Key Insights

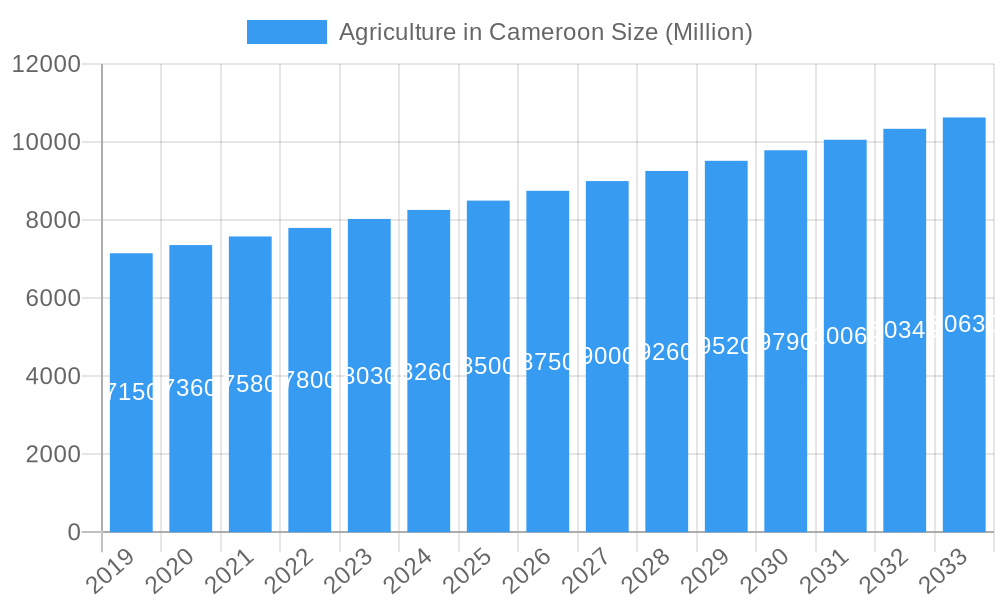

Cameroon's agriculture sector is projected to achieve a market size of $49,157.7 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6% through 2033. This growth is underpinned by escalating domestic food demand, government modernization initiatives, and rising interest in export-oriented cash crops. The sector's diversification potential across staple crops, fruits, vegetables, and cash crops offers substantial opportunities for local and international stakeholders. The adoption of advanced technologies, including improved seeds, efficient irrigation, and enhanced post-harvest management, is crucial for boosting yields and minimizing losses. Improved market access and value chain integration are also key drivers for farmer income enhancement and investment stimulation.

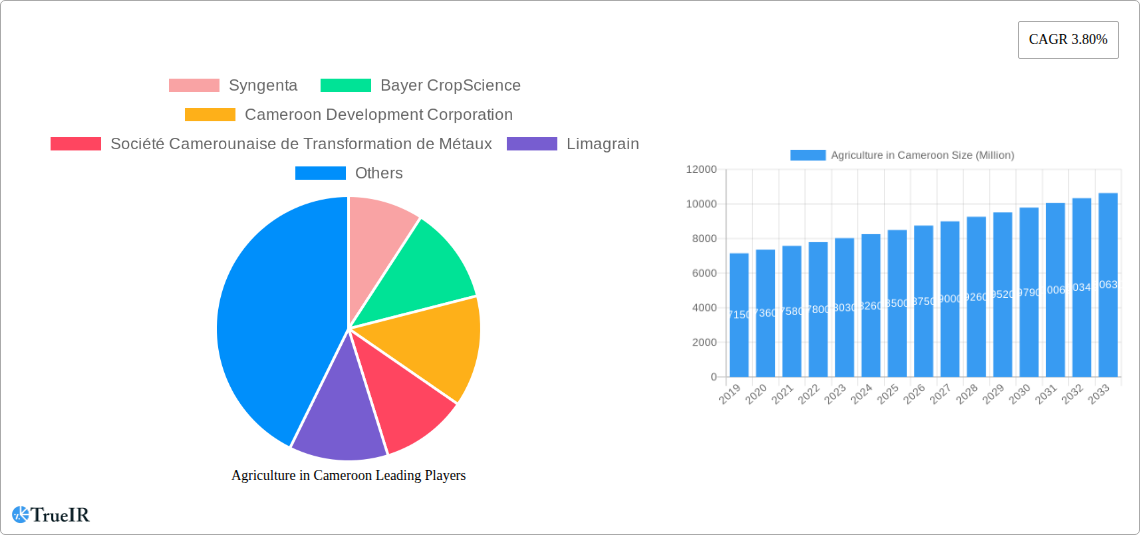

Agriculture in Cameroon Market Size (In Billion)

Despite this positive outlook, the sector confronts several obstacles. Climate change impacts, characterized by inconsistent rainfall and extreme weather events, necessitate robust investment in climate-resilient agricultural practices. Limited access to affordable credit and modern equipment for smallholder farmers impedes their capacity for expansion and technology adoption. Furthermore, infrastructural deficiencies in rural areas hinder efficient produce transportation, resulting in post-harvest losses and reduced profitability. Strategic policy interventions, public-private collaborations, and farmer training programs are essential to overcome these challenges and realize the sector's full potential for sustained and inclusive growth. Key focus areas include cereals, fruits, vegetables, and cash crops, with engagement from major industry players to foster a resilient agricultural landscape.

Agriculture in Cameroon Company Market Share

Agriculture in Cameroon: Market Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Agriculture in Cameroon market, offering an in-depth analysis of its structure, competitive landscape, evolving trends, and significant opportunities. Covering the study period of 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report leverages high-volume keywords such as "Cameroon agriculture," "African agribusiness," "crop production Cameroon," "food security Cameroon," and "agricultural investment Cameroon" to provide unparalleled insights. For industry stakeholders, investors, and policymakers, this report is an indispensable resource for understanding the present and future trajectory of Cameroon's vital agricultural sector.

Agriculture in Cameroon Market Structure & Competitive Landscape

The Agriculture in Cameroon market exhibits a moderately concentrated structure, influenced by a blend of large-scale agricultural corporations and a substantial number of smallholder farmers. Key industry players like Syngenta and Bayer CropScience are instrumental in driving innovation through advanced crop protection solutions and high-yield seeds. The Cameroon Development Corporation (CDC), a state-owned enterprise, holds significant sway in certain segments, particularly in large-scale plantation agriculture. Société Camerounaise de Transformation de Métaux (SCTM), while seemingly tangential, can influence agricultural inputs or processing. Limagrain contributes to the seed market with its focus on research and development. Innovation drivers include the increasing adoption of modern farming techniques, the development of climate-resilient crop varieties, and advancements in irrigation technologies. Regulatory impacts are significant, with government policies aimed at enhancing food security and promoting agribusiness playing a crucial role. Product substitutes are abundant, ranging from traditional farming methods to imported agricultural goods, necessitating a focus on competitive pricing and superior quality. End-user segmentation spans diverse demographics, from subsistence farmers to large food processing companies. Mergers and acquisitions (M&A) trends are still nascent but are expected to grow as larger players seek to expand their footprint and consolidate market share. Over the historical period (2019-2024), M&A volumes have been minimal, estimated at less than 10 transactions annually, primarily involving smaller, local entities. Concentration ratios in key segments like cereal production hover around 30-40%, indicating room for further consolidation.

Agriculture in Cameroon Market Trends & Opportunities

The Agriculture in Cameroon market is poised for significant growth, driven by a confluence of demographic shifts, increasing demand for food, and strategic government initiatives. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated value of USD 15 Billion by the end of the forecast period. Technological shifts are rapidly transforming agricultural practices, with a growing adoption of precision farming, digital agricultural tools, and improved mechanization. Consumer preferences are evolving, with a rising demand for higher quality, diversified produce, and sustainably sourced food products. This presents a significant opportunity for farmers and agribusinesses that can adapt to these changing tastes. Competitive dynamics are intensifying, pushing for greater efficiency, product differentiation, and value-added processing. The market penetration rate for modern agricultural inputs is steadily increasing, estimated at around 40% for improved seeds and 35% for crop protection chemicals within the historical period, indicating substantial untapped potential. Opportunities abound in areas such as:

- Horticulture: Expanding production of fruits and vegetables for both domestic consumption and export markets, capitalizing on favorable climatic conditions.

- Agro-processing: Developing value-added products from raw agricultural commodities, increasing shelf life, and creating new market opportunities.

- Aquaculture and Livestock: Diversifying agricultural activities beyond traditional crop farming to meet the growing demand for protein.

- Sustainable Agriculture: Implementing eco-friendly farming practices that enhance soil health, conserve water, and reduce environmental impact, aligning with global sustainability trends.

- Digital Agriculture: Leveraging mobile technology and data analytics for crop monitoring, market information dissemination, and improved farm management.

The burgeoning urban population and a growing middle class are key drivers of increased demand for diverse and high-quality agricultural produce. Furthermore, government policies aimed at boosting agricultural productivity and export competitiveness are creating a more conducive environment for investment and growth.

Dominant Markets & Segments in Agriculture in Cameroon

Within the Agriculture in Cameroon market, several segments are demonstrating robust growth and holding dominant positions. The Cash Crops segment, encompassing commodities like cocoa, coffee, cotton, and rubber, consistently emerges as a major contributor to the national economy and export revenue. Its dominance is underscored by established export markets and ongoing efforts to improve production quality and yields.

- Cash Crops:

- Key Growth Drivers: Favorable international commodity prices, government support for export-oriented crops, and the presence of established international buyers. Cameroon's cocoa and coffee are renowned for their quality, driving sustained demand.

- Market Dominance: This segment is estimated to account for over 40% of the total agricultural output value and contributes a significant portion of foreign exchange earnings. Historical data from 2019-2024 shows consistent growth averaging 7% annually.

The Fruits segment is rapidly gaining prominence, driven by increased domestic consumption and growing export potential. Varieties like bananas, plantains, mangoes, and pineapples are seeing expanded cultivation and improved access to processing and distribution channels.

- Fruits:

- Key Growth Drivers: Rising domestic demand, increased investment in modern fruit cultivation techniques, and opportunities for export to regional and international markets. The development of cold chain logistics is crucial for expanding this segment.

- Market Dominance: This segment is projected to experience a CAGR of 8% during the forecast period, driven by diversification efforts and market access improvements. Its market share is estimated to grow from 20% to 25% by 2033.

The Vegetables segment is also witnessing expansion, fueled by urbanization and a growing awareness of dietary health. Local production is increasingly meeting a larger proportion of domestic demand, reducing reliance on imports.

- Vegetables:

- Key Growth Drivers: Urbanization, changing dietary habits, and the adoption of intensive farming practices in peri-urban areas. Government initiatives promoting local food production are also vital.

- Market Dominance: This segment is expected to grow at a steady pace of 6% CAGR, with its market share holding firm at around 15-18%.

The Cereals segment, while foundational for food security, is undergoing a transformation with a focus on increasing yields and reducing post-harvest losses. Maize, rice, and millet are critical staples, with ongoing efforts to boost domestic production to meet rising consumption.

- Cereals:

- Key Growth Drivers: Government programs aimed at enhancing food security, investments in irrigation and improved seed varieties, and the growing demand from a large population.

- Market Dominance: This segment remains a cornerstone of the agricultural sector, with its share estimated around 20-22%, experiencing a CAGR of 5.5%.

Agriculture in Cameroon Product Analysis

Cameroon's agricultural product landscape is characterized by a diversification of offerings and continuous innovation. In the Cash Crops segment, advancements in cocoa and coffee processing are yielding premium products with enhanced flavors and market appeal. For Fruits, improved post-harvest management techniques and the introduction of disease-resistant varieties are key. In Vegetables, the development of hybrid seeds and organic cultivation methods are enhancing both yield and quality. The Cereals sector is witnessing the introduction of high-yielding rice and maize varieties tailored to local conditions. Competitive advantages are increasingly derived from sustainable farming practices, adherence to international quality standards, and the development of value-added processed goods, such as fruit purees, vegetable powders, and fortified cereal products, catering to evolving consumer demands and export market requirements.

Key Drivers, Barriers & Challenges in Agriculture in Cameroon

Key Drivers, Barriers & Challenges in Agriculture in Cameroon

Key Drivers: The Agriculture in Cameroon market is propelled by several critical drivers. Technological advancements, including the adoption of climate-resilient seeds and improved irrigation systems, are enhancing productivity. Economic factors such as increasing domestic and regional demand for food, coupled with a growing middle class, stimulate market growth. Government policies aimed at boosting agricultural output, promoting agribusiness, and securing food security, such as the establishment of agricultural development funds, are instrumental. For instance, the USD 200 million loan from the World Bank for irrigation infrastructure is a significant catalyst.

Key Barriers & Challenges: Despite the promising outlook, significant challenges restrain the growth of the Agriculture in Cameroon market. Supply chain inefficiencies, including poor road networks and inadequate cold storage facilities, lead to substantial post-harvest losses, estimated at 20-30% for perishable goods. Regulatory hurdles and complex land tenure systems can impede investment and expansion. Competitive pressures from imported agricultural products, often subsidized in their countries of origin, create an uneven playing field. Access to finance remains a critical barrier for smallholder farmers, with only an estimated 15% of agricultural enterprises having formal access to credit. Climate change impacts, including unpredictable weather patterns and increased pest infestations, pose persistent threats to crop yields.

Growth Drivers in the Agriculture in Cameroon Market

The Agriculture in Cameroon market is experiencing robust growth driven by several interconnected factors. Technological adoption, particularly in irrigation and improved seed varieties, is significantly boosting crop yields and resilience. Economic growth and demographic shifts, characterized by a rising urban population and an expanding middle class, are fueling an increased demand for diverse and high-quality food products. Government initiatives, such as the establishment of the Agricultural Sector Development Fund through an agreement between the Ministry of Agriculture and Rural Development and the Commercial Bank of Cameroon, are crucial for providing medium-term financing to agricultural enterprises, thereby enhancing their capacity and competitiveness. Furthermore, international development partnerships, like the USD 200 million World Bank loan for irrigation infrastructure, are critical enablers of large-scale development projects.

Challenges Impacting Agriculture in Cameroon Growth

Several barriers and restraints are impacting the growth trajectory of the Agriculture in Cameroon market. Infrastructural deficits, including poor rural road networks and limited cold chain facilities, contribute to substantial post-harvest losses, estimated to affect up to 30% of certain crop yields. Regulatory complexities and bureaucratic inefficiencies can hinder investment and the smooth operation of agricultural businesses. Limited access to affordable finance remains a persistent challenge for smallholder farmers, restricting their ability to adopt modern technologies and expand their operations. Climate change impacts, such as erratic rainfall patterns and increased pest and disease outbreaks, pose significant risks to agricultural productivity and stability. Intense competition from imported agricultural products, often at lower price points, also challenges the competitiveness of local produce.

Key Players Shaping the Agriculture in Cameroon Market

- Syngenta

- Bayer CropScience

- Cameroon Development Corporation (CDC)

- Société Camerounaise de Transformation de Métaux (SCTM)

- Limagrain

Significant Agriculture in Cameroon Industry Milestones

- November 2022: The International Development Association of the World Bank agreed on a USD 200 million loan to support the development of irrigation infrastructure, aiming to enhance regional water security and governance, promote agriculture and agribusiness production, and support a new rice cultivation plan. This milestone signifies a major investment in climate-resilient agriculture and food production.

- September 2022: Cameroon's Minister of Agriculture and Rural Development and the General Manager of the Commercial Bank of Cameroon signed an agreement for the establishment of an Agricultural Sector Development Fund. This fund, part of the Agricultural Value Chain Development Project, aims to provide medium-term resources to microfinance institutions, facilitating flexible loans for agricultural enterprises. This development is crucial for improving access to finance for businesses within the agricultural value chain.

Future Outlook for Agriculture in Cameroon Market

The future outlook for the Agriculture in Cameroon market is characterized by sustained growth and increasing diversification. Strategic opportunities lie in leveraging advancements in agricultural technology, expanding value-added processing capabilities, and enhancing export market access for high-value commodities. The ongoing investments in irrigation infrastructure and the establishment of dedicated agricultural development funds are expected to significantly bolster productivity and competitiveness. As Cameroon continues to focus on food security and agribusiness development, the market is poised to attract further domestic and international investment, driving innovation and creating employment opportunities. The shift towards sustainable agricultural practices will also be a key determinant of long-term success, aligning with global environmental and market demands.

Agriculture in Cameroon Segmentation

- 1. Cereals

- 2. Fruits

- 3. Vegetables

- 4. Cash Crops

- 5. Cereals

- 6. Fruits

- 7. Vegetables

- 8. Cash Crops

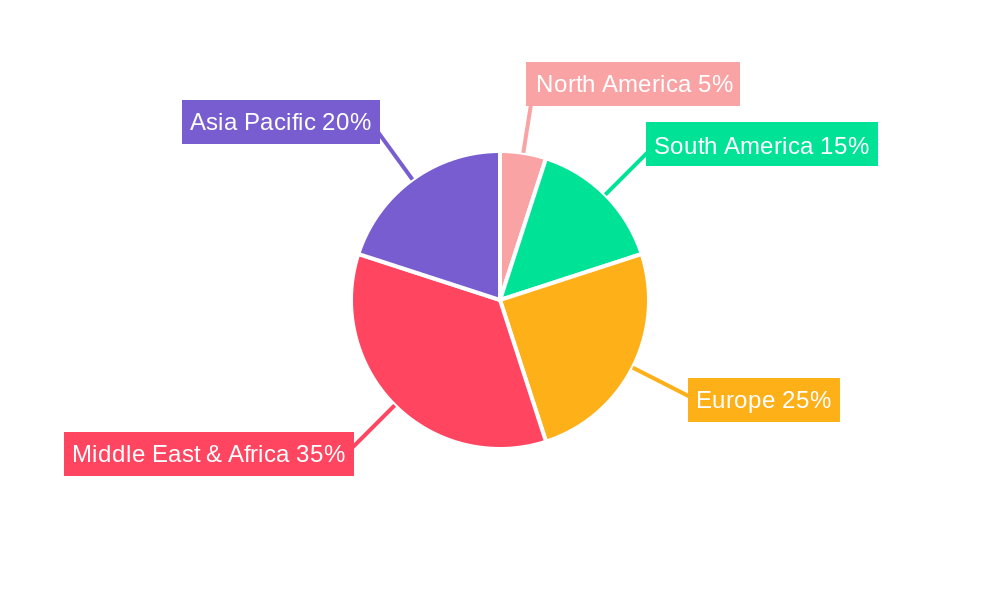

Agriculture in Cameroon Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agriculture in Cameroon Regional Market Share

Geographic Coverage of Agriculture in Cameroon

Agriculture in Cameroon REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Growing Consumer Preference for Locally Produced Fruits and Vegetables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture in Cameroon Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cereals

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Cash Crops

- 5.5. Market Analysis, Insights and Forecast - by Cereals

- 5.6. Market Analysis, Insights and Forecast - by Fruits

- 5.7. Market Analysis, Insights and Forecast - by Vegetables

- 5.8. Market Analysis, Insights and Forecast - by Cash Crops

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. North America

- 5.9.2. South America

- 5.9.3. Europe

- 5.9.4. Middle East & Africa

- 5.9.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Cereals

- 6. North America Agriculture in Cameroon Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Cereals

- 6.2. Market Analysis, Insights and Forecast - by Fruits

- 6.3. Market Analysis, Insights and Forecast - by Vegetables

- 6.4. Market Analysis, Insights and Forecast - by Cash Crops

- 6.5. Market Analysis, Insights and Forecast - by Cereals

- 6.6. Market Analysis, Insights and Forecast - by Fruits

- 6.7. Market Analysis, Insights and Forecast - by Vegetables

- 6.8. Market Analysis, Insights and Forecast - by Cash Crops

- 6.1. Market Analysis, Insights and Forecast - by Cereals

- 7. South America Agriculture in Cameroon Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Cereals

- 7.2. Market Analysis, Insights and Forecast - by Fruits

- 7.3. Market Analysis, Insights and Forecast - by Vegetables

- 7.4. Market Analysis, Insights and Forecast - by Cash Crops

- 7.5. Market Analysis, Insights and Forecast - by Cereals

- 7.6. Market Analysis, Insights and Forecast - by Fruits

- 7.7. Market Analysis, Insights and Forecast - by Vegetables

- 7.8. Market Analysis, Insights and Forecast - by Cash Crops

- 7.1. Market Analysis, Insights and Forecast - by Cereals

- 8. Europe Agriculture in Cameroon Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Cereals

- 8.2. Market Analysis, Insights and Forecast - by Fruits

- 8.3. Market Analysis, Insights and Forecast - by Vegetables

- 8.4. Market Analysis, Insights and Forecast - by Cash Crops

- 8.5. Market Analysis, Insights and Forecast - by Cereals

- 8.6. Market Analysis, Insights and Forecast - by Fruits

- 8.7. Market Analysis, Insights and Forecast - by Vegetables

- 8.8. Market Analysis, Insights and Forecast - by Cash Crops

- 8.1. Market Analysis, Insights and Forecast - by Cereals

- 9. Middle East & Africa Agriculture in Cameroon Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Cereals

- 9.2. Market Analysis, Insights and Forecast - by Fruits

- 9.3. Market Analysis, Insights and Forecast - by Vegetables

- 9.4. Market Analysis, Insights and Forecast - by Cash Crops

- 9.5. Market Analysis, Insights and Forecast - by Cereals

- 9.6. Market Analysis, Insights and Forecast - by Fruits

- 9.7. Market Analysis, Insights and Forecast - by Vegetables

- 9.8. Market Analysis, Insights and Forecast - by Cash Crops

- 9.1. Market Analysis, Insights and Forecast - by Cereals

- 10. Asia Pacific Agriculture in Cameroon Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Cereals

- 10.2. Market Analysis, Insights and Forecast - by Fruits

- 10.3. Market Analysis, Insights and Forecast - by Vegetables

- 10.4. Market Analysis, Insights and Forecast - by Cash Crops

- 10.5. Market Analysis, Insights and Forecast - by Cereals

- 10.6. Market Analysis, Insights and Forecast - by Fruits

- 10.7. Market Analysis, Insights and Forecast - by Vegetables

- 10.8. Market Analysis, Insights and Forecast - by Cash Crops

- 10.1. Market Analysis, Insights and Forecast - by Cereals

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Syngenta

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer CropScience

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cameroon Development Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Société Camerounaise de Transformation de Métaux

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Limagrain

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Syngenta

List of Figures

- Figure 1: Global Agriculture in Cameroon Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 3: North America Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 4: North America Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 5: North America Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 6: North America Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 7: North America Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 8: North America Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 9: North America Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 10: North America Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 11: North America Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 12: North America Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 13: North America Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 14: North America Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 15: North America Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 16: North America Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 17: North America Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 18: North America Agriculture in Cameroon Revenue (million), by Country 2025 & 2033

- Figure 19: North America Agriculture in Cameroon Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 21: South America Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 22: South America Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 23: South America Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 24: South America Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 25: South America Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 26: South America Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 27: South America Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 28: South America Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 29: South America Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 30: South America Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 31: South America Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 32: South America Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 33: South America Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 34: South America Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 35: South America Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 36: South America Agriculture in Cameroon Revenue (million), by Country 2025 & 2033

- Figure 37: South America Agriculture in Cameroon Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 39: Europe Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 40: Europe Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 41: Europe Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 42: Europe Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 43: Europe Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 44: Europe Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 45: Europe Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 46: Europe Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 47: Europe Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 48: Europe Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 49: Europe Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 50: Europe Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 51: Europe Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 52: Europe Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 53: Europe Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 54: Europe Agriculture in Cameroon Revenue (million), by Country 2025 & 2033

- Figure 55: Europe Agriculture in Cameroon Revenue Share (%), by Country 2025 & 2033

- Figure 56: Middle East & Africa Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 57: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 58: Middle East & Africa Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 59: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 60: Middle East & Africa Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 61: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 62: Middle East & Africa Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 63: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 64: Middle East & Africa Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 65: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 66: Middle East & Africa Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 67: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 68: Middle East & Africa Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 69: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 70: Middle East & Africa Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 71: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 72: Middle East & Africa Agriculture in Cameroon Revenue (million), by Country 2025 & 2033

- Figure 73: Middle East & Africa Agriculture in Cameroon Revenue Share (%), by Country 2025 & 2033

- Figure 74: Asia Pacific Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 75: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 76: Asia Pacific Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 77: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 78: Asia Pacific Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 79: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 80: Asia Pacific Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 81: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 82: Asia Pacific Agriculture in Cameroon Revenue (million), by Cereals 2025 & 2033

- Figure 83: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Cereals 2025 & 2033

- Figure 84: Asia Pacific Agriculture in Cameroon Revenue (million), by Fruits 2025 & 2033

- Figure 85: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Fruits 2025 & 2033

- Figure 86: Asia Pacific Agriculture in Cameroon Revenue (million), by Vegetables 2025 & 2033

- Figure 87: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Vegetables 2025 & 2033

- Figure 88: Asia Pacific Agriculture in Cameroon Revenue (million), by Cash Crops 2025 & 2033

- Figure 89: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Cash Crops 2025 & 2033

- Figure 90: Asia Pacific Agriculture in Cameroon Revenue (million), by Country 2025 & 2033

- Figure 91: Asia Pacific Agriculture in Cameroon Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 2: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 3: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 4: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 5: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 6: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 7: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 8: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 9: Global Agriculture in Cameroon Revenue million Forecast, by Region 2020 & 2033

- Table 10: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 11: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 12: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 13: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 14: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 15: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 16: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 17: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 18: Global Agriculture in Cameroon Revenue million Forecast, by Country 2020 & 2033

- Table 19: United States Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Canada Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 23: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 24: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 25: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 26: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 27: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 28: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 29: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 30: Global Agriculture in Cameroon Revenue million Forecast, by Country 2020 & 2033

- Table 31: Brazil Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 35: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 36: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 37: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 38: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 39: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 40: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 41: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 42: Global Agriculture in Cameroon Revenue million Forecast, by Country 2020 & 2033

- Table 43: United Kingdom Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Germany Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: France Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Italy Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: Spain Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Russia Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: Benelux Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Nordics Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 53: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 54: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 55: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 56: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 57: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 58: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 59: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 60: Global Agriculture in Cameroon Revenue million Forecast, by Country 2020 & 2033

- Table 61: Turkey Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Israel Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 63: GCC Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: North Africa Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 65: South Africa Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East & Africa Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 67: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 68: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 69: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 70: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 71: Global Agriculture in Cameroon Revenue million Forecast, by Cereals 2020 & 2033

- Table 72: Global Agriculture in Cameroon Revenue million Forecast, by Fruits 2020 & 2033

- Table 73: Global Agriculture in Cameroon Revenue million Forecast, by Vegetables 2020 & 2033

- Table 74: Global Agriculture in Cameroon Revenue million Forecast, by Cash Crops 2020 & 2033

- Table 75: Global Agriculture in Cameroon Revenue million Forecast, by Country 2020 & 2033

- Table 76: China Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 77: India Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Japan Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 79: South Korea Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 80: ASEAN Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 81: Oceania Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Asia Pacific Agriculture in Cameroon Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture in Cameroon?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Agriculture in Cameroon?

Key companies in the market include Syngenta , Bayer CropScience , Cameroon Development Corporation, Société Camerounaise de Transformation de Métaux, Limagrain .

3. What are the main segments of the Agriculture in Cameroon?

The market segments include Cereals, Fruits, Vegetables, Cash Crops, Cereals, Fruits, Vegetables, Cash Crops.

4. Can you provide details about the market size?

The market size is estimated to be USD 491577 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Growing Consumer Preference for Locally Produced Fruits and Vegetables.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

November 2022: The International Development Association of the World Bank agreed on a USD 200 million loan to support the development of irrigation infrastructure which aims to support regional water security and governance of water resources, also promote agriculture and agribusiness production, and support the implementation of a new rice cultivation plan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture in Cameroon," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture in Cameroon report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture in Cameroon?

To stay informed about further developments, trends, and reports in the Agriculture in Cameroon, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence