Key Insights

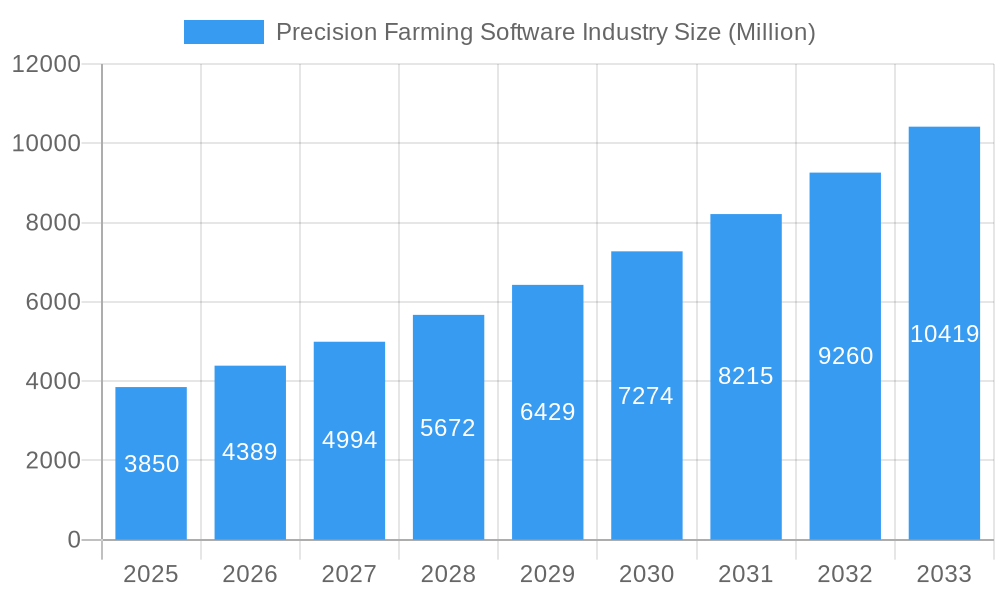

The Precision Farming Software market is set for significant expansion, projected to reach a market size of $2.7 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 13.9% through 2033. This growth is driven by the increasing adoption of advanced agricultural technologies designed to boost crop yields, optimize resource management, and enhance farm profitability. Key factors include escalating global food demand, the imperative for sustainable farming to reduce environmental impact, and growing farmer awareness of data-driven decision-making benefits. Government support for modern agriculture and advancements in sensor technology, IoT, and AI are also significant catalysts. The market is segmented by application, including crop management, financial management, farm inventory, personnel management, and weather tracking, alongside specialized functions. Cloud-based solutions are expected to lead, offering scalability, accessibility, and advanced analytics.

Precision Farming Software Industry Market Size (In Billion)

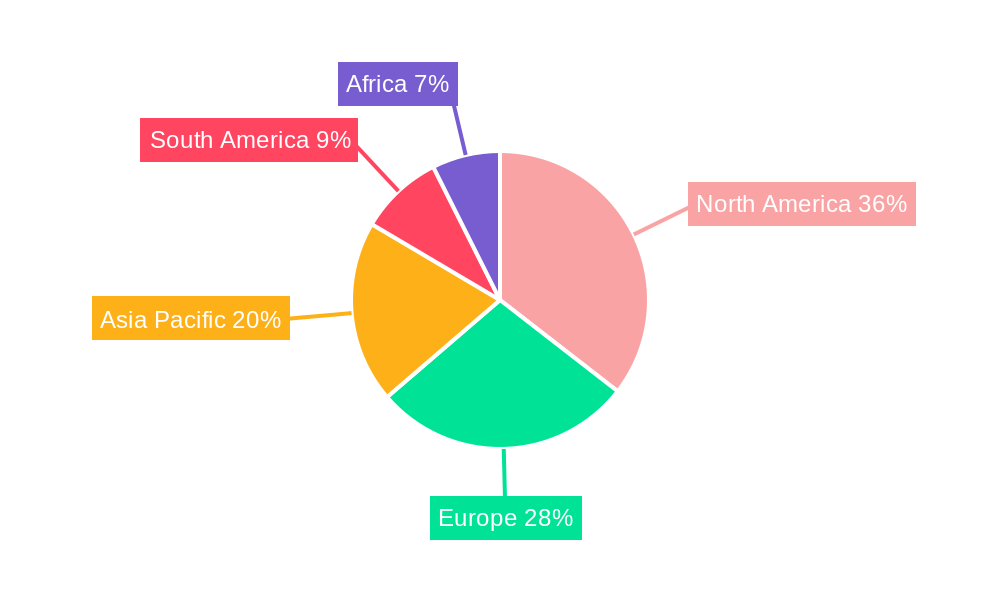

The competitive landscape includes established agricultural manufacturers like Deere & Company and AGCO Corporation, as well as specialized software providers such as Conservis Corporation and Trimble Inc. Innovation in data analytics, predictive modeling with machine learning, and integrated farm management platforms are critical for market players. Potential challenges include high initial investment costs, a shortage of skilled labor, and data security concerns. Nevertheless, the overarching trend towards smart agriculture, driven by food security and environmental sustainability needs, ensures a promising future. North America and Europe are expected to lead adoption, while the Asia Pacific region offers substantial growth potential due to its large agricultural sector and increasing modernization investments.

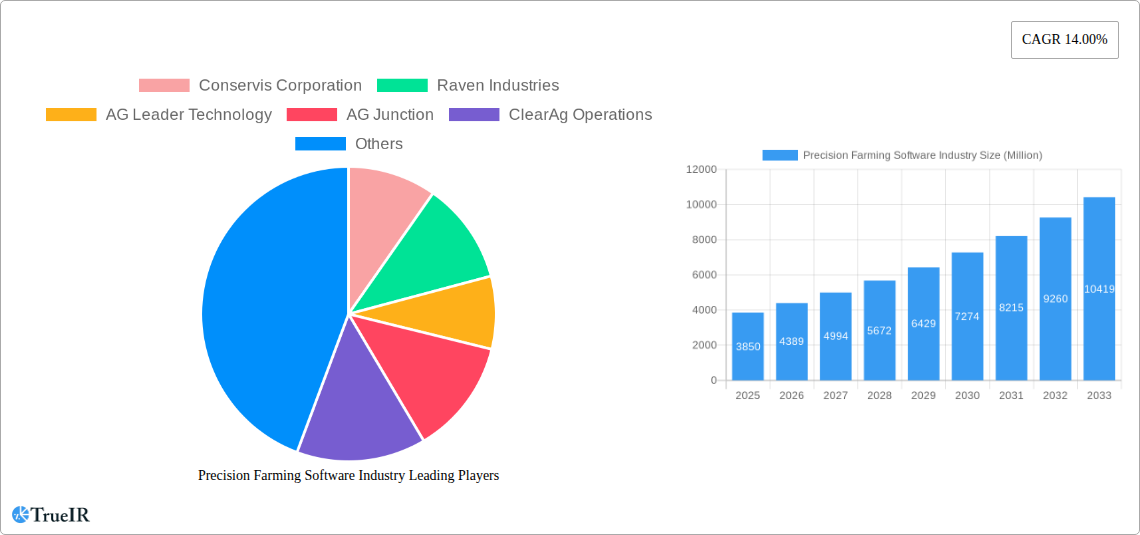

Precision Farming Software Industry Company Market Share

Precision Farming Software Industry Market Structure & Competitive Landscape

The global Precision Farming Software market exhibits a moderately concentrated structure, characterized by a blend of established agricultural technology giants and emerging specialized solution providers. Innovation drivers are paramount, fueled by advancements in IoT, AI, machine learning, and big data analytics, enabling more precise resource allocation and yield optimization. Regulatory impacts, while generally supportive of technological adoption for increased sustainability and food security, can introduce complexities in data privacy and interoperability. Product substitutes are gradually evolving, moving beyond traditional farm management tools to integrated digital ecosystems. End-user segmentation reveals a growing demand from large-scale commercial farms seeking sophisticated data-driven insights, alongside increasing adoption by medium-sized operations looking for cost-effective efficiency gains. Mergers and acquisitions (M&A) are a significant trend, with larger corporations acquiring innovative startups to expand their product portfolios and market reach. For instance, the past few years have seen over 50 significant M&A deals, with a combined valuation exceeding $10 Billion, consolidating market share and fostering strategic partnerships. The Herfindahl-Hirschman Index (HHI) for the overall market is estimated to be around 1800, indicating moderate concentration.

Precision Farming Software Industry Market Trends & Opportunities

The Precision Farming Software industry is poised for substantial growth, projected to reach a market size of over $50 Billion by 2033, expanding from an estimated $20 Billion in 2025. This robust expansion is driven by a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. Technological shifts are central to this trajectory, with the integration of AI and machine learning algorithms enabling predictive analytics for crop health, disease detection, and optimized irrigation schedules. The increasing adoption of IoT devices on farms, such as smart sensors and drones, generates vast amounts of data that precision farming software leverages for actionable insights, significantly enhancing operational efficiency. Consumer preferences are evolving, with a growing demand for sustainably produced food and increased traceability, pushing farmers towards digital solutions that can document and verify their practices. Competitive dynamics are intensifying as companies vie for market share through product differentiation, strategic alliances, and value-added services. Cloud-based solutions are gaining dominance due to their scalability, accessibility, and lower upfront costs, facilitating broader market penetration, which is projected to reach over 70% among commercial farms by 2030. Furthermore, the growing emphasis on data-driven decision-making to mitigate the impacts of climate change and fluctuating market prices is creating new opportunities for software providers to offer advanced scenario planning and risk management tools. The development of interoperable platforms that seamlessly integrate with existing farm machinery and other agricultural data sources is also a key trend, fostering a more connected and efficient agricultural ecosystem.

Dominant Markets & Segments in Precision Farming Software Industry

The Crop Management application segment is unequivocally the dominant force within the Precision Farming Software industry, driven by its direct impact on yield optimization and resource efficiency. This segment is projected to account for over 40% of the total market revenue by 2033. Within this, cloud-based solutions are experiencing the fastest growth, estimated at a CAGR of 15% from 2025 to 2033, owing to their inherent scalability, remote accessibility, and ability to handle large datasets. North America, particularly the United States, currently leads the market, contributing over 35% of the global revenue. This dominance is attributed to early adoption of advanced agricultural technologies, supportive government policies, and the prevalence of large-scale commercial farming operations.

Key Growth Drivers in Crop Management:

- Demand for Increased Yields: Continuous pressure to feed a growing global population necessitates maximizing crop output.

- Optimized Resource Utilization: Precise application of fertilizers, pesticides, and water reduces waste and environmental impact.

- Early Disease and Pest Detection: AI-powered image analysis and sensor data enable proactive interventions, preventing significant crop loss.

- Variable Rate Application (VRA): Software facilitating VRA ensures that inputs are applied only where and when needed, improving efficiency and reducing costs.

Dominance of Cloud-Based Solutions:

- Accessibility and Scalability: Farmers can access data and insights from anywhere, and solutions can be scaled to farms of all sizes.

- Data Integration: Cloud platforms facilitate the seamless integration of data from various sources like sensors, drones, and machinery.

- Reduced IT Burden: Eliminates the need for significant on-premises IT infrastructure for end-users.

- Advanced Analytics: Cloud environments support sophisticated AI and machine learning algorithms for deeper insights.

The Weather Tracking and Forecasting application segment also holds significant importance, often integrated within broader crop management platforms, showing a market share of approximately 15% and a CAGR of 11% during the forecast period. Its critical role in decision-making regarding planting, harvesting, and irrigation makes it indispensable.

- Growth Drivers in Weather Tracking & Forecasting:

- Climate Change Mitigation: Accurate weather data helps farmers adapt to unpredictable weather patterns.

- Improved Planning: Enables better scheduling of fieldwork and resource allocation.

- Risk Management: Helps in anticipating extreme weather events and mitigating potential losses.

The Financial Management segment, valued at over $3 Billion in 2025 and growing at a CAGR of 10%, plays a crucial role in farm profitability by tracking expenses, revenue, and providing budgeting tools. The Farm Inventory Management segment, while smaller, is essential for optimizing stock levels and reducing spoilage, with an estimated market value of $2 Billion in 2025.

Precision Farming Software Industry Product Analysis

Precision farming software innovations are rapidly transforming agriculture, offering enhanced efficiency, sustainability, and profitability. Products now integrate advanced AI for predictive analytics, drone imagery for detailed field mapping, and IoT sensor networks for real-time data collection. These solutions provide critical insights for crop management, enabling precise application of inputs and early detection of diseases. Competitive advantages lie in user-friendly interfaces, seamless integration with farm machinery, and robust data security. For example, solutions offering real-time yield monitoring and historical data analysis empower farmers with data-driven decision-making capabilities, leading to optimized resource allocation and increased ROI.

Key Drivers, Barriers & Challenges in Precision Farming Software Industry

Key Drivers: The precision farming software industry is propelled by the imperative to enhance food security for a growing global population, coupled with increasing regulatory pressures for sustainable agricultural practices. Technological advancements, including AI, IoT, and big data analytics, are fundamental drivers, enabling more efficient resource management and yield optimization. Economic factors, such as fluctuating commodity prices and the rising cost of inputs, also encourage the adoption of technologies that improve profitability and reduce waste. Supportive government initiatives and subsidies aimed at promoting agricultural modernization further bolster market growth.

Barriers & Challenges: Despite its growth, the industry faces significant barriers. High initial investment costs for software and associated hardware can be a restraint for small and medium-sized farms. Limited internet connectivity in rural areas poses a challenge for cloud-based solutions. A shortage of skilled labor capable of operating and interpreting data from these advanced systems is another considerable hurdle. Regulatory complexities, particularly concerning data privacy and ownership, can create uncertainty. Furthermore, the need for interoperability between different software platforms and machinery can lead to vendor lock-in and integration issues. Supply chain disruptions for critical hardware components also present a risk.

Growth Drivers in the Precision Farming Software Industry Market

The precision farming software market is significantly driven by the escalating global demand for increased food production and the urgent need for sustainable agricultural practices. Technological innovation, particularly the pervasive integration of Artificial Intelligence (AI) for predictive analytics, machine learning for optimizing resource allocation, and the Internet of Things (IoT) for real-time data collection, serves as a powerful catalyst. Government policies and subsidies encouraging the adoption of modern farming technologies, alongside farmers' keenness to reduce operational costs and enhance profitability in the face of volatile commodity prices, are pivotal growth factors. The growing awareness of climate change impacts and the associated need for resilient farming strategies further propel the adoption of these data-driven solutions.

Challenges Impacting Precision Farming Software Industry Growth

The growth trajectory of the precision farming software industry is impeded by several substantial challenges. The initial capital outlay for sophisticated software and required hardware can be prohibitively high for many farmers, especially in developing regions. Inadequate or unreliable internet infrastructure in rural areas poses a significant obstacle to the effective deployment and utilization of cloud-based solutions. A notable skills gap, characterized by a scarcity of agricultural professionals trained in operating and interpreting data from advanced technological systems, hinders widespread adoption. Furthermore, the lack of standardization and interoperability between different software platforms and farm machinery can create complex integration challenges and potential vendor lock-in issues. Regulatory uncertainties surrounding data privacy and ownership can also create hesitation among users.

Key Players Shaping the Precision Farming Software Industry Market

- Conservis Corporation

- Raven Industries

- AG Leader Technology

- AG Junction

- ClearAg Operations

- Deere & Company

- Fairport Farm Software

- AG DNA

- Topcon Positioning Systems

- Trimble Inc

- Bayer CropScience AG

- Agribotix

- Case IH Agriculture

- Mapshots Inc

- IBM

- AGCO Corporation

Significant Precision Farming Software Industry Industry Milestones

- 2019: Launch of advanced AI-powered pest and disease detection algorithms, significantly improving early intervention capabilities.

- 2020: Introduction of integrated farm management platforms combining crop, financial, and inventory management, offering a holistic view.

- 2021: Major advancements in drone-based imagery analysis, providing higher resolution data for precise field assessments.

- 2022: Increased adoption of IoT sensors for real-time soil moisture and nutrient monitoring, enabling highly targeted irrigation and fertilization.

- 2023: Emergence of blockchain technology for enhanced farm-to-fork traceability and supply chain transparency.

- 2024: Significant investment in cloud infrastructure to support the growing volume of agricultural data and predictive analytics.

Future Outlook for Precision Farming Software Industry Market

The future outlook for the Precision Farming Software industry is exceptionally promising, fueled by ongoing technological advancements and a global push towards sustainable agriculture. The market will witness further integration of AI, machine learning, and IoT, leading to more sophisticated predictive analytics and automated decision-making processes. Opportunities abound in developing user-friendly, cost-effective solutions for a wider range of farm sizes and types. Strategic collaborations between software providers, machinery manufacturers, and agricultural research institutions will be crucial for driving innovation and market penetration. The increasing emphasis on data-driven insights for climate resilience and supply chain optimization will continue to propel market growth, creating a more efficient, sustainable, and profitable agricultural sector.

Precision Farming Software Industry Segmentation

-

1. Application

- 1.1. Crop Management

- 1.2. Financial Management

- 1.3. Farm Inventory Management

- 1.4. Personnel Management

- 1.5. Weather Tracking and Forecasting

- 1.6. Other Applications

-

2. Type

- 2.1. Local or Web-based

- 2.2. Cloud-based

-

3. Application

- 3.1. Crop Management

- 3.2. Financial Management

- 3.3. Farm Inventory Management

- 3.4. Personnel Management

- 3.5. Weather Tracking and Forecasting

- 3.6. Other Applications

-

4. Type

- 4.1. Local or Web-based

- 4.2. Cloud-based

Precision Farming Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Precision Farming Software Industry Regional Market Share

Geographic Coverage of Precision Farming Software Industry

Precision Farming Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Farm Labor Shortage and Rise in Average Farm Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Precision Farming Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Crop Management

- 5.1.2. Financial Management

- 5.1.3. Farm Inventory Management

- 5.1.4. Personnel Management

- 5.1.5. Weather Tracking and Forecasting

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Local or Web-based

- 5.2.2. Cloud-based

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Crop Management

- 5.3.2. Financial Management

- 5.3.3. Farm Inventory Management

- 5.3.4. Personnel Management

- 5.3.5. Weather Tracking and Forecasting

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Type

- 5.4.1. Local or Web-based

- 5.4.2. Cloud-based

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Precision Farming Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Crop Management

- 6.1.2. Financial Management

- 6.1.3. Farm Inventory Management

- 6.1.4. Personnel Management

- 6.1.5. Weather Tracking and Forecasting

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Local or Web-based

- 6.2.2. Cloud-based

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Crop Management

- 6.3.2. Financial Management

- 6.3.3. Farm Inventory Management

- 6.3.4. Personnel Management

- 6.3.5. Weather Tracking and Forecasting

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Type

- 6.4.1. Local or Web-based

- 6.4.2. Cloud-based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Precision Farming Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Crop Management

- 7.1.2. Financial Management

- 7.1.3. Farm Inventory Management

- 7.1.4. Personnel Management

- 7.1.5. Weather Tracking and Forecasting

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Local or Web-based

- 7.2.2. Cloud-based

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Crop Management

- 7.3.2. Financial Management

- 7.3.3. Farm Inventory Management

- 7.3.4. Personnel Management

- 7.3.5. Weather Tracking and Forecasting

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Type

- 7.4.1. Local or Web-based

- 7.4.2. Cloud-based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Precision Farming Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Crop Management

- 8.1.2. Financial Management

- 8.1.3. Farm Inventory Management

- 8.1.4. Personnel Management

- 8.1.5. Weather Tracking and Forecasting

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Local or Web-based

- 8.2.2. Cloud-based

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Crop Management

- 8.3.2. Financial Management

- 8.3.3. Farm Inventory Management

- 8.3.4. Personnel Management

- 8.3.5. Weather Tracking and Forecasting

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Type

- 8.4.1. Local or Web-based

- 8.4.2. Cloud-based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Precision Farming Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Crop Management

- 9.1.2. Financial Management

- 9.1.3. Farm Inventory Management

- 9.1.4. Personnel Management

- 9.1.5. Weather Tracking and Forecasting

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Local or Web-based

- 9.2.2. Cloud-based

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Crop Management

- 9.3.2. Financial Management

- 9.3.3. Farm Inventory Management

- 9.3.4. Personnel Management

- 9.3.5. Weather Tracking and Forecasting

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Type

- 9.4.1. Local or Web-based

- 9.4.2. Cloud-based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Africa Precision Farming Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Crop Management

- 10.1.2. Financial Management

- 10.1.3. Farm Inventory Management

- 10.1.4. Personnel Management

- 10.1.5. Weather Tracking and Forecasting

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Local or Web-based

- 10.2.2. Cloud-based

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Crop Management

- 10.3.2. Financial Management

- 10.3.3. Farm Inventory Management

- 10.3.4. Personnel Management

- 10.3.5. Weather Tracking and Forecasting

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Type

- 10.4.1. Local or Web-based

- 10.4.2. Cloud-based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Conservis Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Raven Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AG Leader Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AG Junction

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ClearAg Operations

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deere & Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fairport Farm Software

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AG DNA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Topcon Positioning Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trimble Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bayer CropScience AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Agribotix

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Case IH Agriculture

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mapshots Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IBM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AGCO Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Conservis Corporation

List of Figures

- Figure 1: Global Precision Farming Software Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Precision Farming Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Precision Farming Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Precision Farming Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Precision Farming Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 25: Asia Pacific Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 26: Asia Pacific Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 29: Asia Pacific Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Precision Farming Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Precision Farming Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 33: South America Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: South America Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 39: South America Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 40: South America Precision Farming Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Precision Farming Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Africa Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 43: Africa Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 44: Africa Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 45: Africa Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Africa Precision Farming Software Industry Revenue (billion), by Application 2025 & 2033

- Figure 47: Africa Precision Farming Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: Africa Precision Farming Software Industry Revenue (billion), by Type 2025 & 2033

- Figure 49: Africa Precision Farming Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 50: Africa Precision Farming Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Africa Precision Farming Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Precision Farming Software Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Precision Farming Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Precision Farming Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Germany Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Spain Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Precision Farming Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: China Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Japan Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: India Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Australia Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 40: Global Precision Farming Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Brazil Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Argentina Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of South America Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 45: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 46: Global Precision Farming Software Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 47: Global Precision Farming Software Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global Precision Farming Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 49: South Africa Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Africa Precision Farming Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Precision Farming Software Industry?

The projected CAGR is approximately 13.9%.

2. Which companies are prominent players in the Precision Farming Software Industry?

Key companies in the market include Conservis Corporation, Raven Industries, AG Leader Technology, AG Junction, ClearAg Operations, Deere & Company, Fairport Farm Software, AG DNA, Topcon Positioning Systems, Trimble Inc, Bayer CropScience AG, Agribotix, Case IH Agriculture, Mapshots Inc, IBM, AGCO Corporation.

3. What are the main segments of the Precision Farming Software Industry?

The market segments include Application, Type, Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Farm Labor Shortage and Rise in Average Farm Size.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Precision Farming Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Precision Farming Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Precision Farming Software Industry?

To stay informed about further developments, trends, and reports in the Precision Farming Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence