Key Insights

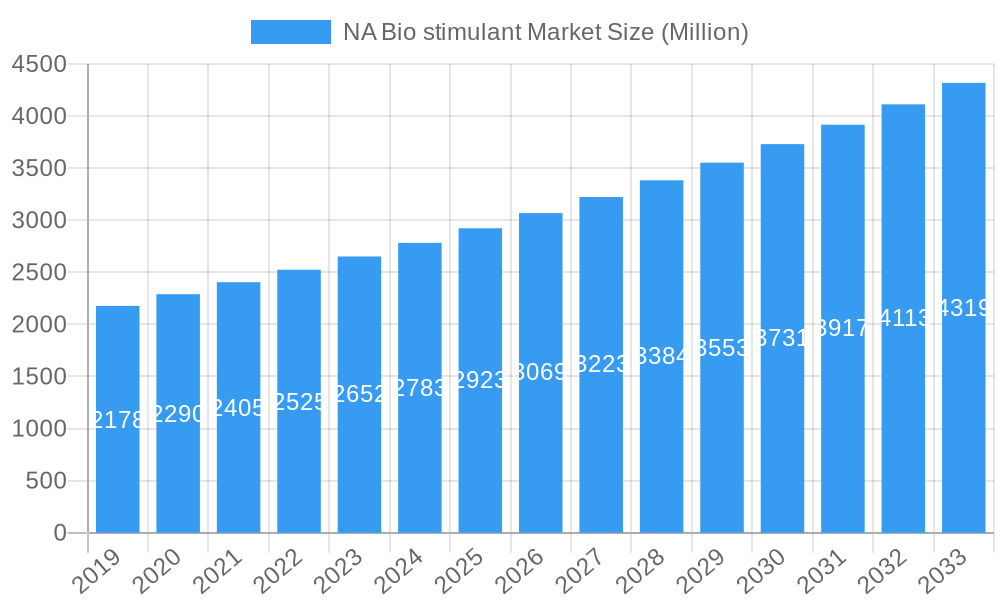

The North American (NA) biostimulant market is poised for robust expansion, estimated to reach approximately USD 2,800 million in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.00% through 2033. This sustained growth is fueled by an increasing demand for sustainable agricultural practices, heightened consumer awareness regarding food quality and safety, and the urgent need to enhance crop yields and resilience amidst climate change challenges. The market is experiencing a significant shift towards biological solutions that improve nutrient uptake, stress tolerance, and overall plant health, thereby reducing reliance on synthetic fertilizers and pesticides. Key drivers include government initiatives promoting eco-friendly farming, advancements in biostimulant formulation, and a growing understanding among farmers of the economic and environmental benefits these products offer.

NA Bio stimulant Market Market Size (In Billion)

The NA biostimulant market exhibits a dynamic segmentation, with Amino Acids and Fulvic Acid emerging as prominent product forms due to their proven efficacy in promoting plant growth and nutrient utilization. Protein Hydrolysates and Seaweed Extracts also hold substantial market share, offering a rich source of bioactive compounds. In terms of crop types, Cash Crops and Horticultural Crops are leading the adoption of biostimulants, driven by their high economic value and the intensive farming practices employed. Row Crops are also showing increasing interest as farmers seek to optimize yields and improve soil health. Key players like Plant Response Biotech Inc., Koppert Biological Systems Inc., and Valagro US are at the forefront of innovation, investing heavily in research and development to introduce novel biostimulant solutions and expand their market reach across North America. The region's advanced agricultural infrastructure and supportive regulatory environment further bolster market growth.

NA Bio stimulant Market Company Market Share

Here is a dynamic, SEO-optimized report description for the NA Bio stimulant Market:

North America Bio stimulant Market: Growth, Trends, and Opportunities (2025-2033) - Comprehensive Industry Analysis & Forecast

Dive deep into the thriving North American Bio stimulant Market with this in-depth report. Discover critical insights into market dynamics, competitive strategies, and future trajectories, leveraging extensive data and expert analysis. This report is essential for stakeholders seeking to capitalize on the burgeoning demand for sustainable agriculture solutions. The North America bio stimulant market is projected to reach $10,500 Million by 2025, with a projected CAGR of 12.8% from 2025 to 2033.

NA Bio stimulant Market Market Structure & Competitive Landscape

The North American bio stimulant market is characterized by a moderate to high level of concentration, with a few key players dominating significant market share. Innovation is a primary driver, fueled by a growing demand for sustainable agricultural practices and increased crop yields. Regulatory frameworks, while evolving, are increasingly supportive of biological solutions, encouraging further research and development. Product substitutes, primarily conventional fertilizers and pesticides, are facing increasing scrutiny due to environmental concerns. End-user segmentation reveals a strong preference for cash crops and horticultural crops, driven by their higher market value and sensitivity to yield optimization. Mergers and acquisitions (M&A) are a significant trend, with recent acquisitions indicating a consolidation of the market and an expansion of product portfolios by major companies. For instance, The Mosaic Company's acquisition of Plant Response Biotech Inc. in February 2022 signifies a move by larger agricultural input providers to integrate biological solutions. The volume of M&A activity is estimated to have been over $750 Million in the historical period.

- Market Concentration: Dominated by key players with strong R&D capabilities.

- Innovation Drivers: Sustainable agriculture mandates, yield enhancement needs, and increasing environmental awareness.

- Regulatory Impacts: Favorable policies promoting bio-based inputs are emerging.

- Product Substitutes: Conventional fertilizers and pesticides.

- End-User Segmentation: Strong demand from Cash Crops and Horticultural Crops.

- M&A Trends: Strategic acquisitions to expand product portfolios and market reach.

NA Bio stimulant Market Market Trends & Opportunities

The North America bio stimulant market is experiencing robust expansion, propelled by a confluence of factors favoring sustainable agriculture and enhanced crop productivity. The global shift towards eco-friendly farming practices, coupled with increasing consumer demand for organically produced food, is significantly bolstering the adoption of bio-stimulants. These biological products, derived from natural sources, offer a sustainable alternative to synthetic inputs, addressing concerns about soil degradation, water pollution, and residue accumulation in food products. The market size is projected to grow from an estimated $5,200 Million in 2019 to over $10,500 Million by 2025, reflecting a strong historical growth trajectory and sustained future potential. Technological advancements in product formulation and application methods are further enhancing the efficacy and accessibility of bio-stimulants, opening new avenues for market penetration. Innovations in areas such as microbial bio-stimulants and advanced extraction techniques for seaweed extracts are yielding more potent and targeted solutions. Consumer preferences are increasingly leaning towards products that promote soil health and plant resilience, aligning perfectly with the benefits offered by bio-stimulants. This burgeoning awareness creates a fertile ground for market growth, with opportunities for companies to develop tailored solutions for specific crop types and regional agricultural challenges. The competitive landscape is dynamic, with both established players and emerging startups actively participating in product development and market expansion. Strategic partnerships and collaborations are becoming crucial for navigating this evolving market. The market penetration rate for bio-stimulants, while still lower than conventional inputs, is rapidly increasing, indicating a significant untapped potential. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.8% between 2025 and 2033, underscoring its high growth potential. This growth is fueled by a growing understanding among farmers of the long-term benefits of bio-stimulants in improving soil fertility, enhancing nutrient uptake, and increasing crop yields under various environmental stresses. The development of novel formulations, such as liquid concentrates and slow-release granules, is also improving user convenience and application efficiency. Furthermore, supportive government initiatives and subsidies aimed at promoting sustainable agricultural practices are providing a significant impetus to the market.

Dominant Markets & Segments in NA Bio stimulant Market

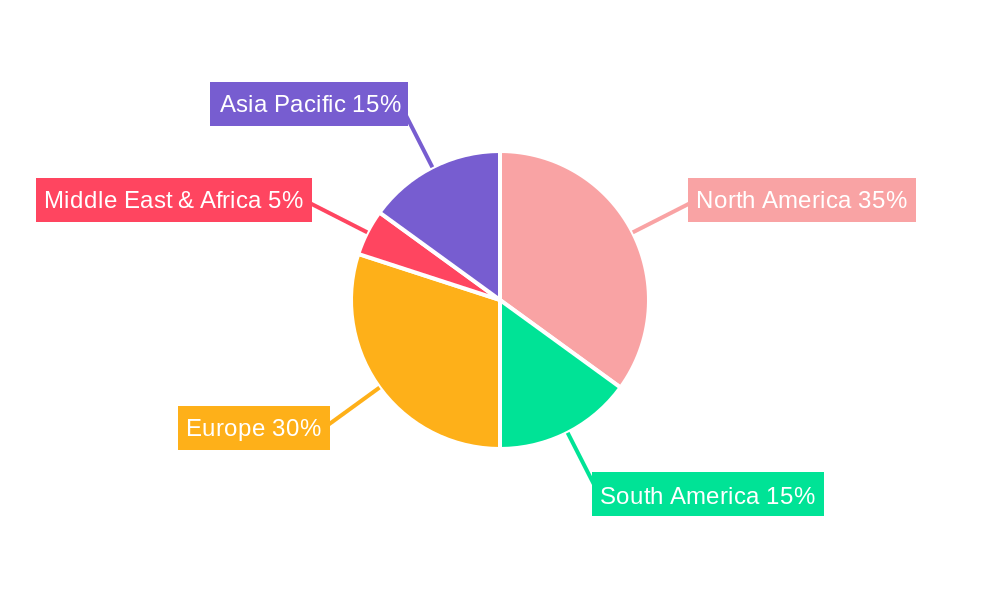

The North American bio stimulant market exhibits a clear dominance within specific geographic regions and crop segments, driven by agricultural infrastructure, policy support, and economic factors. The United States and Canada represent the primary geographic markets, accounting for approximately 70% of the total market value. Within these regions, certain states and provinces with extensive agricultural activity, such as California, Iowa, and Ontario, lead in bio stimulant adoption. This dominance is attributed to the presence of large-scale farming operations, higher disposable income for agricultural inputs, and a proactive approach to adopting innovative farming techniques.

The dominance in crop types is notably concentrated in Cash Crops and Horticultural Crops. Cash crops, including corn, soybeans, and wheat, benefit significantly from bio-stimulants that enhance yield and improve resilience against abiotic stresses like drought and salinity, which are increasingly prevalent. Horticultural crops, such as fruits, vegetables, and ornamental plants, also represent a lucrative segment due to their high-value nature and demand for premium quality produce. Bio-stimulants play a crucial role in improving fruit set, enhancing color and flavor, and extending shelf life.

Dominant Regions:

- United States: Driven by extensive agricultural land, advanced farming practices, and strong R&D investments.

- Canada: Supported by government initiatives promoting sustainable agriculture and a growing organic farming sector.

Dominant Crop Types:

- Cash Crops:

- Key Growth Drivers: Need for increased yield and improved stress tolerance in major field crops.

- Detailed Analysis: The large acreage dedicated to crops like corn, soybeans, and wheat makes this segment a significant consumer of bio-stimulants. Farmers are increasingly investing in products that offer intrinsic yield improvement and enhanced nutrient use efficiency, aligning with the capabilities of various bio-stimulant formulations.

- Horticultural Crops:

- Key Growth Drivers: Demand for high-quality produce, enhanced shelf life, and improved plant health in high-value crops.

- Detailed Analysis: This segment includes fruits, vegetables, and flowers. Bio-stimulants contribute to superior quality, better appearance, and increased resistance to diseases, justifying the premium prices often commanded by these crops. The focus on soil health and reduced chemical residues in produce also drives adoption here.

- Cash Crops:

Dominant Forms of Bio-stimulants:

- Humic Acid and Fulvic Acid: Widely adopted due to their proven efficacy in improving soil structure, nutrient availability, and water retention. These components are crucial for revitalizing degraded soils and enhancing the effectiveness of fertilizers.

- Seaweed Extracts: Their rich composition of phytohormones, amino acids, and micronutrients makes them highly effective in promoting plant growth, flowering, and stress tolerance. The growing awareness of their benefits for crop quality and yield is driving their market share.

The market’s segmentation reveals a clear preference for bio-stimulants that offer tangible benefits in terms of yield increase, stress mitigation, and overall plant health improvement, directly impacting the profitability and sustainability of farming operations in North America.

NA Bio stimulant Market Product Analysis

The North American bio stimulant market is witnessing a surge in innovative product development, driven by advancements in biological sciences and a demand for sustainable agricultural solutions. Key product innovations focus on enhancing plant nutrient uptake, improving abiotic stress tolerance, and boosting intrinsic yield. Amino acids and protein hydrolysates are gaining traction for their role in stimulating plant growth and metabolic processes. Humic and fulvic acids remain foundational, prized for their soil conditioning and nutrient chelation properties. Seaweed extracts continue to be a significant category, offering a rich blend of natural growth stimulants and micronutrients. The competitive advantage of these products lies in their ability to deliver specific benefits with reduced environmental impact compared to conventional inputs, aligning with market demand for sustainable and efficient agricultural practices.

Key Drivers, Barriers & Challenges in NA Bio stimulant Market

The North America bio stimulant market is propelled by several key drivers, including increasing awareness of sustainable agriculture, growing demand for organic produce, and supportive government policies promoting biological inputs. Technological advancements in formulation and application are making bio-stimulants more effective and accessible. The economic benefits, such as improved crop yields and reduced reliance on synthetic fertilizers, are also significant drivers.

However, the market faces several barriers and challenges. Regulatory complexities and the lack of standardized labeling can hinder adoption. Supply chain issues, particularly for niche biological ingredients, can impact availability and cost. Farmers' education and awareness regarding the efficacy and proper application of bio-stimulants remain a challenge. Intense competition from established conventional agricultural inputs also presents a restraint. The market value of these restraints is estimated to be over $500 Million in potential lost revenue due to slower adoption.

Growth Drivers in the NA Bio stimulant Market Market

Growth in the North America bio stimulant market is primarily driven by the escalating demand for sustainable agricultural practices and the increasing adoption of organic farming methods. Government initiatives and favorable regulatory frameworks are actively encouraging the use of bio-based inputs, creating a conducive environment for market expansion. Technological innovation, particularly in the development of advanced formulations and delivery systems for bio-stimulants, is enhancing their efficacy and appeal to farmers. Economic factors, such as the rising cost of synthetic fertilizers and the growing realization of long-term benefits like improved soil health and increased crop resilience, further fuel market growth. For example, the projected increase in government subsidies for sustainable farming practices, estimated at 15% annually, directly translates to market growth opportunities.

Challenges Impacting NA Bio stimulant Market Growth

Despite robust growth, the North America bio stimulant market encounters significant challenges. Regulatory hurdles, including inconsistent approval processes and a lack of harmonized standards across regions, can impede market access and innovation. Supply chain disruptions, particularly for specialized raw materials like microbial strains or specific plant extracts, can lead to price volatility and availability issues, impacting the market by an estimated $300 Million annually. Farmer education and awareness regarding the optimal use and proven benefits of bio-stimulants remain a critical area for improvement, with adoption rates directly tied to understanding. Furthermore, the established market position and extensive marketing of conventional agricultural inputs present a competitive pressure, requiring bio-stimulant companies to invest heavily in demonstrating value and efficacy.

Key Players Shaping the NA Bio stimulant Market Market

- Plant Response Biotech Inc

- Koppert Biological Systems Inc

- Sigma Agriscience LLC

- Hello Nature USA Inc

- Actagro LLC

- Humic Growth Solutions Inc

- Agrocare Canada Inc

- Agriculture Solutions Inc

- Agrinos

- Valagro US

Significant NA Bio stimulant Market Industry Milestones

- February 2022: Plant Response was acquired by The Mosaic Company, a global fertilizer manufacturer. This strategic move significantly strengthened Plant Response's global presence and its ability to develop new, sustainable products and solutions for customers.

- May 2021: Plant Response Inc. announced its acquisition of WISErg, a startup focused on upcycling nutrients from recovered food for use in fertilizers and nutrient-efficient products that enhance plant and soil health. This acquisition expanded Plant Response's portfolio towards circular economy principles.

- January 2020: Plant Response Inc. acquired Pathway BioLogic, an applied microbial science company. This acquisition was aimed at broadening Plant Response's portfolio of biological products, enabling it to offer greater value to channel partners and farmers in areas such as intrinsic yield improvement, abiotic stress tolerance, increased nutrient use efficiency, and enhanced plant innate immunity.

Future Outlook for NA Bio stimulant Market Market

The future outlook for the North America bio stimulant market is exceptionally promising, driven by persistent global trends towards sustainable agriculture and increasing consumer demand for responsibly produced food. Strategic opportunities lie in the development of integrated bio-stimulant solutions that synergize with existing crop management practices. Further research into novel biological agents and advanced application technologies will unlock new market segments and enhance product efficacy. The market potential is substantial, with ongoing regulatory support and increasing farmer adoption expected to drive continued growth and innovation. The market is projected to see an expansion of over $6,000 Million in value from 2025 to 2033, underscoring its significant growth trajectory.

NA Bio stimulant Market Segmentation

-

1. Form

- 1.1. Amino Acids

- 1.2. Fulvic Acid

- 1.3. Humic Acid

- 1.4. Protein Hydrolysates

- 1.5. Seaweed Extracts

- 1.6. Other Biostimulants

-

2. Crop Type

- 2.1. Cash Crops

- 2.2. Horticultural Crops

- 2.3. Row Crops

-

3. Form

- 3.1. Amino Acids

- 3.2. Fulvic Acid

- 3.3. Humic Acid

- 3.4. Protein Hydrolysates

- 3.5. Seaweed Extracts

- 3.6. Other Biostimulants

-

4. Crop Type

- 4.1. Cash Crops

- 4.2. Horticultural Crops

- 4.3. Row Crops

NA Bio stimulant Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

NA Bio stimulant Market Regional Market Share

Geographic Coverage of NA Bio stimulant Market

NA Bio stimulant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Bio stimulant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Amino Acids

- 5.1.2. Fulvic Acid

- 5.1.3. Humic Acid

- 5.1.4. Protein Hydrolysates

- 5.1.5. Seaweed Extracts

- 5.1.6. Other Biostimulants

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Cash Crops

- 5.2.2. Horticultural Crops

- 5.2.3. Row Crops

- 5.3. Market Analysis, Insights and Forecast - by Form

- 5.3.1. Amino Acids

- 5.3.2. Fulvic Acid

- 5.3.3. Humic Acid

- 5.3.4. Protein Hydrolysates

- 5.3.5. Seaweed Extracts

- 5.3.6. Other Biostimulants

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Cash Crops

- 5.4.2. Horticultural Crops

- 5.4.3. Row Crops

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North America NA Bio stimulant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Amino Acids

- 6.1.2. Fulvic Acid

- 6.1.3. Humic Acid

- 6.1.4. Protein Hydrolysates

- 6.1.5. Seaweed Extracts

- 6.1.6. Other Biostimulants

- 6.2. Market Analysis, Insights and Forecast - by Crop Type

- 6.2.1. Cash Crops

- 6.2.2. Horticultural Crops

- 6.2.3. Row Crops

- 6.3. Market Analysis, Insights and Forecast - by Form

- 6.3.1. Amino Acids

- 6.3.2. Fulvic Acid

- 6.3.3. Humic Acid

- 6.3.4. Protein Hydrolysates

- 6.3.5. Seaweed Extracts

- 6.3.6. Other Biostimulants

- 6.4. Market Analysis, Insights and Forecast - by Crop Type

- 6.4.1. Cash Crops

- 6.4.2. Horticultural Crops

- 6.4.3. Row Crops

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. South America NA Bio stimulant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Amino Acids

- 7.1.2. Fulvic Acid

- 7.1.3. Humic Acid

- 7.1.4. Protein Hydrolysates

- 7.1.5. Seaweed Extracts

- 7.1.6. Other Biostimulants

- 7.2. Market Analysis, Insights and Forecast - by Crop Type

- 7.2.1. Cash Crops

- 7.2.2. Horticultural Crops

- 7.2.3. Row Crops

- 7.3. Market Analysis, Insights and Forecast - by Form

- 7.3.1. Amino Acids

- 7.3.2. Fulvic Acid

- 7.3.3. Humic Acid

- 7.3.4. Protein Hydrolysates

- 7.3.5. Seaweed Extracts

- 7.3.6. Other Biostimulants

- 7.4. Market Analysis, Insights and Forecast - by Crop Type

- 7.4.1. Cash Crops

- 7.4.2. Horticultural Crops

- 7.4.3. Row Crops

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Europe NA Bio stimulant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Amino Acids

- 8.1.2. Fulvic Acid

- 8.1.3. Humic Acid

- 8.1.4. Protein Hydrolysates

- 8.1.5. Seaweed Extracts

- 8.1.6. Other Biostimulants

- 8.2. Market Analysis, Insights and Forecast - by Crop Type

- 8.2.1. Cash Crops

- 8.2.2. Horticultural Crops

- 8.2.3. Row Crops

- 8.3. Market Analysis, Insights and Forecast - by Form

- 8.3.1. Amino Acids

- 8.3.2. Fulvic Acid

- 8.3.3. Humic Acid

- 8.3.4. Protein Hydrolysates

- 8.3.5. Seaweed Extracts

- 8.3.6. Other Biostimulants

- 8.4. Market Analysis, Insights and Forecast - by Crop Type

- 8.4.1. Cash Crops

- 8.4.2. Horticultural Crops

- 8.4.3. Row Crops

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Middle East & Africa NA Bio stimulant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Amino Acids

- 9.1.2. Fulvic Acid

- 9.1.3. Humic Acid

- 9.1.4. Protein Hydrolysates

- 9.1.5. Seaweed Extracts

- 9.1.6. Other Biostimulants

- 9.2. Market Analysis, Insights and Forecast - by Crop Type

- 9.2.1. Cash Crops

- 9.2.2. Horticultural Crops

- 9.2.3. Row Crops

- 9.3. Market Analysis, Insights and Forecast - by Form

- 9.3.1. Amino Acids

- 9.3.2. Fulvic Acid

- 9.3.3. Humic Acid

- 9.3.4. Protein Hydrolysates

- 9.3.5. Seaweed Extracts

- 9.3.6. Other Biostimulants

- 9.4. Market Analysis, Insights and Forecast - by Crop Type

- 9.4.1. Cash Crops

- 9.4.2. Horticultural Crops

- 9.4.3. Row Crops

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Asia Pacific NA Bio stimulant Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Amino Acids

- 10.1.2. Fulvic Acid

- 10.1.3. Humic Acid

- 10.1.4. Protein Hydrolysates

- 10.1.5. Seaweed Extracts

- 10.1.6. Other Biostimulants

- 10.2. Market Analysis, Insights and Forecast - by Crop Type

- 10.2.1. Cash Crops

- 10.2.2. Horticultural Crops

- 10.2.3. Row Crops

- 10.3. Market Analysis, Insights and Forecast - by Form

- 10.3.1. Amino Acids

- 10.3.2. Fulvic Acid

- 10.3.3. Humic Acid

- 10.3.4. Protein Hydrolysates

- 10.3.5. Seaweed Extracts

- 10.3.6. Other Biostimulants

- 10.4. Market Analysis, Insights and Forecast - by Crop Type

- 10.4.1. Cash Crops

- 10.4.2. Horticultural Crops

- 10.4.3. Row Crops

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Plant Response Biotech Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Koppert Biological Systems Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sigma Agriscience LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hello Nature USA Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Actagro LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Humic Growth Solutions Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Agrocare Canada Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Agriculture Solutions Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agrinos

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Valagro US

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Plant Response Biotech Inc

List of Figures

- Figure 1: Global NA Bio stimulant Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 3: North America NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 4: North America NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 5: North America NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 6: North America NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 7: North America NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 8: North America NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 9: North America NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 10: North America NA Bio stimulant Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America NA Bio stimulant Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 13: South America NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 14: South America NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 15: South America NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 16: South America NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 17: South America NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 18: South America NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 19: South America NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 20: South America NA Bio stimulant Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America NA Bio stimulant Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 23: Europe NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 24: Europe NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 25: Europe NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 26: Europe NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 27: Europe NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 28: Europe NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 29: Europe NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 30: Europe NA Bio stimulant Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe NA Bio stimulant Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 33: Middle East & Africa NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 34: Middle East & Africa NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 35: Middle East & Africa NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 36: Middle East & Africa NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 37: Middle East & Africa NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 38: Middle East & Africa NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 39: Middle East & Africa NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 40: Middle East & Africa NA Bio stimulant Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa NA Bio stimulant Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 43: Asia Pacific NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 44: Asia Pacific NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 45: Asia Pacific NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 46: Asia Pacific NA Bio stimulant Market Revenue (Million), by Form 2025 & 2033

- Figure 47: Asia Pacific NA Bio stimulant Market Revenue Share (%), by Form 2025 & 2033

- Figure 48: Asia Pacific NA Bio stimulant Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 49: Asia Pacific NA Bio stimulant Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 50: Asia Pacific NA Bio stimulant Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific NA Bio stimulant Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 3: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 4: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 5: Global NA Bio stimulant Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 7: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 8: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 9: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 10: Global NA Bio stimulant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 15: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 16: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 17: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 18: Global NA Bio stimulant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 23: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 24: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 25: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 26: Global NA Bio stimulant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 37: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 38: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 39: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 40: Global NA Bio stimulant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 48: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 49: Global NA Bio stimulant Market Revenue Million Forecast, by Form 2020 & 2033

- Table 50: Global NA Bio stimulant Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 51: Global NA Bio stimulant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific NA Bio stimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Bio stimulant Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the NA Bio stimulant Market?

Key companies in the market include Plant Response Biotech Inc, Koppert Biological Systems Inc, Sigma Agriscience LLC, Hello Nature USA Inc, Actagro LLC, Humic Growth Solutions Inc, Agrocare Canada Inc, Agriculture Solutions Inc, Agrinos, Valagro US.

3. What are the main segments of the NA Bio stimulant Market?

The market segments include Form, Crop Type, Form, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

February 2022: Plant Response was acquired by The Mosaic Company, which is a global fertilizer manufacturer. This acquisition strengthened the company's global presence. Through the acquisition, the company develops new products and solutions for the customers in a sustainable way.May 2021: Plant Response Inc. announced its acquisition of WISErg, which is a startup that upcycles nutrients from recovered food for use in fertilizer and nutrient-efficient products that enhance plant and soil health.January 2020: Plant Response Inc. acquired Pathway BioLogic, an applied microbial science company, to expand its portfolio of biological products offered to the agricultural industry. The acquisition has allowed the company to create value for channel partners and farmers in multiple categories, including intrinsic yield improvement, abiotic stress tolerance, increased nutrient use efficiency, and enhanced plant innate immunity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Bio stimulant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Bio stimulant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Bio stimulant Market?

To stay informed about further developments, trends, and reports in the NA Bio stimulant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence