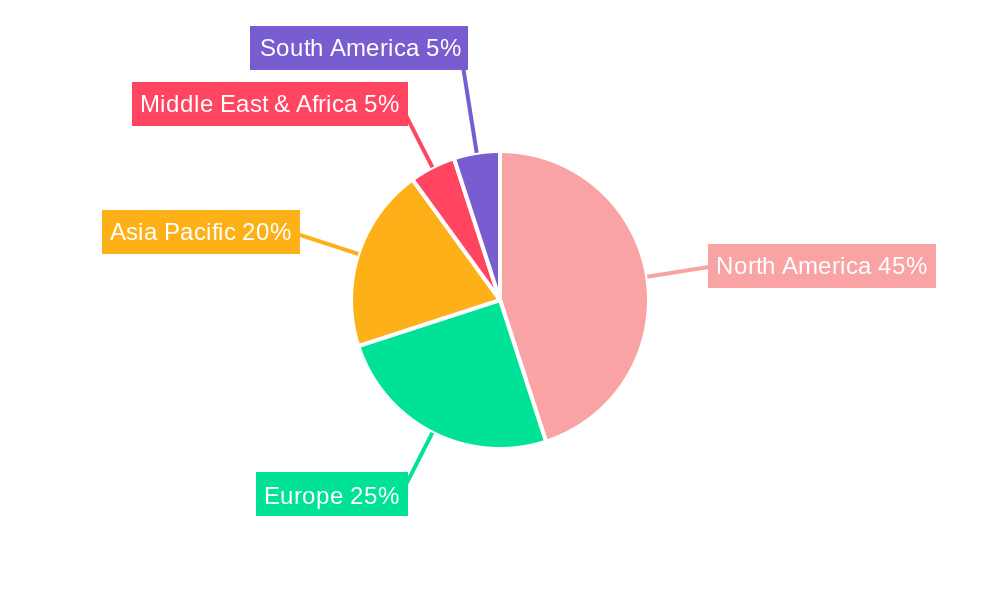

Key trends shaping this dynamic landscape include the rapid rise of digital wallets, such as mobile payment solutions and the integration of payment functionalities into broader digital ecosystems. The growing demand for seamless, contactless payment experiences is also a significant driver, accelerated by recent global health events. While the market is characterized by strong growth, certain restraints such as evolving regulatory frameworks and data security concerns necessitate continuous innovation and robust security measures from market participants. The competitive environment is fierce, with established financial institutions and agile fintech companies, including giants like Stripe, Amazon Pay, Google Pay, and PayPal, vying for market share through enhanced user experiences and expanded service offerings. The dominant presence of North America within the global digital payment arena, with the United States as a leading contributor, underscores the significant opportunities and the strategic importance of this market.

USA Digital Payment Market Company Market Share

Here's a dynamic, SEO-optimized report description for the USA Digital Payment Market, designed for immediate use:

Unlock unparalleled insights into the burgeoning USA Digital Payment Market with this definitive report. Covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025–2033, this analysis delves deep into the market's structure, trends, opportunities, and competitive landscape. Leveraging high-volume keywords such as "digital payments USA," "mobile payments market," "online payment solutions," "fintech growth," and "e-commerce payments," this report is engineered to capture the attention of industry leaders, investors, and stakeholders seeking a comprehensive understanding of this rapidly evolving sector. We project the USA Digital Payment Market to reach a colossal size, with market size exceeding $40 billion by 2025 and a projected CAGR of 15% from 2025–2033.

USA Digital Payment Market Market Structure & Competitive Landscape

The USA Digital Payment Market exhibits a moderately concentrated structure, characterized by the presence of both large, established financial institutions and agile fintech innovators. Innovation drivers are primarily fueled by the relentless pursuit of enhanced customer convenience, improved security protocols, and seamless integration across various platforms. Regulatory impacts, while often stringent, also foster trust and encourage the adoption of secure digital payment solutions. Product substitutes exist, particularly in emerging markets, but the entrenched network effects and user familiarity with established digital payment methods provide significant barriers to entry. End-user segmentation reveals a diverse adoption landscape, with retail and online sales dominating current usage. Mergers and Acquisitions (M&A) trends are a critical feature, indicating strategic consolidation and expansion of service offerings. Over the historical period (2019–2024), we observed an average of 15 M&A deals annually, primarily focused on acquiring innovative technologies and expanding market reach. The leading players, including Stripe Inc., Amazon Pay, and PayPal, hold a combined market share estimated at over 60% in 2024.

USA Digital Payment Market Market Trends & Opportunities

The USA Digital Payment Market is poised for exponential growth, driven by a confluence of technological advancements, evolving consumer behaviors, and an expanding digital economy. The market size is projected to surge from an estimated $35 billion in 2024 to over $40 billion in 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 15% anticipated from 2025 to 2033. This robust expansion is underpinned by several key trends. The increasing ubiquity of smartphones and high-speed internet connectivity has democratized access to digital payment services, making them an integral part of daily transactions. Consumers are increasingly prioritizing speed, convenience, and security, leading to a significant shift away from traditional payment methods towards digital wallets, contactless payments, and peer-to-peer (P2P) transfer applications. The e-commerce boom, further accelerated by recent global events, has created a massive demand for secure and efficient online payment gateways.

Technological shifts are playing a pivotal role. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing fraud detection and personalization, thereby bolstering consumer confidence. Blockchain technology, while still in its nascent stages of widespread adoption for payments, holds the potential to revolutionize cross-border transactions and micropayments by offering enhanced security and reduced transaction costs. The rise of Buy Now, Pay Later (BNPL) services has also opened new avenues for consumer spending and merchant revenue.

Opportunities abound for companies that can offer integrated, omnichannel payment solutions that cater to the diverse needs of both consumers and businesses. The expansion of digital payments into emerging sectors like healthcare and the continued penetration into the entertainment industry present significant growth avenues. Furthermore, the development of open banking initiatives and the increasing interoperability of payment systems will foster greater competition and innovation, ultimately benefiting the end-user. The market penetration rate for digital payments in the US is estimated to reach 75% by 2025, with substantial room for further growth in underserved segments and rural areas.

Dominant Markets & Segments in USA Digital Payment Market

The USA Digital Payment Market is characterized by the dominance of specific segments and end-user industries, driven by infrastructure, policy, and evolving consumer adoption patterns.

Mode of Payment:

Point of Sale (POS): This segment is witnessing a dynamic shift.

- Digital Wallet (includes Mobile Wallets): This sub-segment is experiencing the most rapid growth, driven by the widespread adoption of smartphones and the increasing preference for contactless and convenient transactions. In 2025, digital wallets are projected to account for approximately 45% of all POS transactions.

- Card Pay: While still significant, traditional card payments are gradually ceding market share to digital alternatives, though they remain a foundational element of the POS landscape. Card pay is expected to represent around 35% of POS transactions in 2025.

- Cash: The use of cash at the point of sale continues its decline, with a projected market share of less than 10% by 2025.

- Others: This includes emerging payment methods and niche POS solutions, holding a smaller but growing share.

Online Sale:

- Others: This broad category encompasses the majority of online payment methods, including credit/debit card processing, digital wallets, BNPL services, and direct bank transfers. The rapid growth of e-commerce solidifies the dominance of online sales, which are projected to constitute over 70% of all digital payment transactions by 2025.

End-user Industry:

- Retail: This remains the largest and most influential end-user industry for digital payments. The continuous expansion of e-commerce, coupled with the integration of digital payment solutions in brick-and-mortar stores, drives substantial transaction volumes. In 2025, the retail sector is expected to contribute over $15 billion to the digital payment market.

- Entertainment: The growth of digital streaming services, online gaming, and ticketing platforms has made the entertainment sector a significant contributor. The convenience of instant digital transactions is a key enabler for this industry.

- Healthcare: Digital payments are increasingly being adopted in healthcare for appointment booking, prescription refills, and insurance co-pays, improving efficiency and patient experience.

- Hospitality: Hotels, restaurants, and travel companies are leveraging digital payment solutions for bookings, in-room services, and contactless check-ins/check-outs.

- Other End-user Industries: This encompasses a wide range of sectors including education, government services, and personal remittances, all of which are progressively adopting digital payment methods.

Key growth drivers include robust internet infrastructure, supportive government policies encouraging digital adoption, and a growing consumer comfort level with online and mobile transactions. The dominance of digital wallets at the POS and the vastness of the retail sector are key indicators of current market leadership.

USA Digital Payment Market Product Analysis

The USA Digital Payment Market is characterized by a rapid evolution of products designed for enhanced security, convenience, and seamless integration. Innovations such as tokenization, biometric authentication, and real-time payment networks are becoming standard, bolstering consumer trust and reducing fraud. Mobile wallets and contactless payment solutions offer unparalleled ease of use, while Buy Now, Pay Later (BNPL) services are transforming consumer purchasing power. The competitive advantage lies in the ability of products to integrate effortlessly across diverse platforms and devices, catering to the omnichannel demands of modern consumers and businesses. The focus is on creating frictionless payment experiences that drive higher conversion rates and customer loyalty.

Key Drivers, Barriers & Challenges in USA Digital Payment Market

Key Drivers:

The USA Digital Payment Market is propelled by powerful forces including technological advancements like AI and blockchain, a strong economic environment favoring digital transactions, and government initiatives promoting financial inclusion and digital literacy. The widespread adoption of smartphones and high-speed internet access forms the bedrock of this growth.

Barriers & Challenges:

Significant challenges include the persistent threat of cybersecurity breaches and data privacy concerns, demanding robust security infrastructure. Regulatory complexities and evolving compliance requirements can also pose hurdles. Furthermore, the digital divide, particularly in underserved rural areas, limits universal access. Competitive pressures among a crowded market landscape can impact profit margins. Supply chain issues impacting hardware availability for POS systems can also be a restraint.

Growth Drivers in the USA Digital Payment Market Market

Growth in the USA Digital Payment Market is primarily fueled by the relentless pace of technological innovation, including advancements in AI for fraud detection and personalized experiences, and the increasing integration of contactless payment technologies. A robust and growing economy, coupled with a high consumer propensity for online spending and digital services, significantly boosts adoption. Government policies aimed at promoting digital financial inclusion and modernizing payment infrastructure create a fertile ground for expansion. The growing acceptance and implementation of Real-Time Payments (RTP) further accelerate transaction speeds and efficiency, driving market growth.

Challenges Impacting USA Digital Payment Market Growth

The USA Digital Payment Market faces significant challenges that can impede its growth trajectory. Regulatory complexities and the constant need for compliance with evolving data privacy laws like CCPA and potential federal regulations present a substantial hurdle. Cybersecurity threats, including sophisticated fraud schemes and data breaches, erode consumer trust and necessitate continuous investment in security measures. Fierce competitive pressures within the market can lead to price wars and squeezed profit margins for service providers. Additionally, the digital divide, where certain demographics or geographical regions lack adequate internet access or digital literacy, limits the universal adoption of digital payment solutions.

Key Players Shaping the USA Digital Payment Market Market

- Beacon Payments LLC

- Stripe Inc

- Amazon Pay

- Blue Pay

- Google Pay

- Tsys (Global Payments Inc)

- PayPal

- Chase Paymentech

- Dwolla

- Ingenico

Significant USA Digital Payment Market Industry Milestones

- September 2021: Global Payments Inc. announced an agreement to acquire MineralTree, a provider of accounts payable automation and B-2-B payments solutions. MineralTree's cloud-native solutions significantly expand the Global Payments target market and offer significant growth opportunities in the compelling technology markets.

- April 2022: Dwolla, a fintech company driving innovation with sophisticated inter-account payment solutions, announced the release of Virtual Account Number (VAN), a long-awaited feature for disconnecting banks and fintech. These VANs are a process management tool enabling organizations to manage complex payment workflows.

Future Outlook for USA Digital Payment Market Market

The future outlook for the USA Digital Payment Market is exceptionally promising, driven by continued innovation in areas such as embedded finance, the expansion of Central Bank Digital Currencies (CBDCs), and the increasing adoption of biometric authentication for enhanced security. The ongoing digital transformation across all industries will create sustained demand for frictionless payment solutions. Strategic opportunities lie in expanding services to underserved markets, developing more sophisticated B2B payment solutions, and leveraging data analytics to offer personalized financial products. The market is projected to witness sustained growth, solidifying its position as a cornerstone of the American economy.

USA Digital Payment Market Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

USA Digital Payment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Digital Payment Market Regional Market Share

Geographic Coverage of USA Digital Payment Market

USA Digital Payment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High proliferation of smartphones and e-commerce driving the market

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations in the Payments Industry

- 3.4. Market Trends

- 3.4.1. Retail businesses gaining more significant payment solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Digital Payment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. North America USA Digital Payment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.1.1. Point of Sale

- 6.1.1.1. Card Pay

- 6.1.1.2. Digital Wallet (includes Mobile Wallets)

- 6.1.1.3. Cash

- 6.1.1.4. Others

- 6.1.2. Online Sale

- 6.1.2.1. Others (

- 6.1.1. Point of Sale

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Entertainment

- 6.2.3. Healthcare

- 6.2.4. Hospitality

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7. South America USA Digital Payment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.1.1. Point of Sale

- 7.1.1.1. Card Pay

- 7.1.1.2. Digital Wallet (includes Mobile Wallets)

- 7.1.1.3. Cash

- 7.1.1.4. Others

- 7.1.2. Online Sale

- 7.1.2.1. Others (

- 7.1.1. Point of Sale

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Entertainment

- 7.2.3. Healthcare

- 7.2.4. Hospitality

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8. Europe USA Digital Payment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.1.1. Point of Sale

- 8.1.1.1. Card Pay

- 8.1.1.2. Digital Wallet (includes Mobile Wallets)

- 8.1.1.3. Cash

- 8.1.1.4. Others

- 8.1.2. Online Sale

- 8.1.2.1. Others (

- 8.1.1. Point of Sale

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Entertainment

- 8.2.3. Healthcare

- 8.2.4. Hospitality

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9. Middle East & Africa USA Digital Payment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.1.1. Point of Sale

- 9.1.1.1. Card Pay

- 9.1.1.2. Digital Wallet (includes Mobile Wallets)

- 9.1.1.3. Cash

- 9.1.1.4. Others

- 9.1.2. Online Sale

- 9.1.2.1. Others (

- 9.1.1. Point of Sale

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Entertainment

- 9.2.3. Healthcare

- 9.2.4. Hospitality

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10. Asia Pacific USA Digital Payment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.1.1. Point of Sale

- 10.1.1.1. Card Pay

- 10.1.1.2. Digital Wallet (includes Mobile Wallets)

- 10.1.1.3. Cash

- 10.1.1.4. Others

- 10.1.2. Online Sale

- 10.1.2.1. Others (

- 10.1.1. Point of Sale

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Entertainment

- 10.2.3. Healthcare

- 10.2.4. Hospitality

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Beacon Payments LLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stripe Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amazon Pay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Blue Pay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google Pay

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tsys (Global Payments Inc )

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PayPal

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chase Paymentech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dwolla

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ingenico

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Beacon Payments LLC*List Not Exhaustive

List of Figures

- Figure 1: Global USA Digital Payment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America USA Digital Payment Market Revenue (billion), by Mode of Payment 2025 & 2033

- Figure 3: North America USA Digital Payment Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 4: North America USA Digital Payment Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America USA Digital Payment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America USA Digital Payment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America USA Digital Payment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Digital Payment Market Revenue (billion), by Mode of Payment 2025 & 2033

- Figure 9: South America USA Digital Payment Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 10: South America USA Digital Payment Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: South America USA Digital Payment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: South America USA Digital Payment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America USA Digital Payment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Digital Payment Market Revenue (billion), by Mode of Payment 2025 & 2033

- Figure 15: Europe USA Digital Payment Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 16: Europe USA Digital Payment Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe USA Digital Payment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe USA Digital Payment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe USA Digital Payment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Digital Payment Market Revenue (billion), by Mode of Payment 2025 & 2033

- Figure 21: Middle East & Africa USA Digital Payment Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 22: Middle East & Africa USA Digital Payment Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Middle East & Africa USA Digital Payment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Middle East & Africa USA Digital Payment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Digital Payment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Digital Payment Market Revenue (billion), by Mode of Payment 2025 & 2033

- Figure 27: Asia Pacific USA Digital Payment Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 28: Asia Pacific USA Digital Payment Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific USA Digital Payment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific USA Digital Payment Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Digital Payment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Digital Payment Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 2: Global USA Digital Payment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global USA Digital Payment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global USA Digital Payment Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 5: Global USA Digital Payment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global USA Digital Payment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global USA Digital Payment Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 11: Global USA Digital Payment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global USA Digital Payment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global USA Digital Payment Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 17: Global USA Digital Payment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global USA Digital Payment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global USA Digital Payment Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 29: Global USA Digital Payment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global USA Digital Payment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global USA Digital Payment Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 38: Global USA Digital Payment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 39: Global USA Digital Payment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Digital Payment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Digital Payment Market?

The projected CAGR is approximately 16.2%.

2. Which companies are prominent players in the USA Digital Payment Market?

Key companies in the market include Beacon Payments LLC*List Not Exhaustive, Stripe Inc, Amazon Pay, Blue Pay, Google Pay, Tsys (Global Payments Inc ), PayPal, Chase Paymentech, Dwolla, Ingenico.

3. What are the main segments of the USA Digital Payment Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.88 billion as of 2022.

5. What are some drivers contributing to market growth?

High proliferation of smartphones and e-commerce driving the market.

6. What are the notable trends driving market growth?

Retail businesses gaining more significant payment solutions.

7. Are there any restraints impacting market growth?

; Stringent Regulations in the Payments Industry.

8. Can you provide examples of recent developments in the market?

September 2021 - Global Payments Inc. announced an agreement to acquire MineralTree, a provider of accounts payable automation and B-2-B payments solutions. MineralTree's cloud-native solutions significantly expand the Global Payments target market and offer significant growth opportunities in the compelling technology markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Digital Payment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Digital Payment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Digital Payment Market?

To stay informed about further developments, trends, and reports in the USA Digital Payment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence