Key Insights

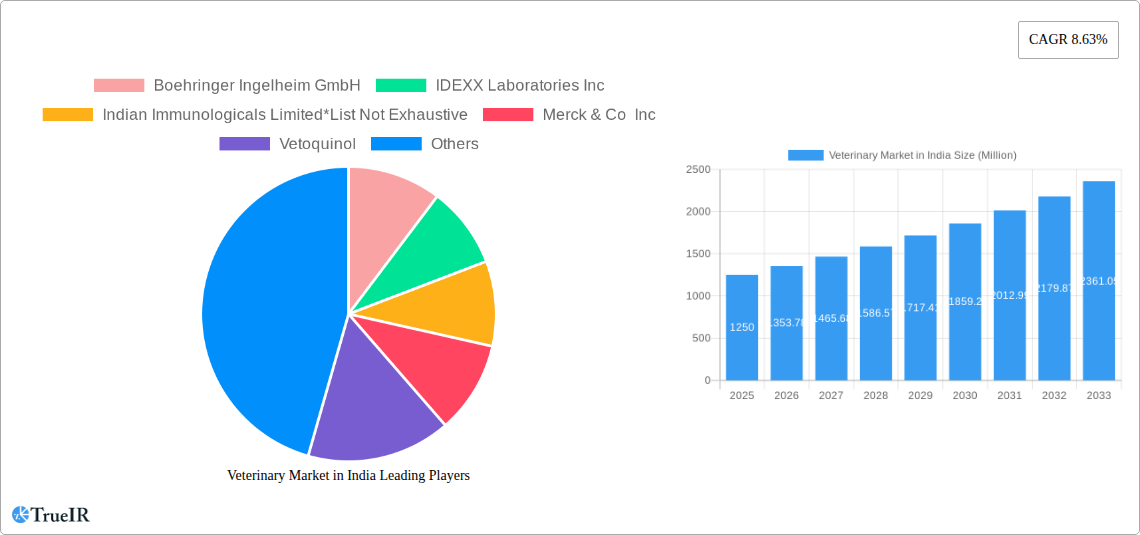

The Indian veterinary market, valued at $1.25 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.63% from 2025 to 2033. This expansion is fueled by several key factors. Rising pet ownership, particularly in urban areas, is driving demand for veterinary pharmaceuticals and diagnostics. Increasing awareness of animal health and welfare among pet owners is translating into higher spending on preventative care, sophisticated treatments, and specialized veterinary services. Furthermore, the growing livestock population, particularly in the dairy and poultry sectors, necessitates greater investment in animal health solutions to boost productivity and prevent disease outbreaks. Government initiatives promoting animal health and disease control are also contributing positively. The market is segmented by product (therapeutics, diagnostics), and animal type (dogs and cats, horses, ruminants, swine, poultry, other animals), reflecting diverse needs across the animal health landscape. Major players like Boehringer Ingelheim, IDEXX Laboratories, and Zoetis are actively shaping market dynamics through innovation and product diversification. Regional variations exist, with potentially higher growth in regions with greater pet ownership and livestock concentration. The market is also subject to some restraints like affordability constraints in certain sectors and regional disparities in veterinary infrastructure.

Veterinary Market in India Market Size (In Billion)

The forecast period (2025-2033) indicates continued growth driven by factors mentioned above, however a cautious approach is required. Economic fluctuations, changing consumer spending patterns and potential regulatory changes might impact growth trajectories. The increasing integration of technology, such as telemedicine and advanced diagnostic tools, is likely to transform service delivery and enhance efficiency. Companies are expected to focus on developing innovative products, expanding their market reach, and investing in research and development to maintain a competitive edge. The competitive landscape is characterized by a mix of multinational corporations and domestic players, reflecting the diverse nature of the market and its potential for further growth. The market will likely witness increased consolidation and strategic partnerships in the coming years.

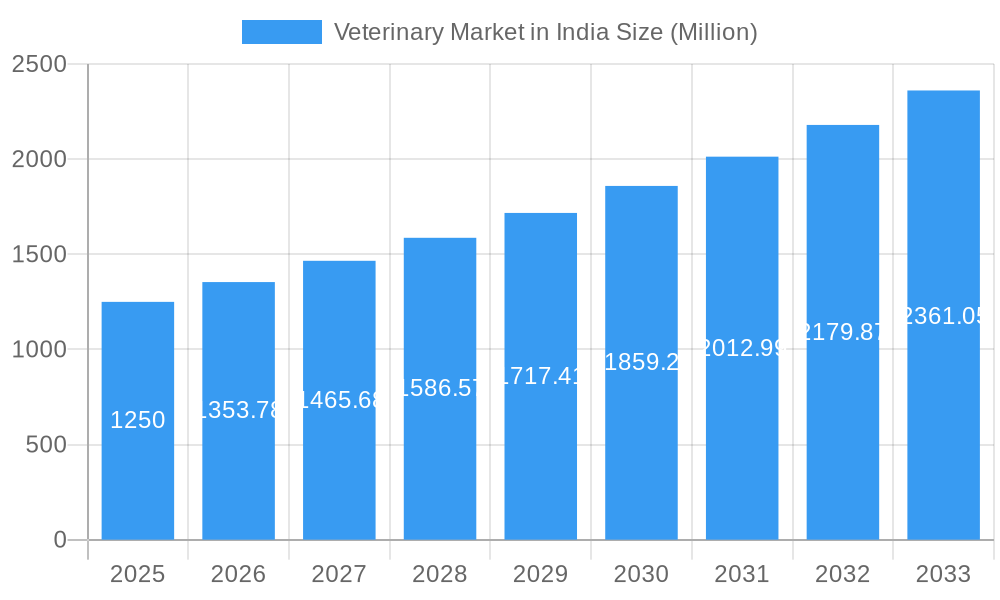

Veterinary Market in India Company Market Share

Veterinary Market in India: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning veterinary market in India, offering invaluable insights for industry stakeholders. With a focus on key segments, competitive dynamics, and future growth projections, this study is essential for strategic decision-making. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is valued in Millions.

Veterinary Market in India Market Structure & Competitive Landscape

The Indian veterinary market is characterized by a moderately concentrated landscape, with a few large multinational corporations and several domestic players vying for market share. The market concentration ratio (CR4) is estimated at xx%, indicating a relatively fragmented yet competitive structure. Key innovation drivers include advancements in diagnostics, therapeutics, and disease prevention technologies. Stringent regulatory frameworks, such as those overseen by the Central Drugs Standard Control Organization (CDSCO), influence product approvals and market entry. Product substitutes, particularly traditional or herbal remedies, continue to pose a challenge, although their market share is gradually declining. The market is segmented by animal type (dogs and cats, horses, ruminants, swine, poultry, other animals) and product type (therapeutics, diagnostics, other).

- Market Concentration: CR4 estimated at xx%.

- Innovation Drivers: Advancements in diagnostics, therapeutics, and vaccines.

- Regulatory Impacts: CDSCO regulations influence product approvals and market entry.

- Product Substitutes: Traditional remedies pose a competitive challenge.

- End-User Segmentation: Dominated by companion animals (dogs and cats) followed by livestock (ruminants, poultry).

- M&A Trends: xx M&A deals recorded in the last 5 years, valued at approximately xx Million.

Veterinary Market in India Market Trends & Opportunities

The Indian veterinary market is experiencing robust growth, driven by increasing pet ownership, rising awareness of animal health, and expanding access to veterinary services. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, such as telemedicine and AI-powered diagnostic tools, are transforming the industry. Consumer preferences are shifting towards premium pet care products and services, creating new opportunities for specialized veterinary practices. The competitive landscape is dynamic, with both domestic and international players investing in research and development, product diversification, and strategic partnerships. Market penetration of advanced diagnostic techniques and pharmaceuticals is growing steadily, but remains lower than in developed countries, indicating significant untapped potential.

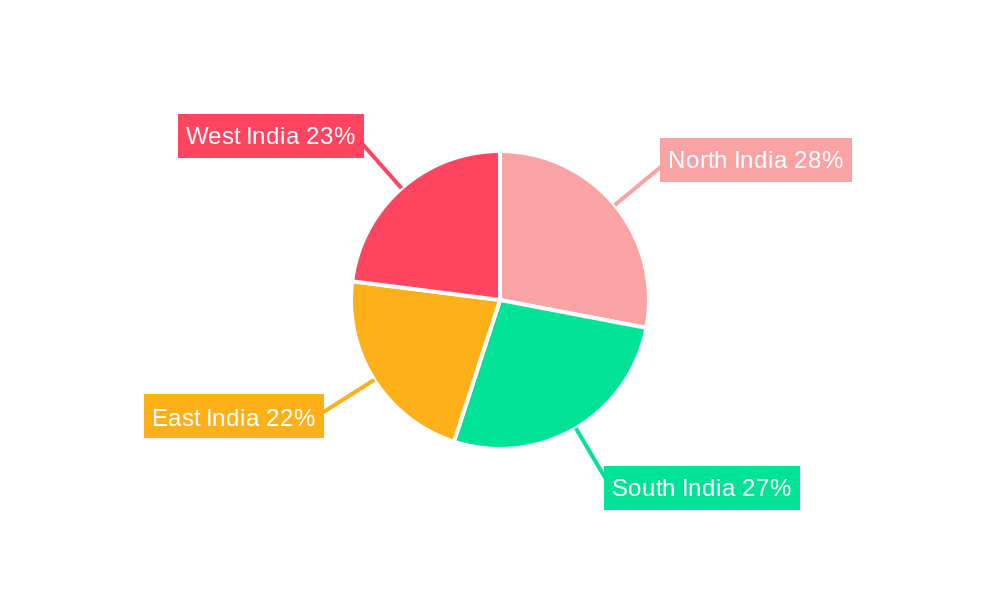

Dominant Markets & Segments in Veterinary Market in India

The companion animal segment (dogs and cats) dominates the Indian veterinary market, accounting for approximately xx% of the total market value in 2025. This is primarily due to increasing pet ownership, particularly in urban areas, coupled with rising disposable incomes and a growing willingness to spend on pet healthcare. The therapeutics segment holds a larger market share compared to diagnostics, although the diagnostics segment is experiencing faster growth due to technological advancements. Geographically, the market is concentrated in urban centers and rapidly developing states like Maharashtra, Tamil Nadu, and Gujarat.

Key Growth Drivers for Companion Animals (Dogs and Cats):

- Rising pet ownership and humanization of pets.

- Increasing disposable incomes in urban areas.

- Greater awareness of pet health and preventive care.

Key Growth Drivers for Therapeutics Segment:

- Growing incidence of zoonotic diseases.

- Increased demand for preventative vaccines.

- Development of novel therapeutics and formulations.

Key Growth Drivers for Diagnostics Segment:

- Adoption of advanced diagnostic technologies (e.g., PCR, ELISA).

- Focus on early disease detection and improved treatment outcomes.

Geographic Dominance: Urban centers of Maharashtra, Tamil Nadu and Gujarat.

Veterinary Market in India Product Analysis

Product innovation focuses on developing advanced diagnostics, effective therapeutics, and preventative vaccines tailored to specific animal needs. The market is witnessing increased adoption of technologically advanced products, including point-of-care diagnostics, personalized medicine, and targeted therapeutics. These innovations are improving treatment outcomes, reducing veterinary costs, and enhancing animal welfare. Companies are leveraging their competitive advantages by focusing on product quality, distribution networks, and brand building.

Key Drivers, Barriers & Challenges in Veterinary Market in India

Key Drivers: Rising pet ownership and increasing disposable incomes are key drivers. Government initiatives promoting animal welfare and disease control also play a significant role. Technological advancements are creating opportunities for improved diagnostic tools and therapeutics.

Key Challenges: Regulatory hurdles related to product approvals and distribution can impede market growth. Supply chain disruptions and logistical challenges, particularly in rural areas, can constrain product availability. Intense competition from both domestic and international players necessitates continuous innovation and strategic partnerships. The estimated xx% of the population still lacks access to quality veterinary care constitutes a significant challenge.

Growth Drivers in the Veterinary Market in India Market

The market’s growth is fueled by the increasing affordability of veterinary care, coupled with rising awareness about animal health and welfare. Government initiatives supporting animal health infrastructure and disease control programs, including vaccination drives, are also instrumental in expanding the market. Technological innovations such as telemedicine and point-of-care diagnostics are enhancing accessibility and affordability, further stimulating growth.

Challenges Impacting Veterinary Market in India Growth

Significant challenges include the fragmented nature of the veterinary services market, particularly in rural areas, resulting in limited reach and uneven access to quality care. Regulatory complexities and bureaucratic processes related to product approvals and distribution are also significant barriers. Furthermore, the competition from both established players and new entrants necessitates continuous innovation and adaptive business strategies to ensure survival.

Key Players Shaping the Veterinary Market in India Market

- Boehringer Ingelheim GmbH

- IDEXX Laboratories Inc

- Indian Immunologicals Limited

- Merck & Co Inc

- Vetoquinol

- Virbac

- Elanco Animal Health

- Zydus Cadila

- Zoetis Inc

- Hester Biosciences Limited

Significant Veterinary Market in India Industry Milestones

October 2022: Indian Immunologicals Limited (IIL) announced a Rs 700 Crore investment in a new animal vaccine manufacturing facility in Hyderabad, creating approximately 750 jobs. This significantly boosts the country's vaccine production capacity and strengthens its biosecurity against diseases like Foot and Mouth Disease.

December 2021: Fujifilm India Pvt. Ltd partnered with A'alda Vet India Pvt. Ltd to enhance pet healthcare facilities by providing advanced medical imaging and screening devices. This improves diagnostic capabilities and treatment outcomes for companion animals.

Future Outlook for Veterinary Market in India Market

The Indian veterinary market is poised for sustained growth, driven by factors such as increasing pet ownership, rising consumer spending on pet healthcare, and technological advancements. Strategic investments in research and development, alongside government support for animal health infrastructure, will further accelerate market expansion. Opportunities exist in expanding veterinary services to rural areas and leveraging technology to improve access to quality care. The market presents significant potential for both domestic and international players.

Veterinary Market in India Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti Infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

Veterinary Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Veterinary Market in India Regional Market Share

Geographic Coverage of Veterinary Market in India

Veterinary Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Adoption of Pet in India

- 3.3. Market Restrains

- 3.3.1. Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. The Vaccine Segment is Expected to Have the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti Infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Therapeutics

- 6.1.1.1. Vaccines

- 6.1.1.2. Parasiticides

- 6.1.1.3. Anti Infectives

- 6.1.1.4. Medical Feed Additives

- 6.1.1.5. Other Therapeutics

- 6.1.2. By Diagnostics

- 6.1.2.1. Immunodiagnostic Tests

- 6.1.2.2. Molecular Diagnostics

- 6.1.2.3. Diagnostic Imaging

- 6.1.2.4. Clinical Chemistry

- 6.1.2.5. Other Diagnostics

- 6.1.1. By Therapeutics

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs and Cats

- 6.2.2. Horses

- 6.2.3. Ruminants

- 6.2.4. Swine

- 6.2.5. Poultry

- 6.2.6. Other Animals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Therapeutics

- 7.1.1.1. Vaccines

- 7.1.1.2. Parasiticides

- 7.1.1.3. Anti Infectives

- 7.1.1.4. Medical Feed Additives

- 7.1.1.5. Other Therapeutics

- 7.1.2. By Diagnostics

- 7.1.2.1. Immunodiagnostic Tests

- 7.1.2.2. Molecular Diagnostics

- 7.1.2.3. Diagnostic Imaging

- 7.1.2.4. Clinical Chemistry

- 7.1.2.5. Other Diagnostics

- 7.1.1. By Therapeutics

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs and Cats

- 7.2.2. Horses

- 7.2.3. Ruminants

- 7.2.4. Swine

- 7.2.5. Poultry

- 7.2.6. Other Animals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Therapeutics

- 8.1.1.1. Vaccines

- 8.1.1.2. Parasiticides

- 8.1.1.3. Anti Infectives

- 8.1.1.4. Medical Feed Additives

- 8.1.1.5. Other Therapeutics

- 8.1.2. By Diagnostics

- 8.1.2.1. Immunodiagnostic Tests

- 8.1.2.2. Molecular Diagnostics

- 8.1.2.3. Diagnostic Imaging

- 8.1.2.4. Clinical Chemistry

- 8.1.2.5. Other Diagnostics

- 8.1.1. By Therapeutics

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs and Cats

- 8.2.2. Horses

- 8.2.3. Ruminants

- 8.2.4. Swine

- 8.2.5. Poultry

- 8.2.6. Other Animals

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. By Therapeutics

- 9.1.1.1. Vaccines

- 9.1.1.2. Parasiticides

- 9.1.1.3. Anti Infectives

- 9.1.1.4. Medical Feed Additives

- 9.1.1.5. Other Therapeutics

- 9.1.2. By Diagnostics

- 9.1.2.1. Immunodiagnostic Tests

- 9.1.2.2. Molecular Diagnostics

- 9.1.2.3. Diagnostic Imaging

- 9.1.2.4. Clinical Chemistry

- 9.1.2.5. Other Diagnostics

- 9.1.1. By Therapeutics

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs and Cats

- 9.2.2. Horses

- 9.2.3. Ruminants

- 9.2.4. Swine

- 9.2.5. Poultry

- 9.2.6. Other Animals

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. By Therapeutics

- 10.1.1.1. Vaccines

- 10.1.1.2. Parasiticides

- 10.1.1.3. Anti Infectives

- 10.1.1.4. Medical Feed Additives

- 10.1.1.5. Other Therapeutics

- 10.1.2. By Diagnostics

- 10.1.2.1. Immunodiagnostic Tests

- 10.1.2.2. Molecular Diagnostics

- 10.1.2.3. Diagnostic Imaging

- 10.1.2.4. Clinical Chemistry

- 10.1.2.5. Other Diagnostics

- 10.1.1. By Therapeutics

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs and Cats

- 10.2.2. Horses

- 10.2.3. Ruminants

- 10.2.4. Swine

- 10.2.5. Poultry

- 10.2.6. Other Animals

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IDEXX Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Indian Immunologicals Limited*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck & Co Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vetoquinol

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Virbac

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elanco Animal Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zydus Cadila

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zoetis Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hester Biosciences Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim GmbH

List of Figures

- Figure 1: Global Veterinary Market in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 5: North America Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 9: South America Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: South America Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: South America Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 17: Europe Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Europe Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Middle East & Africa Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East & Africa Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 29: Asia Pacific Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Asia Pacific Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Global Veterinary Market in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 30: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 39: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Market in India?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Veterinary Market in India?

Key companies in the market include Boehringer Ingelheim GmbH, IDEXX Laboratories Inc, Indian Immunologicals Limited*List Not Exhaustive, Merck & Co Inc, Vetoquinol, Virbac, Elanco Animal Health, Zydus Cadila, Zoetis Inc, Hester Biosciences Limited.

3. What are the main segments of the Veterinary Market in India?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Adoption of Pet in India.

6. What are the notable trends driving market growth?

The Vaccine Segment is Expected to Have the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

October 2022 : Hyderabad-based Indian Immunologicals Limited (IIL) announced that the company will invest about Rs 700 Crores to set up a new animal vaccine manufacturing facility in Genome Valley, Hyderabad - the 'Vaccine Hub of the World', to meet the vaccine security of the nation against economically important diseases such as Foot and Mouth disease (FMD) and other emerging diseases. The facility will create total employment for around 750 people.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Market in India?

To stay informed about further developments, trends, and reports in the Veterinary Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence