Key Insights

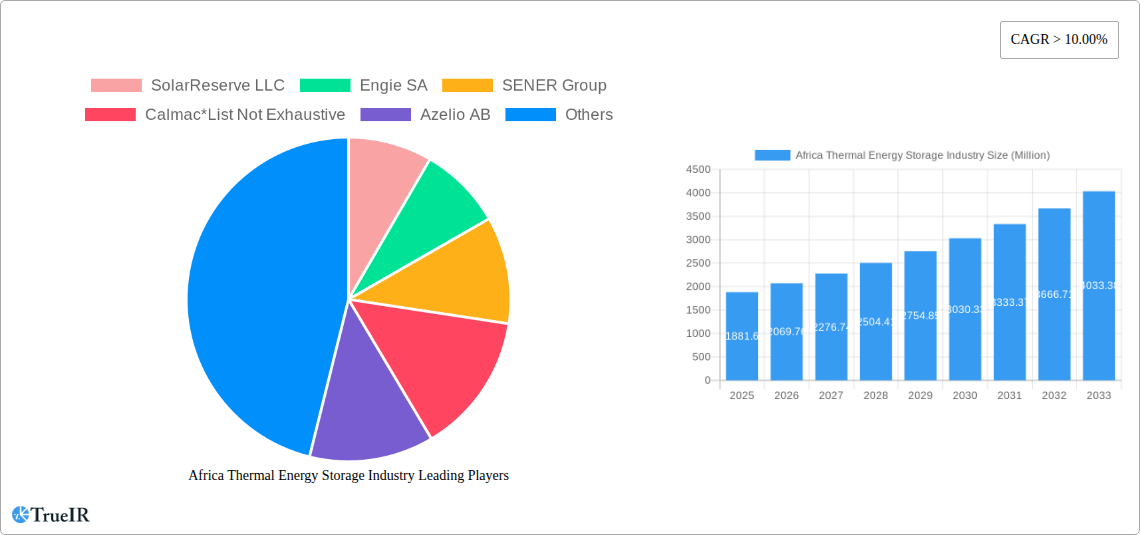

The African Thermal Energy Storage (TES) market is poised for significant expansion, projected to reach an estimated USD 1881.6 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of 10% from 2019 to 2033. This growth is primarily fueled by the increasing demand for reliable and renewable energy solutions across the continent. South Africa and Morocco are anticipated to lead this surge, driven by government initiatives promoting renewable energy integration and the inherent need for stable power grids. The Power Generation application segment is expected to dominate, as TES systems play a crucial role in mitigating the intermittency of solar and wind power, ensuring a consistent electricity supply. Furthermore, the growing adoption of Heating and Cooling applications in both commercial and industrial sectors, especially in regions experiencing fluctuating temperatures, will contribute substantially to market growth.

Africa Thermal Energy Storage Industry Market Size (In Billion)

The market's trajectory is also influenced by a complex interplay of drivers and restraints. Key drivers include the declining cost of renewable energy technologies, increasing energy security concerns, and supportive government policies aimed at decarbonization. The burgeoning industrial sector and the growing urbanization across Africa further amplify the demand for efficient thermal energy solutions. However, challenges such as high initial investment costs for TES systems, limited awareness and understanding of TES technologies in some developing regions, and the need for robust grid infrastructure to support large-scale integration of renewable energy can temper rapid adoption. Emerging trends like the integration of advanced molten salt and heat storage technologies, alongside innovative ice and other storage types, are expected to enhance efficiency and cost-effectiveness, paving the way for broader market penetration. Companies like SolarReserve LLC, Engie SA, and ACWA Power International are at the forefront, investing in R&D and project development to capture this growing opportunity.

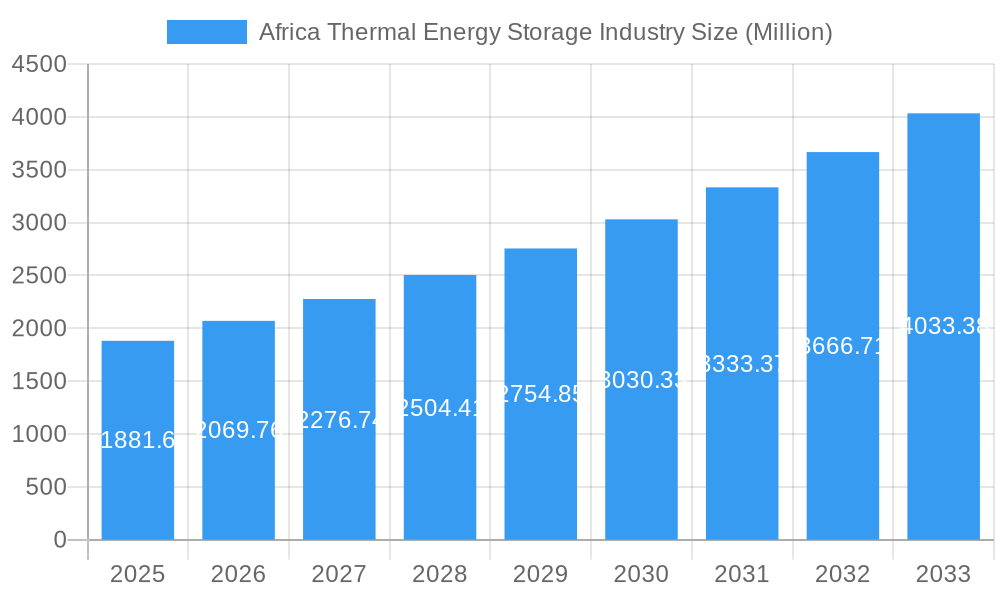

Africa Thermal Energy Storage Industry Company Market Share

Africa Thermal Energy Storage Industry: Comprehensive Market Analysis, Trends, and Future Outlook (2019-2033)

Report Description:

Unlock the immense potential of the Africa Thermal Energy Storage Industry with this in-depth, SEO-optimized market report. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report provides critical insights into market dynamics, technological advancements, and growth opportunities across the continent. Leverage high-volume keywords like "Africa thermal energy storage," "CSP energy storage Africa," "molten salt storage Africa," "renewable energy storage Africa," and "South Africa energy storage" to enhance your online visibility. This report is meticulously structured to offer unparalleled clarity and actionable intelligence for industry stakeholders, investors, and policymakers seeking to capitalize on the rapidly evolving African energy landscape.

Africa Thermal Energy Storage Industry Market Structure & Competitive Landscape

The Africa Thermal Energy Storage Industry is characterized by a moderately concentrated market, with key players investing heavily in innovative solutions for renewable energy integration. Innovation drivers include the increasing demand for grid stability, the integration of intermittent renewable sources like solar and wind, and the drive towards decarbonization. Regulatory impacts are significant, with supportive government policies and incentives playing a crucial role in market expansion. Product substitutes are emerging, including battery energy storage systems (BESS), but thermal energy storage, particularly molten salt, retains a competitive edge for large-scale applications due to cost-effectiveness and long-duration capabilities. End-user segmentation spans utility-scale power generation, industrial heating and cooling, and residential applications, with power generation dominating current market share. Mergers and acquisitions (M&A) activity, while nascent, is projected to increase as established players seek to expand their footprint and technological capabilities. For instance, the acquisition by ENGIE SA of a stake in Xina Solar One exemplifies strategic consolidation. Concentration ratios for major technology providers are estimated to be around 40-50% in the molten salt segment. The market is poised for significant growth, driven by substantial investments in renewable energy infrastructure.

Africa Thermal Energy Storage Industry Market Trends & Opportunities

The Africa Thermal Energy Storage Industry is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12% from 2025 to 2033. This expansion is fueled by an escalating demand for reliable and dispatchable power, a direct consequence of the continent's burgeoning energy needs and the increasing penetration of renewable energy sources. Market size is anticipated to reach over USD 15,000 million by 2033, a significant leap from an estimated USD 5,000 million in 2025. Technological shifts are leaning towards more efficient and scalable thermal energy storage solutions, with molten salt systems continuing to lead in utility-scale power generation due to their proven reliability and cost-effectiveness for long-duration energy storage. Heat storage technologies are gaining traction for industrial processes and district heating networks. Consumer preferences are increasingly aligning with sustainable and cost-effective energy solutions, pushing for greater adoption of technologies that can integrate with existing grid infrastructure and reduce reliance on fossil fuels. Competitive dynamics are intensifying, with both established international players and emerging local companies vying for market share. Opportunities lie in developing localized manufacturing capabilities, tailoring solutions to specific regional requirements, and fostering robust public-private partnerships to overcome infrastructure challenges. The growing awareness of energy security and the need for grid modernization are paramount drivers, creating a fertile ground for innovation and investment in the African thermal energy storage sector.

Dominant Markets & Segments in Africa Thermal Energy Storage Industry

The Power Generation application segment is the dominant force within the Africa Thermal Energy Storage Industry, primarily driven by the widespread adoption of Concentrated Solar Power (CSP) technologies that inherently integrate thermal energy storage. This dominance is particularly pronounced in geographies with high solar irradiation.

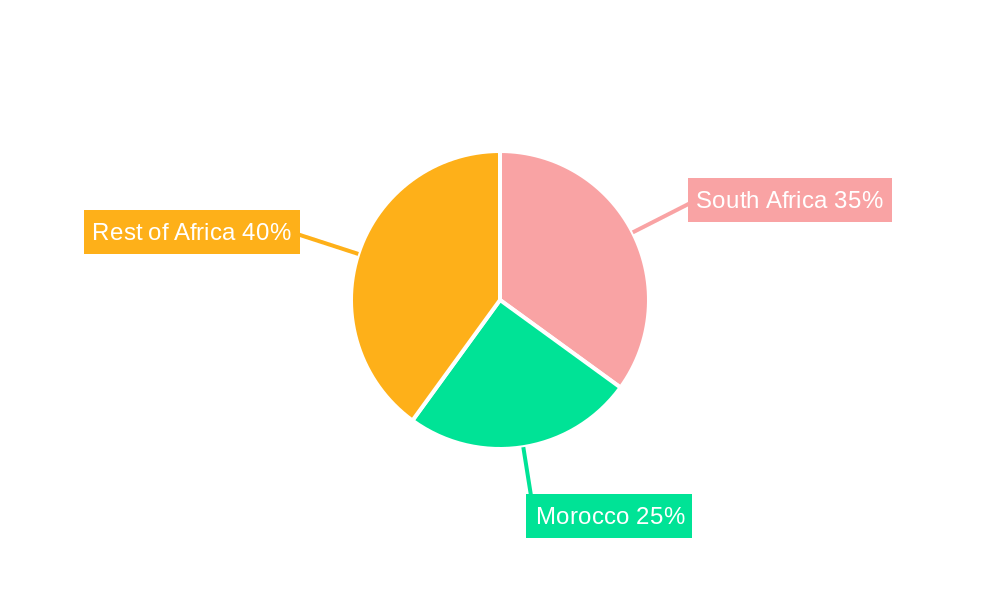

Geography:

- South Africa stands as a leading market, propelled by its ambitious renewable energy targets and significant investment in CSP projects. Eskom Holdings SOC Ltd's involvement in the energy landscape underscores the importance of grid-scale storage solutions. The country's existing infrastructure and policy framework provide a conducive environment for thermal energy storage deployment.

- Morocco is another key player, actively pursuing renewable energy goals through large-scale solar projects that incorporate thermal energy storage, aiming to enhance energy independence and exports.

- Rest of Africa: Emerging markets within the Rest of Africa are showing increasing interest, particularly in countries with high solar potential and a growing need for reliable electricity. The recent tender for a CSP with energy storage project in Namibia, valued between USD 600 million and USD 1 billion, highlights this burgeoning interest.

Storage Type:

- Molten Salt storage is the most prevalent type for large-scale power generation applications due to its high temperature capabilities and cost-effectiveness for extended storage durations, enabling dispatchable renewable energy.

- Heat Storage is gaining traction for industrial applications and potentially for district heating systems, offering energy efficiency benefits.

- Ice Storage is more relevant for cooling applications in commercial and industrial sectors, contributing to peak load management.

Application:

- Power Generation: This segment directly benefits from CSP plants, where thermal energy storage is crucial for providing electricity when the sun is not shining, thus ensuring grid stability and reliability.

- Heating and Cooling: While currently a smaller segment, opportunities exist for industrial process heat and district heating/cooling networks, leveraging thermal energy storage for improved efficiency and reduced carbon emissions.

Africa Thermal Energy Storage Industry Product Analysis

Product innovation in the Africa Thermal Energy Storage Industry is primarily centered on enhancing the efficiency, scalability, and cost-effectiveness of existing technologies, especially molten salt systems. Companies like SolarReserve LLC and BrightSource Energy Inc. have been at the forefront of developing advanced CSP with molten salt storage solutions, offering competitive advantages through improved thermal performance and longer discharge durations. These innovations are crucial for enabling baseload renewable power, thus addressing the intermittency of solar resources. The competitive advantage lies in the ability to store large amounts of thermal energy economically, providing grid stability and reducing reliance on fossil fuel backup. Integration with existing power grids and the development of modular, scalable systems are key market trends, catering to diverse energy needs across the African continent.

Key Drivers, Barriers & Challenges in Africa Thermal Energy Storage Industry

Key Drivers:

- Increasing Demand for Renewable Energy Integration: The rapid expansion of solar and wind power necessitates reliable energy storage to ensure grid stability.

- Government Support and Favorable Policies: Incentives, renewable energy targets, and supportive regulatory frameworks are crucial for market growth.

- Falling Costs of Renewable Technologies: The decreasing cost of CSP and associated storage solutions makes them increasingly competitive.

- Energy Security and Access: Thermal energy storage plays a vital role in enhancing energy independence and expanding access to reliable electricity.

Barriers & Challenges:

- High Upfront Capital Costs: While decreasing, the initial investment for large-scale thermal energy storage projects can still be a significant barrier.

- Infrastructure Limitations: Inadequate transmission and distribution infrastructure in some regions can hinder the deployment of large-scale storage projects.

- Regulatory Complexities and Policy Uncertainty: Inconsistent or evolving regulatory frameworks can create uncertainty for investors and developers.

- Technical Expertise and Skilled Workforce: A shortage of specialized technical expertise for the installation, operation, and maintenance of thermal energy storage systems can pose a challenge.

- Competition from Battery Storage: While complementary, battery energy storage systems (BESS) offer an alternative, especially for shorter-duration storage needs, presenting competitive pressure.

Growth Drivers in the Africa Thermal Energy Storage Industry Market

The Africa Thermal Energy Storage Industry is propelled by a confluence of powerful growth drivers. Technologically, the maturation of molten salt technology for Concentrated Solar Power (CSP) is paramount, offering cost-effective, long-duration storage essential for grid stability. Economically, the increasing affordability of renewable energy sources like solar PV and CSP, coupled with the imperative for energy security and reduced fossil fuel dependence, creates a compelling business case. Regulatory tailwinds, including national renewable energy targets and supportive feed-in tariffs or power purchase agreements, are instrumental in de-risking investments and encouraging project development. Furthermore, the growing need for grid modernization and the desire to mitigate the impacts of climate change are driving demand for dispatchable renewable energy solutions.

Challenges Impacting Africa Thermal Energy Storage Industry Growth

Challenges impacting the Africa Thermal Energy Storage Industry's growth are multifaceted. High upfront capital expenditure remains a significant hurdle, particularly for less developed markets or projects requiring substantial investment. Supply chain complexities, including the sourcing of specialized components and materials, can lead to project delays and increased costs. Regulatory hurdles, such as lengthy permitting processes and evolving grid connection standards, can stifle project development timelines. Competitive pressures from rapidly advancing battery energy storage technologies, especially for shorter-duration applications, necessitate continuous innovation and cost reduction in thermal energy storage solutions. Furthermore, the availability of a skilled workforce for the installation, operation, and maintenance of these advanced systems needs consistent development.

Key Players Shaping the Africa Thermal Energy Storage Industry Market

- SolarReserve LLC

- Engie SA

- SENER Group

- Calmac

- Azelio AB

- Eskom Holdings SOC Ltd

- Abengoa SA

- ACWA Power International

- BrightSource Energy Inc

Significant Africa Thermal Energy Storage Industry Industry Milestones

- December 2021: Namibia Power Corporation Ltd (NamPower) announced a tender for a project combining concentrated solar power (CSP) with energy storage of 50MW-130MW, anticipated to cost between USD 600 million and USD 1 billion. This signifies substantial investment and potential for large-scale thermal energy storage deployment in Southern Africa.

- November 2021: ENGIE completed the acquisition of Abengoa's indirect stake in Xina Solar One (Pty) Ltd. Post-transaction, ENGIE holds 40% of the 100 MW CSP plant and 46% of its Operations & Maintenance Company. This marks significant consolidation and strategic expansion by a major energy player in the African renewable energy storage sector.

Future Outlook for Africa Thermal Energy Storage Industry Market

The future outlook for the Africa Thermal Energy Storage Industry is exceptionally bright, driven by strong growth catalysts and significant market potential. Strategic opportunities lie in expanding the application of molten salt storage for CSP projects, particularly in regions with high solar irradiance like North and Southern Africa. The development of localized manufacturing and supply chains will be crucial for cost reduction and job creation. Furthermore, the increasing demand for industrial process heat and the potential for integration into district heating and cooling networks present emerging avenues for growth. As the continent continues its transition towards a sustainable energy future, thermal energy storage will play an indispensable role in ensuring grid reliability and enabling the widespread adoption of renewable energy. The market is poised for sustained expansion, with investments anticipated to reach over USD 15,000 million by 2033.

Africa Thermal Energy Storage Industry Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Heating and Cooling

-

2. Storage Type

- 2.1. Molten Salt

- 2.2. Heat

- 2.3. Ice

- 2.4. Other Storage Types

-

3. Geography

- 3.1. South Africa

- 3.2. Morocco

- 3.3. Rest of Africa

Africa Thermal Energy Storage Industry Segmentation By Geography

- 1. South Africa

- 2. Morocco

- 3. Rest of Africa

Africa Thermal Energy Storage Industry Regional Market Share

Geographic Coverage of Africa Thermal Energy Storage Industry

Africa Thermal Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Secure

- 3.2.2 Sustainable

- 3.2.3 and Clean Energy

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Production of Biofuels

- 3.4. Market Trends

- 3.4.1. Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Heating and Cooling

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Molten Salt

- 5.2.2. Heat

- 5.2.3. Ice

- 5.2.4. Other Storage Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Morocco

- 5.3.3. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Morocco

- 5.4.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Generation

- 6.1.2. Heating and Cooling

- 6.2. Market Analysis, Insights and Forecast - by Storage Type

- 6.2.1. Molten Salt

- 6.2.2. Heat

- 6.2.3. Ice

- 6.2.4. Other Storage Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Morocco

- 6.3.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Morocco Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Generation

- 7.1.2. Heating and Cooling

- 7.2. Market Analysis, Insights and Forecast - by Storage Type

- 7.2.1. Molten Salt

- 7.2.2. Heat

- 7.2.3. Ice

- 7.2.4. Other Storage Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Morocco

- 7.3.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of Africa Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Generation

- 8.1.2. Heating and Cooling

- 8.2. Market Analysis, Insights and Forecast - by Storage Type

- 8.2.1. Molten Salt

- 8.2.2. Heat

- 8.2.3. Ice

- 8.2.4. Other Storage Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Morocco

- 8.3.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 SolarReserve LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Engie SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 SENER Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Calmac*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Azelio AB

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Eskom Holdings SOC Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Abengoa SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 ACWA Power International

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BrightSource Energy Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 SolarReserve LLC

List of Figures

- Figure 1: Africa Thermal Energy Storage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Thermal Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 3: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 7: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 11: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 15: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Thermal Energy Storage Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Africa Thermal Energy Storage Industry?

Key companies in the market include SolarReserve LLC, Engie SA, SENER Group, Calmac*List Not Exhaustive, Azelio AB, Eskom Holdings SOC Ltd, Abengoa SA, ACWA Power International, BrightSource Energy Inc.

3. What are the main segments of the Africa Thermal Energy Storage Industry?

The market segments include Application, Storage Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Secure. Sustainable. and Clean Energy.

6. What are the notable trends driving market growth?

Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Production of Biofuels.

8. Can you provide examples of recent developments in the market?

In December 2021, Namibia Power Corporation Ltd (NamPower), the national electric power utility of the country, announced a tender for a project combining concentrated solar power (CSP) with energy storage of 50MW-130MW. It is anticipated that the proposed project will cost between USD 600 million and USD 1 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Thermal Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Thermal Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Thermal Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Africa Thermal Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence