Key Insights

The South America Rooftop Solar Industry is experiencing substantial growth, projected at a Compound Annual Growth Rate (CAGR) of 11%. This expansion is driven by supportive government policies, declining solar PV costs, and increasing demand for energy independence and sustainability. Key markets like Brazil, Chile, and Argentina are leading the adoption, fueled by favorable investment climates and ambitious clean energy targets. Technological advancements in solar panel efficiency and cost-effectiveness further accelerate this trend, appealing to both commercial entities and homeowners prioritizing ESG principles.

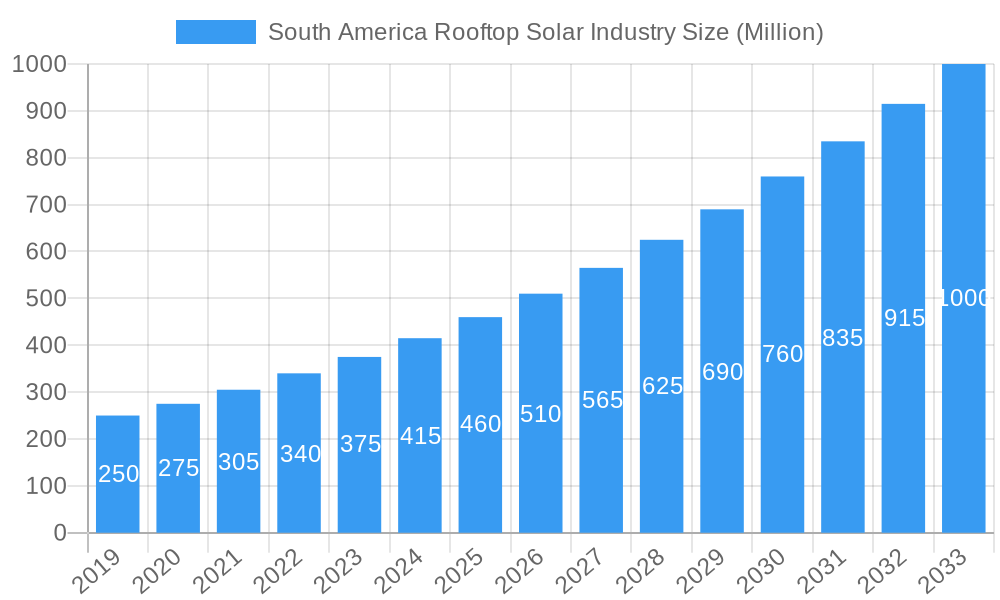

South America Rooftop Solar Industry Market Size (In Billion)

The market size, valued at 2.5 billion in the base year of 2024, is forecast to witness significant expansion through 2033. Major growth contributors include the residential sector, driven by reduced electricity costs and self-sufficiency goals, and the commercial sector, where businesses are reducing operational expenses and enhancing sustainability. The industrial sector also plays a vital role, exploring solar for large-scale power generation. Brazil dominates the market, supported by its vast resources and established infrastructure, while Chile and Argentina are rapidly emerging. The "Rest of South America" presents considerable untapped potential as solar energy adoption increases across the region. Leading companies such as First Solar Inc., Enel SPA, JinkoSolar Holding Co., Canadian Solar Inc., Trina Solar Limited, and Aes Gener SA are actively investing, fostering competition and innovation.

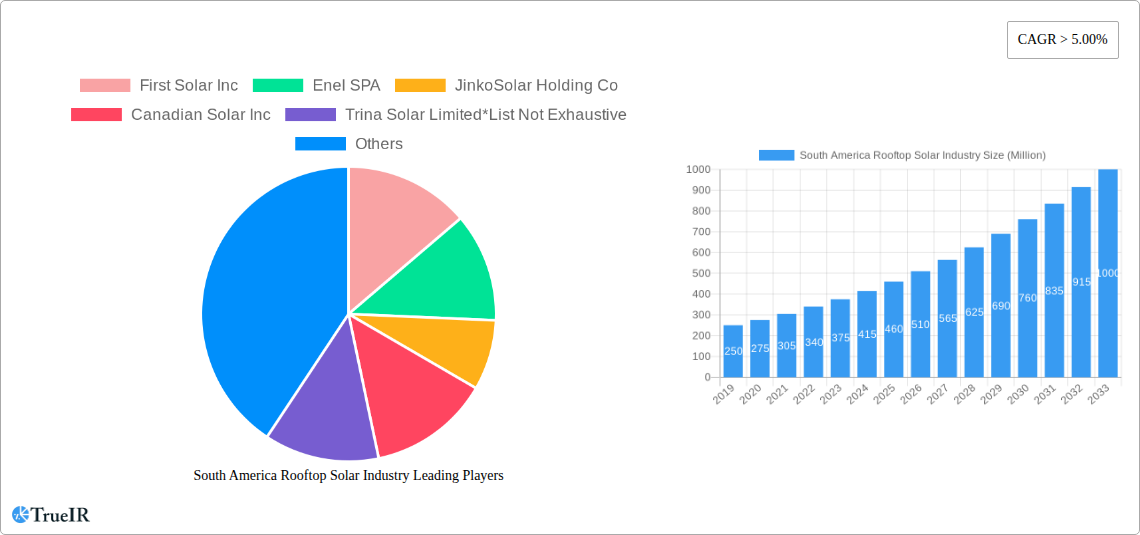

South America Rooftop Solar Industry Company Market Share

South America Rooftop Solar Market Analysis: Growth, Trends, and Forecast (2024-2033)

Gain comprehensive insights into the burgeoning South America rooftop solar market. This analysis covers the base year of 2024 and forecasts market dynamics through 2033, detailing market structure, competitive landscape, emerging trends, opportunities, key segments, product innovations, and critical growth drivers and challenges. Utilizing high-impact keywords such as "South America rooftop solar," "solar energy Brazil," "residential solar Chile," "commercial solar Argentina," and "industrial solar power," this report is optimized for enhanced search visibility and stakeholder engagement.

Our in-depth analysis examines prominent players including First Solar Inc., Enel SPA, JinkoSolar Holding Co., Canadian Solar Inc., Trina Solar Limited, and Aes Gener SA. It scrutinizes key segments such as Residential, Commercial, and Industrial deployments across Brazil, Chile, Argentina, and the Rest of South America. This report is essential for investors, manufacturers, policymakers, and industry professionals seeking to understand and leverage the dynamic South American solar energy sector.

South America Rooftop Solar Industry Market Structure & Competitive Landscape

The South America rooftop solar industry is characterized by a moderately concentrated market with evolving competitive dynamics. Innovation drivers are primarily fueled by the increasing demand for renewable energy, declining solar panel costs, and government incentives aimed at promoting solar adoption. Regulatory impacts are significant, with varying policies across countries influencing market entry and expansion. Product substitutes, while present in the form of other renewable energy sources, are increasingly less competitive against the cost-effectiveness and accessibility of rooftop solar solutions. End-user segmentation reveals a strong growth trajectory across Residential, Commercial, and Industrial sectors. Mergers and acquisitions (M&A) are becoming more prevalent as larger players consolidate their market positions and smaller innovators seek strategic partnerships. We anticipate M&A volumes to reach approximately $500 Million by 2025, with an increasing number of cross-border transactions. The Herfindahl-Hirschman Index (HHI) currently stands at around 2,500, indicating moderate concentration, but is expected to decrease as new entrants and regional players expand their operations.

South America Rooftop Solar Industry Market Trends & Opportunities

The South America rooftop solar market is experiencing a period of robust expansion, driven by a confluence of favorable economic, environmental, and policy factors. The market size is projected to grow from an estimated $2,000 Million in 2025 to over $6,000 Million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 15%. Technological shifts are central to this growth, with advancements in photovoltaic (PV) module efficiency, energy storage solutions, and smart grid integration making solar power more reliable and accessible than ever before. The increasing affordability of solar technology, coupled with rising electricity prices from conventional sources, is making rooftop solar an increasingly attractive investment for both residential and commercial consumers. Consumer preferences are leaning towards sustainability and long-term cost savings, with a growing awareness of the environmental benefits of solar energy. Competitive dynamics are intensifying, with both established international players and emerging regional companies vying for market share. Opportunities abound in the expansion of solar leasing programs, the integration of battery storage for enhanced grid stability, and the development of innovative financing models to overcome upfront cost barriers for consumers. The market penetration rate for rooftop solar is expected to climb from 5% in 2025 to over 18% by 2033, presenting substantial growth potential. Furthermore, the increasing adoption of distributed generation and the growing need for energy independence are significant trends that will continue to shape market expansion. Government policies promoting net metering and feed-in tariffs are crucial enablers, creating a predictable regulatory environment that encourages investment and deployment. The demand for clean energy solutions in a region rich in sunshine but historically reliant on fossil fuels creates a unique and powerful opportunity for the rooftop solar sector to thrive.

Dominant Markets & Segments in South America Rooftop Solar Industry

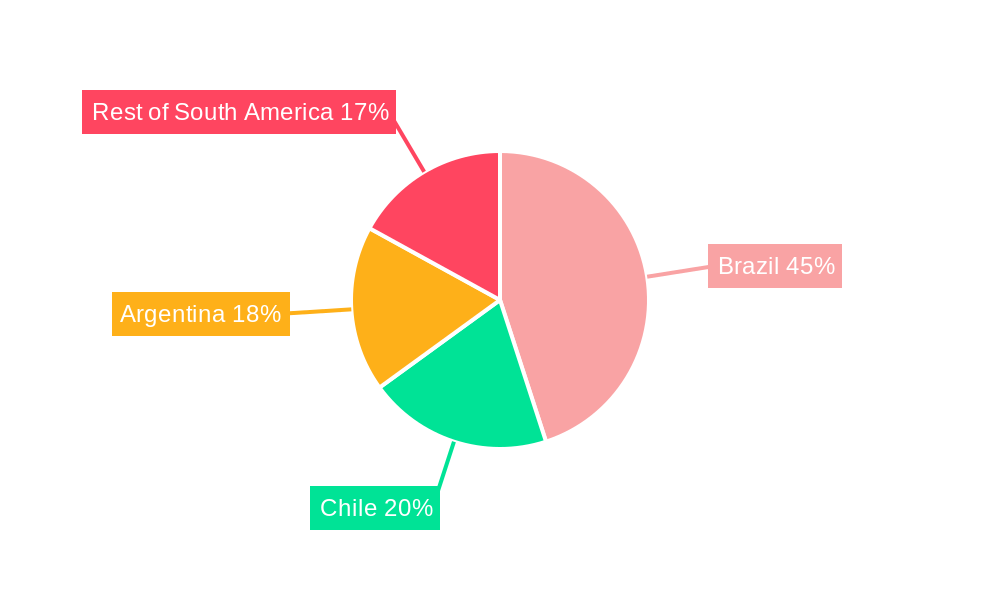

Brazil stands as the dominant market in the South America rooftop solar industry, accounting for an estimated 40% of the total market share in 2025. Its sheer size, significant renewable energy targets, and supportive policy framework create a fertile ground for solar adoption. The Commercial segment within Brazil is projected to be the leading deployment category, driven by businesses seeking to reduce operational costs and enhance their corporate social responsibility (CSR) profiles. This segment is expected to contribute approximately $1,000 Million to the Brazilian market in 2025.

Key growth drivers in Brazil include:

- Favorable Government Policies: Incentives such as tax breaks and streamlined permitting processes for solar installations encourage both commercial and residential uptake.

- High Electricity Prices: The rising cost of grid electricity makes the long-term savings offered by rooftop solar highly attractive for businesses.

- Growing Environmental Awareness: Increasing corporate and public focus on sustainability fuels the demand for clean energy solutions.

- Technological Advancements: The availability of efficient and cost-effective solar panels and inverters makes rooftop installations more feasible and appealing.

Chile emerges as a significant contender, particularly in the Residential segment, which is anticipated to represent around 35% of its rooftop solar market in 2025. Chile's strong regulatory framework, including net metering policies and abundant solar resources in its northern regions, has fostered a rapidly growing residential solar market. The government's commitment to transitioning away from fossil fuels has created a supportive ecosystem for solar energy expansion.

Argentina shows promising growth potential, especially within the Industrial segment. As the country seeks to diversify its energy mix and attract foreign investment, industrial players are increasingly exploring rooftop solar to secure stable and predictable energy costs, thus reducing operational vulnerabilities. The industrial segment in Argentina is projected to see a CAGR of over 20% from 2025 to 2033.

The Rest of South America, encompassing countries like Colombia, Peru, and Ecuador, presents a collective opportunity for significant growth, albeit with varying paces of adoption. These markets are gradually adopting supportive policies and experiencing a surge in interest from both domestic and international investors, particularly in the residential and commercial sectors. The collective market share for the "Rest of South America" is expected to grow from 15% in 2025 to 22% by 2033. Overall, the interplay between geography, segment focus, and supportive policies will define the dominant markets and segments within the South American rooftop solar industry.

South America Rooftop Solar Industry Product Analysis

Product innovations in the South America rooftop solar industry are primarily focused on enhancing efficiency, durability, and integration capabilities. Advances in photovoltaic cell technology, such as PERC and bifacial solar panels, are leading to higher energy yields even in variable South American weather conditions. String inverters and microinverters are becoming more sophisticated, offering better performance monitoring and grid compatibility. The integration of battery storage systems with rooftop solar installations is a key trend, addressing intermittency issues and enabling greater energy independence for end-users. Competitive advantages are being realized through solutions that offer optimized energy management, reduced installation costs, and extended product warranties, making solar a more attractive and reliable investment across residential, commercial, and industrial applications.

Key Drivers, Barriers & Challenges in South America Rooftop Solar Industry

Key Drivers: The South America rooftop solar industry is propelled by a trifecta of technological advancements, favorable economics, and supportive government policies. Declining solar panel costs, coupled with increasing electricity prices from conventional sources, create a strong economic case for solar adoption. Technological innovations, such as higher efficiency panels and integrated storage solutions, enhance the value proposition. Furthermore, government initiatives, including tax incentives, net metering regulations, and renewable energy targets, are crucial in stimulating market growth across Brazil, Chile, and Argentina.

Key Barriers & Challenges: Despite the positive trajectory, the industry faces significant hurdles. Regulatory complexities and inconsistent policy implementation across different countries can create uncertainty for investors and developers. Supply chain issues, including potential disruptions in the availability of key components and skilled labor shortages, can impact project timelines and costs. Intense competitive pressures, particularly from established energy providers and an increasing number of solar installers, can affect profit margins. Furthermore, the upfront cost of installation, though decreasing, remains a barrier for some segments of the population, necessitating innovative financing solutions.

Growth Drivers in the South America Rooftop Solar Industry Market

The South America rooftop solar industry is experiencing significant growth driven by a powerful combination of factors. Technologically, advancements in photovoltaic (PV) panel efficiency, such as the widespread adoption of PERC and bifacial technology, are maximizing energy generation from limited rooftop space. Economically, the declining cost of solar modules and balance-of-system components, alongside rising conventional electricity tariffs in countries like Brazil and Chile, makes rooftop solar an increasingly attractive and cost-effective investment for consumers and businesses. Policy-wise, supportive government regulations, including net metering schemes, tax incentives, and ambitious renewable energy targets, are creating a stable and predictable environment that encourages investment and adoption across key geographies such as Brazil, Chile, and Argentina.

Challenges Impacting South America Rooftop Solar Industry Growth

Several challenges are impacting the growth trajectory of the South America rooftop solar industry. Regulatory complexities and intermittent policy shifts across different nations can create investment uncertainty and slow down project development. Supply chain disruptions, including potential shortages of key components like inverters and mounting hardware, alongside challenges in securing specialized labor for installation and maintenance, can lead to project delays and increased costs. Intense competitive pressures from both established energy utilities and a burgeoning landscape of solar installers can impact pricing and profitability. Moreover, while the upfront cost of solar systems continues to fall, it remains a significant barrier for some consumers and businesses, highlighting the need for accessible financing and leasing options.

Key Players Shaping the South America Rooftop Solar Industry Market

- First Solar Inc.

- Enel SPA

- JinkoSolar Holding Co.

- Canadian Solar Inc.

- Trina Solar Limited

- Aes Gener SA

Significant South America Rooftop Solar Industry Industry Milestones

- 2019: Several South American countries begin to formalize their net metering policies, encouraging residential and commercial solar adoption.

- 2020: Major international solar manufacturers increase their focus on the South American market, expanding product offerings and distribution networks.

- 2021: Significant advancements in battery storage technology become more accessible, addressing intermittency concerns for rooftop solar in the region.

- 2022: Brazil implements new regulatory frameworks aimed at streamlining solar project approvals, leading to a surge in installations.

- 2023: Chile experiences record growth in residential solar installations, driven by declining system costs and consumer demand for energy independence.

- 2024: Major industrial players in Argentina begin to invest heavily in large-scale rooftop solar projects to reduce operational expenses.

Future Outlook for South America Rooftop Solar Industry Market

The future outlook for the South America rooftop solar industry is exceptionally bright, driven by sustained growth catalysts. Strategic opportunities lie in the increasing demand for decentralized energy generation and the growing imperative for energy security across the region. The continued decline in solar technology costs, coupled with supportive government policies and a rising awareness of climate change, will further accelerate market penetration. Expansion into new geographies within the "Rest of South America" and the deepening integration of energy storage solutions present substantial untapped market potential. The industry is poised for transformative growth, becoming a cornerstone of the region's sustainable energy future.

South America Rooftop Solar Industry Segmentation

-

1. Location of Deployment

- 1.1. Residential

- 1.2. Commericial

- 1.3. Industrial

-

2. Geography

- 2.1. Brazil

- 2.2. Chile

- 2.3. Argentina

- 2.4. Rest of South America

South America Rooftop Solar Industry Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Argentina

- 4. Rest of South America

South America Rooftop Solar Industry Regional Market Share

Geographic Coverage of South America Rooftop Solar Industry

South America Rooftop Solar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Demand for Clean Energy Sources 4.; Efforts to Reduce Over-Reliance on Coal-Based Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Adoption of Alternate Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Commercial Segment to be the Largest Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Rooftop Solar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Residential

- 5.1.2. Commericial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Chile

- 5.2.3. Argentina

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Argentina

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Brazil South America Rooftop Solar Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Residential

- 6.1.2. Commericial

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Chile

- 6.2.3. Argentina

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Chile South America Rooftop Solar Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Residential

- 7.1.2. Commericial

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Chile

- 7.2.3. Argentina

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Argentina South America Rooftop Solar Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Residential

- 8.1.2. Commericial

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Chile

- 8.2.3. Argentina

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Rest of South America South America Rooftop Solar Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Residential

- 9.1.2. Commericial

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Chile

- 9.2.3. Argentina

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 First Solar Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Enel SPA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 JinkoSolar Holding Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Canadian Solar Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Trina Solar Limited*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aes Gener SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 First Solar Inc

List of Figures

- Figure 1: South America Rooftop Solar Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Rooftop Solar Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Rooftop Solar Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: South America Rooftop Solar Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: South America Rooftop Solar Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South America Rooftop Solar Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 5: South America Rooftop Solar Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Rooftop Solar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: South America Rooftop Solar Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 8: South America Rooftop Solar Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: South America Rooftop Solar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: South America Rooftop Solar Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 11: South America Rooftop Solar Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Rooftop Solar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Rooftop Solar Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 14: South America Rooftop Solar Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: South America Rooftop Solar Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Rooftop Solar Industry?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the South America Rooftop Solar Industry?

Key companies in the market include First Solar Inc, Enel SPA, JinkoSolar Holding Co, Canadian Solar Inc, Trina Solar Limited*List Not Exhaustive, Aes Gener SA.

3. What are the main segments of the South America Rooftop Solar Industry?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Demand for Clean Energy Sources 4.; Efforts to Reduce Over-Reliance on Coal-Based Power Plants.

6. What are the notable trends driving market growth?

Commercial Segment to be the Largest Market.

7. Are there any restraints impacting market growth?

4.; Rising Adoption of Alternate Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Rooftop Solar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Rooftop Solar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Rooftop Solar Industry?

To stay informed about further developments, trends, and reports in the South America Rooftop Solar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence