Key Insights

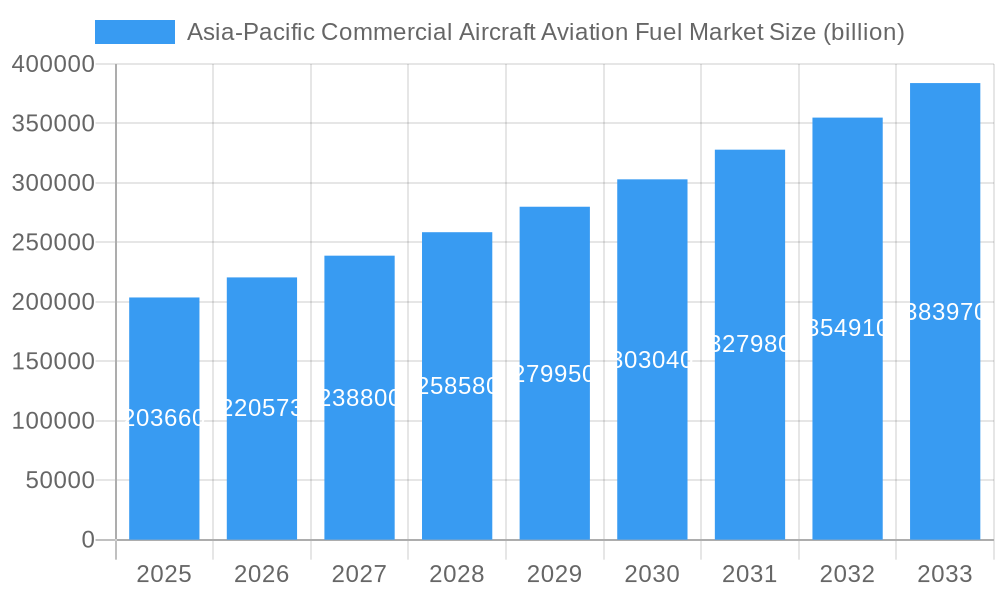

The Asia-Pacific Commercial Aircraft Aviation Fuel Market is poised for significant expansion, projected to reach an estimated USD 203.66 billion in 2025. This robust growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.3% during the forecast period of 2025-2033. This expansion is primarily driven by the burgeoning air travel demand across the region, fueled by a growing middle class, increasing tourism, and expanding trade activities. The liberalized aviation policies in several key Asian economies are further bolstering the growth of low-cost carriers and international routes, directly translating into higher consumption of aviation fuel. Furthermore, the ongoing modernization of fleets with more fuel-efficient aircraft, alongside the increasing adoption of sustainable aviation fuels (SAFs), are shaping the market dynamics. The push towards decarbonization within the aviation sector is creating new avenues for growth and innovation in fuel technologies, with countries like China, Japan, and India at the forefront of these developments.

Asia-Pacific Commercial Aircraft Aviation Fuel Market Market Size (In Billion)

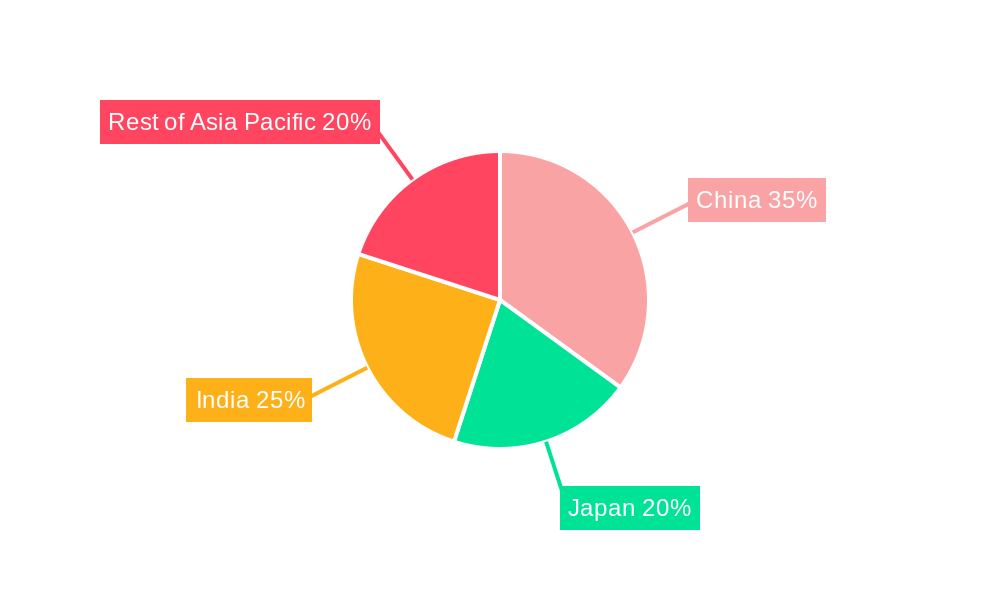

The market's segmentation reveals a dynamic landscape with Air Turbine Fuel (ATF) currently dominating, driven by its established infrastructure and widespread use. However, Aviation Biofuel is emerging as a critical growth segment, propelled by environmental regulations and corporate sustainability initiatives. Geographically, China, Japan, and India represent the largest and fastest-growing markets due to their vast populations, expanding economies, and significant investments in aviation infrastructure. While the market presents substantial opportunities, potential restraints such as fluctuating crude oil prices, geopolitical instability impacting supply chains, and the high initial investment required for developing and deploying sustainable aviation fuels could pose challenges. Nevertheless, the overarching trend of increasing air connectivity and the imperative for a greener aviation future are expected to drive sustained demand and innovation in the Asia-Pacific commercial aircraft aviation fuel sector.

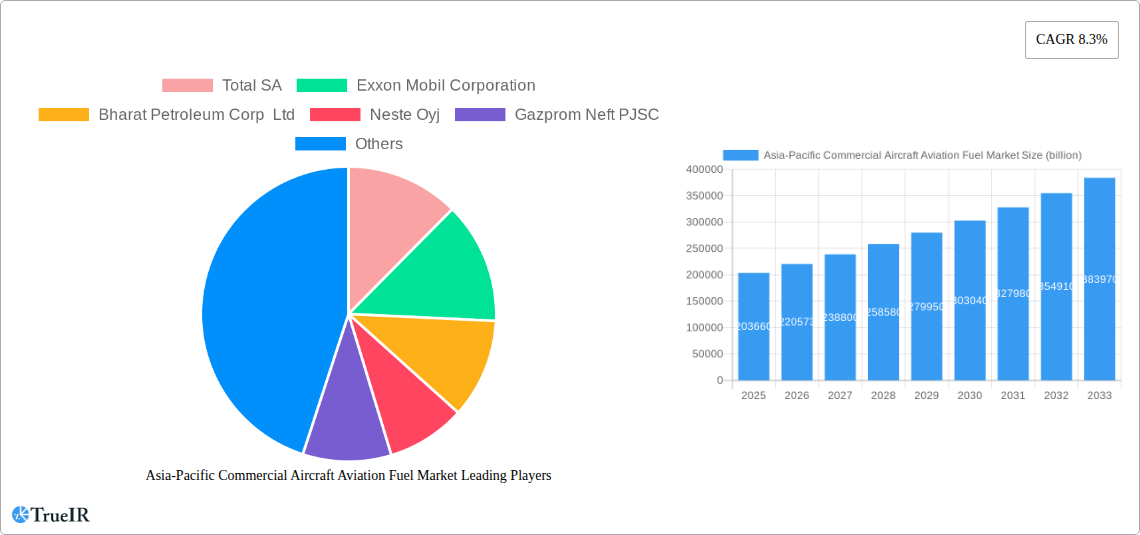

Asia-Pacific Commercial Aircraft Aviation Fuel Market Company Market Share

Asia-Pacific Commercial Aircraft Aviation Fuel Market: In-Depth Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Commercial Aircraft Aviation Fuel Market, offering critical insights into market dynamics, key players, trends, opportunities, and future projections. Leveraging high-volume SEO keywords such as "Asia-Pacific aviation fuel," "commercial aircraft fuel market," "ATF market," "aviation biofuel," and "aerospace fuel consumption," this report is designed to enhance search rankings and engage industry professionals. Our extensive study period spans from 2019 to 2033, with a base year of 2025, and a detailed forecast period from 2025 to 2033.

Asia-Pacific Commercial Aircraft Aviation Fuel Market Market Structure & Competitive Landscape

The Asia-Pacific Commercial Aircraft Aviation Fuel Market is characterized by a moderately concentrated structure, with leading players like Total SA, Exxon Mobil Corporation, Bharat Petroleum Corp Ltd, Neste Oyj, Gazprom Neft PJSC, Chevron Corporation, Royal Dutch Shell PLC, BP PLC, and Honeywell International Inc. (list not exhaustive) holding significant market share. Innovation is a key driver, fueled by the growing demand for sustainable aviation fuels and advancements in fuel efficiency technologies. Regulatory impacts are substantial, with governments across the region implementing policies to promote biofuel adoption and reduce carbon emissions. Product substitutes, while nascent, include electric and hydrogen-powered aircraft technologies, though their widespread adoption in commercial aviation is still distant. End-user segmentation primarily includes major airlines, cargo carriers, and regional flight operators. Merger and acquisition (M&A) trends are on the rise as established fuel providers seek to expand their biofuel portfolios and enter new geographic markets. For instance, M&A volumes in the broader energy sector indicate a growing investment in renewable fuel sources, expected to translate to an estimated $5 billion in M&A activity within the Asia-Pacific aviation fuel sector by 2025. The competitive landscape is dynamic, driven by price volatility of crude oil, geopolitical factors, and the increasing emphasis on environmental sustainability.

Asia-Pacific Commercial Aircraft Aviation Fuel Market Market Trends & Opportunities

The Asia-Pacific Commercial Aircraft Aviation Fuel Market is poised for robust growth, driven by an escalating demand for air travel and an increasing focus on sustainability. Market size is projected to reach an estimated $150 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. Technological shifts are central to this evolution, with significant investments in the development and adoption of Aviation Biofuel as a sustainable alternative to traditional Air Turbine Fuel (ATF). The increasing passenger traffic and cargo volumes across major hubs like China, India, and Southeast Asia are creating immense opportunities for fuel suppliers. Consumer preferences are gradually shifting towards airlines demonstrating a commitment to environmental responsibility, thereby encouraging the use of greener aviation fuels. Competitive dynamics are intensifying, with traditional oil and gas majors actively diversifying into renewable energy sources, while specialized biofuel producers are scaling up their operations to meet the growing demand. The market penetration rate of Aviation Biofuel, currently at an estimated 2%, is expected to climb to over 10% by 2030, driven by regulatory mandates and airline sustainability goals. Opportunities also lie in enhancing fuel efficiency through advanced fuel formulations and optimized logistics to reduce operational costs for airlines. The growing middle class in emerging economies, particularly in India and other Southeast Asian nations, will continue to fuel the demand for air travel, thereby creating sustained demand for aviation fuels. Furthermore, the expansion of airport infrastructure and the increasing number of commercial aircraft deliveries in the region will directly contribute to higher fuel consumption. The shift towards electric and hybrid-electric aircraft, while still in its early stages for commercial long-haul flights, presents a long-term disruptive trend that necessitates strategic planning and investment in next-generation fuel technologies. The report will delve deeper into how these trends will shape the market landscape and unlock new avenues for growth and profitability.

Dominant Markets & Segments in Asia-Pacific Commercial Aircraft Aviation Fuel Market

The Asia-Pacific Commercial Aircraft Aviation Fuel Market is dominated by several key regions and segments, driven by distinct growth factors.

Dominant Geography: China

- China's burgeoning economy and massive population are the primary drivers of its dominance in the aviation fuel market. The country's continuous expansion of its air travel network, including the development of new airports and the modernization of existing ones, directly translates to a significant increase in ATF consumption.

- Government policies aimed at boosting domestic tourism and facilitating international trade further amplify air traffic, creating sustained demand. The sheer volume of commercial aircraft operations within China positions it as the largest consumer of aviation fuel in the region.

- Infrastructure development, including the expansion of fuel storage and distribution networks at major airports, is crucial for supporting this demand. China's commitment to decarbonization initiatives also presents opportunities for the adoption of sustainable aviation fuels.

Dominant Segment: Air Turbine Fuel (ATF)

- Air Turbine Fuel (ATF) remains the cornerstone of the commercial aircraft aviation fuel market due to its established use in virtually all commercial jet engines. The current fleet of commercial aircraft relies almost exclusively on ATF for propulsion.

- The continued growth in passenger and cargo air traffic directly fuels the demand for ATF. As airlines expand their fleets and flight frequencies to meet this demand, the consumption of ATF escalates.

- Advancements in ATF formulations, focusing on improved efficiency and reduced emissions, are critical for the continued dominance of this segment. The sheer volume of ATF consumed daily by the global commercial aviation sector underscores its importance and the substantial market share it holds.

Key Growth Driver: India

- India's rapidly growing economy, expanding middle class, and increasing urbanization are propelling its aviation sector to new heights. The country's focus on improving connectivity and promoting regional air travel through various government initiatives has led to a surge in passenger and cargo volumes.

- The ongoing modernization and expansion of airport infrastructure across India are critical enablers of this growth, facilitating increased flight operations and, consequently, higher aviation fuel demand.

- The "Make in India" initiative and efforts to boost the aviation manufacturing sector could also indirectly lead to increased domestic demand for aviation fuel as more aircraft are put into service.

Emerging Opportunity: Aviation Biofuel

- While ATF currently dominates, Aviation Biofuel represents the fastest-growing segment, driven by global sustainability mandates and airline commitments to reduce their carbon footprint. The Asia-Pacific region is witnessing increasing investment and pilot programs for biofuel production and usage.

- Supportive government policies and incentives for renewable energy sources are crucial for the wider adoption of Aviation Biofuel. As the technology matures and production scales up, its cost-competitiveness is expected to improve, further accelerating its market penetration.

- The development of robust supply chains and the establishment of blending facilities at key airports are essential for the widespread deployment of Aviation Biofuel in the region.

Asia-Pacific Commercial Aircraft Aviation Fuel Market Product Analysis

The Asia-Pacific Commercial Aircraft Aviation Fuel Market is primarily driven by the demand for Air Turbine Fuel (ATF), the standard jet fuel for commercial aviation. Innovations in ATF focus on enhancing engine efficiency and reducing emissions through advanced additive technologies and cleaner refining processes, aiming to meet stringent environmental regulations. Concurrently, the market is witnessing significant advancements in Aviation Biofuel, derived from sustainable sources like used cooking oil and agricultural waste. These biofuels offer a substantial reduction in lifecycle carbon emissions compared to conventional fuels. The competitive advantage of ATF lies in its established infrastructure and compatibility with existing aircraft fleets, while Aviation Biofuel's advantage is its environmental performance, albeit with ongoing efforts to improve cost-effectiveness and scalability. The "Others" segment encompasses nascent technologies and alternative fuels, representing future potential.

Key Drivers, Barriers & Challenges in Asia-Pacific Commercial Aircraft Aviation Fuel Market

Key Drivers:

- Robust Air Traffic Growth: The burgeoning economies and expanding middle classes across Asia-Pacific are fueling unprecedented growth in passenger and cargo air travel, directly driving demand for aviation fuel. For example, passenger traffic in the region is projected to grow at an average annual rate of over 7% in the coming years.

- Technological Advancements in Sustainable Aviation Fuels (SAFs): Increasing research and development in Aviation Biofuel and other SAFs are making them more viable and cost-competitive, supported by governmental incentives and airline sustainability targets.

- Government Support and Environmental Regulations: Proactive government policies and mandates promoting the use of cleaner fuels and reducing carbon emissions are significant catalysts for market expansion.

Barriers & Challenges:

- High Cost of Sustainable Aviation Fuels: The current premium pricing of Aviation Biofuel compared to conventional ATF remains a significant barrier to widespread adoption, despite its environmental benefits. For instance, SAFs can be 2-5 times more expensive than traditional jet fuel.

- Supply Chain Limitations and Scalability: Establishing a robust and scalable supply chain for SAFs, from feedstock sourcing to distribution at airports, presents significant logistical challenges across the vast Asia-Pacific region.

- Infrastructure Investment Requirements: Significant investment is required for developing new blending facilities, upgrading storage infrastructure, and ensuring compatibility with existing aircraft and airport systems for SAFs.

- Volatility of Crude Oil Prices: Fluctuations in crude oil prices directly impact the cost of ATF, creating uncertainty and influencing purchasing decisions, particularly for airlines operating on thin margins.

- Regulatory Harmonization: Lack of uniform regulatory frameworks and mandates across different Asia-Pacific countries can hinder the seamless adoption and trade of aviation fuels.

Growth Drivers in the Asia-Pacific Commercial Aircraft Aviation Fuel Market Market

The growth trajectory of the Asia-Pacific Commercial Aircraft Aviation Fuel Market is primarily propelled by a confluence of factors. The burgeoning economic landscape across the region is leading to a significant increase in disposable incomes, thereby driving robust demand for air travel. This surge in passenger traffic, coupled with expanding e-commerce and global trade, is also boosting cargo operations, both of which are direct consumers of aviation fuel. Furthermore, government initiatives focused on enhancing air connectivity, expanding airport infrastructure, and promoting tourism are creating a fertile ground for sustained growth. The increasing emphasis on sustainability and decarbonization is a critical growth driver, pushing airlines and fuel providers to invest heavily in Aviation Biofuel and other Sustainable Aviation Fuels (SAFs). Supportive policies and mandates from regional governments are further accelerating the adoption of these cleaner alternatives.

Challenges Impacting Asia-Pacific Commercial Aircraft Aviation Fuel Market Growth

The Asia-Pacific Commercial Aircraft Aviation Fuel Market faces several formidable challenges that could impede its growth. The high cost of Sustainable Aviation Fuels (SAFs) remains a significant deterrent, making them less accessible for many airlines compared to conventional Air Turbine Fuel (ATF). The nascent supply chain for SAFs, from feedstock procurement to refining and distribution, is currently not scaled to meet widespread demand, leading to availability issues and price volatility. Moreover, the substantial capital investment required for developing new production facilities, storage, and blending infrastructure at airports poses a considerable barrier. Regulatory complexities and the lack of harmonized standards across different countries in the Asia-Pacific region can create operational hurdles and uncertainty for fuel suppliers and airlines. Lastly, the inherent volatility of crude oil prices directly influences the cost of conventional jet fuel, impacting profit margins and investment decisions for fuel providers.

Key Players Shaping the Asia-Pacific Commercial Aircraft Aviation Fuel Market Market

- Total SA

- Exxon Mobil Corporation

- Bharat Petroleum Corp Ltd

- Neste Oyj

- Gazprom Neft PJSC

- Chevron Corporation

- Royal Dutch Shell PLC

- BP PLC

- Honeywell International Inc.

Significant Asia-Pacific Commercial Aircraft Aviation Fuel Market Industry Milestones

- 2019: Launch of several pilot projects for Aviation Biofuel blending by major airlines in China and India, signaling early adoption efforts.

- 2020: Increased investment in SAF research and development by global energy giants like Shell and BP, with a focus on Asia-Pacific market potential.

- 2021: Introduction of carbon emission reduction targets by various Asia-Pacific governments, providing a regulatory impetus for cleaner aviation fuels.

- 2022: Significant capacity expansions announced by biofuel producers like Neste, anticipating growing demand in the Asia-Pacific region.

- 2023: Partnerships formed between airlines and fuel suppliers to secure long-term offtake agreements for Aviation Biofuel, enhancing supply chain stability.

- 2024: Several countries in the Rest of Asia-Pacific region begin exploring the feasibility of introducing SAF mandates to align with global sustainability goals.

Future Outlook for Asia-Pacific Commercial Aircraft Aviation Fuel Market Market

The future outlook for the Asia-Pacific Commercial Aircraft Aviation Fuel Market is one of sustained and dynamic growth, driven by a confluence of accelerating air travel demand and a strong commitment to sustainability. The increasing focus on reducing the carbon footprint of aviation will see a significant rise in the adoption of Aviation Biofuel and other Sustainable Aviation Fuels (SAFs), moving from niche applications to mainstream usage. Strategic opportunities lie in the development of advanced SAF production technologies, the expansion of robust and efficient supply chains across the region, and collaborative efforts between fuel providers, airlines, and governments to overcome cost and infrastructure challenges. Investments in next-generation fuel technologies and infrastructure will be critical for capturing market share. The market is expected to witness increased M&A activity as companies seek to consolidate their position and expand their offerings in the burgeoning renewable aviation fuel space, promising a more sustainable and resilient future for aviation in the Asia-Pacific region.

Asia-Pacific Commercial Aircraft Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Air Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

- 1.3. Others

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. Rest of Asia-Pacific

Asia-Pacific Commercial Aircraft Aviation Fuel Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Rest of Asia Pacific

Asia-Pacific Commercial Aircraft Aviation Fuel Market Regional Market Share

Geographic Coverage of Asia-Pacific Commercial Aircraft Aviation Fuel Market

Asia-Pacific Commercial Aircraft Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Air Turbine Fuel (ATF) Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Air Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. China Asia-Pacific Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Air Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Japan Asia-Pacific Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Air Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. India Asia-Pacific Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Air Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of Asia Pacific Asia-Pacific Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Air Turbine Fuel (ATF)

- 9.1.2. Aviation Biofuel

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Total SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Exxon Mobil Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bharat Petroleum Corp Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Neste Oyj

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Gazprom Neft PJSC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chevron Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Royal Dutch Shell PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BP PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Honeywell International Inc *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Total SA

List of Figures

- Figure 1: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Commercial Aircraft Aviation Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Fuel Type 2020 & 2033

- Table 3: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Fuel Type 2020 & 2033

- Table 9: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Geography 2020 & 2033

- Table 11: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Fuel Type 2020 & 2033

- Table 15: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Geography 2020 & 2033

- Table 17: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 20: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Fuel Type 2020 & 2033

- Table 21: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Fuel Type 2020 & 2033

- Table 27: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Commercial Aircraft Aviation Fuel Market Volume Litre Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Commercial Aircraft Aviation Fuel Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Asia-Pacific Commercial Aircraft Aviation Fuel Market?

Key companies in the market include Total SA, Exxon Mobil Corporation, Bharat Petroleum Corp Ltd, Neste Oyj, Gazprom Neft PJSC, Chevron Corporation, Royal Dutch Shell PLC, BP PLC, Honeywell International Inc *List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Commercial Aircraft Aviation Fuel Market?

The market segments include Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 203.66 billion as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Air Turbine Fuel (ATF) Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Litre.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Commercial Aircraft Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Commercial Aircraft Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Commercial Aircraft Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Commercial Aircraft Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence