Key Insights

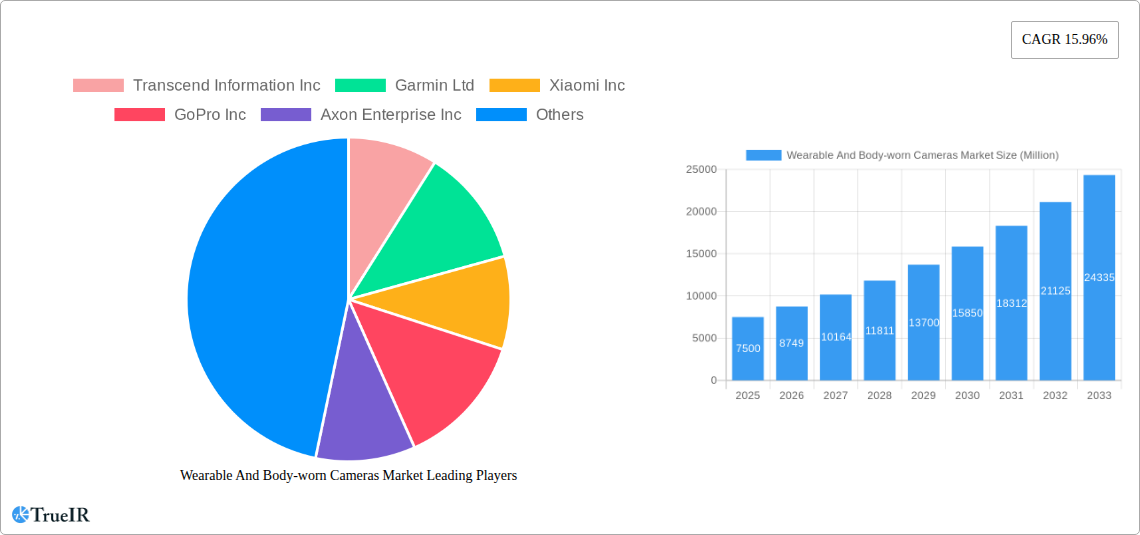

The Wearable and Body-Worn Cameras Market is experiencing robust expansion, driven by increasing adoption across law enforcement, personal safety, and industrial sectors. With a current market size of $7.5 Billion in 2025, the sector is projected to witness a significant Compound Annual Growth Rate (CAGR) of 15.96% through 2033. This impressive growth trajectory is fueled by several key factors. The escalating demand for enhanced accountability and transparency in public services, particularly within law enforcement agencies, is a primary driver. The increasing need for robust evidence collection in criminal investigations and legal proceedings further bolsters market demand. Furthermore, advancements in technology, leading to more compact, durable, and feature-rich camera devices with improved battery life and data storage capabilities, are making these solutions more attractive. The growing awareness and implementation of personal safety devices, especially for individuals in high-risk professions or environments, also contribute to market expansion. The integration of AI and cloud-based data management is also emerging as a significant trend, offering advanced analytical capabilities and efficient data handling for both law enforcement and commercial applications.

Wearable And Body-worn Cameras Market Market Size (In Billion)

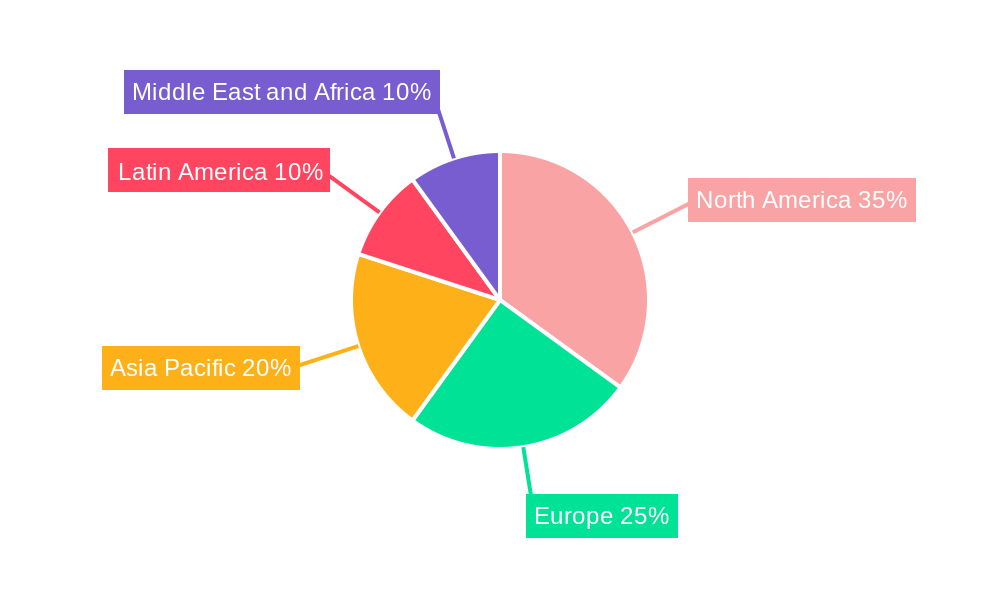

The market is segmented by end-user into Local Police, Special Law Enforcement Agencies, Sports and Adventure, and Other End Users. The application areas include Personal Safety and Security, Law Enforcement, Sports and Adventure, and Industrial. While law enforcement remains a dominant segment, the growing adoption in industrial settings for safety monitoring and training, as well as the expanding use in adventure sports for recording and safety, present significant growth opportunities. Key players like Garmin Ltd., Xiaomi Inc., GoPro Inc., and Axon Enterprise Inc. are actively innovating and expanding their product portfolios to cater to these diverse needs. Geographically, North America is expected to lead the market due to early adoption and stringent regulations, followed by Europe and the Asia Pacific region, which is witnessing rapid growth due to increasing security concerns and government initiatives. Challenges such as high initial investment costs and data privacy concerns are present but are being addressed through technological advancements and evolving regulatory frameworks.

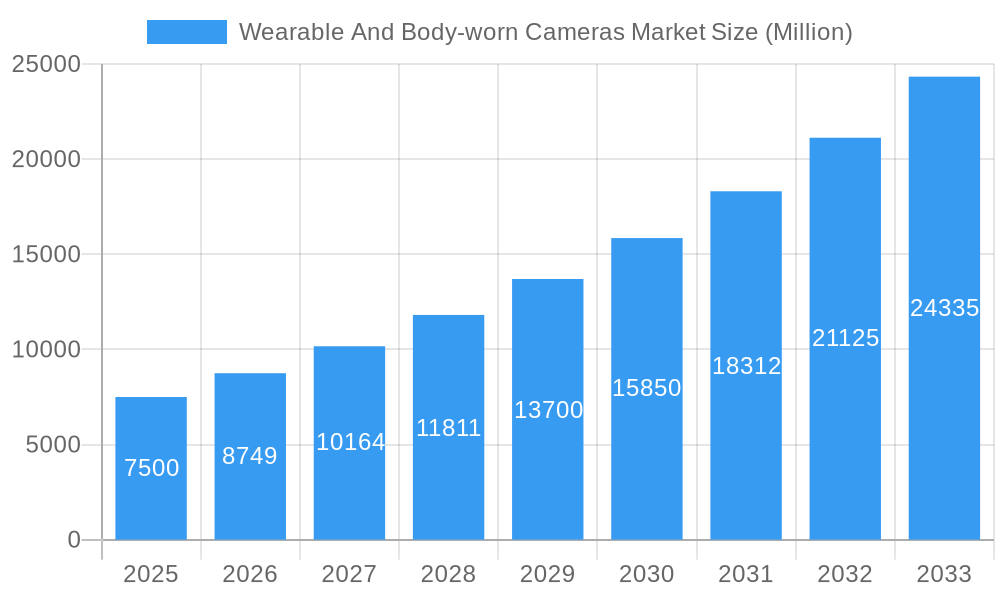

Wearable And Body-worn Cameras Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Wearable And Body-worn Cameras market, offering critical insights into market dynamics, key players, emerging trends, and future growth prospects. Leveraging extensive data and expert analysis, this report is an essential resource for stakeholders seeking to understand and capitalize on this rapidly evolving sector. The study period spans from 2019 to 2033, with a base year of 2025, and a detailed forecast period from 2025 to 2033, built upon historical data from 2019 to 2024. The estimated market value for 2025 is projected to be in the billions of dollars, with significant growth anticipated.

Wearable And Body-worn Cameras Market Market Structure & Competitive Landscape

The Wearable And Body-worn Cameras market exhibits a moderately fragmented structure, characterized by the presence of both established global manufacturers and emerging niche players. The competitive landscape is intensely driven by continuous technological innovation, stringent regulatory frameworks, and evolving end-user demands. Innovation in areas such as enhanced battery life, improved video resolution, advanced data management capabilities, and integrated communication features are crucial for maintaining a competitive edge. Regulatory impacts, particularly concerning privacy, data retention, and evidence admissibility, play a significant role in shaping product development and market entry strategies. While the market currently shows a concentration ratio of approximately 40% amongst the top five players, strategic mergers and acquisitions (M&A) are expected to further consolidate the market in the coming years. Product substitutes, such as mobile phone camera functionalities, are present but lack the dedicated features and robust design of specialized body-worn cameras. The segmentation by end-user, with Local Police and Special Law Enforcement Agencies forming a dominant segment, alongside the growing applications in Personal Safety and Security, drives significant R&D investments. The increasing adoption across diverse sectors, from industrial safety to sports and adventure, further fuels market competition and diversification.

- Market Concentration: Moderately fragmented with top players holding approximately 40% of the market share.

- Innovation Drivers: Enhanced battery life, HD/4K recording, AI-powered analytics, secure cloud storage, real-time streaming, ruggedized designs.

- Regulatory Impacts: Evolving privacy laws, data security standards, and legal admissibility of recorded evidence.

- Product Substitutes: Smartphone cameras, dashcams (limited scope).

- End-User Segmentation: Dominated by law enforcement, with significant growth in industrial and personal safety.

- M&A Trends: Expected to increase as companies seek to expand product portfolios and market reach.

Wearable And Body-worn Cameras Market Market Trends & Opportunities

The global Wearable And Body-worn Cameras market is on an upward trajectory, projected to witness substantial growth and expansion over the forecast period (2025–2033). This surge is fueled by a confluence of factors including escalating public safety concerns, increasing demand for transparency and accountability in law enforcement, and the burgeoning use of these devices across various industrial and recreational sectors. The market size is estimated to reach tens of billions of dollars by 2033, with a robust Compound Annual Growth Rate (CAGR) of approximately 15%. Technological advancements are at the forefront of this market's evolution. We are witnessing a significant shift towards higher resolution cameras, improved low-light performance, enhanced battery longevity, and more sophisticated data management solutions, including cloud-based storage and AI-powered analytics for incident reconstruction and evidence management.

Consumer preferences are increasingly leaning towards user-friendly interfaces, lightweight and ergonomic designs, and seamless integration with existing communication and data systems. The "always-on" recording capabilities, coupled with advanced features like live streaming and real-time location tracking, are becoming standard expectations. The competitive dynamics are intensifying, with key players differentiating themselves through superior product features, robust software ecosystems, and strategic partnerships with government agencies and private enterprises. The market penetration rate for body-worn cameras in law enforcement is already high in developed nations but continues to expand globally, while its adoption in sectors like industrial safety, security services, and even personal safety is rapidly gaining momentum.

Emerging opportunities lie in the development of specialized cameras for niche applications, such as extreme sports, remote site monitoring, and emergency services. The integration of Internet of Things (IoT) capabilities, enabling these cameras to communicate with other smart devices and create comprehensive data networks, presents a significant growth avenue. Furthermore, the increasing focus on preventative safety measures and the need for irrefutable evidence in case of disputes or incidents are driving demand across a wider spectrum of end-users. The development of secure and encrypted data transmission protocols will be crucial for maintaining user trust and ensuring compliance with privacy regulations. The market is ripe for solutions that offer end-to-end data security, from capture to storage and retrieval.

Dominant Markets & Segments in Wearable And Body-worn Cameras Market

The Wearable And Body-worn Cameras market demonstrates clear dominance in specific geographic regions and end-user segments, driven by a complex interplay of policy, infrastructure, and demand. North America, particularly the United States, stands as the leading market, largely attributed to extensive government mandates and funding for law enforcement agencies to adopt body-worn camera programs. The infrastructure for secure data storage and management is well-established, facilitating widespread adoption. Europe follows closely, with increasing adoption rates driven by privacy concerns and a growing emphasis on police accountability.

Within the end-user segmentation, Local Police and Special Law Enforcement Agencies represent the most significant and dominant segment. These sectors have been early adopters, driven by the critical need for evidence collection, officer safety, and community trust-building. The sheer volume of deployments in these agencies, often supported by government initiatives and grants, solidifies their leading position. The global market size for law enforcement applications alone is projected to be in the billions of dollars.

The Personal Safety and Security application segment is experiencing a significant surge in growth, driven by individual consumers seeking enhanced personal security. This is further propelled by the increasing urbanization and rising crime rates in certain regions, making individuals more inclined to invest in personal safety devices. The market penetration for personal safety cameras, while currently lower than law enforcement, is exhibiting a substantial CAGR, indicating a strong future growth potential.

Sports and Adventure is another noteworthy segment, with an increasing number of athletes and adventure enthusiasts utilizing wearable cameras to capture their experiences. The proliferation of action cameras, exemplified by brands like GoPro, underscores the demand for rugged, high-definition recording devices for extreme activities. This segment, though smaller in market size compared to law enforcement, is characterized by rapid innovation and a strong consumer-driven demand for durable and user-friendly products.

The Industrial application segment, encompassing sectors like construction, oil and gas, and manufacturing, is also demonstrating robust growth. These industries are increasingly deploying body-worn cameras for worker safety, incident investigation, and training purposes. The ability to document hazardous environments and operational procedures accurately contributes to improved safety protocols and reduced liability. The market size in this segment is also expected to grow steadily as more companies recognize the value proposition of these devices.

- Leading Region: North America (especially the United States) due to government mandates and funding.

- Dominant End User: Local Police and Special Law Enforcement Agencies, driven by accountability and evidence needs.

- Key Growth Application: Personal Safety and Security, fueled by rising safety concerns.

- Emerging Application: Industrial, driven by safety and operational documentation requirements.

- Growth Drivers in Dominant Segments:

- Law Enforcement: Government mandates, public demand for transparency, legal admissibility of evidence, officer safety initiatives.

- Personal Safety: Increasing urbanization, rising crime rates, consumer desire for self-protection, technological advancements in compact cameras.

- Industrial: Enhanced worker safety regulations, need for incident documentation, training and compliance purposes, remote monitoring capabilities.

Wearable And Body-worn Cameras Market Product Analysis

The wearable and body-worn cameras market is characterized by continuous product innovation focused on enhancing functionality, durability, and user experience. Key advancements include higher resolution imaging (4K and beyond), superior low-light performance, extended battery life for extended operational periods, and integrated GPS for location tracking. Many devices now feature wide-angle lenses to capture a broader field of view, crucial for comprehensive evidence gathering. Furthermore, the integration of advanced features like pre-event recording buffers, secure data encryption, and seamless cloud synchronization for evidence management are becoming standard. Competitive advantages are being carved out through ruggedized designs capable of withstanding harsh environmental conditions and impact resistance, along with intuitive user interfaces for easy operation by end-users in demanding situations.

Key Drivers, Barriers & Challenges in Wearable And Body-worn Cameras Market

Key Drivers:

- Public Safety and Law Enforcement Mandates: Increasing global emphasis on transparency, accountability, and evidence-based policing is a primary growth driver. Government initiatives and funding for law enforcement agencies to equip officers with body-worn cameras are significant.

- Technological Advancements: Continuous improvements in camera resolution, battery life, data storage, and connectivity are making devices more effective and accessible.

- Growing Demand for Personal Safety: Rising concerns about personal security in both public and private spheres are driving individual adoption for self-protection.

- Industrial Safety and Compliance: The need to document hazardous environments, ensure worker safety, and meet regulatory compliance in industries like construction, mining, and manufacturing is fueling adoption.

Barriers & Challenges:

- High Initial Investment and Ongoing Costs: The purchase price of professional-grade body-worn cameras, coupled with associated costs for data storage, management software, and maintenance, can be a significant barrier, especially for smaller organizations. The projected initial investment for widespread law enforcement deployment can exceed tens of millions of dollars.

- Privacy Concerns and Data Security: The vast amounts of data collected raise significant privacy issues, necessitating robust data protection policies and secure storage solutions to prevent breaches and misuse. This can also lead to complex legal challenges regarding data access and retention.

- Regulatory Complexities and Standardization: The lack of uniform global standards for data collection, storage, and admissibility of evidence can create hurdles for manufacturers and users operating across different jurisdictions.

- Battery Life Limitations and Data Management: While improving, battery life can still be a constraint for extended operations, and the sheer volume of video data generated poses significant challenges for efficient storage, retrieval, and analysis.

Growth Drivers in the Wearable And Body-worn Cameras Market Market

The growth of the wearable and body-worn cameras market is primarily propelled by escalating demands for transparency and accountability across various sectors. In law enforcement, the push for improved community relations and evidence integrity remains a critical catalyst, often reinforced by legislative mandates and public outcry for greater police oversight. Technological advancements are continuously enhancing device capabilities, offering higher resolution video, extended battery life, and more sophisticated data management solutions, thereby increasing their utility and appeal. The growing awareness and concern for personal safety among individuals, especially in urban environments, are spurring the adoption of body-worn cameras for self-protection. Furthermore, stringent industrial safety regulations and the need for accurate incident documentation in high-risk sectors like construction and manufacturing are opening new avenues for market expansion. Economic factors, including government funding for public safety initiatives and the decreasing cost of advanced technologies, also contribute to the market's upward trajectory.

Challenges Impacting Wearable And Body-worn Cameras Market Growth

Despite robust growth, the wearable and body-worn cameras market faces several significant challenges. The substantial upfront cost of acquiring these devices, coupled with the ongoing expenses associated with data storage, cloud services, and system maintenance, can be a considerable barrier, particularly for smaller law enforcement agencies and private organizations. Privacy concerns and the ethical implications of constant surveillance necessitate stringent data protection regulations and secure storage infrastructure to prevent data breaches and unauthorized access, adding complexity and cost. The lack of universally standardized protocols for data collection, retention, and the admissibility of recorded evidence across different jurisdictions creates regulatory hurdles. Moreover, the sheer volume of data generated by these cameras presents immense challenges in terms of efficient storage, retrieval, and analysis, often requiring significant IT infrastructure and specialized personnel. Supply chain disruptions and the reliance on certain component manufacturers can also impact production and availability.

Key Players Shaping the Wearable And Body-worn Cameras Market Market

- Transcend Information Inc

- Garmin Ltd

- Xiaomi Inc

- GoPro Inc

- Axon Enterprise Inc

- Panasonic Holding Corporation

- Wolfcom Enterprise

- Pinnacle Response Ltd

- Digital Ally Inc

- Sony Corporation

Significant Wearable And Body-worn Cameras Market Industry Milestones

- April 2023: Axon released its new body camera, Axon Body 4, featuring real-time multi-person communication, an emergency alert watch with a remote button, and automatic recording capabilities triggered by proximity to critical locations. This launch signifies advancements in integrated officer safety and communication.

- May 2023: Motorola Solutions announced that the London police force will begin utilizing body-worn cameras. This deployment highlights the growing international adoption of these devices for incident recording, promoting fairness, accountability, and safety for both police officers and the public.

Future Outlook for Wearable And Body-worn Cameras Market Market

The future outlook for the Wearable And Body-worn Cameras market is exceptionally promising, driven by ongoing technological innovation and expanding application landscapes. The convergence of AI, 5G connectivity, and advanced analytics will lead to more intelligent cameras capable of real-time threat detection, automated incident analysis, and seamless integration with broader public safety networks. The increasing adoption of these devices by industrial sectors for enhanced worker safety and operational efficiency, alongside a continued strong demand from law enforcement and a burgeoning personal safety segment, will fuel substantial market growth. Opportunities lie in developing highly specialized cameras for niche environments, such as extreme weather conditions or confined spaces, and in creating comprehensive ecosystem solutions that manage the entire data lifecycle from capture to archival and analysis. Strategic partnerships and continuous product development will be key to capitalizing on the significant market potential.

Wearable And Body-worn Cameras Market Segmentation

-

1. End User

- 1.1. Local Police

- 1.2. Special Law Enforcement Agencies

- 1.3. Sports and Adventure

- 1.4. Other End Users

-

2. Application

- 2.1. Personal Safety and Security

- 2.2. Law Enforcement

- 2.3. Sports and Adventure

- 2.4. Industrial

Wearable And Body-worn Cameras Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Wearable And Body-worn Cameras Market Regional Market Share

Geographic Coverage of Wearable And Body-worn Cameras Market

Wearable And Body-worn Cameras Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Demand from Adventure Tourism; Rising Crime Rate Across Various Regions

- 3.3. Market Restrains

- 3.3.1. Data Stored can be Tampered

- 3.4. Market Trends

- 3.4.1. Rising Crime Rate Across Various Regions Will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable And Body-worn Cameras Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Local Police

- 5.1.2. Special Law Enforcement Agencies

- 5.1.3. Sports and Adventure

- 5.1.4. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Safety and Security

- 5.2.2. Law Enforcement

- 5.2.3. Sports and Adventure

- 5.2.4. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Wearable And Body-worn Cameras Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Local Police

- 6.1.2. Special Law Enforcement Agencies

- 6.1.3. Sports and Adventure

- 6.1.4. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Safety and Security

- 6.2.2. Law Enforcement

- 6.2.3. Sports and Adventure

- 6.2.4. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Wearable And Body-worn Cameras Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Local Police

- 7.1.2. Special Law Enforcement Agencies

- 7.1.3. Sports and Adventure

- 7.1.4. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Safety and Security

- 7.2.2. Law Enforcement

- 7.2.3. Sports and Adventure

- 7.2.4. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Wearable And Body-worn Cameras Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Local Police

- 8.1.2. Special Law Enforcement Agencies

- 8.1.3. Sports and Adventure

- 8.1.4. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Safety and Security

- 8.2.2. Law Enforcement

- 8.2.3. Sports and Adventure

- 8.2.4. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Wearable And Body-worn Cameras Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Local Police

- 9.1.2. Special Law Enforcement Agencies

- 9.1.3. Sports and Adventure

- 9.1.4. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Safety and Security

- 9.2.2. Law Enforcement

- 9.2.3. Sports and Adventure

- 9.2.4. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Wearable And Body-worn Cameras Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Local Police

- 10.1.2. Special Law Enforcement Agencies

- 10.1.3. Sports and Adventure

- 10.1.4. Other End Users

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Safety and Security

- 10.2.2. Law Enforcement

- 10.2.3. Sports and Adventure

- 10.2.4. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Transcend Information Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Garmin Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Xiaomi Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GoPro Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Axon Enterprise Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic Holding Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wolfcom Enterprise

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pinnacle Response Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Digital Ally Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sony Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Transcend Information Inc

List of Figures

- Figure 1: Global Wearable And Body-worn Cameras Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Wearable And Body-worn Cameras Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Wearable And Body-worn Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America Wearable And Body-worn Cameras Market Volume (K Unit), by End User 2025 & 2033

- Figure 5: North America Wearable And Body-worn Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Wearable And Body-worn Cameras Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Wearable And Body-worn Cameras Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Wearable And Body-worn Cameras Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Wearable And Body-worn Cameras Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Wearable And Body-worn Cameras Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Wearable And Body-worn Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Wearable And Body-worn Cameras Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Wearable And Body-worn Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Wearable And Body-worn Cameras Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Wearable And Body-worn Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 16: Europe Wearable And Body-worn Cameras Market Volume (K Unit), by End User 2025 & 2033

- Figure 17: Europe Wearable And Body-worn Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Wearable And Body-worn Cameras Market Volume Share (%), by End User 2025 & 2033

- Figure 19: Europe Wearable And Body-worn Cameras Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Wearable And Body-worn Cameras Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Wearable And Body-worn Cameras Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Wearable And Body-worn Cameras Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Wearable And Body-worn Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Wearable And Body-worn Cameras Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Wearable And Body-worn Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Wearable And Body-worn Cameras Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Wearable And Body-worn Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Asia Pacific Wearable And Body-worn Cameras Market Volume (K Unit), by End User 2025 & 2033

- Figure 29: Asia Pacific Wearable And Body-worn Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Wearable And Body-worn Cameras Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Asia Pacific Wearable And Body-worn Cameras Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific Wearable And Body-worn Cameras Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Wearable And Body-worn Cameras Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Wearable And Body-worn Cameras Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Wearable And Body-worn Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Wearable And Body-worn Cameras Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Wearable And Body-worn Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Wearable And Body-worn Cameras Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Wearable And Body-worn Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 40: Latin America Wearable And Body-worn Cameras Market Volume (K Unit), by End User 2025 & 2033

- Figure 41: Latin America Wearable And Body-worn Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 42: Latin America Wearable And Body-worn Cameras Market Volume Share (%), by End User 2025 & 2033

- Figure 43: Latin America Wearable And Body-worn Cameras Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Latin America Wearable And Body-worn Cameras Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Latin America Wearable And Body-worn Cameras Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Latin America Wearable And Body-worn Cameras Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Latin America Wearable And Body-worn Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Wearable And Body-worn Cameras Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Wearable And Body-worn Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Wearable And Body-worn Cameras Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Wearable And Body-worn Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 52: Middle East and Africa Wearable And Body-worn Cameras Market Volume (K Unit), by End User 2025 & 2033

- Figure 53: Middle East and Africa Wearable And Body-worn Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Middle East and Africa Wearable And Body-worn Cameras Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Middle East and Africa Wearable And Body-worn Cameras Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Wearable And Body-worn Cameras Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Wearable And Body-worn Cameras Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Wearable And Body-worn Cameras Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Wearable And Body-worn Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Wearable And Body-worn Cameras Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Wearable And Body-worn Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Wearable And Body-worn Cameras Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 3: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 9: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 21: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 33: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global Wearable And Body-worn Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Wearable And Body-worn Cameras Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable And Body-worn Cameras Market?

The projected CAGR is approximately 15.96%.

2. Which companies are prominent players in the Wearable And Body-worn Cameras Market?

Key companies in the market include Transcend Information Inc, Garmin Ltd, Xiaomi Inc, GoPro Inc, Axon Enterprise Inc, Panasonic Holding Corporation, Wolfcom Enterprise, Pinnacle Response Ltd, Digital Ally Inc, Sony Corporation.

3. What are the main segments of the Wearable And Body-worn Cameras Market?

The market segments include End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.5 Million as of 2022.

5. What are some drivers contributing to market growth?

High Demand from Adventure Tourism; Rising Crime Rate Across Various Regions.

6. What are the notable trends driving market growth?

Rising Crime Rate Across Various Regions Will Drive the Market.

7. Are there any restraints impacting market growth?

Data Stored can be Tampered.

8. Can you provide examples of recent developments in the market?

April 2023: Axon has released its new camera that police officers wear on their bodies. It's called the Axon Body 4. This new camera lets the person wearing it talk to different people at the same time, and they can talk to each other right away. There is a special button on a watch that someone can wear. When they press this button, it tells other people that they need help. It also shows where they are on a special map that only certain people can see. If a police officer gets near a place where something important might happen, the watch can start recording automatically.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable And Body-worn Cameras Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable And Body-worn Cameras Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable And Body-worn Cameras Market?

To stay informed about further developments, trends, and reports in the Wearable And Body-worn Cameras Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence