Key Insights

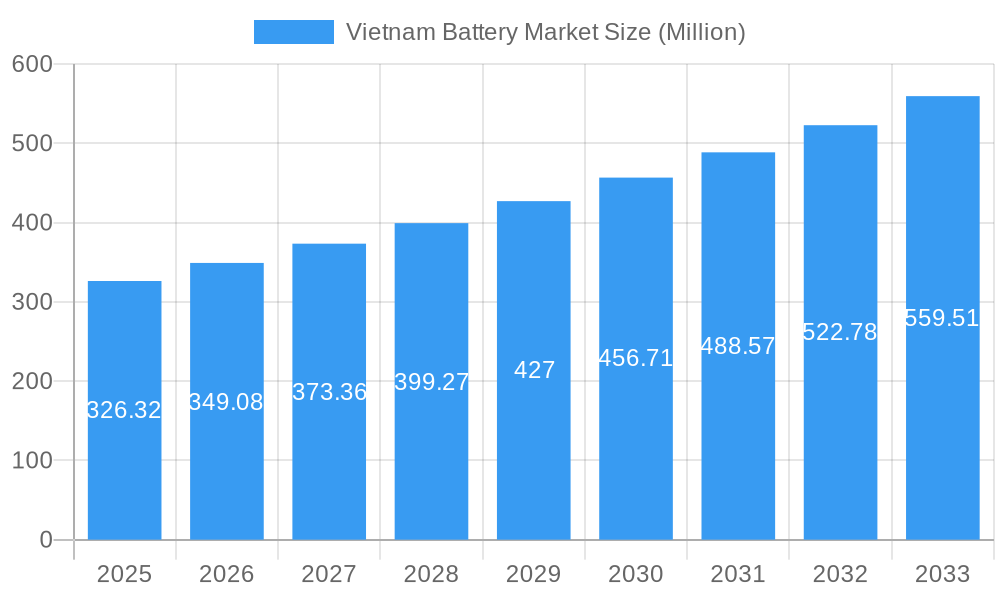

The Vietnam battery market is poised for significant expansion, with a current market size of $326.32 million and a projected Compound Annual Growth Rate (CAGR) of 6.83%. This robust growth trajectory is fueled by a confluence of factors, including the burgeoning automotive sector's increasing demand for reliable power sources, particularly with the rise of electric vehicles. The telecommunication industry's continuous evolution and expansion also necessitate a steady supply of high-performance batteries. Furthermore, the growing emphasis on renewable energy integration and the need for stable power grids are driving substantial investments in energy storage solutions. Key battery technologies like Lithium-ion batteries are at the forefront of this demand due to their superior energy density, longer lifespan, and faster charging capabilities, gradually displacing traditional Lead-acid batteries in critical applications. The overall market is characterized by dynamic growth, driven by technological advancements and increasing industrial and consumer needs across various sectors.

Vietnam Battery Market Market Size (In Million)

The market's expansion is further propelled by supportive government initiatives aimed at promoting the adoption of cleaner energy solutions and fostering domestic manufacturing capabilities. While the market benefits from strong drivers, it also faces certain restraints. High initial investment costs for advanced battery technologies and the ongoing development of recycling infrastructure can present challenges. However, the inherent demand for dependable and efficient energy storage across automotive, data centers, telecommunication, and diverse energy storage applications signifies a promising future. Leading companies like Ritar Power, PINACO, GS Battery Vietnam, and TIA Sang Battery are actively engaged in expanding their production capacities and product portfolios to meet this escalating demand, indicating a competitive yet opportunity-rich landscape for battery manufacturers, distributors, and importers within Vietnam.

Vietnam Battery Market Company Market Share

This in-depth report offers a dynamic, SEO-optimized analysis of the Vietnam Battery Market, a rapidly evolving sector driven by burgeoning demand for electric vehicles, renewable energy storage, and robust telecommunication infrastructure. Leveraging high-volume keywords such as "Vietnam battery market," "lithium-ion battery Vietnam," "lead-acid battery Vietnam," and "energy storage Vietnam," this research is meticulously structured to provide unparalleled insights for industry stakeholders, investors, and policymakers. The study encompasses a comprehensive historical period from 2019 to 2024, with a base year of 2025, and projects future trends and opportunities through a detailed forecast period of 2025–2033.

Vietnam Battery Market Market Structure & Competitive Landscape

The Vietnam Battery Market is characterized by a dynamic and evolving competitive landscape, with a moderate level of market concentration. Key players are actively engaged in innovation and strategic partnerships to capture market share. The presence of both established international manufacturers and growing domestic enterprises contributes to a competitive environment. Innovation drivers are primarily fueled by the accelerating adoption of electric vehicles (EVs) and the increasing demand for reliable energy storage solutions. Regulatory impacts, particularly government incentives for green energy and EV adoption, are playing a crucial role in shaping market dynamics. Product substitutes, while present, are increasingly challenged by the superior performance and evolving cost-effectiveness of advanced battery technologies. End-user segmentation reveals strong growth across automotive, telecommunication, and energy storage applications. Merger and acquisition (M&A) trends are on the rise, as companies seek to consolidate their positions, acquire new technologies, and expand their operational capabilities. For instance, October 2023 saw VinES merge with VinFast, aiming to enhance battery technology's self-efficiency and R&D for EVs, a significant move that could alter market concentration. The overall market concentration, as indicated by a XX% concentration ratio for the top five players in 2025, is expected to see a slight decrease to XX% by 2033 due to the entry of new players and expansion of existing ones. M&A activities are projected to involve approximately $XX Million worth of deals between 2025 and 2033, focusing on battery technology advancements and supply chain integration.

Vietnam Battery Market Market Trends & Opportunities

The Vietnam Battery Market is poised for substantial growth, projected to expand from an estimated $XX Billion in 2025 to $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This impressive trajectory is underpinned by several key trends. The rapid expansion of the Vietnamese automotive sector, coupled with a strong governmental push towards electrification, is a primary growth catalyst. This surge in EV adoption directly translates into an escalating demand for high-performance lithium-ion batteries. Concurrently, the nation's commitment to renewable energy sources, such as solar and wind power, is driving significant investment in battery energy storage systems (BESS). These systems are crucial for grid stability, load balancing, and ensuring a consistent power supply from intermittent renewable sources. The telecommunications industry also presents a robust opportunity, with the ongoing 5G rollout necessitating more reliable and efficient backup power solutions, often provided by advanced battery technologies.

Consumer preferences are increasingly shifting towards sustainable and technologically advanced solutions, further propelling the market. The growing awareness of environmental issues and the declining costs of battery production are making electric vehicles and renewable energy more accessible and attractive to a wider consumer base. Technologically, advancements in battery chemistries, particularly in lithium-ion variants like LFP (lithium iron phosphate) and NMC (nickel manganese cobalt), are offering improved energy density, longer lifespan, and enhanced safety features, catering to diverse application needs.

The competitive landscape is dynamic, with established players expanding their production capacities and new entrants seeking niche markets. Collaborations and partnerships are becoming increasingly prevalent. For example, the May 2023 announcement of Marubeni Corporation of Japan collaborating with VinES to create energy storage facilities in Southeast Asia highlights the international interest and potential for large-scale BESS deployments. These collaborations are crucial for knowledge transfer, technological innovation, and market penetration. Opportunities abound for companies that can offer localized manufacturing, competitive pricing, and tailored solutions for the specific needs of the Vietnamese market. The increasing penetration rate of electric vehicles in Vietnam, projected to rise from XX% in 2025 to XX% by 2033, underscores the immense potential for battery manufacturers and suppliers. Furthermore, the development of a robust domestic battery manufacturing ecosystem, supported by government policies, presents significant opportunities for both local and international investors.

Dominant Markets & Segments in Vietnam Battery Market

The Vietnam Battery Market exhibits dominance across several key segments, driven by specific industry developments and policy directives.

Battery Technology:

- Lithium-ion Battery: This segment is experiencing the most rapid growth, projected to capture a XX% market share by 2033. Its dominance is fueled by its superior energy density, longer lifespan, and suitability for high-demand applications like electric vehicles and portable electronics. The increasing focus on EV production in Vietnam, spearheaded by companies like VinFast, directly boosts the demand for lithium-ion batteries. Continuous technological advancements in lithium-ion chemistries, including LFP and NMC, are further solidifying its leading position.

- Lead-acid Battery: While mature, lead-acid batteries continue to hold a significant market share, particularly in automotive starter batteries and backup power applications where cost-effectiveness is paramount. This segment is expected to grow at a CAGR of XX% during the forecast period, driven by existing infrastructure and replacement markets.

- Other Battery Types: This category, encompassing technologies like nickel-metal hydride (NiMH) and emerging solid-state batteries, currently holds a smaller market share but is poised for growth, especially in specialized applications and future technological advancements.

Application:

- Automotive: This is the leading application segment, projected to account for XX% of the total market by 2033. The surge in electric vehicle sales in Vietnam, supported by government subsidies and infrastructure development, is the primary driver. Companies like VinFast are at the forefront of this revolution, demanding a massive supply of EV batteries.

- Energy Storage: The demand for energy storage solutions is rapidly increasing, driven by the integration of renewable energy sources and the need for grid stability. This segment is expected to grow at a CAGR of XX%, supported by government initiatives promoting clean energy. The collaboration between Marubeni Corporation and VinES for energy storage facilities highlights this trend.

- Telecommunication: With the ongoing expansion of 5G networks and the increasing reliance on mobile communication, the telecommunication sector represents a significant and growing market for batteries, particularly for backup power and uninterruptible power supply (UPS) systems.

- Data Centers: The booming digital economy and the growth of cloud computing are leading to an increased demand for reliable power solutions for data centers, making batteries a critical component.

- Other Applications: This includes portable electronics, industrial equipment, and consumer goods, which collectively contribute to the market's diversification.

The dominance of the Automotive application, coupled with the Lithium-ion Battery technology, forms the most powerful growth engine for the Vietnam Battery Market. Key growth drivers in these dominant segments include government policies promoting EV adoption and renewable energy, falling battery prices due to economies of scale, and advancements in battery manufacturing technology within Vietnam. The infrastructure development supporting EV charging stations and renewable energy projects further solidifies the leading position of these segments.

Vietnam Battery Market Product Analysis

The Vietnam Battery Market is witnessing a wave of product innovation focused on enhancing performance, safety, and cost-effectiveness. Lithium-ion battery technologies, particularly LFP and NMC chemistries, are leading the charge with advancements in energy density for longer EV ranges and improved charging speeds. Product innovations are also geared towards developing batteries with longer cycle lives, reduced degradation, and enhanced thermal management for improved safety in demanding applications like electric vehicles and large-scale energy storage. Competitive advantages are being built on the back of localized manufacturing, robust supply chain integration, and the development of specialized battery solutions tailored to the unique environmental and operational conditions in Vietnam. The focus on sustainable sourcing of raw materials and efficient recycling processes is also emerging as a key differentiator.

Key Drivers, Barriers & Challenges in Vietnam Battery Market

Key Drivers: The Vietnam Battery Market is propelled by several potent drivers. Technologically, the rapid advancement in lithium-ion battery chemistries is enabling higher energy density, faster charging, and enhanced safety, directly benefiting the EV sector. Economically, decreasing battery production costs due to economies of scale and increasing global demand are making battery-powered solutions more affordable. Policy-driven factors, such as the Vietnamese government's strong support for EV adoption through subsidies, tax incentives, and ambitious renewable energy targets, are creating a favorable market environment. For instance, the government's commitment to phasing out fossil fuel vehicles by 2040 will significantly boost the demand for batteries.

Key Barriers & Challenges: Despite the growth, the market faces significant challenges. Supply chain issues, particularly for critical raw materials like lithium, cobalt, and nickel, can lead to price volatility and production delays. Regulatory hurdles, though generally supportive, can sometimes be complex, requiring clear frameworks for battery recycling and disposal. Competitive pressures from established international players with advanced technology and economies of scale can pose a challenge for emerging domestic manufacturers. Furthermore, the initial high cost of electric vehicles, although decreasing, remains a barrier to widespread consumer adoption. The development of robust and widespread charging infrastructure is also crucial and can be a bottleneck.

Growth Drivers in the Vietnam Battery Market Market

The Vietnam Battery Market is experiencing robust growth driven by several key factors. Technologically, continuous improvements in lithium-ion battery performance, including higher energy density and faster charging capabilities, are fueling demand, especially for electric vehicles. Economically, the declining cost of battery production, coupled with increasing consumer affordability, is making battery-powered solutions more accessible. Government policies, such as ambitious renewable energy targets and incentives for electric vehicle adoption, are creating a highly supportive market environment. For example, the “National Green Growth Strategy” is a significant catalyst. The burgeoning demand from the automotive sector, the expansion of telecommunication networks, and the need for reliable energy storage solutions for renewable energy integration are all significant growth drivers.

Challenges Impacting Vietnam Battery Market Growth

Several challenges can impact the growth of the Vietnam Battery Market. Supply chain vulnerabilities, particularly for critical raw materials, can lead to price fluctuations and hinder production scaling. Regulatory complexities, including the need for comprehensive battery recycling frameworks and safety standards, require careful navigation. Intense competitive pressures from global manufacturers with established technologies and economies of scale can pose a challenge for local players. Furthermore, the upfront cost of electric vehicles, although declining, remains a barrier to mass consumer adoption. The development and widespread availability of charging infrastructure are also crucial for the seamless integration of EVs.

Key Players Shaping the Vietnam Battery Market Market

- Ritar Power (Vietnam) Company Limited

- PINACO

- GS Battery Vietnam Co Ltd

- Leoch International Technology Limited

- TIA Sang Battery Joint Stock Company

- Kung Long Batteries Industrial Co Ltd

- Eni- Florence Vietnam Co Ltd

- Heng Li (Vietnam) Battery Technology Co Ltd

- Saite Power Source(Vietnam) Co Ltd

- Vision Group

Significant Vietnam Battery Market Industry Milestones

- October 2023: VinES announced its merger with VinFast to enhance battery technology's self-efficiency and leverage resources to increase battery research and development for EVs.

- May 2023: Marubeni Corporation of Japan announced its collaboration with VinES, a Vietnamese battery and energy-as-a-service provider, to create energy storage facilities in the Southeast Asian country. Marubeni will begin with a feasibility study for battery energy storage system (BESS) installations at Vingroup commercial and industrial (C&I) locations.

Future Outlook for Vietnam Battery Market Market

The Vietnam Battery Market is projected for a bright and dynamic future, driven by sustained demand from key sectors and ongoing technological advancements. Strategic opportunities lie in expanding domestic manufacturing capabilities, fostering innovation in advanced battery chemistries, and developing robust battery recycling infrastructure. The increasing integration of renewable energy sources and the accelerating adoption of electric vehicles will continue to fuel market growth. The Vietnamese government's commitment to a green economy and its supportive policies are expected to attract further foreign investment and technological collaboration. The market's potential is further amplified by the growing regional demand for energy storage solutions and the positioning of Vietnam as a key manufacturing hub in Southeast Asia, presenting a promising outlook for stakeholders in the coming years.

Vietnam Battery Market Segmentation

-

1. Battery Technology

- 1.1. Lead-acid Battery

- 1.2. Lithium-ion Battery

- 1.3. Other Battery Types

-

2. Application

- 2.1. Automotive

- 2.2. Data Centers

- 2.3. Telecommunication

- 2.4. Energy Storage

- 2.5. Other Applications

Vietnam Battery Market Segmentation By Geography

- 1. Vietnam

Vietnam Battery Market Regional Market Share

Geographic Coverage of Vietnam Battery Market

Vietnam Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country

- 3.3. Market Restrains

- 3.3.1. 4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems

- 3.4. Market Trends

- 3.4.1. The Lead-acid Battery Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Technology

- 5.1.1. Lead-acid Battery

- 5.1.2. Lithium-ion Battery

- 5.1.3. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Data Centers

- 5.2.3. Telecommunication

- 5.2.4. Energy Storage

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Battery Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ritar Power (Vietnam) Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PINACO

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GS Battery Vietnam Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leoch International Technology Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TIA Sang Battery Joint Stock Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kung Long Batteries Industrial Co Ltd*List Not Exhaustive 6 4 Potential List of Distributors/Importers with Their Battery Brands6 5 Market Ranking Analysi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eni- Florence Vietnam Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heng Li (Vietnam) Battery Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saite Power Source(Vietnam) Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vision Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ritar Power (Vietnam) Company Limited

List of Figures

- Figure 1: Vietnam Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Battery Market Revenue Million Forecast, by Battery Technology 2020 & 2033

- Table 2: Vietnam Battery Market Volume K Units Forecast, by Battery Technology 2020 & 2033

- Table 3: Vietnam Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Vietnam Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 5: Vietnam Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Vietnam Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Vietnam Battery Market Revenue Million Forecast, by Battery Technology 2020 & 2033

- Table 8: Vietnam Battery Market Volume K Units Forecast, by Battery Technology 2020 & 2033

- Table 9: Vietnam Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Vietnam Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 11: Vietnam Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Vietnam Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Battery Market?

The projected CAGR is approximately 6.83%.

2. Which companies are prominent players in the Vietnam Battery Market?

Key companies in the market include Ritar Power (Vietnam) Company Limited, PINACO, GS Battery Vietnam Co Ltd, Leoch International Technology Limited, TIA Sang Battery Joint Stock Company, Kung Long Batteries Industrial Co Ltd*List Not Exhaustive 6 4 Potential List of Distributors/Importers with Their Battery Brands6 5 Market Ranking Analysi, Eni- Florence Vietnam Co Ltd, Heng Li (Vietnam) Battery Technology Co Ltd, Saite Power Source(Vietnam) Co Ltd, Vision Group.

3. What are the main segments of the Vietnam Battery Market?

The market segments include Battery Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 326.32 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country.

6. What are the notable trends driving market growth?

The Lead-acid Battery Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems.

8. Can you provide examples of recent developments in the market?

October 2023: VinES announced its merger with VinFast to enhance battery technology's self-efficiency and leverage resources to increase battery research and development for EVs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Battery Market?

To stay informed about further developments, trends, and reports in the Vietnam Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence