Key Insights

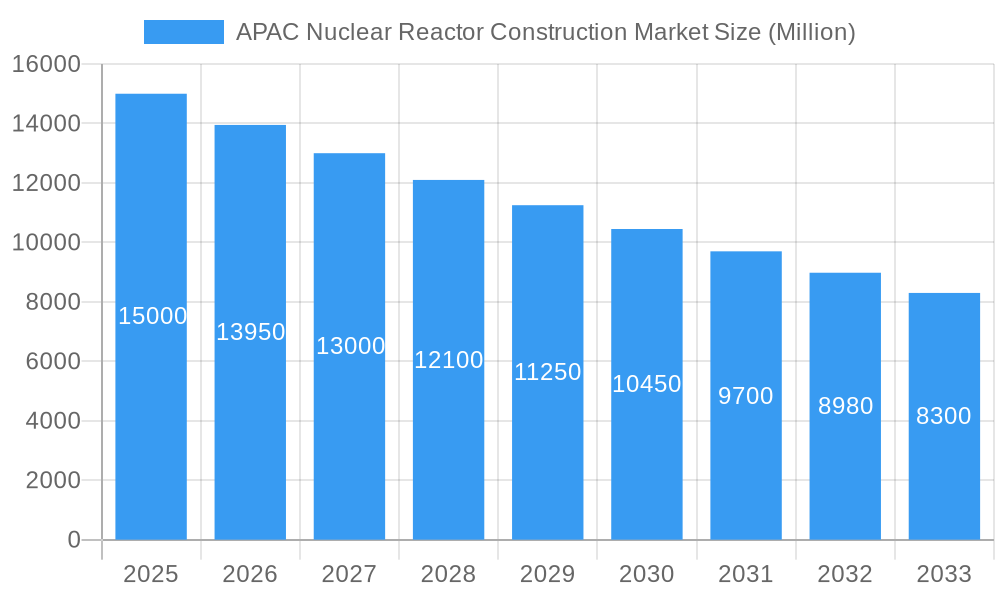

The APAC Nuclear Reactor Construction Market, valued at $7.73 billion in 2025, is projected for a significant contraction with a Compound Annual Growth Rate (CAGR) of -2.47% through 2033. While demand for clean energy and government initiatives for energy security and emissions reduction support nuclear power, the market faces substantial headwinds. These include escalating construction costs, project delays, and persistent public and regulatory challenges. The growing cost-effectiveness and deployment of renewable energy sources such as solar and wind also present significant competition.

APAC Nuclear Reactor Construction Market Market Size (In Billion)

Market performance will be shaped by key segments and regions. Pressurized Water Reactors (PWRs) are expected to lead due to proven technology and established supply chains. However, niche growth opportunities may arise for advanced reactor designs like High-temperature Gas-Cooled Reactors (HTGRs) and Liquid Metal Fast Breeder Reactors (LMFBRs) focusing on enhanced safety and efficiency. China and India are anticipated to be the primary hubs for nuclear reactor construction, driven by ambitious energy expansion plans. Despite this, the overall negative CAGR suggests potential slowdowns even in these key markets. The "Rest of Asia-Pacific" region is expected to contribute less due to perceived risks and less developed regulatory frameworks. The services sector, particularly for new projects, will be impacted, potentially shifting focus to maintenance and decommissioning of existing facilities.

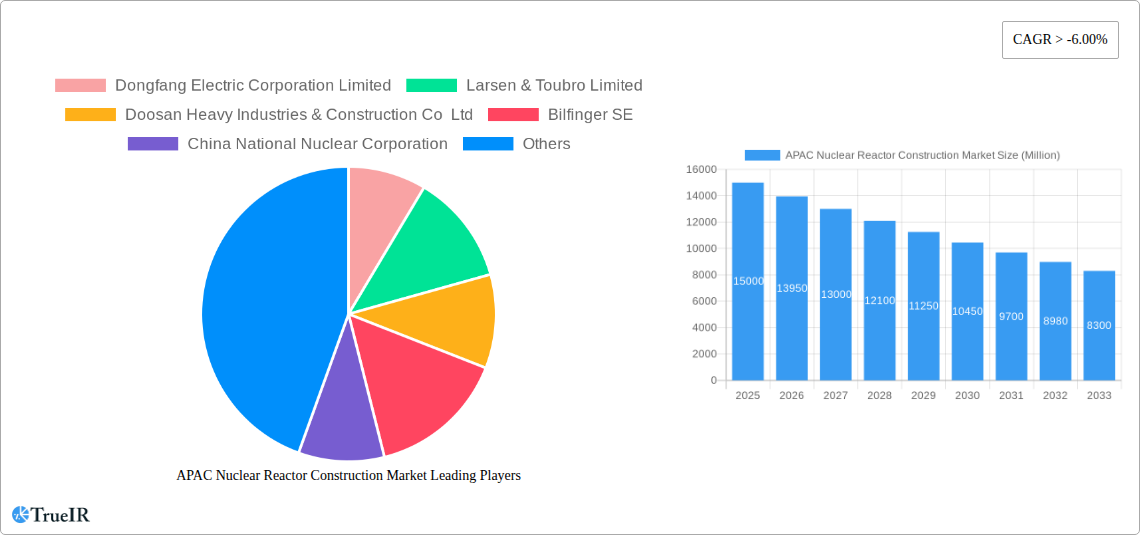

APAC Nuclear Reactor Construction Market Company Market Share

This comprehensive market research report analyzes the APAC Nuclear Reactor Construction Market from 2019–2024, with forecasts extending to 2033. Based on a 2025 starting point, the study provides in-depth insights into market dynamics, technological advancements, competitive strategies, and growth opportunities in the Asia-Pacific nuclear energy sector. Keywords include: APAC nuclear reactor construction market, nuclear power plant construction in Asia, nuclear reactor projects in China, India nuclear energy development, and advanced reactor technologies in APAC.

APAC Nuclear Reactor Construction Market Market Structure & Competitive Landscape

The APAC Nuclear Reactor Construction Market exhibits a moderately consolidated structure, characterized by the presence of several large, established global players and a growing number of regional contenders. Innovation drivers are primarily fueled by the increasing demand for low-carbon energy solutions, stringent environmental regulations, and government-backed initiatives promoting nuclear power as a baseload energy source. Regulatory impacts are significant, with evolving safety standards, licensing processes, and waste management policies heavily influencing project timelines and investment decisions across the Asia-Pacific nuclear market. Product substitutes, such as renewable energy sources like solar and wind power, pose a competitive challenge, although nuclear power's consistent baseload generation capabilities remain a key differentiator. End-user segmentation reveals a strong reliance on government utilities and state-owned enterprises as the primary customers for nuclear reactor construction services. Mergers and acquisitions (M&A) trends, while not as prevalent as in some other industries, are focused on consolidating expertise, expanding geographical reach, and acquiring advanced technological capabilities within the nuclear construction sector. For instance, strategic partnerships are becoming crucial to navigate complex projects and share technological risks. The market concentration ratio is estimated to be around xx%, indicating a substantial market share held by the top players. The volume of M&A activities in the historical period was approximately xx Million USD, with a projected increase of xx% in the forecast period.

APAC Nuclear Reactor Construction Market Market Trends & Opportunities

The APAC Nuclear Reactor Construction Market is experiencing a robust growth trajectory, driven by an escalating global demand for clean and sustainable energy solutions. Market size is projected to reach an estimated XXX Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is underpinned by government commitments to decarbonization targets, the need for reliable baseload power to complement intermittent renewable sources, and advancements in reactor technology that enhance safety and efficiency. Nuclear reactor projects in China and India nuclear energy development are at the forefront of this surge, with both nations actively expanding their nuclear power capacity to meet rapidly growing energy demands and reduce reliance on fossil fuels. Technological shifts are a significant trend, with a growing interest in Small Modular Reactors (SMRs) and advanced reactor designs such as High-temperature Gas-Cooled Reactors (HTGRs) and Liquid Metal Fast Breeder Reactors (LMFBRs). These innovations promise enhanced safety features, improved fuel utilization, and greater flexibility in deployment, opening up new market opportunities. Consumer preferences, while often swayed by public perception and safety concerns, are increasingly acknowledging the role of nuclear power in achieving energy security and climate goals. Competitive dynamics are intensifying, with key players vying for lucrative contracts by offering advanced technological solutions, competitive pricing, and robust project execution capabilities. The market penetration rate of nuclear power in the overall energy mix of APAC is expected to rise from approximately XX% in 2025 to XX% by 2033. Investments in research and development for next-generation reactors are expected to reach XXX Million USD annually by 2030. The increasing focus on energy independence and grid stability further amplifies the demand for nuclear power.

Dominant Markets & Segments in APAC Nuclear Reactor Construction Market

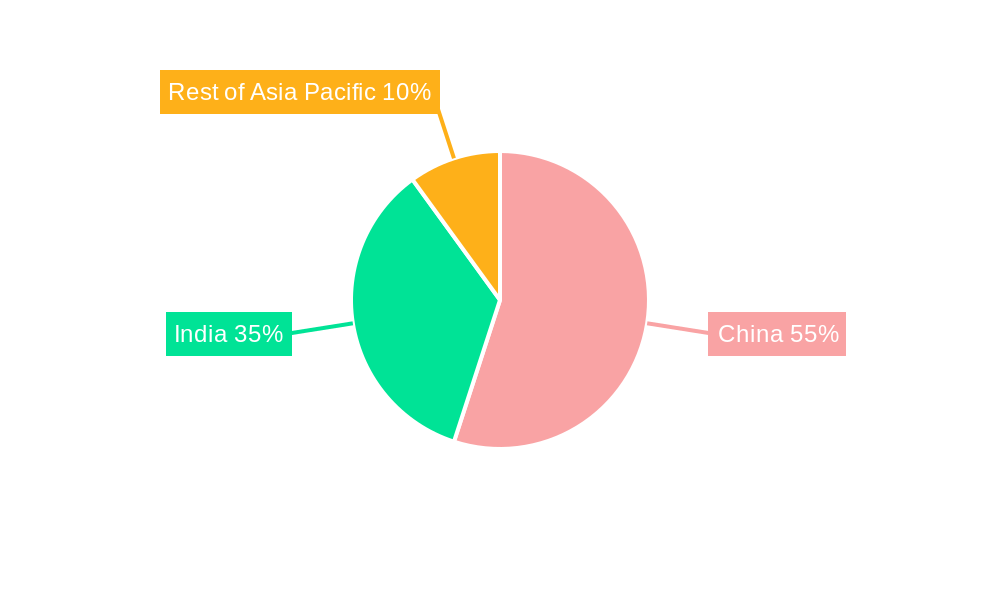

The APAC Nuclear Reactor Construction Market is predominantly shaped by the powerful economies of China and India, with China currently holding the largest market share due to its ambitious nuclear expansion plans. India is also a significant and rapidly growing market, driven by its commitment to increasing nuclear energy's contribution to its energy portfolio. The Rest of Asia-Pacific region, encompassing countries like South Korea, Japan, and Vietnam, also presents considerable opportunities, albeit with varying paces of development and regulatory frameworks.

Dominant Segments by Geography:

- China:

- Key Growth Drivers: Government mandates for carbon neutrality, rapid industrialization, and a strong focus on energy security.

- Market Dominance: China leads in the number of operational reactors and new builds. It is a hub for domestic manufacturing of nuclear components and possesses extensive expertise in constructing Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs). The government's strategic long-term energy plans heavily favor nuclear power expansion.

- India:

- Key Growth Drivers: Growing electricity demand, a push for clean energy to meet climate targets, and a strategic vision to reduce reliance on imported fossil fuels.

- Market Dominance: India is a significant market for Pressurized Heavy Water Reactors (PHWRs), leveraging its indigenous technological capabilities. The country is actively pursuing international collaborations to enhance its nuclear fleet and explore advanced reactor designs.

- Rest of Asia-Pacific:

- Key Growth Drivers: Energy diversification goals, stringent emission reduction targets, and the potential for technological innovation.

- Market Dominance: South Korea, with its advanced nuclear technology and established manufacturing base, is a key player. Japan, despite past challenges, continues to operate and upgrade its fleet, while countries like Vietnam are exploring nuclear power for future energy needs. This segment also sees growing interest in exploring advanced reactor types.

Dominant Segments by Reactor Type:

- Pressurized Water Reactor (PWR):

- Key Growth Drivers: Proven safety record, established supply chains, and wide acceptance globally.

- Market Dominance: PWRs are the most prevalent reactor type globally and in the APAC region, forming the backbone of many new nuclear construction projects. Their reliability and mature technology make them a preferred choice for large-scale power generation.

- Pressurized Heavy Water Reactor (PHWR):

- Key Growth Drivers: India's indigenous expertise and its ability to utilize natural uranium.

- Market Dominance: A significant segment, particularly in India, due to its domestic technological capabilities and strategic importance in national energy planning.

- Boiling Water Reactor (BWR):

- Key Growth Drivers: Simpler design and potentially lower construction costs in some applications.

- Market Dominance: While less prevalent than PWRs, BWRs remain an important reactor type in several APAC countries.

Dominant Segments by Service:

- Equipment:

- Key Growth Drivers: High demand for specialized components, including reactor vessels, steam generators, and turbines, to support new builds and upgrades.

- Market Dominance: This segment is crucial for the entire construction process, requiring sophisticated manufacturing capabilities and adherence to stringent quality standards.

- Installation:

- Key Growth Drivers: Large-scale infrastructure projects necessitate specialized engineering, procurement, and construction (EPC) services for site preparation, civil works, and component assembly.

- Market Dominance: A highly complex and capital-intensive service requiring extensive project management expertise and a skilled workforce.

APAC Nuclear Reactor Construction Market Product Analysis

The APAC Nuclear Reactor Construction Market is witnessing significant product innovations primarily centered around enhancing safety, improving efficiency, and reducing the levelized cost of electricity for nuclear power. Advanced reactor designs like High-temperature Gas-Cooled Reactors (HTGRs) are gaining traction for their inherent safety features and potential for industrial heat applications. Small Modular Reactors (SMRs) represent a transformative product innovation, offering greater flexibility in deployment, modular construction benefits, and potentially lower upfront capital costs, making nuclear power accessible to a wider range of energy needs and geographical locations. The development of next-generation fuel cycles and advanced materials further enhances the performance and longevity of nuclear reactors. These product advancements are crucial for maintaining nuclear power's competitive edge against other energy sources and for addressing public concerns regarding safety and waste management, thereby driving market fit and adoption.

Key Drivers, Barriers & Challenges in APAC Nuclear Reactor Construction Market

Key Drivers:

- Growing Demand for Clean Energy: Increasing global pressure to reduce carbon emissions and meet climate targets makes nuclear power a critical component of the energy mix for countries in APAC.

- Energy Security Concerns: Many APAC nations are focused on enhancing their energy independence and reducing reliance on volatile fossil fuel markets, positioning nuclear power as a stable and reliable source.

- Technological Advancements: Innovations in reactor design, including SMRs and advanced reactors, are making nuclear power more efficient, safer, and cost-effective.

- Government Support and Policy Initiatives: Favorable government policies, subsidies, and long-term energy planning are crucial enablers for nuclear reactor construction projects.

Barriers & Challenges:

- High Upfront Capital Costs: The immense capital investment required for building nuclear power plants remains a significant barrier, impacting project feasibility and attracting investment.

- Stringent Regulatory Hurdles and Licensing: Navigating complex and evolving regulatory frameworks, safety standards, and licensing processes can lead to significant delays and cost overruns.

- Public Perception and Safety Concerns: Negative public perception and concerns surrounding nuclear accidents, waste disposal, and security can hinder project development and deployment.

- Supply Chain Complexities and Skilled Workforce Shortages: The specialized nature of nuclear construction requires a robust and reliable supply chain for critical components and a highly skilled workforce, which can be challenging to maintain. The impact of supply chain disruptions can add an estimated xx% to project costs.

Growth Drivers in the APAC Nuclear Reactor Construction Market Market

The APAC Nuclear Reactor Construction Market is propelled by several interconnected growth drivers. A primary catalyst is the escalating global imperative for decarbonization, with APAC nations actively seeking low-carbon energy solutions to meet ambitious climate targets. This aligns with a strong need for energy security, as countries aim to reduce their dependence on imported fossil fuels and ensure a stable, reliable power supply for their rapidly industrializing economies. Technological advancements are also pivotal, with the emergence of Small Modular Reactors (SMRs) and advanced reactor designs promising enhanced safety, greater operational flexibility, and potentially reduced construction times and costs. Government support, manifested through favorable policies, long-term energy strategies, and direct investment, plays a crucial role in de-risking these massive infrastructure projects and fostering their development.

Challenges Impacting APAC Nuclear Reactor Construction Market Growth

Despite the strong growth prospects, the APAC Nuclear Reactor Construction Market faces several formidable challenges. Foremost among these are the substantial upfront capital requirements for nuclear power plants, which can be a significant deterrent for investors and governments alike. Navigating the complex and often lengthy regulatory and licensing processes, alongside evolving safety standards, presents another major hurdle, frequently leading to project delays and escalating costs. Public perception and ongoing safety concerns, stemming from historical incidents and the perceived risks of nuclear technology, can also impede progress and lead to public opposition. Furthermore, the industry grapples with intricate supply chain dependencies for specialized components and a persistent shortage of a highly skilled workforce, both of which can significantly impact project timelines and overall execution.

Key Players Shaping the APAC Nuclear Reactor Construction Market Market

- Dongfang Electric Corporation Limited

- Larsen & Toubro Limited

- Doosan Heavy Industries & Construction Co Ltd

- Bilfinger SE

- China National Nuclear Corporation

- Electricite de France SA (EDF)

- KEPCO Engineering & Construction

- Westinghouse Electric Company LLC (Toshiba)

- Shanghai Electric Group Company Limited

- Rosatom State Nuclear Energy Corporation

- Mitsubishi Heavy Industries Ltd

- GE-Hitachi Nuclear Energy Inc

Significant APAC Nuclear Reactor Construction Market Industry Milestones

- 2019: China announces plans to construct several new nuclear power plants, accelerating its ambitious expansion targets.

- 2020: India operationalizes its Kudankulam Nuclear Power Plant Units 3 and 4, boosting its nuclear capacity.

- 2021: South Korea advances its plans for Small Modular Reactor (SMR) development and deployment.

- 2022: The APAC region witnesses increased government commitments to nuclear power as a key component of clean energy strategies.

- 2023: Several major nuclear reactor construction projects across China and India achieve significant construction milestones.

- 2024: Growing interest and investment in research and development for advanced reactor technologies and SMRs gain momentum.

Future Outlook for APAC Nuclear Reactor Construction Market Market

The future outlook for the APAC Nuclear Reactor Construction Market is exceptionally bright, driven by an unyielding demand for clean, reliable energy and supportive government policies. The anticipated widespread adoption of Small Modular Reactors (SMRs) and other advanced reactor designs is poised to revolutionize the market by offering greater flexibility, enhanced safety, and potentially lower capital costs. Strategic investments in domestic manufacturing capabilities and the development of a skilled workforce will be crucial for sustained growth. Opportunities abound for companies that can offer innovative technological solutions, efficient project management, and robust safety protocols, positioning the APAC region as a global leader in nuclear energy expansion. The market is projected to witness significant growth catalysts from nations accelerating their net-zero transition goals and prioritizing energy independence.

APAC Nuclear Reactor Construction Market Segmentation

-

1. Service

- 1.1. Equipment

- 1.2. Installation

-

2. Reactor Type

- 2.1. Pressurized Water Reactor

- 2.2. Pressurized Heavy Water Reactor

- 2.3. Boiling Water Reactor

- 2.4. High-temperature Gas Cooled Reactor

- 2.5. Liquid Metal Fast Breeder Reactor

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Rest of Asia-Pacific

APAC Nuclear Reactor Construction Market Segmentation By Geography

- 1. China

- 2. India

- 3. Rest of Asia Pacific

APAC Nuclear Reactor Construction Market Regional Market Share

Geographic Coverage of APAC Nuclear Reactor Construction Market

APAC Nuclear Reactor Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactor to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Equipment

- 5.1.2. Installation

- 5.2. Market Analysis, Insights and Forecast - by Reactor Type

- 5.2.1. Pressurized Water Reactor

- 5.2.2. Pressurized Heavy Water Reactor

- 5.2.3. Boiling Water Reactor

- 5.2.4. High-temperature Gas Cooled Reactor

- 5.2.5. Liquid Metal Fast Breeder Reactor

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. China APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Equipment

- 6.1.2. Installation

- 6.2. Market Analysis, Insights and Forecast - by Reactor Type

- 6.2.1. Pressurized Water Reactor

- 6.2.2. Pressurized Heavy Water Reactor

- 6.2.3. Boiling Water Reactor

- 6.2.4. High-temperature Gas Cooled Reactor

- 6.2.5. Liquid Metal Fast Breeder Reactor

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. India APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Equipment

- 7.1.2. Installation

- 7.2. Market Analysis, Insights and Forecast - by Reactor Type

- 7.2.1. Pressurized Water Reactor

- 7.2.2. Pressurized Heavy Water Reactor

- 7.2.3. Boiling Water Reactor

- 7.2.4. High-temperature Gas Cooled Reactor

- 7.2.5. Liquid Metal Fast Breeder Reactor

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Rest of Asia Pacific APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Equipment

- 8.1.2. Installation

- 8.2. Market Analysis, Insights and Forecast - by Reactor Type

- 8.2.1. Pressurized Water Reactor

- 8.2.2. Pressurized Heavy Water Reactor

- 8.2.3. Boiling Water Reactor

- 8.2.4. High-temperature Gas Cooled Reactor

- 8.2.5. Liquid Metal Fast Breeder Reactor

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Dongfang Electric Corporation Limited

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Larsen & Toubro Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Doosan Heavy Industries & Construction Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bilfinger SE

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 China National Nuclear Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Electricite de France SA (EDF)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 KEPCO Engineering & Construction

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Westinghouse Electric Company LLC (Toshiba)

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Shanghai Electric Group Company Limited

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Rosatom State Nuclear Energy Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Mitsubishi Heavy Industries Ltd

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 GE-Hitachi Nuclear Energy Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Dongfang Electric Corporation Limited

List of Figures

- Figure 1: Global APAC Nuclear Reactor Construction Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 3: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: China APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 5: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 6: China APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 9: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 11: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: India APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 13: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 14: India APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 17: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 19: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 20: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 21: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 22: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 3: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 7: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 11: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 15: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Nuclear Reactor Construction Market?

The projected CAGR is approximately 2.47%.

2. Which companies are prominent players in the APAC Nuclear Reactor Construction Market?

Key companies in the market include Dongfang Electric Corporation Limited, Larsen & Toubro Limited, Doosan Heavy Industries & Construction Co Ltd, Bilfinger SE, China National Nuclear Corporation, Electricite de France SA (EDF), KEPCO Engineering & Construction, Westinghouse Electric Company LLC (Toshiba), Shanghai Electric Group Company Limited, Rosatom State Nuclear Energy Corporation, Mitsubishi Heavy Industries Ltd, GE-Hitachi Nuclear Energy Inc.

3. What are the main segments of the APAC Nuclear Reactor Construction Market?

The market segments include Service, Reactor Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.73 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Pressurized Water Reactor to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Nuclear Reactor Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Nuclear Reactor Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Nuclear Reactor Construction Market?

To stay informed about further developments, trends, and reports in the APAC Nuclear Reactor Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence