Key Insights

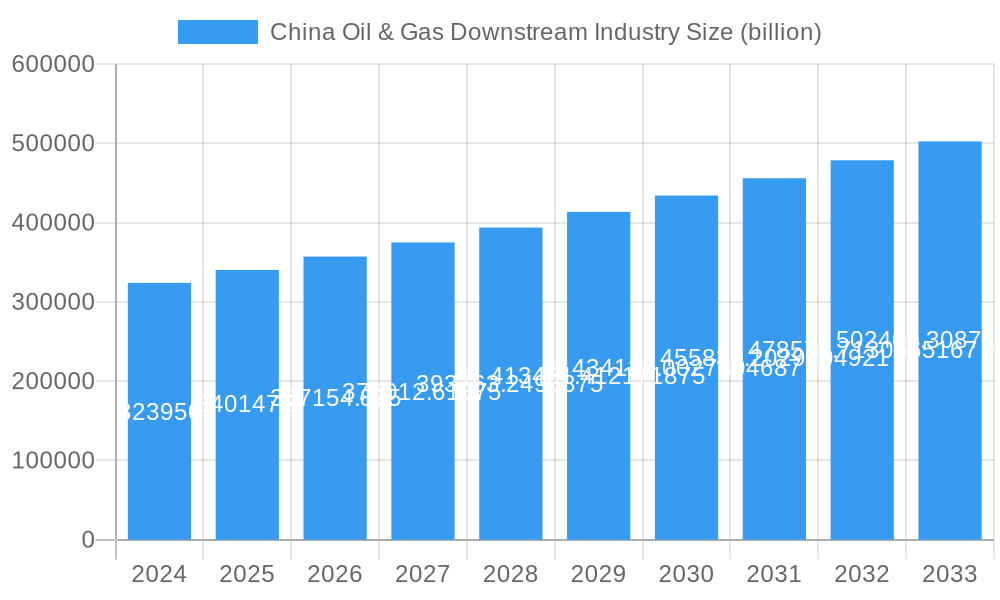

The China Oil & Gas Downstream Industry is projected for robust expansion, with a current estimated market size of $323.95 billion in 2024. The industry is poised for steady growth, driven by a CAGR of 5%, indicating a consistent upward trajectory throughout the forecast period of 2025-2033. This growth is fueled by several key factors, including the increasing demand for refined petroleum products and petrochemicals to support China's vast industrial base and burgeoning consumer market. Infrastructure development, technological advancements in refining processes, and government initiatives promoting energy security and efficiency further bolster the industry's expansion. The downstream sector plays a critical role in converting crude oil and natural gas into a wide array of essential products, from fuels and lubricants to plastics and chemicals, all of which are vital for the nation's economic engine.

China Oil & Gas Downstream Industry Market Size (In Billion)

The market is segmented into two primary areas: Refineries and Petrochemical Plants, both of which are experiencing significant investment and innovation. Leading global and domestic players like Sinopec, PetroChina, Shell Energy (China) Limited, and SABIC are actively expanding their operations and investing in advanced technologies to enhance production efficiency and product quality. Emerging trends include a growing emphasis on sustainable refining practices, the development of higher-value specialty chemicals, and the integration of digital technologies for optimized operations. Challenges such as stringent environmental regulations and the global shift towards cleaner energy sources necessitate strategic adaptation, pushing companies to focus on cleaner fuel production and diversification into petrochemicals with lower carbon footprints. The industry's resilience and adaptability, coupled with strong domestic demand, position it for sustained growth and contribution to China's economic development.

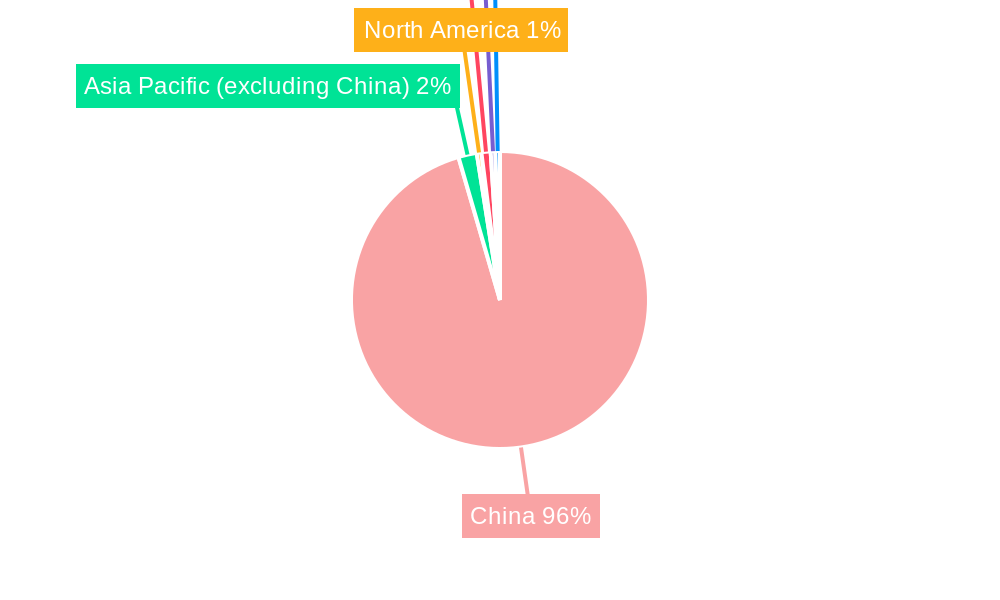

China Oil & Gas Downstream Industry Company Market Share

China Oil & Gas Downstream Industry Market Structure & Competitive Landscape

The China oil and gas downstream industry is characterized by a moderately concentrated market structure, with state-owned enterprises and major international players dominating. Key innovation drivers include the relentless pursuit of operational efficiency through advanced refining and petrochemical technologies, alongside the strategic development and launch of new, higher-value products. Regulatory frameworks, while evolving, continue to shape market access, environmental standards, and pricing mechanisms. Product substitutes, such as renewable energy sources, are gradually emerging but their impact on the immediate downstream sector remains limited. End-user segmentation is diverse, spanning transportation fuels, chemical feedstocks, and specialized industrial materials. Mergers and acquisitions (M&A) play a crucial role in consolidating market share and acquiring technological capabilities. For example, the historical period 2019-2024 has witnessed M&A volumes totaling an estimated xx billion, reflecting strategic consolidation. Concentration ratios in key refining segments are estimated to be above xx%, indicating significant market power held by the top few entities.

China Oil & Gas Downstream Industry Market Trends & Opportunities

The China oil and gas downstream industry is poised for significant expansion, driven by robust economic growth and increasing energy demand. Market size is projected to grow from an estimated $xx billion in 2025 to over $xx billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Technological shifts are at the forefront of this evolution, with a strong emphasis on the development of new technologies to improve operational efficiency. This includes advancements in catalysis, process optimization, and digital transformation across refining and petrochemical operations. The adoption of artificial intelligence and big data analytics is enhancing predictive maintenance, yield optimization, and energy efficiency. Furthermore, a key trend is the launch of new products and services designed to meet evolving market needs. This encompasses the production of higher-grade fuels, advanced petrochemicals for diverse applications like polymers and specialty chemicals, and the exploration of cleaner energy solutions. Consumer preferences are increasingly leaning towards higher-quality, environmentally compliant products, prompting significant investment in upgrading existing facilities and constructing new, more sophisticated plants. Competitive dynamics are intensifying, with both domestic giants and global energy majors vying for market dominance. The strategic development of integrated refining and petrochemical complexes is a major focus, aiming to capture value across the entire downstream chain. Market penetration rates for advanced petrochemical derivatives are expected to rise, driven by demand from sectors such as automotive, construction, and consumer goods. The industry is also witnessing a gradual shift towards more sustainable practices, with investments in carbon capture technologies and the integration of bio-based feedstocks gaining traction. This period of dynamic change presents substantial opportunities for companies capable of adapting to technological advancements, regulatory shifts, and evolving consumer demands.

Dominant Markets & Segments in China Oil & Gas Downstream Industry

The dominant segment within the China oil and gas downstream industry is undeniably Petrochemical Plants. While refineries are foundational, the sheer scale and value addition potential of petrochemical production are driving unparalleled growth and investment.

Key Growth Drivers for Petrochemical Plants:

- Infrastructure Development: Massive government investment in building world-class petrochemical complexes across coastal and inland regions is a primary catalyst. This includes the construction of new refineries and petrochemical plants, designed with advanced technology and significant production capacities, estimated to reach over xx million tons per annum for key monomers by 2033.

- Policy Support and Strategic Vision: The Chinese government has identified the petrochemical sector as a strategic pillar of its economic development, aiming for self-sufficiency in high-value chemical products and reducing reliance on imports. Policies encouraging technological innovation and industrial upgrades are directly benefiting this segment.

- Enormous Domestic Demand: China's vast population and rapidly expanding manufacturing base create an insatiable demand for petrochemical products, ranging from plastics and synthetic fibers to fertilizers and specialty chemicals. The automotive sector, construction industry, and consumer electronics manufacturing are particularly significant end-users.

- Integration with Refining Operations: The trend towards integrated refining and petrochemical complexes allows for optimized feedstock utilization and enhanced profitability. This synergy enables producers to efficiently convert refinery byproducts into valuable petrochemical intermediates and finished products.

- Technological Advancements and Diversification: The development of new technologies to improve operational efficiency and expand product portfolios is crucial. This includes the production of advanced materials, high-performance polymers, and specialty chemicals that cater to niche but high-margin markets. The launch of new products and services is a continuous process, driven by research and development.

The dominance of petrochemical plants is further underscored by their contribution to the overall market value, projected to account for an estimated xx% of the total downstream market revenue by 2033. While refining remains critical for fuel production, the higher profit margins and greater diversification opportunities inherent in petrochemicals position it as the leading segment for future growth and investment within China's oil and gas downstream industry.

China Oil & Gas Downstream Industry Product Analysis

The China oil and gas downstream industry is experiencing a surge in product innovation, driven by the development of new technologies to improve operational efficiency and the launch of new products and services. Refined fuels are evolving towards higher quality and lower sulfur content to meet stringent environmental regulations. In the petrochemical sector, there's a strong focus on producing advanced polymers, specialty chemicals, and high-performance materials for applications in automotive, electronics, and construction. These innovations offer enhanced durability, lighter weight, and superior performance, providing a significant competitive advantage. The market fit for these products is robust, directly addressing the growing demand for sophisticated materials in China's industrial and consumer sectors.

Key Drivers, Barriers & Challenges in China Oil & Gas Downstream Industry

Key Drivers:

The China oil and gas downstream industry is propelled by several key drivers. These include robust economic growth fueling demand for energy and petrochemical products, significant government investment in infrastructure such as new refineries and petrochemical plants, and the continuous development of new technologies to improve operational efficiency. The launch of new products and services is also a critical factor, catering to evolving market needs and creating new revenue streams. Furthermore, supportive government policies promoting industrial upgrades and technological innovation play a pivotal role.

Barriers & Challenges:

Despite strong growth prospects, the industry faces significant challenges. Regulatory complexities, particularly evolving environmental standards and carbon emission targets, can pose hurdles. Supply chain issues, including feedstock availability and logistics, can impact operational continuity and cost-effectiveness. Intense competitive pressures from both domestic and international players necessitate constant innovation and cost optimization. The substantial capital expenditure required for new plant construction and technological upgrades also presents a financial barrier. Geopolitical uncertainties and global price volatility for crude oil can further impact profitability.

Growth Drivers in the China Oil & Gas Downstream Industry Market

Key growth drivers in the China oil and gas downstream industry include the relentless expansion of China's economy, which spurs demand for fuels and petrochemicals. The ongoing construction of new refineries and petrochemical plants signifies massive capital investment and capacity expansion. The development of new technologies to improve operational efficiency, such as advanced catalysis and digital integration, enhances profitability and competitiveness. The launch of new products and services, particularly in the specialty chemicals and advanced materials sectors, opens up new market avenues. Favorable government policies, including incentives for technological innovation and infrastructure development, are crucial accelerators.

Challenges Impacting China Oil & Gas Downstream Industry Growth

Several challenges impact the growth of China's oil and gas downstream industry. Regulatory complexities, especially concerning environmental protection and carbon emission reduction targets, require significant investment in compliance and may slow down expansion plans. Supply chain disruptions, whether due to global events or domestic logistics, can affect feedstock security and operational costs. Intense competitive pressures from established players and the emergence of alternative energy sources necessitate continuous innovation and cost management strategies. Furthermore, the substantial capital investment required for upgrading existing facilities and building new ones, coupled with volatile crude oil prices, can pose financial risks and impact profitability.

Key Players Shaping the China Oil & Gas Downstream Industry Market

- Shell Energy (China) Limited

- Total SA

- Sinopec Shanghai Petrochemical Company Limited

- China National Petroleum Corporation

- Chevron Corporation

- PetroChina Company Limited

- SABIC (Saudi Basic Industries Corporation)

- Sinochem International Corporation

- China National Chemical Corporation (ChemChina)

- Huaqiang Chemical Group

Significant China Oil & Gas Downstream Industry Industry Milestones

- 2019: Launch of new high-performance polymer products by Sinopec Shanghai Petrochemical Company Limited, expanding its specialty chemical portfolio.

- 2020: Completion of a major refinery upgrade by China National Petroleum Corporation, enhancing operational efficiency and fuel quality.

- 2021: PetroChina Company Limited announces significant investment in advanced petrochemical technologies to improve yield and reduce emissions.

- 2022: Sinochem International Corporation commences construction of a new, large-scale petrochemical plant aimed at increasing domestic production of key chemical intermediates.

- 2023: Shell Energy (China) Limited explores partnerships for developing advanced refining catalysts to boost operational efficiency.

- 2024 (Est.): China National Chemical Corporation (ChemChina) consolidates key downstream assets, signaling strategic restructuring and focus on high-value products.

- Ongoing (2019-2033): Continuous development of new technologies to improve operational efficiency across all major players.

- Ongoing (2019-2033): Consistent launch of new products and services catering to diverse industrial and consumer demands.

Future Outlook for China Oil & Gas Downstream Industry Market

The future outlook for China's oil and gas downstream industry is marked by continued robust growth, driven by increasing domestic demand and ongoing technological advancements. Strategic opportunities lie in the further development of high-value petrochemical products, advanced materials, and cleaner fuel technologies. The industry is poised to benefit from significant capital investments in constructing new refineries and petrochemical plants, enhancing operational efficiency through cutting-edge technologies. The launch of innovative products and services will cater to evolving market needs and create new avenues for revenue generation. While regulatory and environmental considerations will remain crucial, the industry's ability to adapt and embrace sustainable practices will be key to unlocking its full market potential.

China Oil & Gas Downstream Industry Segmentation

-

1. Type

- 1.1. Refinery

- 1.2. Petrochemical Plants

China Oil & Gas Downstream Industry Segmentation By Geography

- 1. China

China Oil & Gas Downstream Industry Regional Market Share

Geographic Coverage of China Oil & Gas Downstream Industry

China Oil & Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Refinery Capacity Expansion is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Oil & Gas Downstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refinery

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell Energy (China) Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sinopec Shanghai Petrochemical Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China National Petroleum Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PetroChina Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SABIC (Saudi Basic Industries Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sinochem International Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China National Chemical Corporation (ChemChina)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huaqiang Chemical Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shell Energy (China) Limited

List of Figures

- Figure 1: China Oil & Gas Downstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Oil & Gas Downstream Industry Share (%) by Company 2025

List of Tables

- Table 1: China Oil & Gas Downstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Oil & Gas Downstream Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: China Oil & Gas Downstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Oil & Gas Downstream Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: China Oil & Gas Downstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: China Oil & Gas Downstream Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 7: China Oil & Gas Downstream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: China Oil & Gas Downstream Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Oil & Gas Downstream Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the China Oil & Gas Downstream Industry?

Key companies in the market include Shell Energy (China) Limited, Total SA, Sinopec Shanghai Petrochemical Company Limited, China National Petroleum Corporation, Chevron Corporation*List Not Exhaustive, PetroChina Company Limited , SABIC (Saudi Basic Industries Corporation) , Sinochem International Corporation , China National Chemical Corporation (ChemChina) , Huaqiang Chemical Group.

3. What are the main segments of the China Oil & Gas Downstream Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 323.95 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Refinery Capacity Expansion is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

The construction of new refineries and petrochemical plants

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Oil & Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Oil & Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Oil & Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the China Oil & Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence