Key Insights

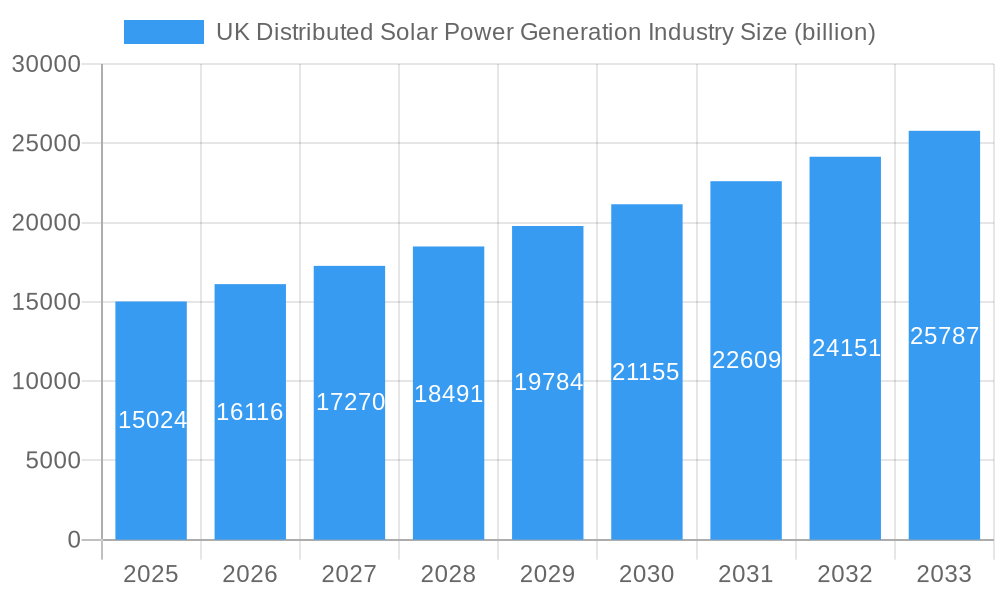

The UK Distributed Solar Power Generation Industry is experiencing robust growth, projected to reach an estimated $15.02 billion by 2025. This expansion is fueled by a confluence of supportive government policies, increasing environmental consciousness among consumers and businesses, and the declining costs of solar technology. The industry is anticipated to witness a Compound Annual Growth Rate (CAGR) of 7.3% during the forecast period of 2025-2033, indicating sustained and significant market development. Key drivers behind this surge include the urgent need to decarbonize the UK's energy sector, enhance energy security, and leverage the abundant solar potential across the nation. Furthermore, rising electricity prices from traditional sources are making solar power an increasingly attractive and economically viable alternative for both residential and commercial energy needs.

UK Distributed Solar Power Generation Industry Market Size (In Billion)

The market is segmented across various end-users, with significant contributions from the residential sector, driven by homeowner adoption of rooftop solar systems, and the commercial sector, where businesses are increasingly investing in solar installations to reduce operational costs and meet sustainability targets. While the industrial sector is also a key segment, its adoption rate may vary based on energy intensity and available space. Emerging trends such as advancements in energy storage solutions, smart grid integration, and the rise of community solar projects are expected to further propel the market forward. Despite these positive trajectories, potential restraints such as grid connection challenges, evolving regulatory frameworks, and the initial capital investment required for large-scale installations could pose hurdles. Nevertheless, the overarching trend points towards a dynamic and expanding UK Distributed Solar Power Generation Industry, with leading companies actively innovating and expanding their offerings.

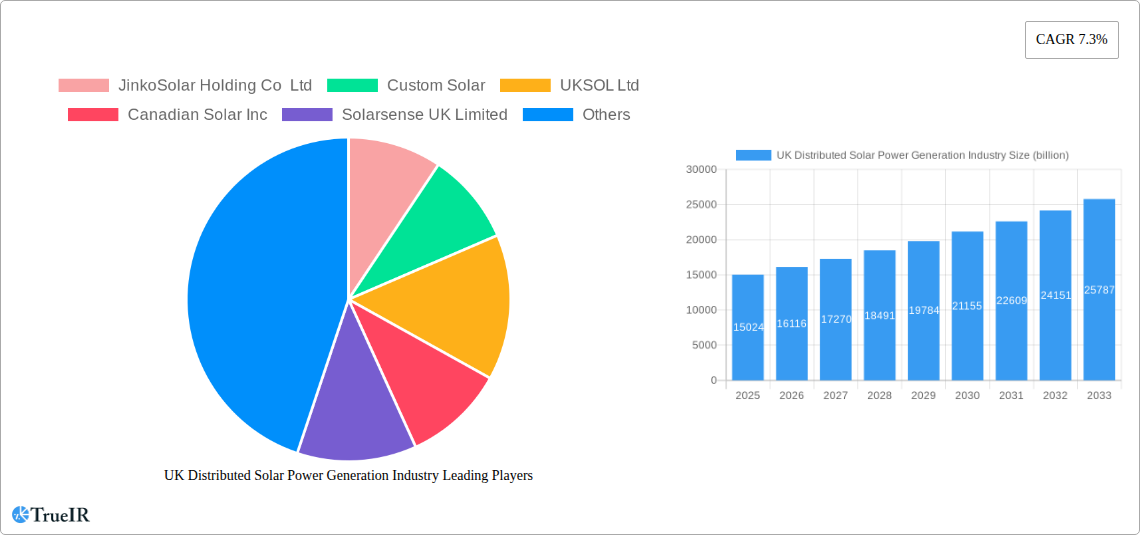

UK Distributed Solar Power Generation Industry Company Market Share

UK Distributed Solar Power Generation Industry: Market Analysis and Forecast 2019-2033

Unlock critical insights into the burgeoning UK distributed solar power generation market. This comprehensive report, spanning from 2019 to 2033 with a base and estimated year of 2025, delves deep into market structure, trends, opportunities, and the competitive landscape. Leveraging high-volume keywords and detailed analysis, this report is an essential resource for investors, policymakers, and industry stakeholders navigating the dynamic UK solar PV market.

UK Distributed Solar Power Generation Industry Market Structure & Competitive Landscape

The UK distributed solar power generation industry is characterized by a moderately concentrated market structure, with a growing number of innovative players challenging established entities. Innovation drivers are primarily fueled by advancements in solar cell technology, leading to higher efficiency and lower installation costs. Regulatory impacts, while generally supportive of renewable energy, can introduce complexities. Product substitutes, such as wind turbines and grid-supplied electricity, are present but face increasing competition from the economic and environmental advantages of solar PV. The end-user segmentation is dominated by the Residential and Commercial and Industrial sectors, each with distinct growth drivers and adoption rates. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger energy companies acquiring smaller, specialized solar installers to bolster their renewable portfolios. For instance, the acquisition of a 49% stake in Eco2solar by E.ON in January 2021 highlights this trend, aiming to enhance technical capabilities and expand market reach. While specific concentration ratios are subject to detailed market analysis, the increasing number of regional installers and the emergence of specialized solar solution providers suggest a gradual shift towards a more fragmented, yet increasingly competitive, landscape. The volume of M&A activities is projected to rise as companies seek to scale operations and secure market share.

UK Distributed Solar Power Generation Industry Market Trends & Opportunities

The UK distributed solar power generation industry is experiencing robust growth, driven by a confluence of technological advancements, supportive government policies, and increasing consumer demand for sustainable energy solutions. The market size is projected to expand significantly, with a considerable Compound Annual Growth Rate (CAGR) anticipated over the forecast period. Technological shifts are central to this expansion, with ongoing innovations in solar panel efficiency and energy storage solutions. The development of record-breaking solar cell technology, such as the one reported in December 2020 by an Oxford Scientist capable of converting 29.5% of solar energy into electricity, represents a paradigm shift, offering substantial improvements over the average 15-20% conversion rates. This technological leap promises to further reduce the levelized cost of electricity (LCOE) from solar installations, making them even more attractive.

Consumer preferences are increasingly leaning towards distributed solar power, driven by rising electricity prices, environmental consciousness, and a desire for energy independence. The "prosumer" model, where households and businesses generate their own electricity, is gaining traction. Furthermore, the integration of battery storage systems with solar PV installations is becoming a standard offering, enhancing grid stability and enabling greater self-consumption of solar energy. This trend is crucial for overcoming the intermittency challenges associated with solar power.

Competitive dynamics are evolving, with a mix of established energy providers, specialized solar installation companies, and international manufacturers of solar components vying for market share. The increasing focus on smart home technology and energy management systems is creating new opportunities for companies to offer integrated solutions. The market penetration rates for solar PV are expected to climb steadily, particularly within the residential and commercial sectors, as the economic case for solar power strengthens and environmental regulations become more stringent. The ongoing development of innovative financing models and government incentives, such as feed-in tariffs and tax credits, are expected to further stimulate market growth and create a favorable investment environment for distributed solar power generation in the UK. The continuous improvement in module efficiency and the declining costs of balance-of-system components are key factors that will continue to drive market expansion and penetration. The rise of community solar projects and the increasing adoption of electric vehicles (EVs) that can be powered by solar energy are also emerging trends that will shape the industry's future.

Dominant Markets & Segments in UK Distributed Solar Power Generation Industry

The UK distributed solar power generation industry exhibits dominance across two primary end-user segments: Residential and Commercial and Industrial (C&I). While both segments are experiencing significant growth, the Residential sector often leads in terms of the sheer volume of installations due to widespread public adoption and government support schemes. However, the Commercial and Industrial segment holds substantial potential for larger-scale deployments, offering significant electricity cost savings and carbon footprint reductions for businesses.

Residential Sector:

- Key Growth Drivers:

- Falling Solar PV Costs: Decreasing prices of solar panels and associated equipment make residential installations increasingly affordable.

- Government Incentives & Support: Schemes like the Smart Export Guarantee (SEG) encourage homeowners to export surplus electricity to the grid, enhancing the financial viability of solar systems.

- Rising Electricity Prices: Higher grid electricity costs incentivize homeowners to generate their own power, leading to long-term savings.

- Environmental Awareness: Growing public concern about climate change and a desire for sustainable living drives demand for solar energy.

- Energy Independence: Homeowners are seeking greater control over their energy supply and protection against energy price volatility.

- Technological Advancements: Improved solar panel efficiency and the integration of battery storage systems make residential solar more attractive and reliable.

Commercial and Industrial Sector:

- Key Growth Drivers:

- Significant Cost Savings: Businesses can achieve substantial reductions in operational expenses by generating their own electricity, especially for energy-intensive operations.

- Corporate Social Responsibility (CSR) & Sustainability Goals: Many companies are investing in renewable energy to meet their environmental targets and enhance their brand image.

- Energy Security: On-site solar generation provides a degree of energy independence and resilience against grid disruptions.

- Scalability of Installations: The C&I sector can accommodate larger solar arrays, leading to greater energy generation capacity and faster return on investment.

- Policy Support for Businesses: Government initiatives and grants specifically targeted at business adoption of renewable technologies further stimulate investment.

- Technological Integration: C&I clients are increasingly seeking integrated solutions including solar, battery storage, and electric vehicle charging infrastructure.

The dominance within these segments is further influenced by regional variations in solar irradiance, grid connection policies, and local economic conditions. While the Residential sector benefits from broad consumer appeal and accessible financing, the Commercial and Industrial sector offers the potential for higher revenue streams and larger project development, making both critical pillars of the UK distributed solar power generation market's expansion. The Commercial and Industrial sector, in particular, is poised for significant growth as businesses increasingly recognize the financial and environmental benefits of on-site solar generation and the need to decarbonize their operations.

UK Distributed Solar Power Generation Industry Product Analysis

The UK distributed solar power generation industry is witnessing a surge in product innovations focused on enhancing efficiency, reliability, and user experience. Monocrystalline solar panels, offering superior efficiency compared to polycrystalline alternatives, are becoming the standard for both residential and commercial installations. The development of bifacial solar modules, capable of capturing sunlight from both sides, is emerging as a key innovation, boosting energy yield. Furthermore, advancements in inverter technology, including intelligent inverters with advanced monitoring and grid-support capabilities, are crucial for optimizing system performance. The integration of sophisticated battery storage systems, offering enhanced capacity and longer lifespans, is transforming distributed solar from a mere generation source to a comprehensive energy management solution. These product advancements are directly contributing to a lower levelized cost of electricity (LCOE) and a faster return on investment, making solar power a more competitive and attractive energy option across the UK.

Key Drivers, Barriers & Challenges in UK Distributed Solar Power Generation Industry

Key Drivers:

- Technological Advancements: Increasing solar cell efficiency and falling component costs, exemplified by the record-breaking 29.5% efficient solar cell developed by an Oxford scientist, are making solar power more economically viable.

- Government Policies & Incentives: Supportive regulations and financial incentives, such as the Smart Export Guarantee, encourage investment and adoption of solar PV systems.

- Environmental Concerns & Sustainability Goals: A growing public and corporate demand for clean energy solutions to combat climate change.

- Rising Electricity Prices: Increased grid electricity costs make self-generation through solar increasingly attractive for cost savings.

Barriers & Challenges:

- Supply Chain Issues: Global supply chain disruptions can lead to delays and increased costs for solar components.

- Regulatory Hurdles & Grid Connection: Complex planning permission processes and challenges in securing timely grid connections can slow down project deployment.

- Intermittency of Solar Power: While improving with battery storage, the reliance on sunlight for generation remains a challenge, requiring effective energy management solutions.

- Competition from Other Renewables: The presence of other renewable energy sources can create a competitive landscape.

- Initial Capital Investment: Despite falling costs, the upfront investment for solar installations can still be a barrier for some individuals and businesses.

Growth Drivers in the UK Distributed Solar Power Generation Industry Market

Several key drivers are propelling the UK distributed solar power generation industry forward. Technologically, the continuous improvement in solar panel efficiency, with advancements like the record-breaking 29.5% efficient solar cell, is making solar energy more potent and cost-effective. Economically, the rising cost of grid electricity and the attractive long-term savings offered by self-generation are powerful motivators for both residential and commercial consumers. Policy-driven factors, including government incentives and a strong commitment to renewable energy targets, are creating a supportive environment for investment and deployment. The growing public consciousness around climate change and a desire for energy independence further fuel this growth.

Challenges Impacting UK Distributed Solar Power Generation Industry Growth

Despite the positive trajectory, the UK distributed solar power generation industry faces several challenges. Regulatory complexities, including evolving planning permissions and grid connection protocols, can introduce delays and uncertainty into project timelines. Supply chain issues, exacerbated by global events, can lead to increased component costs and extended delivery times, impacting project feasibility. Competitive pressures from other renewable energy sources and traditional energy providers also necessitate continuous innovation and cost optimization. Furthermore, while battery storage is improving, the inherent intermittency of solar power requires robust energy management strategies to ensure reliable energy supply, posing an ongoing challenge for widespread adoption.

Key Players Shaping the UK Distributed Solar Power Generation Industry Market

- JinkoSolar Holding Co Ltd

- Custom Solar

- UKSOL Ltd

- Canadian Solar Inc

- Solarsense UK Limited

- Trina Solar Ltd

- EvoEnergy Ltd

- Eco2solar Ltd

Significant UK Distributed Solar Power Generation Industry Industry Milestones

- January 2021: E.ON, a German energy company, acquired a 49% stake in the UK solar energy company, Eco2solar. This acquisition is expected to enhance Eco2solar's technical capabilities, thereby helping the company expand its business in the United Kingdom.

- December 2020: An Oxford Scientist developed a new, record-breaking solar cell technology that can convert 29.5% of solar energy into electricity, a significant improvement over the average 15-20% conversion rate of existing solar cells.

Future Outlook for UK Distributed Solar Power Generation Industry Market

The future outlook for the UK distributed solar power generation industry is exceptionally bright, driven by an ongoing commitment to decarbonization and energy independence. Strategic opportunities lie in the continued integration of solar PV with advanced battery storage systems, creating robust and resilient energy solutions for homes and businesses. Market potential is further amplified by supportive government policies and the growing consumer appetite for sustainable energy. Innovations in smart grid technology and the increasing adoption of electric vehicles will create synergistic growth avenues, positioning distributed solar as a cornerstone of the UK's clean energy future. The industry is poised for sustained growth, with substantial investment expected in both utility-scale and decentralized solar deployments, contributing significantly to the UK's net-zero ambitions.

UK Distributed Solar Power Generation Industry Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial and Industrial

UK Distributed Solar Power Generation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

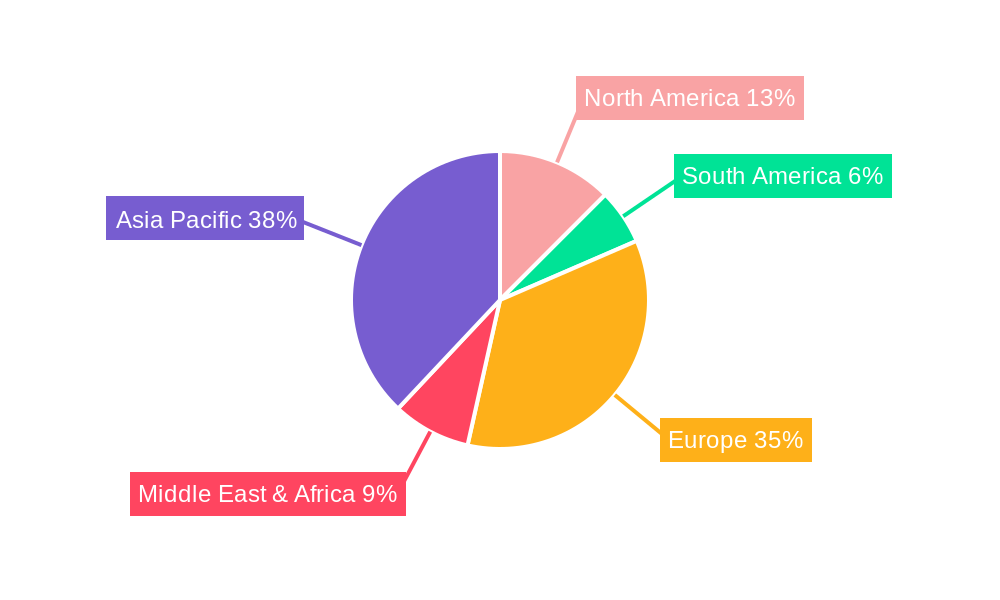

UK Distributed Solar Power Generation Industry Regional Market Share

Geographic Coverage of UK Distributed Solar Power Generation Industry

UK Distributed Solar Power Generation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. The Residential Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial and Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America UK Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Residential

- 6.1.2. Commercial and Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. South America UK Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Residential

- 7.1.2. Commercial and Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Europe UK Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Residential

- 8.1.2. Commercial and Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Middle East & Africa UK Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Residential

- 9.1.2. Commercial and Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Asia Pacific UK Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Residential

- 10.1.2. Commercial and Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JinkoSolar Holding Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Custom Solar

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UKSOL Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canadian Solar Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Solarsense UK Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Trina Solar Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EvoEnergy Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eco2solar Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Global UK Distributed Solar Power Generation Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Distributed Solar Power Generation Industry Revenue (billion), by End User 2025 & 2033

- Figure 3: North America UK Distributed Solar Power Generation Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America UK Distributed Solar Power Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UK Distributed Solar Power Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Distributed Solar Power Generation Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: South America UK Distributed Solar Power Generation Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: South America UK Distributed Solar Power Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UK Distributed Solar Power Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Distributed Solar Power Generation Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe UK Distributed Solar Power Generation Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe UK Distributed Solar Power Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UK Distributed Solar Power Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Distributed Solar Power Generation Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Middle East & Africa UK Distributed Solar Power Generation Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Middle East & Africa UK Distributed Solar Power Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Distributed Solar Power Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Distributed Solar Power Generation Industry Revenue (billion), by End User 2025 & 2033

- Figure 19: Asia Pacific UK Distributed Solar Power Generation Industry Revenue Share (%), by End User 2025 & 2033

- Figure 20: Asia Pacific UK Distributed Solar Power Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Distributed Solar Power Generation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 33: Global UK Distributed Solar Power Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Distributed Solar Power Generation Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Distributed Solar Power Generation Industry?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the UK Distributed Solar Power Generation Industry?

Key companies in the market include JinkoSolar Holding Co Ltd, Custom Solar, UKSOL Ltd, Canadian Solar Inc, Solarsense UK Limited, Trina Solar Ltd, EvoEnergy Ltd*List Not Exhaustive, Eco2solar Ltd.

3. What are the main segments of the UK Distributed Solar Power Generation Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.24 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

The Residential Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In January 2021, E.ON, a German energy company, acquired a 49% stake in the UK solar energy company, Eco2solar. The acquisition is expected to enhance Eco2solar's technical capabilities, thereby helping the company expand its business in the United Kingdom. The acquisition is expected to have no impact on Eco2solar business activities. It may continue to install solar systems, battery storage, and other smart technologies across the UK solar PV market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Distributed Solar Power Generation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Distributed Solar Power Generation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Distributed Solar Power Generation Industry?

To stay informed about further developments, trends, and reports in the UK Distributed Solar Power Generation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence