Key Insights

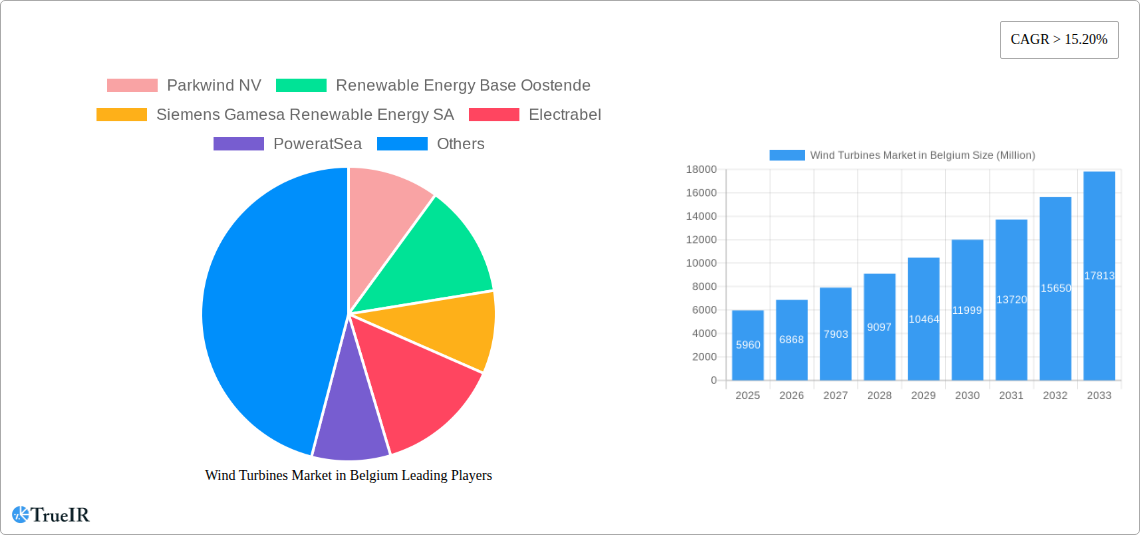

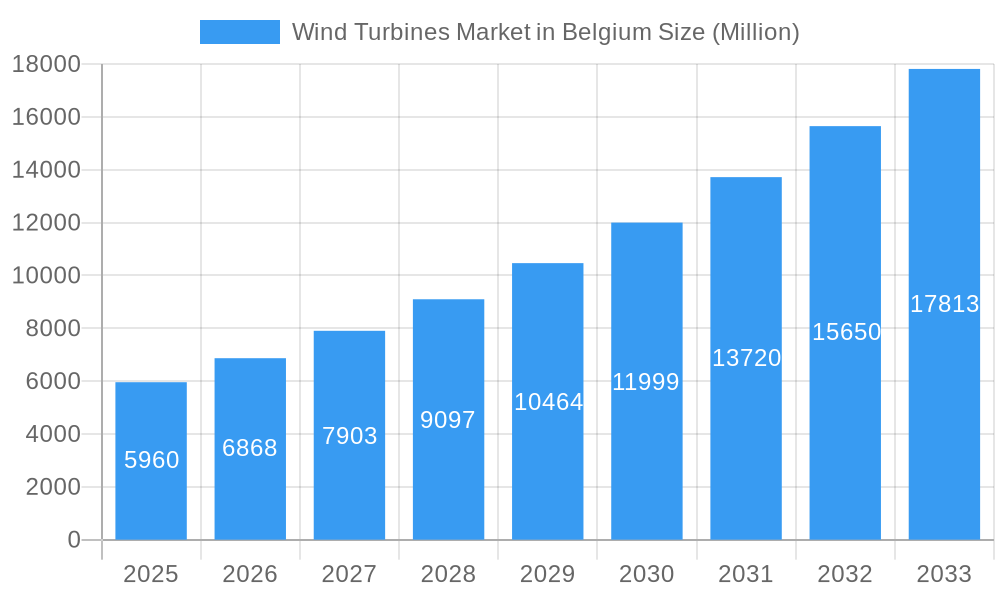

The Belgian wind turbines market is poised for significant expansion, driven by ambitious renewable energy targets and a strategic focus on offshore wind development. The market, estimated at USD 4.5 billion in 2023, is projected to experience robust growth at a compound annual growth rate (CAGR) of 15.2% from 2019-2033. This impressive expansion is fueled by government policies promoting decarbonization and energy independence, coupled with substantial investments in large-scale offshore wind farms. The "drivers" behind this growth are multifaceted, encompassing supportive regulatory frameworks, technological advancements leading to more efficient and cost-effective turbines, and increasing corporate demand for renewable energy solutions. Belgium’s strategic location, with its extensive coastline, positions it as a prime hub for offshore wind energy generation, attracting both domestic and international investment. The increasing electrification of various sectors, from transportation to industrial processes, further amplifies the need for clean and reliable energy sources, with wind power playing a crucial role in meeting these escalating demands.

Wind Turbines Market in Belgium Market Size (In Billion)

The market is characterized by several key "trends," including the continuous innovation in turbine technology, leading to larger and more powerful units capable of harnessing greater wind resources. There's a discernible shift towards more sophisticated monitoring and predictive maintenance systems, enhancing operational efficiency and reducing downtime. On the "restrains" side, while the market is strong, challenges such as grid integration complexities for intermittent renewable sources, potential environmental concerns related to marine ecosystems during offshore installations, and the initial high capital expenditure for large projects require careful management and strategic planning. However, the strong policy support and the clear economic and environmental benefits of wind energy are expected to outweigh these challenges. The market segments, particularly the "offshore" deployment location, are anticipated to dominate due to Belgium's geographical advantages and the scale of projects being undertaken. Key players like Parkwind NV and Siemens Gamesa Renewable Energy SA are at the forefront of developing and deploying these advanced wind turbine solutions in the region.

Wind Turbines Market in Belgium Company Market Share

Here's a dynamic, SEO-optimized report description for the Wind Turbines Market in Belgium, incorporating all your specifications:

This in-depth report provides a strategic analysis of the Wind Turbines Market in Belgium, covering the historical period of 2019–2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025–2033. Dive into the intricate dynamics of Belgium's booming renewable energy sector, exploring the crucial role of wind energy in its sustainable future. Our research meticulously examines market structure, competitive landscape, evolving trends, dominant segments, product innovations, and the key drivers and challenges shaping this vital industry. With a focus on high-volume keywords such as "Belgium wind energy," "offshore wind Belgium," "onshore wind turbines Belgium," "renewable energy Belgium," and "wind power market," this report is designed to be the definitive resource for investors, policymakers, manufacturers, and industry stakeholders seeking actionable insights and competitive intelligence.

Wind Turbines Market in Belgium Market Structure & Competitive Landscape

The Wind Turbines Market in Belgium is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Key players like Siemens Gamesa Renewable Energy SA and Parkwind NV are at the forefront of innovation and deployment. The market's growth is propelled by substantial investments in renewable energy infrastructure, driven by stringent EU targets and national commitments to decarbonization. Regulatory frameworks play a pivotal role, with government incentives and supportive policies creating a favorable environment for wind energy expansion. Product substitutes, such as solar photovoltaics and other renewable sources, are present but face limitations in consistent power generation compared to wind turbines, particularly in Belgium's advantageous wind regimes. End-user segmentation primarily includes utility-scale wind farm developers and industrial/commercial energy consumers seeking to reduce their carbon footprint and energy costs. Mergers and acquisitions (M&A) are anticipated to increase as companies seek to consolidate market positions, acquire new technologies, and expand their operational portfolios. For instance, the market is witnessing strategic partnerships aimed at developing next-generation turbines and optimizing operational efficiency. The competitive landscape is shaped by technological advancements, cost competitiveness, and the ability to secure large-scale project approvals, with a growing emphasis on sustainability and lifecycle management of wind turbine components.

Wind Turbines Market in Belgium Market Trends & Opportunities

The Wind Turbines Market in Belgium is experiencing robust growth, driven by an escalating demand for clean energy and supportive government policies. The market size is projected to expand significantly over the forecast period, fueled by a compound annual growth rate (CAGR) of xx%. This expansion is underpinned by a strong commitment to increasing renewable energy capacity, with wind power playing a central role. Technological shifts are a major trend, with a focus on larger, more efficient turbines capable of capturing greater energy from wind resources. Innovations in blade design, materials science, and digital monitoring systems are enhancing turbine performance and reducing operational costs. Consumer preferences are increasingly leaning towards sustainable energy solutions, further stimulating the demand for wind-generated electricity. This is evident in the growing corporate power purchase agreements (PPAs) for wind energy. Competitive dynamics are intensifying, with established global players vying for market share alongside emerging local entities. Opportunities abound in the expansion of offshore wind farms, leveraging Belgium's extensive coastline and the strategic North Sea region agreements. Furthermore, the repowering of older wind farms with advanced technologies presents a significant growth avenue. The integration of energy storage solutions with wind power generation is another burgeoning trend, addressing the intermittency of wind and enhancing grid stability. The increasing digitalization of wind farm operations, including predictive maintenance and remote monitoring, is improving efficiency and lowering the levelized cost of energy (LCOE). The market penetration of wind energy is expected to rise dramatically as Belgium strives to meet its ambitious climate targets, creating substantial opportunities for all stakeholders in the wind turbine value chain.

Dominant Markets & Segments in Wind Turbines Market in Belgium

The Offshore segment is unequivocally the dominant and fastest-growing market within Belgium's wind turbines landscape. This dominance is a direct consequence of the nation's strategic geographical position along the North Sea, which offers exceptional and consistent wind resources. Belgium has made significant strides in harnessing this potential, establishing itself as a key player in offshore wind energy development. The governmental commitment to offshore wind is monumental, evidenced by the substantial offshore wind contract signed in May 2022 for USD 142.45 Billion, a landmark agreement between North Sea countries including Germany, Denmark, the Netherlands, and Belgium. This cooperation pact explicitly aims for a tenfold increase in offshore wind power capacity in the region by 2030, underscoring the immense growth trajectory anticipated for this segment.

- Key Growth Drivers for Offshore Wind:

- Abundant Wind Resources: The North Sea offers high and stable wind speeds, ideal for large-scale wind turbine deployment.

- Governmental Support and Policy Frameworks: Belgium has implemented aggressive policies and subsidies to promote offshore wind development, including ambitious capacity targets and streamlined permitting processes.

- Technological Advancements: Innovations in turbine size, foundation technologies, and installation methods are making offshore wind more economically viable and efficient.

- Strategic North Sea Cooperation: The intergovernmental agreement significantly boosts cross-border collaboration, shared infrastructure development, and market expansion opportunities.

- Corporate Demand for Green Energy: Increasing commitments from large corporations to source renewable energy are driving demand for large-scale offshore wind projects.

- Energy Security and Decarbonization Goals: Offshore wind is crucial for Belgium to reduce its reliance on fossil fuels and achieve its climate neutrality objectives.

While offshore wind is commanding the lead, the Onshore segment also plays a vital role, contributing to the overall renewable energy mix. Onshore wind farms are often more accessible for maintenance and can be deployed in a wider array of locations, though they are subject to greater landscape and community impact considerations. The development of onshore wind farms is supported by local initiatives and regional renewable energy targets. The recent agreement by Aspiravi in November 2022 to procure 43.2 MW of wind turbines from Nordex for four wind farms, including a 20-year service contract, exemplifies the continued investment and operational focus within the onshore sector. This ongoing activity in onshore wind highlights its complementary role in achieving Belgium's diversified renewable energy portfolio. However, the sheer scale of investment and the potential capacity of the offshore sector position it as the primary engine of growth and market dominance in the coming years.

Wind Turbines Market in Belgium Product Analysis

The Wind Turbines Market in Belgium is witnessing a surge in product innovation focused on enhancing efficiency, reliability, and cost-effectiveness. Key advancements include the development of larger rotor diameters and higher power output turbines, particularly for offshore applications, enabling greater energy capture per turbine. Innovations in materials science are leading to lighter, stronger, and more durable blades, while advanced digital technologies, such as AI-powered predictive maintenance and remote monitoring systems, are optimizing operational performance and reducing downtime. These product developments are crucial for meeting the increasing demand for renewable energy and achieving competitive levelized costs of energy (LCOE).

Key Drivers, Barriers & Challenges in Wind Turbines Market in Belgium

Key Drivers: The Wind Turbines Market in Belgium is propelled by a confluence of strong drivers. Technologically, advancements in turbine design, including larger rotor diameters and improved efficiency, are increasing energy yields. Economically, falling LCOE for wind power makes it increasingly competitive with conventional energy sources. Policy-driven factors are paramount, with the Belgian government and the EU setting ambitious renewable energy targets and providing substantial financial incentives, subsidies, and supportive regulatory frameworks. The significant offshore wind contract signed with North Sea partners highlights a powerful geopolitical and collaborative driver.

Barriers & Challenges: Despite the positive outlook, challenges persist. Grid connection capacity and infrastructure limitations can hinder the rapid deployment of new wind farms, especially in areas with high potential. Permitting processes, while being streamlined, can still be complex and time-consuming, leading to project delays. Public acceptance and visual impact concerns can also present hurdles for onshore wind projects. Supply chain vulnerabilities, particularly for specialized components and skilled labor, can impact project timelines and costs. Furthermore, the intermittent nature of wind power necessitates robust grid management and energy storage solutions, adding to the overall system costs.

Growth Drivers in the Wind Turbines Market in Belgium Market

The Wind Turbines Market in Belgium is experiencing substantial growth driven by strong technological advancements, making turbines more efficient and cost-effective. Economically, the declining levelized cost of energy (LCOE) for wind power positions it as an attractive investment compared to fossil fuels. Policy support is a critical factor, with ambitious renewable energy targets set by the Belgian government and the European Union, coupled with attractive incentives and streamlined permitting processes for wind projects, particularly offshore. The strategic cooperation agreements within the North Sea region are also catalyzing large-scale offshore wind development, creating a significant upward trajectory for the market.

Challenges Impacting Wind Turbines Market in Belgium Growth

Despite the robust growth, several challenges impact the Wind Turbines Market in Belgium. Grid integration and capacity limitations can slow down the connection of new wind farms. Regulatory complexities and lengthy permitting procedures, although improving, still pose a significant hurdle. Public acceptance and potential visual amenity concerns can complicate the development of onshore wind projects. Moreover, global supply chain disruptions and shortages of critical components, along with a scarcity of skilled labor, can lead to project delays and increased costs. The effective management of intermittency through energy storage and grid modernization also presents ongoing technical and economic challenges.

Key Players Shaping the Wind Turbines Market in Belgium Market

- Parkwind NV

- Renewable Energy Base Oostende

- Siemens Gamesa Renewable Energy SA

- Electrabel

- PoweratSea

- Senvion SA

- Storm

Significant Wind Turbines Market in Belgium Industry Milestones

- November 2022: Aspiravi, a leading wind farm operator in Belgium, contracted Nordex to supply wind turbines for four wind farms totaling 43.2 MW capacity. This agreement included a 20-year premium service contract, with installations scheduled to commence in 2023.

- May 2022: Belgium, along with Germany, Denmark, and the Netherlands, signed an offshore wind contract valued at USD 142.45 Billion. This cooperation agreement aims to tenfold the region's offshore wind power capacity by 2030.

Future Outlook for Wind Turbines Market in Belgium Market

The future outlook for the Wind Turbines Market in Belgium is exceptionally bright, driven by a strong political will to accelerate the green transition and achieve ambitious decarbonization goals. The ongoing expansion of offshore wind capacity, bolstered by international cooperation and technological advancements, will be a primary growth catalyst. Investments in grid modernization and energy storage solutions are expected to further enhance the reliability and integration of wind power. Continued innovation in turbine technology, focusing on efficiency and sustainability, will maintain competitive pricing. The increasing demand for renewable energy from both public and private sectors, coupled with supportive policy frameworks, positions Belgium for significant growth in wind energy deployment over the forecast period.

Wind Turbines Market in Belgium Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

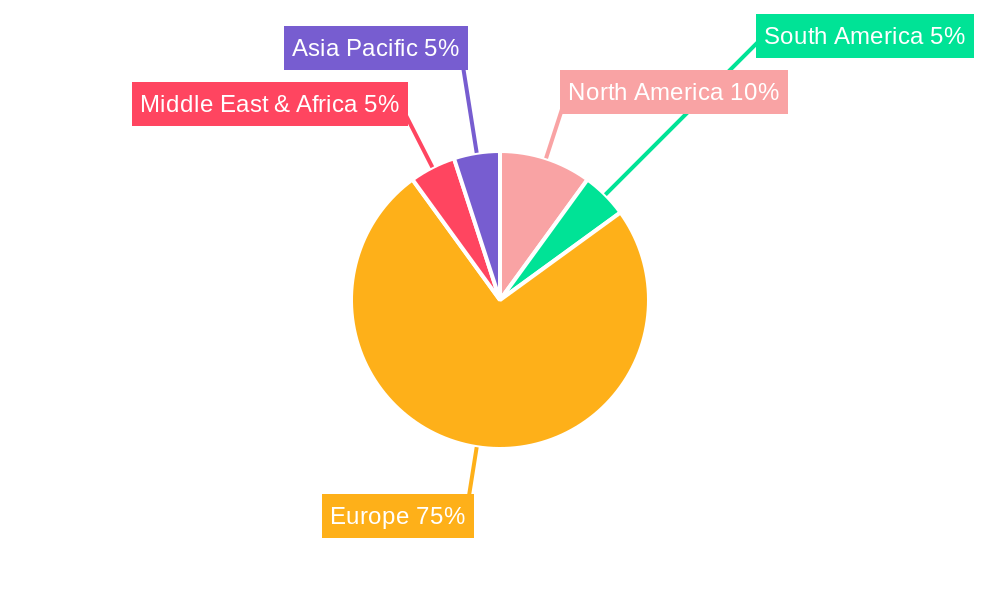

Wind Turbines Market in Belgium Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wind Turbines Market in Belgium Regional Market Share

Geographic Coverage of Wind Turbines Market in Belgium

Wind Turbines Market in Belgium REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Offshore Wind Energy is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wind Turbines Market in Belgium Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Wind Turbines Market in Belgium Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. South America Wind Turbines Market in Belgium Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Europe Wind Turbines Market in Belgium Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Middle East & Africa Wind Turbines Market in Belgium Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Asia Pacific Wind Turbines Market in Belgium Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Parkwind NV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renewable Energy Base Oostende

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens Gamesa Renewable Energy SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Electrabel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PoweratSea

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Senvion SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Storm

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Parkwind NV

List of Figures

- Figure 1: Global Wind Turbines Market in Belgium Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Wind Turbines Market in Belgium Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 3: North America Wind Turbines Market in Belgium Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 4: North America Wind Turbines Market in Belgium Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Wind Turbines Market in Belgium Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Wind Turbines Market in Belgium Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 7: South America Wind Turbines Market in Belgium Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 8: South America Wind Turbines Market in Belgium Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America Wind Turbines Market in Belgium Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Wind Turbines Market in Belgium Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 11: Europe Wind Turbines Market in Belgium Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 12: Europe Wind Turbines Market in Belgium Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Wind Turbines Market in Belgium Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Wind Turbines Market in Belgium Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 15: Middle East & Africa Wind Turbines Market in Belgium Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 16: Middle East & Africa Wind Turbines Market in Belgium Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa Wind Turbines Market in Belgium Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Wind Turbines Market in Belgium Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 19: Asia Pacific Wind Turbines Market in Belgium Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 20: Asia Pacific Wind Turbines Market in Belgium Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Wind Turbines Market in Belgium Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 2: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 4: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 9: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 14: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 25: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 33: Global Wind Turbines Market in Belgium Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Wind Turbines Market in Belgium Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wind Turbines Market in Belgium?

The projected CAGR is approximately 15.2%.

2. Which companies are prominent players in the Wind Turbines Market in Belgium?

Key companies in the market include Parkwind NV, Renewable Energy Base Oostende, Siemens Gamesa Renewable Energy SA, Electrabel, PoweratSea, Senvion SA, Storm.

3. What are the main segments of the Wind Turbines Market in Belgium?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand.

6. What are the notable trends driving market growth?

Offshore Wind Energy is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

November 2022: Aspiravi, one of the largest wind farm operators in Belgium, roped in Nordex to supply wind turbines for four wind farms totaling a capacity of 43.2 MW. This order also included a premium service contract of 20 years to service the wind turbines. The activities on installations are scheduled to be commenced in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wind Turbines Market in Belgium," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wind Turbines Market in Belgium report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wind Turbines Market in Belgium?

To stay informed about further developments, trends, and reports in the Wind Turbines Market in Belgium, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence