Key Insights

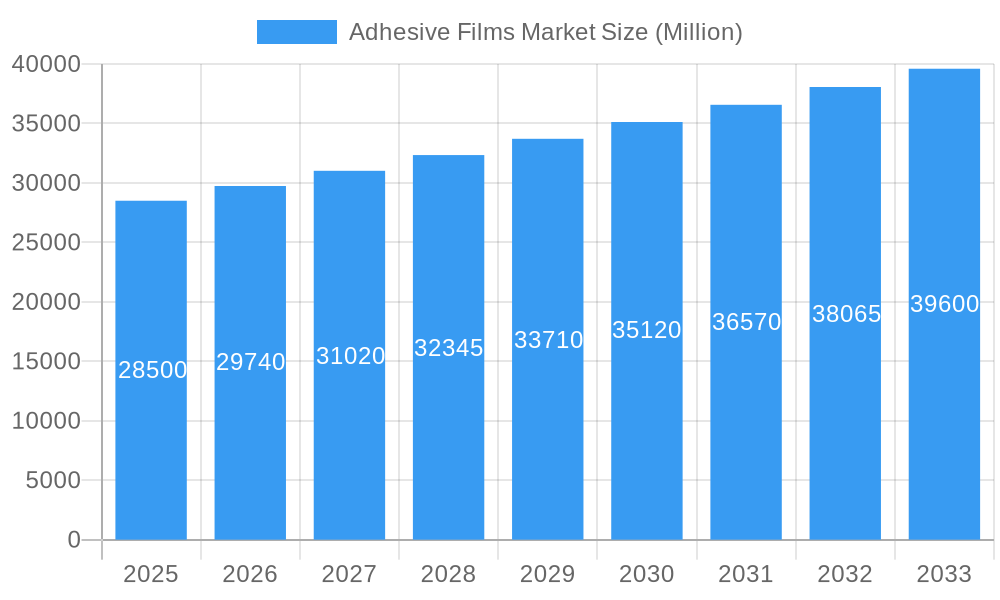

The global Adhesive Films Market is poised for robust growth, projected to reach a substantial market size of approximately USD 28,500 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 4.00% throughout the forecast period of 2025-2033. This expansion is primarily fueled by escalating demand across diverse end-user industries, particularly in packaging, transportation, and electrical & electronics. The inherent properties of adhesive films, such as their protective capabilities, cost-effectiveness, and ease of application, make them indispensable components in a wide array of products and manufacturing processes. Innovations in material science are driving the development of advanced adhesive films with enhanced performance characteristics, including superior adhesion, increased durability, and improved environmental sustainability. This continuous evolution caters to the ever-changing needs of industries seeking high-performance bonding solutions.

Adhesive Films Market Market Size (In Billion)

The market is characterized by significant drivers including the increasing global consumption of packaged goods, the growing automotive sector's reliance on lightweight and efficient assembly solutions, and the expanding electronics industry's need for specialized bonding materials. Trends such as the rising adoption of eco-friendly and sustainable adhesive film formulations, coupled with the development of specialized films for niche applications like high-temperature resistance or chemical inertness, are shaping the market landscape. However, the market also faces restraints, including the fluctuating raw material prices, particularly for polymers like polyethylene and polypropylene, and the stringent regulatory compliance requirements in certain regions and applications. Key players such as Henkel AG & Co KGaA, 3M, and Avery Dennison Corporation are actively investing in research and development to introduce innovative products and expand their global footprint, further stimulating market competition and growth.

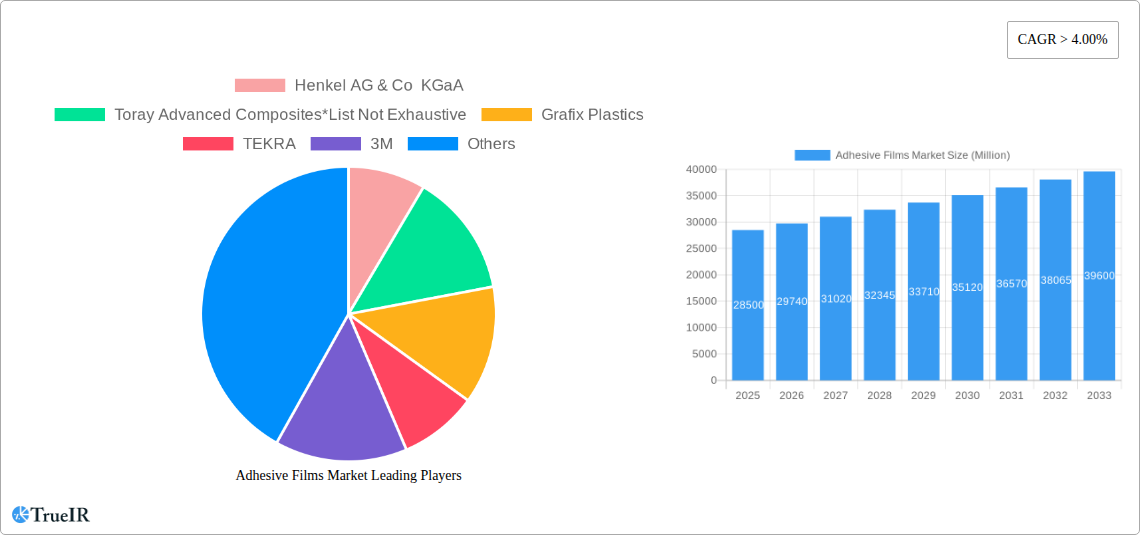

Adhesive Films Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Adhesive Films Market, covering historical trends, current dynamics, and future projections. Leveraging high-volume SEO keywords such as "adhesive films market," "tapes market," "protective films," "packaging films," "transportation adhesives," and "electronics adhesives," this report is optimized for industry professionals seeking critical market intelligence. The study encompasses a detailed examination of market structure, competitive landscape, key trends, dominant segments, product analysis, growth drivers, challenges, key players, significant industry milestones, and future outlook. The report utilizes a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, offering actionable insights for strategic decision-making.

Adhesive Films Market Market Structure & Competitive Landscape

The Adhesive Films Market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized regional players. Innovation drivers, including advancements in material science, sustainability initiatives, and demand for high-performance solutions, are shaping the competitive landscape. Regulatory impacts, particularly those related to environmental compliance and product safety standards, are becoming increasingly significant, influencing product development and market entry strategies. Product substitutes, such as liquid adhesives and mechanical fasteners, present ongoing competition, necessitating continuous differentiation and value proposition enhancement by adhesive film manufacturers.

End-user segmentation plays a crucial role, with diverse requirements across packaging, transportation, electrical & electronics, and other industries. Mergers and acquisitions (M&A) trends are indicative of market consolidation and the pursuit of synergistic capabilities. For instance, over the historical period (2019-2024), an estimated 15-20 M&A deals were observed, primarily focused on acquiring innovative technologies or expanding geographical reach. Concentration ratios, while varying by specific product sub-segments, suggest that the top 5-7 players collectively hold an estimated 40-50% market share. The constant pursuit of technological superiority and cost-effectiveness fuels intense competition among established giants and emerging innovators.

Adhesive Films Market Market Trends & Opportunities

The Adhesive Films Market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% projected during the forecast period (2025-2033). This expansion is driven by escalating demand across various end-user industries, fueled by global economic recovery and evolving consumer preferences. Technological shifts are central to market evolution, with a pronounced trend towards developing advanced adhesive films that offer superior performance characteristics such as enhanced adhesion strength, improved temperature resistance, UV stability, and eco-friendly formulations. The increasing adoption of sustainable packaging solutions, driven by heightened environmental awareness and stringent regulations, presents a significant opportunity for biodegradable and recyclable adhesive films.

Consumer preferences are leaning towards convenience, durability, and aesthetic appeal, which directly impacts the demand for specialized adhesive films in graphic applications, protective coatings, and high-performance tapes. The automotive industry, with its focus on lightweighting and enhanced safety, is a key growth driver for specialized adhesive films in structural bonding and component assembly. Similarly, the burgeoning electrical and electronics sector, characterized by miniaturization and advanced functionalities, requires innovative adhesive solutions for thermal management, shielding, and component attachment. The e-commerce boom further amplifies the need for robust and efficient packaging solutions, boosting the demand for high-quality adhesive tapes and labels. Market penetration rates for advanced adhesive films are expected to increase significantly as their benefits in terms of cost savings, improved product performance, and sustainability become more widely recognized.

Dominant Markets & Segments in Adhesive Films Market

The Packaging end-user industry stands as a dominant force within the Adhesive Films Market, driven by the insatiable global demand for consumer goods, the rapid expansion of e-commerce, and the critical need for product protection and brand integrity. Within this sector, adhesive tapes and labels represent substantial segments, facilitating everything from sealing shipping boxes to providing essential product information and branding. The growth in packaging is intrinsically linked to population growth, urbanization, and evolving retail formats, all of which necessitate efficient and reliable packaging solutions.

- Key Growth Drivers in Packaging:

- E-commerce Boom: The exponential growth of online retail necessitates robust and secure packaging, driving demand for high-strength adhesive tapes for sealing and tamper-evident applications.

- Consumer Goods Demand: Continuous global demand for food and beverages, personal care products, and household items directly translates to sustained need for adhesive films in primary and secondary packaging.

- Sustainability Initiatives: Growing pressure for eco-friendly packaging is spurring innovation in recyclable and biodegradable adhesive films, opening new market avenues.

- Brand Enhancement: Adhesive labels play a crucial role in product differentiation and marketing, driving demand for high-quality, visually appealing adhesive films.

In terms of Material, Polyethylene (PE) and Polypropylene (PP) dominate the market due to their cost-effectiveness, versatility, and excellent mechanical properties. These materials are widely used in a broad spectrum of applications, from flexible packaging films to labels and tapes. The Transportation end-user industry is another significant contributor, where adhesive films are increasingly utilized for vehicle assembly, repair, and interior finishing. The push for lightweighting vehicles to improve fuel efficiency, coupled with advancements in automotive design and manufacturing, is creating substantial opportunities for specialized structural adhesives and protective films. Furthermore, the Electrical & Electronics sector is a high-growth area, requiring advanced adhesive films for thermal management, EMI shielding, and securing delicate components.

Adhesive Films Market Product Analysis

Product innovation in the Adhesive Films Market is characterized by a focus on enhanced performance and specialized functionalities. Key advancements include the development of high-strength, temperature-resistant adhesive films for demanding applications in the transportation and electronics sectors. Innovations in eco-friendly materials, such as biodegradable and recyclable adhesive films, are gaining traction, aligning with global sustainability trends. Competitive advantages are increasingly derived from films offering superior adhesion to challenging substrates, improved UV resistance for outdoor applications, and specialized properties like conductivity or insulation for electronics. The market is witnessing a surge in custom-formulated adhesive films designed to meet precise end-user requirements, thereby solidifying their market fit.

Key Drivers, Barriers & Challenges in Adhesive Films Market

Key Drivers: The Adhesive Films Market is propelled by several key drivers. Technological advancements in polymer science and adhesive formulation are leading to the creation of higher-performing films with enhanced adhesion, durability, and specialized functionalities. The growing global demand across key end-user industries like packaging, transportation, and electrical & electronics provides a substantial market impetus. Furthermore, increasing regulatory support for sustainable materials and practices encourages the adoption of eco-friendly adhesive films. Economic growth in emerging economies fuels industrial expansion, consequently boosting the demand for adhesive solutions.

Barriers & Challenges: Conversely, the market faces several barriers and challenges. Fluctuations in raw material prices, particularly for petrochemical derivatives, can impact manufacturing costs and profit margins. Stringent environmental regulations regarding volatile organic compounds (VOCs) and end-of-life disposal of plastic materials necessitate continuous product reformulation and compliance efforts. Intense price competition from lower-cost alternatives and established players can restrain profitability. Supply chain disruptions, as witnessed in recent global events, can affect the availability of raw materials and finished goods, impacting delivery timelines and customer satisfaction.

Growth Drivers in the Adhesive Films Market Market

The Adhesive Films Market is experiencing significant growth, primarily fueled by ongoing technological advancements in polymer science and adhesive formulations. These innovations are leading to the development of higher-performance films with superior adhesion properties, increased durability, and enhanced resistance to extreme temperatures and environmental factors. The expansion of key end-user industries, such as the burgeoning e-commerce sector demanding robust packaging solutions, and the automotive industry's focus on lightweighting and structural integrity, are major growth catalysts. Furthermore, increasing global environmental awareness and a growing preference for sustainable products are driving the demand for eco-friendly, recyclable, and biodegradable adhesive films, creating a significant market opportunity. Government initiatives promoting green manufacturing and circular economy principles also contribute to this positive growth trajectory.

Challenges Impacting Adhesive Films Market Growth

Despite the positive growth trajectory, the Adhesive Films Market confronts several critical challenges. Volatility in raw material prices, particularly for petrochemical derivatives, can significantly impact manufacturing costs and profitability, making consistent pricing a challenge for manufacturers. Stringent environmental regulations concerning the use of certain chemicals and the disposal of plastic waste necessitate ongoing research and development for compliant and sustainable alternatives, adding to operational costs. Intense price competition, especially from established players and emerging economies offering lower-cost products, can put pressure on profit margins and market share. Furthermore, global supply chain disruptions, including logistical bottlenecks and material shortages, can impede production and timely delivery, affecting customer relationships and market stability.

Key Players Shaping the Adhesive Films Market Market

- Henkel AG & Co KGaA

- Toray Advanced Composites

- Grafix Plastics

- TEKRA

- 3M

- H B Fuller Company

- Avery Dennison Corporation

- Adhesive Films Inc

- L&L Products

- NITTO DENKO CORPORATION

Significant Adhesive Films Market Industry Milestones

- 2021: Launch of a new range of bio-based adhesive films by a leading manufacturer, responding to increasing demand for sustainable packaging solutions.

- 2022: Acquisition of a specialty adhesive film company by a major player to expand its product portfolio and technological capabilities in the electrical & electronics sector.

- 2023: Introduction of advanced high-temperature resistant adhesive films for automotive applications, enabling lightweighting and improved performance.

- 2023 (Late): Significant investment in R&D for recyclable adhesive tapes, aimed at addressing environmental concerns and regulatory pressures.

- 2024 (Early): Expansion of production capacity for protective films in Asia-Pacific to cater to the growing demand from the electronics manufacturing hub.

Future Outlook for Adhesive Films Market Market

The future outlook for the Adhesive Films Market is exceptionally promising, characterized by sustained growth driven by innovation and expanding applications. Strategic opportunities lie in the continued development of high-performance, sustainable adhesive films that address evolving regulatory landscapes and consumer preferences. The increasing adoption of advanced materials in sectors like electric vehicles and renewable energy will create new avenues for specialized adhesive solutions. Furthermore, the global push towards a circular economy will favor manufacturers who can offer recyclable, compostable, or bio-based adhesive films. The market is expected to witness further consolidation through M&A activities as companies seek to gain competitive advantages, expand their technology portfolios, and achieve greater market reach. The overall market potential remains substantial, driven by the indispensable role adhesive films play across a vast array of industries.

Adhesive Films Market Segmentation

-

1. Material

- 1.1. Polyethylene

- 1.2. Polypropylene

- 1.3. Polyvinyl Chloride

- 1.4. Polyvinyl Butyral

- 1.5. Others

-

2. Application

- 2.1. Protective

- 2.2. Graphics

- 2.3. Labels

- 2.4. Tapes

- 2.5. Others

-

3. End-user Industry

- 3.1. Packaging

- 3.2. Transportation

- 3.3. Electrical & Electronics

- 3.4. Others

Adhesive Films Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

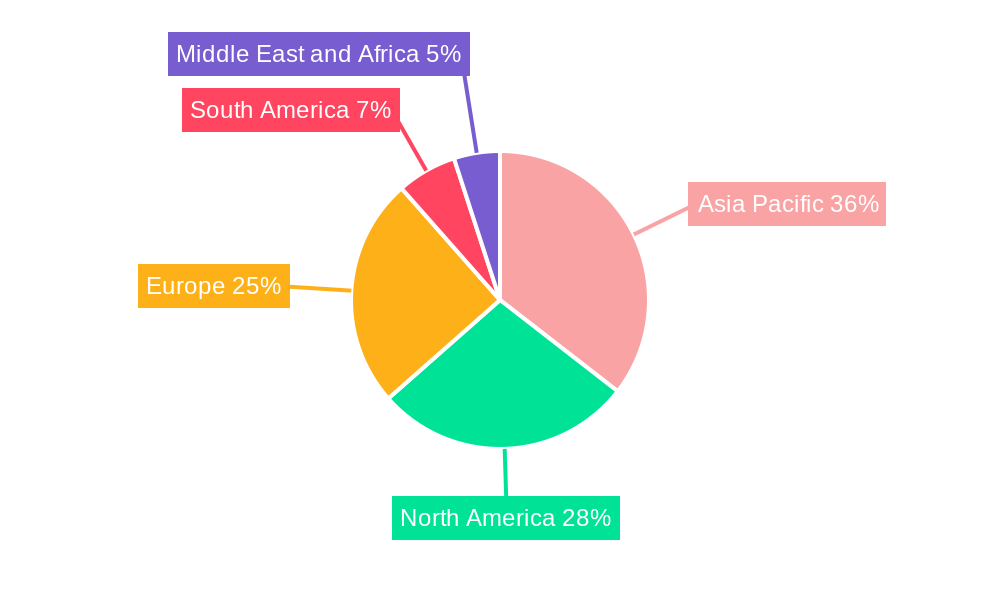

Adhesive Films Market Regional Market Share

Geographic Coverage of Adhesive Films Market

Adhesive Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from Packaging Industry; Growing Application in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Application in Packaging Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adhesive Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polyethylene

- 5.1.2. Polypropylene

- 5.1.3. Polyvinyl Chloride

- 5.1.4. Polyvinyl Butyral

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Protective

- 5.2.2. Graphics

- 5.2.3. Labels

- 5.2.4. Tapes

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Packaging

- 5.3.2. Transportation

- 5.3.3. Electrical & Electronics

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Adhesive Films Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polyethylene

- 6.1.2. Polypropylene

- 6.1.3. Polyvinyl Chloride

- 6.1.4. Polyvinyl Butyral

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Protective

- 6.2.2. Graphics

- 6.2.3. Labels

- 6.2.4. Tapes

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Packaging

- 6.3.2. Transportation

- 6.3.3. Electrical & Electronics

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Adhesive Films Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polyethylene

- 7.1.2. Polypropylene

- 7.1.3. Polyvinyl Chloride

- 7.1.4. Polyvinyl Butyral

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Protective

- 7.2.2. Graphics

- 7.2.3. Labels

- 7.2.4. Tapes

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Packaging

- 7.3.2. Transportation

- 7.3.3. Electrical & Electronics

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Adhesive Films Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polyethylene

- 8.1.2. Polypropylene

- 8.1.3. Polyvinyl Chloride

- 8.1.4. Polyvinyl Butyral

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Protective

- 8.2.2. Graphics

- 8.2.3. Labels

- 8.2.4. Tapes

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Packaging

- 8.3.2. Transportation

- 8.3.3. Electrical & Electronics

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Adhesive Films Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polyethylene

- 9.1.2. Polypropylene

- 9.1.3. Polyvinyl Chloride

- 9.1.4. Polyvinyl Butyral

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Protective

- 9.2.2. Graphics

- 9.2.3. Labels

- 9.2.4. Tapes

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Packaging

- 9.3.2. Transportation

- 9.3.3. Electrical & Electronics

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Adhesive Films Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Polyethylene

- 10.1.2. Polypropylene

- 10.1.3. Polyvinyl Chloride

- 10.1.4. Polyvinyl Butyral

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Protective

- 10.2.2. Graphics

- 10.2.3. Labels

- 10.2.4. Tapes

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Packaging

- 10.3.2. Transportation

- 10.3.3. Electrical & Electronics

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toray Advanced Composites*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Grafix Plastics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TEKRA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 H B Fuller Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Avery Dennison Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Adhesive FilmsInc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 L&L Products

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NITTO DENKO CORPORATION

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Adhesive Films Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Adhesive Films Market Revenue (Million), by Material 2025 & 2033

- Figure 3: Asia Pacific Adhesive Films Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Adhesive Films Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Adhesive Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Adhesive Films Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Adhesive Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Adhesive Films Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Adhesive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Adhesive Films Market Revenue (Million), by Material 2025 & 2033

- Figure 11: North America Adhesive Films Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: North America Adhesive Films Market Revenue (Million), by Application 2025 & 2033

- Figure 13: North America Adhesive Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Adhesive Films Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: North America Adhesive Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Adhesive Films Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Adhesive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Adhesive Films Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe Adhesive Films Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Adhesive Films Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Adhesive Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Adhesive Films Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Adhesive Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Adhesive Films Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Adhesive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Adhesive Films Market Revenue (Million), by Material 2025 & 2033

- Figure 27: South America Adhesive Films Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: South America Adhesive Films Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Adhesive Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Adhesive Films Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: South America Adhesive Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Adhesive Films Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Adhesive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Adhesive Films Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Middle East and Africa Adhesive Films Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Adhesive Films Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Adhesive Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Adhesive Films Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Adhesive Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Adhesive Films Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Adhesive Films Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Adhesive Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Adhesive Films Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Adhesive Films Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Adhesive Films Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Adhesive Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Adhesive Films Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Adhesive Films Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Adhesive Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Adhesive Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 15: Global Adhesive Films Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Adhesive Films Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Adhesive Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Adhesive Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Adhesive Films Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Adhesive Films Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Adhesive Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Adhesive Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 31: Global Adhesive Films Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Adhesive Films Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Adhesive Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Adhesive Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 38: Global Adhesive Films Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Adhesive Films Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Adhesive Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Adhesive Films Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adhesive Films Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Adhesive Films Market?

Key companies in the market include Henkel AG & Co KGaA, Toray Advanced Composites*List Not Exhaustive, Grafix Plastics, TEKRA, 3M, H B Fuller Company, Avery Dennison Corporation, Adhesive FilmsInc, L&L Products, NITTO DENKO CORPORATION.

3. What are the main segments of the Adhesive Films Market?

The market segments include Material, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from Packaging Industry; Growing Application in Automotive Sector.

6. What are the notable trends driving market growth?

Increasing Application in Packaging Industry.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adhesive Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adhesive Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adhesive Films Market?

To stay informed about further developments, trends, and reports in the Adhesive Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence