Key Insights

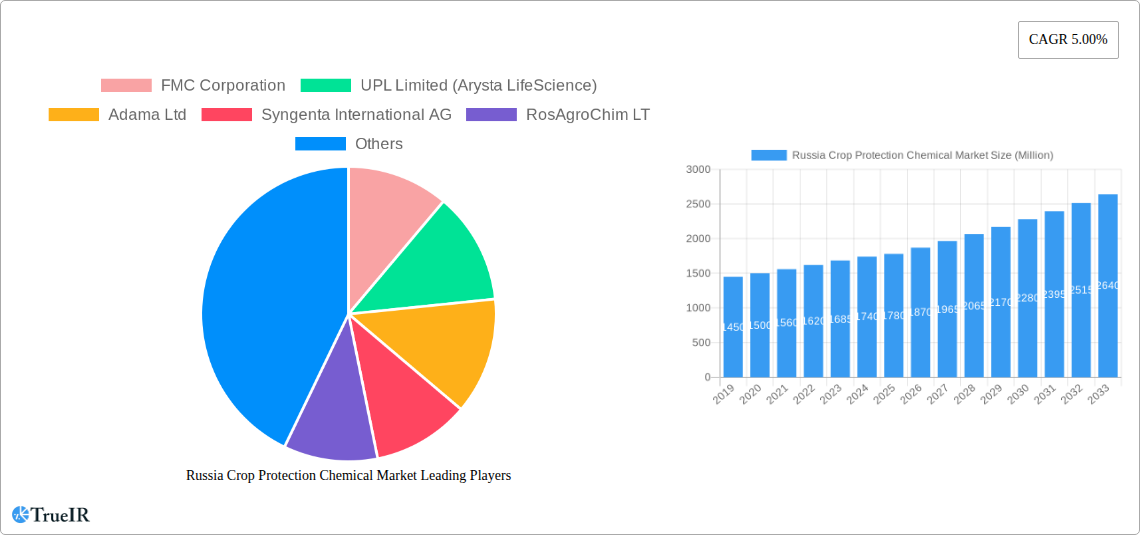

The Russian crop protection chemical market is poised for robust expansion, projected to reach approximately USD 1.78 billion by 2025, with a significant Compound Annual Growth Rate (CAGR) of 5.00% anticipated through 2033. This growth is primarily propelled by the increasing demand for agricultural output to ensure food security, coupled with the continuous adoption of advanced farming practices that necessitate effective pest and disease management solutions. Government initiatives aimed at boosting domestic agricultural production and modernizing farming techniques further underpin this upward trajectory. The market benefits from a growing awareness among farmers regarding the economic advantages of crop protection chemicals in preventing yield losses and improving crop quality. Furthermore, the introduction of innovative and sustainable agrochemical formulations is expected to cater to evolving environmental regulations and consumer preferences, thereby driving market penetration.

Russia Crop Protection Chemical Market Market Size (In Billion)

The market's expansion is further influenced by several key trends, including the rising adoption of integrated pest management (IPM) strategies, which often incorporate chemical interventions as part of a broader solution. The ongoing consolidation within the agrochemical industry, with major global players actively seeking to strengthen their presence in promising markets like Russia, also plays a crucial role. However, certain restraints, such as fluctuating raw material prices and the logistical challenges associated with distribution in a vast geographical area, could temper the pace of growth. Nevertheless, the overarching demand for enhanced agricultural productivity and the continuous efforts of leading companies like Bayer CropScience AG, Syngenta International AG, and BASF SE to offer tailored solutions to the Russian agricultural landscape are expected to drive sustained market development. Analysis of production, consumption, import-export dynamics, and price trends will provide a comprehensive understanding of the market's intricate workings and future potential within Russia.

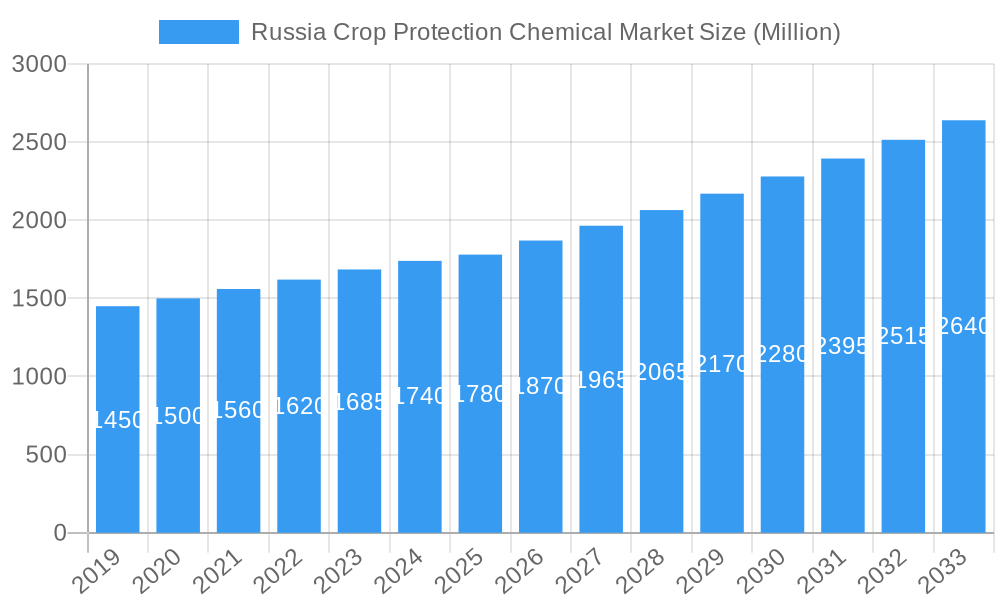

Russia Crop Protection Chemical Market Company Market Share

Russia Crop Protection Chemical Market: Comprehensive Market Analysis and Forecast (2019–2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the Russia Crop Protection Chemical Market. Leveraging high-volume keywords such as "Russia pesticides," "agricultural chemicals Russia," "crop protection solutions," and "fungicides market Russia," this report is designed to engage industry professionals and enhance search rankings. With a detailed historical analysis from 2019-2024, a base year of 2025, and a robust forecast period extending to 2033, this study offers unparalleled insights into market dynamics, competitive strategies, and future growth trajectories. All financial values are presented in Millions of USD.

Russia Crop Protection Chemical Market Market Structure & Competitive Landscape

The Russia Crop Protection Chemical Market exhibits a moderately concentrated structure, with a few key international players dominating the landscape. The presence of global giants like FMC Corporation, UPL Limited (Arysta LifeScience), Adama Ltd, Syngenta International AG, Corteva Agriscience, Bayer CropScience AG, and BASF SE underscores the competitive intensity. Innovation drivers are primarily centered around the development of more effective and environmentally sustainable crop protection solutions, including novel herbicide formulations, advanced insecticide technologies, and eco-friendly fungicides. Regulatory impacts, while present, are often balanced by government initiatives aimed at bolstering domestic agricultural output and food security, which indirectly supports the crop protection chemical sector. Product substitutes, such as integrated pest management (IPM) strategies and biological control agents, are gaining traction but currently represent a smaller share compared to conventional chemical solutions. End-user segmentation reveals a strong reliance on large-scale agricultural enterprises and individual farming operations seeking to maximize yields and minimize crop losses. Mergers and acquisition (M&A) trends, though not extensively publicized in recent years, remain a potential avenue for consolidation and market share expansion, with historical M&A volumes estimated in the hundreds of millions. The market's future structure will likely be shaped by a blend of technological innovation, evolving regulatory frameworks, and strategic partnerships.

Russia Crop Protection Chemical Market Market Trends & Opportunities

The Russia Crop Protection Chemical Market is poised for significant growth and transformation, driven by a confluence of compelling trends and emerging opportunities. The market size is projected to expand considerably, with an estimated Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This expansion is fueled by Russia's vast agricultural land, its strategic importance as a global food supplier, and the ongoing need to enhance crop yields and protect against pest and disease outbreaks. Technological shifts are a major catalyst, with a pronounced movement towards precision agriculture, the development of targeted chemical formulations that minimize environmental impact, and the increasing adoption of bio-pesticides and bio-stimulants. Consumer preferences are also evolving, with a growing demand for sustainably produced food, which in turn influences the types of crop protection chemicals favored by farmers and their supply chains. Competitive dynamics are characterized by intense R&D efforts among leading players to introduce novel products with improved efficacy and reduced toxicity. Opportunities abound in segments such as advanced herbicide formulations for weed management in key crops like wheat and barley, and the development of specialized fungicides and insecticides to combat prevalent diseases and pests affecting oilseeds, corn, and potatoes. Market penetration rates for advanced crop protection solutions are expected to rise as farmers become more aware of and adopt innovative technologies that offer a higher return on investment. Furthermore, government support for agricultural modernization and subsidies for adopting advanced farming practices create a favorable environment for market expansion. The integration of digital tools for crop monitoring and application management presents another significant opportunity for enhanced product delivery and efficacy. The continuous pursuit of more efficient and environmentally conscious crop protection solutions will define the market's trajectory, creating lucrative avenues for both established players and new entrants.

Dominant Markets & Segments in Russia Crop Protection Chemical Market

The Russia Crop Protection Chemical Market is characterized by distinct dominant segments and regions, driven by specific agricultural demands and market conditions.

Production Analysis:

- Dominant Region: Western Russia, particularly the Southern Federal District, is the dominant region for crop protection chemical production. This is due to its favorable climate for agriculture, well-established agricultural infrastructure, and proximity to major consumption centers.

- Key Growth Drivers:

- Proximity to arable land and major farming operations.

- Availability of skilled labor and established industrial clusters.

- Government incentives for domestic manufacturing of agricultural inputs.

- Detailed Analysis: Production facilities are concentrated in this region to cater to the high demand from grain, oilseed, and vegetable cultivation. Investments in upgrading manufacturing processes to meet international quality standards are ongoing.

Consumption Analysis:

- Dominant Crop: Cereals, particularly wheat and barley, represent the largest segment by consumption of crop protection chemicals. Russia's status as a leading global wheat exporter directly translates to a high demand for herbicides, fungicides, and insecticides to protect these vital crops.

- Key Growth Drivers:

- Vast land under cereal cultivation and the need to maximize yield.

- Incidence of common cereal diseases and pest infestations.

- Favorable pricing of cereal crops on the global market.

- Detailed Analysis: The consumption patterns are closely tied to crop cycles and the prevailing weather conditions, which can exacerbate pest and disease pressures. The adoption of more advanced formulations is steadily increasing among large agricultural holdings.

Import Market Analysis (Value & Volume):

- Dominant Product Category: Herbicides constitute the largest import category by both value and volume. This is driven by the extensive need for weed control in Russia's vast agricultural landscapes, particularly for broad-acre crops.

- Key Growth Drivers:

- Demand for specific herbicide chemistries not yet produced domestically.

- Technological superiority of imported formulations.

- Seasonal demand fluctuations requiring timely supply.

- Detailed Analysis: Imports are crucial for meeting the diverse needs of Russian agriculture. Major importing nations often supply specialized and branded agrochemicals. The import volume for herbicides is estimated to be in the tens of millions of tons, with a value in the hundreds of millions of USD.

Export Market Analysis (Value & Volume):

- Dominant Product Category: While Russia is a net importer of many crop protection chemicals, certain domestically produced formulations and active ingredients are exported, particularly to neighboring CIS countries. Fungicides and insecticides manufactured with local cost advantages can find export markets.

- Key Growth Drivers:

- Cost competitiveness of certain Russian-made products.

- Established trade relationships with CIS nations.

- Niche market demand for specific product types.

- Detailed Analysis: The export market for crop protection chemicals from Russia is smaller compared to imports but holds potential for growth, especially with increased investment in domestic manufacturing capabilities and quality control.

Price Trend Analysis:

- Dominant Factor: Global commodity prices for raw materials used in crop protection chemical manufacturing significantly influence domestic price trends. Fluctuations in oil prices, for instance, impact the cost of petrochemical-based active ingredients.

- Key Growth Drivers:

- Global supply and demand dynamics for chemical intermediates.

- Currency exchange rates between the Russian Ruble and major trading currencies.

- Government policies on tariffs and import duties.

- Detailed Analysis: Price trends are often volatile, reacting to global economic factors and geopolitical events. The base year of 2025 is expected to see moderate price increases due to inflationary pressures and raw material costs.

Russia Crop Protection Chemical Market Product Analysis

The Russia Crop Protection Chemical Market is characterized by a diverse product portfolio encompassing herbicides, insecticides, fungicides, and other plant protection agents. Product innovations are increasingly focused on enhancing efficacy, reducing application rates, and minimizing environmental persistence. Key advancements include the development of selective herbicides targeting specific weed species in major crops like wheat and corn, alongside novel insecticide formulations with improved modes of action to combat resistant pest populations. Fungicides with systemic properties that offer longer-lasting protection against diseases such as rust and blight are also gaining prominence. The competitive advantage lies in products that offer broad-spectrum control with favorable toxicological profiles and compatibility with integrated pest management (IPM) strategies. The market fit for these products is driven by the need to maximize crop yields in Russia's vast agricultural regions while adhering to evolving environmental regulations and consumer demands for safer food production.

Key Drivers, Barriers & Challenges in Russia Crop Protection Chemical Market

Key Drivers:

The Russia Crop Protection Chemical Market is propelled by several key factors. Technological advancements in agrochemical formulation and application, leading to more efficient and targeted solutions, are crucial. Economic growth in the agricultural sector, driven by increasing global demand for food and Russia's role as a major agricultural exporter, directly fuels the need for crop protection. Government policies that support agricultural modernization, provide subsidies for advanced farming techniques, and aim to enhance food security create a favorable market environment. For example, initiatives promoting self-sufficiency in food production necessitate robust crop protection measures.

Barriers & Challenges:

Despite the drivers, the market faces significant challenges. Regulatory complexities and lengthy approval processes for new agrochemicals can hinder innovation adoption. Supply chain disruptions, exacerbated by geopolitical events and global logistics challenges, can impact the availability and cost of raw materials and finished products. Competitive pressures from both domestic and international players, coupled with the rising cost of R&D and manufacturing, can squeeze profit margins. The increasing awareness and demand for organic and sustainable farming practices also present a challenge to the dominance of conventional chemical solutions, necessitating a shift towards integrated pest management and biological alternatives.

Growth Drivers in the Russia Crop Protection Chemical Market Market

The Russia Crop Protection Chemical Market is experiencing robust growth driven by several interconnected factors. Technological innovation in developing targeted and efficient agrochemicals, including advanced herbicides and fungicides, is paramount. Economic incentives, such as government support for agricultural modernization and export promotion policies, significantly boost demand. Favorable climatic conditions for agriculture across vast regions of Russia, combined with the inherent need to protect crops from pests and diseases to ensure yield stability, are fundamental drivers. Furthermore, increasing global food demand positions Russia as a key supplier, necessitating enhanced agricultural productivity through effective crop protection.

Challenges Impacting Russia Crop Protection Chemical Market Growth

Several challenges significantly impact the growth of the Russia Crop Protection Chemical Market. Regulatory hurdles, including evolving environmental standards and the complex registration process for new active ingredients, can impede market entry and product launches. Supply chain vulnerabilities, particularly concerning the import of key raw materials and active ingredients, pose a constant risk of disruption, leading to potential price volatility and availability issues. Intense competition from both established global players and emerging domestic manufacturers drives down prices and necessitates continuous innovation. Moreover, a growing consumer preference for organic and sustainable agricultural products is creating pressure to reduce reliance on conventional chemical inputs, pushing for greater adoption of biological alternatives and integrated pest management strategies.

Key Players Shaping the Russia Crop Protection Chemical Market Market

- FMC Corporation

- UPL Limited (Arysta LifeScience)

- Adama Ltd

- Syngenta International AG

- RosAgroChim LT

- Corteva Agriscience

- Bayer CropScience AG

- BASF SE

Significant Russia Crop Protection Chemical Market Industry Milestones

- August 2022: Bayer restarted supplying essential agricultural inputs to Russia after the country ceased to war with Ukraine. Bayer helped the farmers and people of Russia with food crises.

- July 2022: The Indian Institute of Spices Research (IISR) under the Indian Council for Agricultural Research (ICAR) made a Memorandum of Understanding (MoU) with Lysterra LLC, a Russia-based company for the commercialization of biocapsule, an encapsulation technology for bio-fertilization. It is used to encapsulate all agriculturally important microorganisms for the delivery of beneficial micro-organisms as bio-fertilizers to crops.

Future Outlook for Russia Crop Protection Chemical Market Market

The future outlook for the Russia Crop Protection Chemical Market is characterized by sustained growth and strategic evolution. Driven by Russia's pivotal role in global food security and the continuous need to enhance agricultural productivity, the market is set to expand. Key growth catalysts include ongoing investment in research and development for more sustainable and targeted crop protection solutions, including biopesticides and precision application technologies. The increasing adoption of digital farming tools will further optimize the use of agrochemicals. Opportunities lie in catering to the evolving demands for safer, residue-free food products and in expanding the domestic manufacturing base for critical agrochemical components. The market's trajectory will be shaped by its ability to adapt to stringent environmental regulations, mitigate supply chain risks, and embrace innovation to meet the dynamic needs of modern agriculture.

Russia Crop Protection Chemical Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Russia Crop Protection Chemical Market Segmentation By Geography

- 1. Russia

Russia Crop Protection Chemical Market Regional Market Share

Geographic Coverage of Russia Crop Protection Chemical Market

Russia Crop Protection Chemical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Booming Agriculture Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Crop Protection Chemical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPL Limited (Arysta LifeScience)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Adama Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Syngenta International AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RosAgroChim LT

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corteva Agriscience

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bayer CropScience AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: Russia Crop Protection Chemical Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Crop Protection Chemical Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Crop Protection Chemical Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Russia Crop Protection Chemical Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Russia Crop Protection Chemical Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Russia Crop Protection Chemical Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Russia Crop Protection Chemical Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Russia Crop Protection Chemical Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Russia Crop Protection Chemical Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Russia Crop Protection Chemical Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Russia Crop Protection Chemical Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Russia Crop Protection Chemical Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Russia Crop Protection Chemical Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Russia Crop Protection Chemical Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Crop Protection Chemical Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Russia Crop Protection Chemical Market?

Key companies in the market include FMC Corporation, UPL Limited (Arysta LifeScience), Adama Ltd, Syngenta International AG, RosAgroChim LT, Corteva Agriscience, Bayer CropScience AG, BASF SE.

3. What are the main segments of the Russia Crop Protection Chemical Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Booming Agriculture Sector.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

August 2022: Bayer restarted supplying essential agricultural inputs to Russia after the country ceased to war with Ukraine. Bayer helped the farmers and people of Russia with food crises.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Crop Protection Chemical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Crop Protection Chemical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Crop Protection Chemical Market?

To stay informed about further developments, trends, and reports in the Russia Crop Protection Chemical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence