Key Insights

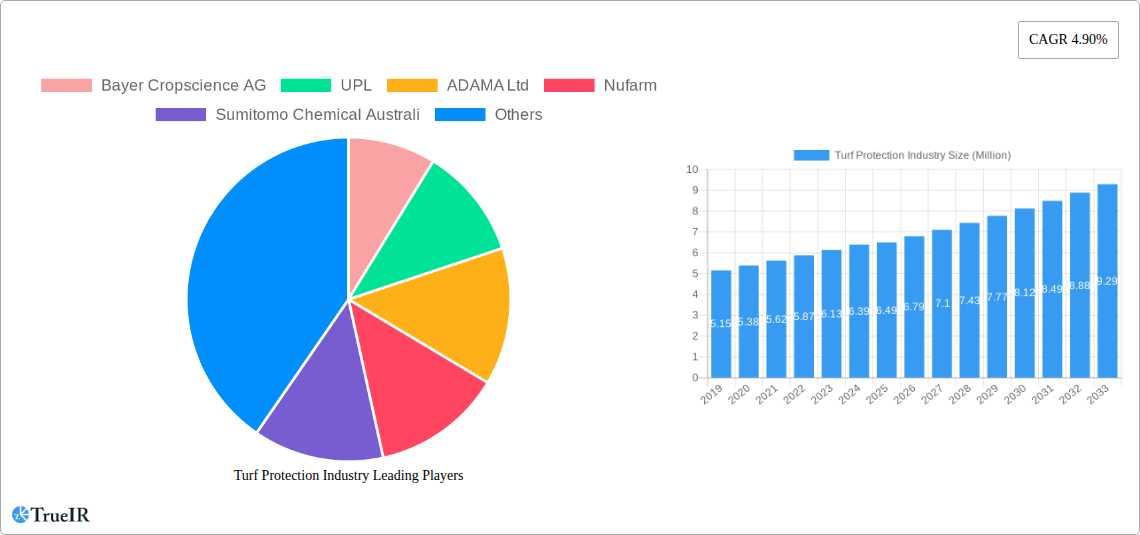

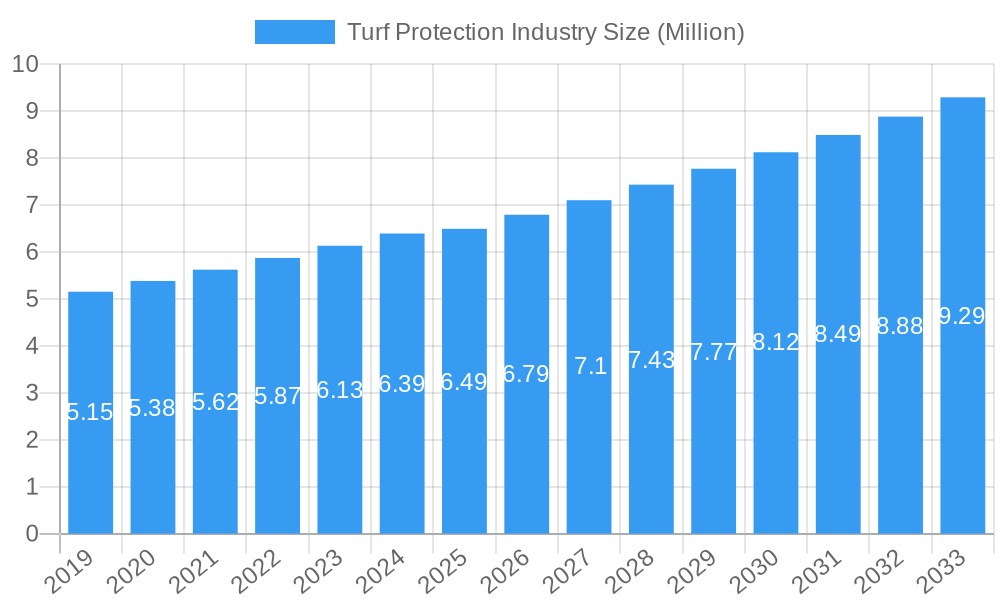

The global Turf Protection market is poised for significant expansion, projected to reach an estimated USD 6.49 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.90% anticipated over the forecast period of 2025-2033. This growth is primarily fueled by the increasing demand for aesthetically pleasing and well-maintained green spaces across various applications. The landscaping sector, driven by urbanization and a growing preference for well-manicured residential and commercial properties, represents a substantial driver. Similarly, the golf industry's continued investment in course maintenance and the sports sector's need for high-quality playing surfaces contribute significantly to market expansion. Sod growers also play a crucial role, requiring effective turf protection solutions to ensure the health and vitality of their crops for commercial sale.

Turf Protection Industry Market Size (In Million)

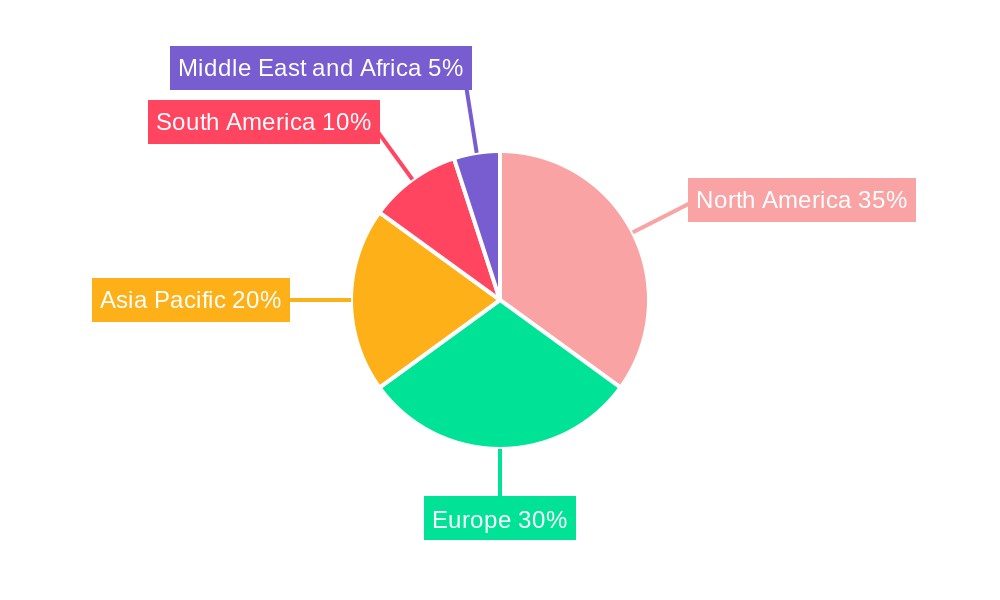

Emerging trends indicate a growing adoption of integrated pest management (IPM) strategies and a rising interest in bio-based and environmentally friendly turf protection solutions. While the market benefits from these positive drivers and trends, certain restraints, such as the potential for developing resistance in pests and diseases to conventional treatments and the fluctuating raw material costs for key active ingredients, could temper growth. Geographically, North America and Europe are expected to dominate the market share, owing to established infrastructure for sports and recreation and a strong awareness of turf health. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by rapid economic development, increasing disposable incomes, and a burgeoning interest in outdoor leisure activities. Key players like Bayer Cropscience AG, Syngenta AG, and BASF SE are actively investing in research and development to introduce innovative and sustainable turf protection products.

Turf Protection Industry Company Market Share

This comprehensive report delves into the dynamic Turf Protection Industry, providing in-depth analysis from 2019 to 2033, with a base and estimated year of 2025. We explore the evolving market structure, key trends, dominant segments, and the strategic initiatives of leading players like Bayer Cropscience AG, UPL, ADAMA Ltd, Nufarm, Sumitomo Chemical Australi, AMVAC Chemical Corporation, Marrone Bio Innovations, Syngenta AG, and BASF SE. This report is designed to equip stakeholders with actionable insights for navigating this high-growth sector.

Turf Protection Industry Market Structure & Competitive Landscape

The global Turf Protection Industry exhibits a moderately consolidated market structure, characterized by the presence of several major multinational corporations alongside a growing number of specialized regional players. Leading companies such as Bayer Cropscience AG, Syngenta AG, and BASF SE hold significant market shares, driven by extensive research and development investments, robust product portfolios, and well-established distribution networks. The concentration ratio is estimated to be around 65% among the top five players. Innovation drivers are primarily focused on developing more environmentally friendly and sustainable turf management solutions, including bio-pesticides and precision application technologies. Regulatory impacts are substantial, with stringent environmental laws in key markets influencing product development and market access. Product substitutes, while present in the form of alternative turfgrass varieties or organic landscaping methods, have a limited impact on the core demand for specialized protection products. End-user segmentation reveals strong demand across Landscaping, Golf, Sports, and Sod Growers applications, each with unique requirements and growth trajectories. Merger and acquisition (M&A) trends are moderately active, with strategic consolidations aimed at expanding product lines, geographical reach, and technological capabilities. The volume of M&A deals in the historical period (2019-2024) is estimated to be between 25 to 35 transactions annually.

Turf Protection Industry Market Trends & Opportunities

The Turf Protection Industry is poised for significant expansion, with a projected market size to reach approximately USD 50,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 5.8% from 2025 to 2033. This robust growth is fueled by increasing investments in sports infrastructure, the burgeoning golf tourism sector, and the growing demand for aesthetically pleasing and well-maintained landscapes in both residential and commercial areas. Technological shifts are paramount, with a pronounced move towards digital agriculture solutions, including drone-based application, sensor technology for real-time monitoring of turf health, and data analytics for optimized treatment plans. Consumer preferences are increasingly leaning towards sustainable and eco-friendly turf management practices. This is creating a substantial opportunity for the development and adoption of bio-based fungicides, herbicides, and insecticides, as well as integrated pest management (IPM) strategies. The competitive dynamics are intensifying, with companies vying to introduce novel formulations and patented technologies that offer superior efficacy, reduced environmental impact, and enhanced user safety. Market penetration rates for advanced turf protection solutions are expected to rise significantly, particularly in developed economies with greater awareness and purchasing power. The increasing adoption of smart irrigation systems and advanced turfgrass varieties further complements the demand for sophisticated protection products. The forecast period anticipates a sustained upward trajectory driven by these converging trends.

Dominant Markets & Segments in Turf Protection Industry

The Landscaping segment is projected to be the largest and fastest-growing segment within the Turf Protection Industry, contributing approximately 40% to the overall market revenue by 2033. This dominance is propelled by several key growth drivers. Firstly, the continuous expansion of urban areas and the increasing demand for attractive and functional green spaces in residential, commercial, and public areas are major contributors. Secondly, the growing emphasis on curb appeal for residential properties and the need for well-maintained commercial landscapes drive consistent demand for turf protection products. Thirdly, the rising popularity of outdoor recreational activities and the aesthetic expectations associated with them further bolster the landscaping sector's importance.

Within the Landscaping application, the growth is particularly strong in regions with high population density and significant disposable income, such as North America and Europe. The development of new housing projects, the renovation of existing properties, and the widespread use of turf in parks, gardens, and along transportation corridors all contribute to the sustained demand. Policies promoting green infrastructure and urban beautification initiatives also play a crucial role in driving market penetration. The need to protect turf from common diseases, insect infestations, and weed encroachment to maintain its visual appeal and health is paramount for landscapers and property owners.

The Golf segment, while smaller in overall size, represents a high-value market due to the specialized needs and stringent requirements of golf course maintenance. The pursuit of pristine playing surfaces necessitates the consistent application of advanced turf protection solutions to combat turf diseases, manage weeds, and ensure optimal turf density and color. Investments in new golf course construction and the renovation of existing courses, particularly in emerging economies and tourist destinations, further contribute to this segment's growth.

The Sports segment, encompassing professional and amateur sports fields, also exhibits steady growth. The demand for durable, safe, and aesthetically pleasing playing surfaces drives the adoption of turf protection products to withstand heavy foot traffic, recover from damage, and resist disease and pest outbreaks. Government and private investments in sports facilities, coupled with the increasing popularity of various sports, are key enablers for this segment.

The Sod Growers segment, while primarily a B2B market, is essential for supplying healthy turf for all other applications. Their reliance on effective turf protection products ensures the quality and marketability of the sod they produce. Innovations in cultivation and protection techniques directly impact the overall health and availability of sod.

Turf Protection Industry Product Analysis

Product innovation in the Turf Protection Industry is largely centered on developing highly targeted and efficient solutions. This includes the introduction of new fungicide and herbicide formulations with improved modes of action, offering broader spectrum control and reduced resistance development. Biopesticides derived from natural sources are gaining traction, appealing to the growing demand for sustainable and environmentally benign turf management. Advanced delivery systems, such as microencapsulation and controlled-release technologies, are enhancing product efficacy and longevity, while minimizing off-target effects. Competitive advantages are being carved out through patented chemistries, proprietary formulations, and integrated solutions that combine biological and chemical approaches.

Key Drivers, Barriers & Challenges in Turf Protection Industry

Key Drivers:

- Increasing demand for aesthetically pleasing and well-maintained green spaces: Driven by urbanization and lifestyle trends.

- Growth in sports and golf infrastructure: Leading to higher demand for turf maintenance.

- Technological advancements: Innovations in precision application, bio-based solutions, and data analytics.

- Government initiatives promoting green spaces and sustainable practices.

Barriers & Challenges:

- Stringent environmental regulations: Impeding product development and market entry for certain chemicals.

- Rising input costs: Including raw materials and energy, impacting profitability.

- Weather variability and climate change: Affecting turf health and the prevalence of pests and diseases.

- Public perception and demand for organic solutions: Creating pressure on conventional products.

- Supply chain disruptions: Affecting the availability and cost of key ingredients.

Growth Drivers in the Turf Protection Industry Market

The Turf Protection Industry is being propelled by several key growth drivers. Technological innovation is paramount, with the development of more targeted herbicides, fungicides, and insecticides that offer enhanced efficacy and reduced environmental impact. The increasing adoption of precision agriculture techniques, including drone-based spraying and sensor-based monitoring, allows for more efficient and targeted application of protection products, optimizing resource use. Economically, rising disposable incomes and increased spending on landscaping and recreational facilities globally are fueling demand. Furthermore, government policies in many regions are encouraging the development and use of sustainable turf management practices, creating opportunities for bio-based and eco-friendly solutions. The growing awareness among consumers and end-users about the importance of healthy turf for aesthetic appeal, environmental benefits, and recreational use is also a significant contributor.

Challenges Impacting Turf Protection Industry Growth

Several challenges are impacting the growth of the Turf Protection Industry. Regulatory complexities present a significant hurdle, with evolving registration processes and restrictions on certain active ingredients that can slow down product development and market access. Supply chain issues, including the availability and cost of raw materials, and logistical challenges, can lead to production delays and increased operational costs. Competitive pressures are intense, with a crowded market landscape and the constant need for companies to innovate and differentiate their offerings. Moreover, the increasing demand for organic and natural turf care solutions, while an opportunity for some, poses a challenge for traditional chemical-based product manufacturers, requiring them to adapt their portfolios or face declining market share in certain segments.

Key Players Shaping the Turf Protection Industry Market

- Bayer Cropscience AG

- UPL

- ADAMA Ltd

- Nufarm

- Sumitomo Chemical Australi

- AMVAC Chemical Corporation

- Marrone Bio Innovations

- Syngenta AG

- BASF SE

Significant Turf Protection Industry Industry Milestones

- 2020: Launch of new broad-spectrum fungicide with enhanced disease control efficacy.

- 2021: Introduction of a bio-based insecticide derived from beneficial nematodes, addressing demand for sustainable solutions.

- 2022: Strategic partnership formed for the development and commercialization of advanced turfgrass disease management technologies.

- 2023: Acquisition of a leading bio-control solutions provider to strengthen portfolio in biological turf protection.

- 2024: Regulatory approval received for a novel herbicide formulation with significantly reduced environmental impact.

Future Outlook for Turf Protection Industry Market

The future outlook for the Turf Protection Industry is exceptionally positive, driven by sustained demand for healthy and well-maintained turf across diverse applications. Growth catalysts include the continued expansion of the global golf and sports infrastructure, coupled with an ever-increasing emphasis on aesthetic landscaping in urban and suburban environments. The relentless pursuit of sustainable solutions will further drive innovation in bio-pesticides and integrated pest management systems. Strategic opportunities lie in leveraging digital technologies for precision turf management and in expanding into emerging markets with growing disposable incomes. The market is expected to witness further consolidation and strategic alliances as companies strive to enhance their competitive positions and cater to evolving customer needs. The projected market size of USD 50,000 Million by 2033 underscores the significant potential within this dynamic sector.

Turf Protection Industry Segmentation

-

1. Application

- 1.1. Landscaping

- 1.2. Golf

- 1.3. Sports

- 1.4. Sod Growers

-

2. Application

- 2.1. Landscaping

- 2.2. Golf

- 2.3. Sports

- 2.4. Sod Growers

Turf Protection Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Rest of Middle East and Africa

Turf Protection Industry Regional Market Share

Geographic Coverage of Turf Protection Industry

Turf Protection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Expansion of Sports Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Turf Protection Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Landscaping

- 5.1.2. Golf

- 5.1.3. Sports

- 5.1.4. Sod Growers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Landscaping

- 5.2.2. Golf

- 5.2.3. Sports

- 5.2.4. Sod Growers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Turf Protection Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Landscaping

- 6.1.2. Golf

- 6.1.3. Sports

- 6.1.4. Sod Growers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Landscaping

- 6.2.2. Golf

- 6.2.3. Sports

- 6.2.4. Sod Growers

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Turf Protection Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Landscaping

- 7.1.2. Golf

- 7.1.3. Sports

- 7.1.4. Sod Growers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Landscaping

- 7.2.2. Golf

- 7.2.3. Sports

- 7.2.4. Sod Growers

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Turf Protection Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Landscaping

- 8.1.2. Golf

- 8.1.3. Sports

- 8.1.4. Sod Growers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Landscaping

- 8.2.2. Golf

- 8.2.3. Sports

- 8.2.4. Sod Growers

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Turf Protection Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Landscaping

- 9.1.2. Golf

- 9.1.3. Sports

- 9.1.4. Sod Growers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Landscaping

- 9.2.2. Golf

- 9.2.3. Sports

- 9.2.4. Sod Growers

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Turf Protection Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Landscaping

- 10.1.2. Golf

- 10.1.3. Sports

- 10.1.4. Sod Growers

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Landscaping

- 10.2.2. Golf

- 10.2.3. Sports

- 10.2.4. Sod Growers

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bayer Cropscience AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UPL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ADAMA Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nufarm

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sumitomo Chemical Australi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AMVAC Chemical Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Marrone Bio Innovations

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Syngenta AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BASF SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Bayer Cropscience AG

List of Figures

- Figure 1: Global Turf Protection Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Turf Protection Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Turf Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Turf Protection Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Turf Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Turf Protection Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Turf Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: South America Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Turf Protection Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Turf Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Turf Protection Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Turf Protection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Turf Protection Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Turf Protection Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Turf Protection Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Turf Protection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Turf Protection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Turf Protection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Turf Protection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Turf Protection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Turf Protection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Turf Protection Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turf Protection Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Turf Protection Industry?

Key companies in the market include Bayer Cropscience AG, UPL, ADAMA Ltd, Nufarm, Sumitomo Chemical Australi, AMVAC Chemical Corporation, Marrone Bio Innovations, Syngenta AG, BASF SE.

3. What are the main segments of the Turf Protection Industry?

The market segments include Application, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Expansion of Sports Activities.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turf Protection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turf Protection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turf Protection Industry?

To stay informed about further developments, trends, and reports in the Turf Protection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence