Key Insights

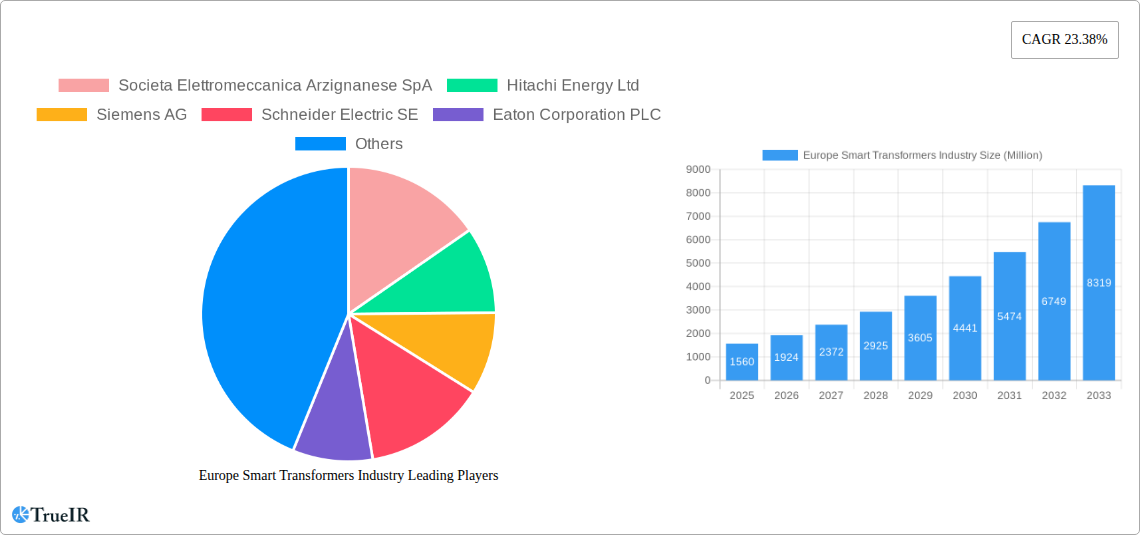

The Europe Smart Transformers Industry is poised for substantial growth, with a projected market size of $1,560 million in 2025. This robust expansion is driven by an impressive Compound Annual Growth Rate (CAGR) of 23.38% from 2019 to 2033, signaling a dynamic and rapidly evolving market. The primary catalyst for this surge is the widespread adoption of smart grid technologies across European nations, aimed at enhancing grid efficiency, reliability, and integration of renewable energy sources. Key drivers include government initiatives supporting grid modernization, increasing demand for electricity, and the necessity to reduce energy losses. Furthermore, advancements in digital technologies, such as IoT, AI, and advanced analytics, are enabling transformers to become "smart," offering real-time monitoring, predictive maintenance, and remote control capabilities, thereby minimizing downtime and operational costs.

Europe Smart Transformers Industry Market Size (In Billion)

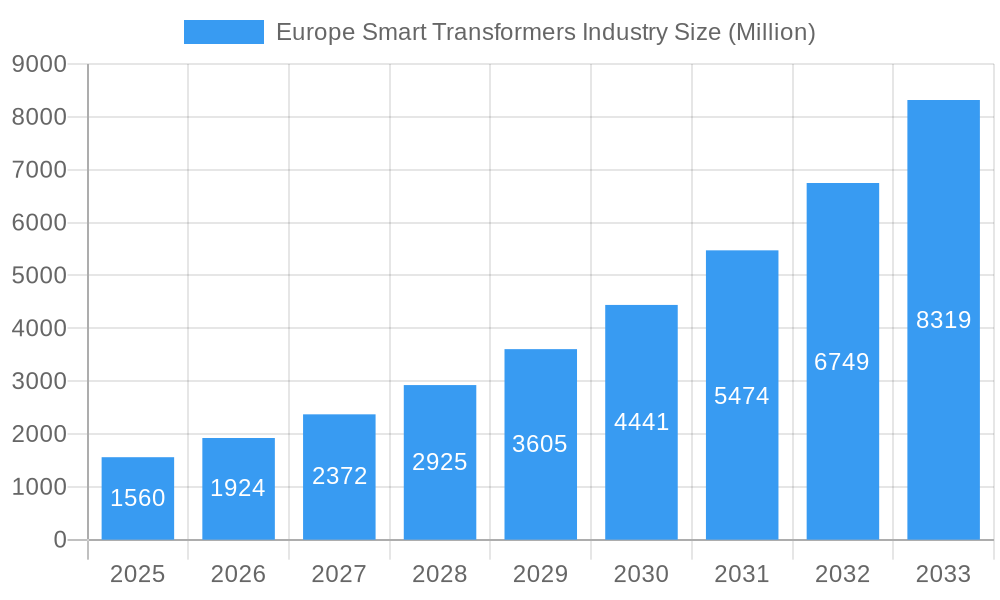

The market segmentation highlights the dominance of Distribution Transformers and Power Transformers, catering to a broad spectrum of applications. The Smart Grid application segment is expected to be the most significant contributor to market growth, fueled by the ongoing digital transformation of electrical infrastructure. While the traction locomotive and other applications also present opportunities, the imperative to build a more resilient and intelligent power network across Europe will underpin the smart transformer market's trajectory. Restraints such as the high initial investment cost for smart transformer technology and the need for skilled personnel for deployment and maintenance are being mitigated by the long-term cost savings and operational efficiencies they offer. Leading companies like Siemens AG, Hitachi Energy Ltd, and Schneider Electric SE are at the forefront, investing heavily in research and development to innovate and capture market share.

Europe Smart Transformers Industry Company Market Share

This in-depth report provides a comprehensive analysis of the Europe Smart Transformers Industry, covering market dynamics, competitive landscape, segmentation, and future outlook from 2019 to 2033. Leveraging high-volume keywords such as "smart grid technology," "digital transformers," "power transformer market Europe," and "IEC standards for transformers," this report is meticulously crafted for industry professionals seeking actionable insights and strategic advantages.

Europe Smart Transformers Industry Market Structure & Competitive Landscape

The Europe Smart Transformers Industry exhibits a moderately concentrated market structure, characterized by the presence of a few dominant players alongside a growing number of specialized manufacturers. Innovation drivers are primarily fueled by the escalating demand for enhanced grid efficiency, reliability, and the integration of renewable energy sources. Regulatory frameworks, particularly those promoting grid modernization and digitalization under European Union directives, significantly influence market entry and product development. The threat of product substitutes, while present in traditional transformer markets, is diminishing with the increasing adoption of advanced digital functionalities. End-user segmentation reveals strong adoption in utility sectors, industrial automation, and the burgeoning smart grid infrastructure. Mergers and acquisitions (M&A) are a notable trend, with strategic consolidations aimed at expanding product portfolios, technological capabilities, and market reach. The combined M&A volume over the historical period reached approximately 150 Million Euros, signaling an active consolidation phase. Key players are focused on acquiring innovative technologies and expanding their geographical footprint across the European landscape.

Europe Smart Transformers Industry Market Trends & Opportunities

The Europe Smart Transformers Industry is poised for substantial growth, driven by the imperative for a more resilient, efficient, and sustainable energy infrastructure. The market size is projected to expand from approximately 2,500 Million Euros in 2019 to an estimated 5,800 Million Euros by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period. This growth is propelled by significant technological shifts, including the widespread adoption of IoT, AI, and advanced sensor technologies for real-time monitoring and predictive maintenance of transformers. Consumer preferences are increasingly leaning towards smart solutions that offer enhanced grid stability, reduced operational costs, and minimized environmental impact. Competitive dynamics are intensifying, with established players investing heavily in research and development to introduce next-generation smart transformer solutions. The market penetration rate of smart transformers, while still in its early stages, is rapidly increasing, with current estimates at around 35% and projected to exceed 70% by 2033. Opportunities abound in upgrading existing grid infrastructure, developing solutions for distributed energy resources (DERs), and catering to the specific needs of industrial and commercial sectors undergoing digital transformation. The increasing demand for high-voltage power transformers and specialized distribution transformers equipped with advanced monitoring capabilities presents a significant market opportunity.

Dominant Markets & Segments in Europe Smart Transformers Industry

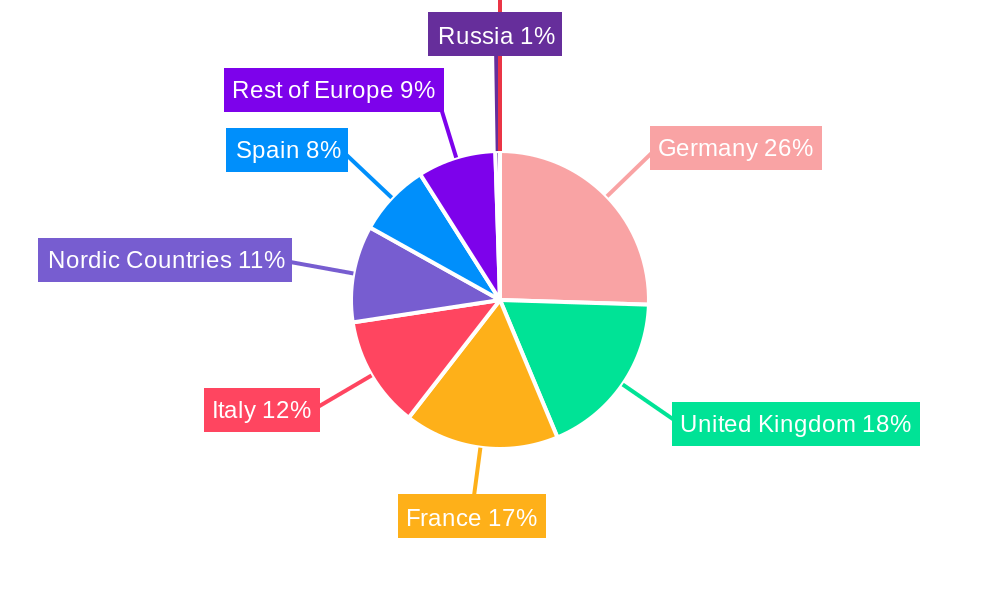

The European smart transformers market is characterized by distinct regional dominance and segment preferences.

Leading Region: Western Europe, particularly Germany, the United Kingdom, and France, currently holds the largest market share, driven by their advanced grid infrastructure, robust regulatory support for smart grid initiatives, and significant investments in renewable energy integration.

Dominant Segments:

- Type:

- Distribution Transformers: This segment is experiencing robust growth due to the decentralized nature of smart grids and the increasing deployment of renewable energy sources at the distribution level. Investments in upgrading aging distribution networks to incorporate smart functionalities are a key driver. The market for distribution transformers is estimated to be valued at 1,800 Million Euros in 2025.

- Power Transformers: While traditionally large-scale infrastructure components, power transformers are increasingly incorporating smart features for enhanced monitoring and control, crucial for managing high-capacity power flow and grid stability.

- Application:

- Smart Grid: This is the primary growth engine for the smart transformers market. The demand for real-time data, remote monitoring, predictive analytics, and automated control systems to optimize grid performance fuels the adoption of smart transformers in smart grid applications. The smart grid segment is projected to account for over 65% of the total market revenue by 2033.

- Traction Locomotive: The electrification of railway networks across Europe, coupled with the need for efficient and reliable power supply for high-speed trains, is driving the demand for specialized smart transformers in this application.

- Other Applications: This includes industrial automation, data centers, and critical infrastructure where enhanced power quality, reliability, and energy efficiency are paramount.

- Type:

Key growth drivers across these segments include government initiatives promoting energy efficiency, the urgent need to modernize aging electrical infrastructure, and the growing adoption of electric vehicles, which necessitate a more dynamic and responsive grid. Policies focused on decarbonization and the integration of intermittent renewable energy sources further accelerate the demand for intelligent transformer solutions.

Europe Smart Transformers Industry Product Analysis

The Europe Smart Transformers Industry is witnessing significant product innovation centered around enhanced connectivity, data analytics, and remote management capabilities. Smart transformers are being equipped with advanced sensors for real-time monitoring of parameters such as temperature, voltage, current, and partial discharge. These transformers integrate digital communication modules that enable seamless data transfer to central control systems. The competitive advantage lies in their ability to provide predictive maintenance insights, thereby reducing downtime and operational costs. Furthermore, features like on-load tap changers with intelligent control algorithms and integrated protection relays are becoming standard. The market fit is driven by the growing demand for grid resilience, energy efficiency, and the integration of renewable energy sources.

Key Drivers, Barriers & Challenges in Europe Smart Transformers Industry

Key Drivers:

- Grid Modernization and Digitalization: Extensive investments in upgrading existing power grids to smart grids are a primary growth catalyst.

- Integration of Renewable Energy Sources: The intermittent nature of solar and wind power necessitates intelligent grid management solutions, including smart transformers.

- Demand for Energy Efficiency and Reliability: Utilities and industrial users are seeking solutions to reduce energy losses and ensure uninterrupted power supply.

- Technological Advancements: The proliferation of IoT, AI, and advanced analytics enables more sophisticated transformer functionalities.

- Supportive Government Policies: European Union directives and national initiatives promoting smart grids and renewable energy adoption provide a favorable regulatory environment.

Key Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of smart transformers can be a deterrent for some utilities, particularly smaller ones.

- Cybersecurity Concerns: The increased connectivity of smart transformers raises concerns about vulnerability to cyber threats, requiring robust security measures.

- Lack of Standardization: While evolving, the absence of fully harmonized international standards for smart transformer technology can create integration challenges.

- Skilled Workforce Shortage: A shortage of skilled personnel to manage, operate, and maintain advanced smart transformer systems can hinder adoption.

- Legacy Infrastructure Integration: Integrating new smart transformers with existing, older grid infrastructure can be technically complex and costly. The estimated cost of retrofitting legacy substations with smart capabilities ranges from 50 Million to 150 Million Euros per substation.

Growth Drivers in the Europe Smart Transformers Industry Market

The Europe Smart Transformers Industry is experiencing accelerated growth driven by several pivotal factors. The overarching trend towards grid modernization and digitalization across the continent, supported by substantial government funding and ambitious policy targets, is a significant growth enabler. The imperative to integrate a growing volume of renewable energy sources, such as solar and wind power, into the existing grid infrastructure necessitates advanced control and monitoring capabilities that smart transformers provide. Furthermore, the increasing global focus on energy efficiency and the reduction of operational costs for utilities and industrial consumers is driving the adoption of transformers that offer predictive maintenance and optimized performance. Technological advancements in areas like artificial intelligence (AI) and the Internet of Things (IoT) are enabling the development of increasingly sophisticated smart transformer solutions with enhanced data analytics and remote management features, further propelling market expansion.

Challenges Impacting Europe Smart Transformers Industry Growth

Despite the promising growth trajectory, the Europe Smart Transformers Industry faces several critical challenges that impact its expansion. The significant initial investment required for smart transformer technology remains a considerable barrier, particularly for smaller utility companies or those with tighter budget constraints. Cybersecurity risks associated with networked devices are a growing concern, demanding substantial investment in robust security protocols to prevent unauthorized access and potential grid disruptions. While progress is being made, the lack of fully harmonized international standards for smart transformer interoperability can complicate integration efforts and create vendor lock-in scenarios. Moreover, a shortage of skilled professionals capable of deploying, operating, and maintaining these advanced systems poses a significant operational hurdle for many organizations. The complexities of integrating these new technologies with existing legacy grid infrastructure also present technical and financial challenges that need to be carefully managed. The projected cost of addressing cybersecurity vulnerabilities is estimated to be around 10 Million Euros annually for a large utility.

Key Players Shaping the Europe Smart Transformers Industry Market

- Societa Elettromeccanica Arzignanese SpA

- Hitachi Energy Ltd

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- GBE SpA

- General Electric Company

- Westrafo SRL

Significant Europe Smart Transformers Industry Industry Milestones

- March 2023: Ganz Transformers, the European technology provider for power grids, entered into a collaboration with Maschinenfabrik Reinhausen (MR) to manufacture digital transformers with the help of MR’s ISM digital platform for intelligent solutions. This partnership aims to accelerate the development and deployment of advanced digital transformer technology.

- February 2023: UK Power Networks, a distribution network operator in South East England, announced an innovative trial, dubbed Project Stratus, which will introduce “world-first” technology from Amp X in the form of smart transformers to two existing substations in East Sussex. This endeavor will offer unprecedented live data regarding electrical usage and demand, allowing the organization to develop greater network resilience and support its goal of achieving a low-carbon future.

Future Outlook for Europe Smart Transformers Industry Market

The future outlook for the Europe Smart Transformers Industry is exceptionally bright, driven by an unyielding demand for grid modernization and the ongoing transition towards a sustainable energy landscape. Strategic opportunities lie in the development of interoperable smart transformer solutions that can seamlessly integrate with diverse grid architectures and renewable energy sources. The increasing adoption of electric vehicles will further necessitate smarter grid management, creating a sustained demand for advanced transformer technologies. Continued investment in research and development, particularly in areas like AI-powered predictive analytics and advanced cybersecurity measures, will be crucial for market leaders. The anticipated growth in the smart grid segment, coupled with evolving regulatory landscapes that encourage decarbonization and grid resilience, will continue to be the primary catalysts for market expansion. The market is projected to reach over 9,000 Million Euros by 2033, indicating a robust and sustained growth trajectory.

Europe Smart Transformers Industry Segmentation

-

1. Type

- 1.1. Distribution Transformers

- 1.2. Power Transfomers

-

2. Application

- 2.1. Smart Grid

- 2.2. Traction Locomotive

- 2.3. Other Applications

Europe Smart Transformers Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Spain

- 4. France

- 5. Italy

- 6. Nordic Countries

- 7. Russia

- 8. Turkey

- 9. Rest of Europe

Europe Smart Transformers Industry Regional Market Share

Geographic Coverage of Europe Smart Transformers Industry

Europe Smart Transformers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Low Accessibility to Electricity in Underdeveloped Nations

- 3.4. Market Trends

- 3.4.1. Distribution Transformers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Distribution Transformers

- 5.1.2. Power Transfomers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smart Grid

- 5.2.2. Traction Locomotive

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Nordic Countries

- 5.3.7. Russia

- 5.3.8. Turkey

- 5.3.9. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Distribution Transformers

- 6.1.2. Power Transfomers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smart Grid

- 6.2.2. Traction Locomotive

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Distribution Transformers

- 7.1.2. Power Transfomers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smart Grid

- 7.2.2. Traction Locomotive

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Distribution Transformers

- 8.1.2. Power Transfomers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smart Grid

- 8.2.2. Traction Locomotive

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Distribution Transformers

- 9.1.2. Power Transfomers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smart Grid

- 9.2.2. Traction Locomotive

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Distribution Transformers

- 10.1.2. Power Transfomers

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Smart Grid

- 10.2.2. Traction Locomotive

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Nordic Countries Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Distribution Transformers

- 11.1.2. Power Transfomers

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Smart Grid

- 11.2.2. Traction Locomotive

- 11.2.3. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Russia Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Distribution Transformers

- 12.1.2. Power Transfomers

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Smart Grid

- 12.2.2. Traction Locomotive

- 12.2.3. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Turkey Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Distribution Transformers

- 13.1.2. Power Transfomers

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Smart Grid

- 13.2.2. Traction Locomotive

- 13.2.3. Other Applications

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Rest of Europe Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Type

- 14.1.1. Distribution Transformers

- 14.1.2. Power Transfomers

- 14.2. Market Analysis, Insights and Forecast - by Application

- 14.2.1. Smart Grid

- 14.2.2. Traction Locomotive

- 14.2.3. Other Applications

- 14.1. Market Analysis, Insights and Forecast - by Type

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Societa Elettromeccanica Arzignanese SpA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Hitachi Energy Ltd

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Siemens AG

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Schneider Electric SE

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Eaton Corporation PLC

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 GBE SpA

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 General Electric Company

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Westrafo SRL

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.1 Societa Elettromeccanica Arzignanese SpA

List of Figures

- Figure 1: Europe Smart Transformers Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Smart Transformers Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Smart Transformers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Transformers Industry?

The projected CAGR is approximately 23.38%.

2. Which companies are prominent players in the Europe Smart Transformers Industry?

Key companies in the market include Societa Elettromeccanica Arzignanese SpA, Hitachi Energy Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, GBE SpA, General Electric Company, Westrafo SRL.

3. What are the main segments of the Europe Smart Transformers Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure.

6. What are the notable trends driving market growth?

Distribution Transformers to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Low Accessibility to Electricity in Underdeveloped Nations.

8. Can you provide examples of recent developments in the market?

March 2023: Ganz Transformers, the European technology provider for power grids, entered into a collaboration with Maschinenfabrik Reinhausen (MR) to manufacture digital transformers with the help of MR’s ISM digital platform for intelligent solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Transformers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Transformers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Transformers Industry?

To stay informed about further developments, trends, and reports in the Europe Smart Transformers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence