Key Insights

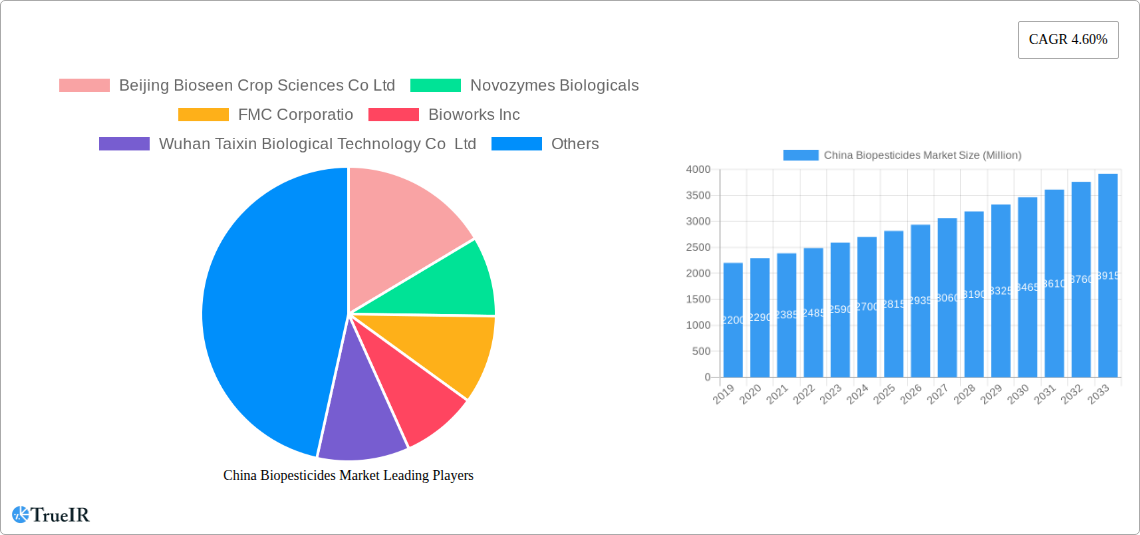

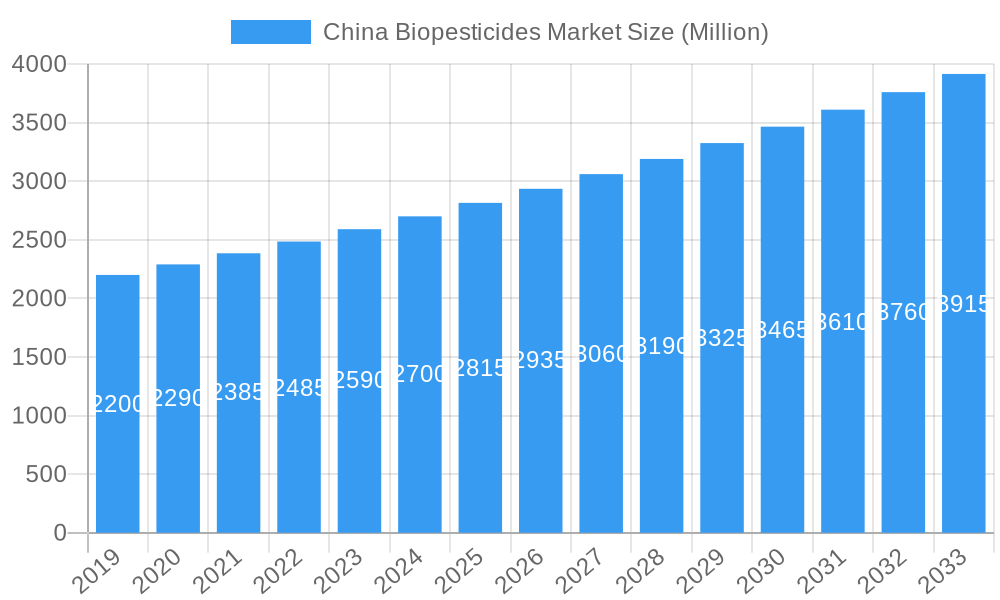

The China biopesticides market is poised for robust growth, driven by increasing agricultural sustainability initiatives, rising consumer demand for organic produce, and stringent government regulations on synthetic pesticide usage. With a current market size of approximately USD 2,500 million (estimated based on CAGR and typical market penetration), the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.60% between 2019 and 2033, reaching a projected value of over USD 4,000 million by 2033. Key drivers include the widespread adoption of integrated pest management (IPM) strategies, the development of innovative microbial and biochemical pest control solutions, and a growing awareness among farmers about the long-term benefits of biopesticides for soil health and environmental protection. Furthermore, the Chinese government's commitment to reducing chemical residues in food production through policies like the "Zero Growth" initiative for chemical fertilizers and pesticides further bolsters the demand for eco-friendly alternatives. This proactive approach by both governmental bodies and the agricultural sector is creating a fertile ground for the biopesticides market to flourish, presenting significant opportunities for both domestic and international players.

China Biopesticides Market Market Size (In Billion)

The market's trajectory is further shaped by distinct trends and challenges. Emerging trends include a greater focus on precision agriculture, where biopesticides are applied more strategically, and the development of novel formulations that enhance efficacy and shelf-life. The segmentation of the market, encompassing production, consumption, import/export, and price trends, highlights the dynamic nature of this industry. Production analysis reveals a growing capacity for biopesticide manufacturing within China, supported by technological advancements and increased investment. Consumption analysis points towards a steady rise in the adoption of biopesticides across various crops, from fruits and vegetables to grains. While imports are significant, particularly for specialized formulations, China is also emerging as a key exporter of biopesticides. However, restraints such as the higher initial cost compared to conventional pesticides, limited farmer awareness in certain regions, and the need for more standardized regulatory frameworks can temper growth. Despite these challenges, the overall outlook remains overwhelmingly positive, with companies like Bayer CropScience AG, BASF SE, Novozymes Biologicals, and FMC Corporation actively participating and innovating within this expanding market.

China Biopesticides Market Company Market Share

China Biopesticides Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the China Biopesticides Market, offering critical insights for stakeholders navigating this rapidly evolving sector. Leveraging high-volume keywords such as "China biopesticides market," "biological pesticides China," "sustainable agriculture China," and "biocontrol solutions," this report is designed to enhance search rankings and engage industry professionals. The study period spans from 2019 to 2033, with a base year of 2025, an estimated year of 2025, and a forecast period from 2025 to 2033, encompassing the historical period of 2019-2024.

China Biopesticides Market Market Structure & Competitive Landscape

The China Biopesticides Market is characterized by a moderate to high degree of market concentration, with key players actively investing in innovation and strategic collaborations to gain market share. Regulatory frameworks, while evolving, play a significant role in shaping market entry and product approvals, with stringent requirements for efficacy and safety. The increasing awareness of environmental sustainability and the demand for organic produce act as powerful innovation drivers, pushing companies to develop novel biological solutions. Product substitutes, primarily conventional chemical pesticides, continue to pose a competitive challenge, although the long-term trend favors biopesticides due to increasing environmental concerns and government policies promoting green agriculture. End-user segmentation is diverse, encompassing large-scale commercial farms, organic farming operations, and home gardening sectors, each with distinct purchasing behaviors and product preferences. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, acquire technological expertise, and consolidate their market presence. For instance, significant M&A activities in the historical period (2019-2024) indicate a trend towards consolidation, with an estimated XX billion USD in M&A transactions.

China Biopesticides Market Market Trends & Opportunities

The China Biopesticides Market is poised for robust growth, driven by a confluence of factors including increasing governmental support for sustainable agriculture, a rising demand for food safety, and growing farmer awareness regarding the benefits of biological pest control. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated XX billion USD by 2033. Technological shifts are a significant trend, with advancements in microbial fermentation, genetic engineering, and formulation technologies enabling the development of more potent and stable biopesticide products. Consumer preferences are increasingly leaning towards organically grown and residue-free food, thereby creating a strong pull for biopesticides in the agricultural supply chain. Competitive dynamics are intensifying as both domestic and international players vie for dominance. Opportunities lie in the development of integrated pest management (IPM) solutions that combine biopesticides with other sustainable practices, catering to the evolving needs of modern agriculture. The market penetration rate for biopesticides, currently estimated at XX% in 2025, is expected to climb significantly as these products become more accessible and cost-effective. Furthermore, the untapped potential in specific crop segments and geographic regions presents substantial growth avenues. Investment in research and development for novel bio-insecticides, bio-fungicides, and bio-herbicides is crucial for sustained market leadership.

Dominant Markets & Segments in China Biopesticides Market

In terms of Production Analysis, the eastern and southern regions of China, characterized by intensive agricultural practices and a higher concentration of chemical pesticide production infrastructure, are currently dominant. However, significant investment in R&D and production facilities is being observed in other regions as the government promotes a balanced development of the biopesticides industry. Key growth drivers include the availability of raw materials for microbial fermentation and government incentives for establishing bio-based manufacturing units.

For Consumption Analysis, the key growth drivers are the large agricultural output and the increasing adoption of biopesticides by large-scale commercial farms and government-supported agricultural projects. The market dominance in consumption is observed in provinces with high demand for fruits, vegetables, and staple crops where pest and disease pressures are most significant.

The Import Market Analysis (Value & Volume) reveals a growing reliance on specialized biopesticide formulations and active ingredients not yet extensively produced domestically. Key growth drivers for imports include technological gaps and the demand for highly effective, patented biological control agents. Value is driven by the premium pricing of advanced formulations, while volume is influenced by the scale of agricultural operations requiring these inputs.

The Export Market Analysis (Value & Volume) is gradually expanding as Chinese biopesticide manufacturers improve their product quality and gain international certifications. Growth drivers include competitive pricing and the increasing global demand for sustainable agricultural inputs. Value is influenced by the adoption of higher-margin products, while volume is linked to the establishment of distribution networks in key international agricultural markets.

Price Trend Analysis indicates a gradual convergence between the prices of high-quality biopesticides and conventional chemical pesticides, driven by economies of scale in production and increased competition. However, specialized and highly effective biopesticide formulations often command a premium price.

China Biopesticides Market Product Analysis

Product innovation in the China Biopesticides Market is largely centered on enhancing the efficacy, shelf-life, and ease of application of microbial and botanical pesticides. Key product categories include bio-insecticides, bio-fungicides, and bio-nematicides, each tailored to specific pest and disease challenges in major crops like rice, vegetables, and fruits. Competitive advantages are being built on developing formulations that offer broader spectrum activity, improved resistance management, and better compatibility with integrated pest management programs. Technological advancements in strain selection, fermentation processes, and delivery systems are crucial differentiators, leading to products with improved biological activity and longer persistence in the field, thereby ensuring better crop protection.

Key Drivers, Barriers & Challenges in China Biopesticides Market

The China Biopesticides Market is propelled by significant growth drivers including robust government support through favorable policies and subsidies promoting sustainable agriculture, a growing consumer demand for safe and organic food products, and continuous technological advancements in biopesticide development. The increasing awareness among farmers regarding the environmental and health benefits of biopesticides, coupled with the rising pest resistance to conventional chemicals, further fuels market expansion.

However, the market faces several barriers and challenges. These include the relatively high initial cost of some biopesticides compared to conventional alternatives, limited farmer awareness and understanding of optimal application techniques, and the inherent variability in efficacy influenced by environmental conditions. Supply chain issues, including the cold chain requirements for certain microbial products and inconsistent distribution networks, can also pose significant restraints. Furthermore, stringent and sometimes lengthy regulatory approval processes for new biopesticide products can impede market entry and innovation. Competitive pressures from established chemical pesticide manufacturers, who often have extensive distribution channels and brand recognition, also present a challenge.

Growth Drivers in the China Biopesticides Market Market

Key drivers propelling the China Biopesticides Market are multifaceted. Technologically, advancements in microbial strain discovery, fermentation optimization, and formulation science are leading to more potent and stable biopesticide products. Economically, increasing disposable incomes and a growing middle class are fueling demand for safer, residue-free food, thereby creating a pull for biopesticides. Regulatory support from the Chinese government, including subsidies for research and development and preferential policies for the registration and use of biopesticides, is a critical catalyst. The rising incidence of pest resistance to conventional chemical pesticides also necessitates the adoption of alternative solutions like biopesticides.

Challenges Impacting China Biopesticides Market Growth

Several challenges impact the growth of the China Biopesticides Market. Regulatory complexities, although improving, can still lead to extended product registration timelines. Supply chain issues, such as the need for specialized storage and transportation for certain biological agents, and the establishment of effective distribution networks in remote agricultural areas, present significant hurdles. Competitive pressures from established chemical pesticide manufacturers, who often possess broader market reach and greater financial resources, also pose a restraint. Furthermore, inconsistent farmer education and extension services regarding the proper application and benefits of biopesticides can lead to underutilization or suboptimal performance, impacting market perception.

Key Players Shaping the China Biopesticides Market Market

- Beijing Bioseen Crop Sciences Co Ltd

- Novozymes Biologicals

- FMC Corporation

- Bioworks Inc

- Wuhan Taixin Biological Technology Co Ltd

- Zhejiang Qianjiang Biochemical Co Ltd

- Bayer CropScience AG

- Koppert Biological Systems

- BASF SE

Significant China Biopesticides Market Industry Milestones

- 2019: Increased government focus on reducing pesticide use and promoting green agriculture, leading to policy shifts favoring biopesticides.

- 2020: Launch of several new microbial biopesticide formulations by leading domestic players, demonstrating enhanced efficacy.

- 2021: Significant increase in R&D investments by multinational corporations in China's biopesticides sector.

- 2022: Introduction of updated regulatory guidelines for biopesticide registration, aiming to streamline the approval process.

- 2023: Growing number of collaborations between research institutions and biopesticide companies to develop novel biological control agents.

- 2024: Anticipated acceleration in market adoption due to rising consumer demand for organic produce and increasing awareness of food safety.

Future Outlook for China Biopesticides Market Market

The future outlook for the China Biopesticides Market is exceptionally promising, driven by sustained governmental commitment to environmental protection and food safety, coupled with advancements in biotechnology. Strategic opportunities lie in the development of highly specific and efficient biopesticides for a wider range of crops and pest complexes, as well as the integration of biopesticides into comprehensive digital farming solutions. The market potential will be further unlocked through increased farmer education, improved distribution networks, and the continued investment in R&D, positioning China as a global leader in sustainable pest management.

China Biopesticides Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

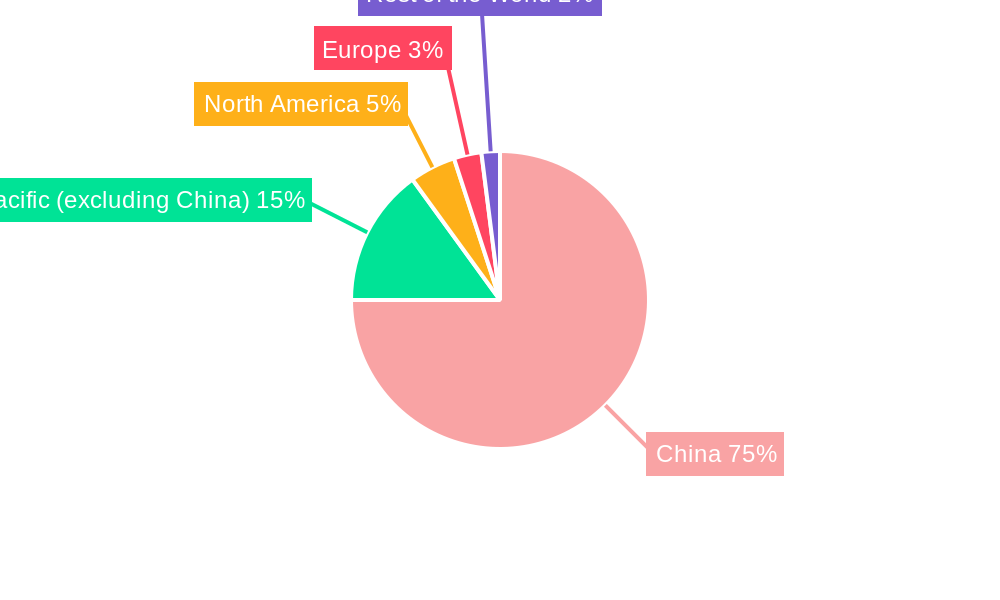

China Biopesticides Market Segmentation By Geography

- 1. China

China Biopesticides Market Regional Market Share

Geographic Coverage of China Biopesticides Market

China Biopesticides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Increased Demand for Organically Grown Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Biopesticides Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beijing Bioseen Crop Sciences Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Novozymes Biologicals

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FMC Corporatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bioworks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wuhan Taixin Biological Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zhejiang Qianjiang Biochemical Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bayer CropScience AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Koppert Biological Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BASF SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Beijing Bioseen Crop Sciences Co Ltd

List of Figures

- Figure 1: China Biopesticides Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Biopesticides Market Share (%) by Company 2025

List of Tables

- Table 1: China Biopesticides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: China Biopesticides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Biopesticides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Biopesticides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Biopesticides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Biopesticides Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: China Biopesticides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: China Biopesticides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Biopesticides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Biopesticides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Biopesticides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Biopesticides Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Biopesticides Market?

The projected CAGR is approximately 16.72%.

2. Which companies are prominent players in the China Biopesticides Market?

Key companies in the market include Beijing Bioseen Crop Sciences Co Ltd, Novozymes Biologicals, FMC Corporatio, Bioworks Inc, Wuhan Taixin Biological Technology Co Ltd, Zhejiang Qianjiang Biochemical Co Ltd, Bayer CropScience AG, Koppert Biological Systems, BASF SE.

3. What are the main segments of the China Biopesticides Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Increased Demand for Organically Grown Products.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Biopesticides Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Biopesticides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Biopesticides Market?

To stay informed about further developments, trends, and reports in the China Biopesticides Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence