Key Insights

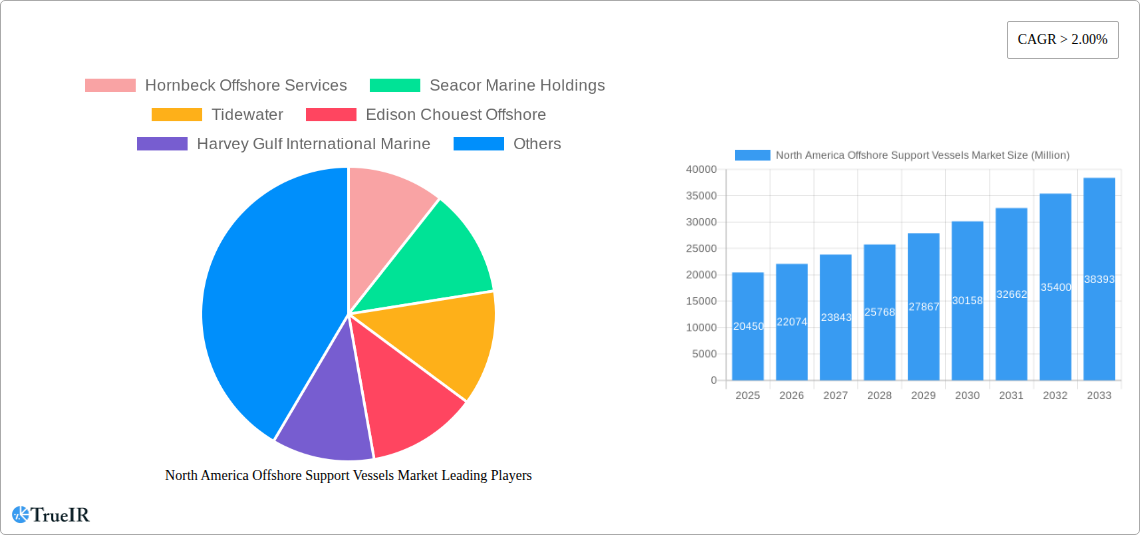

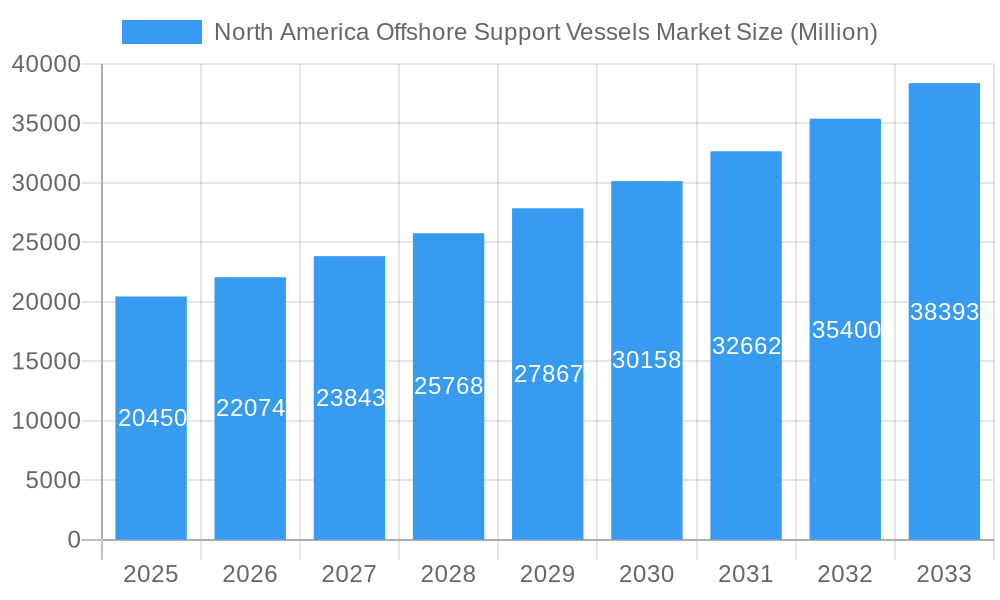

The North America Offshore Support Vessels (OSVs) market is poised for significant expansion, projected to reach an estimated USD 20.45 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 7.94% through 2033. This growth is primarily propelled by escalating offshore exploration and production activities across the region, driven by the increasing global demand for oil and gas. Investments in deeper water exploration, coupled with a focus on maintaining and expanding existing offshore infrastructure, are key demand generators for a diverse range of OSVs, including supply vessels, anchor handling tugs, and platform supply vessels. Furthermore, the burgeoning renewable energy sector, particularly offshore wind farms, is emerging as a substantial growth avenue, requiring specialized vessels for installation, maintenance, and support. Marine contractors and oil and gas companies represent the dominant end-user segments, actively seeking advanced and efficient OSV solutions to optimize their operations.

North America Offshore Support Vessels Market Market Size (In Billion)

Navigating this dynamic market presents certain challenges. While the demand for OSVs is strong, the sector is influenced by fluctuating crude oil prices, which can impact exploration budgets and subsequently OSV charter rates. Stringent environmental regulations and the growing emphasis on decarbonization are also driving the adoption of more fuel-efficient and environmentally friendly propulsion systems, such as diesel-electric and hybrid technologies, presenting both an opportunity and a challenge for vessel operators and manufacturers to invest in next-generation fleets. The market's future trajectory will likely be shaped by the ability of stakeholders to balance cost-effectiveness with the imperative for sustainable and technologically advanced offshore operations.

North America Offshore Support Vessels Market Company Market Share

Here is a dynamic, SEO-optimized report description for the North America Offshore Support Vessels Market, crafted without placeholders and ready for immediate use.

This comprehensive market research report provides an exhaustive analysis of the North America Offshore Support Vessels Market, covering the historical period of 2019–2024, the base year of 2025, and an extensive forecast period from 2025 to 2033. With the market size projected to reach XX billion by 2033, this study delves into critical market dynamics, trends, opportunities, and challenges shaping the industry. Leveraging high-volume keywords such as "offshore support vessels," "OSV market," "North America oil and gas," "renewable energy offshore," "subsea construction," and "marine contractors," this report is designed to enhance search engine rankings and provide unparalleled insights for industry stakeholders. The analysis is segmented by Vessel Type, End User, Application, and Propulsion System, offering a granular view of market penetration and growth trajectories.

North America Offshore Support Vessels Market Market Structure & Competitive Landscape

The North America Offshore Support Vessels Market exhibits a moderately concentrated structure, with key players like Hornbeck Offshore Services, Seacor Marine Holdings, Tidewater, Edison Chouest Offshore, and Harvey Gulf International Marine dominating market share. The market concentration ratio for the top five players is estimated to be around XX%. Innovation drivers are primarily fueled by the increasing demand for specialized vessels for complex offshore exploration, production, and maintenance activities, coupled with the burgeoning renewable energy sector's offshore wind farm development. Regulatory impacts, particularly concerning environmental standards and safety protocols, significantly influence operational strategies and vessel design. Product substitutes are limited in the specialized OSV segment, though advancements in onshore technologies can indirectly affect demand. End-user segmentation reveals a strong reliance on traditional oil and gas companies, with a growing but still nascent contribution from renewable energy companies and marine contractors. Merger and acquisition (M&A) trends are indicative of consolidation efforts, with an estimated XX M&A deals recorded in the historical period, aiming to expand fleet size, geographical reach, and technological capabilities.

North America Offshore Support Vessels Market Market Trends & Opportunities

The North America Offshore Support Vessels Market is poised for substantial growth, driven by a confluence of robust demand from the oil and gas sector and the burgeoning renewable energy landscape. The overall market size is projected to expand from an estimated $XX billion in 2025 to $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Technological shifts are at the forefront, with a pronounced trend towards the adoption of more fuel-efficient and environmentally friendly propulsion systems, such as diesel-electric and hybrid solutions, aiming to reduce operational costs and meet stricter emission regulations. Consumer preferences are increasingly leaning towards vessels offering enhanced operational efficiency, greater deck space, improved accommodation for crew, and advanced dynamic positioning systems to navigate challenging offshore environments. Competitive dynamics are characterized by a strategic focus on fleet modernization, fleet rationalization, and the pursuit of long-term charter agreements. Opportunities abound in supporting the expansion of offshore wind farms, which require specialized vessels for installation, maintenance, and operations. The increasing complexity of offshore exploration and production activities, particularly in deeper waters, also necessitates the deployment of advanced offshore support vessels, creating a sustained demand for specialized tonnage. Furthermore, the growing emphasis on decommissioning aging offshore infrastructure presents another significant avenue for growth, requiring dedicated vessels for demolition and removal operations. The market penetration rate of advanced OSVs is expected to rise as operators prioritize efficiency and sustainability.

Dominant Markets & Segments in North America Offshore Support Vessels Market

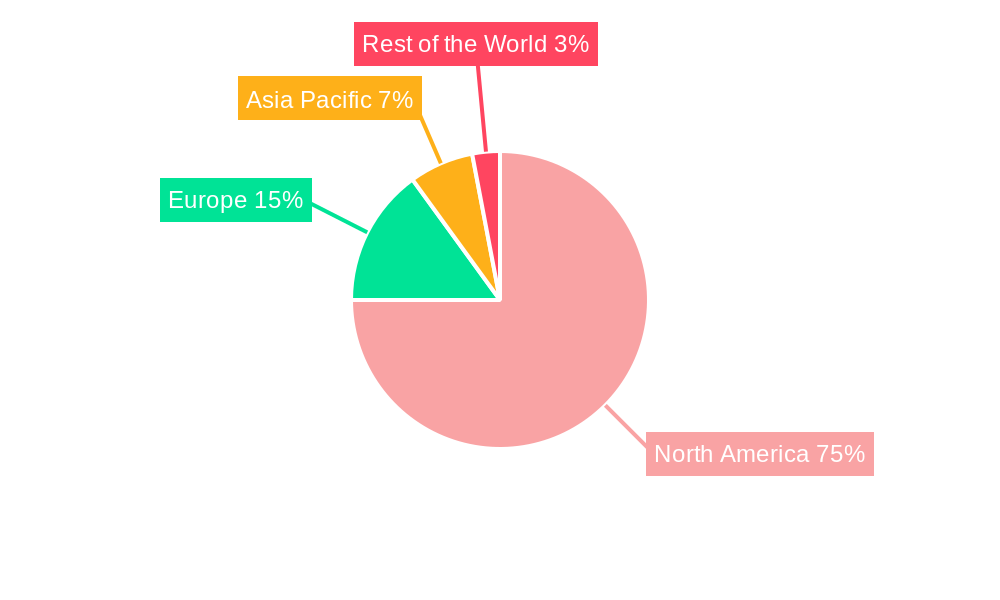

The North America Offshore Support Vessels Market is significantly influenced by the dominant position of the United States within the region, driven by its extensive coastline and established offshore oil and gas industry. Within vessel types, Supply Vessels and Platform Supply Vessels (PSVs) continue to hold the largest market share due to their essential role in transporting vital supplies, equipment, and personnel to offshore platforms.

- Key Growth Drivers for Dominant Segments:

- Oil and Gas Companies: Sustained exploration and production activities in the Gulf of Mexico remain a primary driver, necessitating a robust fleet of OSVs for logistical support, crew transfer, and emergency response. Investments in enhanced oil recovery (EOR) techniques also contribute to demand.

- Offshore Exploration & Offshore Production: The ongoing need to discover and extract hydrocarbons from deep-water and challenging environments directly fuels the demand for specialized offshore support vessels capable of handling complex operations.

- Diesel-electric Propulsion: This propulsion system is gaining traction due to its superior fuel efficiency, reduced emissions, and enhanced maneuverability, aligning with industry trends towards sustainability and cost optimization.

The End User segment is overwhelmingly dominated by Oil and Gas Companies, which account for approximately XX% of the market. However, the Renewable Energy Companies segment is exhibiting the highest growth potential, driven by the rapid expansion of offshore wind farms along the North American coastlines. Marine contractors are also a significant end-user, playing a crucial role in subsea construction and maintenance projects.

- Market Dominance Analysis:

- Vessel Type: While PSVs and Supply Vessels lead, Anchor Handling Tugs (AHTs) are critical for towing and positioning offshore structures, and Multi-purpose Support Vessels (MPSVs) are increasingly sought after for their versatility in handling various offshore tasks. Dive Support Vessels (DSVs) are indispensable for subsea construction and inspection.

- Application: Offshore Production and Offshore Exploration represent the largest application segments. However, Subsea Construction is experiencing rapid growth as new infrastructure is developed and existing facilities are upgraded. Offshore Maintenance and Repair also contributes steadily to the demand for OSVs.

- Propulsion System: Currently, Diesel propulsion systems are the most prevalent. However, the market is witnessing a notable shift towards Diesel-electric and Hybrid propulsion systems due to environmental regulations and operational efficiency demands. Gas-electric and Steam propulsion systems are less common in the contemporary OSV market.

North America Offshore Support Vessels Market Product Analysis

The North America Offshore Support Vessels market is characterized by ongoing product innovations focused on enhancing operational efficiency, safety, and environmental compliance. Vessel types like advanced Platform Supply Vessels and Multi-purpose Support Vessels are being equipped with cutting-edge dynamic positioning systems, increased deck load capacities, and improved accommodation modules. The integration of sophisticated subsea intervention equipment and remotely operated vehicles (ROVs) on dive support vessels is expanding their application scope. A key competitive advantage lies in the development of vessels with hybrid or diesel-electric propulsion systems, offering significant fuel savings and reduced emissions, which are increasingly mandated by regulatory bodies and sought by environmentally conscious operators.

Key Drivers, Barriers & Challenges in North America Offshore Support Vessels Market

Key Drivers:

- Resurgent Oil & Gas Exploration: Continued investments in offshore oil and gas exploration and production, particularly in deepwater regions like the Gulf of Mexico, are a primary growth catalyst.

- Renewable Energy Expansion: The rapid development of offshore wind farms is creating substantial demand for specialized vessels for construction, installation, and maintenance.

- Technological Advancements: The adoption of more fuel-efficient and environmentally friendly propulsion systems, alongside advanced navigation and operational technologies, enhances vessel capabilities and market appeal.

- Infrastructure Development: The need for new offshore infrastructure, including pipelines and platforms, and the maintenance of existing assets, drives consistent demand for OSVs.

Barriers & Challenges:

- Volatile Oil Prices: Fluctuations in global crude oil prices can directly impact the profitability of offshore E&P activities, leading to hesitant investment and reduced demand for OSVs.

- Stringent Environmental Regulations: Increasing environmental regulations and the push for decarbonization necessitate costly fleet upgrades and operational adjustments, posing a significant challenge.

- Geopolitical Instability: Global geopolitical events can disrupt supply chains, affect commodity prices, and influence investment decisions in the offshore sector.

- High Capital Investment: The acquisition and maintenance of specialized offshore support vessels require substantial capital outlay, which can be a barrier for smaller operators.

- Competition: Intense competition among OSV operators can lead to price pressures and impact profit margins.

Growth Drivers in the North America Offshore Support Vessels Market Market

The North America Offshore Support Vessels market is experiencing robust growth fueled by several interconnected factors. Technologically, the demand for sophisticated vessels capable of operating in increasingly challenging deepwater environments and supporting complex subsea construction projects is on the rise. Economically, sustained high energy prices, albeit volatile, incentivize continued investment in offshore oil and gas exploration and production, directly translating to a greater need for support vessels. Furthermore, the burgeoning renewable energy sector, particularly offshore wind, is a significant growth engine, requiring specialized vessels for turbine installation, maintenance, and logistical support. Regulatory drivers, such as government incentives for renewable energy development and stricter environmental standards for offshore operations, are also pushing the adoption of cleaner and more efficient vessel technologies, such as hybrid and diesel-electric propulsion systems.

Challenges Impacting North America Offshore Support Vessels Market Growth

Several challenges are impacting the growth trajectory of the North America Offshore Support Vessels market. Regulatory complexities, including evolving environmental standards and permitting processes for offshore activities, can lead to project delays and increased operational costs. Supply chain disruptions, exacerbated by global events, can affect the availability of essential components and increase lead times for vessel construction and maintenance, impacting timely deployment. Competitive pressures from both established players and emerging regional operators can lead to pricing wars and reduced profit margins. Furthermore, the ongoing energy transition and the push towards decarbonization present a long-term challenge, potentially reducing future demand from the traditional oil and gas sector if not adequately offset by growth in offshore renewables and other maritime services.

Key Players Shaping the North America Offshore Support Vessels Market Market

- Hornbeck Offshore Services

- Seacor Marine Holdings

- Tidewater

- Edison Chouest Offshore

- Harvey Gulf International Marine

Significant North America Offshore Support Vessels Market Industry Milestones

- 2019: Increased focus on fleet modernization and consolidation through strategic partnerships and acquisitions by major players to enhance operational efficiency and market positioning.

- 2020-2021: Impact of the COVID-19 pandemic leading to temporary slowdowns in offshore activity and a subsequent recalibration of fleet utilization and newbuild orders.

- 2022: Resurgence of offshore oil and gas exploration activities driven by elevated energy prices, leading to increased charter rates and demand for offshore support vessels.

- 2023: Growing momentum in the offshore wind sector, with significant investments announced for new projects, driving demand for specialized construction and maintenance vessels.

- 2024: Continued emphasis on the adoption of sustainable technologies, with a notable increase in the retrofitting and construction of vessels featuring hybrid and electric propulsion systems.

Future Outlook for North America Offshore Support Vessels Market Market

The future outlook for the North America Offshore Support Vessels Market is characterized by a dual growth trajectory driven by both traditional energy sectors and the rapidly expanding renewable energy industry. Strategic opportunities lie in the continued development of deepwater oil and gas fields, alongside the immense potential presented by offshore wind farm construction and maintenance. The market will witness an accelerated adoption of cleaner propulsion technologies, such as diesel-electric and hybrid systems, to meet stringent environmental regulations and reduce operational costs. Investment in advanced vessel designs capable of supporting complex subsea operations and remote interventions will also be a key growth catalyst. The diversification of services offered by OSV operators, including decommissioning support and roles in carbon capture and storage (CCS) infrastructure development, will further bolster market resilience and expansion.

North America Offshore Support Vessels Market Segmentation

-

1. Vessel Type

- 1.1. Supply vessels

- 1.2. Anchor handling tugs

- 1.3. Platform supply vessels

- 1.4. Multi-purpose support vessels

- 1.5. Dive support vessels

-

2. End User

- 2.1. Oil and gas companies

- 2.2. renewable energy companies

- 2.3. marine contractors

-

3. Application

- 3.1. Offshore exploration

- 3.2. offshore production

- 3.3. offshore maintenance and repair

- 3.4. subsea construction

-

4. Propulsion System

- 4.1. Diesel-electric, hybrid

- 4.2. gas-electric, steam

North America Offshore Support Vessels Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Offshore Support Vessels Market Regional Market Share

Geographic Coverage of North America Offshore Support Vessels Market

North America Offshore Support Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices

- 3.3. Market Restrains

- 3.3.1. 4.; The Country's Inefficient Electricity Grid Infrastructure

- 3.4. Market Trends

- 3.4.1. Platform Supply Vessels (PSVs) Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Supply vessels

- 5.1.2. Anchor handling tugs

- 5.1.3. Platform supply vessels

- 5.1.4. Multi-purpose support vessels

- 5.1.5. Dive support vessels

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and gas companies

- 5.2.2. renewable energy companies

- 5.2.3. marine contractors

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Offshore exploration

- 5.3.2. offshore production

- 5.3.3. offshore maintenance and repair

- 5.3.4. subsea construction

- 5.4. Market Analysis, Insights and Forecast - by Propulsion System

- 5.4.1. Diesel-electric, hybrid

- 5.4.2. gas-electric, steam

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. United States North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6.1.1. Supply vessels

- 6.1.2. Anchor handling tugs

- 6.1.3. Platform supply vessels

- 6.1.4. Multi-purpose support vessels

- 6.1.5. Dive support vessels

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and gas companies

- 6.2.2. renewable energy companies

- 6.2.3. marine contractors

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Offshore exploration

- 6.3.2. offshore production

- 6.3.3. offshore maintenance and repair

- 6.3.4. subsea construction

- 6.4. Market Analysis, Insights and Forecast - by Propulsion System

- 6.4.1. Diesel-electric, hybrid

- 6.4.2. gas-electric, steam

- 6.1. Market Analysis, Insights and Forecast - by Vessel Type

- 7. Canada North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vessel Type

- 7.1.1. Supply vessels

- 7.1.2. Anchor handling tugs

- 7.1.3. Platform supply vessels

- 7.1.4. Multi-purpose support vessels

- 7.1.5. Dive support vessels

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and gas companies

- 7.2.2. renewable energy companies

- 7.2.3. marine contractors

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Offshore exploration

- 7.3.2. offshore production

- 7.3.3. offshore maintenance and repair

- 7.3.4. subsea construction

- 7.4. Market Analysis, Insights and Forecast - by Propulsion System

- 7.4.1. Diesel-electric, hybrid

- 7.4.2. gas-electric, steam

- 7.1. Market Analysis, Insights and Forecast - by Vessel Type

- 8. Mexico North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vessel Type

- 8.1.1. Supply vessels

- 8.1.2. Anchor handling tugs

- 8.1.3. Platform supply vessels

- 8.1.4. Multi-purpose support vessels

- 8.1.5. Dive support vessels

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and gas companies

- 8.2.2. renewable energy companies

- 8.2.3. marine contractors

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Offshore exploration

- 8.3.2. offshore production

- 8.3.3. offshore maintenance and repair

- 8.3.4. subsea construction

- 8.4. Market Analysis, Insights and Forecast - by Propulsion System

- 8.4.1. Diesel-electric, hybrid

- 8.4.2. gas-electric, steam

- 8.1. Market Analysis, Insights and Forecast - by Vessel Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Hornbeck Offshore Services

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Seacor Marine Holdings

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Tidewater

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Edison Chouest Offshore

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Harvey Gulf International Marine

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 Hornbeck Offshore Services

List of Figures

- Figure 1: North America Offshore Support Vessels Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Offshore Support Vessels Market Share (%) by Company 2025

List of Tables

- Table 1: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 2: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 5: North America Offshore Support Vessels Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 7: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 10: North America Offshore Support Vessels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 12: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 13: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 15: North America Offshore Support Vessels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 17: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 20: North America Offshore Support Vessels Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Offshore Support Vessels Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the North America Offshore Support Vessels Market?

Key companies in the market include Hornbeck Offshore Services , Seacor Marine Holdings , Tidewater , Edison Chouest Offshore, Harvey Gulf International Marine .

3. What are the main segments of the North America Offshore Support Vessels Market?

The market segments include Vessel Type , End User , Application , Propulsion System .

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices.

6. What are the notable trends driving market growth?

Platform Supply Vessels (PSVs) Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Country's Inefficient Electricity Grid Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Offshore Support Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Offshore Support Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Offshore Support Vessels Market?

To stay informed about further developments, trends, and reports in the North America Offshore Support Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence