Key Insights

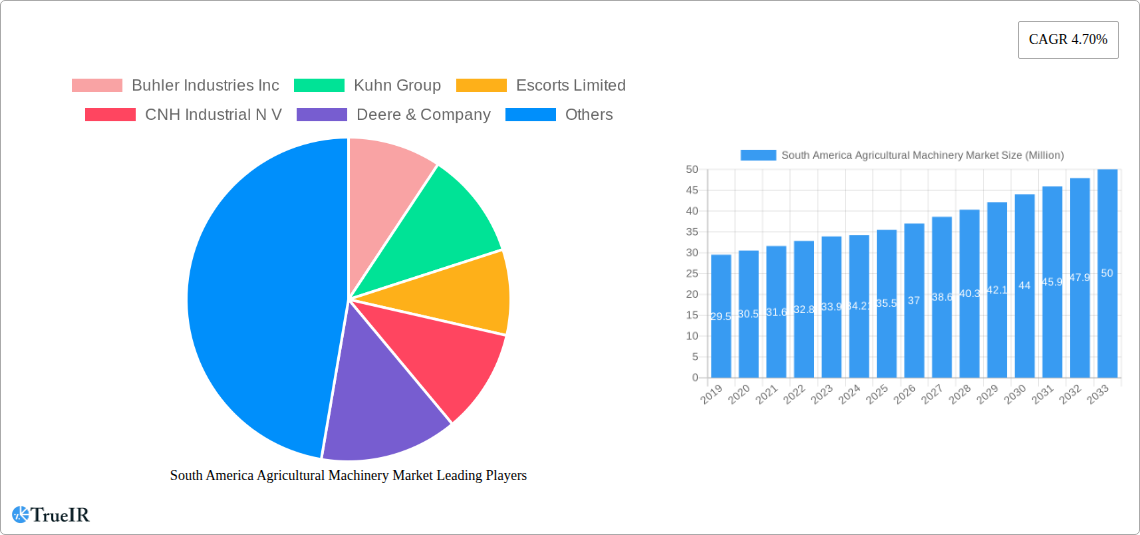

The South America Agricultural Machinery Market is poised for significant growth, with a current estimated market size of USD 34.21 million and a projected Compound Annual Growth Rate (CAGR) of 4.70% through 2033. This expansion is largely driven by the increasing adoption of advanced farming technologies to boost agricultural productivity and efficiency across the region. Key drivers include the growing demand for food due to population growth, the need to enhance crop yields on limited arable land, and supportive government initiatives aimed at modernizing the agricultural sector. The market is experiencing a surge in demand for precision farming equipment, automated machinery, and sustainable agricultural solutions. This shift is fueled by a growing awareness among farmers regarding the benefits of technology in reducing operational costs, optimizing resource utilization (such as water and fertilizers), and improving overall farm management. Furthermore, the inherent resourcefulness of South American agriculture, with its vast tracts of arable land and diverse climatic zones, provides a fertile ground for innovation and investment in agricultural machinery.

South America Agricultural Machinery Market Market Size (In Million)

The market's growth trajectory is further shaped by emerging trends such as the increasing integration of IoT and AI in agricultural machinery for data-driven decision-making, the rise of robotic farming solutions for specific tasks, and a greater emphasis on eco-friendly and energy-efficient equipment. However, certain restraints could influence the pace of adoption. These include the high initial investment costs associated with advanced machinery, which can be a barrier for smallholder farmers, and the need for adequate infrastructure, including reliable power supply and internet connectivity, in some rural areas. Moreover, fluctuations in commodity prices and the availability of skilled labor for operating and maintaining sophisticated equipment present ongoing challenges. The market is segmented across production, consumption, import/export, and price trends, with key players like John Deere, CNH Industrial, and AGCO Corporation actively competing to capture market share by offering innovative solutions tailored to the specific needs of South American agriculture. The region's dominant players, particularly in Brazil and Argentina, are at the forefront of adopting and developing these advanced agricultural technologies.

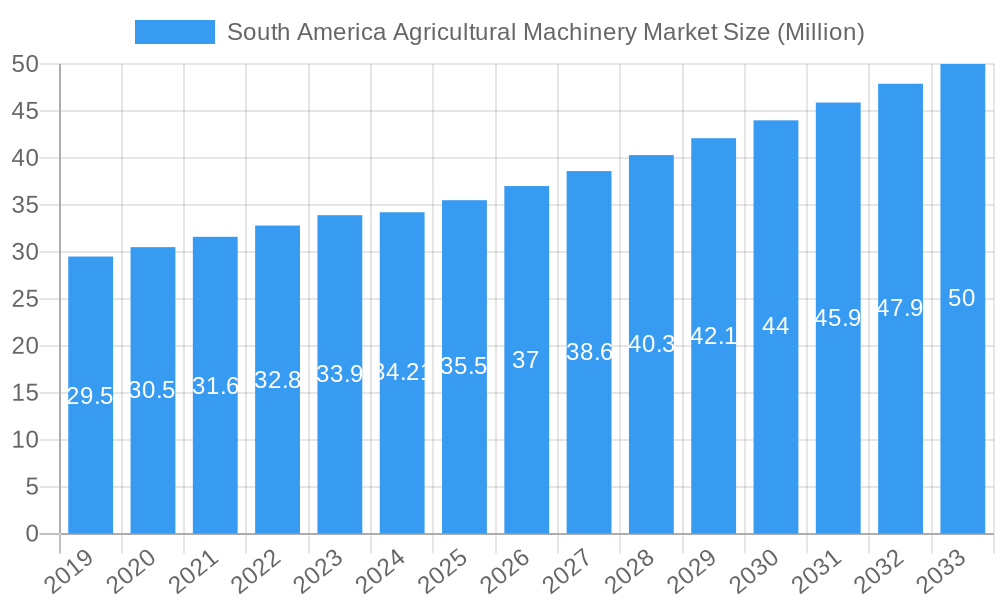

South America Agricultural Machinery Market Company Market Share

Here's a dynamic, SEO-optimized report description for the South America Agricultural Machinery Market:

This in-depth report provides a definitive analysis of the South America Agricultural Machinery Market, offering critical insights and actionable intelligence for stakeholders. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into the intricate dynamics shaping one of the world's most significant agricultural regions. We explore production and consumption trends, import and export volumes and values, evolving price dynamics, and key industry developments. Leveraging high-volume SEO keywords such as "South America agricultural machinery," "farm equipment Brazil," "tractors Argentina," "combines Uruguay," "agricultural technology LATAM," and "precision agriculture South America," this report is engineered to capture maximum search visibility and engage a discerning industry audience.

South America Agricultural Machinery Market Market Structure & Competitive Landscape

The South America Agricultural Machinery Market exhibits a moderately concentrated structure, with a few key global players dominating significant market share. Companies like Deere & Company, CNH Industrial N.V., and AGCO Corporation are prominent, alongside strong regional manufacturers and specialized providers. Innovation serves as a crucial driver, with a surge in demand for precision agriculture technologies, autonomous machinery, and sustainable farming solutions. Regulatory frameworks, particularly concerning agricultural subsidies, import tariffs, and environmental standards, significantly influence market entry and operational strategies. Product substitutes, while limited in core functionality, exist in the form of used machinery and alternative mechanization approaches. End-user segmentation reveals distinct needs across large-scale commercial farms, smallholder farms, and specialized crop operations. Mergers and acquisitions (M&A) activity, while not at peak levels, remains a strategic tool for market consolidation and technological integration. For instance, the historical period saw several key acquisitions aimed at expanding product portfolios and geographical reach. Concentration ratios are estimated to be around 60% for the top five players. M&A volumes in the recent past have averaged approximately 15-20 significant transactions annually across the continent, indicating ongoing consolidation efforts.

South America Agricultural Machinery Market Market Trends & Opportunities

The South America Agricultural Machinery Market is poised for robust growth, driven by a confluence of escalating food demand, a growing focus on agricultural modernization, and favorable government policies aimed at boosting productivity. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period, reaching an estimated value of over $25,000 million by 2033. Technological shifts are at the forefront of this expansion, with significant advancements in precision agriculture, including GPS-guided systems, variable rate technology (VRT), and sensor-based data analytics, enhancing crop yields and resource efficiency. The adoption of smart farming solutions and IoT-enabled machinery is accelerating, offering real-time monitoring and predictive maintenance capabilities. Consumer preferences are increasingly leaning towards machinery that offers fuel efficiency, reduced environmental impact, and greater automation to address labor shortages and rising operational costs. Competitive dynamics are intensifying, with both global manufacturers and emerging regional players vying for market share. Opportunities lie in developing affordable and accessible technologies for a diverse range of farm sizes, as well as in catering to the specific needs of key agricultural economies like Brazil, Argentina, and Colombia. The penetration rate of advanced agricultural machinery, particularly in countries with significant smallholder farming populations, presents a substantial untapped market potential. Furthermore, the growing emphasis on sustainable agricultural practices is creating demand for eco-friendly machinery and solutions that minimize soil degradation and water usage.

Dominant Markets & Segments in South America Agricultural Machinery Market

The Production Analysis: of agricultural machinery in South America is significantly led by Brazil, which boasts a substantial domestic manufacturing base and accounts for over 40% of the region's production volume. Argentina and Colombia follow, with developing manufacturing capabilities. Key growth drivers include strong government support for local manufacturing, availability of raw materials, and a large domestic market for farm equipment. The Consumption Analysis: is also heavily dominated by Brazil, followed by Argentina, accounting for over 70% of the total regional consumption. This dominance is driven by the vast agricultural land, extensive cultivation of high-value crops like soybeans, corn, and sugarcane, and the continuous need for mechanization to meet export demands. Infrastructure development, including improved logistics and rural electrification, plays a crucial role in facilitating consumption. Policies promoting farm modernization and mechanization further bolster demand. The Import Market Analysis (Value & Volume): reveals that while Brazil is a significant producer, it also imports specialized and high-end machinery, particularly for advanced applications. Argentina and Colombia are also substantial importers of tractors, harvesters, and planting equipment to supplement their domestic production and meet specific agricultural needs. The value of agricultural machinery imports in South America is estimated to be around $7,000 million in 2025. The Export Market Analysis (Value & Volume): highlights Brazil as the primary exporter, shipping agricultural machinery to other South American nations and some African markets. Argentina also has a notable export presence within the region. Key growth drivers for exports include competitive pricing of locally manufactured equipment and trade agreements that facilitate intra-regional commerce. The Price Trend Analysis: indicates a steady upward trend in agricultural machinery prices, driven by rising raw material costs (steel, aluminum), inflation, and the incorporation of advanced technologies. However, the price sensitivity of a segment of the market necessitates a balance between innovation and affordability. Predicted price increases are in the range of 4-6% annually.

South America Agricultural Machinery Market Product Analysis

The South America Agricultural Machinery Market is characterized by a strong emphasis on tractors, harvesters (combines), and implements such as plows, planters, and sprayers. Innovations are heavily focused on enhancing efficiency, reducing operational costs, and minimizing environmental impact. This includes the integration of precision agriculture technologies, GPS guidance systems for accurate field operations, and variable rate application for fertilizers and pesticides. The competitive advantage for manufacturers lies in offering durable, fuel-efficient machinery with advanced features that can withstand the diverse climatic and soil conditions across South America. Product development is also driven by the increasing demand for autonomous and semi-autonomous farming solutions, aiming to address labor shortages and improve productivity.

Key Drivers, Barriers & Challenges in South America Agricultural Machinery Market

Key Drivers:

- Growing Food Demand: Increasing global and regional demand for agricultural commodities necessitates higher productivity, driving mechanization.

- Technological Advancements: Adoption of precision agriculture, IoT, and automation enhances efficiency and yield.

- Government Support: Favorable policies, subsidies, and incentives for agricultural modernization boost market growth.

- Modernization of Farming Practices: A shift towards more efficient and sustainable farming methods requires advanced machinery.

- Expansion of Arable Land: Ongoing efforts to expand cultivated areas create a demand for new equipment.

Barriers & Challenges:

- High Initial Investment: The cost of advanced agricultural machinery can be prohibitive for small and medium-sized farmers.

- Infrastructure Deficiencies: Limited rural infrastructure, including poor road networks and unreliable power supply, can hinder machinery operation and maintenance.

- Financing Accessibility: Difficulty in accessing affordable credit and financing options for machinery purchases.

- Skilled Labor Shortage: A lack of trained operators and maintenance technicians for sophisticated equipment.

- Regulatory Complexities: Navigating diverse and sometimes evolving import regulations, taxes, and environmental standards across different countries.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components and finished machinery, leading to an estimated 5-10% increase in lead times for critical parts.

Growth Drivers in the South America Agricultural Machinery Market Market

The South America Agricultural Machinery Market is propelled by several key growth drivers. Technological advancements in precision farming, including GPS-guided tractors and variable rate applicators, are enhancing operational efficiency and crop yields, contributing to an estimated 7-10% increase in productivity for adopters. Economic factors, such as rising commodity prices and increased agricultural exports, provide farmers with greater capital to invest in modern machinery. Government initiatives like subsidies for machinery purchases and tax incentives for agricultural modernization further stimulate demand. The growing adoption of sustainable farming practices is also a significant driver, pushing demand for eco-friendly and resource-efficient equipment. The demand for automated solutions is also on the rise, addressing labor shortages and improving overall operational efficiency.

Challenges Impacting South America Agricultural Machinery Market Growth

Several challenges impact the growth of the South America Agricultural Machinery Market. High initial investment costs remain a significant barrier, particularly for smallholder farmers, with the average cost of a high-horsepower tractor exceeding $100,000. Limited access to affordable financing and credit further exacerbates this issue. Inadequate rural infrastructure, including poor road networks and unreliable electricity supply, hinders the effective deployment and maintenance of advanced machinery. Regulatory complexities and trade barriers across different South American countries can also create hurdles for manufacturers and distributors. Furthermore, a shortage of skilled labor to operate and maintain sophisticated agricultural equipment poses a constraint on widespread adoption. Supply chain disruptions can also lead to increased lead times and costs, impacting the availability of machinery.

Key Players Shaping the South America Agricultural Machinery Market Market

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kuhn Group

- Buhler Industries Inc

- Escorts Limited

- Mahindra & Mahindra Ltd

- Kverneland AS

- Kubota Agricultural Machinery

- Escorts Group

- New Holland Agricultur

Significant South America Agricultural Machinery Market Industry Milestones

- 2019: Launch of advanced autonomous tractor prototypes by leading manufacturers, signaling a shift towards automation.

- 2020: Increased investment in precision agriculture technologies across Brazil and Argentina to improve crop yields amidst market volatility.

- 2021: Several key mergers and acquisitions aimed at expanding product portfolios and market reach within the region.

- 2022: Introduction of new regulations in Colombia and Peru focusing on sustainable agricultural practices, influencing machinery design and adoption.

- 2023: Significant advancements in drone technology for agricultural spraying and monitoring, gaining traction in niche markets.

- 2024: Growing emphasis on connected machinery and data analytics for real-time farm management and predictive maintenance.

Future Outlook for South America Agricultural Machinery Market Market

The future outlook for the South America Agricultural Machinery Market is exceptionally positive, driven by sustained growth catalysts. The increasing adoption of digital farming solutions and smart machinery will continue to redefine agricultural practices, leading to enhanced productivity and sustainability. Opportunities abound for manufacturers who can offer integrated solutions that cater to the diverse needs of the region, from large-scale commercial operations to smallholder farms. The ongoing focus on food security and export competitiveness will further fuel demand for advanced and reliable agricultural equipment. Strategic partnerships and localized manufacturing will be crucial for capitalizing on the market's immense potential, with a projected growth trajectory that promises significant returns for industry stakeholders.

South America Agricultural Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

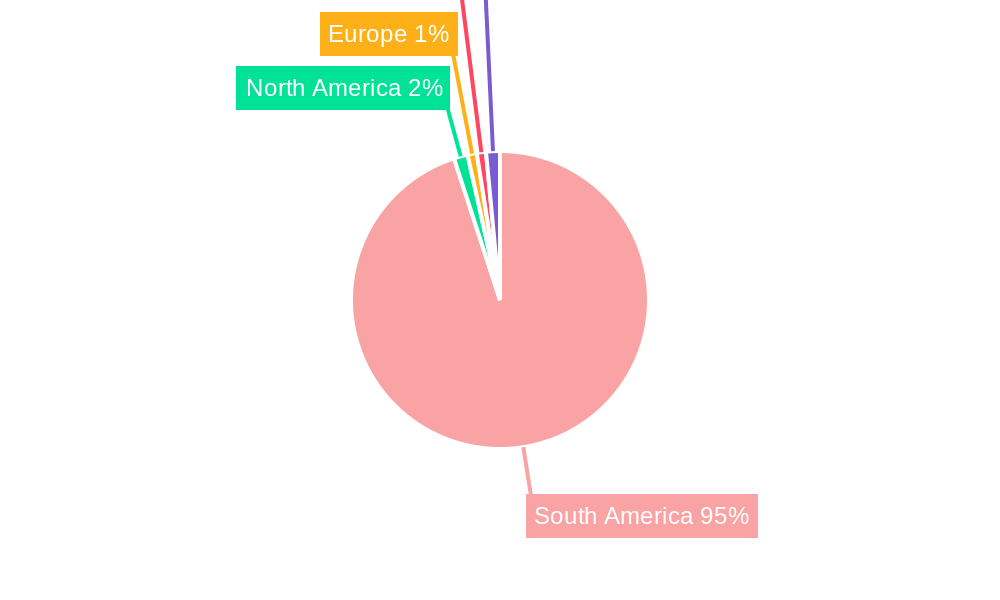

South America Agricultural Machinery Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Agricultural Machinery Market Regional Market Share

Geographic Coverage of South America Agricultural Machinery Market

South America Agricultural Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Landscaping Maintenance; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns

- 3.4. Market Trends

- 3.4.1. Increase in Area Harvested

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Agricultural Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Buhler Industries Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kuhn Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Escorts Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CNH Industrial N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deere & Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mahindra & Mahindra Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kverneland AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kubota Agricultural Machinery

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Escorts Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Holland Agricultur

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AGCO Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Buhler Industries Inc

List of Figures

- Figure 1: South America Agricultural Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Agricultural Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: South America Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Agricultural Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South America Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Agricultural Machinery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Agricultural Machinery Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the South America Agricultural Machinery Market?

Key companies in the market include Buhler Industries Inc, Kuhn Group, Escorts Limited, CNH Industrial N V, Deere & Company, Mahindra & Mahindra Ltd, Kverneland AS, Kubota Agricultural Machinery, Escorts Group, New Holland Agricultur, AGCO Corporation.

3. What are the main segments of the South America Agricultural Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Landscaping Maintenance; Technological Advancements.

6. What are the notable trends driving market growth?

Increase in Area Harvested.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Agricultural Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Agricultural Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Agricultural Machinery Market?

To stay informed about further developments, trends, and reports in the South America Agricultural Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence