Key Insights

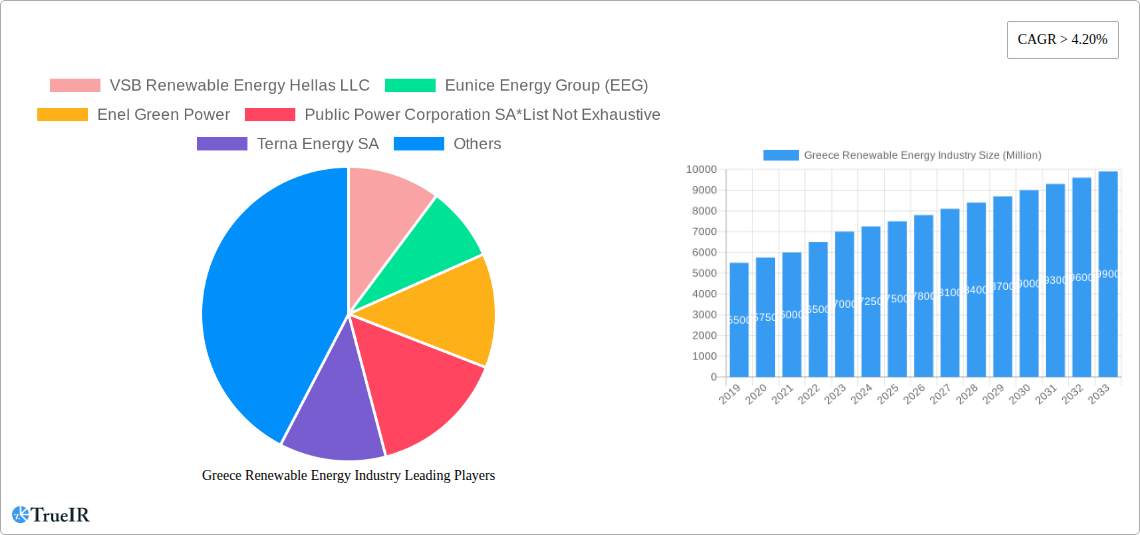

The Greek renewable energy industry is poised for significant expansion, driven by a strong commitment to decarbonization and energy independence. In 2023, the market size is estimated at a robust €7 billion, reflecting substantial investments in clean energy infrastructure. This growth is propelled by a CAGR of 4% over the forecast period from 2019 to 2033, indicating a steady and upward trajectory for the sector. Key drivers for this expansion include favorable government policies, increasing investor confidence, and the strategic imperative to reduce reliance on fossil fuels, particularly in light of evolving geopolitical landscapes. Greece's abundant natural resources, including high solar irradiation and consistent wind speeds along its coastlines and islands, further bolster the potential for renewable energy development. The diversification of the energy mix, with a growing emphasis on wind and solar power, is a defining trend. These sources are increasingly becoming cost-competitive with traditional energy generation, making them attractive investment options.

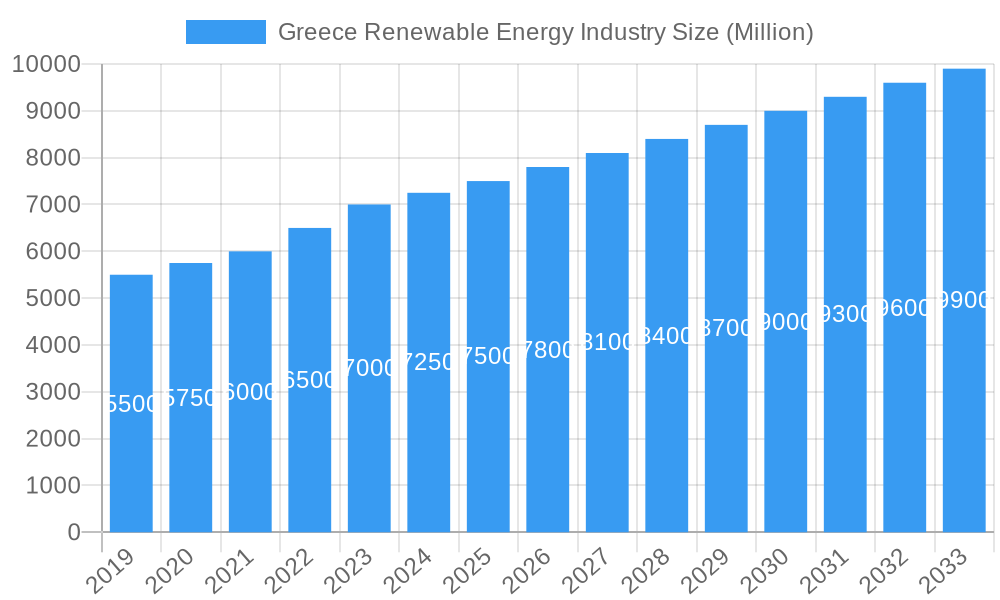

Greece Renewable Energy Industry Market Size (In Billion)

The market is segmented across wind, solar, hydro, and other renewable sources, with wind and solar power leading the charge in terms of new capacity installations and investment. Major players like Enel Green Power, Public Power Corporation SA, and Terna Energy SA are actively investing in and developing a wide range of renewable energy projects across the country. While the market is experiencing robust growth, certain restraints such as grid integration challenges and the need for continuous infrastructure upgrades to accommodate the increasing penetration of intermittent renewable sources need to be addressed. However, ongoing technological advancements and strategic planning by both the government and private sector are expected to mitigate these challenges. The strong forecast for the Greek renewable energy market underscores its critical role in achieving national and European climate targets, creating a sustainable and resilient energy future.

Greece Renewable Energy Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Greece Renewable Energy Industry, structured as requested:

Greece Renewable Energy Industry Market Structure & Competitive Landscape

The Greece Renewable Energy Industry is characterized by a dynamic and evolving market structure, increasingly driven by ambitious national and European Union targets for decarbonization. Market concentration is moderate, with a few key players dominating significant portions of the installed capacity, particularly in wind and solar. Innovation drivers are primarily focused on enhancing efficiency, reducing Levelized Cost of Energy (LCOE), and integrating smart grid technologies. Regulatory impacts are profound, with government incentives, auction mechanisms, and grid access policies playing a pivotal role in shaping investment decisions and market entry. Product substitutes are limited in the core renewable energy generation sector itself, but the broader energy market sees competition from fossil fuels, although this is diminishing. End-user segmentation spans industrial, commercial, and residential consumers, with a growing trend towards direct power purchase agreements (PPAs) and behind-the-meter solutions. Mergers & Acquisitions (M&A) trends are on an upward trajectory as larger international and domestic players consolidate portfolios and seek to leverage economies of scale. The report analyzes concentration ratios, M&A volumes, and provides qualitative insights into strategic alliances and partnerships that are reshaping the competitive landscape.

Greece Renewable Energy Industry Market Trends & Opportunities

The Greece Renewable Energy Industry is poised for significant expansion, with robust market size growth anticipated over the forecast period of 2025–2033. This growth is propelled by a confluence of factors, including the nation's abundant natural resources, particularly solar and wind potential, and strong governmental support aimed at achieving EU climate objectives. Technological shifts are continuously optimizing renewable energy generation, with advancements in photovoltaic (PV) panel efficiency, larger and more advanced wind turbines, and improved energy storage solutions playing a crucial role. These innovations are not only increasing output but also driving down costs, making renewables increasingly competitive against conventional energy sources.

Consumer preferences are rapidly shifting towards sustainable energy solutions, driven by environmental consciousness, desire for energy independence, and the potential for cost savings. This is evident in the increasing demand for rooftop solar installations, community energy projects, and green energy tariffs. The competitive dynamics within the market are intensifying, with established utility companies, independent power producers, and international developers vying for market share. The integration of battery storage systems is emerging as a critical trend, addressing the intermittency of solar and wind power and enhancing grid stability. This creates substantial opportunities for companies specializing in storage technologies, grid modernization, and smart energy management solutions.

Furthermore, the Hellenic Republic's National Energy and Climate Plan (NECP) outlines aggressive targets for renewable energy deployment, providing a clear roadmap for future investments and development. The ongoing liberalization of the energy market and the introduction of new auction frameworks are fostering a more competitive and transparent environment, attracting both domestic and foreign direct investment. The report delves into the projected Compound Annual Growth Rate (CAGR) for various renewable energy segments, market penetration rates, and the evolving consumer behavior that is shaping the future of Greece's clean energy transition. Opportunities abound in areas such as offshore wind development, green hydrogen production, and the repowering of existing renewable energy installations.

Dominant Markets & Segments in Greece Renewable Energy Industry

The Wind segment is a dominant force within the Greece Renewable Energy Industry, consistently leading in installed capacity and contributing significantly to the nation's energy mix. Key growth drivers for wind power include Greece's extensive coastline and mountainous terrain, which offer prime locations for both onshore and increasingly offshore wind farm development. Supportive policies, such as feed-in tariffs, auction mechanisms, and streamlined permitting processes, have historically incentivized wind energy investments. The ongoing technological advancements in turbine design, leading to higher capacity factors and reduced operational costs, further bolster its dominance.

Solar energy is another pivotal segment, experiencing exponential growth and rapidly challenging wind's leading position. Greece's exceptional solar irradiation levels make it an ideal candidate for photovoltaic (PV) power generation across all scales, from utility-scale solar farms to residential rooftop installations. Key growth drivers include the declining costs of solar PV technology, supportive government subsidies and tax incentives, and the increasing adoption of energy storage solutions, which mitigate the intermittency of solar power. The implementation of ambitious solar targets within national energy plans, coupled with the growing interest in self-consumption and virtual net metering schemes, fuels this segment's expansion.

While Hydro power has a long-standing presence, its growth potential is more constrained due to geographical limitations and environmental considerations. However, existing hydro facilities continue to provide valuable baseload power and grid stability. The "Other Sources" segment, encompassing emerging technologies like geothermal and biomass, represents a smaller but growing portion of the market. Growth drivers here are linked to national diversification efforts, the utilization of local resources, and the development of innovative waste-to-energy solutions. The report provides a detailed analysis of the market dominance within each of these segments, exploring the infrastructure development, policy frameworks, and investment trends that are shaping their respective trajectories.

Greece Renewable Energy Industry Product Analysis

The Greece Renewable Energy Industry is defined by a range of technologically advanced products crucial for decarbonization. Innovations in wind turbines focus on larger rotor diameters, higher hub heights, and advanced control systems to maximize energy capture in varying wind conditions. Solar photovoltaic (PV) modules are seeing continuous improvements in cell efficiency, durability, and reduced material costs, with advancements in bifacial panels and perovskite technology showing significant promise. Energy storage solutions, particularly advanced battery technologies like lithium-ion and emerging flow batteries, are critical for grid integration and ensuring power reliability. Competitive advantages lie in increased energy yield, reduced LCOE, enhanced grid stability, and the ability to meet stringent environmental regulations.

Key Drivers, Barriers & Challenges in Greece Renewable Energy Industry

Key Drivers:

- Ambitious EU and National Decarbonization Targets: Greece is committed to significant reductions in carbon emissions, driving substantial investment in renewable energy.

- Abundant Natural Resources: High solar irradiation and strong wind potential across the country provide a natural advantage.

- Decreasing Technology Costs: The falling prices of solar PV and wind turbine technology make renewables increasingly cost-competitive.

- Government Incentives and Support Schemes: Auctions, tax breaks, and favorable grid access policies encourage project development.

- Growing Environmental Awareness and Consumer Demand: Increased public and corporate demand for clean energy solutions.

Barriers & Challenges:

- Grid Integration and Infrastructure Limitations: The existing grid infrastructure requires substantial upgrades to accommodate the increasing influx of variable renewable energy.

- Permitting and Bureaucratic Hurdles: Lengthy and complex permitting processes can delay project timelines and increase development costs.

- Financing and Investment Risk: Securing adequate and affordable financing, especially for large-scale projects, can be challenging.

- Intermittency of Renewable Sources: The inherent variability of wind and solar power necessitates robust energy storage solutions and grid management strategies.

- Supply Chain Volatility: Global supply chain disruptions can impact the availability and cost of key components.

Growth Drivers in the Greece Renewable Energy Industry Market

The Greece Renewable Energy Industry's growth is propelled by several key factors. Technologically, ongoing advancements in wind turbine efficiency, solar PV panel performance, and the burgeoning field of energy storage are making renewables more reliable and cost-effective. Economically, the decreasing Levelized Cost of Energy (LCOE) for wind and solar power positions them favorably against fossil fuels, attracting significant domestic and international investment. Regulatory drivers are also paramount, with Greece's adherence to ambitious EU climate targets and the implementation of supportive national policies, including competitive auction schemes and grid access frameworks, creating a conducive environment for new project development.

Challenges Impacting Greece Renewable Energy Industry Growth

Several challenges continue to impact the growth trajectory of the Greece Renewable Energy Industry. Regulatory complexities and evolving legal frameworks can create uncertainty for investors, while lengthy permitting processes often lead to project delays. Supply chain issues, including the availability and cost of critical raw materials and components for solar panels and wind turbines, can impact project timelines and profitability. Competitive pressures are mounting as more developers enter the market, potentially leading to increased price competition in auctions. Furthermore, the significant investment required for grid modernization and the integration of large-scale renewable energy sources presents an ongoing financial and technical challenge.

Key Players Shaping the Greece Renewable Energy Industry Market

- VSB Renewable Energy Hellas LLC

- Eunice Energy Group (EEG)

- Enel Green Power

- Public Power Corporation SA

- Terna Energy SA

Significant Greece Renewable Energy Industry Industry Milestones

- December 2021: National Energy Holdings Ltd, a UK-based renewable energy company, successfully closed the financial deal for a 60.3 MWp solar project in Greece. This abroad program, valued at USD 68 million, encompasses a 51.5 MWp solar project in Viotia and an additional 8.8 MWp in Peloponnese, signifying substantial investment and project execution within the Greek solar market.

Future Outlook for Greece Renewable Energy Industry Market

The future outlook for the Greece Renewable Energy Industry is exceptionally bright, driven by a powerful synergy of supportive government policies, rapidly advancing technologies, and a growing market appetite for clean energy. Strategic opportunities lie in the further expansion of utility-scale wind and solar farms, the development of offshore wind potential, and the integration of green hydrogen production. Market potential is immense, with Greece well-positioned to not only meet its renewable energy targets but also become a regional leader in sustainable energy generation and export, fostering economic growth and energy security.

Greece Renewable Energy Industry Segmentation

-

1. Source

- 1.1. Wind

- 1.2. Solar

- 1.3. Hydro

- 1.4. Other Sources

Greece Renewable Energy Industry Segmentation By Geography

- 1. Greece

Greece Renewable Energy Industry Regional Market Share

Geographic Coverage of Greece Renewable Energy Industry

Greece Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Integration of Renewable Energy4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. High infrastructure costs

- 3.4. Market Trends

- 3.4.1. Wind Energy Expected to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Wind

- 5.1.2. Solar

- 5.1.3. Hydro

- 5.1.4. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 VSB Renewable Energy Hellas LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eunice Energy Group (EEG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enel Green Power

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Public Power Corporation SA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Terna Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 VSB Renewable Energy Hellas LLC

List of Figures

- Figure 1: Greece Renewable Energy Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Greece Renewable Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Greece Renewable Energy Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: Greece Renewable Energy Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Greece Renewable Energy Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 4: Greece Renewable Energy Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece Renewable Energy Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Greece Renewable Energy Industry?

Key companies in the market include VSB Renewable Energy Hellas LLC, Eunice Energy Group (EEG), Enel Green Power, Public Power Corporation SA*List Not Exhaustive, Terna Energy SA.

3. What are the main segments of the Greece Renewable Energy Industry?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Integration of Renewable Energy4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Wind Energy Expected to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

High infrastructure costs.

8. Can you provide examples of recent developments in the market?

In December 2021, National Energy Holdings Ltd, a UK-based renewable energy company, closed the financial deal for a 60.3 MWp of solar project in Greece. The company signed an abroad program for USD 68 million, including a 51.5 MWp solar project in Viotia and 8.8 MWp in Peloponnese.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the Greece Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence